비트코인 현물 ETF 출시를 앞두고 있는데 OTC 자금은 얼마나 들어오나요?

오리지널 - 오데일리

작성자-0xAyA

비트코인 현물 ETF 소식이 계속해서 울고 있는 늑대 이야기를 늘어놓고 있지만, 암호화폐 전체 시가총액은 실제로 상승했고, 다양한 좋은 소식에 자극받아 비트코인 가격도 35,000달러 선을 넘어섰다. 16개월 최고치를 기록했다.

전체 암호화폐 커뮤니티가 Bull Return을 외치는 가운데 시장에 새로운 증분 자금이 유입되고 있습니까? 오데일리 통계는 최근 기간 동안의 다양한 데이터를 정리하여 다음과 같이 정리하였습니다.

BTC 포지션

BTC 보유량 변동은 다음을 참조하세요.@Phyrex_Ni제공된 데이터에 따르면 소규모 투자자(100 BTC 미만 보유)의 전반적인 추세는 여전히 저조한 추세입니다. 확실한 좋은 정보가 나오기 전에는 중간 규모의 소규모 투자자들이 한때 매수의 주역으로 변했지만, DTCC 관련 이벤트가 시작된 이후에는 이들 투자자들이 새로 진입한 칩을 빠르게 소진하는 반면 고액 순익 투자자들은 가치 있는 투자자(100BTC 이상 보유 사용자)는 거의 모두 보유액을 늘리는 추세입니다.

세부 데이터 분석을 보면 10월 16일 이후 소규모 투자자들의 포지션이 감소하고 있는 것을 확연히 알 수 있으며, 특히 10~100 BTC 사이의 포지션을 보유한 투자자들이 보유량을 줄이는 주요 주체이다. 이 기간 동안 10,000코인 이상 포지션을 보유한 투자자들은 보유량을 줄이는 경향이 있으나 감소폭은 높지 않아 그럴 가능성도 배제할 수 없다. 거래소의 포지션 변화로 인해.

종합해 보면, BTC 현물 보유에 대한 시장 투자자의 전반적인 태도는 여전히 상대적으로 모호합니다. 장기 보유자는 시간 규모상의 이유로 현물을 보유하고 투자하려는 의지가 더 높으며 좋은 소식이 영향을 미칩니다. 대규모 투자자의 의사결정에 있어서 그들이 보유 지분을 늘리기로 결정하는 것은 놀라운 일이 아닙니다. 그러나 단기 보유자들은 여전히 불확실한 시장 환경과 최근의 격동적인 국제 정세의 영향에 직면해 있으며 의사 결정에서 여전히 신속한 접근을 하는 경향이 있어 시장이 미래에 대해 여전히 의견 차이가 있음을 나타냅니다. BTC의 추세. , 과감한 투자 결정을 서두르지 마십시오.

금융상품 유입

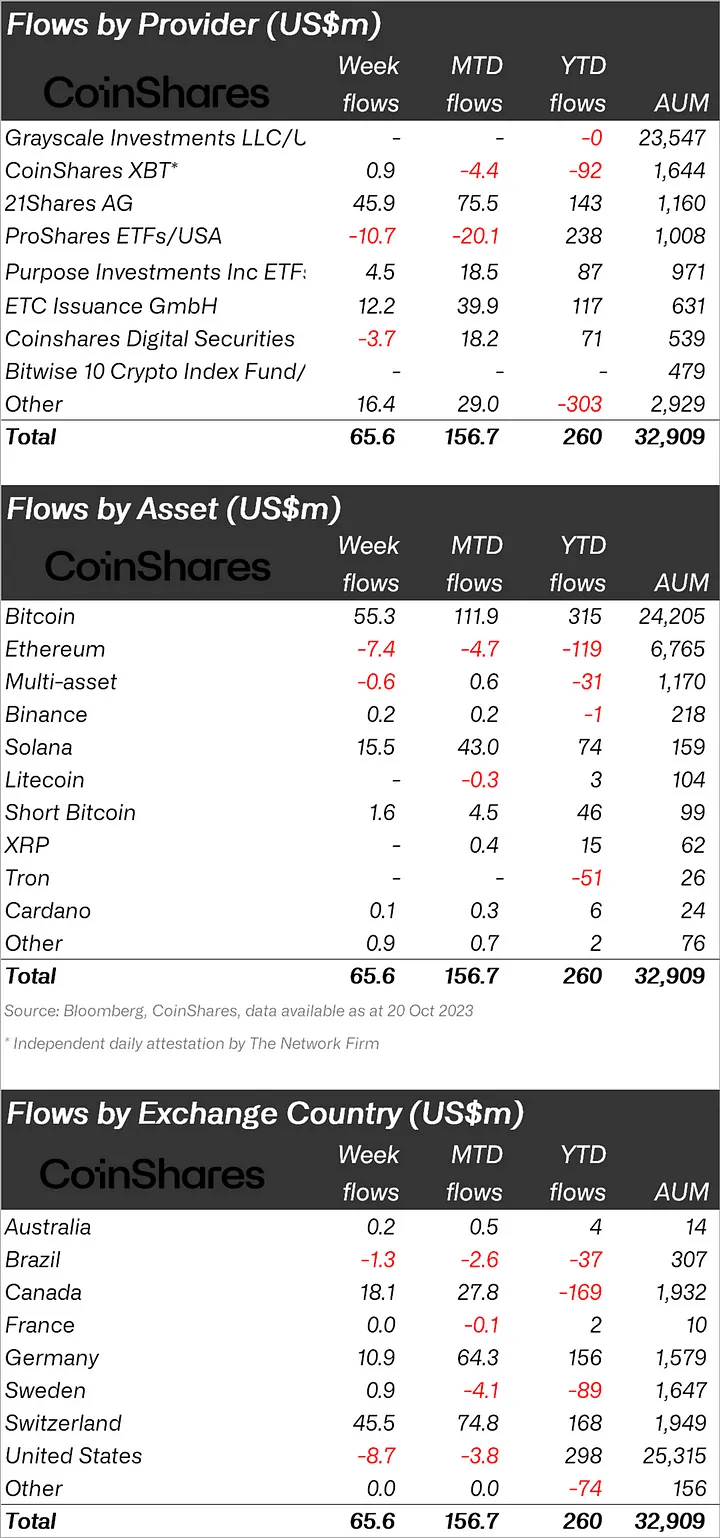

CoinShares가 발표한 데이터 분석에 따르면 디지털 자산 투자 상품은 지난 주 6,600만 달러의 유입을 기록하여 4주 연속 순 유입을 기록했습니다. 이들 상품의 총 AUM은 현재 330억 달러로 증가했으며, 지난 4주 동안 총 유입액은 1억 7,900만 달러에 달했습니다. 최근 가격 상승에 따라 이들 상품의 총 운용자산은 9월 초 최저치 이후 15% 증가해 8월 중순 이후 최고치를 거의 경신하고 있다.

최근 유입은 미국 현물 비트코인 ETF 출시와 관련이 있을 수 있지만 지난 6월 제품 출시를 발표한 후 4주 연속 유입된 블랙록의 초기 유입(총액 8억 700만 달러)에 비하면 상대적으로 낮은 수준이다. 이는 그레이스케일과 SEC 법원 판결의 긍정적인 소식에도 불구하고 이번에는 투자자들이 더욱 신중하다는 것을 의미합니다.

그 흐름의 84%가 비트코인 투자 상품에 들어갔고, 연간 유입액은 3억 1500만 달러에 달했습니다. 비트코인 매도 포지션은 지난 주 초 가격이 상승하면서 2,300만 달러까지 증가했지만, 주말에는 이러한 포지션이 크게 감소하여 순 유입액이 총 170만 달러에 그쳐 공매도자들이 자신감을 잃었음을 나타냅니다.

이더리움에 대한 지속적인 우려로 인해 지난주 유출이 발생한 유일한 암호화폐인 740만 달러가 유출되었습니다. 이와는 대조적으로 솔라나는 지난주에 1,550만 달러의 유입을 유치하여 연간 유입액이 7,400만 달러, 즉 전체 AUM의 47%에 이르렀습니다.

Fidelity, Charles Schwab, Citadel Securities의 지원을 받는 EDX Markets는 올해 6월 디지털 자산 시장을 출시했으며, 또한 Mitsubishi UFJ 등 일본 은행들도 암호화폐 신탁 및 스테이블 코인 탐색에 적극적으로 참여하고 있습니다. 전통적인 기관들이 암호화폐 자산에 관심을 갖고 있다는 것을 쉽게 알 수 있으며 레이아웃의 일부가 완료되었습니다. 정책과 뉴스에 충분히 가까운 OTC 기관의 경우 OTC 호환 금융 상품을 선택하거나 직접 ETF를 발행하는 것이 좋은 선택입니다.이러한 증가는 이들 기관에 대한 작은 시련으로 볼 수 있다고 믿을 만한 이유가 있습니다.

스테이블코인

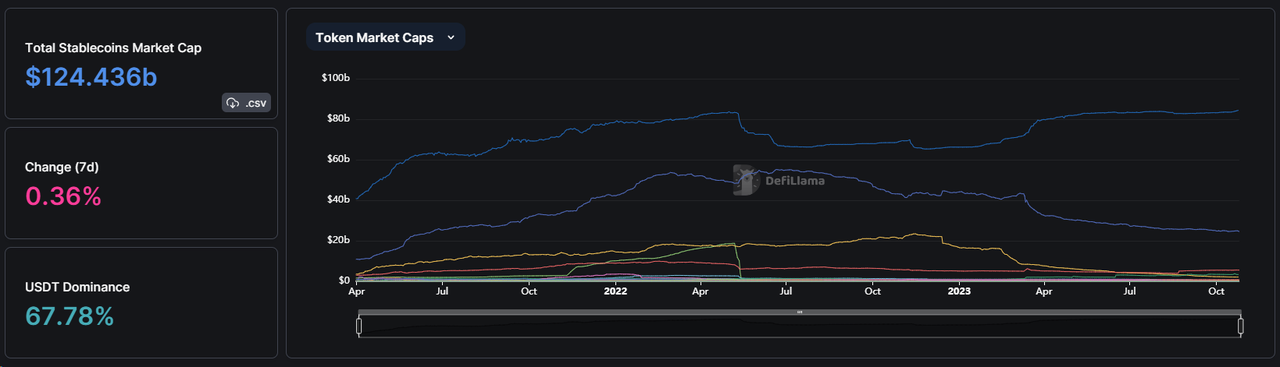

DefiLlama 데이터에 따르면 현재 스테이블 코인의 총 시장 가치는 1,244억 3,660만 달러에 달하며 그 중 USDT가 67.78%를 차지합니다. 스테이블 코인의 총 시장 가치는 지난 주에 비해 0.67% 증가했습니다. CEX로 유입되는 스테이블 코인의 수가 증가했습니다. 하지만 지난해 같은 기간과 비교하면 그 규모는 아직 크지 않다.

USDC의 경우 10월 27일 현재 Circle에서 총 약 14억 달러의 USDC를 발행했으며 지난 7일 동안 약 11억 달러의 USDC를 상환했습니다. 유통량이 약 4억 달러 증가한 반면, TUSD의 시장 가치는 약 3억 9천만 달러 증가했으며, 이는 최소 8억 달러가 암호화폐 시장에 유입되었음을 의미합니다.

대규모 스테이블코인 유입을 보면 CEX에 진입하는 USDT, USDC 등 기타 스테이블코인이 지난 7일 동안 증가했다. 8,700만 달러 증가해 약 8.96% 증가했다. 종합해보면, 스테이블코인의 거래소 순유입은 증가했지만, 시장변동에 비하면 아직 그 증가폭은 턱없이 부족하다. 케이크 위에 장식.

CME 미결제약정

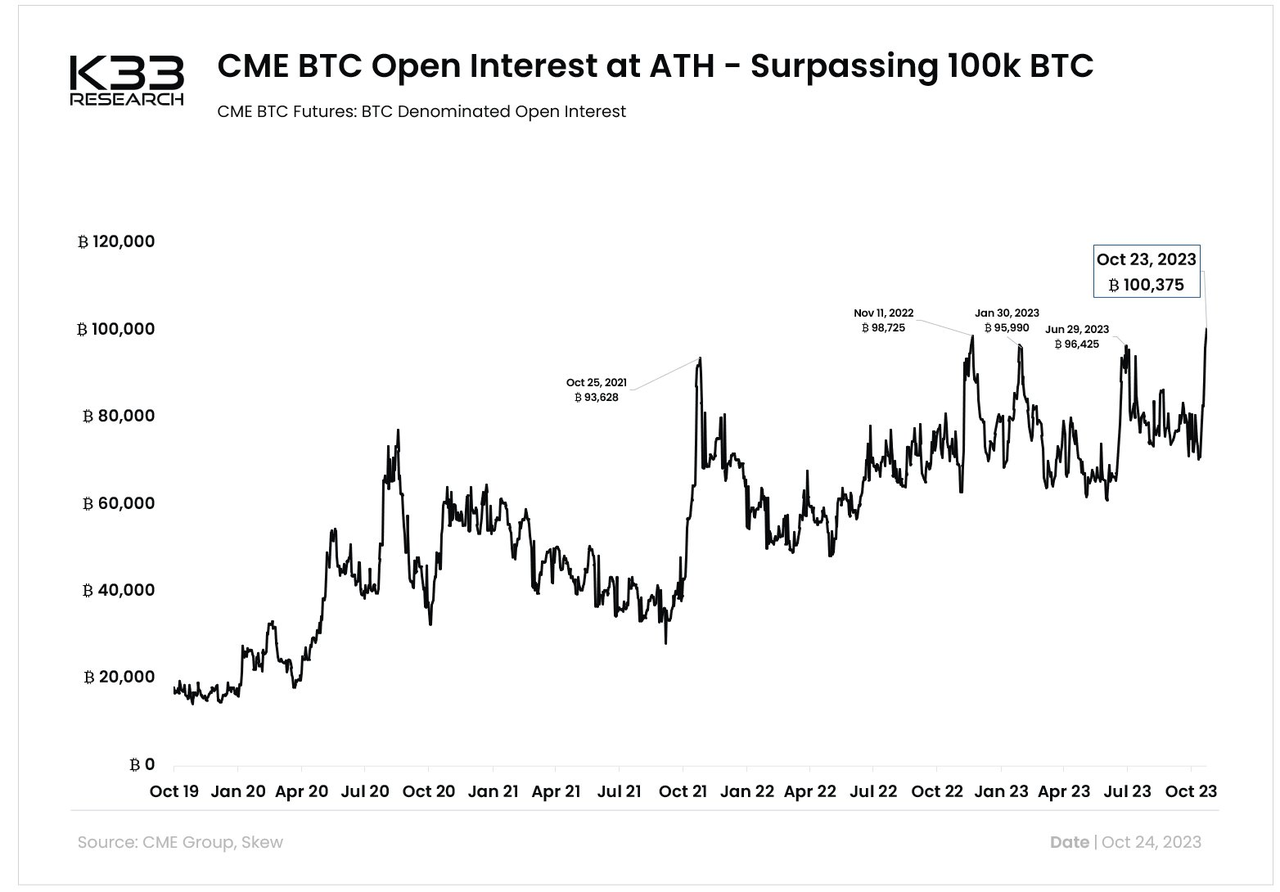

CME BTC 선물은 10월 23일 처음으로 100,000 BTC를 돌파했습니다. 미결제약정이 계속 상승하고 있으며 CME 비트코인 파생상품 계약 시장 점유율(25%)이 빠르게 1개월 BTC 선물 프리미엄인 바이낸스(29%)에 접근하고 있습니다. 또한 13%에 도달했는데, 이는 일부 OTC 투자자들이 실제로 CME를 통해 시장에 자금을 보내고 있으며 장기 투자 심리가 강하다는 것을 나타냅니다.

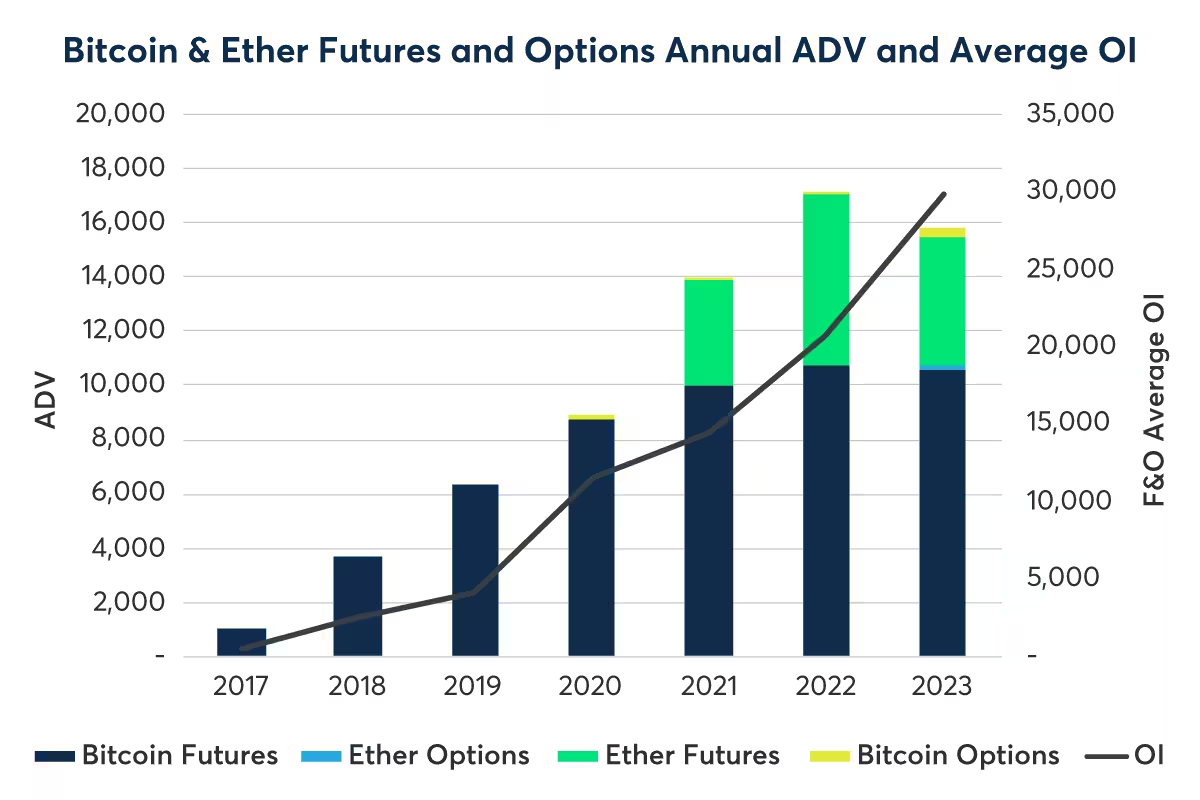

비트코인과 이더리움의 미결제약정도 2022년 수준에 가깝게 돌아왔습니다. 연초부터 8월까지 CME 비트코인 선물·옵션 거래량은 전년 동기 대비 154% 증가했고, 미결제약정도 87% 증가했으며, 비트코인 역시 연초부터 상승세를 이어갔다. 이 두 암호화폐에 대한 전통적인 시장의 투자자 관심 증가는 부분적으로 향후 비트코인에 대한 시장의 낙관적인 신뢰를 나타내는 신호입니다.

비트코인과 이더리움의 미결제약정도 2022년 수준에 가깝게 돌아왔습니다. 연초부터 8월까지 CME 비트코인 선물·옵션 거래량은 전년 동기 대비 154% 증가했고, 미결제약정도 87% 증가했으며, 비트코인 역시 연초부터 상승세를 이어갔다. 이 두 암호화폐에 대한 전통적인 시장의 투자자 관심 증가는 부분적으로 향후 비트코인에 대한 시장의 낙관적인 신뢰를 나타내는 신호입니다.

정리하면, 데이터 플레인을 통해 얻을 수 있는 정보는 다음과 같습니다.

시장의 투자자들은 여전히 시장에 대해 이견을 갖고 있지만, 미래의 시장 추세는 주로 시장에 의해 결정되지 않습니다.

장외자본 유입은 잠재력이 있는 BTC, 알트코인에 편향되어 있으며, 기존 금융기관은 이미 포지셔닝을 하거나 특정 포지션을 사전에 배치했지만 여전히 보다 명확한 신호가 나오길 기다리고 있습니다.

오데일리는 본 기사가 과거 상황에 대한 통계적 분석일 뿐 향후 시장 동향에 대한 투자 지침 추천이 아님을 상기시킵니다.