在空投之后,Blur能否颠覆OpenSea的主导地位?

Mar. 2023, Daniel

数据源: NFT Aggregators Overview & Aggregator Statistics Overview & Blur Airdrop

一年前,通过聚合器进行的 NFT 交易量开始像滚雪球一样增长,有时甚至超过了直接通过市场平台的交易量。

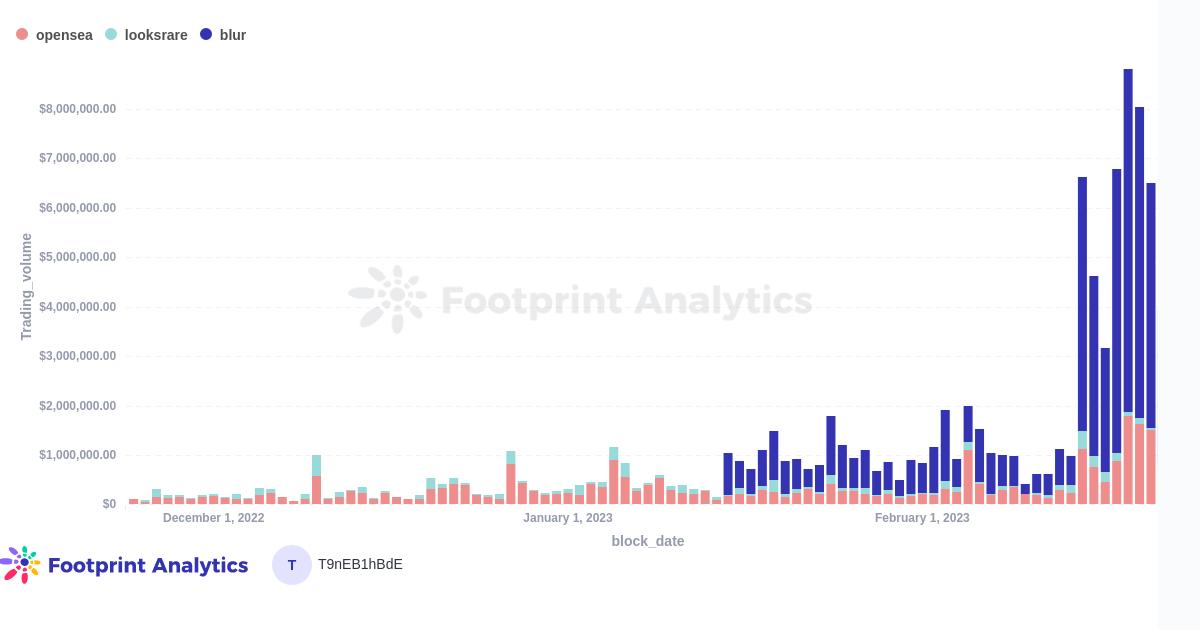

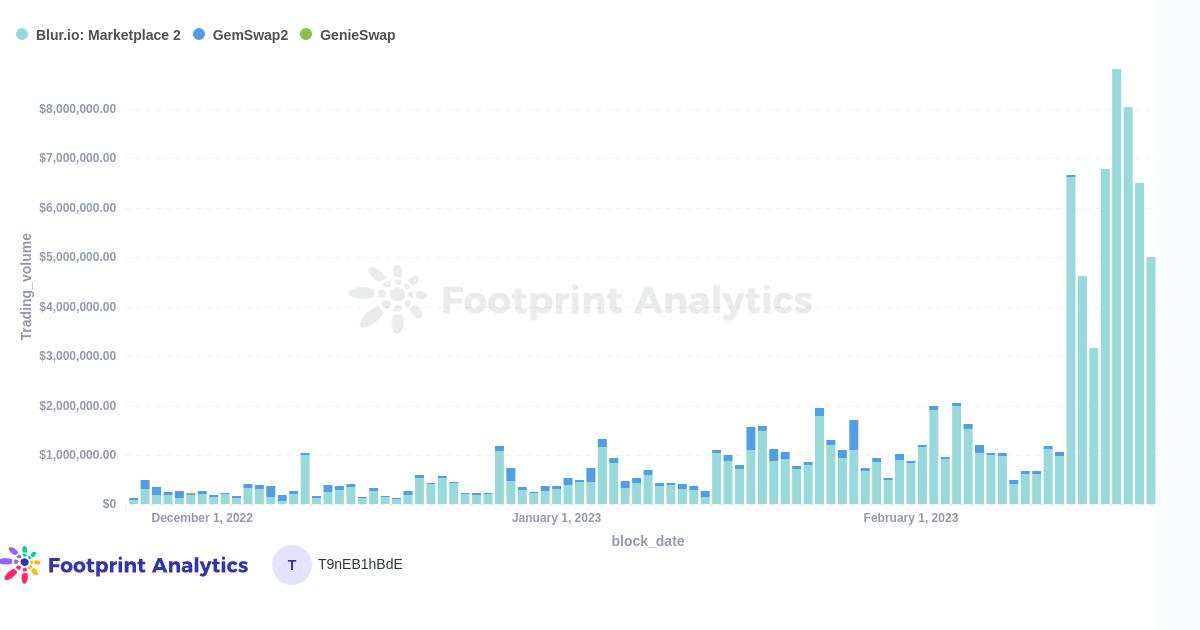

虽然聚合器的使用量从 10 月到 1 月有所下降,但 Blur.io 此后在 2023 年爆炸性增长,甚至与 OpenSea 就版税问题进行了公开对峙。

本月,Blur 在交易量上超过了 OpenSea,并发生了大规模的空投事件。

Blur Aggregator Trading Volume vs. Marketplaces

在过去的一年里,Footprint Analytics 一直在报道聚合器的崛起。然而,这些平台是什么,它们能给市场带来什么价值?赠送 3 亿 Blur 代币的 Blur Airdrop 是什么?从这次空投来看,Blur 相对于其竞争对手的表现如何?

什么是 NFT 聚合器?

NFT 聚合器是策划和展示来自不同市场的 NFT 的平台或网站,允许用户在一个地方浏览和发现来自不同来源的 NFT。它们将来自多个区块链和市场的 NFT 聚合起来,如 OpenSea、Rarible 和 SuperRare,并在一个统一的、用户友好的界面上展示它们。

NFT 聚合器通常提供各种功能,如搜索和过滤选项、可定制的观察清单和价格提醒,以帮助用户找到符合其标准的 NFT。一些 NFT 聚合器还提供服务,如投资组合跟踪、NFT 估值工具和社交功能,使用户能够与其他 NFT 收集者互动。

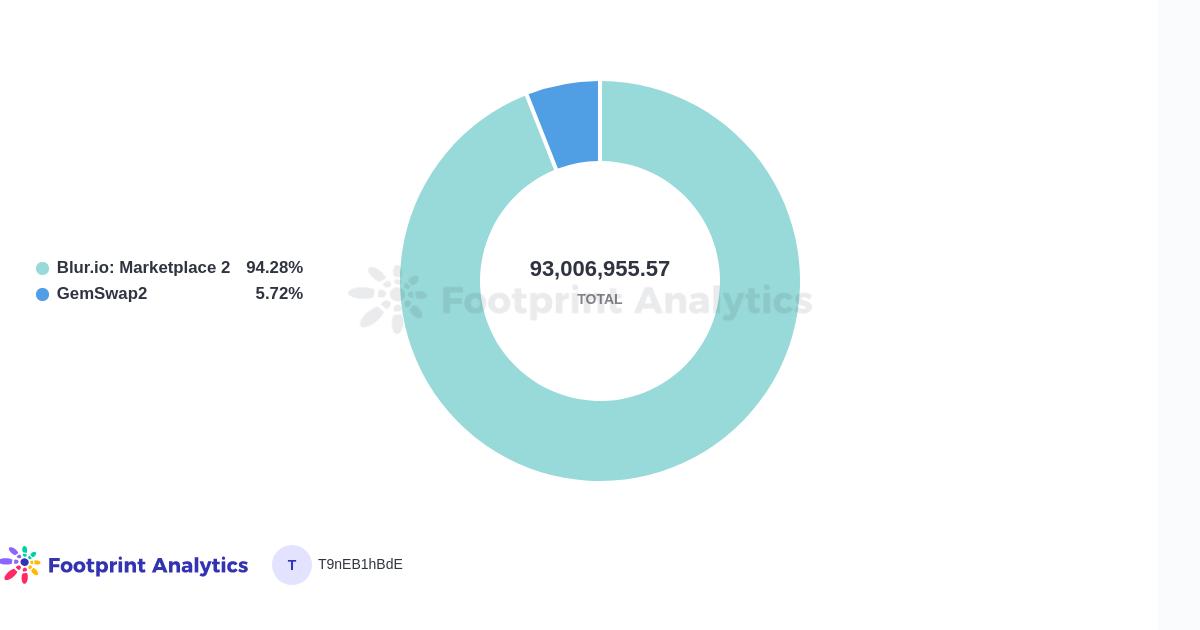

Blur 占据了大部分的市场份额

Blur 的功能是为 NFT 专家交易者和炒家明确定制的。Blur 的交易费用为零,并纳入了扫货功能——即以其底价购买许多 NFT——如高级批量购买。

其他方便交易者的功能包括交易分析和项目识别,以及项目的上架列表。它还声称比市场平台和其他聚合器更快。

在熊市中,公众对 NFT 兴趣不大,但内部人士和交易商却在持续活动,Blur 的定位和技术使其能够超越更多的初学者友好平台。

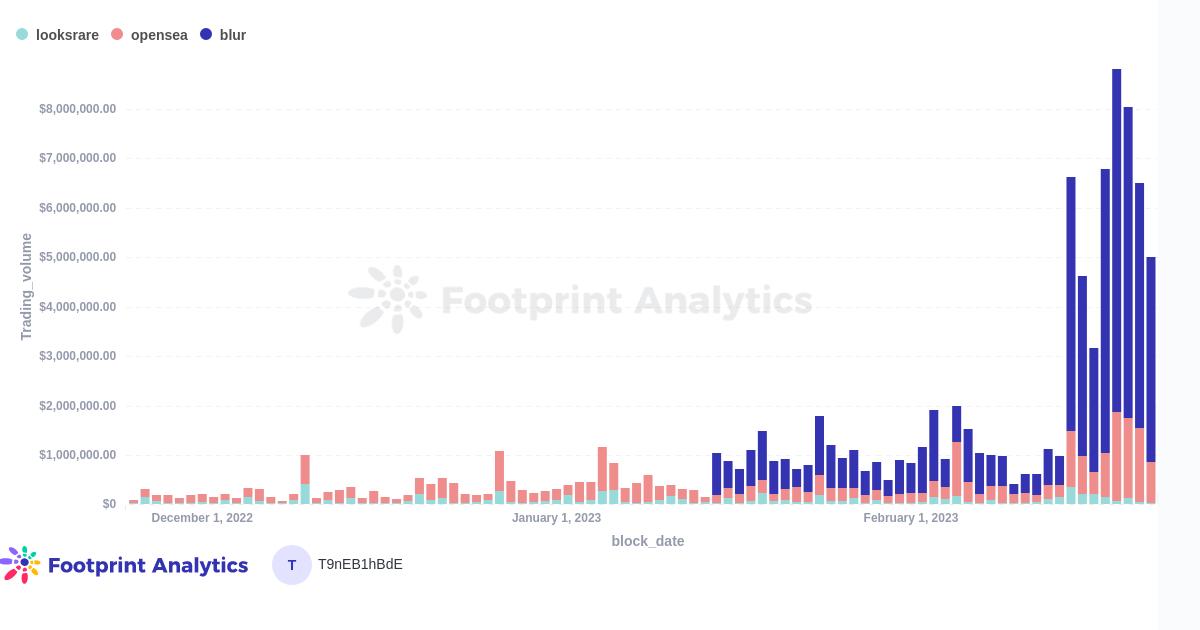

Blur Aggregator Trading Volume by Marketplace

除了它的功能,它的大规模空投是其营销战略的重要组成部分。

Blur 空投是什么?

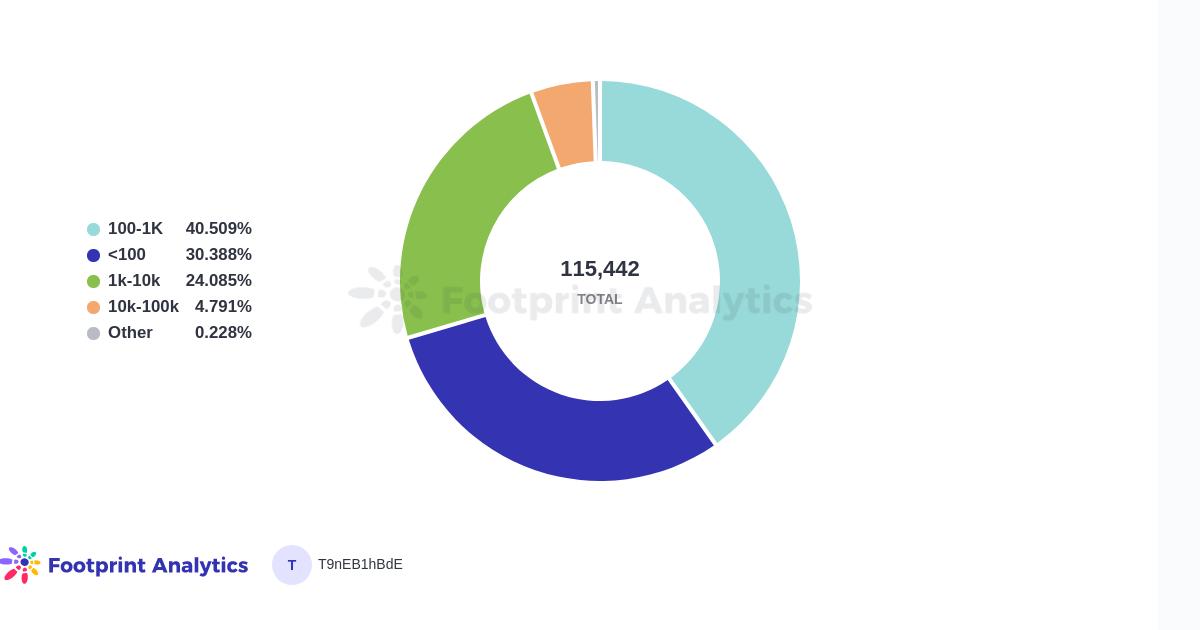

助长 Blur 人气的因素之一是其拖延已久的空投,该空投已于本月交付。根据 Footprint 的数据,自2 月 14 日以来,有超过 26, 000 名新用户被带到 Blur 市场,占平台上总交易者的 22% 。

此外,在这些新用户中,有超过 2 万名用户是从其他市场上带来的,这使得空投成为一次成功的吸血鬼攻击。

Blur 在 2 月 14 日推出了第一轮空投,投放了 "关怀包",可以向之前 6 个月内交易过的所有人兑换 BLUR 美元。第二轮空投是针对 11 月前在 Blur 上积极上市的交易者。空投 3 将是针对在 Blur 上出价的交易者,将是最大的一次 Blur 空投(大约是空投 2 的 1-2 倍)。

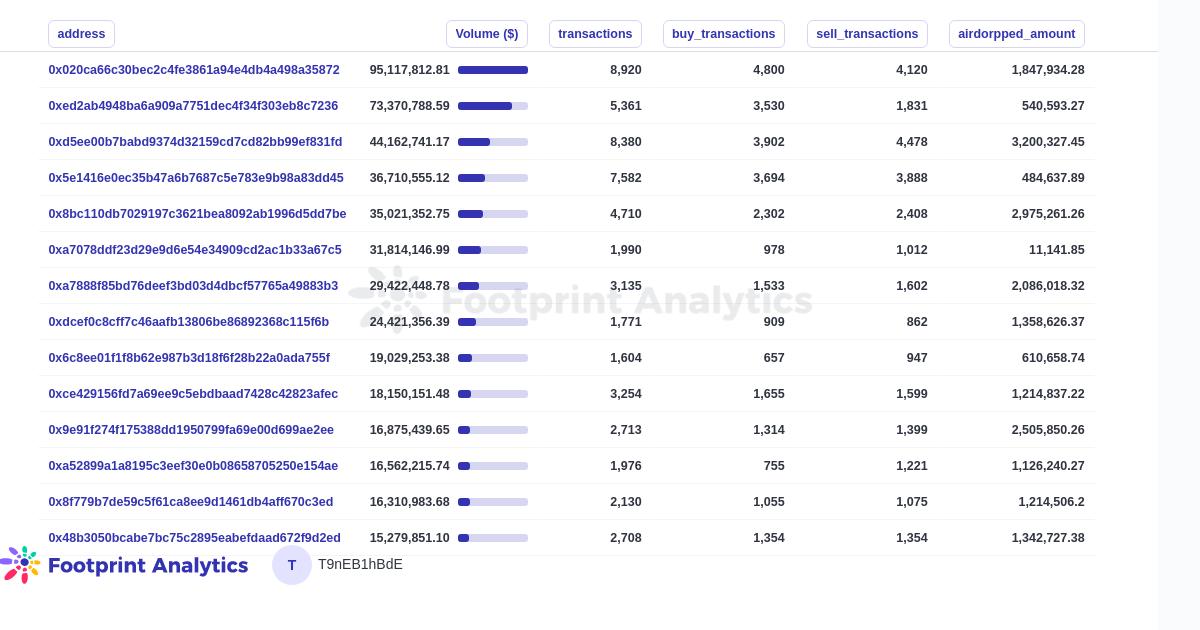

Transaction Volume of Blur Airdrop Addresses

分发的 BLUR 美元总金额为 3.6 亿,其中 94% 已经被领走。虽然大多数收款人的钱包收到的金额在 1 千以下,但有 4.7% 的人收到了 10 K-100 K。2 月 22 日,$BLUR 的价格是 1.06 美元。

排名第一的地址,在 Blur 的交易量中达到了惊人的 9, 500 万美元,收到了 180 万。然而,最大的空投接收者(获得 320 万美元)的交易量为 4, 400 万美元。

2023 年 Blur 与竞品 之间的竞争

自 1 月以来,Blur 的交易量已经增长到聚合器市场的 94% ,而 OpenSea 的竞争对手 Gem 只有 6% 。Gem 的目标市场与 Blur 相似,即有经验的交易者。

今年早些时候,Gem 似乎有现实的机会成为顶级聚合器,在某些日子里,其交易量约为 Blur 的一半。然而,自从空投开始后,Blur 已经完全超越了 Gem。

值得关注的是,大约15% 的交易量是由使用该平台的前 15 名交易者完成的。

Aggregator Daily Trading Volume (Share)

本文来自 Footprint Analytics 社区贡献。

Footprint Community 是一个全球化的互助式数据社区,成员利用可视化的数据,共同创造有传播力的见解。在 Footprint 社区里,你可以得到帮助,建立链接,交流关于 Web 3 ,元宇宙,GameFi 与 DeFi 等区块链相关学习与研究。许多活跃的、多样化的、高参与度的成员通过社区互相激励和支持,一个世界性的用户群被建立起来,以贡献数据、分享见解和推动社区的发展。

Footprint Website: https://www.footprint.network

Twitter: https://twitter.com/Footprint_Data