2022 年の新しい仮想通貨ユニコーン トップ 10 を概観

原作者: wesely

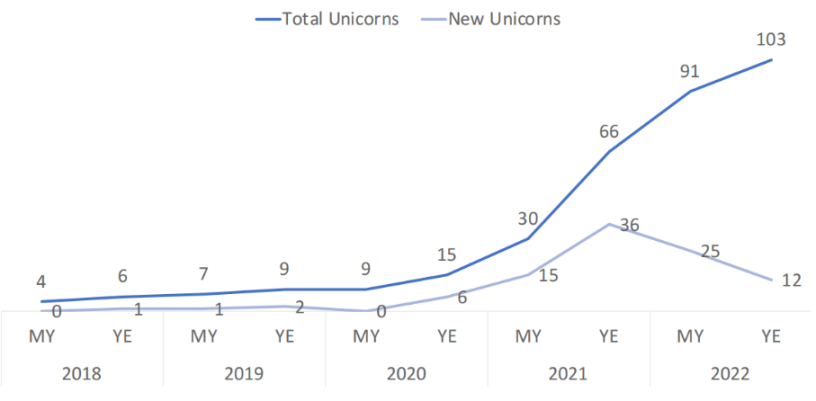

ユニコーン企業とは、一般に評価額10億ドル以上の新興企業を指しますが、ブロックチェーン投資プラットフォームであるブロックチェーン・コインベスターズが発表した最新レポートによると、12月初旬現在、ブロックチェーン業界におけるユニコーン企業の累計数は、ユニコーン企業の半数以上は北米にあり、過去最高の 103 社に達しました。

画像の説明

2018 年から 2022 年のブロックチェーン暗号化ユニコーン ビジネスの成長曲線データ ソース: Blockchain Coinvestors

1. マターラボ (zkSync)

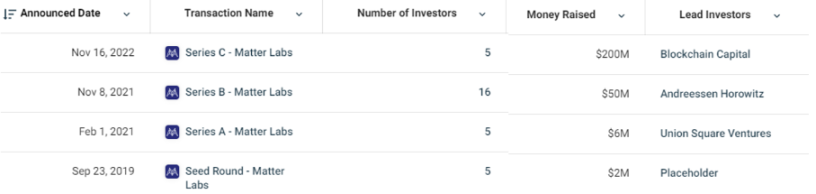

zkSyncの開発会社であるMatter Labsは、今年11月16日にBlockchain CapitalとDragonflyが主導する2億ドルのシリーズC資金調達を完了しており、評価額は明らかにしていないが、競合他社であるStarkNetの資金評価額と比較することができる。値を比較できます。

昨年11月、StarkWareはSequoia Capital主導による5,000万ドルのシリーズC資金調達を評価額20億ドルで完了し、レイヤー2分野で2番目のユニコーン企業となった(1番目はArbitrum)。は再び評価額80億ドルで1億ドルのDラウンドを完了し、レイヤー2分野で最も高い評価額を持つプレーヤーとなった。ただし、zkSyncは、プロジェクト開発の位置づけ、投資背景、プロジェクトの人気などの点でStarkNetと似ています。弱気市場の影響を考慮しても、zkSyncのCラウンド資金調達額はStarkwareのDラウンド資金調達の2倍であり、zkSyncの評価額も高くなります。より低い場合もあれば、より高い場合もあります。

画像の説明

Matter Labs の資金調達データ ソース: Crunchbase

2. ユガラボ

Yuga Labs は、NFT 分野の現在のリーディングカンパニーとして、BAYC プロジェクトの設立から、2022 年 3 月 22 日に評価額 40 億米ドルで 4 億 5,000 万米ドルの資金調達を完了するまで、わずか 11 か月しかかかりませんでした。 、これは奇跡とも言えますが、同時にこの資金調達はNFT分野での単一資金調達額の最高記録も打ち立て、彼を2022年の新しいユニコーンの1人にしました。

さらに、Yuga Labs は BAYC、BAKC、Meebits、MAYC、CryptoPunks などのトップ IP を買収やデリバティブ発行を通じて所有しており、年初の NFT 市場ではこれらのプロジェクトだけで時価総額が一時は市場の半分を占めていました。 NFT市場全体が国内にあります。その後、NFT OthersideやBAYCトークンAPEの再発行などで多額の資金と人気を集め、Yuga LabsはNFT分野における「空母」と言える存在であることは間違いありません。

しかし弱気相場の下、Yuga Labsも苦境に立たされている。

NFT製品の下限価格が下がり続ける中、アメリカの法律事務所Scott+Scottは以前、Yuga Labsが有名人の推薦を通じて価格をつり上げているとして集団訴訟を起こし、カリーやジャスティンなどの有名人も同様の理由でYuga Labsを告発した。 BAYCは「Boring Ape」のプロモーションを巡り、一部の投資家から訴訟を起こされている。それでも、他の有名なNFT発行会社と比較して、Yuga Labsはこの寒い冬にはるかに豊富な資本準備金を持っています。

3. アプトス(アプトス・ラボ)

Aptos は Move パブリック チェーンの代表的な企業の 1 つです。元 Meta (Facebook) 従業員によって設立されました。2022 年 3 月と 7 月に、a16z が主導する 2 億ドルの投資と、FTX Ventures/Jump Crypto が主導する 1 億 5,000 万ドルの投資を獲得しました。米ドルでの資金調達後、その人気は急上昇し、すぐにパブリック チェーン界のトップに食い込み、評価額は 27 億 5,000 万米ドルとなり、今年昇格した最初のパブリック チェーン暗号化ユニコーンとなりました。

フィナンシャル・タイムズ(FT)紙が明らかにしたFTX投資詳細によれば、FTX主導による1億5000万米ドルのAラウンド資金調達では、FTXだけで7500万元近くが投資されたことは言及に値する。 Aptos Labs または Aptos Foundation から資金を保有していますが、FTX は依然として中核株主の 1 つです。

10月18日、Aptosは独自のトークンを正式にローンチし、同時にテストネット参加者に大量のエアドロップを配布し、執筆時点でAptos Liuの流通市場価値は約5,700万米ドルで、63位にランクされています。

4. 不変

2022年3月、イミュータブルは評価額25億米ドルで2億米ドルの資金調達を完了し、今年5番目の新しい暗号通貨ユニコーンとなった。

Immutableは2018年に設立され、当初はFuel Gameという名前でしたが、2019年にImmutableに社名を変更しました。チェーンゲーム「Gods Unchained」、「Guild of Guardians」、NFT取引プラットフォームImmutable Xなど、さまざまなプロダクトを次々とリリースしてきました。

その中で、Immutable X は Starkware チームによって開発された StarEx テクノロジーに基づいて構築されており、徐々にイーサリアム NFT の独占的なレイヤー 2 になりました。その公式ウェブサイトのデータによると、執筆時点で、2022 年までにミント NFT の総数が増加します。 Immutable X プラットフォームでは 5,570 万件以上のトランザクションが行われ、年間トランザクション数は 960 万件以上に達します。

5.スイ(ミステンラボ)

上記のSuiとAptosは同じMove派に属しており、このプロジェクトはMysten Labsが開発したもので、今年9月にSuiは20億ドル以上の評価で3億ドルのBラウンドを完了し、そのうちFTXが約100ドルの投資を主導した。また、FTXを約束するSuiトークンは100万以上あり、Suiのトークンはまだオンライン化されていないが、前回の資金調達ラウンドで調達された資産の割合から判断すると、FTXの雷雨の影響を受けることは避けられない。 Move パブリック チェーンは、特に Aptos エアドロップ、そのコミュニティ活動、プロジェクト開発などの刺激を受けて、他の新しい L1 と比較して、依然として弱気市場で高い人気を維持しています。

6. 楽観主義

4 つの主要なレイヤー 2 プロジェクトの 1 つとして、オプティミズムは 2022 年 3 月に評価額 16 億 5,000 万米ドルで 1 億 5,000 万米ドルの資金調達を完了し、Arbitrum と StarkNet に次いで評価額 15 億米ドルを超える唯一のレイヤー 2 プロジェクトとなりました。 Optimism は評価という点では 4 つの主要な L2 のうち他の 3 つほどの価値はありませんが、その中でトークンを発行し、それを使用して独自のエコロジーを構築した最初の L2 です。

オプティミズム R&D チームは、旧イーサリアム サイドチェーン ソリューション研究組織である Plasma Group から発展しました。2022 年 6 月 1 日、ネットワークのネイティブ トークン OP が正式に開始されました。エアドロップと流動性インセンティブを通じて、チェーン上の TVL は、アクティブになるとすぐに Aribitrum を上回りました。チェーン上の L2 と、頻繁に言及される他の 2 つの L2 プロジェクト、Metis と Boba も Optimism から分岐しました。

しかし、FTXの雷雨事件と市場の転換の影響で、明るい瞬間と比較すると、オプティミズムチェーンのTVLはほぼ半分に減り、競合他社のアリビトラムはエコプロジェクトのダークホースであるGMX、TreasureDAO、Theに依存しています。ビーコン等はFTX雷雨で発生したTVLの下落を回復しただけでなく、若干の増加を達成しており、12月中旬時点で楽観主義とアリビトラムの連鎖上のTVLは5億5,000万ドル、10億2,000万ドルとなっている現在の比較から、後者の生態学的発展の回復力は大幅に充実しています。

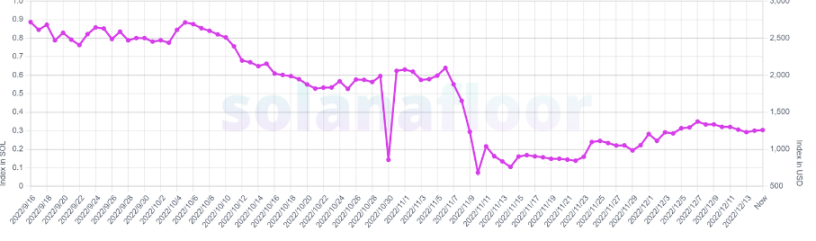

7. マジックエデン

Solana の主要な NFT 取引プラットフォームとして、Magic Eden はこのチェーンの取引量の大部分を占めています。コンセンシスが発表した統計によると、マジックエデンプラットフォーム上のNFT取引は11月にはソラナNFT取引市場全体の85%を占め、今年6月にはその割合は92%にも達した。

画像の説明

SolanaFloor NFT ブルーチップインデックスのデータソース: solanafloor

8. アレオ

今年2月、有名なゼロ知識ZKプライバシーパブリックチェーンであるAleoは、ソフトバンク・ビジョン・ファンドIIと有名な米ドルが共同主導し、評価額14億5,000万ドルで2億ドルのBラウンド資金調達を完了した。ヘッジファンドの Kora Management も、Aleo は仮想通貨ユニコーンのファミリーに正式に加わり、プライベートでプログラム可能なアプリケーションをサポートする初の分散型オープンソース プラットフォームです。

著名な機関投資家の背景、総額 2 億 2,800 万米ドルの資金調達、Google、Amazon、Meta などから集められたプロジェクト チームにより、Aleo はすぐに非常に期待されるパブリック チェーン プロジェクトになりました。トクネはまだリリースされていないため、多くのウール部隊の標的となっており、これまでのテスト活動も新たな高みに達しました。

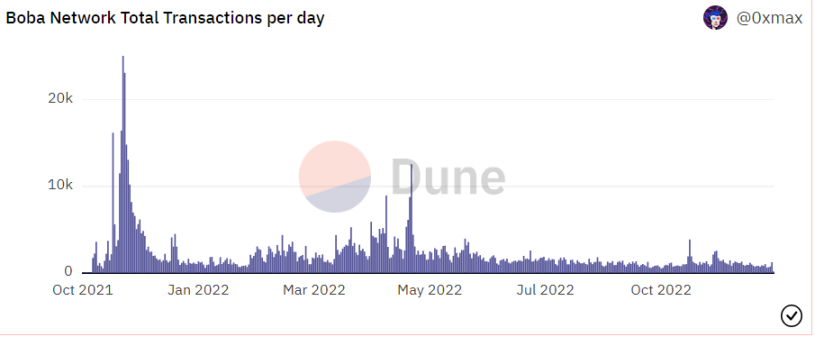

9. ボバネットワーク

Boba Network は、OMG Foundation によって立ち上げられました。OMG Foundation は、以前はプラズマ拡張ソリューションに重点を置いていましたが、その後、Optimistic Rollup の急速な開発に伴い、研究の焦点をこの分野に移し、独自のレイヤー 2 拡張ソリューションを立ち上げました。 ——Baba Network、その後、OMG ホルダー向けのエアドロップの波が起こりました。

ボバネットワークは4月6日、評価額15億ドルで4,500万ドルのAラウンド資金調達を完了したと発表、評価額の観点からはユニコーンの判断基準を超えているが、この点は注目に値する。ラウンドの資金調達 11 は Boba Network のオリジナル トークン (BOBA) を販売する形で完了し、そのトークン価格は資金調達時の 1.69 ドルから現在 0.18 ドルに下落しました。

画像の説明

Boba の毎日のオンチェーン トランザクション データ ソース: dune: 0 xmax

10.5 アイアチェーン

今年7月、L1チェーンネットワーク5ireは英国の複合企業SRAM&MRAMグループ主導によるシリーズAラウンドで1億米ドルの資金調達を完了し、評価額は15億米ドルとなった。ただし、ファイナンス情報からプロジェクトの信頼性に至るまで、5 ire は疑問に満ちていることは注目に値します。ただし、CB Insight と Blockchain Coinvestors の関連レポートでは、5 ire が新しいユニコーンのランクに含まれているため、以下に従ってランク付けします。 2022 年の新しい仮想通貨ユニコーンのリストに含めます。

2021 年 8 月に、5 ire は数人のインドの起業家によって設立されました。彼らは 5 ireChain を「第 5 世代ブロックチェーン」と呼んでいましたが、いわゆる第 5 世代の技術的特徴は彼らのホワイトペーパーには詳しく記載されていませんでした。白書をまとめるなど、人気のある科学コンテンツが多数含まれています。さらに、チェーンキャッチャーが拾ったプロジェクトファイナンス情報の矛盾、公式サイトに表示された誤った情報、投資家のホワイトネーム申請の押し付けなど、さまざまな不審点がこのユニコーンプロジェクトに危険をもたらしている。弱気相場に突如現れたラベル。

結局のところ、ユニコーンは弱気市場から必ずしも安全なのでしょうか?

ブロックチェーンコイン投資家の統計によると、2022年には、Opensea、Blockchain.com、Robinhood、Geminiなどの暗号化企業だけでなく、かつての暗号化ユニコーン企業であるDeribit、BlockFi、FTX、Genesis Digital Assetsもすべてリストから外れている。も今年複数回の人員削減を開始しており、Genies、Grayscale、Babel Finance などの大手暗号化機関は危機的な状況にあります。

この寒い冬が続く発展の中で、多くの暗号化されたユニコーンが必然的に倒れるでしょう。ユニコーンは過去を証明しますが、未来はまだわかりませんが、少なくともこの寒い冬を生き延びることができる人々はそれほど悪くはありません。