รายงาน NFT ประจำไตรมาสที่ 3 ของปี 2022: เพื่อรับมือกับการลดลงของตลาดหมี ขั้นตอนต่อไปคือที่ไหน?

บทความนี้มาจากDappRaderต้นฉบับโดย Sara Gherghelas

นักแปล Odaily |

ในไตรมาสที่สามของปี 2022 อุตสาหกรรมการเข้ารหัสทั้งหมดตกอยู่ในภาวะตกต่ำ และเราพบปัญหาหลายประการ เช่น การแข่งขันในตลาดที่รุนแรงขึ้น จำนวนผู้ซื้อและผู้ขายรายใหม่ลดลง และความเสี่ยงในการฉ้อโกงเพิ่มขึ้น ในขณะเดียวกัน ดูเหมือนว่า NFT จะต้านทานการลดลงของตลาดหมีได้ ด้วยการเข้ามาของบริษัทข้ามชาติ เช่น Starbucks ฟิลด์ที่เกิดขึ้นใหม่นี้ได้ดึงเอาความมีชีวิตชีวากลับมาอย่างมาก ต่อไป เราจะใช้รายงานล่าสุดนี้เพื่อทำความเข้าใจการเปลี่ยนแปลงของตลาด NFT ในช่วงเวลาที่ผ่านมา

ชื่อเรื่องรอง

ภาพรวมอุตสาหกรรม NFT ไตรมาสที่ 3

ณ สิ้นไตรมาสที่ 1 ของปี 2022 ปริมาณธุรกรรมทั้งหมดของ NFT เกิน 12 พันล้านดอลลาร์สหรัฐ และปริมาณการขายสูงถึง 28 ล้าน อย่างไรก็ตาม หลังจากเข้าสู่ไตรมาสที่สอง ซึ่งมีเหตุการณ์หลายอย่าง เช่น การล่มสลายของระบบนิเวศ Terra และการเลิกกิจการ CeFi ที่ตามมา ปริมาณธุรกรรมของตลาด NFT ลดลง 33% (8 พันล้านดอลลาร์) และปริมาณการขายลดลง 29 % (2023 พันปากกา) ความไม่แน่นอนทางเศรษฐกิจระดับสูงและเหตุการณ์การเข้ารหัสที่เกิดขึ้นในไตรมาสที่สองทำให้ปริมาณธุรกรรม NFT ลดลงอย่างมากในไตรมาสที่สาม (สร้างเพียง 2.5 พันล้านดอลลาร์) แต่ความต้องการของตลาดยังคงทรงตัวแม้ในกรณีที่ลดลงอย่างรวดเร็วใน ปริมาณธุรกรรม NFT ผู้ค้า NFT อิสระ จำนวน (มากกว่า 2.2 ล้าน) ยังคงสูงกว่าระดับ และที่สำคัญกว่านั้น เมื่อเทียบกับไตรมาสที่สามของปีที่แล้ว ตัวบ่งชี้นี้ยังเพิ่มขึ้น 36%

ในขณะที่นักลงทุนที่มีพอร์ตการลงทุนขนาดใหญ่ (มักเรียกว่า "ปลาวาฬ") ยังคงผลักดันการขาย NFT การเพิ่มขึ้นของจำนวนผู้ซื้อรายใหม่แสดงให้เห็นว่ายังมีผู้คนจำนวนมากที่สงสัยเกี่ยวกับ NFT และต้องการลงทุนในสินทรัพย์ประเภทนี้มากขึ้น การลงทุน.

ต่อไป ด้วยการวิเคราะห์โครงการบลูชิปบางโครงการในหมวด NFT ให้เราเจาะลึกถึงสถานะและแนวโน้มที่ตามมาในสาขานี้

ชื่อเรื่องรอง

1. คอลเลกชันดิจิตอล NFT

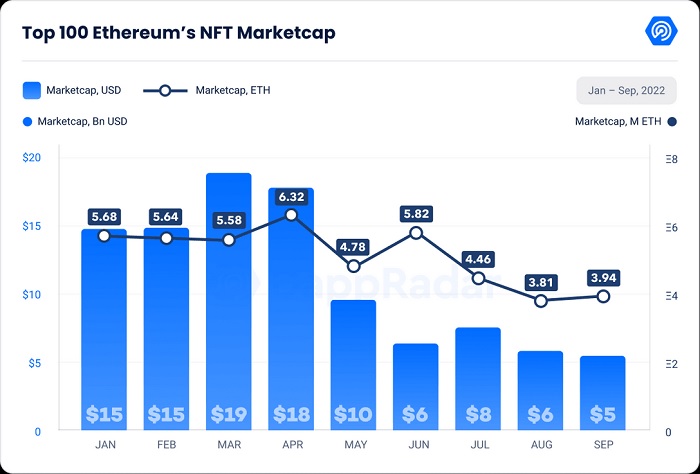

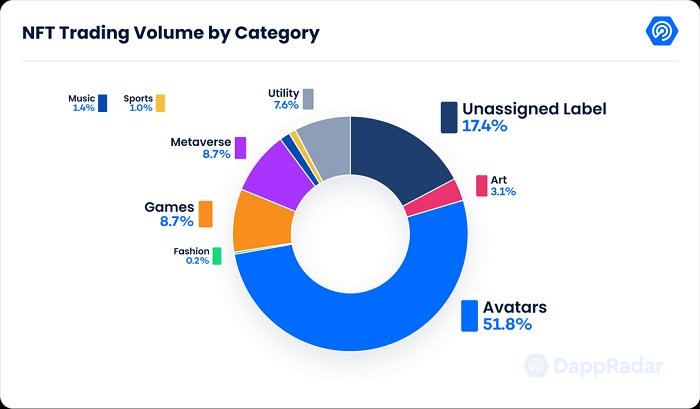

ไม่ต้องสงสัยเลยว่าของสะสมดิจิทัลยังคงครองตลาด NFT ในระดับใหญ่ ในไตรมาสแรกของปี 2022 มูลค่าการทำธุรกรรมทั้งหมดที่เกิดจากคอลเลกชันดิจิทัลของ NFT เกิน 9 พันล้านดอลลาร์สหรัฐ ลดลง 49.5% ในไตรมาสที่สองเหลือ 5 พันล้านดอลลาร์ และในไตรมาส 3 ลดลงอีก 84% เป็น 713 ล้านดอลลาร์ ซึ่งเป็นไตรมาสที่ต่ำที่สุดนับตั้งแต่ไตรมาสแรกของปี 2564 เป็นมูลค่าการกล่าวขวัญว่า 52% ของคอลเลกชันดิจิตอล NFT เป็นอวาตาร์ PFP

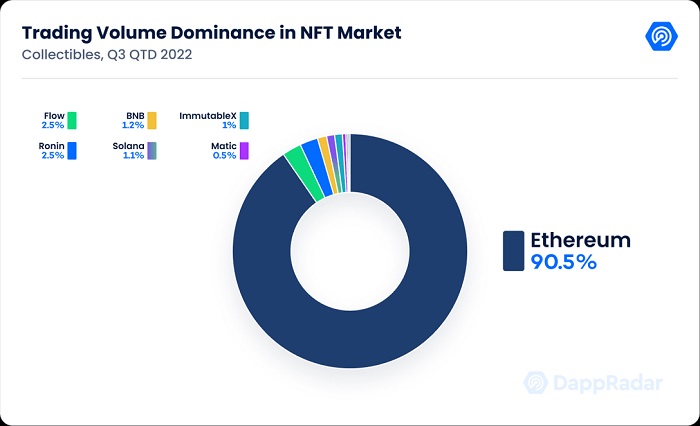

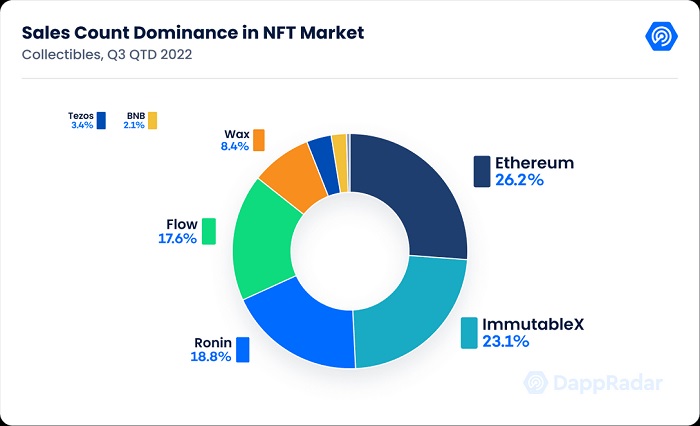

ในแง่ของเครือข่ายสาธารณะ Ethereum ยังคงเป็นเครือข่ายบล็อกเชนที่สร้างปริมาณธุรกรรม NFT มากที่สุด โดยให้การสนับสนุนอย่างมากสำหรับสินทรัพย์ NFT ที่มีค่าที่สุดและตลาดนวัตกรรมและผู้รวบรวม (เช่น OpenSea, X2Y2, Gem เป็นต้น) NFT ธุรกรรมบนเชน Ethereum คิดเป็น 91% ของธุรกรรม NFT ทั้งหมดในเครือข่ายทั้งหมด ($645 ล้าน)

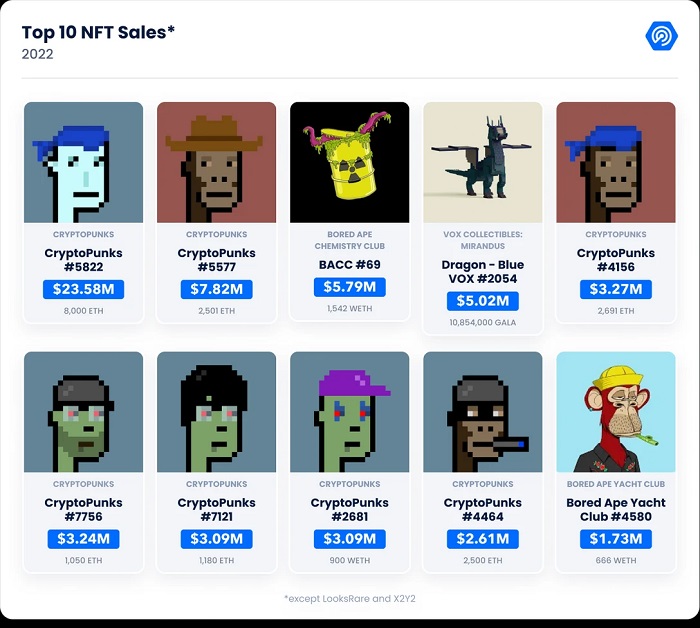

ไตรมาสที่ 3 ปี 2022 ปริมาณธุรกรรมลดลง 93% เมื่อเทียบกับไตรมาสที่ 3 ปี 2021 แต่ CryptoPunk #5822 เป็นไฮไลต์ของช่วงเวลานั้นด้วยสถิติ 8,000 ETH (ประมาณ 23.7 ล้านดอลลาร์) และการขายเป็นธุรกรรมที่ใหญ่ที่สุดในประวัติศาสตร์ของ CryptoPunks NFT NFT ถูกซื้อโดย Chain CEO Deepak Thapliyal (Deepak.eth)

นอกจากนี้ ปริมาณธุรกรรม NFT ของ Flow blockchain คิดเป็น 2.54% และปริมาณธุรกรรม NFT ของ Ronin blockchain คิดเป็น 2.53% เป็นที่น่าสังเกตว่าปริมาณธุรกรรมทั้งหมดของ NFT บนห่วงโซ่ ImmutableX เพิ่มขึ้น 87% เมื่อเทียบกับไตรมาสก่อนหน้า ทำให้เป็นบล็อกเชนเดียวที่มีปริมาณธุรกรรม NFT เพิ่มขึ้นในเชิงบวกในปีนี้

ในทางกลับกัน ต้องขอบคุณโซลูชันการขยายตัวที่หลากหลายสำหรับเกม Web3 และ GameFi DApp ปริมาณธุรกรรม NFT ของ ImmutableX คิดเป็น 23.12% และปริมาณธุรกรรม NFT ของ Ronin คิดเป็น 18.81% ซึ่งกลายเป็นผู้เล่นหลักในธุรกรรม NFT ตลาด

ชื่อเรื่องรอง

2. ชิปสีน้ำเงิน NFT

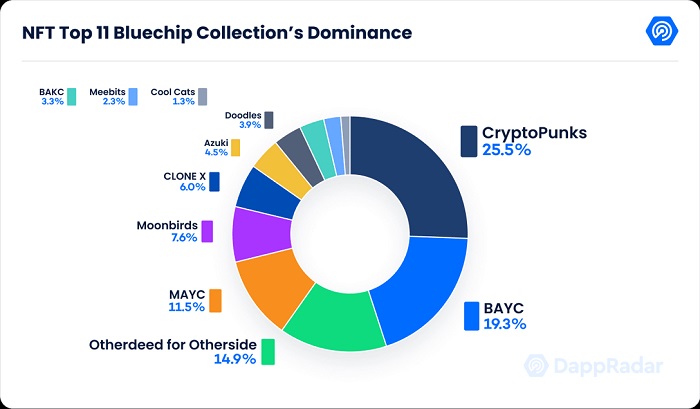

ในบรรดาโครงการ NFT 11 อันดับแรก (แสดงด้านล่าง) Yuga Labs มีสี่โครงการ: CryptoPunks, Bored Ape Yacht Club (BAYC), Otherdeeds for Otherside และ Mutant Ape Yacht Club (MAYC) ซึ่งซื้อขายในไตรมาสที่สองมีมูลค่ามากกว่า $237 ล้าน. แต่ในไตรมาสที่สาม ปริมาณธุรกรรมของซีรีส์ NFT บลูชิป 11 อันดับแรกลดลง 88% เหลือเพียง 334 ล้านดอลลาร์ ซึ่งไม่แตกต่างจากไตรมาสที่สองของปี 2021 มากนัก

หากแยกเป็นรายเดือน เราจะพบว่าปริมาณธุรกรรมของ blue-chip NFT ในเดือนมิถุนายนอยู่ที่ 203 ล้านดอลลาร์สหรัฐ ลดลงอย่างรวดเร็วถึง 83% จาก 1.2 พันล้านดอลลาร์สหรัฐในเดือนพฤษภาคม อย่างไรก็ตาม แม้ว่าปริมาณธุรกรรมทั้งหมดจะลดลง แต่ราคาพื้นของซีรีส์ NFT บลูชิป 11 อันดับแรกไม่ได้ลดลงอย่างรวดเร็ว ซึ่งใกล้เคียงกับราคาพื้นก่อนที่ Terra จะพัง

เนื่องจาก NFT เหล่านี้ไม่เพียงแต่เป็นตัวแทนของคอลเลคชันดิจิทัล แต่ยังเป็นสัญลักษณ์ของบัตรผ่านที่กลายเป็นตัวตนของทุกคน ตัวบ่งชี้ "จำนวนวันที่ถือครองโดยเฉลี่ย" จึงมีความสำคัญอย่างยิ่ง ในเรื่องนี้ CryptoPunks อยู่ในอันดับแรกด้วย "การถือครองเฉลี่ย" ที่ 239 วัน ตามมาด้วย BAYC ที่ 129.8 วัน และ MAYC และ Otherdeed ที่มีวันถือครองเฉลี่ยเท่ากันที่ 96.9 วัน นอกจากนี้ Azuki ยังมีค่าที่ต่ำที่สุดสำหรับเมตริก “จำนวนวันถือครองเฉลี่ย” ซึ่งบ่งชี้ว่า Azuki NFT อาจถูกมองว่าเป็นเครื่องมือในการลงทุนมากกว่าการรวบรวม “ภักดี” ระยะยาวที่เจ้าของถือครอง

ชื่อเรื่องรอง

3. ดิจิตอลอาร์ต NFT

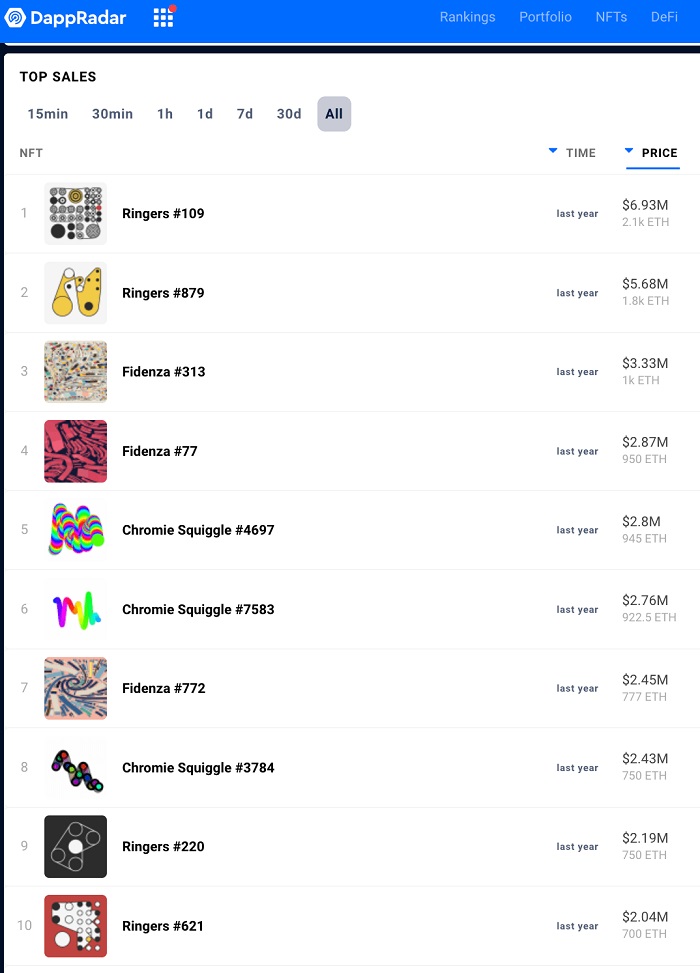

ตั้งแต่เดือนมกราคม 2021 มีการขาย NFT ของศิลปะดิจิทัลไปแล้วกว่า 4.5 ล้านชิ้น โดยมีมูลค่าธุรกรรมรวมกว่า 3 พันล้านดอลลาร์ ว่ากันว่านักสะสมหันไปหาตลาดศิลปะดิจิทัลเนื่องจากความยากลำบากในการซื้องานศิลปะที่จับต้องได้ระหว่างการแพร่ระบาดของโควิด-19 ซึ่ง Beeple, Pak, Fewocious และศิลปินอื่นๆ อีกหลายคนเป็นผู้มีส่วนร่วมหลักในตลาด และยังผลักดัน NFTs สู่ตลาดมวลชน

อย่างไรก็ตาม มีจุดสว่างบางอย่างในด้านศิลปะดิจิทัล NFT ในไตรมาสที่สาม ตัวอย่างเช่น พิพิธภัณฑ์ศิลปะสมัยใหม่ (MoMA) ในนิวยอร์กได้เริ่มพิจารณาที่จะใช้เงิน 70 ล้านดอลลาร์เพื่อซื้องานศิลปะที่เกี่ยวข้องกับ NFT

ชื่อเรื่องรอง

4. เกมเอ็นเอฟที

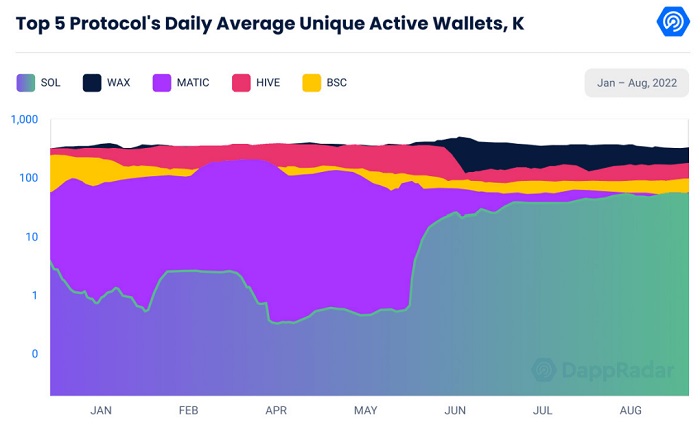

มูลค่ากว่า 8.6 พันล้านเหรียญสหรัฐ GameFi ได้ลงทะเบียนกระเป๋าเงินแบบไม่ซ้ำ (UAW) จำนวน 847,000 ใบต่อวันในเดือนสิงหาคม และคาดว่าจะเติบโตอย่างทวีคูณในอีกไม่กี่ปีข้างหน้า เกมที่ใช้บล็อกเชนยอดนิยมหลายเกม เช่น Axie Infinity, Gods Unchained และ Aavegotchi ใช้ NFT สำหรับการโต้ตอบ และบริษัทเกมรายใหญ่ เช่น Ubisoft ก็ได้รวม NFT ไว้ในการออกแบบเกมด้วย

อย่างไรก็ตาม ชุมชนเกมดั้งเดิมบางชุมชนไม่รองรับ NFT ตัวอย่างเช่น บริษัทเกมสามแห่ง ได้แก่ EA Games, Mojang Studios และ Team ได้ประกาศว่าจะไม่ใช้ NFT ในเกมอีกต่อไป

ในไตรมาสแรกของปี 2022 ปริมาณธุรกรรมรวมของเกม NFT เกิน 1 พันล้านดอลลาร์สหรัฐ ซึ่งลดลง 53% ในไตรมาสที่สอง และลดลงอีกเป็น 71 ล้านดอลลาร์สหรัฐในไตรมาสที่สาม ซึ่งลดลงมากถึง 84% ในแง่ของปริมาณการขาย แนวโน้มของตลาดก็ไม่ดีเช่นกัน ในไตรมาสแรกของปี 2022 ปริมาณการขายเกม NFT เกือบ 12 ล้านเกม ในไตรมาสที่สองลดลงเหลือ 6 ล้านเกม ลดลง 50% และ ในไตรมาสที่สามลดลงเหลือเพียง 3.3 ล้านเพน

ควรสังเกตว่าแม้ว่าปริมาณการทำธุรกรรมทั้งหมดและยอดขายของเกมบล็อกเชน NFT จะลดลงอย่างรวดเร็ว แต่ก็ยังดึงดูดเงินลงทุนมากกว่า 4 พันล้านดอลลาร์

ชื่อเรื่องรอง

5. แฟชั่นและความหรูหรา NFT

"การทดลอง" ครั้งแรกในแฟชั่นของ NFT เกิดขึ้นในตลาดรองเท้าเมื่อ RTFKT Studios เปิดตัวรองเท้าผ้าใบเสมือนจริงคู่หนึ่งของแบรนด์ของตนเอง และ Gucci ยักษ์ใหญ่สุดหรูก็เปิดตัวรองเท้าเสมือนจริงที่เรียกว่า "Gucci Virtual 22" เทรนด์นี้ได้รับแม้กระทั่ง ถ่ายโอนไปยังแพลตฟอร์มเกม ตัวอย่างเช่น League of Legends ได้ประกาศความร่วมมือกับ Louis Vuitton และ Burberry ยักษ์ใหญ่ด้านแฟชั่นของอังกฤษได้ร่วมกันเปิดตัว NFT ที่สวมใส่ได้กับ Blankos แพลตฟอร์มเกม Web3

อย่างไรก็ตาม มีจุดสว่างบางอย่างในตลาด NFT แฟชั่นในไตรมาสที่สาม เช่น การเปิดตัวคอลเลกชัน "NFTiff" ในธีม CryptoPunks จำนวน 250 ชุดของ Tiffany & Co ซึ่งสร้างรายได้ 12.5 ล้านดอลลาร์

ชื่อเรื่องรอง

6. กีฬาเอ็นเอฟที

ชื่อเรื่องรอง

สรุป

สรุป

แม้ว่าจะไม่มีใครสามารถทำนายอนาคตของตลาดสกุลเงินดิจิทัลทั่วโลกได้อย่างแม่นยำ แต่ NFT กำลังดึงดูดผู้เข้าร่วมตลาดในวงกว้างขึ้น และบล็อกเชน เช่น Solana, Flow และ Tezos ก็กำลังส่งเสริม NFT เพื่อนำเทคโนโลยีบล็อกเชนที่เกิดขึ้นใหม่มาใช้ในอุตสาหกรรมต่างๆ เช่น เกมและความบันเทิง .

เป็นมูลค่าการกล่าวขวัญว่าหลายแบรนด์ได้เริ่มนำเทคโนโลยี NFT มาใช้อย่างแข็งขัน Ticketmaster เพิ่งร่วมมือกับ Flow เพื่อรวม NFT เข้ากับธุรกิจตั๋ว Starbucks ยังประกาศเปิดตัว "Starbucks Odyssey" ซึ่งรวมโปรแกรมสมาชิก Starbucks Rewards เข้ากับแพลตฟอร์ม NFT การอนุญาตให้ลูกค้าได้รับและซื้อสินทรัพย์ดิจิทัลเพื่อปลดล็อกประสบการณ์และรางวัลพิเศษ เช่น สิทธิประโยชน์หรือเครื่องดื่มฟรี กำลังพยายามใช้ Odyssey เพื่อให้รางวัลแก่ลูกค้าประจำในวงกว้างขึ้น ขณะเดียวกันก็สร้างชุมชนที่มีส่วนร่วมมากขึ้น