从做市基金出发,Solv V3引领链上资产走向多元化新纪元

尽管市场处于熊市之中,行业中仍存在诸如做市、LSD 等真实收益来源,然而多数散户的财富不但没有增值反而承受了损失。

以做市为例,作为 DeFi 最早的真实收益来源之一,早期的做市策略和操作方式都很简单,即便伴随着行情上升出现一定的无常损失,但总体收益仍然非常可观。而如今,以 Uniswap 为代表的老牌 DEX 已经经过了几次迭代,GMX 一类新兴协议作为行业最高收益来源之一也为 LP 提供了更灵活的功能和策略空间,DeFi 参与需要配合更多灵活高效的策略,同时具备一定的风控管理能力。普通散户在 DeFi 市场中的生存空间越来越小,想要获得更高的收益越来越难。

另一方面,加密市场并不缺少可以带来增值收益的实体,专业的 DeFi 做市团队就是在这样的行业趋势下出现的,他们利用专业的量化交易工具制定交易策略辅之以严密的风险管理,赚取着可观收益,而散户却只有眼红的份。散户想从中分一杯羹就要撬动专业团队的智慧,问题的关键是专业团队的策略和散户的资金如何连接与匹配。专业策略团队难以建立信任自证清白、也无从创造金融工具拓展融资渠道,信任问题和金融工具的缺失导致专业策略很难扩大规模。

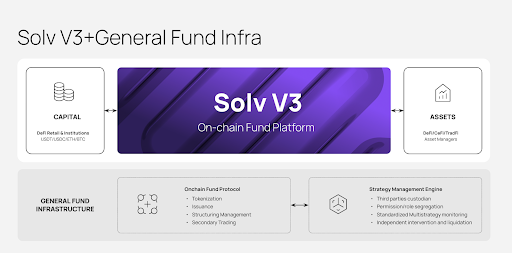

Solv Protocol 自 2020 年 8 月创立以来,一直致力于降低链上金融工具的创造与使用门槛,相继推出了行业首个 1.5 级市场流动性解决方案 Vesting Voucher,以及第一个链上债券市场,实现了超过 1 亿美金的债券发行与交易。2023 年 3 月正式推出的 Solv V 3 定位链上基金平台,实现了链上基金发行、交易与清结算的全流程标准。Solv V 3 背后是一个通用的基金基础设施,由两个关键模块组成:

1)链上基金协议,支持基金创造、发行与交易;

2)多环节链上风控体系,从资产筛选、资金权限、清算等多环节保护资金安全。

7 月 31 日,Solv V 3 正式推出首个灵活申赎的开放式基金——Blockin GMX Delta Neutral Pool,不仅具备更长的存续期,更支持投资人更加灵活地进行申购或赎回。8 月 1 日,Solv Protocol 宣布完成 600 万美元融资,日本银行巨头野村证券投资部门 Laser Digital、大华银行、Matrix Partners 等机构投资,在此之前 Solv 也已获得 Binance Labs、Blockchain Capital 等机构的背书。

Solv V 3 :一站式链上基金发行与投资

Solv V 3 是一个面向行业的去中心化基础设施,为创建、发行、管理和结算链上资金提供统一、安全和透明驱动的平台,支持资金需求与供给双方通过链上基金的发行与购买,实现高效的资金融通。

下面,我们将通过 Solv 推出的两个做市商策略基金 iZUMi 202301 以及 Blockin GMX Delta Neutral Pool,来展现 Solv V 3 强大之处。

(1)iZUMi 202301 封闭式基金

iZUMi 202301 是多链一站式流动性提供商 iZUMi Finance 在 Solv V 3 平台发行的一个封闭式基金,通过募资为 iZiSwap 提供流动性。

为了满足不同投资者的收益期待和风险偏好,该基金将投资份额设计为了两个部分——Senior Tranche(优先基金)和 Junior Tranche(劣后基金)。前者优先获得收益,但仅能获得 7% 的固定收益;后者为追求更高风险、更高收益的投资者而设计,优先承担风险,但可以根据份额分配除 7% 以外的收益部分。实际结算时,购买 Junior Tranche 的高风险用户获得了高达 31.6% 的超高收益率。

基金经理得以在 Solv V 3 高效创建分层基金得益于 Solv 团队原创的 ERC-3525 标准,它具备灵活拆分的特性,专为高级金融资产而设计,可支持多种复杂的基金结构。除分层基金外,Solv 也支持提供 First Loss Capital 等其他安全垫的模式,为投资者提供更加多样化的资产选择。

在「 202301 」完成后,iZUMi Finance 又相继在 Solv V 3 发行了多个主打 zkSync Era 网络做市的基金产品,募集到价值 2200 万美金的 ETH、stETH、USDC、USDT 等,获得了 Unicode Digital、NextGen Digital Venture、Bella Protocol、Incuba Alpha 等基金和个人投资者的支持。毫无例外,所有基金产品全都按时全额赎回,显示出良好的信用记录。

(2)Blockin GMX Delta Neutral Pool 开放式基金

GMX 是今年加密市场最热门的项目之一。作为 Arbitrum 上最大的去中心化衍生品平台,GMX 也是产生真实收益的代表性项目,成为 DeFi 炙手可热的收益来源之一。用户可以通过提供流动性铸造 GLP,从而获得收益:一部分来自于 GMX 日常活动产生的交易费用和协议奖励,另一部分来自交易对手的损益。

不过,由于 GLP 背后锚定了 BTC、ETH、稳定币等一揽子资产,因此持有者还需要承担 BTC 和 ETH 价格波动带来的无偿损失风险。不仅如此,当交易者不断获利时,GLP 也可能在极端单边市场中遭受损失。DeFiLlama GLP 仪表盘显示,收益率最高可达 54.42% ,最低可达 5.43% ,波动率极大。

专业的做市商团队 Blockin Capital 于今年 1 月在 Solv 上发行了一只名为 GMX Delta Neutral Fund 的封闭式基金,该基金不仅在 GMX 上提供流动性,同时实时监测 Trader 仓位及 GLP 成分币种变化,并在 Binance 通过永续合约对冲对应敞口,将 GLP 转变成为了一个低风险、高收益的稳定币矿池。实盘数据显示,该策略仅在 USDC 脱钩期间有小幅 1.1% 的回撤,实现了 20.02% 的年化收益。

7 月 31 日,Blockin Capital 再次基于 Solv V 3 发行了第一只开放式基金——Blockin GMX Delta Neutral Pool,采用与此前的 GMX 做市基金采取相同的交易策略,同时允许随时申购和赎回。

为了降低市场风险,Solv 还推动 Blockin Capital 一同为该支开放式基金设立了极为严格的暂停和清算机制。每当赎回净值低于 30 日平均净值数 3% 时,该基金都会强制暂停,将所有基金全部换回 USDC 投资币种,并由 Solv、Blockin Capital、风险管理人等共同发起社区投票,决定基金的重启或清算。风险管理人在资金共管过程中仅有暂停权限,将实时地对基金净值进行监控,并及时地发起干预或暂停。

Solv V 3 为加密市场持续带来更丰富的收益来源

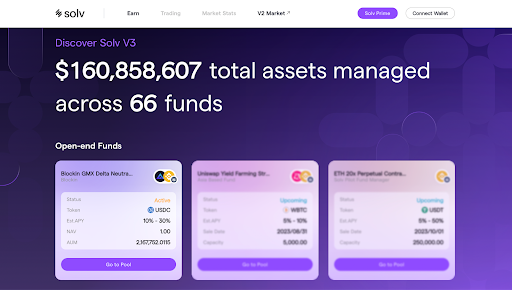

根据官方数据,V 3 上线以来已完成 1 亿 5000 万美金的基金发售,目前在以太坊、BNB Chain、Arbitrum 上,Solv V 3 已吸引超过 10 个基金经理,发行了 40 多支基金。

但做市商策略基金仅是 Solv V 3 资产类别中的一个重要部分,Solv 还将发挥其在资产筛选、资产创造等方面的优势,持续为市场带来更丰富的收益来源。

得益于 ERC-3525 强大的资产表达能力,Solv V 3 使基金经理可以高度定制化自己的基金产品。就像定制 NFT 一样,他们可以通过可视化的方式,定制基金的认购规则、收费结构以及由智能合约管理的收益策略。主要体现在三个方面:

丰富的底层资产:在 DeFi 方向上,在 DEX、衍生品市场、流动性质押、NFTFi 上构建更丰富的管理策略,提供多元化的收益来源;在 CeFi 方向上,将陆续推出量化基金、套利策略基金以及 CeFi 做市基金;在 TradFi 方向上,封装更多真实世界资产,匹配相应的收益策略,为加密市场持续带来充足而稳定的收益来源。

丰富的收益策略:Solv V 3 支持主动管理、收益增强、Copy Trading、结构化等多种基金管理策略。

丰富的产品结构:Solv 也支持分层基金和 First Loss Capital 保护基金等多种产品结构,服务不同风险偏好的投资者,也为投资者建立更强的信心。

本月初,Solv 也宣布将于 8 月内集成 Pine Protocol 等 NFT 抵押借贷平台,并将于明年第一季度推出基金份额的二级交易市场,解锁更多 DeFi 乐高玩法,提供更多的流动性解决方案及收益机会。

Solv V 3 带来更成熟的风险管理机制

在为市场创造优质资产品类的同时,Solv 也建立了一套完善的链上风控机制。

一方面,它基于智能合约实现了资金共管和权限分层。无论采用 DeFi 或 CeFi 策略,各支基金在 Solv 平台上募得的资金均会通过 Solv V 3 智能合约转入指定的 MPC 解决方案,并根据角色授予相应的权利,实现资金转移权、清算权和操作权的充分隔离,消除了单点故障,确保资金专款专用。全程链上监控,一旦发现基金创建者违背基金策略,擅自挪用资产,Solv 会立即冻结资金避免更大损失;对于投资者来说,也可以通过 UI 页面实时监控资金使用情况以及基金收益,盈亏自动化可视化,真正做到流程透明、链上可追溯。

另一方面,它也实现了高效响应的清算机制。Solv 组织可信机构网络为每支基金设置合理的清算线,选举并委任专业的 Risk Manager 负责维护资金安全,以应对可能存在的极端情况。Risk Manager 将实时监控仓位及保证金,发出风险警报并提供风险报告,并在清算事件发生时,以有序方式关闭仓位并进行合理结算。以 GMX 开放式基金为例,投资者预期获得 10% -30% 的收益率的同时,享有 30 日平均回撤 3% 即暂停的保护机制。

Solv V 3 构建了一个高度协作的去中心化机构网络,为基金提供可靠的服务与风险管理,也为链上投资奠定了可信的基础。

结语

Solv Protocol 的创始人 Ryan Chow 在接受采访时也表示:“基金市场是 DeFi 世界最具价值捕获能力的几个方向之一。随着 RWA、LSD 等新叙事的发展,DeFi 资产也必然会迎来更多元化的爆发。Solv V 3 已经具备了相对成熟的基础设施,处于市场领先地位。我们也将持续通过去中心化基金平台桥接优质的资产和行业流动性,为 DeFi 的下一阶段大规模采用做好准备。”

Solv 在官方文档中介绍,$SOLV 代币的最大部分将用于进行社区激励,参与开放式基金购买和持有的用户也有机会获得空投激励。

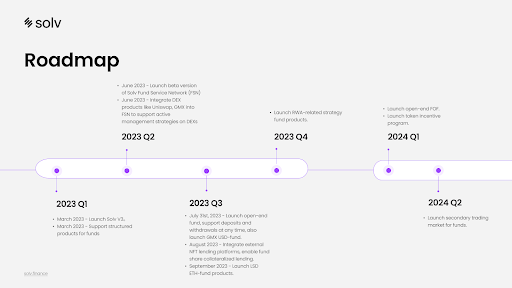

在更详细的 Roadmap 中,Solv 表示于今年 8 月集成 NFT 抵押借贷平台,在 LSD 协议上推出 ETH 基准策略基金。今年第四季度,Solv 将推出 RWA(真实世界资产)相关策略基金。2024 年一季度,推出开放式母基金及代币奖励;2024 年第二季度,推出基金份额二级交易市场。

Solv V 3 的出现,降低了加密基金创建、投资门槛,让拥有收益创造能力的人可以快速创建基金获取现金流,也让更多普通加密玩家和增量投资者可以接触到更多优质基金收益产品,放心地提供流动性。期待 Solv 为加密市场创造更多全新资产品类,带动更多增量资产入场,推动加密市场发展迈上新的台阶。感兴趣的用户,可以加入 Solv 社群。