加密市场情绪研究报告(2024.02.16-02.23):探寻WLD与JASMY背后推动币价飙升的力量

通貨価格の高騰を引き起こすWLDとJASMYの背後にある力を探る

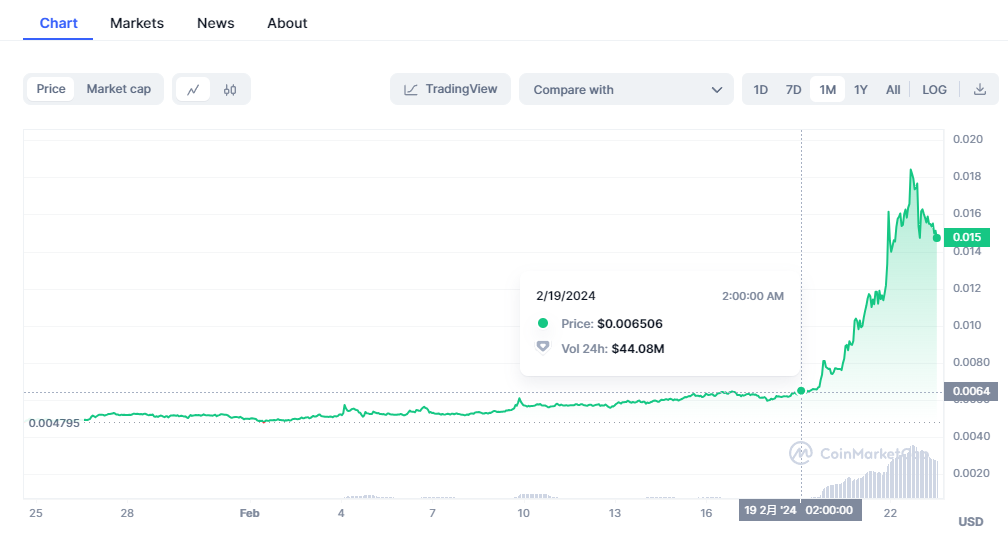

過去1ヶ月のWLD価格推移

WLDは2.15の3米ドルから始まり、2.22には最高9米ドルに達しました。

OpenAI は 2 月 15 日に新しい人工知能モデル SORA をリリースしました。これは、ユーザーの入力テキストに基づいて驚くべき品質の短いビデオを生成し、AI 分野の急成長を促しました。

NVIDIAは水曜日の市場終了後に2024会計年度第4四半期を発表したが、2.21日水曜日の市場開始前に大量の利益確定売りが入り、株価は市場開始前に-2.85%下落した。財務レポートの収益は予想を上回り、第4四半期の収益は221億米ドル(純利益122億米ドル)に達し、前四半期比22%増、前年比265%増、164億米ドル増加しました。 2.22では%。

まとめると、AI とハイパフォーマンス コンピューティングが将来の最高のストーリーになっていますが、注目すべき主な点は、Worldcoin と Sora は実際にはまったく異なる 2 つのプロジェクトであるということであり、現時点では OpenAI と Worldcoin は関連プロジェクトを正式に発表していません。技術協力。

過去1ヶ月のJASMY価格推移

ジャスミー(日本のビットコイン)は、主に日本政府のブロックチェーンの積極的な支援と開発の恩恵を受けて、2.19の0.0065から2.22の最大0.018まで急騰しました。日本が導入した法律や規制は、適法かつ準拠したブロックチェーン投資を許可しており、米国、日本、香港などの先進金融地域が暗号資産の投資と開発をサポートしていることを証明しています。また、日本のマクロ環境もジャスミーの台頭に寄与し、円安が進み日経平均株価がバブル以来の高値を更新したこともあり、ジャスミーを追って大量の資金が集まった。 」。

以上は事象と環境の分析ですが、現在の市場過熱によるFOMOセンチメントに直面し、市場投資家はリスク管理と慎重な判断を適切に行う必要があります。

ビットコインの半減期は今日から約 61 日後です (2024.02.23)

半減期へのカウントダウン:https://www.nicehash.com/countdown/btc-halving-2024-05-10-12-00?_360safeparam=1289146171

市場の技術的および感情的環境分析

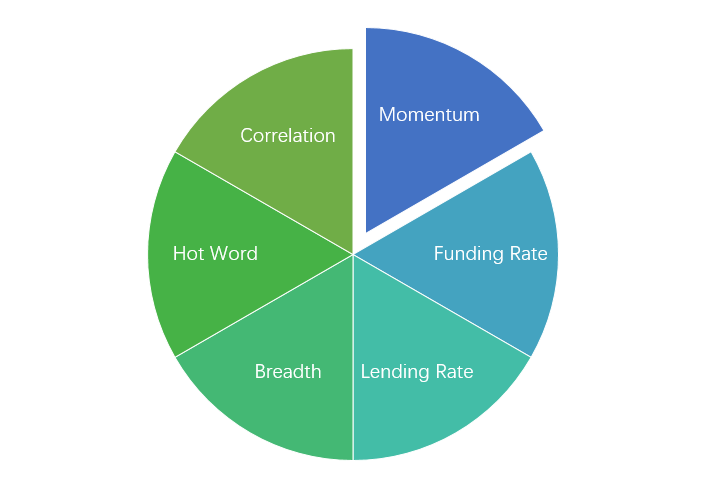

感情分析コンポーネント

テクニカル指標

価格推移

過去 1 週間で BTC 価格は -1.14% 下落しましたが、ETH 価格は 5.27% 上昇しました。

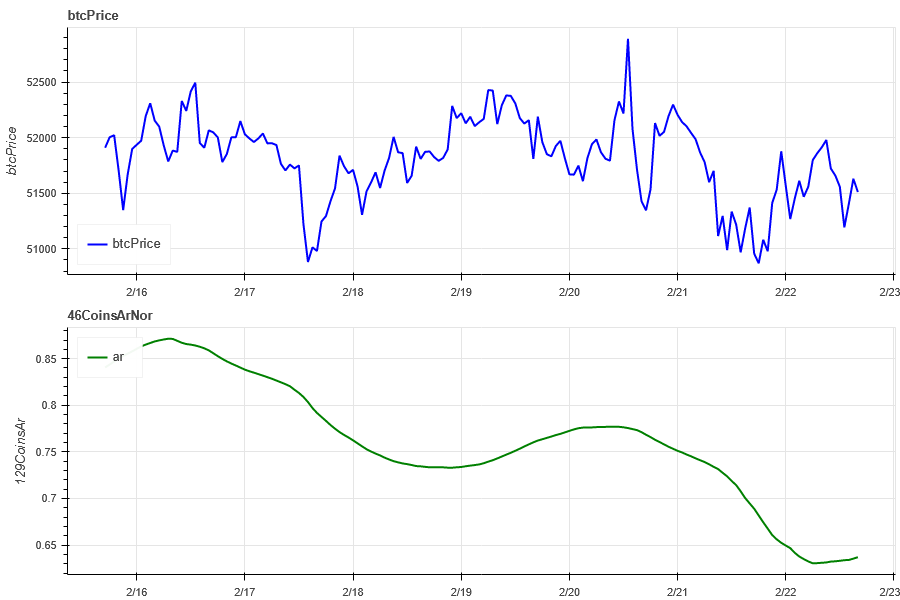

上の写真は過去1週間のBTCの価格チャートです

上の写真は過去1週間のETHの価格チャートです

過去 1 週間の価格変動率を示す表

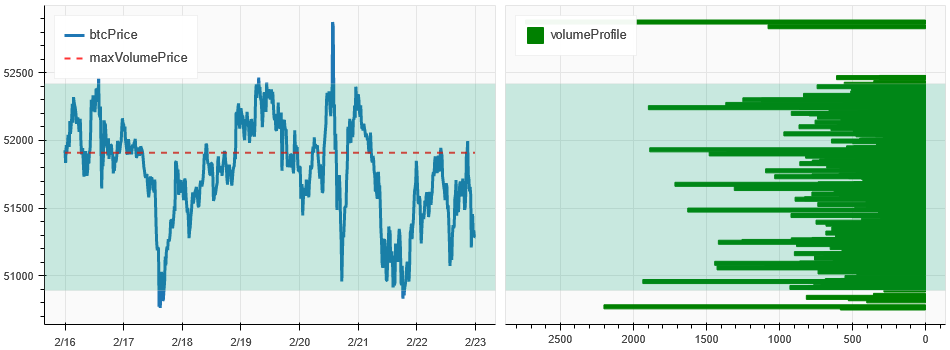

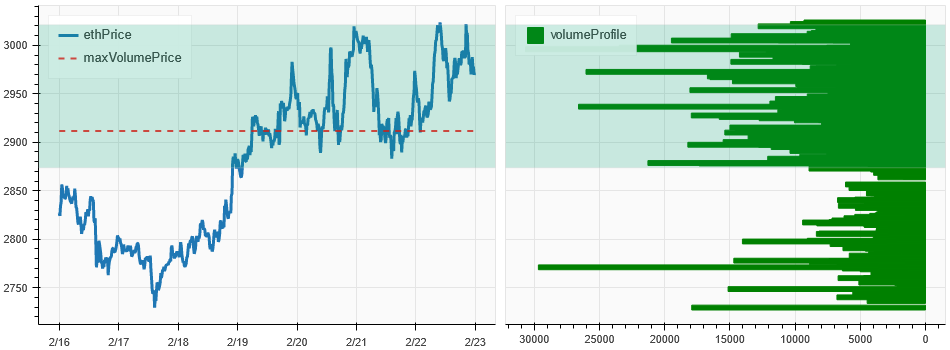

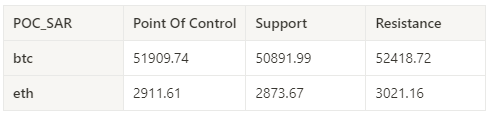

価格と出来高の分布図(サポートとレジスタンス)

過去1週間、BTCの価格は集中取引領域内で変動し、ETHの価格が上昇した後、高集中取引領域を形成しました。

上の写真は、過去 1 週間の BTC の集中取引地域の分布図です。

上の写真は、過去 1 週間の ETH の集中取引地域の分布図です。

過去 1 週間の BTC と ETH の集中的な週間取引範囲を示す表

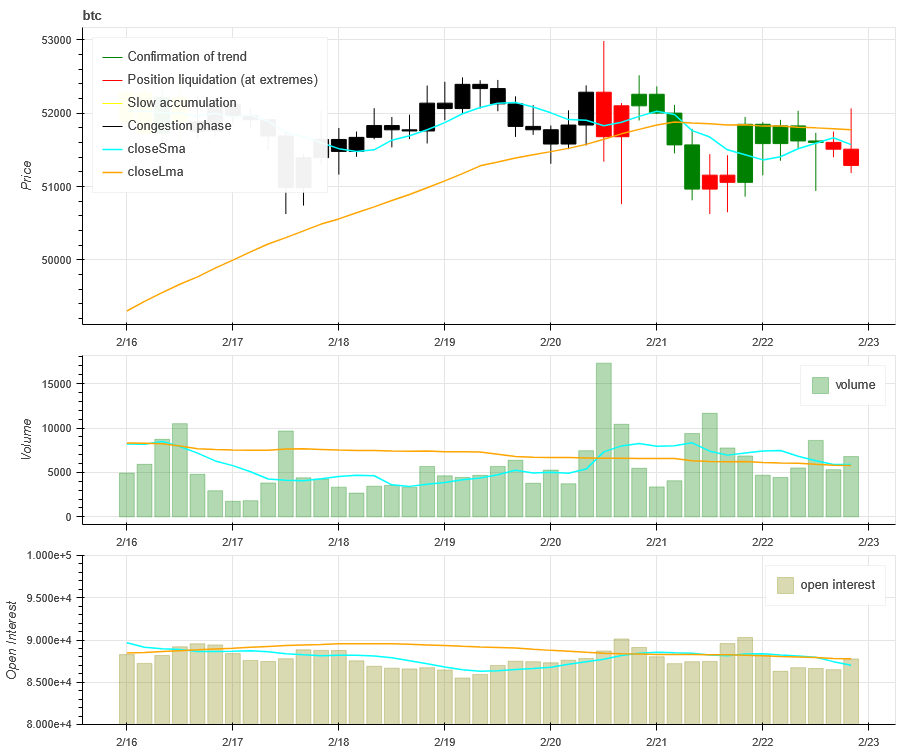

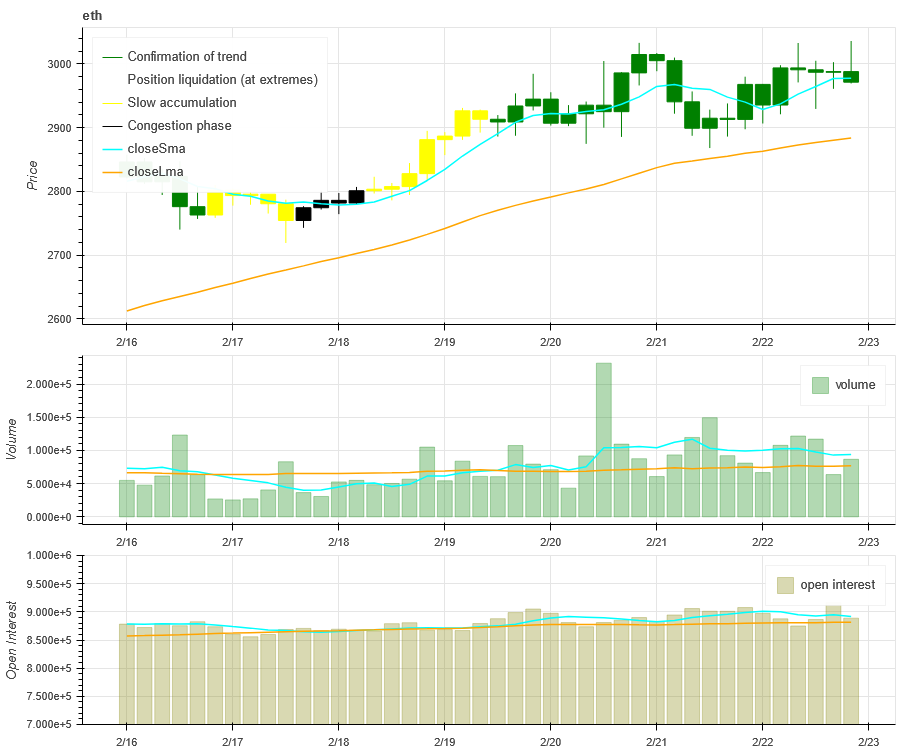

出来高と建玉

過去 1 週間の BTC と ETH の取引高は、2.20 の新高値を突破した後の反動期間中に最大となり、BTC と ETH の建玉はあまり変化しませんでした。

上の画像の上部がBTCの価格推移、中央が出来高、下が建玉、水色が1日平均、オレンジが7日平均です。 Kラインの色は現状を表しており、緑は出来高に支えられて価格上昇、赤はポジションがクローズ中、黄色はポジションが徐々に蓄積中、黒は混雑を表しています。

上の写真の上部がETHの価格推移、真ん中が出来高、下が建玉、水色が1日平均、オレンジが7日平均です。 Kラインの色は現状を表しており、緑は出来高に支えられて価格上昇、赤はポジションがクローズ中、黄色はポジションが徐々に蓄積中、黒は混雑を表しています。

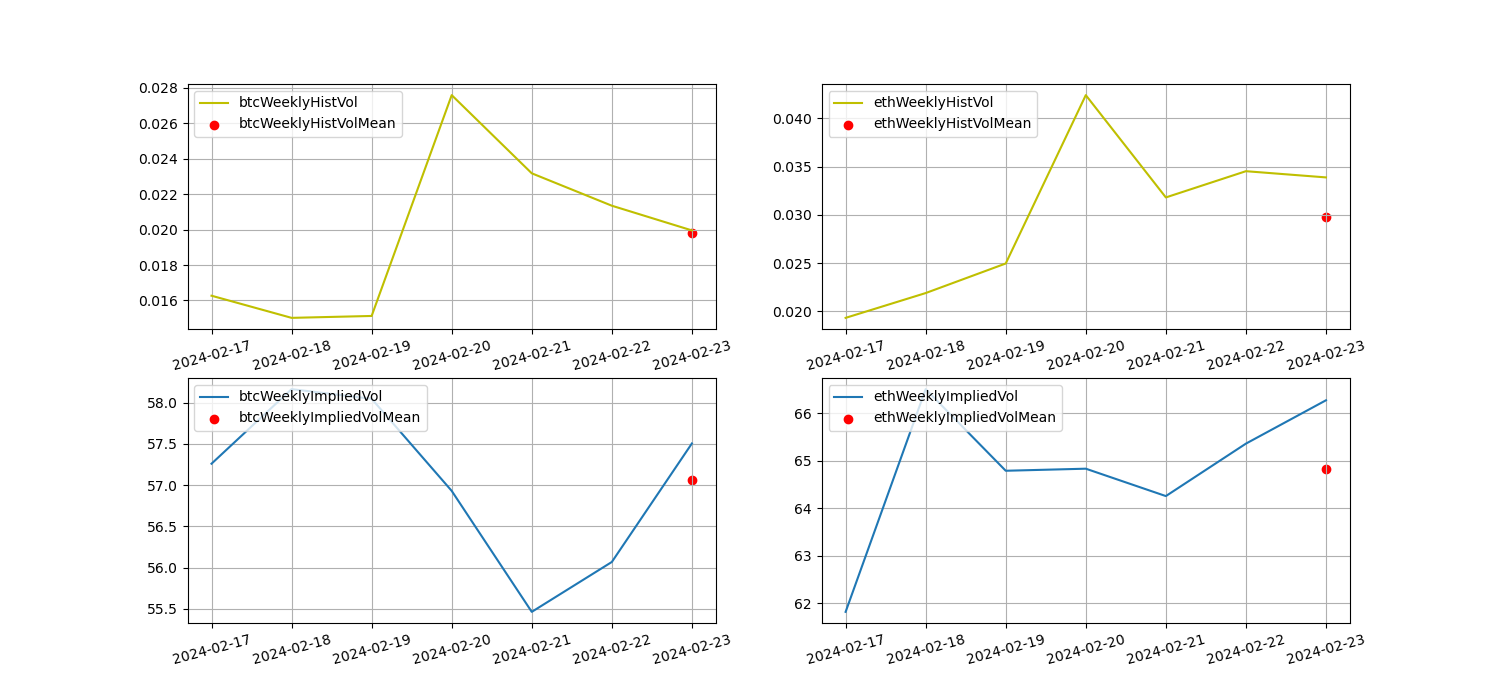

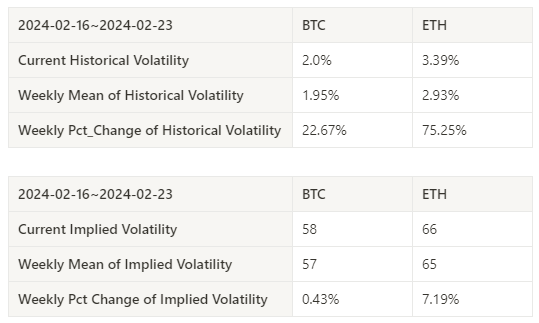

ヒストリカルボラティリティとインプライドボラティリティ

過去 1 週間の BTC と ETH の歴史的なボラティリティは、2024.02.20 に最大でした。BTC のインプライド ボラティリティはあまり変化せず、ETH は上昇し続けました。

黄色の線はヒストリカル ボラティリティ、青色の線はインプライド ボラティリティ、赤色の点は 7 日間の平均です。

イベント駆動型

今週のイベントデータはありません。

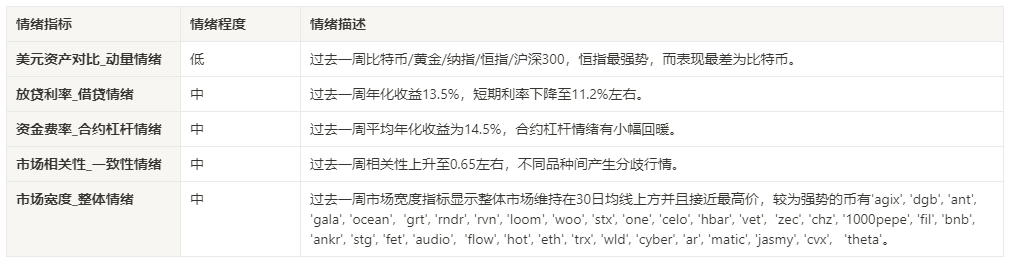

感情指標

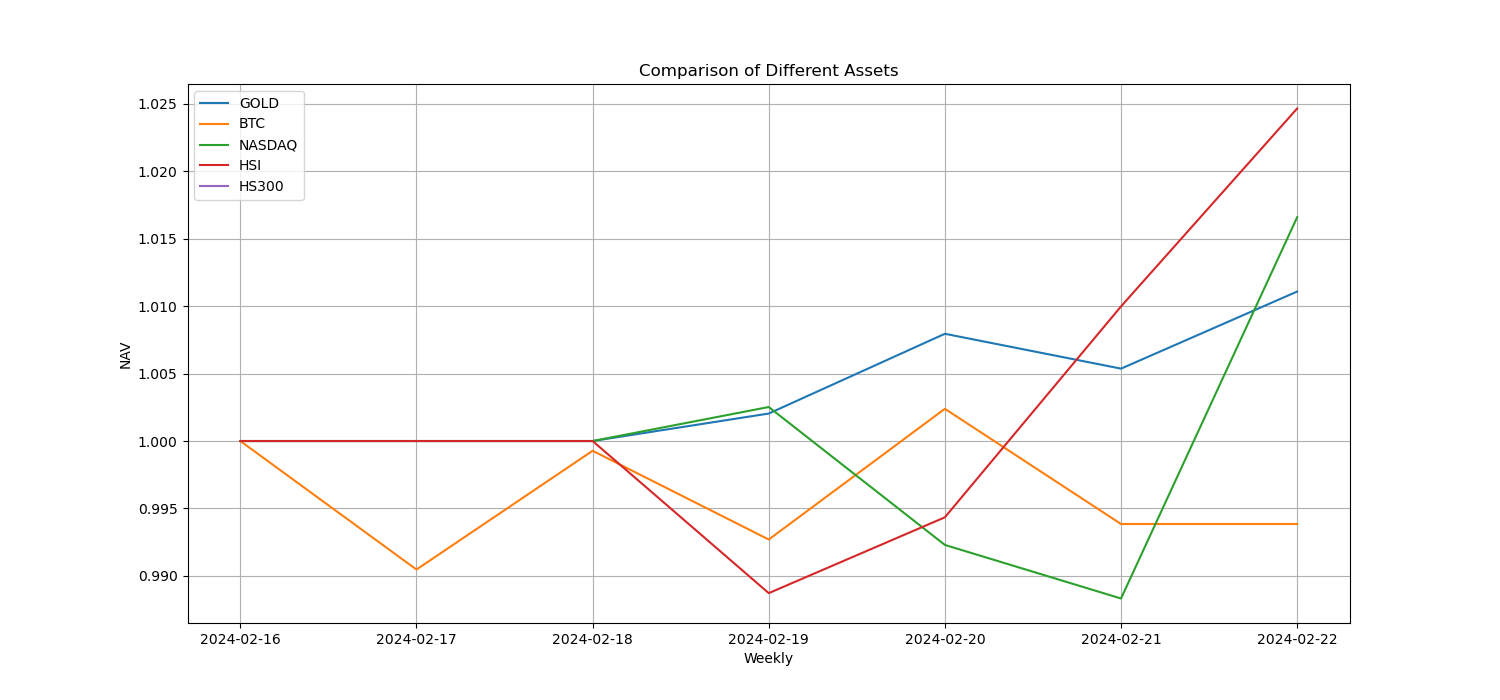

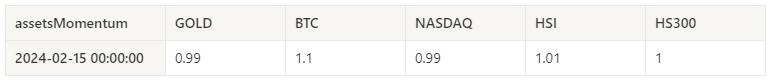

勢いセンチメント

ビットコイン/ゴールド/ナスダック/HSI/CSI 300の中で、ハンセン指数は過去1週間で最も好調でしたが、ビットコインのパフォーマンスは最も悪かったです。

上の図は、過去 1 週間のさまざまな資産の傾向を示しています。

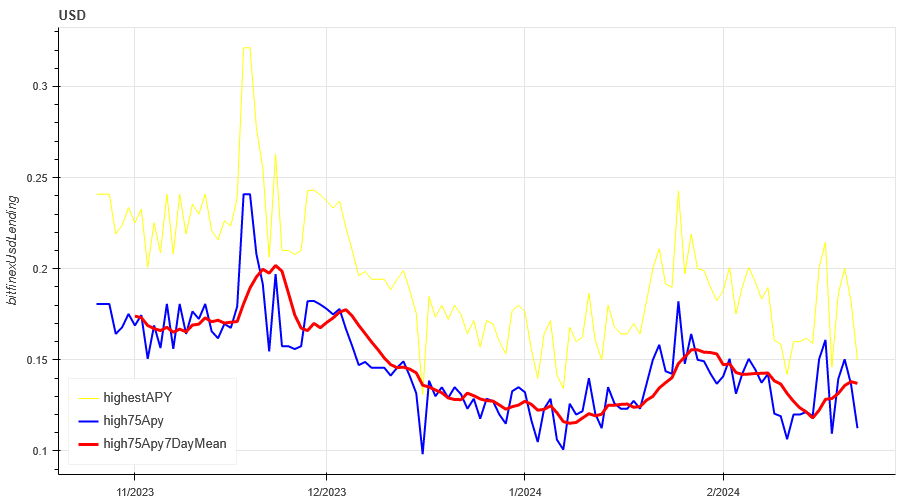

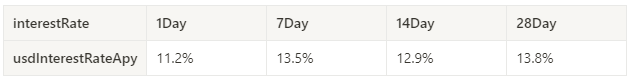

貸出金利_貸出心理

過去1週間の米ドル融資の年率平均利回りは13.5%で、短期金利は約11.2%まで低下し続けた。

黄色の線は米ドル金利の最高値、青色の線は最高値の75%、赤色の線は最高値の75%の7日間平均です。

この表は、過去のさまざまな保有日における米ドル金利の平均リターンを示しています。

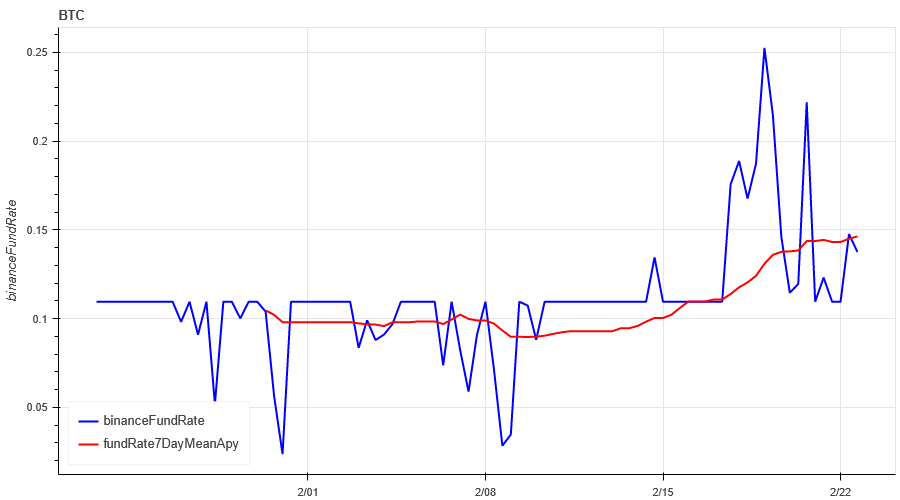

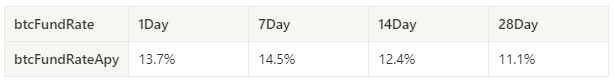

資金調達率_契約レバレッジセンチメント

過去 1 週間の BTC 関税の平均年率リターンは 14.5% であり、契約レバレッジセンチメントはわずかに回復しました。

青線はBinanceでのBTCの資金調達率、赤線は7日間の平均です。

この表は、過去のさまざまな保有日における BTC 手数料の平均リターンを示しています。

市場相関性_一貫したセンチメント

過去 1 週間で選択された 129 コインの間では、相関関係は約 0.65 に低下し、その結果、種類ごとに価格にばらつきが生じました。

上の図の青い線はまずビットコインの価格を示し、緑の線は [1000 Floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave、ada、agix、algo、ankr、ant、ape、apt、arb、ar、astr、atom、audio 、avax、axs、bal、band、bat、bch、bigtime、blur、bnb、btc、celo、cfx、 chz、ckb、comp、crv、cvx、cyber、dash、dgb、doge、dot、dydx、egld、enj 、ens、eos、etc、eth、fet、fil、flow、ftm、fxs、gala、gmt、gmx、 grt、hbar、hot、icp、icx、imx、inj、iost、iotx、jasmy、kava、klay、ksm 、「ldo」、「link」、「loom」、「lpt」、「lqty」、「lrc」、「ltc」、「luna 2」、「magic」、「mana」、「matic」、「meme」、 mina、 mkr、near、neo、ocean、one、ont、op、pendle、qnt、qtum、rndr、rose 、ルーン、rvn、サンド、セイ、sfp、skl、snx、sol、ssv、stg、storj、stx、 「sui」、「sushi」、「sxp」、「theta」、「tia」、「trx」、「t」、「uma」、「uni」、「vet」、「waves」、「wld」、「woo」 , xem , xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] 全体の相関関係

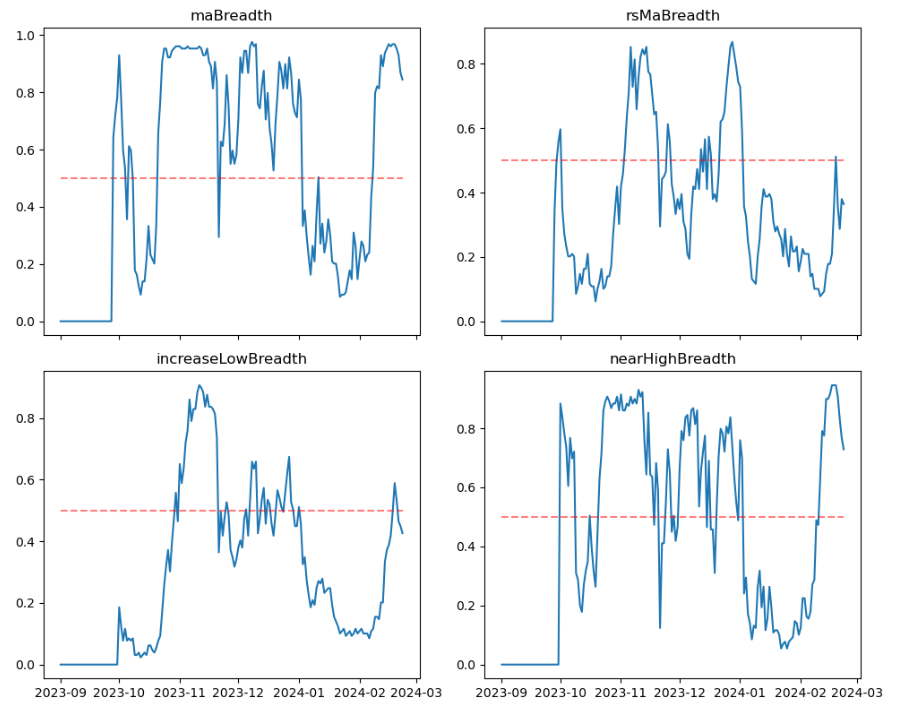

市場の広がり_全体的なセンチメント

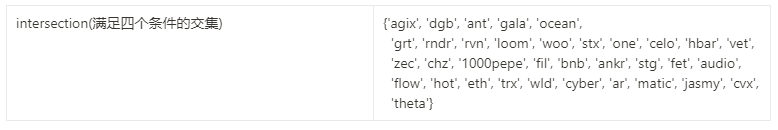

過去 1 週間で選択された 129 コインのうち、85% の価格が 30 日移動平均を上回っていました。一方、BTC 価格の 36% は 30 日移動平均を上回っており、42% の価格は最低価格から 20% を超えていました。過去 30 日間。 , 73% は過去 30 日間の最高値から 10% 未満です。過去 1 週間の市場幅指標は、市場全体が引き続き 30 日移動平均を上回り、最高値に近いことを示しています。価格。より強力なコインには、「agix」、「dgb」、「ant」、「gala」、「ocean」、「grt」、「rndr」、「rvn」、「loom」、「woo」、「stx」、 one、celo、hbar、vet、zec、chz、1000 pepe、fil、bnb、ankr、stg、fet、 audio、flow、hot、eth、trx、wld、cyber、ar、matic、jasmy、cvx、theta。

上の画像は [1000 floki、1000 lunc、1000 pepe、1000 shib、100 0x ec、1inch、aave、ada、agix、algo 、ankr、ant、ape、apt、arb、ar、astr、atom、audio、avax、axs、bal、バンド 、bat、bch、bigtime、blur、bnb、btc、celo、cfx、chz、ckb、comp、crv 、cvx、サイバー、ダッシュ、dgb、doge、dot、dydx、egld、enj、ens、eos、etc、 eth 、fet、fil、flow、ftm、fxs、gala、gmt、gmx、grt、hbar、hot、icp 、icx、imx、inj、iost、iotx、jasmy、kava、klay、ksm、ldo、link、loom、 lpt 、lqty、lrc、ltc、luna 2、magic、mana、matic、meme、mina、mkr、near、neo 、ocean、one、ont、op、pendle、qnt、qtum、rndr、rose、rune、rvn、sand、 「sei」、「sfp」、「skl」、「snx」、「sol」、「ssv」、「stg」、「storj」、「stx」、「sui」、「sushi」、「sxp」、「theta」 、tia、trx、t、uma、uni、vet、waves、wld、woo、xem、xlm、xmr、 xrp, xtz, yfi, zec, zen, zil, zrx] 30日目の各幅指標の割合

要約する

今週の相場は、BTCはレンジ内で推移、ETHは上昇後高水準で推移し、20日に価格が新高値を更新し、その後反落した際のボラティリティと取引高は過去最大となった。あまり変化なし、ETHは若干上昇、変動を示唆 BTCレートはあまり変化なし、ETHは上昇継続 主流通貨全体は高水準で堅調、調達レートは若干回復、129バイナンスの市場幅指標は、市場全体が 30 日移動平均を上回っており、高値に近いことを示しています。比較的強い通貨には、「agix」、「dgb」、「ant」、「gala」、「ocean」、「grt」があります。 、「rndr」、「rvn」、「loom」、「woo」、「stx」、「one」、「celo」、「hbar」、「vet」、「zec」、「chz」、「1000 pepe」、 fil、bnb、ankr、stg、fet、audio、flow、hot、eth、trx、wld、cyber、ar 、matic、jasmy、cvx、theta; イベントに関しては、今週リリースされたデータはなく、来月の非農業データを待っています。

Twitter: @DerivativesCN

Website: https://dcbot.ai/