Weekly Financing Express | 34 のプロジェクトが投資を受け、開示された資金調達総額は約 1 億 8,000 万米ドル (2.26 ~ 3.3)

Odailyの不完全な統計によると、2月26日から3月3日までに合計34件の国内外のブロックチェーンファイナンスイベントが発表され、先週のデータ(30件)から増加しました。開示された資金総額は約1億8000万ドルで、先週の数字(2億5700万ドル)から減少した。

先週、最も多額の投資を受けたプロジェクトは Web3 インフラストラクチャー層の Avail (2,700 万米ドル) で、流動性再担保プロトコル ether.fi もそれに僅差で続きました (2,700 万米ドル)。

以下は、具体的な資金調達イベントです(注: 1. 発表された金額に従って並べ替えています。2. 資金調達および合併・買収は除きます。3. *事業の一部にブロックチェーンが関与する「従来型」分野の企業を表します)。

Avail は Founders Fund と Dragonfly が主導し、SevenX Ventures も参加して 2,700 万ドルを調達

2 月 26 日、Web3 インフラストラクチャ層の Avail は、Founders Fund と Dragonfly が主導し、SevenX Ventures、Figment、Nomad Capital、および数名のエンジェル投資家が参加した 2,700 万ドルのシードラウンドの完了を発表しました。アベイルは今回の資金調達を利用して、同社のプラットフォーム上の3つの中核製品、DA、Nexus、Fusionの開発を加速する予定だ。 Avail Trinity を構成するこれらのコア コンポーネントにより、ネットワークによる Web3 統合の加速が可能になります。

流動性再仮説プロトコルether.fiが2,700万ドルの資金調達完了を発表

2 月 28 日、流動性再仮説プロトコル ether.fi は、2,700 万米ドルの資金調達の完了を発表しました。この資金調達ラウンドは、Bullish と CoinFund が主導し、95 名を超える投資家の支援を受けました。

クリプトファンタジースポーツプラットフォームのMonkey TiltがHack VCなどの参加を得て2,100万ドルの資金調達を完了

2月27日、暗号化ファンタジースポーツプラットフォームMonkey Tiltは、Polychain Capital、Hack VC、Poker Go、Accomplice、Paper Ventures、Folius Venturesの参加を得て、2,100万米ドルの資金調達が完了したと発表した。ファンタジー ゲーム プラットフォーム MTFantasy が開始され、ベータ版が間もなく公開されます。

バックパックは、プレースホルダーの主導により、1 億 2,000 万米ドルの評価額で 1,700 万米ドルの戦略的資金調達を完了

2月28日、Backpack.exchange取引所とその環境プロジェクトは、1,700万米ドルの戦略的資金調達の完了を発表し、評価額は1億2,000万米ドルに達しました。この資金調達ラウンドは Placeholder が主導し、Hashed、Wintermute、Amber Group、Robot Ventures、Selini、Delphi Digital などが参加しました。

イーサリアム拡張プロジェクト Taiko がシリーズ A で 1,500 万ドルの資金調達を完了

3 月 3 日、イーサリアム レイヤー 2 ネットワーク Taiko は、1,500 万ドルのシリーズ A 資金調達を完了しました。この資金調達ラウンドは、Lightspeed Faction、Hashed、Generative Ventures、Token Bay Capital が共同主導し、Wintermute Ventures、Flow Traders、Amber Group、OKX が参加しました。 VenturesやGSRなどが出資に参加した。

MXC、JDI Ventures主導による1,000万ドルの資金調達完了を発表

2月26日、公式ニュースによると、MXCは、ブロックチェーンハードウェアメーカーJDI Global傘下のDePINに特化した投資ファンドであるJDI Venturesが主導する戦略的投資1,000万ドルを受け取ったと発表した。

MXC チームは 2017 年に設立され、ドイツのベルリンに本社を置き、DePIN 分野の発展に取り組んできました。チームは、イーサリアム エコシステムの DePIN インフラストラクチャになるというビジョンを掲げ、Arbitrum でレイヤー 3 zkEVM ソリューションを開始しました。

ブロックチェーンプラットフォームのInitiaがDelphi VenturesとHack VC主導で750万米ドルの資金調達を完了

2月27日、ブロックチェーンプラットフォームのInitiaは、Delphi VenturesとHack VCが共同で投資を主導し、Nascent、Figment Capital、Big Brain、A.Capital、そして匿名仮想通貨トレーダーのCobie、DCF Godが共同で750万米ドルの資金調達を完了したと発表した。 、Split Capitalの共同創設者Zaheer Ebtikar氏、Fiskantes氏、WSB Mod氏、Celestia COOのNick White氏を含むエンジェル投資家が投資に参加した。

BounceBit、Blockchain CapitalとBreyer Capitalが共同主導し、シードラウンドで600万米ドルの資金調達を完了

2 月 29 日、ビットコイン プレッジ L1 プロジェクト BounceBit は 600 万米ドルのシード ラウンドを完了しました。この資金調達ラウンドは、Blockchain Capital と Breyer Capital が共同で主導し、dao 5、CMS Holdings、Bankless Ventures、NGC Ventures、Matrixport Ventures が参加しました。 、DeFiance Capital、OKX Ventures、HTX Venturesが投資に参加しており、個人投資家にはEigenLayerの最高戦略責任者であるCalvin Liu氏が含まれている。

Web3 データ ストリーミングおよびインフラストラクチャ企業 Validation Cloud が、Cadenza Ventures 主導で 580 万ドルの資金を調達

2 月 27 日、Web3 データ フローおよびインフラストラクチャ企業 Validation Cloud は、Cadenza Ventures が主導し、Blockchain Founders Fund、Bloccelerate、Blockwall、Side Door Ventures、Metamatic、GS Futures、AP Capital の参加により、580 万米ドルの資金調達が完了したと発表しました。 Validation Cloud は、ユーザーにプレッジ、ノード API、およびデータ サービスを提供する独自のシステム アーキテクチャを構築し、高速でスケーラブルでインテリジェントなプラットフォームを通じて企業および機関ユーザーを Web3 に接続することを目指しています。

オーストラリアのブロックチェーンファッションテクノロジー企業BlockTexxがシリーズBで約457万米ドルの資金調達を完了

2月28日、オーストラリアのブロックチェーンファッションテクノロジー企業BlockTexxは、世界的なオルタナティブ投資管理会社Artesian Investmentsの参加を得て、700万豪ドル(約457万米ドル)のシリーズB資金調達の完了を発表した。 BlockTexx は、繊維メーカー、小売ブランド、物流プロバイダーを結び付けるブロックチェーン マーケットプレイスを構築し、混合繊維資源のリサイクルをサポートします。

分散型レピュテーションプロトコル開発チームである Karma 3 Labs は、SevenX Ventures の参加により 450 万ドルの資金調達を完了しました

3 月 1 日、分散型レピュテーション プロトコル OpenRank 開発チーム Karma 3 Labs は、Galaxy と IDEO CoLab Ventures が主導し、Spartan、SevenX Ventures、HashKey、Flybridge、Delta Fund、Draper Dragon、および Draper Dragon が参加して、450 万米ドルの資金調達が完了したと発表しました。コンパキャピタルのキャスト。 OpenRank は、主に評価と推奨を通じて Web3 に対するユーザーの信頼を高めることに取り組んでおり、新たな資金はその製品の採用を促進し、開発者が使用するプロトコルの初期バージョンの立ち上げを支援するために使用されます。

Silence Laboratories が Pi Ventures と Kira Studio 主導で 410 万ドルを調達

2月29日、暗号化セキュリティ会社Silence Laboratoriesは、Pi VenturesとKira Studioが共同で投資を主導し、410万米ドルの資金調達が完了したと発表した。 Silence Laboratories は総額 600 万米ドルの資金を調達しており、この資金調達ラウンドをチームの拡大と研究開発パイプラインの強化に利用する予定です。

ブロックチェーンデータ分析会社 Octav が 400 万米ドルの戦略的資金調達を完了

2月29日、公式ニュースによると、ブロックチェーンデータ分析会社Octavは、暗号化分野の富裕層主導による400万米ドルの戦略的投資の完了を発表したが、具体的な投資家の情報はまだ明らかにされていない。明らかにした。現在、Octav は主に機械学習テクノロジーを使用してオンチェーン データの可能性を解き放ち、データの注釈と分類の精度を向上させることに重点を置いています。

ブロックチェーンゲームインフラ企業READYggがDelphi Digitalなどの参加で400万米ドルの資金調達を完了

2月28日、ブロックチェーンゲームインフラ会社READYggは、Delphi Digital、NeoTokyo、Merit Circle、Momentum 6、Purechain Capital、Alex Becker、Token Metrics Venturesの参加を得て、400万米ドルの資金調達を完了したが、評価額は明らかにされていない。

新しい資金は、世界中のより多くの地域をカバーするためにスタートアップの事業開発の取り組みを拡大し、暗号ゲーム経済の発展を支援するためにより多くのエンジニアを紹介し、「プレイヤー中心のコミュニティ」の立ち上げを支援するために使用されると報告されています。

DePIN プロジェクト Geodnet が North Island Ventures 主導で 350 万米ドルの資金調達を完了

2月26日、DePINプロジェクトGeodnetは、Modular Capital、Road Capital、Tangent、Reverie、既存投資家のBorderlessとIoTeXの参加を得て、North Island Ventures主導で350万米ドルの資金調達を完了した。

Geodnet はコミュニティベースの DePIN プロジェクトであり、Satellite Miner をインストールして操作することで誰でもネットワークに貢献できます。

AIブロックチェーンプラットフォームTalus NetworkがPolychain Capital主導で300万米ドルの第1ラウンド資金調達を完了

2月26日、AIブロックチェーンプラットフォームTalus Networkは、Polychain Capital、dao 5、Hash 3、TRGC、WAGMI Ventures、Inception Capitalのほか、以下の投資家が主導する300万米ドルの第1ラウンド資金調達の完了を発表した。 Nvidia、IBM、Blue 7、Capital や Render Network などの主要テクノロジーおよびブロックチェーン企業からの Symbolic Angel 投資家が参加しました。

RIFT財団はシチズン・キャピタルなどの参加により300万米ドルの戦略的資金調達を完了

3 月 2 日、RIFT 財団は、Web3 や Alex Becker、FaZe Banks、ElliotTrades などのゲーム コンテンツ クリエーターのほか、Citizen Capital、SwissBorg、 XBorg、MH Ventures。新たな資金は、Immutable と Raid をベースにしたマルチプレイヤー アクション ロールプレイング ゲームである ChronoForge ゲーム エコシステムのサポートに使用されると報告されており、最近 MON プロトコルとの協力関係に達しました。

スイのエコロジー融資プロトコルScallopがTHE CMSと6MVの共同主導で300万米ドルを調達

3月3日、Suiエコロジー融資プロトコルScallopは、THE CMSと6 MV、KuCoin Labs、7 UpDAO、Side Door Ventures、Oak Grove Ventures、Signum Capital、Blockchain Founders Fundが共同主導し、300万米ドルの戦略的資金調達の完了を発表した。 、Cypher Capital Group、Mysten Labs、Kyros Venturesなどが投資に参加した。

zk-NativeプロトコルQEDがArrington Capital主導で300万米ドルの資金調達を完了

3月27日、zk-NativeブロックチェーンプロトコルQEDは、Arrington Capitalが主導し、Starkware、Draper Dragon、Blockchain Builders Fund、Lbk Labsなどの多くの有名なベンチャーキャピタル企業の参加により、300万米ドルの資金調達が完了したと発表した。この資金調達は、QED がビットコインエコシステムにおけるイノベーションを促進し、より革新的なソリューションを提供するのに役立ちます。

Web3開発ツールBuildBear LabsがTribe Capitalなどが主導し190万米ドルの資金調達を完了

シンガポールに本拠を置くWeb3開発ツールBuildBear Labsは3月1日、190万米ドルの資金調達が完了したと発表した。 Superscrypt、Tribe Capital、1kx が投資を主導し、Iterative、Plug-N-Play、および Typechain と DethCrypto の創設者である Kris Kaczor 氏と Ken Fromm 氏を含むエンジェル投資家が参加しました。 BuildBear Labs は、この資金を、安全な分散アプリケーションを作成するためのテストおよび検証ソリューションを開発者に提供する主力プラットフォームの開発を加速するために使用する予定です。

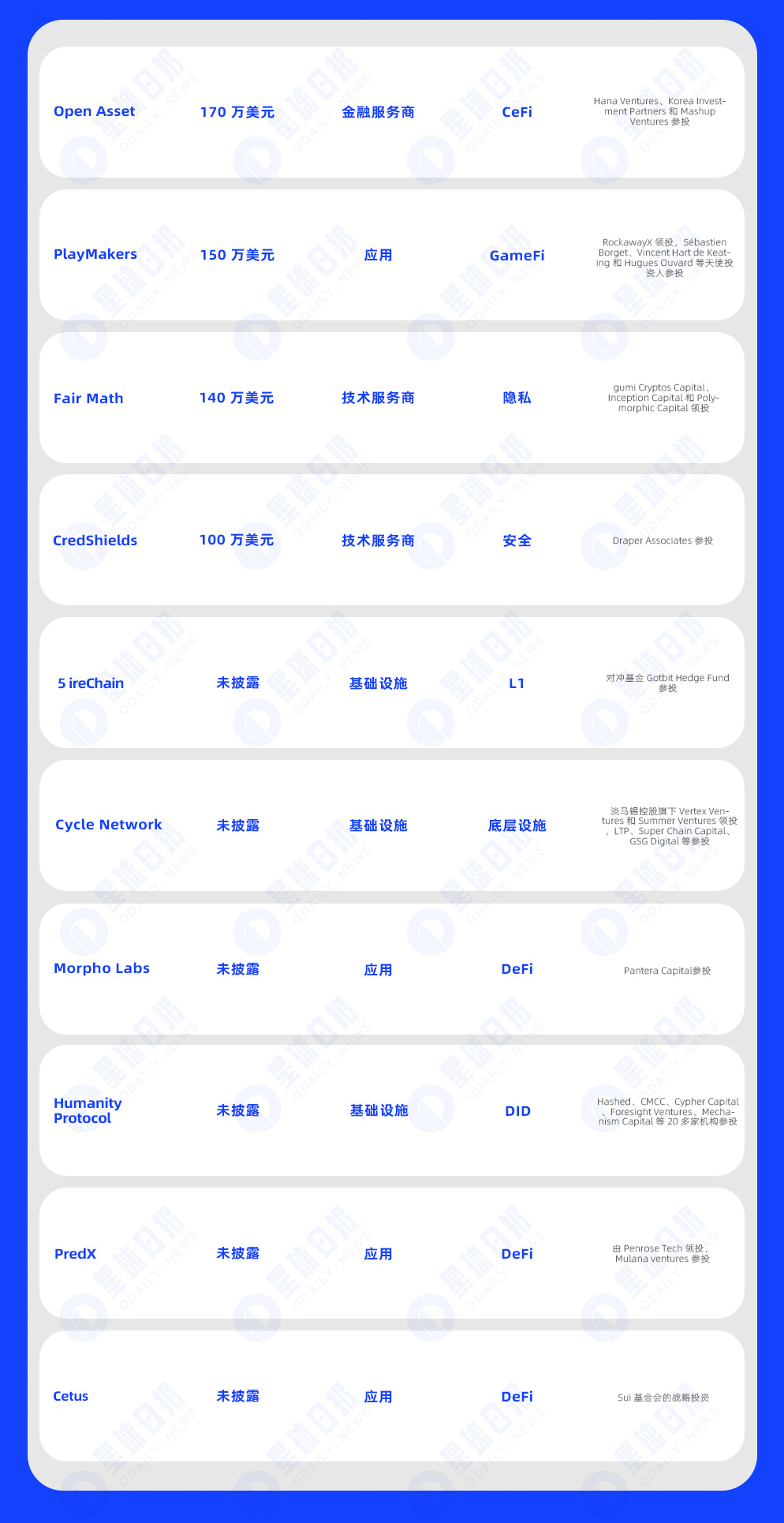

トークン資産フィンテック企業Open Assetは、hana Venturesなどの参加を得てシードラウンドで約170万米ドルの資金調達を完了した

3月2日、トークン資産金融テクノロジー企業であるOpen Assetは、hana Ventures、Korea Investment Partners、Mashup Venturesの参加を得て、約170万米ドルの資金調達のシードラウンドが完了したと発表した。オープンアセットは今回の資金調達を利用して、事業開発、営業、サービス企画、フロントエンド開発などの分野で優秀な人材を採用する予定だ。

オープンアセットは、金融機関がブロックチェーンを簡単かつ効果的に導入し、トークン資産を取引できるようにするソリューションを推進していると報告されています。

PlayMakers、RockawayX主導によるPre-Seedラウンドで150万米ドルの資金調達を完了

2 月 27 日、Web3 ゲームのユーザー生成コンテンツのスタートアップ PlayMakers は、RockawayX が主導し、Sébastien Borget、Vincent Hart de Keating、Hugues Ouvard などのエンジェル投資家が参加した 150 万ドルのプレシード ラウンドの完了を発表しました。

暗号化プライバシー保護技術開発者のFair MathがPolymorphic Capitalなどが主導し140万米ドルを調達

3月3日、完全準同型暗号化プライバシー保護技術の開発者であるFair Mathは、guim Cryptos Capital、Inception Capital、Polymorphic Capitalが主導する140万ドルのプレシードラウンドの資金調達が完了したと発表した。

Web3 セキュリティのスタートアップ CredShields が、Draper Associates の参加により 100 万ドルの戦略的資金調達ラウンドを完了

3月2日、Web3セキュリティスタートアップのCredShieldsは、Draper Associatesも参加し、100万米ドルの戦略的資金調達ラウンドの完了を発表した 現在、同社は主にWeb3セキュリティサービスを提供しており、デジタル資産の保護とブロックチェーンベースの完全性を保証するソリューションを提供している新しい資金は、自動化および簡素化されたスマート コントラクト監査ツールである SolidityScan の開発を加速するために使用されます。

レイヤー1ブロックチェーン5 ireChainが「100万ドル」の資金調達を完了、Gotbitヘッジファンドが投資に参加

2月26日、レイヤー1ブロックチェーン5のireChainがヘッジファンドのゴットビット・ヘッジファンドの参加のもと「100万ドル」の資金調達を完了したが、具体的な金額はまだ明らかにされていない。この投資は、開発者を誘致し、5ireChainチェーン上の分散型アプリケーションのアプリケーションを促進することを目的としており、マルチチェーンプロジェクト、EVM互換性、RWAなどの分野のプロジェクトに焦点を当てています。5ireChainはこの新しい資金を次の目的に使用する予定であると報告されています。エコシステムの革新を加速します。

フルチェーン台帳プロトコル Cycle Network が Vertex Ventures 主導で「数百万ドル」の第 1 ラウンドの資金調達を完了

2月27日、トラストレスフルチェーン台帳プロトコルのサイクルネットワークは、「数百万ドル」の第1ラウンドの資金調達を完了したと発表したが、具体的な金額はまだ明らかにされていない。投資には、LTP、Super Chain Capital、GSG Digitalなどが参加した。 Cycle Network は、ブロックチェーン分野の相互運用性問題の解決策を開始し、革新的な完全分散型台帳技術 (ODLT) を通じて、インタラクティブな情報のトラストレスな方法をブロックチェーンに導入し、ブロックチェーン ネットワークの問題と断片化の問題を解決します。

Pantera Capitalが、a16zが支援するDeFi融資プロトコルであるMorpho Labsへの投資を発表

2月28日、仮想通貨投資機関のPantera Capitalは、Xプラットフォーム上のDeFiレンディングプロトコルMorpho Labsへの投資を発表したが、具体的な金額はまだ明らかにされていない。

2022年、モルフォは、Nascent、Semantic Ventures、Cherry Crypto、Mechanism Capital、Standard Crypto、Coinbase Venturesの参加を得て、a16zとVariantが主導するネイティブトークン販売を通じて1,800万ドルの資金調達を完了した。

Humanity Protocolが戦略的資金調達を完了、Hashedらが投資に参加

2月28日の公式ニュースによると、Humanity Protocolは戦略的資金調達の完了を発表し、Hashed、CMCC、Cypher Capital、Foresight Ventures、Mechanism Capitalを含む20以上の機関が投資に参加したが、具体的な金額は明らかにされていない。

この資金調達ラウンドの資金は、Humanity Protocol の開発と展開を加速し、そのスケーラビリティ、効率性、ユーザー アクセシビリティを向上させ、今後のテストネットの立ち上げに備えるために使用されます。

PredX、Penrose Tech主導、Malana Venturesの参加によるプレシードラウンドの資金調達完了を発表

今年2月29日、PredXは、Penrose Techが主導し、Mulana Venturesが参加したプレシードラウンドの資金調達が完了したと発表した。 PredX は現在、評価額 2,000 万米ドルのシードラウンドで資金調達を行っています。資金調達は、AI をトレーニングして予測市場に適応し、グローバル コミュニティを構築するために使用されます。

Sui と Aptos をベースとした DEX である Cetus は、Sui Foundation から戦略的投資を受けました

2月29日、SuiとAptosに基づくDEXおよび流動性プロトコルであるCetusは、Xプラットフォーム上でSui財団から戦略的投資を受けたと発表したが、具体的な金額は明らかにされていない。

昨年5月、CetusはOKX VenturesとKuCoin Venturesが主導し、Comma 3 Ventures、NGC Ventures、Jump Crypto、Animoca Ventures、IDG Capital、Leland Ventures、AC Capital、Adaverseが参加したシードラウンドの資金調達の完了を発表した。 、コイン98ベンチャーズなど。

Web3トラフィックアグリゲーションマーケティングプラットフォームLinkToがシードラウンド資金調達を完了、Adaverseなどが投資に参加

2 月 29 日、Web3 トラフィック アグリゲーション マーケティング プラットフォームである LinkTo は、Adaverse、Ruby Capital、Warrior Wealth Fund、BitValue Capital、Block Infinity Limited を含む投資機関からの資金調達のシードラウンドが完了したと発表しました。

シンガポールに本拠を置く Web3 エンターテイメント会社 Imaginary Ones が、Animoca Brands などの参加を得て新たな資金調達ラウンドを完了

2月29日、シンガポールに本拠を置くWeb3エンターテインメント会社Imaginary Onesは、Cypher Capital、Animoca Brands、ED 3 N Ventures、MH Venturesの参加を得て新たな資金調達ラウンドの完了を発表したが、具体的な資金調達ファンドはまだ公表されていない。以前のニュースによると、iQiyiの副社長Kuek Yu-Chuang氏がImaginary Onesの新たな投資家兼アドバイザーに就任し、Imaginary Onesは2023年に国際ファッションブランドのHUGO BOSSと協力して仮想宇宙体験を生み出す予定だという。

Ring Protocolは、Continue Capitalなどが参加したプレシードラウンドの資金調達の完了を発表した。

3月1日、BlastエコロジカルDeFiプロジェクトRing Protocolは、Manifold Trading、Continue Capital、Synergiscap、m 0x Capital、C L2 07、DefiSquared、Bored Chiliを含む投資家によるプレシードラウンドの資金調達の完了を発表した。

OKX Ventures、イーサリアム第2層ネットワークTaikoへの追加投資を発表

公式ニュースによると、3月3日、OKX Venturesは第2層イーサリアムネットワークであるTaikoへの追加投資を発表した。 Taiko は、分散型の Type-1 ZK-EVM です。 2022 年以来、Taiko は 6 つのテストネットの実行に成功し、1,100,000 を超える固有のウォレット、30,000 を超える提案者、14,000 を超える検証者を擁し、100 を超えるライブ アプリケーションをサポートしています。