叙事楔子:利润和生存指南

原文作者:JOEL JOHN

原文编译:深潮 TechFlow

在过去的一周里,我有一个观察。你可以在游戏热潮开始时将资金投入到 Axie Infinity,然后离开,回来时发现你的收益比大多数 Web3 游戏的风险投资者还要多。Axie 的价格曾经跌至 0.14 美元,而现在已经涨到了 6 美元,回报率达到了 40 倍。

它的最高峰曾经超过了 1000 倍。原因是 Web3 游戏中的大多数种子阶段风险投资项目要么离流动性很远,要么可能在当前市场环境下筹集更多资金之前就夭折了。但我的想法中存在一些缺陷:

种子阶段的风险投资项目不应该在 18-24 个月的时间范围内获得回报。

我假设了投资者在游戏还是一个无人关注的叙事时,就将资金分配给 Axie Infinity。

但是底层的逻辑仍然是,你可以在熊市期间将资金投入到一种流动性资产中,并获得比在该叙事的早期风险投资交易中更好的回报。这个难题让我对加密货币中的风险范围、注意力如何先于风险投资有了一些思考。本文总结了我对叙事如何驱动我们行业中的资金和关注的思考。

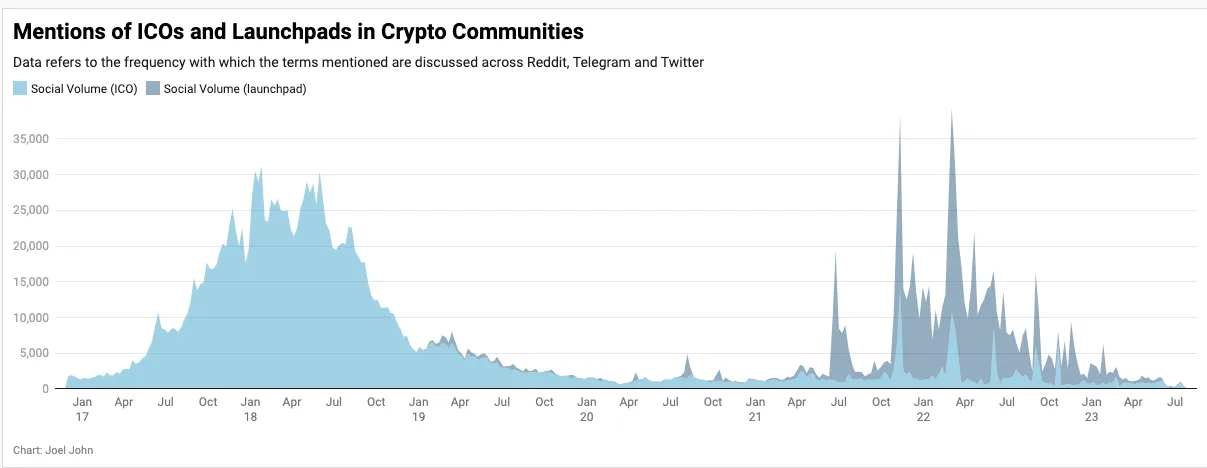

在我们开始之前,先来看一些数字。根据我使用的数据产品追踪,超过 3500 个代币中有近 1300 个在过去一个月中只有不到 10 个钱包进行了转移。根据 DappRadar 追踪的 14000 个 dApp 中,只有不到 150 个拥有 1000 个用户。在这个行业,我们的关注点很快从一个资产转移到另一个资产。我们对筹款机制的信心也存在类似的情况。下面的数据显示了过去几年中在知名的加密货币社区中对 ICO 和发行平台的提及次数。

如果你在 2017 年的时候就在圈子里,你可能会认为风险投资将永远改变。那个市场上筹集到资金的许多初创公司现在已经不复存在了。根据数据来源,当年加密货币从散户和机构参与者那里筹集到了 190 亿到 600 亿美元。但是那批 ICO 项目的存活率与我们传统上看到的初创公司的存活率相当。

你可以在上面的图表中看到 2019 年 1 月至 2021 年 1 月之间的结果——这是加密货币风险投资的黄金时代。对 ICO 的兴趣迅速消失。投资者在一个短暂的时期里看到了机会,那时那些充满梦想的创始人们不再能够获得散户资本来进行建设。初创公司的估值在 500 万到 1000 万美元之间。创始人和投资者不得不重新合作以求生存。

创始人们转而向 VC 筹集资金的部分原因是更好地理解过早发行代币的风险。你必须花时间管理社区,进行法律工作以确保合规,并将自己的净资产与一种流动性资产联系起来,同时还要经营一家公司。创始人可能会因为 Discord 上的某个人对团队成员的评论感到恼火,决定将他们所有的代币在一个只有 1 万美元流动性的交易所上抛售,导致自己一觉醒来就贫穷了 20% 。

多年过去了,我们又回到了 Launchpad 的季节——交易所扮演着上帝的角色,决定哪个风险投资项目能从散户那里获得数百万美元的资金。虽然这一次有很多门槛,但至少他们确保散户投资者在投资方面获得了比 2017 年 ICO 中看到的数十亿美元估值更好的条件。

我选择了 ICO 如何让位于 Launchpad 这个案例,是因为有相关的数据。自 ICO 繁荣以来已经过去了足够多的年份,我们可以事后了解到发生了什么。如果你看一些更新兴的主题,比如 DeFi、NFT 或 Web3 游戏,你会发现公众对它们的讨论兴趣已经完全消失了。

但与 ICO 不同,DeFi、Web3 游戏和 NFT 的故事仍在不断发展。

逐渐消亡的叙事

DeFi 已经从过度期望的高峰转向了启蒙的阶段。Uniswap 竞争对手没有出现。Aave 和 Compound 在借贷市场(针对现货、超额抵押资产)上占据了强势地位。这些产品的连续迭代将更加面向消费者或机构,并且不再过于痴迷投机。

Robert Leshner 将重点转向推出一只共同基金,Stani 则转向 Lens(Web3 社交),这显示了那些一直在行业中的创始人们如何为下一轮做准备。

谷歌搜索趋势、TVL 和用户数量是观察 DeFi 中关注度和资金流动的好指标。截至目前,DeFi 平台上的资金已从最高点的 1, 600 亿美元下降到了 400 亿美元的低点。

如果你看一下用户数量的数据,过去几个月已经减少了 50% 。但与 2020 年 3 月 DeFi Summer 刚刚开始相比,用户数量仍增长了 100 倍。

换句话说,虽然兴趣和使用率有所减少,但这些产品类别内的用户数量仍然远远超过以前。然而,如果你看同样功能的搜索趋势,你会看到一个完全不同的故事。

兴趣已经回到了 2018 年的熊市水平。就好像没有人再关心这个行业了。我查看了 NFT 和 ChatGPT 的数据,它们都呈现出类似的趋势。外星人的搜索趋势正在上升。(也许我们需要开始投资外星人服务业务。)

综合这些 DeFi 的数据,我有几点观察。

叙事在牛市开始时就蓄势待发。

通常是由技术发展引起的。

特定领域的早期参与者由于叙事和使用规模同时扩大而获得了超额回报。

Compound、UniSwap 和 Bored Apes 都是叙事风口与产品使用相结合,为投资者带来超额回报的例子。

挑战在于,你必须投资那些在可能吸引足够多用户之前就会消失的叙事。我们可能需要再次回到 Axie Infinity 来捋一捋。

把握正确的时机

我之所以回到 Axie,是因为它很好地涵盖了几个主题。

到 2021 年,Axie 已经上所并进行了大约 2 年的产品开发。

可以说当时它被低估了。

Axie 标志着 Web3 游戏主题的开始。

需要注意的是,这并不是对 Axie 的评价。我对团队能做的事情持乐观态度,并且我们内部一直在研究关于 Web3 游戏的论点。我仍然是 Sky Mavis 的忠实粉丝,以及他们为消费级区块链应用所做的工作。我们的关注点在于价格和用户活动。

如果你注意上面的图表,你会发现在 Axie 的价格大幅上涨到 150 美元之前,有大量用户涌入。链上的调查人员很可能看到了新用户涌入产品的程度,并在 2021 年 7 月之前将其定价得很好。

但到了 10 月,当新用户数量开始减少时,Axie 变得更像是一种资产而不是产品。这是所有链上产品都容易陷入的陷阱。游戏内资产的超级金融化意味着纽约的对冲基金可以为一个在游戏中努力的公会成员支付报酬。赚取游戏内收益的模式依赖于游戏内资产的流入流动性。有时,这种流动性来自投机者和机构。

在 2021 年 7 月和 2022 年 1 月之间,许多投资者在观望中形成了信念,并撰写了关于该行业如何发展的论文。创始人们也会意识到在构建 DeFi dApps 方面的困难,并相信游戏是下一个大趋势。就像今天许多创始人都在涉足人工智能一样。

真正的风险在于 2022 年 1 月之后的 18 个月。你看到了上面的图表中新用户数量的平稳下降吗?这是所有 Web3 原生游戏应用的用户基数在缩小。在边缘构建的工具,比如“Web3 游戏的 Steam”之类的东西,很快就难以找到用户。

这种对短期价格上涨对实际消费者需求的误解是我们看到的许多创始人陷入的陷阱。创始人面临的风险是,如果没有吸引力,在当前的市场环境下很难进行后续融资。

创始人很可能是在正确的市场上错过了正确的时机。对于创始人来说,危险在于在足够的关注或资本流入该类别之前就关闭业务。

作为风险投资者,一方面,你会看到流动市场对交易者给予了巨大回报,另一方面,你将与一群与你一起涉足该主题的创始人竞争。这对任何参与者来说都不是一种愉快的经历。

我的观点是:

市场通常会在短期内对叙事定价。

鉴于 Web3 投资的流动性特点,流动性资产可能在一个季度内退出。

鉴于风险投资的非流动性特点,当产品上线时,创业公司可能没有市场可以利用,因为产品需要时间发展。

这往往意味着慢性死亡,并对用户的回归进行赌博。产品实际上成为对“牛回”的赌注。

例外情况是当一个类别扩大到拥有足够感兴趣的用户,并且你构建了独特的东西。有些具有讽刺意味的是,DeFi 已经跨越了鸿沟。在 300 万用户的规模下,构建 DeFi 的创始人不再担心新用户进入市场。

进行风险投资的加密原生投资者要么是欣赏者,要么是先行者。他们要么具有分发和影响力来开创一个新的类别,要么有远见,了解到一个全新的行业正在崛起。如果仅凭价格行动作为驱动力来制定新的论点,那么他们进入市场的时机就非常晚了。很可能他们看不到退出机会,除非这是一个可以扩展到 IPO 或被收购的业务。而这两种情况在代币领域都很少见。

影响创始人的另一种方式是商业模式演变。例如,由于 Blur 等免版税市场的出现,去年 NFT 的有效版税率已从约 2.5% 降至 0.6% 。截至撰写本文时,约 90% 的 NFT 交易不收取任何版税。

从本质上讲,这意味着任何建立在大量传统艺术家将进入该行业的想法基础上的企业会彻底消失,而他们反过来需要工具来创造收入。去年,随着模式的转变,无数创作者经济企业不得不转向。

对于所有新兴技术而言,混乱是加密世界的一种生活方式。

免费

让我们退后一步,回到 2000 年代末。在学校度过漫长一天之后,你登录 Facebook 与朋友聊天。YouTube 上有无数有趣的视频。在这些活动中散布着广告,但你很少为这些事情支付一分钱。互联网在你付费之前就已经形成了习惯。

相比之下,Web3 对所有权和独占的迷恋使我们创造了小规模的用户群体。根据他们的博客,Arkham Intelligence 拥有超过 10 万用户。Nansen 的 V2 产品今天已经注册了超过 50 万用户。Dune 拥有业内最大的数据科学家社区之一。它们之间只有一个共同点:免费。

互联网的天才之处在于让用户不承担大部分行动的成本。作为回报,它获得了影响力。Web3 的巨大危险在于每次互动所需的成本有多高。对于不需要在线社交的用户来说,花费 8 美元购买区块链上的图像并不吸引人。

对于几十年来免费拥有电子邮件地址的用户来说,为什么要花费 50 美元购买 ENS?Axie Infinity 最初需要花费 1200 美元购买 NFT 才能玩游戏。公会模式依赖于这个高门槛。去年,他们发布了一个免费游玩的版本,意识到保持这种高门槛的危险性。

在今天,Reddit 将这种"免费"和"拥有"结合得非常巧妙。作为一个拥有 4 亿月活跃用户的社交网络,Reddit 是一个巨头。到目前为止,大约有 1500 万个钱包收集了他们的收藏品。这大致是 DeFi 用户在高峰月份的两倍。具有特定年份和特征的帐户被允许从 Reddit 购买收藏品。

在这种情况下,大多数用户仍然使用"免费"产品,只有一小部分用户在铸造、交易和拥有收藏品。分发是一个通过已经运行了 18 年的网站解决的。

Rabbithole 和 Layer 3 非常符合这一模式。它们不向用户收费,而是向那些足够好奇以在链上探索新机会的人提供价值。根据 Layer 3 创始人的推文,该产品为对加密货币感兴趣的人提供了大约 1500 万次链上操作。

产品战略的转变已经在发生。如果你访问 Beam.eco,你会看到一个在不到 10 秒钟内设置好的钱包。Asset.money 帮助你用不到三次点击就收集 NFT。用户不必担心 Gas 费用、入口或设置钱包。当然,这里存在安全权衡。这与电子邮件从每个人都运行自己的服务器转变为由 Hotmail 和 Google 等服务提供商运行的第三方服务器类似。

对销贸易

还记得我说过,仅凭叙事无法确定加密风险投资的时机吗?逃脱这个陷阱的方法是书中最古老的伎俩:

吸引用户群体并长期保持;

在长时间框架内稳定积累价值。

行业中的一些代币已经成功做到了这一点。提到 DeFi 领域,我就会想到 Uniswap。尽管版税遭到攻击,OpenSea 仍然保持着相关性。风险投资领域的尾部是一个关于注意力和资本如何以及何时流动的大赌注。

摆脱对投资者或投机者资本的不健康依赖的唯一方法是利用所有企业都可以获得的最纯粹的资本形式,即他们的客户的注意力。随着风险投资的收缩,越来越多的初创公司(和协议)将不得不寻找关心他们产品的用户。

我找到的最相关的例子是 Manifold.xyz。该产品专注于帮助创作者相对轻松地铸造 NFT。根据 TokenTerminal 的数据,上个月他们的手续费超过了 100 万美元。它是表现做好的吗?可能不是。在当前市场中相关吗?绝对是。

我发现在许多成功度过市场周期的参与者中有一个共同点,那就是他们的先发优势。这是一个反复出现的故事。

小团队在市场情绪达到高峰时进入一个行业。他们看到市场正在逐渐萎缩。通常只有不到五个参与者愿意在竞争离开时继续建设。当注意力和资本回归时,他们是最有可能扩大规模的人。通过这个视角来看,只要你能够生存下来,那些大投资者放弃的叙事就是你应该参与的。

一段时间以前,加入 Web3 很“酷”,现在提到你在这个行业工作可能会让人感到尴尬。团队感到有必要编造统计数据来保持相关性。我们经常看到创始人通过空投,驱动交易量来夸大自己的产品。

对于创始人来说,这是一个生存的备忘录。

了解押注于叙事的 VC 和深入挖掘你所在板块的 VC 之间的区别。

早期进入市场本身就是一种护城河。但这也意味着需要有几个月或者更长的时间,才会有人对你的产品产生信仰。你的大部分推销将成为投资者教育课程。这既是一种福音,也是一种诅咒。

在所有同行都倒闭的市场中,生存才是最终的游戏。将开支保持在最低限度以求生存通常是正确的做法。

消费者的关注往往先于投资者的资金。在向投资者推销产品之前,与用户交流有助于在产品上进行迭代。

如果在一个有意义的时间范围内找不到产品市场契合度,结束业务是有意义的。

鉴于加密市场是一个流动性很强的市场,投资(时间或金钱)需要了解自己处于叙事的哪一个阶段。陷阱通常在于花费多年时间在一个正在崩溃的板块上。就我个人而言,我不认为 Web3 游戏已经结束。它的故事仍然由无数仍对这个板块有信念的创始人书写。

陷阱在于混淆了公开市场的价格行为和私人市场的投资机会。当产品上市时,叙事可能就已经死了。后续融资可能会消失。消费者可能不关心。这是许多创始人在未来几个季度中将不得不面对的一场艰苦战斗。