OKX Ventures研报:重新思考预言机,看到及未被看到的

本文内容由 OKX Ventures 研究员 Sally Gu 提供,不构成任何投资参考。引用请注明来源,转载请联系 OKX Ventures 团队。

引言

随着 Vitalik 最近在文章提及终极预言机的问题, “预言机”重新走进加密社区关注视野。目前预言机已经在保险、金融、随机预测、物联网等多个领域和板块中有着不可替代的价值,OKX Ventures 的核心观点是只要链下数据还有价值,预言机这类中间件在整个Web3的叙述中将持续发挥关键作用。具体为如下几个方面:

• 在Web3生态系统的不断发展的背景下,可以预见的是 dapps 和平台增加会带动通过 oracle 调用数据源和 API 的需求膨胀。在未来 dapp 尤其是 defi 交易所很可能会整合一个以上的预言机(通常以一个为主要数据来源,以 1-2 个作为交叉验证的备份)来获取链下元数据,从而避免单个预言机延迟或被攻击,造成协议的难以承受的损失(类似 Venus 等协议事故)。

• 在投资机会上,尽管传统 defi 以数据喂价功能为主的预言机方向,短时间很难看到谁会打破 chainlink 的垄断,但在剩下的 10% 左右的市场上仍然可能存在第二名的竞争空间。此外,细分领域上的预言机,如L2、信用、NFT、DID 等几个方向都有值得注意的创新协议和叙事出现。

• 基于 DEX 和L1的经验,从增量市场需求和L2/ZK 以及细分的新兴场景维度来看,预言机赛道长远来看不可能只被一个赢家垄断。更大的发展潜力和市场空间仍然值得探索,比如链下计算场景、NFT 等非标链上资产定价和 AI/ML 的深度结合。

在下文中,我们将对预言机的概念、分类、应用场景及投资机会分别作出深入阐释。

事件背景

根据 Vitalik 最近的文章,他认为在未来一定会有一个信任机制更加有效的预言机协议出现。他在文中提到了自己的两个解决思路:

• 价格预言机:一种是不完全加密经济的去中心化预言机,一种基于验证器投票的预言机。

○ 后者主要通过紧急恢复策略而非诉诸L1共识来恢复。例如,价格预测器依赖于投票参与者有可能会被贿赂腐化的信任假设,用户可以提前获悉攻击预警,退出任何依赖于该预言机的系统。这类预言机可以故意在长时间延迟后才给予奖励,因而如果该协议失效,参与者不会得到奖励。

○ 价格预言机的提案主要基于以前提出的schellingcoin/point 机制,设想一个反向囚徒困境式的博弈论

○ 其核心思想还是保持链的简洁性,避免单个预言机失效直接造成链的硬分叉

• 更复杂的真相预言机:用于报告比价格更主观的事实

○ 类似于某种建立在不完全加密经济 DAO上的去中心化法院系统。

○ Rocket PoolOracle DAO 由节点组成一个 DAO 的思路应该也符合以太坊对于预言机发展的预期

○ 但根据 Vitalik 的思路来看,他似乎更倾向于第一种基于复杂博弈论的投票验证器方案。

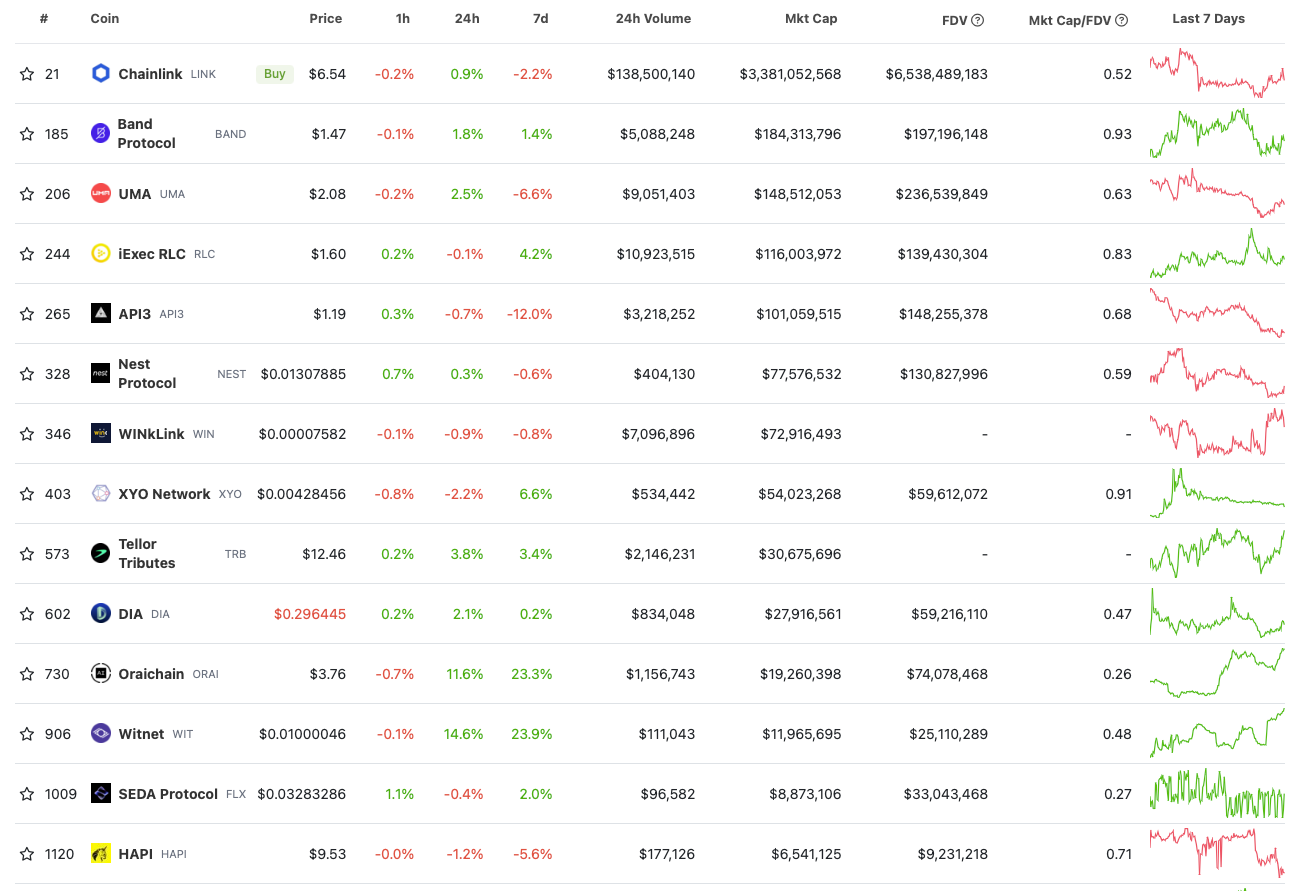

赛道数据

观察整体的预言机赛道数据,Chainlink 在市场中仍处于一家独大的领跑位置。在整个 defi 赛道的细分中,预言机作为核心的中间件却并没有获得很大关注,这一方面是由于多数协议币价缺乏实际用例,另一方面也是因为市场普通用户缺乏认知和学习动力。

• 但值得注意的是,参考赛道后几名比如 Band、UMA 的币价,其在历史上也有不错的表现。

• 此外,像 Gelato 等提供 automation、跨链和链下计算等类似服务的协议由于具备良好的基本面,随着团队逐步开始对 token 赋能增加 utility,也预期有很大的想象空间。

• 随着下一周期更多开发者的加入和 dapps 的出现,对 oracle 调用数据源和 API 的需求不可能逆向萎缩。大量未被激发的市场增量有可能带动板块腾飞。

综上,我们认为预言机,尤其是在细分赛道上的垂直预言机品类,依然可以被视为一个在中长期内值得关注的投资方向。

解读预言机

1.1 概念

预言机(oracle)通常被认为是串联链上链下数据的桥梁。简而言之,预言机是一个为区块链项目提供值得信任的链下数据服务的中间件。

我们需要预言机最大的原因是当前区块链本身所产生的信任还不足以支持上层应用程序的所有需求,所以需要预言机注入更多的信任:

• 目前链下和链上的数据量依然是不对等的,相比起拥有丰富数据类型和庞大数据量的链下真实世界,链上世界的数据量远远不足以支撑其完全脱离链下独立发展。 当前绝大多数协议如果没有接入预言机则会难以生存。

• 这也是为什么很多人说预言机对于区块链而言是“necessary evil 必要的邪恶”。等到有一天链上数据的丰富度超越了链下,变得足够厚了,我们其实也便不再需要依赖预言机或者类似的中继代理了,这也是很多 DEX 和 DeFi 协议非常执着于 oracleless 的链上原生设计的根本动因。

区块链是一个无法直接联网的封闭系统,智能合约无法直接调取互联网和现实世界的确定性信息,包括股票价格、汇率、总统大选的最终结果等,并且其由于共识机制也需要可信的第三方对数据进行验证。所以预言机扮演的更像是一个撮合链上链下信任的 broker 角色。

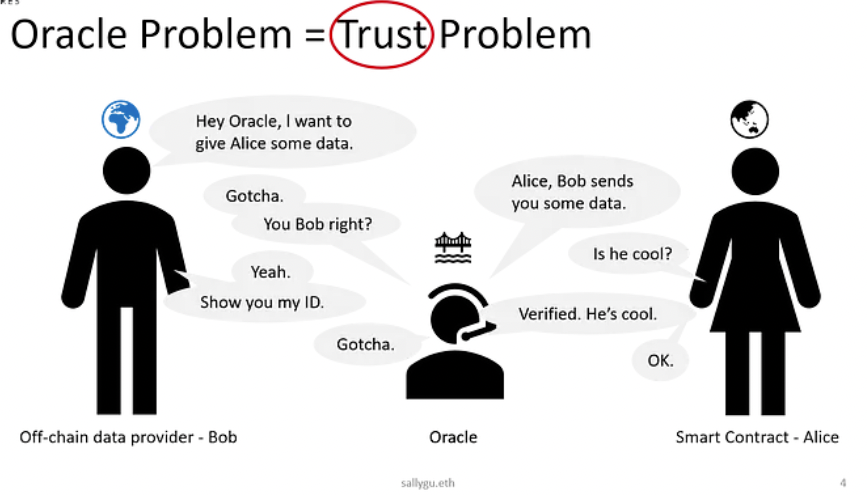

值得指出的是,这里预言机解决的关键问题:不是如何从现实世界获得信息(事实上任何人,你我他,都可以把链下的数据上传到链上),而是如何帮助区块链去信任来自现实世界的信息(就算你我他把链下的数据传到链上也没用,不会有人相信,进而也不会有人会采用,这里当然还涉及到诚实节点的问题)。

产生信任的是沟通,而不仅仅是连接。所以预言机的内在价值取决于其打通了链上链下的沟通渠道,也就是其通过转发、验证和筛选信息为来自链下的现实世界的数据注入信任的功能。所以,判断一个预言机的好坏关键点在于搞清楚它有“多大程度是值得信任的”。

1.2 分类

根据形式,我们可以根据预言机形式将其分为软件预言机、硬件预言机:

• 软件预言机:提供 API/SDK 等服务帮助协议访问和传输第三方服务器数据,如商品价格、天气指数、航班号等。

• 硬件预言机:硬件预言机在 IoT 中被广泛采用,常见如电子传感器和数据收集器。

根据数据来源,可以将其分为中心化预言机和去中心化预言机:

• 中心化预言机:通常只集成单个值得信赖的第三方如政府部门、官方机构、信誉良好的公司等提供数据。它的优势是可以将数据从本地设备的不受信任的操作系统中分离出来,防止数据篡改和丢失。劣势是单一中心化的数据来带来了单点失效的风险。

• 去中心化预言机:去中心化预言机是指具有分布式共识机制的预言机,也称为共识预言机。它从多个而非单个外部来源获取数据,因此它更加可靠且无需信任。

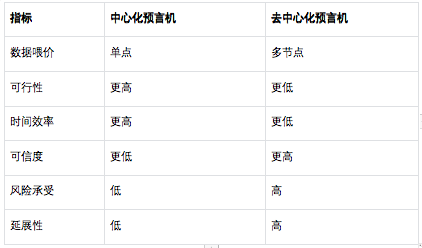

中心化 vs 去中心化

中心化预言机具有高效和可行性大等优势。而去中心化的预言机由于具备离散的多节点和交叉引用过程,所以更值得信赖,也更安全。

当效率不是主要目的时,中心化的解决方案就不是最可取的。显然,单个节点所提供的信息很可能是有偏见和独断的,在这种情况下,权威来自于专制而不是其可信度。

出于对信任风险管控的要求和担忧,大多数 DeFi 应用都基本直接采用 Chainlink 这样的第三方去中心化预言机而不是自己独立去做一个简单的中心化预言机或者自己跑节点搬运链下数据到链(再次强调项目方或个人就算自己传数据上链也无法取得社区信任)。

1.3 应用场景

2021 年 Chainlink 2.0 的白皮书首次引入DON(去中心化预言机网络)的概念。DON 是由一组 Chainlink 节点维护的网络,可以允许 Chainlink 通过无需信任的链下计算向区块链提供外部数据。为了达成愿景,Chainlink 推出了 VRF、Keepers、CCIP 等一系列产品和服务,从而进一步打开了预言机在 web3 应用场景。在下图中我们分别列出了预言机在 DeFi、NFT、GameFi、Social、DAO、跨链等几个不同场景的应用案例以供参考:

1.4 赛道图谱

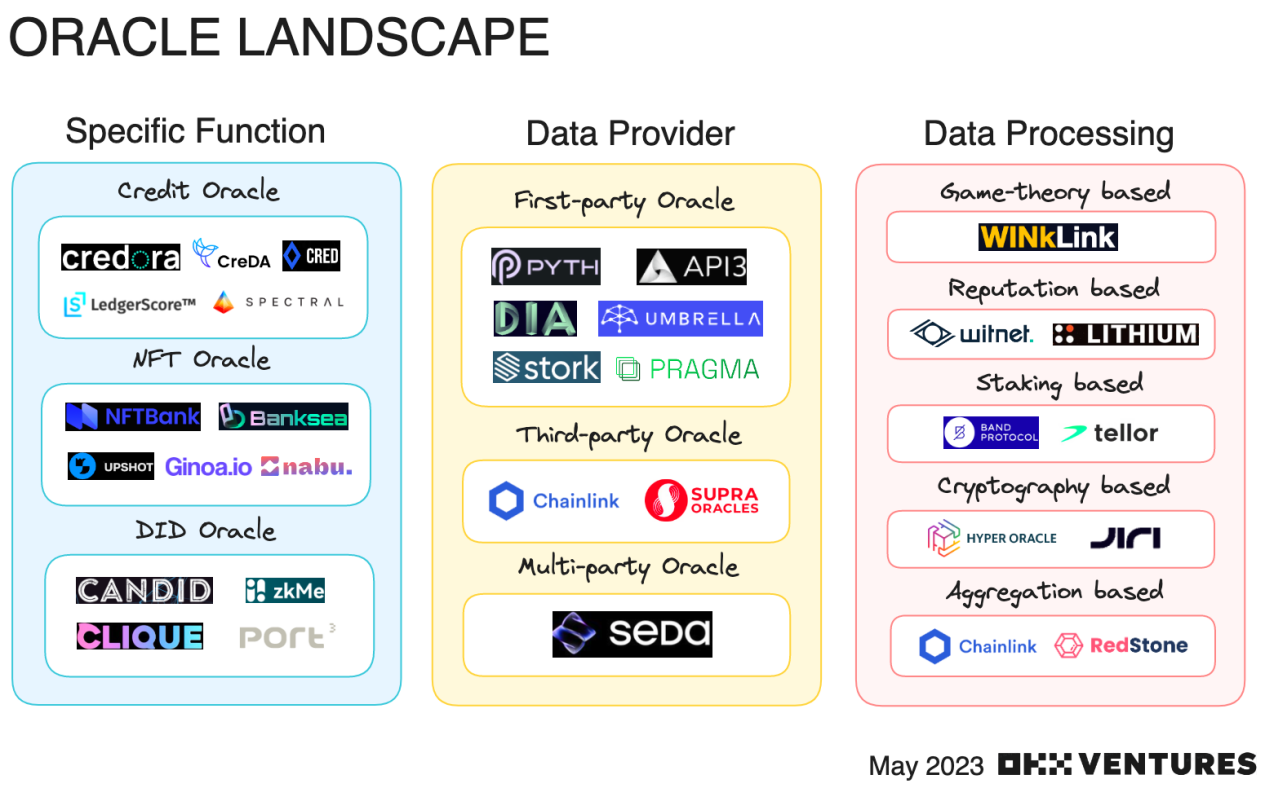

我们认为可以采用三个维度来对预言机进行简单的分类:

分别是根据具体功能,数据来源,和数据处理方式。

1. 根据具体功能,除了常见的 defi 预言机以外,这里列举了三种常见的类型:信用预言机、NFT 预言机和身份(DID)预言机。

2. 根据数据来源,可以分为三种类型:第一方预言机、第三方预言机和多方预言机。

3. 按照数据处理方式,可以分为五种类型:基于博弈论的预言机、基于声誉的预言机、基于质押的预言机、基于密码学的预言机和基于聚合的预言机。

投资机会预期

2.1 观点

A. 传统 defi 以数据喂价功能为主的预言机方向,短时间哪很难看到谁会打破 chainlink 的垄断(市场占有率 80-90% )。但在剩下的10% 左右的市场上仍然可能存在第二名的竞争空间:

○ 一个是这个项目有共识机制创新,Vitalik 给了两个方案未来可能会有理论落地的项目出现

▪ 以博弈论 game-theory 为核心,结合 PoS/PoW

▪ DAO 委员会/去中心化法院的形式

○ 一个是在功能性价比上有大幅提升,喂价或者随机数生成比 Chainlink 更加便宜,比如 Redstone,Ontropy 等声称其喂价可以相比 Chainlink 等传统方案便宜 80-100 倍的。因为一般而言只有在大幅降低调用成本的前提下,defi 或 gaming 项目方出于经济效益考虑才会可能为用其取代 chainlink 等原先的服务提供方。

B. 细分领域上的预言机,L2、信用、NFT、DID等几个方向都有潜在机会:

○ L2预言机主要是 op/zk 两种生态的原生解决方案,低延迟和安全性应当是核心关切要素,喂价便宜相对次要

▪ 要考虑到 chainlink 的在 non-EVM 各种链上的扩张进度,如果某条链上喂价已经基本全部被 chainlink 垄断则竞争难度会大大提升。

▪ L2 oracle 很大程度上应该是切衍生品交易所的高频交易诉求(L2更够提供更高的 tps 支撑因而可以支撑起链上去中心化衍生品交易),类似于 pyth、empiric 这样喂价更精细 or 数据集成过程更鲁棒(比如直接做 on-chain first party 数据集成+验证,这样就不需要链下节点了)的预言机协议

▪ 如果tokenomics 设计合理加入更多的 utility(Chainlink 的 tokenomics 设计由于缺乏 utility 曾经饱受诟病,但后期出现了 LinkPool 类似的流动性质押+生息协议,在一定程度上激活了流动性),我们认为通常预言机协议的币价可以期待有一个较为平稳的表现。

○信用预言机结合链上信用扩张理论,很可能会在下一个周期引爆

▪ 链上信用评级系统的完善和健全是是构建链上保险和追偿机制的前提,因此其在整个 defi 的发展和演进过程中扮演着重要角色。在上文等赛道图谱中我们已经给出了几个信用预言机的案例: CreDA\Cred Protocol\LedgerScore\Spectral\Credora: Infrastructure for Institutional Credit, etc.

▪ 就这个具体的细分方向而言,我们认为应该更多地关注同类型产品在链上数据验证和整合的差别(链上数据的覆盖度、清洗能力和信用评级精确性等)。此外,如果团队有很强的金融工程背景或精算能力会是不错的加分项

▪ 与此同时,我们也注意到链下信用系统上链的整个工程会比预期更加复杂:

• 一方面,单个项目很难直接和某国的社会信用体系联动,一个关键的问题可能是:链下的经济行为活动真的能够为链上的信用能力背书吗。不过像 Spectral Finance 这样本身 BD 能力较强,直接和美国大型信用评级机构合作也许是个很好的解决方案。

• 另一方面,集成链下公开的信用数据上链本身壁垒不高(传统互联网的云团队理论上都具备能力研发并落地相关功能)。

○ NFT 预言机主要分为两种思路:

▪ 一种是twap 时间加权平均,当然也有用 moving average 的

• 目前还无法实现 vwap 因为交易量不够,考虑到 NFT 本身非流动性非同质的属性,短时间我们也不太可能预见 NFT vwap 的实现。

• chainlink、DIA 几个传统的 defi 预言机目前已经提供 NFT 的 twap 喂价服务,很多会直接采用 chainlink 的 twap 方案。

• 与相关技术团队沟通后,我们倾向于认为当下大部分 NFT twap 喂价功能仍在初步阶段,集成方式存在一定优化空间,但总体而言这个方向发展前景不大。

▪ 一种是采用AI/ML 结合的链下计算估值定价方案,我们认为相对更有前景。

• 可以在后期进行一些横向集成,转型成为full-stack 的 NFT 数据分析+购买+评估应用(NFT 现货的流量入口和流动性激活方案)是一个不错的潜在场景。

• 但这类方案因为算法不开源基本是黑盒,很难获取合作协议信任(如 upshot,banksea,尽管在融资层面取得了不错的成绩,但由于项目难以在短时间内创造收入来源或发币,盈利靠的是其他衍生业务,比如钱包数据分析和市场集成服务收手续费)。

• Nabu 类似的开源 ML 也许是一个不错的透明方案,但其未来的盈利能力仍然很难预测。不过如果类似协议能够转型为一个开源 ML 模型 DAO+发币,参考安全赛道的 Forta/Go+等商业化思路,理论上发展前景也有不错的想象空间。

○ DID 身份预言机就是集合用户链下数据上链为需要身份验证和绘制社交图谱的协议服务,这个细分领域长期来看有着很高的价值度。

▪ Chainlink 旗下的 CanDID(DECO)团队依靠高度优化的多方计算和零知识证明技术试图打造一个去中心化的链上身份基础设施。类似 legalDAO,Intuition 等 zkDID 项目也在通过设计 DAO 委员会类型身份验证服务提供相似的解决方案。

▪ 不过,目前大部分看到的身份预言机基本都是中心化的,壁垒很低(虽然大部分打算以后转型成为去中心化形式,但未实际落地很难验证其可行性)。

▪ 同时需要重点关注其验证过程(比如节点质量如何,验证是否可信)和存储用的是什么怎么实现的。

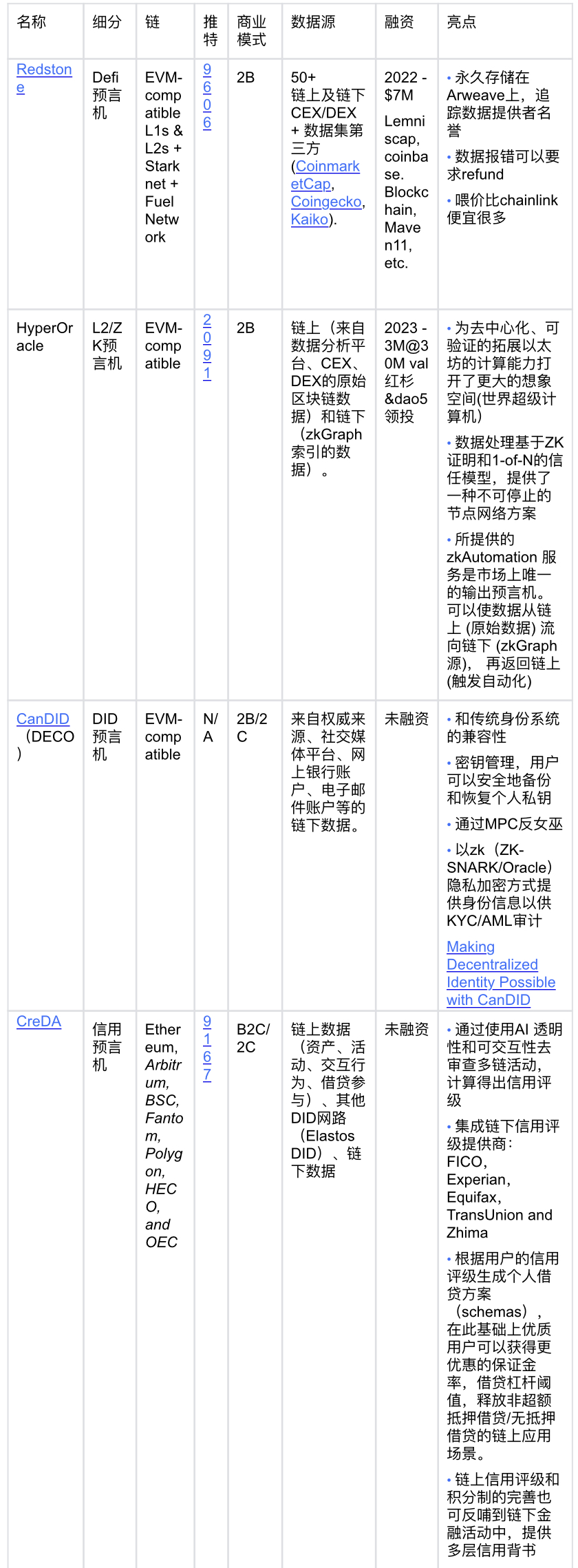

2.2 案例

依照上文给出的投资观点,我们在每个细分方向上分别选取了一个案例进行简单分析以供参考。

综上,OKX Ventures 认为随着区块链技术的不断发展,预言机在下一周期内仍然讲将在加密赛道中扮演不可或缺的重要一环,更大的发展潜力和市场空间仍然值得探索,比如链下计算场景、NFT 等非标链上资产定价和 AI/ML 的深度结合。我们也将对预言机赛道的创新协议和投资机会保持密切关注。