ภายใต้ตลาดหมี ความสัมพันธ์ระหว่าง Bitcoin และหุ้นสหรัฐฯ คืออะไร?

บทความนี้มาจากcaiaโดย Roxanna Islam รองผู้อำนวยการ VettaFi Research

นักแปล Odaily |

นักแปล Odaily |

ในสถานการณ์ปัจจุบันของความวุ่นวายในตลาดมหภาค "ความสัมพันธ์" เป็นปัจจัยที่ต้องพิจารณาอย่างรอบคอบ อันที่จริง "ประเด็นความสัมพันธ์" ที่กล่าวถึงมากที่สุด 2 ประเด็นในอุตสาหกรรมคริปโตคือ:

1. ความสัมพันธ์ระหว่าง Bitcoin และหุ้นสหรัฐฯ เป็นอย่างไร ความสัมพันธ์นี้หมายความว่าอย่างไร

ต่อไปเรามาวิเคราะห์กัน

ชื่อเรื่องรอง

คำถามที่ 1: ความสัมพันธ์ระหว่าง Bitcoin และหุ้นสหรัฐฯ เป็นอย่างไร และความสัมพันธ์นี้หมายความว่าอย่างไร

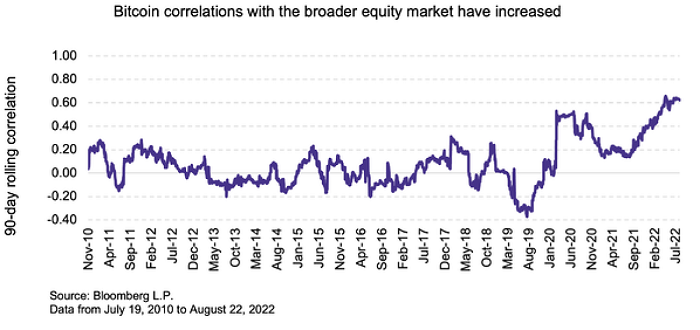

ในวงจรชีวิตส่วนใหญ่ของ Bitcoin โดยทั่วไปแล้วไม่มีความสัมพันธ์มากนักกับหุ้นสหรัฐฯ แบบดั้งเดิม และบางครั้งก็แสดงความสัมพันธ์เชิงลบด้วยซ้ำ ด้วยเหตุนี้ Bitcoin จึงมักถูกมองว่าเป็นพอร์ตการลงทุนที่หลากหลายหรือเป็นสินทรัพย์ป้องกันความเสี่ยงจากเงินเฟ้อ แต่ในช่วงไม่กี่ปีที่ผ่านมา พบว่าความสัมพันธ์ระหว่าง Bitcoin และหุ้นสหรัฐเพิ่มขึ้น และนักลงทุนไม่แน่ใจว่าเป็นการควบรวมระหว่าง Bitcoin หรือไม่ และหุ้นสหรัฐเป็นปรากฏการณ์ระยะสั้นหรือแนวโน้มระยะยาว

สำหรับตอนนี้ มีการตีความหลักสองประการเกี่ยวกับความสัมพันธ์ระหว่าง Bitcoin และหุ้นสหรัฐในตลาดการเข้ารหัส:

ประการแรก ในช่วงเวลาของความผันผวนของตลาดและทิศทางของตลาดที่ไม่แน่นอน ประเภทสินทรัพย์ที่ดูเหมือนไม่มีความสัมพันธ์กันจะแสดงความสัมพันธ์ที่สูงขึ้น ในความเป็นจริง นอกจาก Bitcoin แล้ว แม้แต่ตลาดตราสารหนี้ซึ่งมีความสัมพันธ์เชิงลบกับหุ้นสหรัฐฯ ก็แสดงความสัมพันธ์เชิงบวกมากขึ้นกับหุ้นสหรัฐฯ ตลอดปี 2022

ประการที่สอง ความสัมพันธ์ที่แสดงระหว่าง Bitcoin และหุ้นของสหรัฐฯ อาจมีสาเหตุมาจากการเติบโตของตลาด cryptocurrency Bitcoin มีมาประมาณ 15 ปีแล้ว แต่การรุกของ cryptocurrency ในการลงทุนกระแสหลักได้เร่งตัวขึ้นในช่วงไม่กี่ปีที่ผ่านมา

ตัวอย่างบางส่วน: เมษายน 2021 Coinbase (COIN) IPO; 6 เดือนต่อมาในเดือนตุลาคม 2021 ProShares Bitcoin Strategy ETF (BITO) ซึ่งเป็นกองทุนซื้อขายแลกเปลี่ยน Bitcoin อิงฟิวเจอร์สแห่งแรกในสหรัฐอเมริกาได้รับการจดทะเบียนอย่างเป็นทางการ นอกจากนี้ การยอมรับของสถาบันยังคงเติบโตอย่างต่อเนื่อง และ ก.ล.ต. ธนาคารกลางสหรัฐ และหน่วยงานกำกับดูแลทางการเงินอื่น ๆ กำลังเริ่มใช้ cryptocurrencies อย่างจริงจัง เช่นเดียวกับการรักษาความปลอดภัยการซื้อขายแลกเปลี่ยนอื่น ๆ

ในทางกลับกัน ความสัมพันธ์ที่สูงขึ้นระหว่างสกุลเงินดิจิทัลกับหุ้นสหรัฐอาจไม่ใช่เรื่องเลวร้ายเสมอไป พูดตามตรง นักลงทุนจำนวนมากเริ่มใช้ Bitcoin และหุ้นสหรัฐที่เกี่ยวข้องกับ Bitcoin เป็น "ตัวเพิ่มผลตอบแทน" การเข้ารหัสเป็นส่วนหนึ่งของการเข้ารหัส การจัดสรรการลงทุนด้านเทคโนโลยีของตนเอง โดยปกติ จะจัดสรรประมาณ 1-5% ของพอร์ตการลงทุนทั้งหมด ด้วยราคาของ Bitcoin ที่อยู่ในช่วง 20,000 ดอลลาร์ นักลงทุนอาจพิจารณาว่านี่เป็นจุดเริ่มต้นที่ดีในการสร้างหรือเพิ่มในการจัดสรรการลงทุนของพวกเขา

ชื่อเรื่องรอง

คำถามที่ 2: การลงทุน cryptocurrency ทางอ้อมมีความสัมพันธ์กับ Bitcoin อย่างไร

เมื่อพูดถึงการลงทุนในสกุลเงินดิจิทัลทางอ้อม โดยทั่วไปมีสองวิธี:

1. ลงทุนใน ETF ที่อิงตามดัชนีซึ่งนำเสนอความเสี่ยงเฉพาะด้านหรือเฉพาะอุตสาหกรรมแก่บริษัท crypto/blockchain

2. ลงทุนใน Bitcoin Futures ETF ที่ติดตามราคา Bitcoin

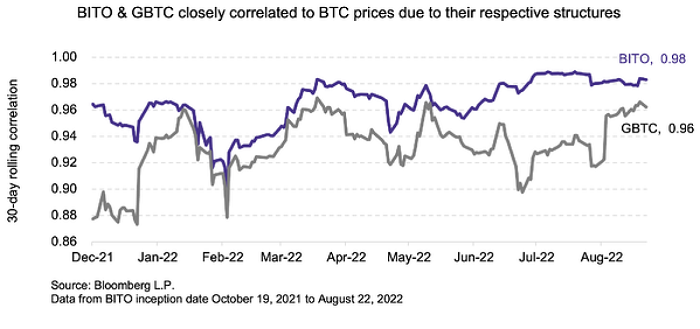

ProShares Bitcoin Strategy ETF (BITO) เป็น Bitcoin Futures ETF ตัวแรกและใหญ่ที่สุดในสหรัฐอเมริกาโดยมีขนาดการจัดการสินทรัพย์ประมาณ $706.3 ล้าน ETF มีความสัมพันธ์สูงกับจุด Bitcoin (ค่าดัชนีปัจจุบันถึง 0.98)

ProShares Bitcoin Strategy ETF (BITO) ขาดทุนมากกว่า 55.3% ตั้งแต่ต้นปี 2022 เมื่อเทียบกับราคาสปอต Bitcoin ที่ลดลง 54.4% ในช่วงเวลาเดียวกัน (ความแตกต่างเกิดจากต้นทุนการหมุนเวียนของสัญญาในอนาคต ซึ่งสามารถ มากเมื่อเวลาผ่านไป ลากเล็ก ๆ )

นอกจากนี้ Greyscale Bitcoin Trust (GBTC) ยังมีความสัมพันธ์อย่างมากกับราคาสปอตของ Bitcoin อย่างไรก็ตาม เนื่องจากกลไกพิเศษ/ส่วนลด ราคาของ GBTC จึงยังคงค่อนข้างแตกต่างจากราคาของ Bitcoin

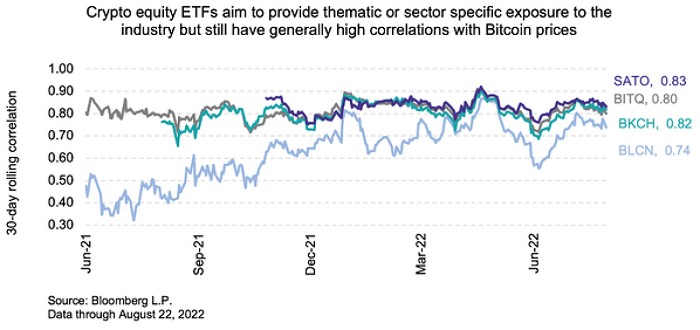

แม้ว่า ETF การเข้ารหัสลับตามดัชนีจะไม่ได้ติดตามราคาของสกุลเงินดิจิทัลโดยตรง แต่ ETF ส่วนใหญ่เหล่านี้มีความสัมพันธ์ที่ค่อนข้างสูงกับราคาสปอตของ Bitcoin ขึ้นอยู่กับขนาดของกองทุนที่ถือครองหุ้น crypto ของสหรัฐอเมริกา (ในตารางด้านล่างที่กล่าวถึงใน รายละเอียดเพิ่มเติมใน ) ตัวอย่างดังนี้

1. ETF บางตัวที่ถือหุ้นในสหรัฐฯ ที่เข้ารหัสล้วน เช่น Bitwise Crypto Industry Innovators ETF (BITQ) และ Global X Blockchain ETF (BKCH) มีค่าสัมประสิทธิ์สหสัมพันธ์ใกล้เคียงกับ 0.80 กับ Bitcoin

2. Siren Nasdaq NexGen Economy ETF (BLCN) และ ETFs ธีมอื่น ๆ ที่มีการถือครองที่หลากหลายมากขึ้นอาจมีความสัมพันธ์ที่ต่ำกว่าเล็กน้อย

3. Invesco Alerian Galaxy Crypto Economy ETF (SATO) มีการถือครองที่หลากหลายเช่นกัน แต่ค่าสัมประสิทธิ์สหสัมพันธ์กับ BTC สูงถึง 0.83 เนื่องจากการจัดสรรการลงทุนของ ETF ให้กับ GBTC สูงถึง 15%

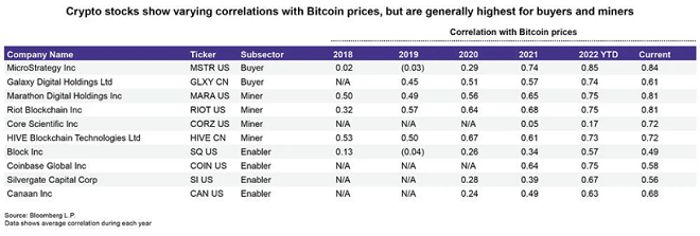

ตารางด้านล่างตรวจสอบความเชื่อมโยงระหว่าง crypto ETF และดัชนีและ Bitcoin โดยการวิเคราะห์ความสัมพันธ์ระหว่างราคาหุ้นของบริษัทจดทะเบียน crypto ในสหรัฐอเมริกาและราคาของ Bitcoin เราพบว่าในขั้นตอนนี้ ค่าสัมประสิทธิ์สหสัมพันธ์ระหว่างราคาหุ้นของบริษัทจดทะเบียนในสหรัฐอเมริกาที่เข้ารหัสและราคา Bitcoin อยู่ระหว่าง 0.60 ถึง 0.85

1. สำหรับบริษัทเช่น Microstrategy (MSTR) ซึ่งหุ้นสหรัฐมีความสัมพันธ์กับราคา Bitcoin สูงที่สุด เนื่องจากบริษัทเหล่านี้ถือ Bitcoin จำนวนมากในงบดุลเป็นกลยุทธ์ "ซื้อและถือ" (ณ ปี 2022 วันที่ 30 มิถุนายน Microstrategy มี 129,699 bitcoins ในงบดุล)

ชื่อเรื่องรอง

สรุป

สรุป

แม้ว่าความสัมพันธ์ระหว่าง Bitcoin และตลาดหุ้นสหรัฐในวงกว้างยังคงสูง แต่ก็ยากที่จะแยกแยะว่าความสัมพันธ์นี้เป็นปรากฏการณ์ระยะสั้นหรือแนวโน้มระยะยาว