7개의 탈중앙화 옵션 프로토콜 살펴보기

원작자: 친칠라

보조 제목

Opyn

Opyn은 현재 이더리움에 배포된 TVL이 5,400만 달러로 가장 큰 옵션 프로토콜이며 아직 거버넌스 토큰을 발행하지 않았습니다. 두 가지 고유한 기능을 제공합니다.

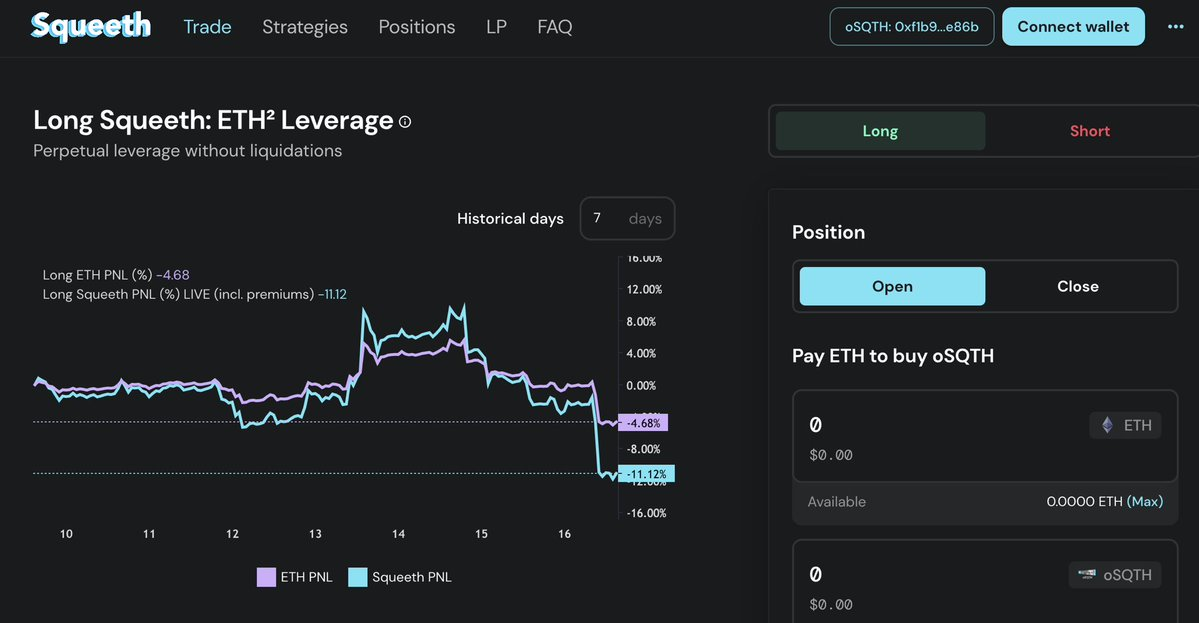

첫 번째는 Squeeth로 사용자가 롱 포지션을 취하면 ETH(Eth^ 2 )의 제곱을 나타내는 ERC-20 토큰 "oSQTH"를 구매하게 됩니다. 따라서 상승할 때 sSQTH를 보유하는 수익이 높아지고, 하락할 때 손실도 커집니다.

사용자가 숏 포지션을 취하면 ETH를 담보로 Squeeth를 매도하는 것과 같은 옵션 수수료를 받게 됩니다.

보조 제목

Premia Finance

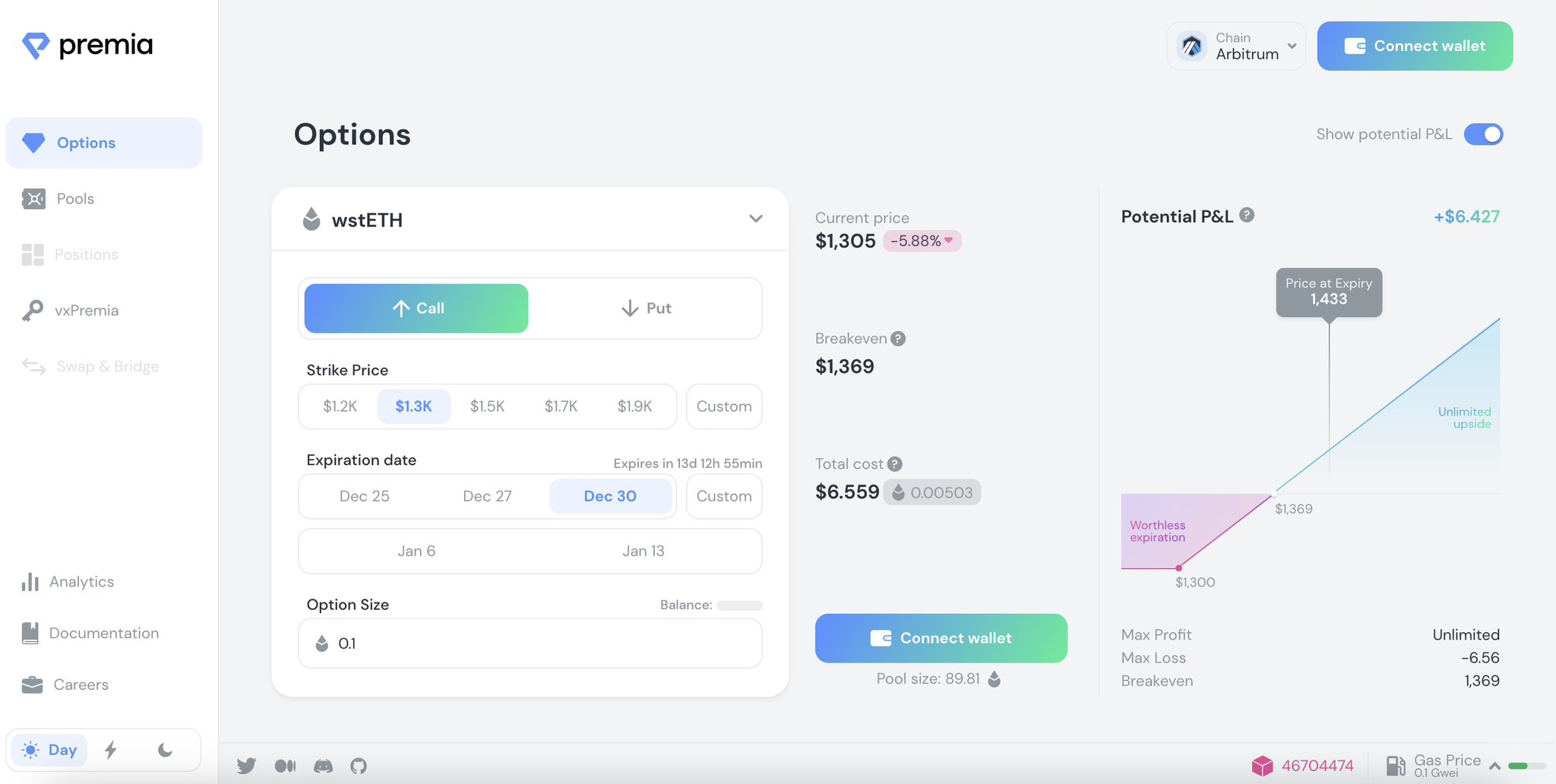

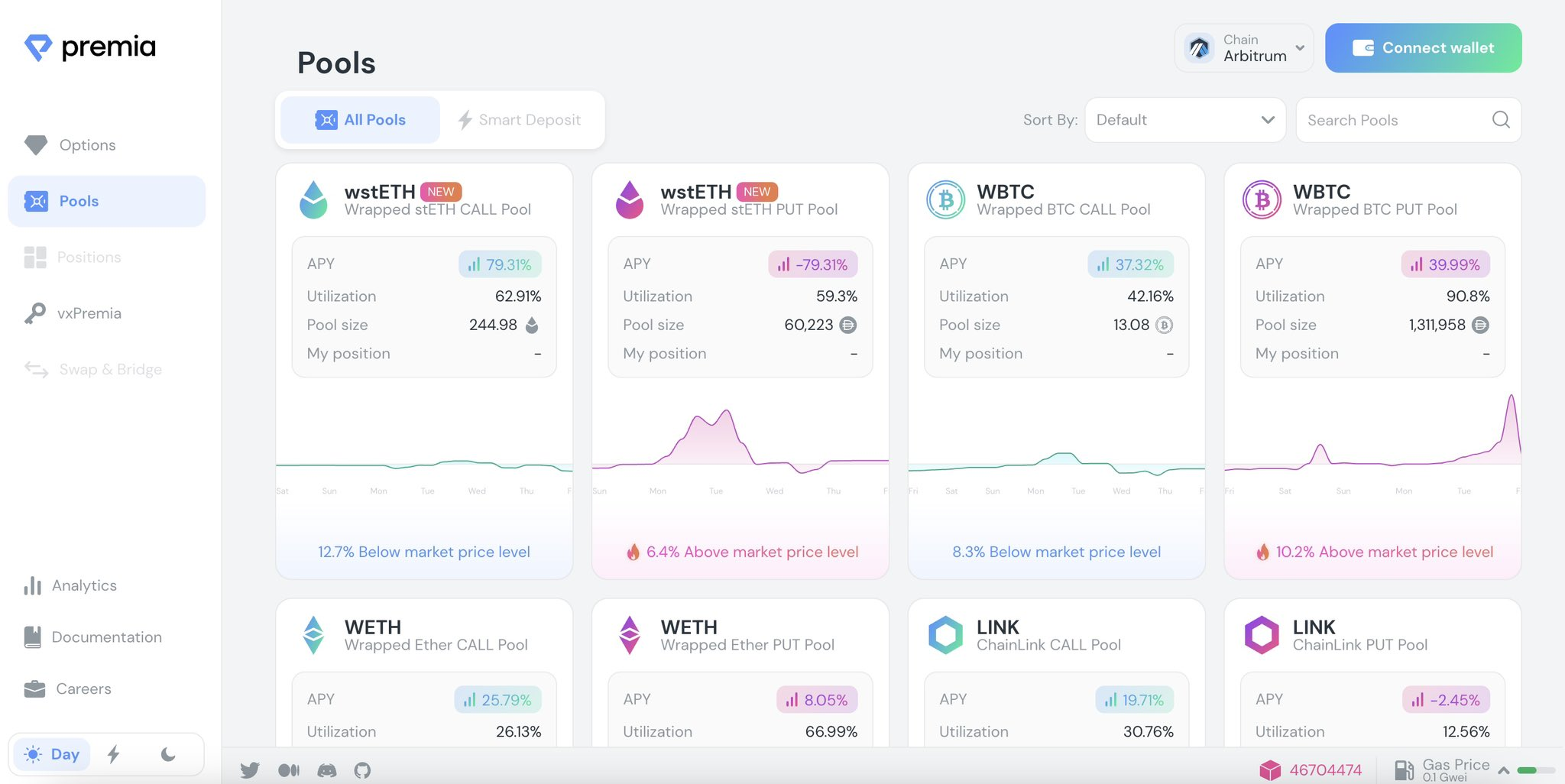

Premia는 Arbitrum을 포함한 여러 체인에 배포되었으며 총 TVL은 700만 달러입니다. Premia의 사용자 경험은 매력적이며 모든 것을 쉽게 찾고 시각화할 수 있으며 만료 전이나 후에 언제든지 옵션을 행사할 수 있습니다.

Dopex와 마찬가지로 사용자는 Premia의 유동성 풀에 유동성을 제공하고 토큰 보상을 받을 수 있습니다. 예를 들어 ETH에 약세를 보이면 ETH를 ETH/DAI 콜 옵션 풀에 넣을 수 있습니다. 반대로 ETH에 대해 낙관적이라면 ETH를 ETH/DAI 풋 옵션 풀에 넣을 수 있습니다.

Dopex

Dopex는 Arbitrum의 매우 흥미로운 프로토콜이며 최근 Polygon에도 배포될 것이라고 발표했습니다. 지금까지 Dopex에서 사용할 수 있는 볼트 유형에는 SSOV(Single-Stake Option Vaults)와 스트래들 두 가지가 있습니다.

SSOV에서 사용자는 콜옵션이나 풋옵션을 매수할 수 있으며 옵션 금고에 유동성을 제공하고 옵션 매수자로부터 옵션 수수료를 징수하여 수익을 얻을 수 있습니다.

보조 제목

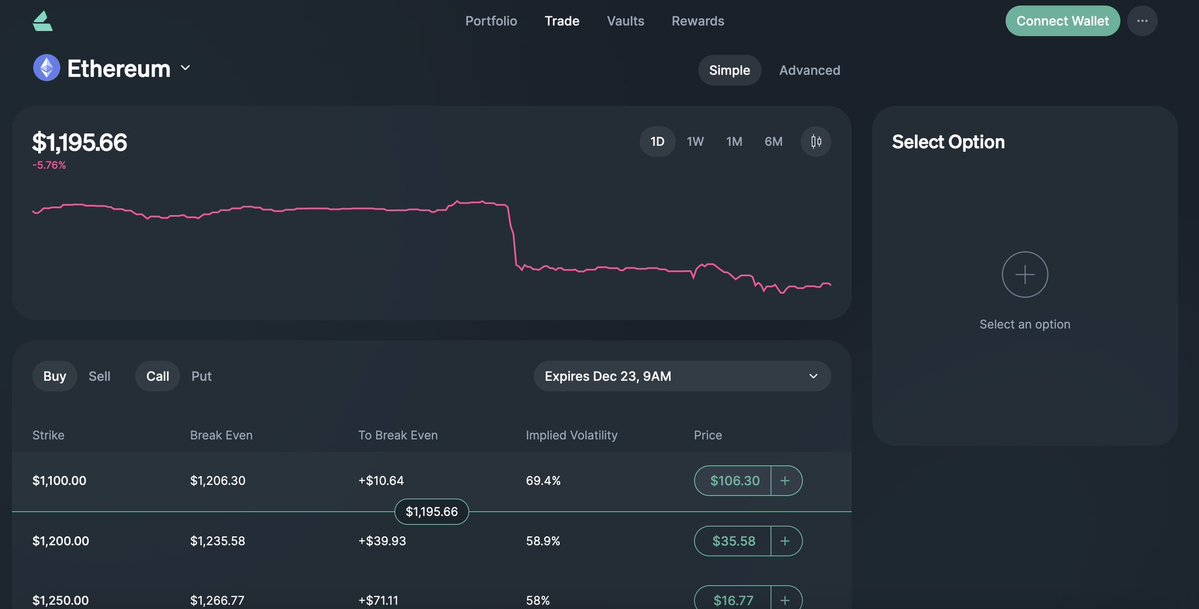

Lyra Finance

Optimism에 기반한 Lyra의 TVL은 1,300만 달러입니다. "간단한" 섹션은 직관적이고 사용하기 쉬우며, 행사가와 만기일에 따라 콜 또는 풋을 매수 또는 매도할 수 있는 옵션이 있습니다.

원하는 경우 고급 기능을 사용하는 옵션도 있습니다.

Buffer Finance

Arbitrum에 구축된 Buffer는 바이너리 옵션 거래를 제공하는 GMX의 포크입니다. 조작은 매우 간단하고 직관적이며 실행 가격, 만료 시간 및 "위" 또는 "아래"를 선택하기만 하면 베팅을 시작할 수 있습니다.

보조 제목

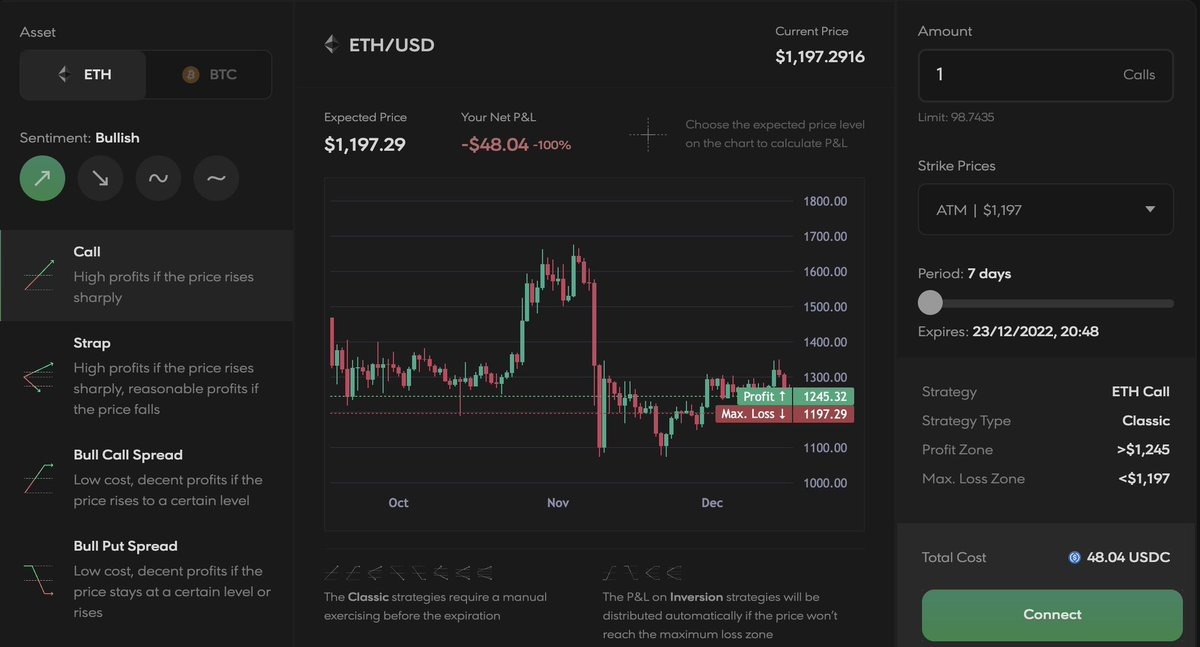

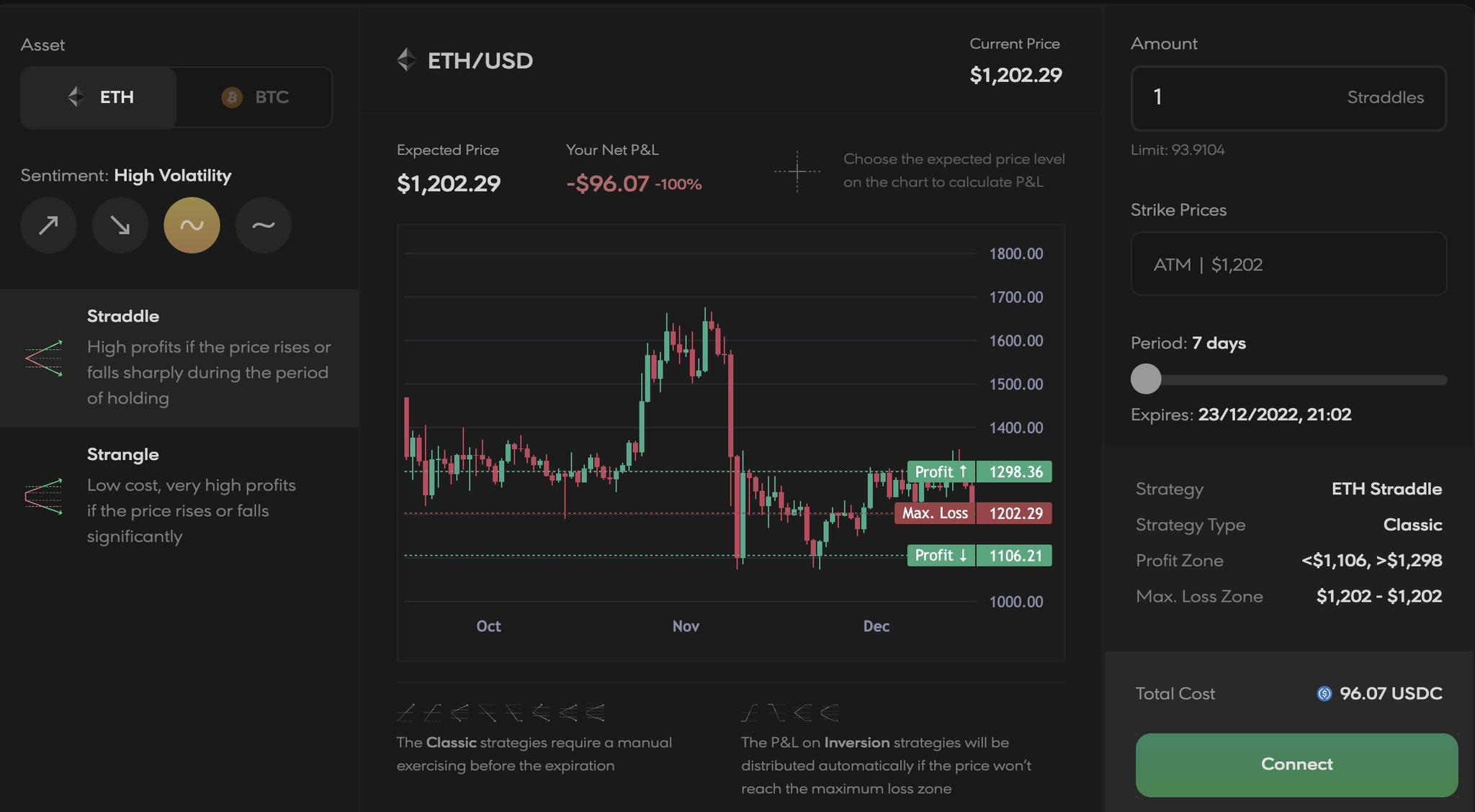

Hegic Options

Arbitrum을 기반으로 구축된 Hegic의 TVL은 지난 달에 150% 증가한 600만 달러입니다. 흥미롭게도 각 방향에서 Hegic은 직관적으로 여러 전략을 제공합니다. 예를 들어 강세라면 아래 그림에서 콜, 스트랩, 불 콜 스프레드, 불 풋 스프레드의 4가지 전략을 선택할 수 있습니다. 마찬가지로 약세의 경우 선택할 수 있는 네 가지 전략도 있습니다.

또한 Hegic에는 높은 변동성 옵션과 낮은 변동성 옵션이 있으며 각각 두 가지 전략을 제공합니다. 예를 들어 높은 변동성을 선택하려면 Straddle 및 Strangle 전략이 있습니다.

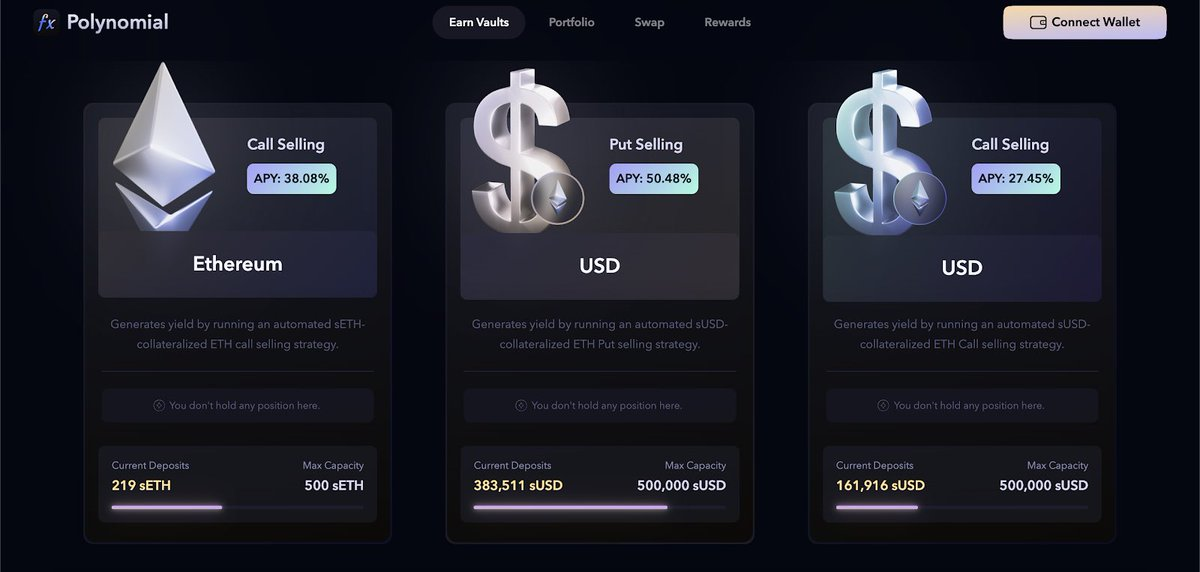

Polynomial Protocol

Polynomial은 Synthetix의 합성 자산을 사용하여 Optimism의 Lyra Finance 위에 구축되었으며 주요 제품은 Vaults 적립입니다. 이러한 볼트는 소극적 소득을 제공하는 옵션 기반 자동화 전략입니다. 적절한 펀드 풀을 선택하면 APY가 높을 수 있습니다(~30%). 전략이 수익성이 있을 때 옵션 수수료를 통해 예금자가 얻은 수익률이 복리화될 수 있고 10%의 성과도 얻을 수 있기 때문입니다. 요금.

지금까지 단 3개의 전략으로 TVL은 약 $800,000입니다. APY는 보장되지 않습니다. 단기/중기/장기 콜이든 풋옵션이든 정확한 펀드 풀(콜옵션/풋옵션)을 선택해야 합니다.

UX도 주목받는 곳이고, 암호화 기술의 대규모 적용도 좋은 UX가 필요합니다. 다항식에서는 전략, 성능, 적합성, 온체인 트랜잭션 등에 대한 정보를 쉽게 찾을 수 있습니다.

또한 이 프로젝트는 최근 Polygon, Arbitrum 및 Ethereum 메인넷의 자금을 예치할 수 있는 "포털"을 시작했습니다. 다항식은 Optimism에서 실행되지만 사용자가 다른 체인에서 유동성을 추가할 수도 있습니다.

원본 링크