LD Capital赛道周报(2023/11/13)

DeFi 借贷

Aave

Aave 社区已投票通过“将稳定币 GHO 借款利率从 3% 提高至 4.72% ”的提案,目前该提案已进入排队等待激活队列。GHO 借款上限为 3500 万美金,目前已借用 3489 万美金,资金利用率达到 99.7% ,接近上限。

Aave 巨鲸地址0x8e74自两周前开始从币安向其个人链上地址提币,截至 13 日,该地址已累积 36.4 万枚 AAVE,价值 3563 万美金,目前已成为 AAVE 最大个人持仓地址。在 11 月 2 日,该地址曾出售其拥有的 19 万枚 UNFI,价值 166 万美金。

Compound

Compound 社区将推出一个为期四个月的增长计划并将拨款 7770 枚 COMP,其中 2760 枚 COMP 将分配给计划下的 BD 基金,用于支持该增长计划的业务发展运营;另外 5010 枚 COMP 将分配给增长基金。该投票将在今日(13 日)结束并将通过。

MakerDAO

MakerDAO 因其 RWA 资产已向瑞士缴纳共计 150 万美元印花税。瑞士离岸实体的印花税是 15 个基点,MakerDAO 的 5 亿美元投资因此产生了 75 万美元的印花税,当这些资产后来被出售时,MakerDAO 再次缴纳了 75 万美元。

LSD

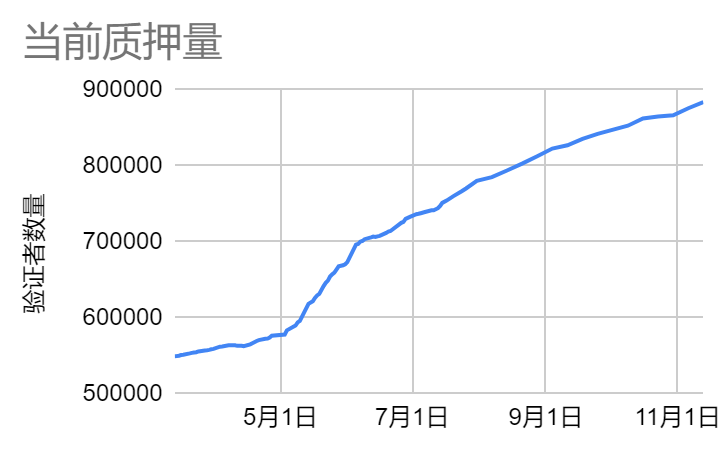

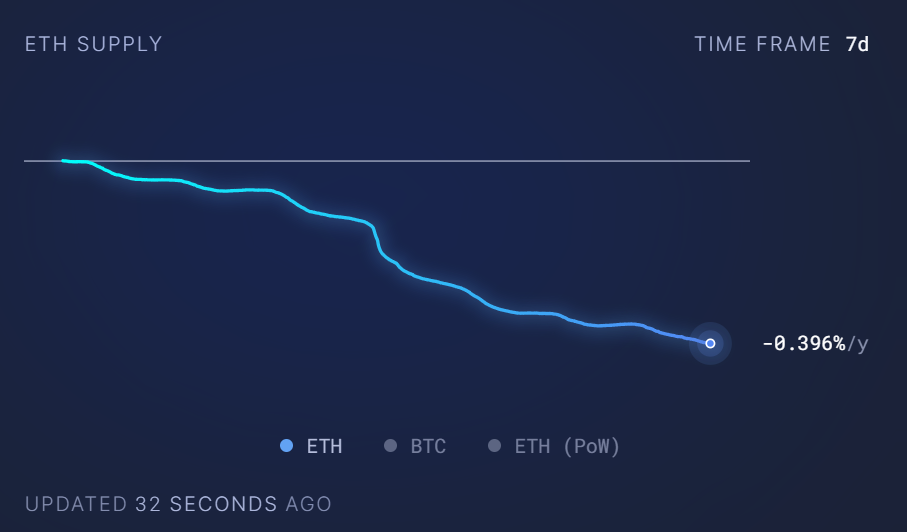

上周有 2863 万枚 ETH 锁定在信标链中,对应质押率 23.81% ,环比增长 1.1% ;其中活跃验证节点 88.18 万个,环比增长 0.72% 。本周 ETH 质押收益率增长 3.7% ;Meme 行情与链上清算使得链上成交活跃,Gas 提升,ETH 年化通胀下降至-0.4% 。

本周 ETH 质押环比增长 1.1%

本周 ETH 质押收益率上升至 3.7%

ETH 年化通胀下降至-0.4%

来源:ultrasound,LD Capital

三大 LSD 协议中,从价格表现来看,LDO 一周上涨 11.7% ,RPL 上涨 21.1% ,FXS 上涨 4.3% ;从 ETH 质押量角度来看,Lido 一周上涨 0.6% ,Rocket Pool 上涨 0.67% ,Frax 上涨 2.21% 。上周 ETH 价格上涨 8.2% ,ETH 的较大涨幅使得信标链中出现较多的解质押出售与新质押者进入,整体来看新进入质押的量大于解质押规模;目前 1340 个验证节点排队进入, 940 个验证节点排队退出。Lido 社区讨论新增社区质押模块,通过要求节点提供抵押品的形式构建无许可节点质押方案(类似 RocketPool,最终参数或许有所不同);上周 Brevan Howard Digital 停止抛售 LDO,其链上钱包剩余约 500 万枚 LDO。目前 Rocket Pool 存款池余额 19102 枚 ETH,RPL 质押率 50.9% ,有效质押比例 93.4% 。

NFTFi

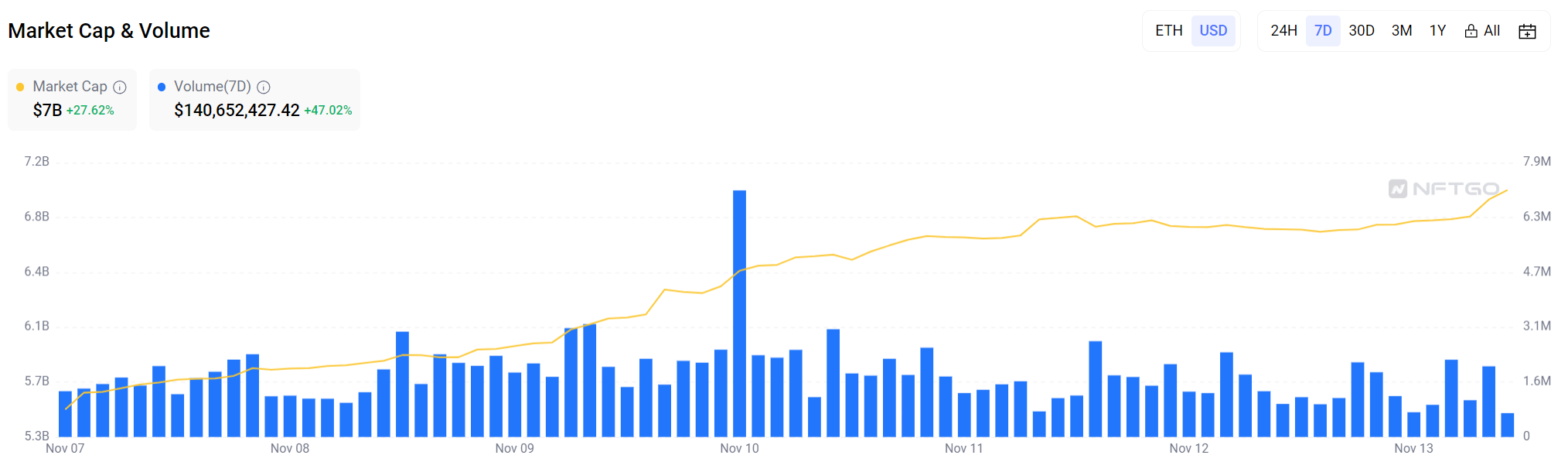

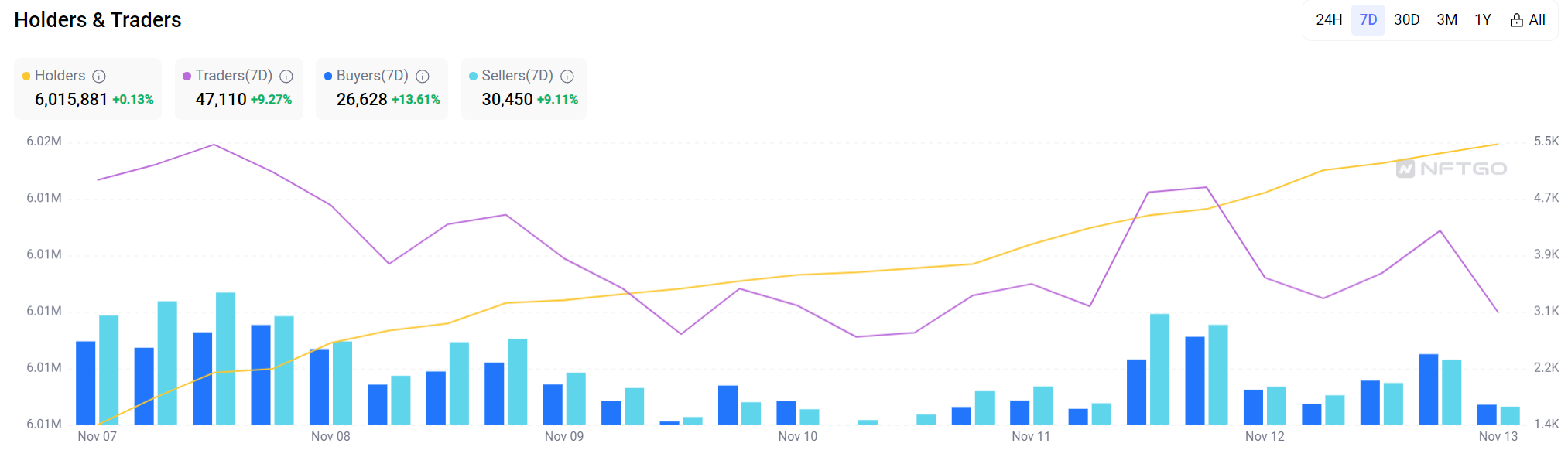

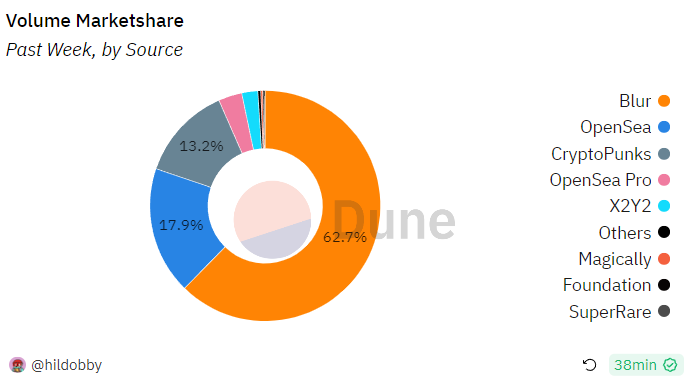

上周 NFT 全市场成交量 1.4 亿美元,环比增长 47.02% ;总市值 69.8 亿美元,环比增长 27.62% ;NFT 持有者 602 万,环比增长 0.13% ,NFT 交易者 4.7 万,环比增长 9.27% 。

来源:NFTGo,LD Capital

来源:NFTGo,LD Capital

NFT 交易平台中,Blur 上周交易量 8388 万美元,市占率 62.7% ,TV L1.19 亿美元,遥遥领先其他已发币的平台(X2Y2、LooksRare);伴随 NFT 市场回暖近期 Blur 价格大幅上涨,需关注第二季空投数量与时间,判断其对二级市场价格的影响。

来源:Dune,LD Capital

NFT 借贷市场中,BendDAO 目前 TV L1.03 亿,ETH 存款利率 5.56% ,ETH 借款利率 0.86% ,BEND 质押利率 5.71% ;Jpeg’d TV L2 596 万,Curve 中 pETH/WETH LP 收益率 24.86% 。关注蓝筹 NFT 价格的上涨对借贷平台业务与利润的带动。伴随行情的轮动,BEND 价格过去一周上涨 54% ,JPEG 价格过去一周上涨 11% ,涨幅滞后与 BEND。

以太坊L2

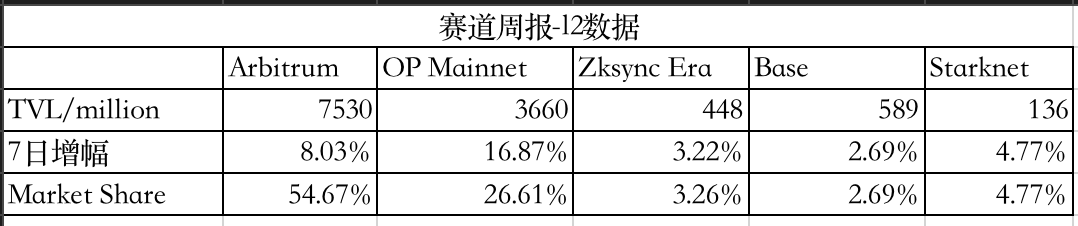

TVL

Layer 2 TVL 总量为 137.7 亿美元,近 7 日整体 TVL 上涨 10.18%

来源:L2 beat, LD Captial

Optimism

1、Optimism 生态系统第一个故障证明 Canyon 将于世界标准时间 11 月 14 日 17: 00 在超级链测试网上线

2、上线 Superchain Faucet,可为为所有 OP 链提供测试网 ETH, 简化了 Optimism Collective 构建者的开发过程。

3、合并 OP Reth,这意味着以太坊节点 Reth 现在可以在 OP Stack 中按原样使用。

Arbitrum

1、第二届#ArbitrumDay 将于 11 月 16 日 Devconnect 期间虚拟举办;

2、Centrifuge 将会将代币化的国库券和房地产等资产引入 Arbitrum。

Starknet

1、V 0.13.0 主网拟于 2024 年 1 月 22 日推出,将支持 STRK 支付交易费用,网络升级的计划日期:

- 2023 年 11 月 19 日:V 0.12.3 Goerli 测试网;

- 2023 年 12 月 11 日:V 0.12.3 主网。;

- 2023 年 12 月 5 日:V 0.13.0 Goerli 测试网。如果需要,这个日期可能会推迟一周,到 12 月 13 日;

- 2024 年 1 月 22 日:V 0.13.0 主网,等待治理投票;

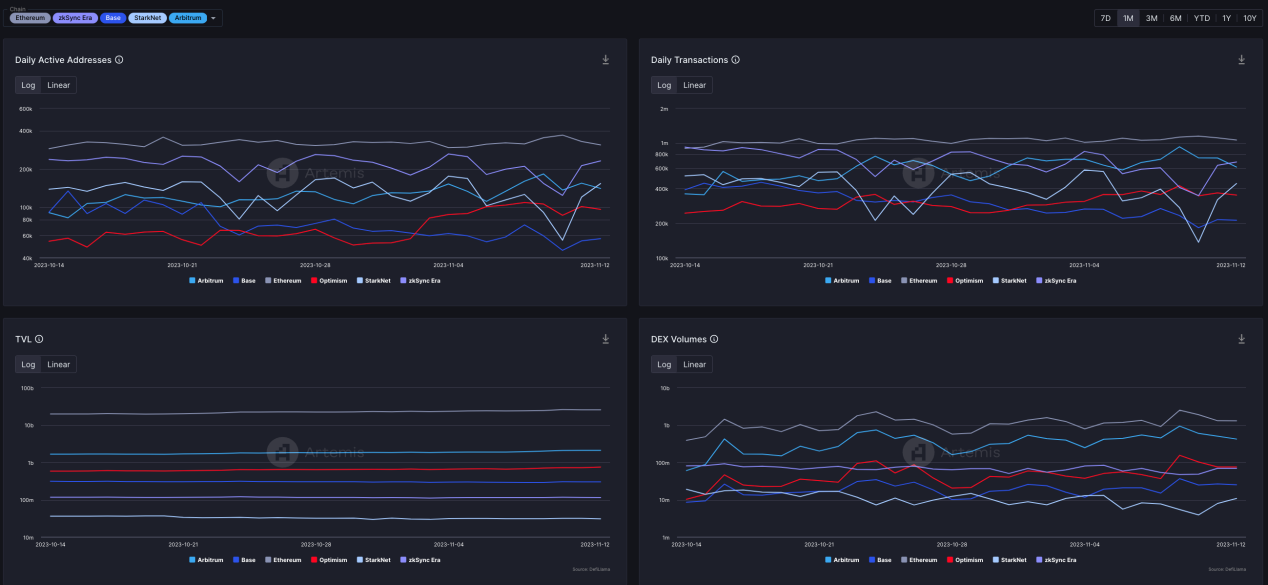

链上活跃度

来源:Artemis

AI

RNDR

1、AI 赛道龙头 RNDR 于 11 月 3 日正式宣布从以太坊网络迁移至 Solana 网络,将向通过计算客户端加入 Render Network 的新节点运营商分发高达 114 万个 RNDR。

2、提案 RNP-005 于 11 月 8 日通过最终投票:Beam 是一项按需 GPU 云服务,旨在为 AI 和 ML 项目提供 GPU。通过此提案,Beam 寻求利用 Render Network 的扩展 GPU 节点来帮助为其客户提供动力,重点是满足 AI/ML 领域较小、用户密集程度较低的项目。

FET

1、Cosmos 生态的头部 AI 项目 FET 于 10 月 5 日发布全新 ai 产品 DeltaV,DeltaV 是一种基于区块链网络新的搜索 AI 聊天界面,致力于打造一个新人工智能经济的开放平台。

2、FET 宣布赞助并参与纽约人工智能峰会,举办时间在 2023 年 12 月 6 日至 7 日。

衍生品 DEX

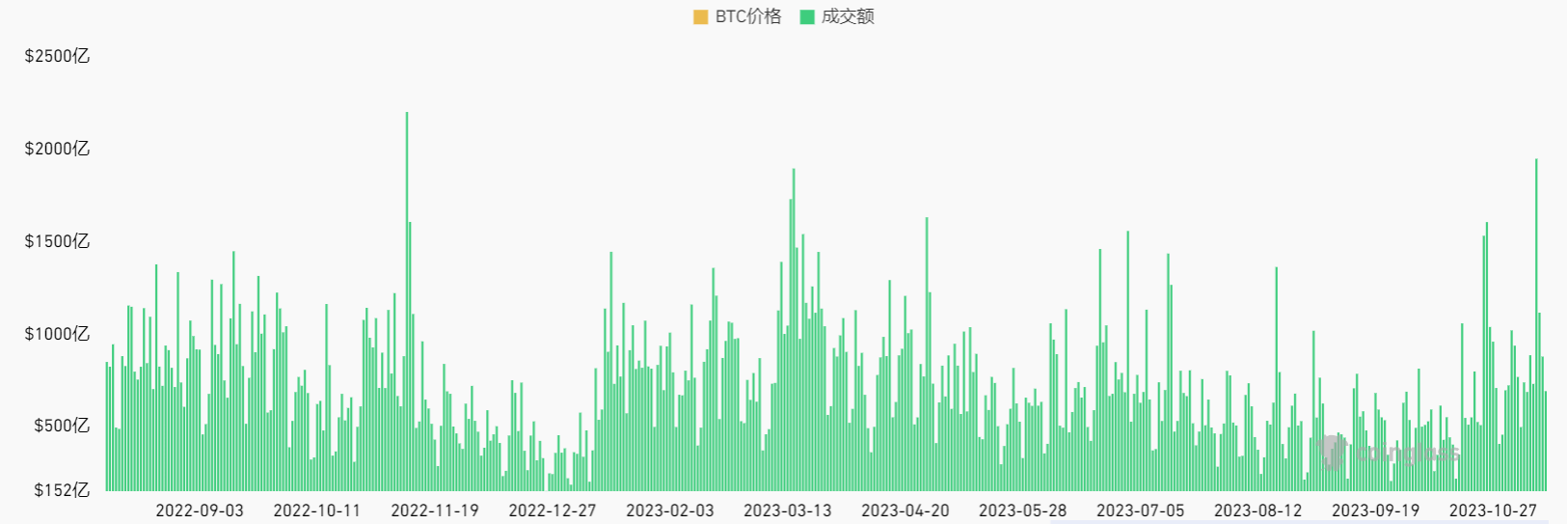

BTC 在上周突破了此前的阻力位 35500 ,插针到 38000 附近,再次创下年度新高。与此同时,合约的持仓量也快速上升,资金费率显著变高,到达年度的高点。

当前合约持仓量为 343 亿,已经高于 2023 年 2 月份的 300 亿,恢复到 2022 年 7 月至 9 月份的水平。较高的持仓显示了较为强烈的市场做多情绪。

来源:coinglass

过去一周也维持着较高的交易量。11 月 10 日,由于大盘的极速回调,交易量达到年度新高,接近 2000 亿美元。这一次剧烈的波动,也引起了 8 月 18 日以后最大一次单日爆仓,当日爆仓大约 4.5 亿美元。

来源:coinglass

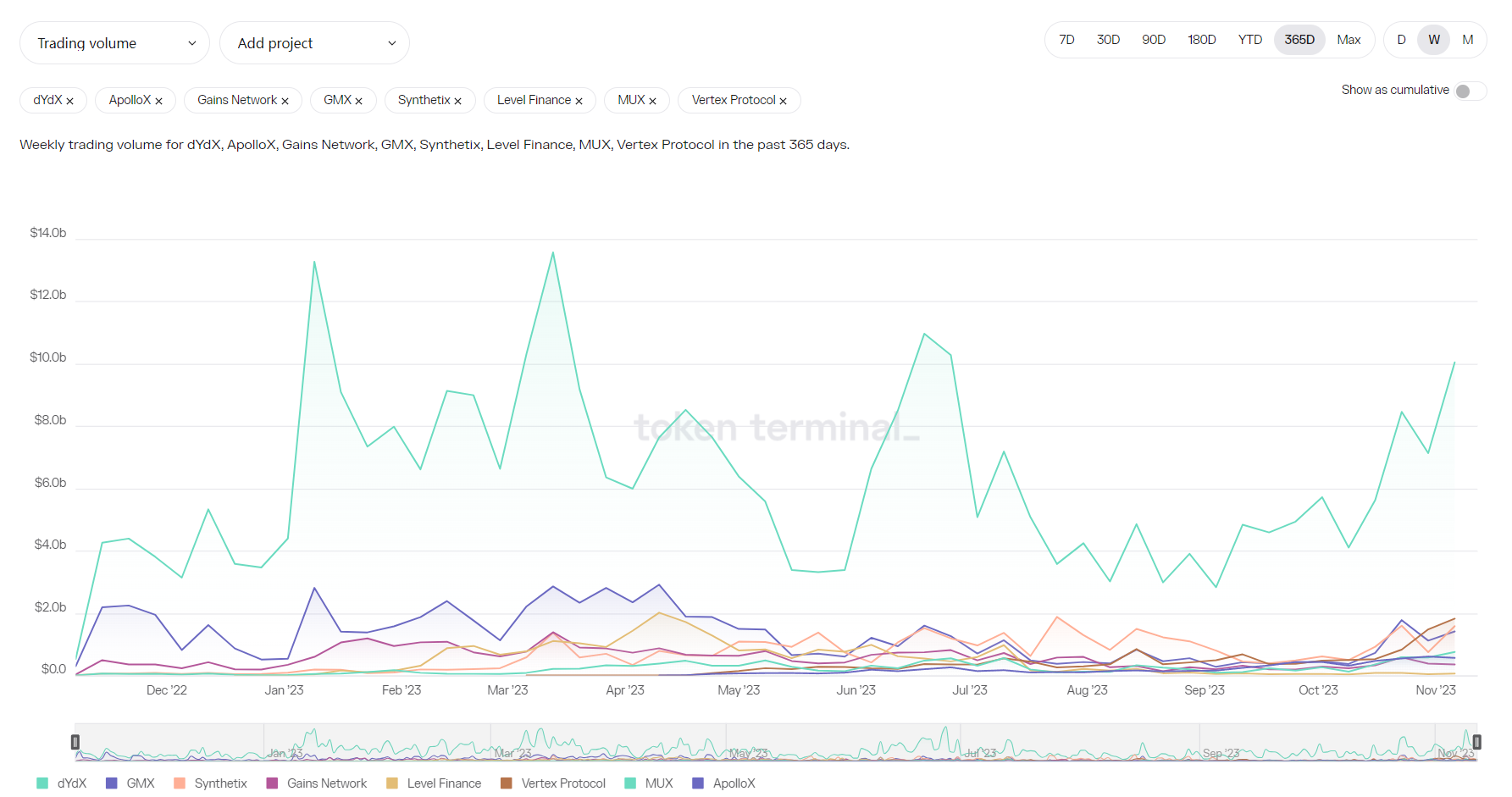

伴随市场的回暖,衍生品 DEX 的交易量得到迅速恢复。最近七日交易量已经回到了年度较高水平。DYDX 的交易量依然明显领先于其他项目,周日均交易额达到 14 亿美元左右。GMX 和 Synthetix 其次,大约在 2 亿美元左右。

从代币价格上看,DYDX 最为强势。主要原因在于其 DYDX Chain 上线,以及代币质押者将参与交易手续费的分配。

POW

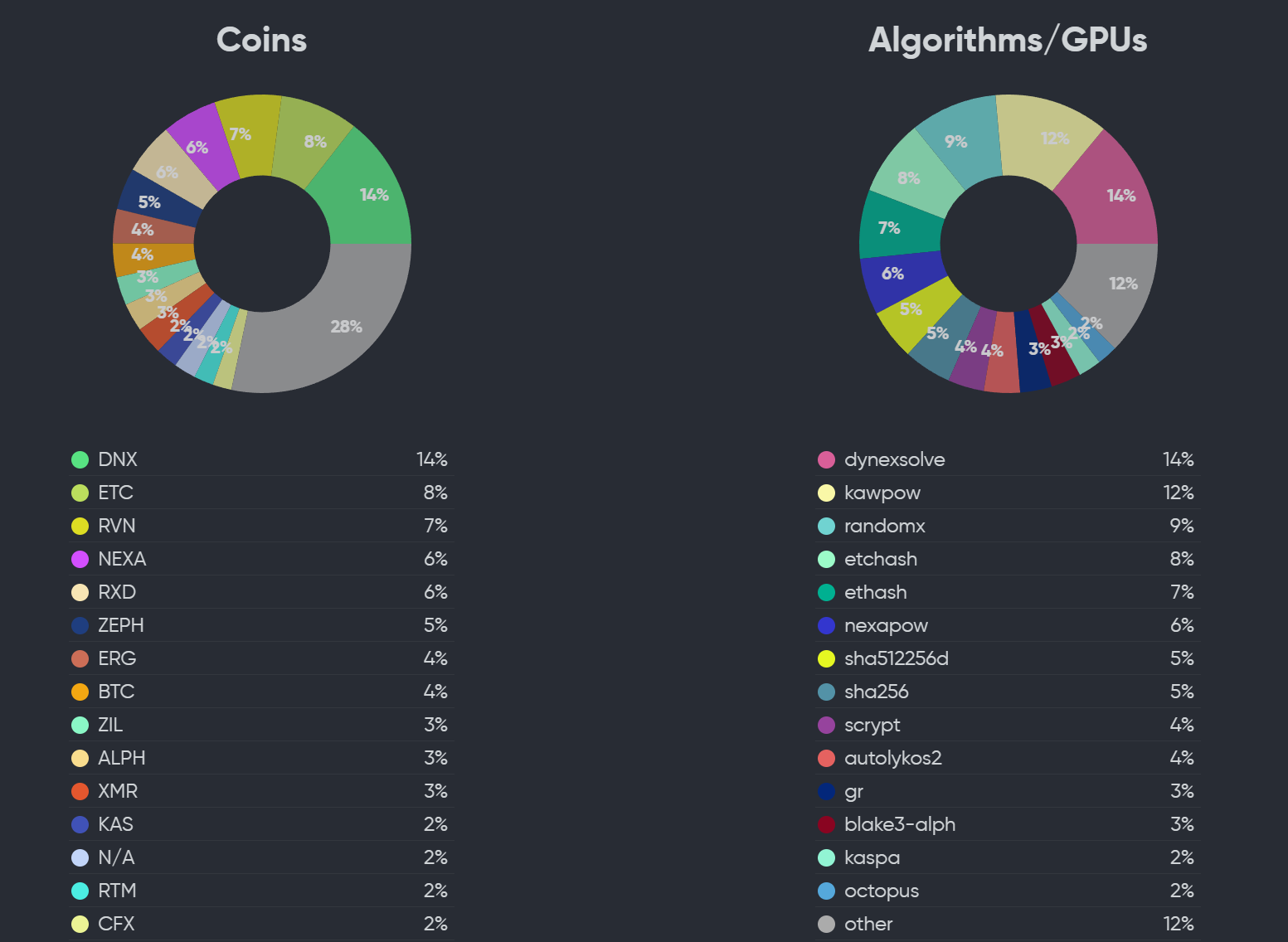

虽然 BTC 强势,但是 POW 代币表现整体一般。BTC 本次的叙事热点主要集中在 BRC 20 ,而不是其他 POW 概念代币。该赛道中,过去一周涨幅最佳的代币是 KAS,创下了历史新高,接近 0.01 美元。该代币上线以来,涨幅已经超过百倍,目前市值进入前 40 名。

从 24 小时产出来看,KAS 的产出收入目前仅次于 BTC,超过了 DOGE 代币,从第三名进入了第二名。Dynex 则出现了明显的下滑,从第七名滑落至第九名。

Dynex 的算力也发生下跌,从最高峰的 24% 下降至 14% 。根据社区提供的信息,是部分显卡存在作弊行为,导致算力虚高,因此这部分显卡停用了。

Kaspa 当前的进展是,RUST 语言重写已经完成,正在进行智能合约平台的开发。智能合约平台开发成功后,可以在 POW 链上进行 DAPP 的开发。社区认为,建立在 POW 基础上的智能合约平台优于建立在 POS 基础上的智能合约平台。次新币 Dynex 在近期的牛市中,表现不佳, 7 天价格跌幅 14% 。

Layerzero

基础数据

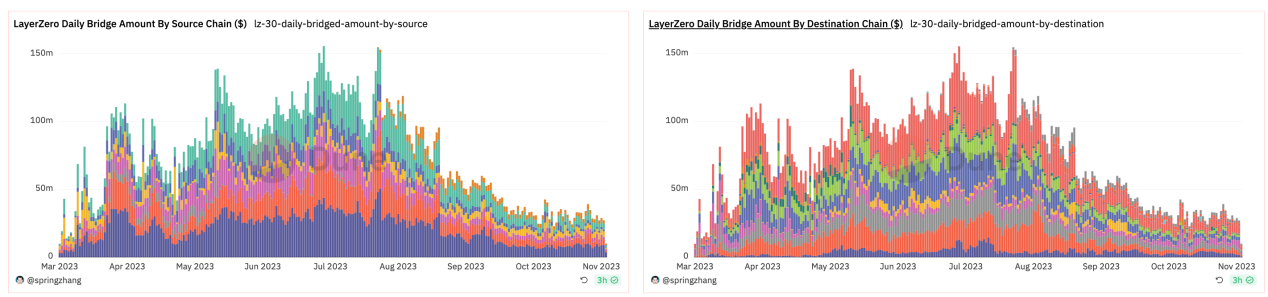

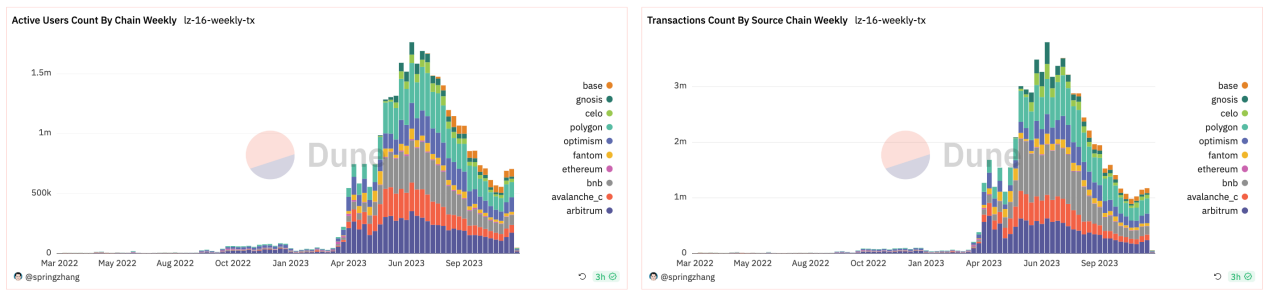

11 月份以来,layerzero 相关的活跃用户和转账数量均有所提升,而转账金额较之前并未出现显著增长。

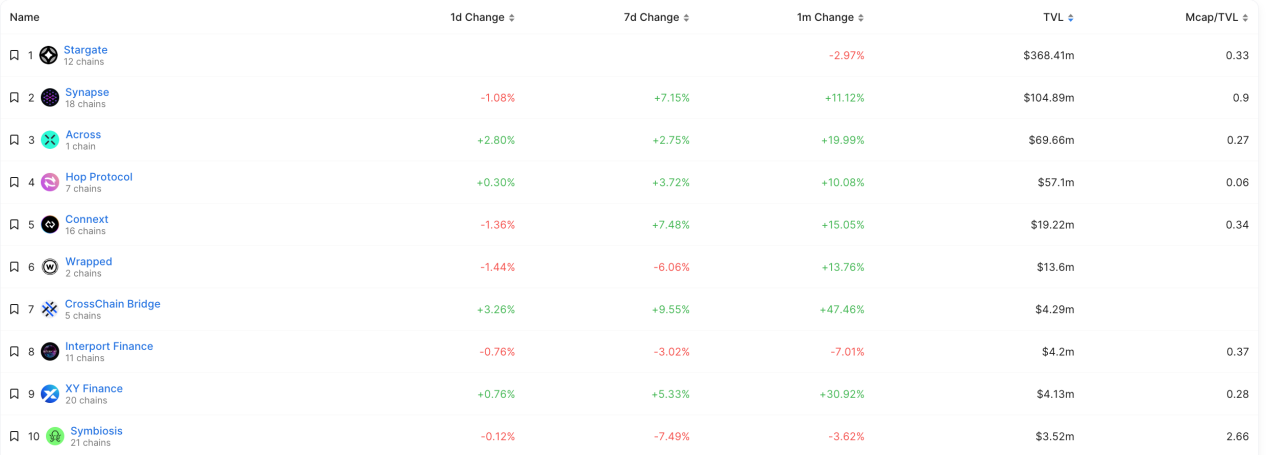

STARGATE

作为基于 LayerZero 的跨链流动性协议,Stargate 的 TVL 在垮链协议中稳居第一,总锁仓金额 3.68 亿美元,远超第二位的 synapse 1.05 亿美元。

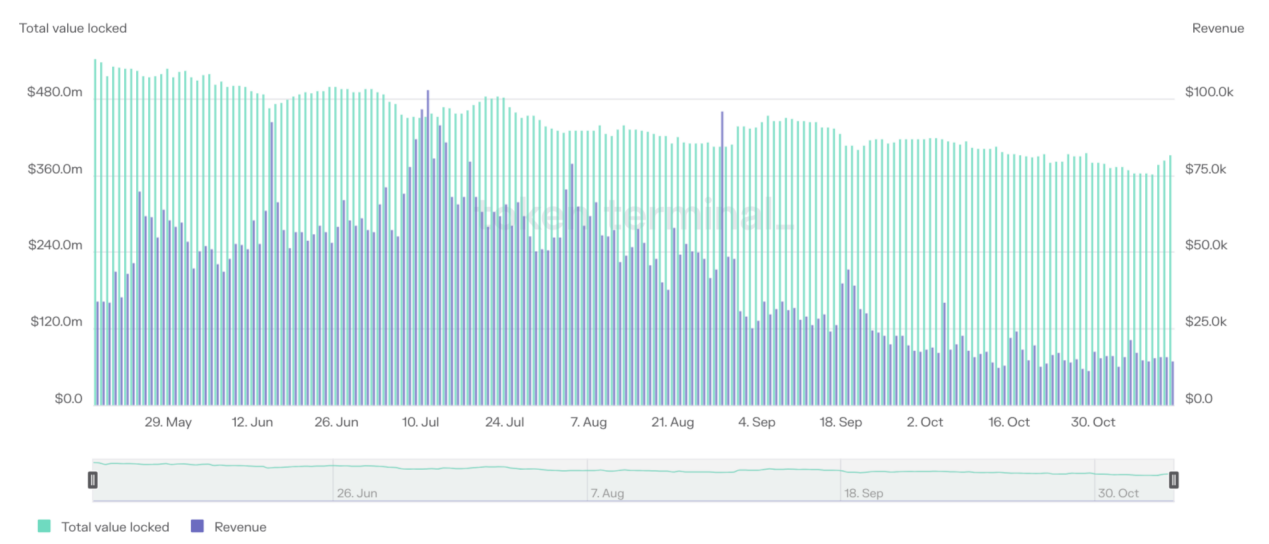

上周 stargateTVL 小幅回升近 30 m,但垮链金额和协议收入并未有回升,仍处于相对低位波动。

生态发展

Kava 已通过 Stargate 在 KAVA 上推出 wETH。

Aragon 宣布集成 LayerZero 和 zkSync 进行多链治理,新插件 Aragon OSx 将实现跨 EVM 链的资产和权限管理,使用 LayerZero 进行跨链消息传递,使用 zkSync Era rollup 实现低成本和安全投票,该插件的代码目前正在接受安全审计。

Gamefi

自 11 月 7 日至 13 日中,Gamefi 板块中价格涨幅前三名的标的为 MEME、ILV 及 IMX。(注:由于 Gamefi 项目过多,只收录部分项目。)

Illuvium

将于 11 月 28 日在 Epic Games Store 上市。

Stepn

Stepn 和 Gas Hero 联合宣布,将针对 Stepn 内的 Genesis、OG 鞋子的持有者发放 Gas Hero 内的 NFT 空投。其中,创世鞋(包括盒子)持有者可获得 1 枚 BCV+ 1 枚 Hero;OG 鞋(包括盒子)持有者可获得 1 枚 Hero。Gas Hero 预计将于 11 月 24 日至 12 月 8 日期间进行社区测试,并使用 GMT 作为游戏代币。

the Sandbox

1、The Sandbox 与 Aave 生态 NFT 游戏 Aavegotchi 合作发布新游戏“Ripples of the Gotchiverse”,并提供 5 万枚 SAND 和 5000 枚 GHST 作为P2E奖励。

2、Gucci 入驻 The sandbox 并推出 Gucci Cosmos Land 体验。

3、the Sandbox 母公司 Animoca Brands 将获得沙特 NEOM 投资基金 5000 万美元投资,其中 2500 万美元将通过发行可转换票据的方式进行。

DEX

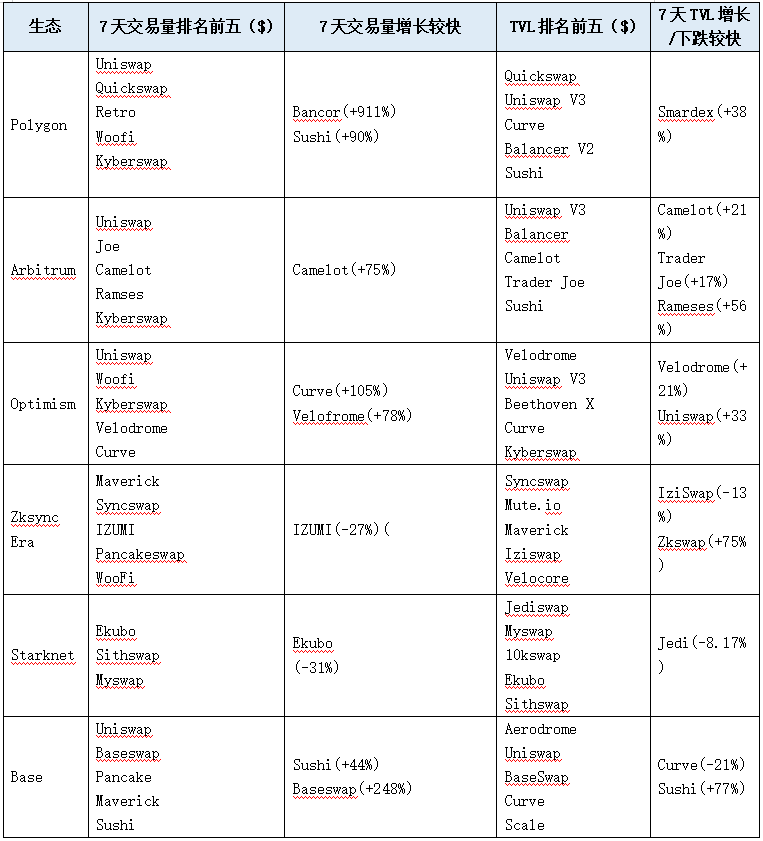

Dex combined TVL 12.85 billion,较上周增加 0.9 billion。Dex 24 小时交易量 3.2b illion, 7 天交易量 25 billion, 较上周大幅增加 7.6 billion。

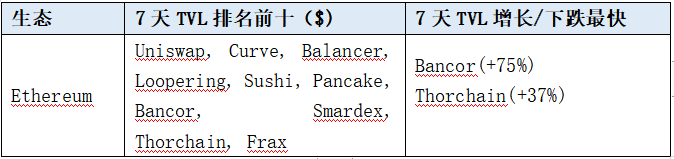

Ethereum

Bancor, Thorchain 是本周 TVL 增长最快的两个协议,分别增加 75% 和 37%

RUNE TVL 已攀升至以太坊上前十。由于 RUNE 本身的套利机制,套利者给 BTC-RUNE, ETH-RUNE 带去大量交易手续费,APY,TVL 双增长,而 RUNE 使用激励机制确保网络上每 1 美元非-RUNE 资产有 3 美元的 RUNE 被锁定,因此 TVL 的增长杠杆放大 RUNE 的需求,增加了买压。

Bancor 在价格抵达 1.96 U 后极速下跌超 50% 。

ETH L2/sidechain

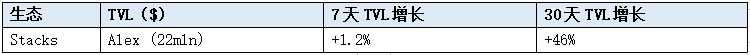

BTC L2/Sidechain

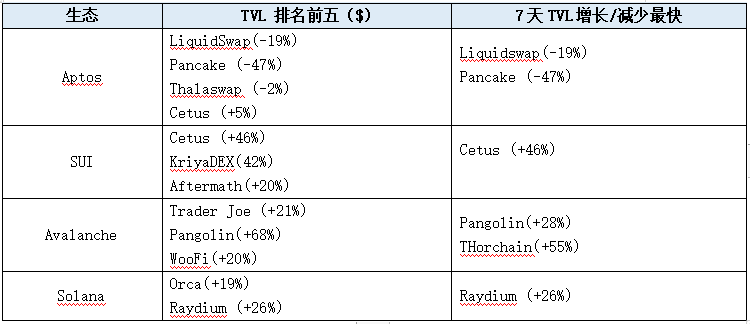

Alt L1

Cosmos

本周 IBC volume 净流入排名前十的项目为:Osmosis, Axelar, Cosmos hub, Neutron, Terra, Celestia, Kujira, Stride, Umee 和 Secret。

TIA 作为融资 5500 万美元的天王项目,本周涨幅超过 120% 。TIA 下次解锁是在 2024 年 10 月 24 日,也就是说 TIA 新增的供应量不会超过 2 亿枚,从流通量上来看,和其他L2相比较小,MC 和其他L2相比仍有空间。

项目基本面比较 solid, DA 服务会和其他L2形成互补,在这个赛道当中属于龙头项目。

此外,Kujira, Quicksilver 和 Stride 继续延续上周的涨幅。