从DAO国库入手,如何分析DAO财务健康状况?

原文作者:Jake、Stake

原文编译:aididiaojp.eth,Foresight News

市场已陷深熊,许多 DAO 及其贡献者开始怀疑他们能否度过这漫长的加密寒冬。

为了了解 DAO 的健康状况,本文提供了一个基本框架。无论你是投资者、贡献者还是用户,每个人都可以使用 Dune Analytics 等工具查看 DAO 资金信息。我们通过仪表盘来监控和跟踪 DAO 组织的财务状况,以判断哪些项目是以可持续发展和长期成功为目标而构建的。

DAO 国库分析的重要性

DAO 是利用代币来激励特定行为的组织。人们经常为 DAO 工作以换取 DAO 治理代币或其他原生加密货币,如 MATIC 和 ETH 等。所有提供任何形式报酬的 DAO 都需要一个金库,如果没有金库,DAO 将无法支付给贡献者报酬,也无法为项目提供资金。除非 DAO 有类似传教士般的贡献者,否则协议很难启动。

这就是为什么了解 DAO 国库对于确定它们在加密经济领域的定位至关重要:

DAO 是否有足够多的稳定币?如果没有,为了持续运营,它们将出售治理代币,并稀释持有者手中的份额。

DAO 是否持有少量的治理代币?如果是这样,它们投票支持对增长至关重要的举措的权力就会减少。

有时 DAO 国库会难以辨别,因为资产可能分散在多个合约地址中,例如根据 openorgs.info 显示,Uniswap 有五个国库地址。

DAO 国库的健康状况不仅对投资者,对用户和贡献者同样重要。本文将提供一些分析 DAO 国库所使用的工具,并重点介绍分析 DAO 健康状况时需要注意的一些细节。

识别国库资产

DAO 资产可以分为四个组成部分:

DAO 治理代币

稳定币

区块链的原生代币

其他合作伙伴的代币

DAO 治理代币

DAO 治理代币具有提供流动性、投票和投资等作用,治理代币通常被用于激励用户来参与协议。就像早期初创公司的股权一样,DAO 会拥很多代币,同时如果 DAO 持有一些其他资产,那么这些资产通常可以被用来换取启动资金来支付给贡献者。

治理代币通常具有很高的流动性,如果代币解锁量非常高,贡献者通常会选择出售其代币以换取稳定币。除非有同样强大的机制来增加需求,否则由于供应增加,持有者会在价格进一步下跌前出售。

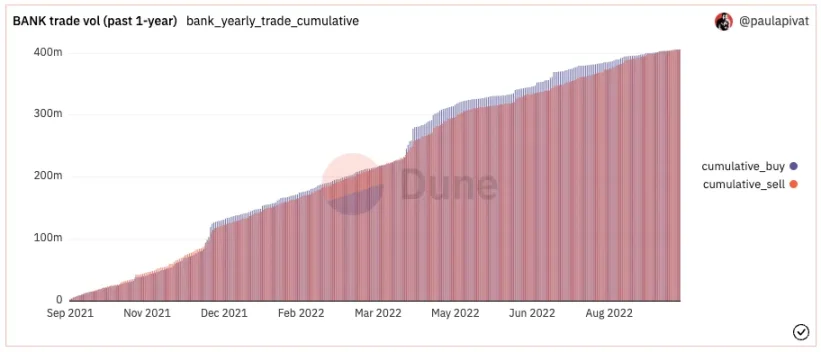

以 BANK 为例,过去一年的交易量:

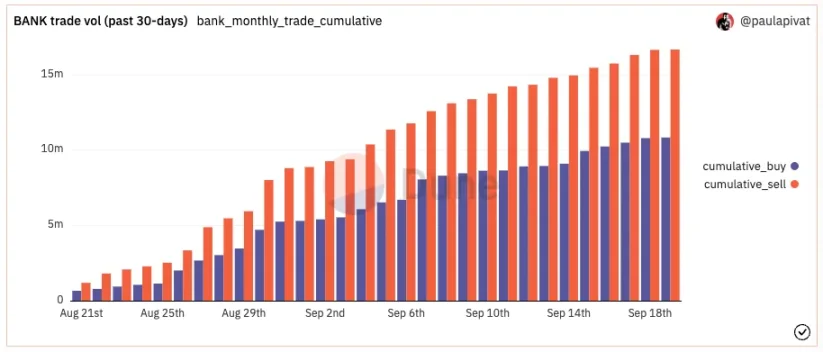

更详细的市场交易量,以过去 30 天为例:

DAO 代币应被视为股票的加密货币等价物,并作为 DAO 资产进行折现。DAO 可以发行新的代币或更改合约,但像企业不会在资产负债表上将股票列为资产一样,DAO 也不应该列出治理代币。

以著名 Uniswap 协议为例,该协议具有大量资产,但没有代币多样性。Uniswap20 亿美元国库资产中绝大多数都是 UNI 代币,通过贴现 UNI 代币(约为 14.7)和未归属 UNI 代币(7.9 亿美元)可以清晰地看清它们的财务状况:

纯粉色代表已归属 UNI 代币,带条纹粉色代表未归属代币

如果市场出现低迷或某种黑客行为导致项目急需大笔资金,DAO 通过出售治理代币将稀释现有持有人的份额,并且造成巨大的价格下行压力。大多数 DEX 没有足够的流动性来面对大量代币的倾销。Hasu 在 DeFi 国债的新心理模型中指出:

想象一下 Uniswap 试图出售 2% 的资金,当通过 1inch 执行交易时,订单路由将到许多链上和链下市场,对 UNI 价格的影响接近 80%。

DAO 国库最好不仅仅持有他们的治理代币。

稳定币

DAO 国库中第二大常见资产是稳定币,其中包括 DAI、FRAX、USDT 和 USDC 等稳定币,它们通常是与美元保持 1:1 的汇率。

由于加密原生资产非常不稳定,价格波动巨大,包括比特币和以太坊同样会像风险资产一样受到市场波动和交易的影响,所以持有稳定币有助于降低国债波动率。

DAO 应该在国库中至少保留一定的稳定币,用于支付贡献者和对冲市场风险。

例如 Maker 从 2018 年到 2020 年积累了 700 万美元的净收益。按照协议要求,Maker 用这些资产购买和销毁 MKR 代币。但在黑色星期四(2020 年 3 月 12 号)加密市场出现暴跌,由于网络拥堵,Maker 未能清算水下头寸,导致亏损 300 万 DAI。

如果这时他们持有 700 万 DAI,并用它来偿还坏账,Maker 将剩下 100 万美元,另外还有 300 万美元稳定币,而 MKR 代币的供应根本不会改变。

或者换一种说法,Maker 持有的资产本可以增加 400 万美元的额外价值。

如果 DAO 希望在未来几年生存下去,它必须经受住熊市和黑天鹅事件的考验。DAO 不能仅仅靠治理代币来抵御风险,否则就会出现在底部最坏的情况出售代币,在顶部最好的情况买回这些代币。持有稳定币来降低国库风险是可取的。

注意:稳定币的选择也是至关重要,如果在脱钩事件(5 月 7 号)期间持有 UST,那么到 5 月 9 号,这些代币价值将下降 65%,而在撰文时已下降 95%。

区块链原生代币

在 DAO 国库中还存在链上原生资产,被用于支付网络交易的 Gas 费用。大多数代币都在 Ethereum 和 Polygon 上运行,因此这些链上 DAO 分别持有 ETH 和 MATIC.

当网络费用变得异常昂贵时,持有其中的一些资产是有意义的。尽管这些资产与 DAO 代币不同,但这些资产之间通常具有高度相关性,所以为了国库资产的稳定,购买区块链原生资产通常应该通过平均美元成本来完成。

战略代币互换

另一个值得关注的地方是国库中的其他 DAO 代币,这些代币代表 DAO 之间的合作关系,并在彼此治理过程中可授予彼此投票权。

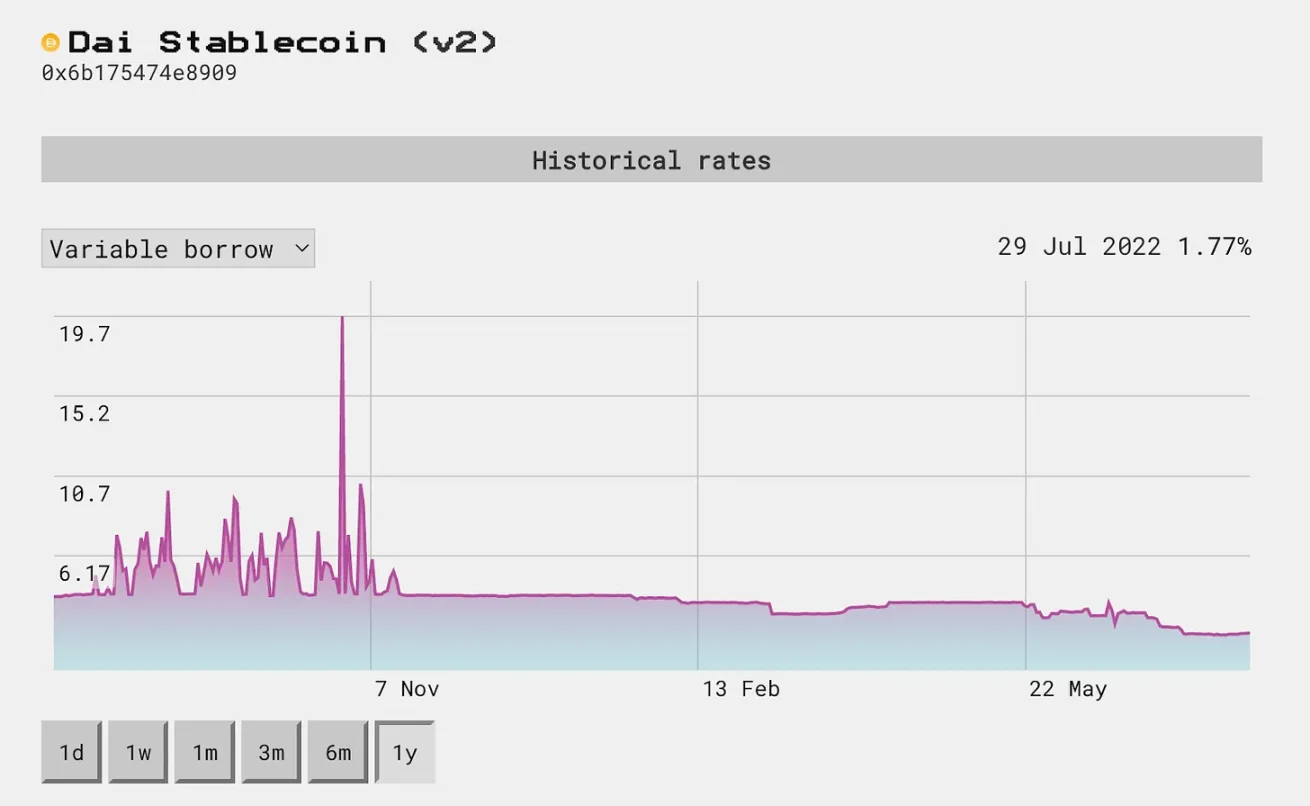

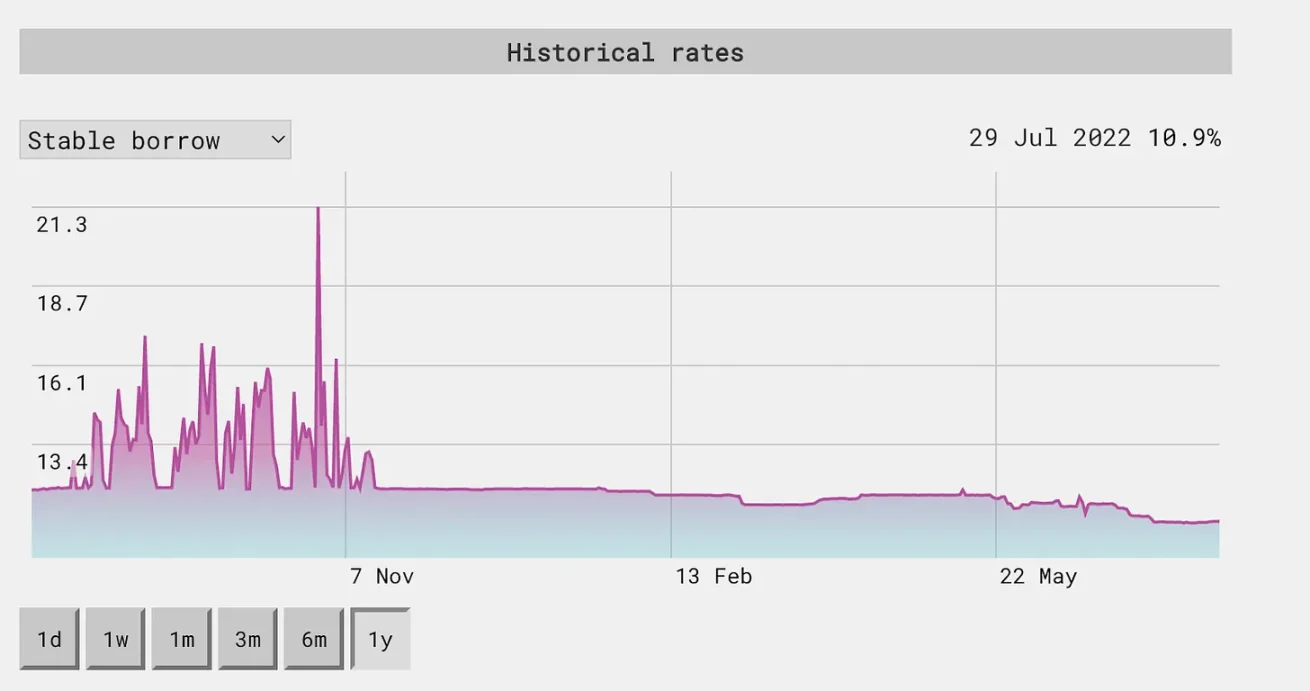

最具有战略意义的合作伙伴之一是 Maker 和 Aave 合作实施 DAI 直接存款模块(3DM)。该模块允许 Maker 将流动性直接存入 Aave 的 DAI 池。随后 Maker 影响 DAI 的供应以稳定贷款利率,使其对借款人更具吸引力。

效果是显著的,自从 2021 年 11 月推出以来,DAI 可变借款利率在 Aave 上已经稳定在 1.7% 至 3.8% 范围内,同时稳定借款利率的结果是相似的。

在此过程中,Maker 赚取 AAVE 代币作为 Aave 流动性质押奖励计划的一部分,让 Maker 在 Aave 的治理过程中拥有发言权。DAO 还可以花费额外的资金来购买其他 DAO 的治理代币,如果有足够的份额,其影响可能是深远的。

从理论上将,它们也是彼此保障对方资金安全的一种方式,如果你倾销我的代币,我也会倾销你的代币。治理代币互换增加了贡献者之间的合作沟通,并且可以本着开源开发精神来促进更好的协作。

可持续性的财务规划

为了能够保障可持续的财务,DAO 的收入应该多于支出。这意味着我们需要分析代币资金的流入流出。

财务报告

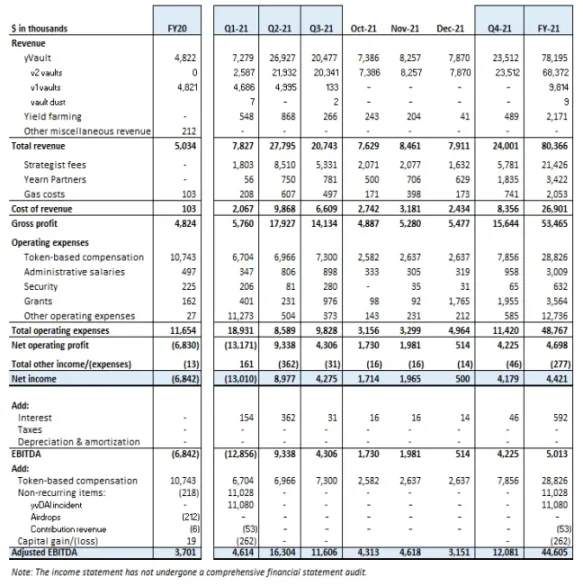

查看 DAO 的财务报告是确定 DAO 财务状况的好方法。以Yearn 的季度报告中显示的收入、支出和营业利润率为例:

从报告中可以看出,Yearn 的毛利润在 2020 年之后有所增长,薪酬和管理成本同时也在增加。许多 DAO 会公开它们的财务报告,贡献者、用户和投资者可以更好了解 DAO 组织。

这些报告里会包含一些比纯数据更多的内容,包括支出的分类、支出目的、代币回收协议以及协议即将发生的决策变化。Yearn 在最近的报告中指出,他们最多的现金支出是给监督和管理 Yearn 保险库的开发人员。但他们也提到了希望不再为管理者提供薪酬,而是为所有 DAO 贡献者建立利润分享模型。此外,Yearn 还记录了他们的资产和负债。

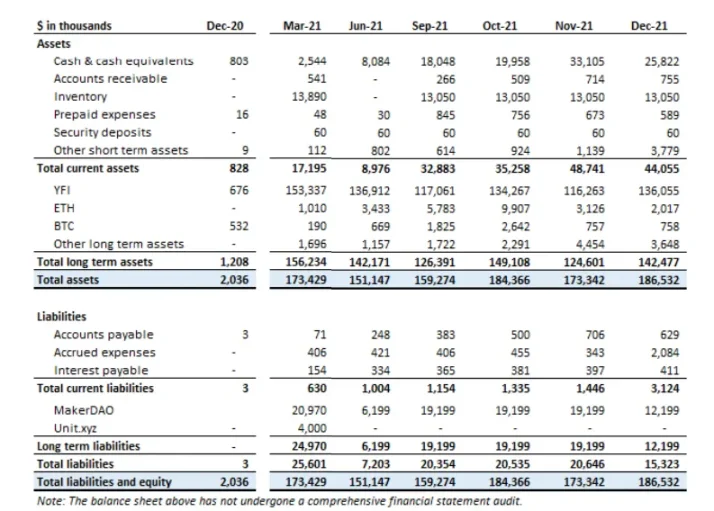

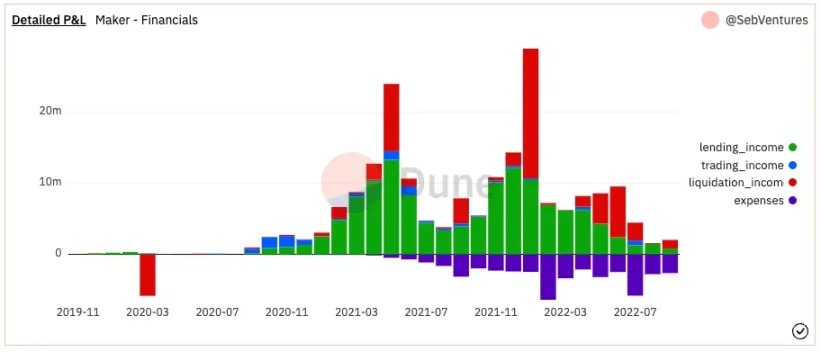

但是这些陈述中会受到人为干预导致出错。另一种方法是创建实时区块链数据的仪表板。例如 Maker 有一个仪表板专门显示实时损益数据。

资产流入

DAO 应该明确他们从费用和其他投资中的收益。一般资产流入可以以多种形式实现:

协议费用

社区成员购买

质押奖励

研究人员可以利用 Maker Dashboard 查明 Maker 如何进行收入分类。Dune SQL 是公开可用的,用户可以自行查看他们的账户。

仪表板可以保存特定于协议本身的各种收入数据。例如,Maker 有一个盈余缓冲区,用于计算稳定费产生的收入。

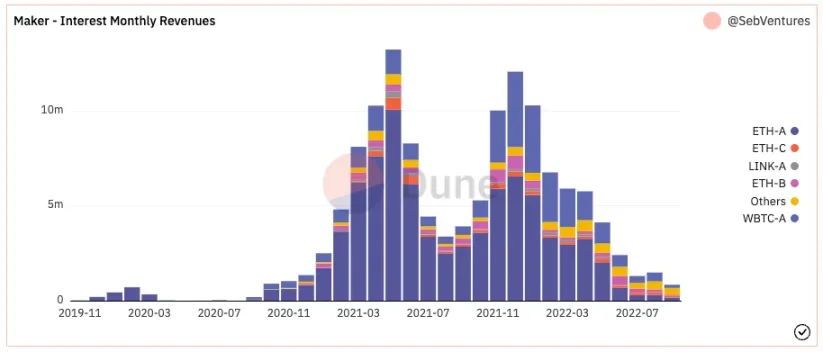

他们按资产类别划分了每月的利息收入:

通过仪表板,可以识别不同产品的收入。在上述仪表板中显示,Maker 有几个细分收入流,包括挂钩稳定模块、现实世界资产和清算。Dune 是一个有用的工具,但需要一些 SQL 知识。

资产流出

通常流出细节不仅可以查看 DAO 的国库,还可以在治理提案和财务报告中找到。整体费用包括工资支付、利润分享、安全审计或赠款。

与传统金融一样,我们通常会关注一下问题:

DAO 的燃烧率是多少?

花了多少钱,这些资金都花在了什么地方?

支出如何增加或减少?

这笔支出是否会对 DAO 的长期路线图产生积极影响?

一些 DAO 会将资金用于多个项目,并让这些团队随意使用这些资金,因此识别和分类 DAO 支出可能会存在一些困难。为了准确识别 DAO 支出,需要密切关注 DAO 的治理建议、识别国库中的交易,同时要及时查看财务报表。

探索 DAO 国库

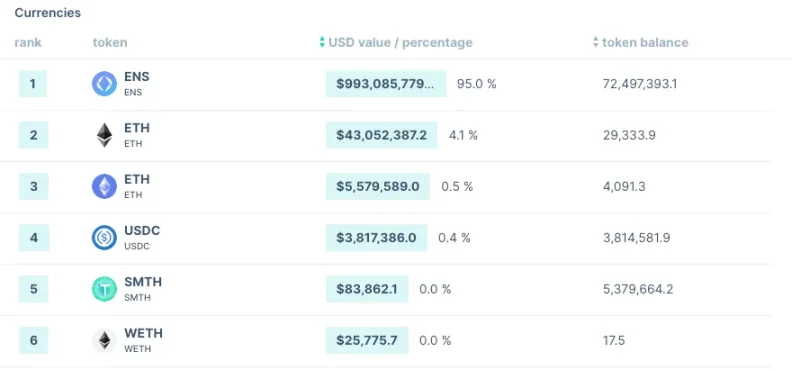

ENS

ENS 国库持有大部分的 ENS 代币,也有相当数量的 ETH,用户必须支付 ETH 才能购买 ENS 域名。

Lido

Lido 国库大部分资金都是治理代币 LDO,作为流动性质押衍生品提供商,他们也持有相当多的 ETH。同时 Lido 资产更加多样化,DAI 是第三大持有资产。

MakerDAO

MakerDAO 同样拥有大量的治理代币 MKR,但并没有显示来自 peg 稳定模块(PSM)中持有的 USDC 和 DAI 等稳定币。了解每种产品如何影响协议的总持有量也是分析师需要额外关注的。

Bankless

虽然 BANK 占 DAO 国库的 80%,但整体比上面的例子更加多样化。不过 Banklss 国库并未持有稳定币,如果出现黑天鹅事件,BanklessDAO 维持项目的购买力会大幅下降。

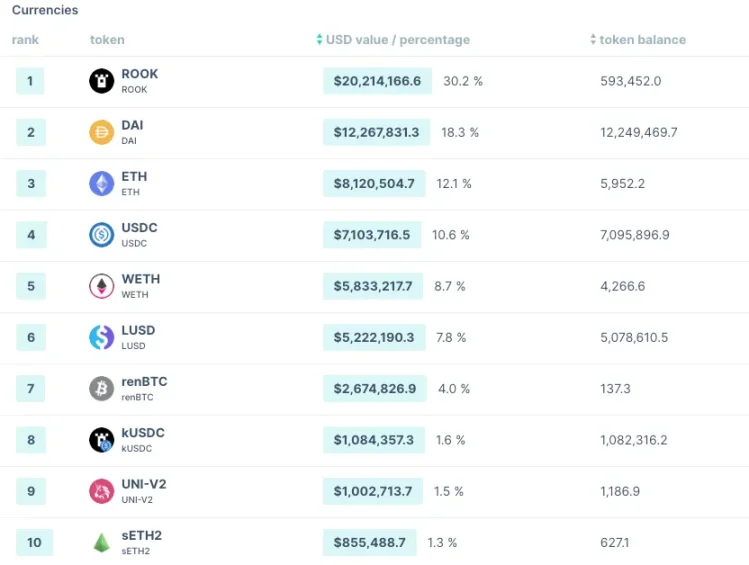

Rook

Rook 前五名持仓份额都不超过 30%,拥有令人难以置信的多样化国库,这将使 Rook 在市场低迷或出现黑天鹅事件时幸存下来。

结论

投资者、贡献者和用户可以通过 DAO 金库了解组织财务的健康状况,但仍需谨慎,一些 DAO 有各种项目收入,同样也会有一些对长期增长有益的支出,但它们并没有在资产负债表汇总注明。

在做财务规划时,需谨记资产多样化,如果 DAO 治理代币与国库中的其他资产高度相关,它会受到市场走势的负面影响。DAO 可以持有流动性代币来产生收入。

DAO 管理者可以使用 Yearn、Balancer 和 Llama 等工具来更好地管理和多样化资金库。在开放金融世界里,每个人都可以查看资产负债表来更好地了解项目的发展进程。