捐赠模式乱象频发,“我,秦始皇,打钱”玩法一周内垮塌?

原创 | Odaily星球日报

作者 | 南枳

随着 BOME 开启了“打钱”模式的潮流,在初期出现了一批具备较高财富效应的加密项目,募资金额也不断水涨船高。但由于过热的情绪,市场对募资发起人的要求也不断降低,乱象频发。热衷于冲“新模式”的一众 Degen 们也从炫耀收益,到笑中带泪,再到怒骂项目方不厚道,经历了一轮情绪的过山车。

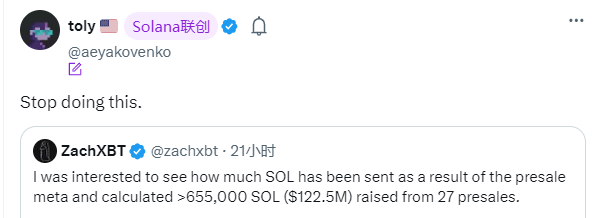

昨日,Solana 联合创始人 Anatoly Yakovenko 转发了 ZachXBT 关于 Solana 链上预售项目的统计图表(27 个 Solana 链预售项目共计募资超 65.5 万 SOL),并呼吁停止向预售项目打钱。

Odaily星球日报于昨日发表《募资型 Meme 项目爆火,如何找到下一个 Alpha?》,介绍爆火项目特征、相关数据信息查询工具,警示参与风险。今天,我们将聚焦风险点——复盘那些已经跑路的捐赠项目,探讨该模式的财富效应还能延续多久。

卷款消失

Avalanche 募资项目 Sener 共募资了约 93000 枚 AVAX,价值约 480 万美元,但在昨夜开盘时,创始人仅向 LP 池添加了 20000 万枚 AVAX,而后转移了其余的所有 AVAX。而项目代币 SENDER 仅开盘轻微上涨,项目方未曾使用剩余资金回购或其他护盘操作,目前代币已进入全面抛售阶段。

创始人@4msener和项目专用账号@Sender_MEME 自代币上线之后已再无相关内容发布。

替你出售“价值币”

Whales Market 创始人@dexter_cap(下称 dexter)旗下项目代币 WHALES 流通市值为 3860 万美元,FDV 达 1.85 亿美元,因该成功的项目背景,原属于捐赠发起人中最为可靠的项目方之一,但昨日其一系列骚操作开始令人担忧项目前景。

昨日晚间 17 时,dexter 募资地址出现异动,该地址将 159802 枚 SOL 转入了币安收款地址,价值近 3000 万美元,市场开始出现跑路的担忧。

不久之后,该地址又重新从币安转回 15, 979 枚 SOL,占其此前向币安存入 SOL 的 10% 。

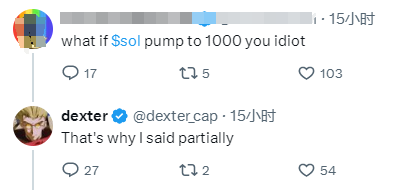

在以上代币转账操作后 1 小时, dexter 在 X 平台发文表示,超募部分即将开始发放,其将剩余的资金转移到币安部分兑换成稳定币,以避免 SOL 大幅贬值。在其向币安转账的前后时点,SOL 币价约为 178 USDT,接近当日最低点,部分用户认为是其主动抛售行为导致了 SOL 价格下跌,更多用户认为 SOL 上行空间更大,此举稀释了项目整体价值。随之而来的,还有如下声音:“我自己不会做波段?”“你要卖成稳定币,为啥不募稳定币”……

吟诗,画饼,然后跑路

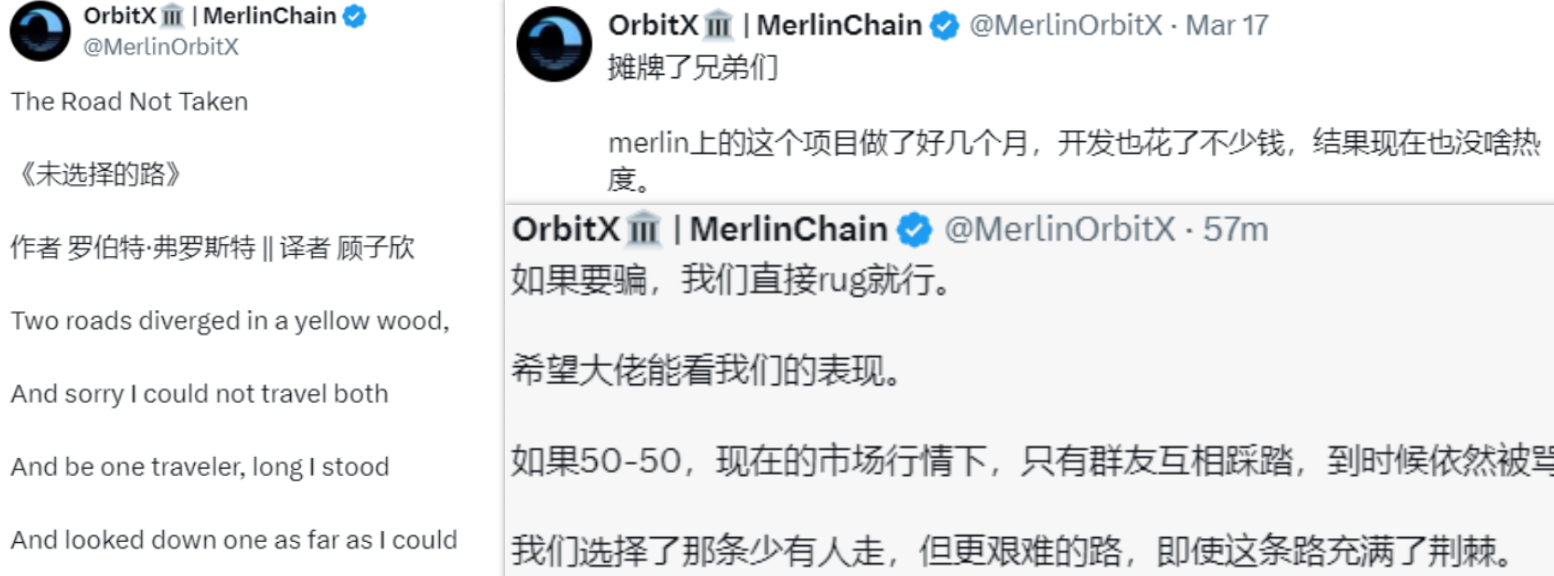

相比“我,秦始皇,打钱”的套路,@MerlinOrbitX的募资形式还略显新奇,项目方多次发文构建了一个“努力开发却不得关注”的人设,但 MerlinChain 的捐赠模式热度不足,最终募集资金约数十万美元。

在代币份额方面,此前仿照 BOME 的通常捐赠套路为—— 50% 代币与募集资金组成 LP, 50% 代币面向捐赠用户空投。但后续部分项目出现募资资金添加 LP 比例或空投份额减小的情况,一般缩减至 20% -30% 。OrbitX“创造性地”将空投份额缩减至 2.5% ,并向用户表示上涨百倍后即可盈利。

昨夜开盘后仅两小时,OrbitX 项目方地址从 LP 池中撤走了所有资金,目前代币已经归零,X 平台账号也已注销。

结论

捐赠模式持续向多链蔓延,项目方占取资金、注销跑路的比例逐步上升。虽还有少部分项目(如 Milady Wif Hat)选择退款全部的 9 万枚 SOL 并发币的。但总体而言,财富效应越来越弱,盈亏比逐渐降低,建议投资者在相关模式中保持警惕。