从这6个特色DeFi项目,探寻去中心化借贷新风向

原文标题:Sept. 22, 2022: Lender's Game,作者:crv.mktcap.eth,译者:Odaily星球日报十文

在下跌的市场中,下轮牛市的种子究竟埋在哪?或许,可以从借贷项目中寻找机会。

加密借贷特别有趣。在 TradFi 中,贷款人可以低价抵押贷款,因为在现实生活中存在 "信用 "这样的衡量保准。但在 DeFi 中,我们没有可以借用的“信用”,因为我们可以很轻松销毁信用,换到另一个钱包上。所以,除非有人成功建立了加密信用,否则贷款必须超额抵押。

这方面,我们仍看到借贷协议在蓬勃发展。开发人员正迅速创新,特别是寻找改善借款人体验的新方法。例如我们最近观察到的两种流行的策略:0 利率和零清算。在本文中,我们将回顾这些尝试,并介绍相关项目的进展。

0 利率贷款

不难看出,为什么 0% 利率贷款会很有吸引力。如果你以 x% 的价格贷款,你必须在你收到的任何东西上获得 >x% 的收益,否则你就会亏损(更不用说这些资产的价格波动了)。

问题是,没有可靠的方法来赚取你所借的代币的收益。DeFi 是一个有风险的游戏。最近,低风险的美元收益率比美国国债还差。高收益是有风险的。

0% 的利率消除了这些担忧。你可能仍然要担心相关资产价格的变化,但至少复利不会对你不利。你可以等到条件更有利的时候再偿还贷款。

真正的风险追求者也可以利用 0% 的利率作为杠杆。用你的贷款来购买更多的抵押品,并不断提高抵押品的数量,达到你满意的程度。这当然不推荐给初学者,虽然在 degens 中很受欢迎的。(注:不是财务建议!)

Liquity 能够提供 0% 的利率,在此基础上,他们构建了一个很好的去中心化稳定币的教科书级范例。借出 ETH 和铸造 LUSD 不产生贷款利率,这对借款人有帮助。该协议通过动态借贷和赎回费用而不是利率来赚钱,该费用根据市场需求进行调整。

借款人确实需要担心清算,因为这通常会伤害到那些利用低抵押率来提高杠杆的人。Liquity 的市值往往会追踪 ETH 的价格,但除此之外,Liquity 的机制已通过多次市场波动证明非常有弹性。

值得提醒的是,他们昨日推出了 Chicken Bonds。

Chicken Bonds 引入了一种新的、创新的债券形式,同时为 LUSD 持有人提供了放大收益和交易的机会,并稳定了 LUSD 价格。

与其他债券机制相比,Chicken Bonds 具有以下优势。

你的本金受到保护

不存在锁定问题

bLUSD 可在任何时候被赎回为 LUSD

你将得到的是一个动态的,随着你的行动而演变的金融 NFT

具体介绍可以在这里查看。

Qi DAO 还提供以 0% 的利率借贷来铸造他们的 Mai 美元挂钩代币。与 Liquity 类似,他们收取还款费用,在这种情况下是 0.5%。

Qi 在多个侧链上测试了这个模式,并将在主网上部署,这值得 DeFi 矿工们研究。

零清算

零清算贷款的概念也非常流行。由于加密货币的波动性,清算对于借款人来说是一个糟糕的用户体验问题,因为价格瞬间的下跌就会引发清算。

Alchemix 推广了无清算、自还贷款的概念。你给他们钱,钱被锁定并获得用于偿还贷款的收益。这是一种友好且被动的借贷选择,特别是对于不主动管理其头寸的用户。

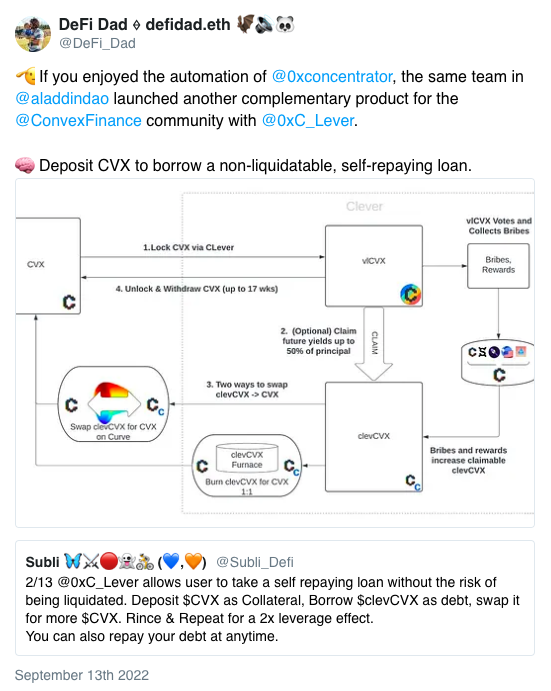

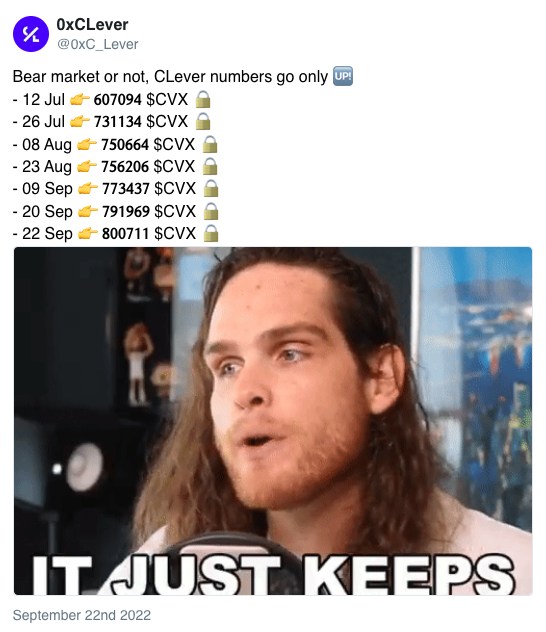

Aladdin DAO 的 CLever 扩展了 Alchemix 的模式以补充 Convex 产量。同样没有清算。CLever 管理自动复合收益率。

尽管进入熊市面临挑战,但 CLever 在增持 Convex 代币的目标方面取得了成功。

他们还在继续发展他们的产品,并将业务扩展到 Frax。

CLever 不久会发布 CLEVER 代币,可能会有空投预期。

Lendflare 是另一个协议。他们为借款人提供了友好的条款:固定利率,固定条款,以及不对选择 Curve LP 头寸进行清算。

他们通过让所有贷款发生在同类资产之间来管理这个问题,即用 USDC 从 3pool 中借款,所以价格波动的风险很小。他们的金库大部分都被利用了。他们面临着在熊市中推出的挑战,所以我们很高兴看到他们继续快速发展,最近发布了他们的 V2 版。

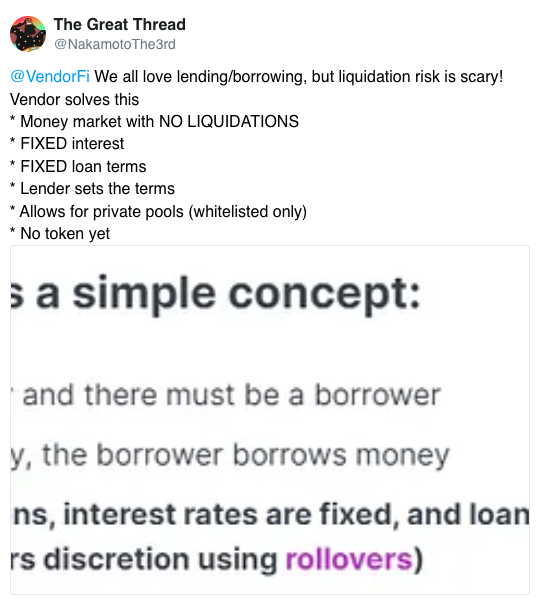

Vendor Finance

本月早些时候,Vendor Finance 在 Arbitrum 上推出了其公开测试版。该协议自夸了下其"不清算、固定利率、永久贷款"的优点。

与之前讨论的协议不同,Vendor 通过要求贷款人预先设定固定的贷款条款来完成他们的 "无清算贷款"。

在 Vendor 上创建的所有贷款都有一个固定的结束日期和一个固定(或递减)的利率。贷款人设定条款,而借款人直接向贷款人借款。

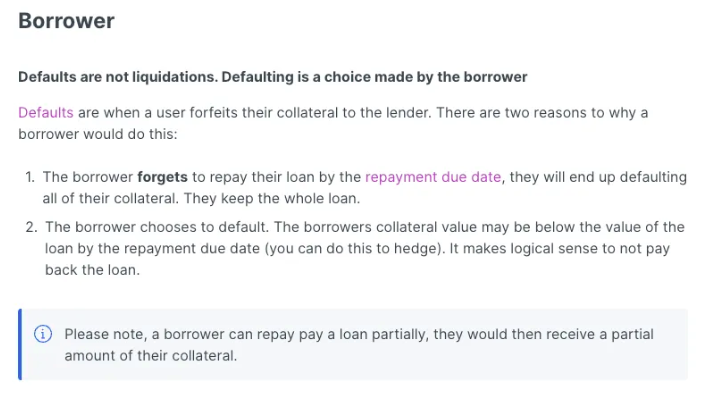

同样,Vendor Finance 在其系统中仍有违约的概念。清算可能会因为随机的价格变动而使你遭受损失,但在 Vendor 中,你只能因为没有履行你事先同意的条款而受到损失。如果借款人没有在到期日前还款,他们就会没收抵押品。价格波动并不影响这个等式。

借款人还可以选择在临近到期日时展期(将你的债务从原始池迁移到具有更长还款期限的目标池的过程)贷款。

如果这将风险转移到贷款人身上,则可以通过贷款人在制定条款时的灵活性来缓解。

任何人都可以无条件地为白名单上的任意资产启动资金池,其中包括常用的资产($WETH、$WBTC、主要的稳定币)以及其他如$CRV、$FRAX、$UMAMI。

因此,该协议为贷款人开辟了新的潜在用例,如为 DAO 创建战略,使他们的库房货币化。例如,DAO 可以使用 Vendor 作为资金工具,从他们的资金中借出任何资产,同时获得他们想要的任何抵押品。

社区的一些想法:

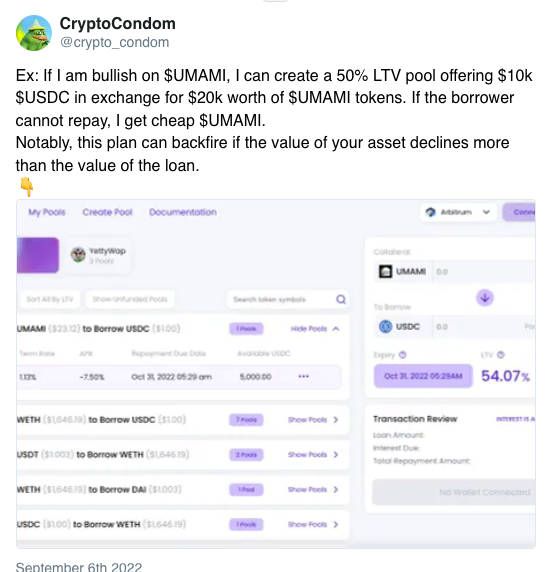

如果我看好 UMAMI 代币,我可以创建一个 50% LTV 池,提供 10000 USDC 以换取价值 20000 的 UMAMI 代币。如果借款人无法偿还,我会得到便宜的 UMAMI 代币。值得注意的是,如果您的资产价值下降超过贷款价值,该计划可能会适得其反。

该协议目前还没有代币。