Multicoin Capital: ราชาแห่งการเข้ารหัสที่ขัดขวาง Ethereum วิทยานิพนธ์ผู้คลั่งไคล้การหักบัญชีพร้อมผลตอบแท

ที่มา: Overseas Unicorn Team

ที่มา: Overseas Unicorn Team

ในฤดูใบไม้ผลิปี 2017 หลังจากประสบกับฟองสบู่ ICO ผู้ก่อตั้ง Multicoin Capital สองคน Kyle และ Tushar ตระหนักถึงการขาดกรอบการวิเคราะห์สำหรับการลงทุน crypto และตัดสินใจที่จะเป็น Benjamin Graham แห่งโลก crypto โดยพยายามเปิดประตู เพื่อเพิ่มมูลค่าการลงทุนในฟิลด์ crypto ยุค

เริ่มจาก "การทำความเข้าใจความเร็วการไหลเวียนของโทเค็น" ทั้งสองใช้บทความที่เฉียบคมเพื่อสร้างบุคคลกองทุนที่ไม่กลัว "การต่อต้านฉันทามติ" เมื่อผู้คนร้องเพลงเกี่ยวกับ Ethereum อย่างกระตือรือร้น พวกเขาเล่นการพนันอย่างหนักกับ EOS "Ethereum Killer" ซึ่ง EOS ล้มเหลวเนื่องจากเหตุผลของโครงการ เมื่อตลาดเฉลิมฉลอง "ความผิดพลาด" ของ Multicoin Multicoin ก็ไม่ "ยอมรับความผิดพลาด" และยืนกรานที่จะทำวิทยานิพนธ์ของตนเอง ชะลอความเร็วของการขยายตัวของ Ethereum และในที่สุดก็โหวตให้กับโครงการที่ยอดเยี่ยมอย่าง Solana

เป็นเวลา 5 ปีแล้วที่รูปแบบการลงทุนของ Multicoin เป็นมาโดยตลอดวิทยานิพนธ์ที่ขับเคลื่อนด้วย: กลุ่มผู้สังเกตการณ์ที่คลั่งไคล้โลกแห่งการเข้ารหัสถกเถียงปัญหาของเครือข่ายสาธารณะทั้งกลางวันและกลางคืน อนุมานการทำซ้ำทางเทคโนโลยีและ "ภาพทางทฤษฎี" ของอนาคตของโลกการเข้ารหัส และสร้างพอร์ตการลงทุนตามนั้น

Multicoin เชื่อว่าวิทยานิพนธ์จะมุ่งเน้นไปที่การลงทุน พวกเขา "ใช้เวลา 10 ปีเป็นเส้นขอบฟ้าและรออย่างอดทนเพื่อให้วิทยานิพนธ์ได้รับการยืนยันตามเวลาแทนที่จะเข้าสู่ตลาดเร็วเกินไป พวกเขากลับกลัวที่จะพลาดโอกาสในการเติบโตแบบทบต้นอย่างไม่มีที่สิ้นสุด"พวกเขาทำงานอย่างใกล้ชิดกับโครงการที่ลงทุนและมีส่วนร่วมในการสร้างระบบนิเวศของ Solana เช่นเดียวกับ Helium, The Graph และโครงการอื่นๆ อีกมากมายที่ทำให้ผู้คนต้องคิดใหม่เกี่ยวกับโมเดล Web 3

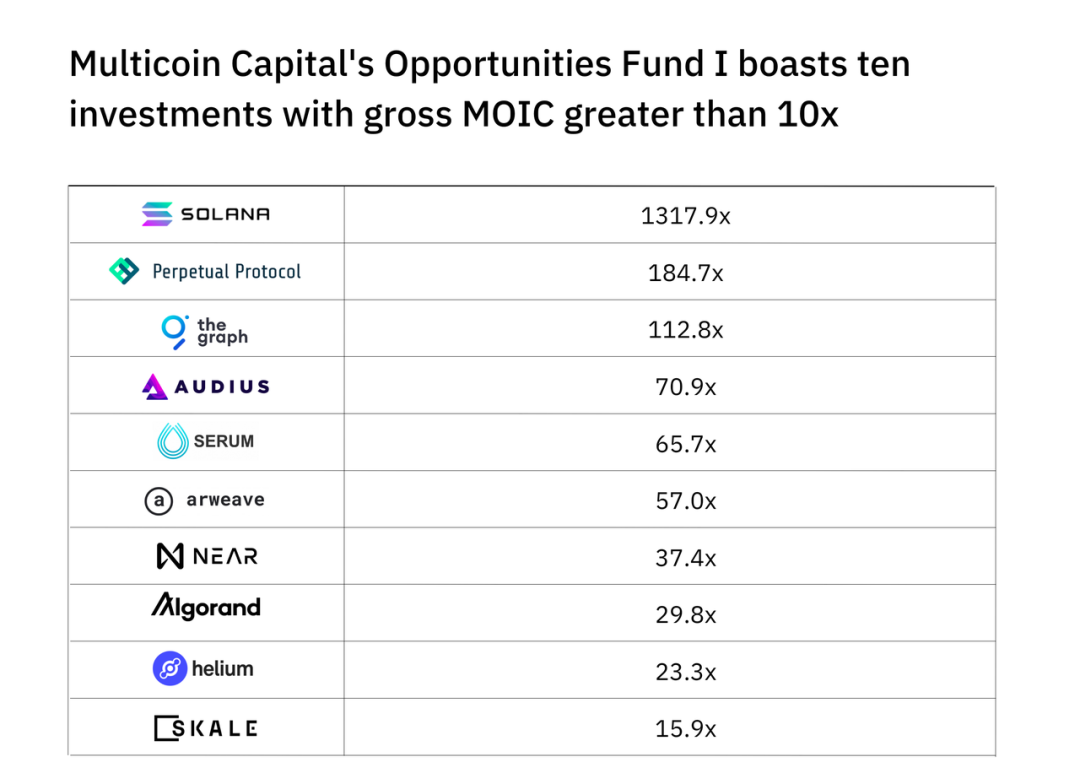

ในไตรมาสที่สามของปีที่แล้ว Gross MOIC ของกองทุน VC แรกของ Multicoin สูงถึง 114.7 เท่า และ DPI อยู่ที่ 47 เท่า รายงานโดย Axios เมื่อปลายปีที่แล้วยังแสดงให้เห็นว่าผลตอบแทนของกองทุนป้องกันความเสี่ยงของ Multicoin อยู่ที่ประมาณ 203 เท่าตั้งแต่เริ่มก่อตั้ง

รายการ LP ของ Multicoin รวมถึงMarc Andreessen (a16z),Sam Bankman-Fried (FTX), Fred Wilson (USV), Su Zhu (Three Arrows) เป็นชื่อที่ไม่ต้องแนะนำอะไรมาก

วัฒนธรรมของ Multicoin ร้อนแรงและตรงไปตรงมาผู้ก่อตั้งทั้งสองกล้าที่จะแสดงความคิดเห็นที่ไม่เป็นที่นิยมในที่สาธารณะ โดยเฉพาะอย่างยิ่งในสภาพแวดล้อมการสนทนาของชนเผ่าและความไม่อดทนของ cryptoต่อไปนี้คือสารบัญของบทความนี้ และขอแนะนำให้อ่านร่วมกับประเด็นหลัก

ต่อไปนี้คือสารบัญของบทความนี้ และขอแนะนำให้อ่านร่วมกับประเด็นหลัก

01 การหลบหนีจากวอลล์สตรีท: ค้นหาโลกใหม่

02 ผู้สังเกตการณ์แห่งโลกที่ถูกเข้ารหัสซึ่งสร้างชื่อเสียงทีละก้าว

03 Winners win big, losers average losers

04 คนคลั่งไคล้การหักเงินที่ขับเคลื่อนด้วยวิทยานิพนธ์

05 "พันธมิตรผู้ประกอบการรายที่สาม"

06 ธีมการลงทุนและอนาคตของการเข้ารหัส

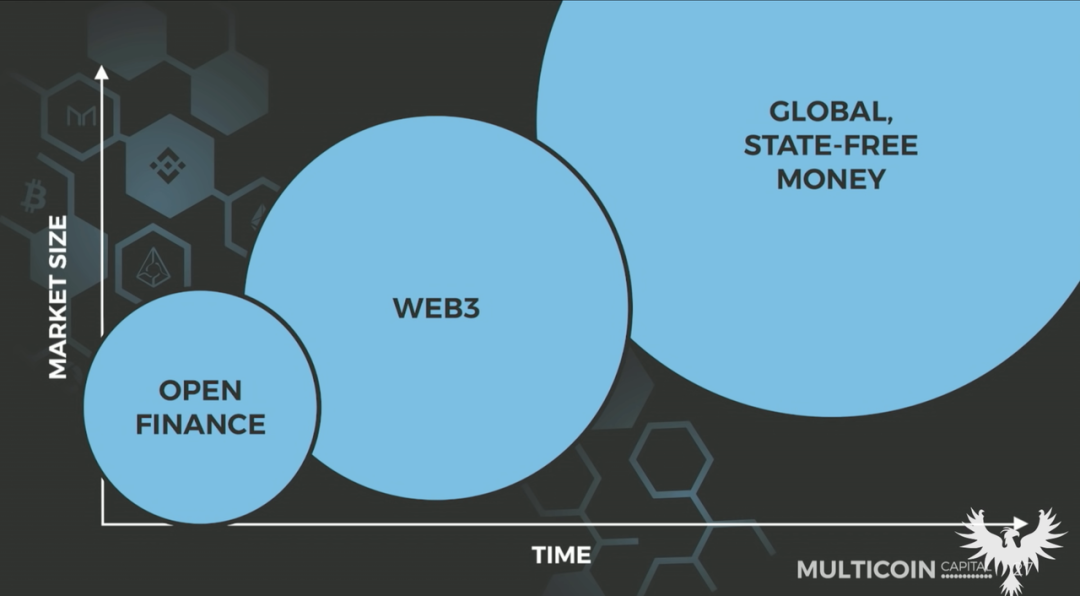

Open Finance: อุดมคติอันยิ่งใหญ่ของการบูรณาการทางการเงิน

Web3: ทบทวนการประสานงานของกิจกรรมทางเศรษฐกิจของมนุษย์

ห่วงโซ่สาธารณะอันยิ่งใหญ่: อนาคตที่ปราศจากสะพาน

ชื่อระดับแรก

01

หลีกหนีจากวอลล์สตรีท: ค้นหาโลกใหม่

ผู้ก่อตั้ง Multicoin ทั้งสองเป็นนักศึกษาระดับปริญญาตรีของมหาวิทยาลัยนิวยอร์กในปี 2008 ทั้งคู่หวังว่าจะฝากผลงานไว้ที่ Wall Street จนกระทั่งเกิดวิกฤตการณ์ทางการเงิน Wall Street และ Silicon Valley ประสบความสูญเสียและความรุ่งเรืองที่ส่งผลกระทบโดยตรงต่อวิถีของพวกเขา Kyle เริ่มติดตามบิดาที่เป็นนักวิทยาศาสตร์คอมพิวเตอร์เพื่อศึกษาการเป็นผู้ประกอบการในบริษัทเวชระเบียนอิเล็กทรอนิกส์ VersaSuite นอกจากนี้ Tushar ต้องการเรียนรู้การเป็นผู้ประกอบการด้วย เขาปฏิเสธข้อเสนอจากธนาคาร PB ขนาดใหญ่หลายแห่งและสมัครใจลดเงินเดือนลงครึ่งหนึ่งเพื่อทำงานในบริษัทของบิดาของ Kyle

หนึ่งปีต่อมา ทั้งสองก็ออกไปตามลำพัง Kyle ได้สร้างอุปกรณ์แสดงผล VR สำหรับศัลยแพทย์โดยใช้ Google Glass ในระหว่างการผ่าตัด เขาสามารถสวมใส่อุปกรณ์นี้เพื่อบันทึกกระบวนการโต้ตอบทั้งหมดกับผู้ป่วย และดูแนวทางการผ่าตัดที่ประสบความสำเร็จในอดีต ในไม่ช้า Google ก็ล้มเลิกแอปชื่อดังในตอนนั้น และ Kyle ก็ถูกบังคับให้ขายสตาร์ทอัพเครื่องแรกของเขา ในแง่ของโอกาสทางการตลาด เขาเร็วกว่า 10 ปีเป็นอย่างน้อย

ความพยายามครั้งแรกของ Tushar ยังเกิดขึ้นในด้านการดูแลสุขภาพ โดยก่อตั้ง ePatientFinder ซึ่งเป็นแพลตฟอร์มสำหรับจับคู่ข้อมูลแพทย์-ผู้ป่วยและการทดลองทางคลินิก ในเวลานั้น การยอมรับ SaaS ของผู้คนยังไม่ดีเท่าปัจจุบัน ห่วงโซ่การขายทั้งหมด ข้อเสนอแนะการทดลองทางคลินิก และวงจรผลิตภัณฑ์ยาวเกินไป ในที่สุด Tushar ก็ขายให้กับคู่แข่ง

สี่ปีแรกหลังจากที่ทั้งสองสำเร็จการศึกษาไม่ถือว่าประสบความสำเร็จในทางโลก และหลายคนยังคิดว่ามันช้าเกินไปด้วยซ้ำ สมุดปกขาว Bitcoin ของ Satoshi Nakamoto ซึ่งตีพิมพ์ในปี 2008 ไม่ถูกหยิบขึ้นมาโดย Tushar จนถึงปี 2013 จากนั้น Kyle ก็ "ค้นพบ" Ethereum และทั้งสองก็เข้าสู่โลกแห่งการเข้ารหัสโดยสมบูรณ์ พวกเขาได้เข้าร่วมในการสนทนาแบบออฟไลน์มากมายเกี่ยวกับ cryptocurrencies ภายในหนึ่งปี และได้พบกับ Adam Mastrelli LP Multicoin ในอนาคต

จนกระทั่งฤดูใบไม้ผลิปี 2017 พวกเขาตัดสินใจที่จะเริ่มต้นกองทุน crypto ด้วยกัน ตั้งแต่นั้นเป็นต้นมา ทุกอย่างได้รับการเร่งความเร็วอย่างน่าทึ่ง และไม่สามารถบรรลุอัตราผลตอบแทนได้ใน 5 ปี

และHeliumและSolanaเป็นตัวแทนของความเชื่อหลักสองประการของพวกเขา:พลังของ Web3 ในการกระจายอำนาจองค์กรในโลกทางกายภาพ และอนาคตของเครือข่ายสาธารณะที่ทรงพลังทั้งหมดในช่วงครึ่งหลังของปีที่แล้วเมื่อมีการระดมทุนครั้งที่สาม Multicoin ได้จัดสรรประมาณ 11% ของกองทุน VC ทั้งสองแห่งใน Helium และ 7% ใน Solana ซึ่งทั้งสองกองทุนได้รับผลตอบแทนมากกว่า 10 เท่า MOIC ของ Solana ถึง อย่างน่าอัศจรรย์ 1318 ครั้ง

ในไตรมาสที่สามของปี 2021 LP ได้แบ่งปันผลตอบแทนของกองทุน VC แรกของพวกเขาใน Multicoin Gross MOIC สูงถึง 114.7 เท่าและ DPI อยู่ที่ 47 เท่า ความสามารถอย่างเป็นทางการของ Multicoin แสดงให้เห็นว่ากองทุน VC แรกและที่สองได้รับผลตอบแทน 33.1x และ 3.6x ตามลำดับ

Kyle ผู้ก่อตั้งมักพูดถึง 'Timing is a bitch' ในการสัมภาษณ์ โดยคิดว่าเป็นไปไม่ได้ที่จะลงทุนในด้าน crypto ที่ดี ดังนั้นเขาจึงต้องถอนตัวออกจากความหลงใหลในจังหวะเวลา "ชนะในสิบปี"

กองทุน VC แห่งแรกของ Multicoin มีมูลค่าเพียง 17 ล้านเหรียญสหรัฐ หลังจากบรรลุผลลัพธ์ที่น่าประทับใจ กองทุนที่สองและสามยังคงระดมทุนได้เพียง 100 ล้านเหรียญสหรัฐ และ 250 ล้านเหรียญสหรัฐเท่านั้น วันนี้ Multicoin ซึ่งมีกองทุนเฮดจ์ฟันด์มูลค่าประมาณ 4.5 พันล้านเหรียญสหรัฐใน AUM ยังคงมุ่งเน้นไปที่การค้นหาผู้ประกอบการ 1% อันดับแรกด้วยทีมงานมากกว่าหนึ่งโหล"เรายังคงอยู่ที่หัวของคลื่น"ชื่อระดับแรก

02

ผู้เฝ้าดูโลก crypto ที่สร้างชื่อเสียงทีละครั้ง

ปี 2017 ถือเป็นปีแรกของวงการคริปโต ในเวลานั้น ฟองสบู่ ICO ก็เช่นเดียวกัน Tushar ยกตัวอย่างว่าแม้แต่แนวคิดไร้สาระของ Dentacoin ก็สามารถดึงดูดกลุ่มผู้เชื่อในตลาดได้ Dentacoin มุ่งมั่นที่จะ ให้ผู้ที่มีสุขอนามัยช่องปากสูง การเสนอรางวัลโทเค็นเพื่อทำลายอุตสาหกรรมทันตกรรมยังจุดประกายความคิดเห็นของสาธารณชนว่าโทเค็นเหล่านี้สามารถใช้เป็น "เทียบเท่าทั่วไป" ของสกุลเงินคำสั่งเพื่อซื้อสินค้า

ปรากฏการณ์ของการเร่งรีบในระยะสั้นและการจดทะเบียนอย่างรวดเร็วทำให้พื้นที่ที่อยู่อาศัยของการลงทุนระยะยาวขาดหายไป ในเวลานั้น มีนักลงทุนสถาบันจำนวนน้อยมากที่ให้ความสนใจกับฟิลด์การเข้ารหัส และการเคลื่อนย้ายเงินทุนถูกซ่อนเร้นอยู่มาก Polychain และ MetaStable ซึ่งค่อนข้างมีอิทธิพลในเวลานั้น ไม่เคยแบ่งปันข้อมูลเชิงลึกของตลาดใด ๆ ต่อสาธารณะ นับประสาอะไรกับการสนับสนุนการลงทุนที่มีมูลค่าอย่างมีเหตุผลมากกว่า

โลก Crypto ปี 2017 ต้องการเบนจามิน เกรแฮม[หมายเหตุ: บิดาแห่ง "การลงทุนแบบเน้นคุณค่า" และผู้เขียน "Smart Investor"]. Kyle และ Tushar พบสุญญากาศและเริ่มเปล่งเสียง

ทั้งสองคนไม่มีเรซูเม่เกี่ยวกับคริปโตที่ดีและอาวุธที่สำคัญที่สุดในการดึงดูดความสนใจและสร้างแบรนด์คือการเขียน ในช่วงเริ่มต้นของการก่อตั้ง บทความของ Kyle เรื่อง "Understanding the Circulation Velocity of Tokens" ถูกส่งต่ออย่างลนลานในแวดวงคริปโต จนถึงขณะนี้ Multicoin ถือได้ว่าเป็นหนึ่งในทีมการลงทุนที่มีเสียงตอบรับมากที่สุดในโลกการเข้ารหัส

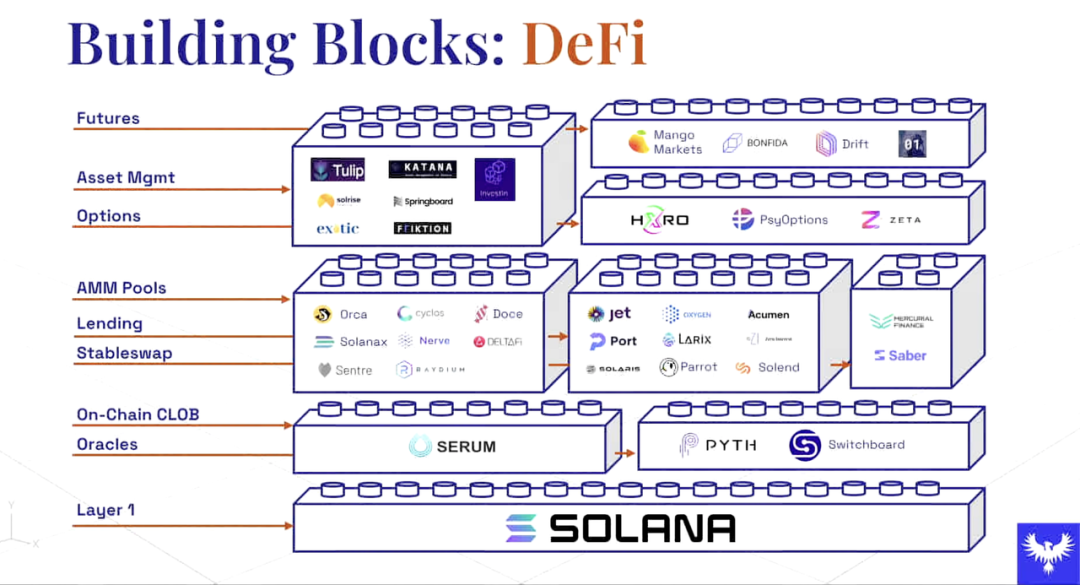

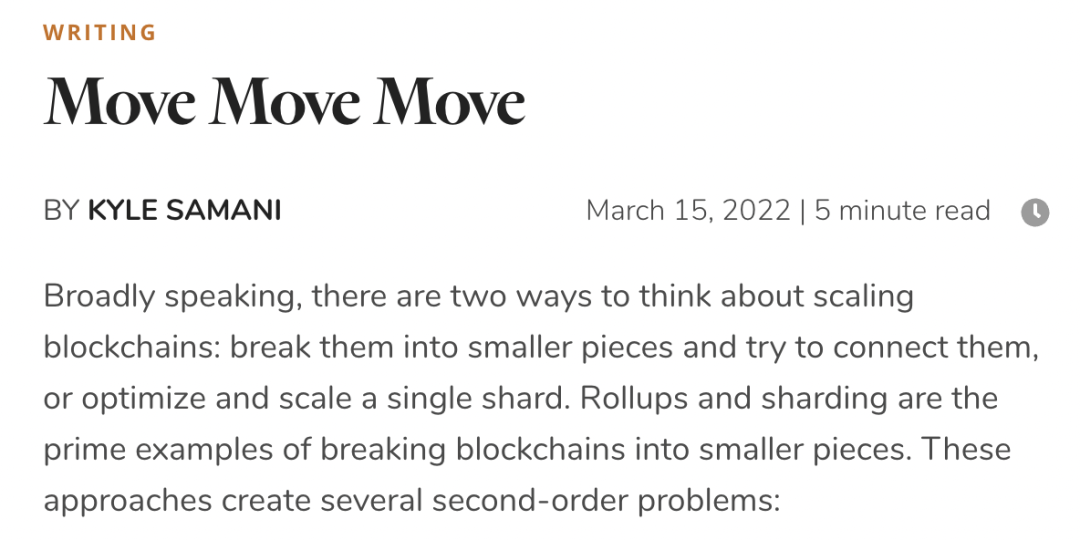

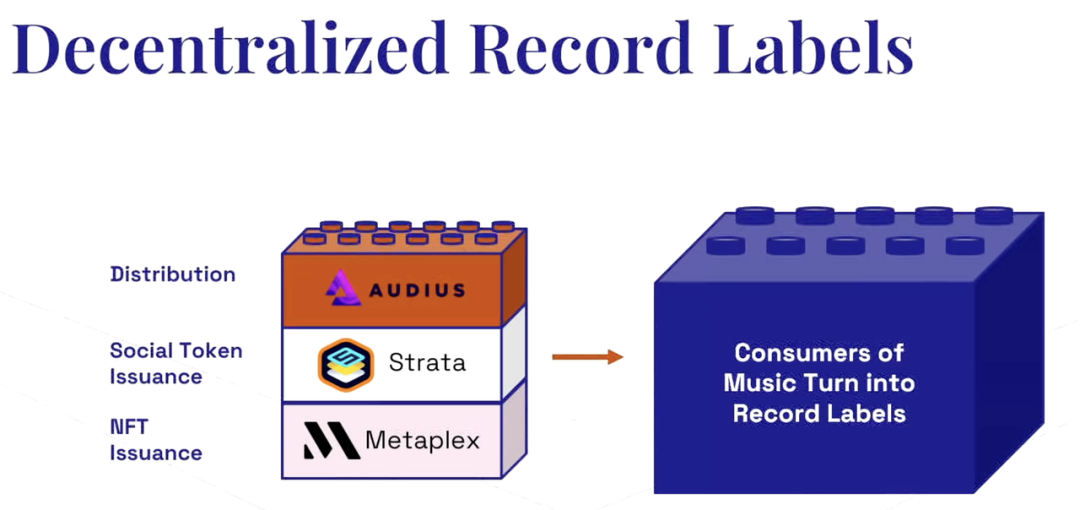

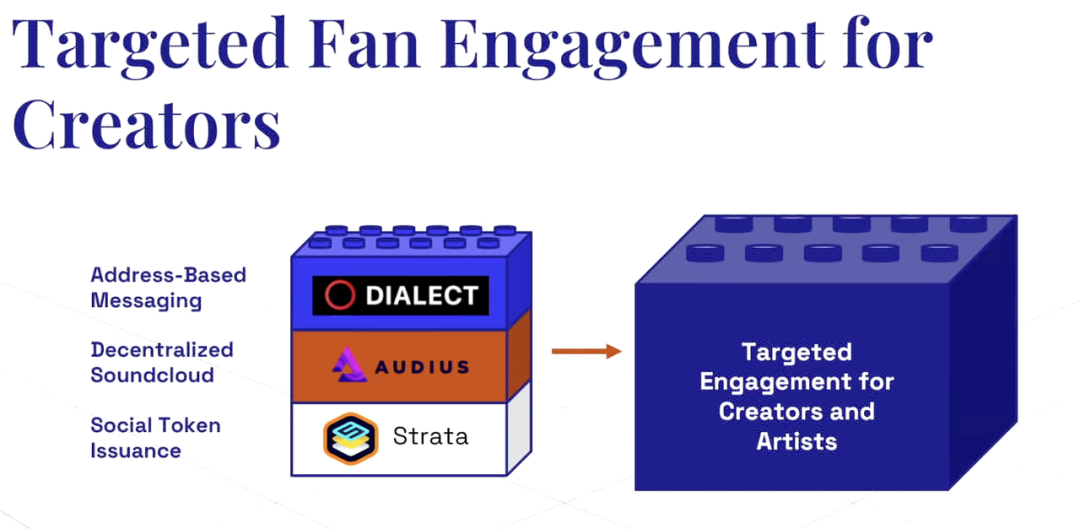

ตัวอย่างเช่น หนึ่งในแนวคิดที่เขียนบ่อยที่สุดใน Multicoin เมื่อเร็ว ๆ นี้: ความสามารถในการประกอบ ซึ่งหมายถึงการสร้างโมดูลใหม่อย่างต่อเนื่องบนแพลตฟอร์มและการเขียนโปรแกรมลงในแอปพลิเคชันระดับสูง มัลติคอยน์คิดถึงเวลาแล้วที่จะสร้าง "เลโก้สำหรับการเข้ารหัส" ซึ่งผู้ใช้สามารถรวมโปรโตคอลพื้นฐานในรูปแบบต่างๆ ในขณะที่แสดงให้เห็นถึงความสามารถในการจัดองค์ประกอบ ไคล์ยังแสดงให้เห็นซ้ำแล้วซ้ำอีกว่าเหตุใดคำตอบของการขยายห่วงโซ่สาธารณะจึงไม่สามารถ "แยกย่อย" ได้

ใช้ Defi เป็นตัวอย่าง อ้างอิงจาก "ฐานเลโก้" (สมุดคำสั่งซื้ออ้างอิง) เซรั่มการซื้อขายแบบกระจายอำนาจและตลาดซื้อขายล่วงหน้า Mango Markets สามารถทำสัญญาระยะยาวและระยะสั้นได้พร้อมกันตามกลยุทธ์ วิธีการจดจำนองทั้งหมดสร้างสกุลเงิน UXD ที่เสถียร นอกจากนี้เชนสาธารณะที่มีประสิทธิภาพสูงยังสามารถซ้อนทับการรวมข้อตกลงของสัญญาการให้ยืม การดูแลสินทรัพย์ดิจิทัล การซื้อขายออปชั่น และแม้แต่เครื่องมือป้องกันความเสี่ยง ซึ่งไม่สามารถเกิดขึ้นได้ในสถานะของการกระจายตัวของหลายเชน : ความล่าช้าในการโหลดข้อมูลระหว่างระบบ ความซับซ้อนทางเทคนิคและต้นทุนการประสานงานในการพัฒนา และช่องโหว่ของแอพพลิเคชั่นข้ามสายโซ่จะทำลายการทำงานของโลกเลโก้ใบนี้

ผู้ก่อตั้งทั้งสองมีความกระตือรือร้นที่จะแบ่งปันว่าพวกเขาเห็นขั้นตอนการสมัครที่เป็นไปได้และเส้นทางทางเทคนิคของโลกที่เข้ารหัสอย่างไร และมักจะประกาศบทความการลงทุนโดยอ้างถึงการยืนยันก่อนหน้านี้ เช่น การทดลองทางสังคมที่มีการประทับเวลา Tushar กล่าวถึงในการให้สัมภาษณ์กับ Capital Allocators:

เราคุ้นเคยกับการเขียนความคิดเห็นของเราและโพสต์ทางออนไลน์ เพราะคนในโลก crypto โดยเฉพาะบน Twitter ชอบที่จะกระตุ้นช่องโหว่ของคุณ ในเวลานี้ คุณถูกบังคับให้ต้องถกเถียงซ้ำแล้วซ้ำอีก เพื่อที่จะแก้ไขและตรวจสอบของคุณอย่างต่อเนื่อง ตำแหน่ง.

ในตอนแรก การระดมทุนของ Multicoin ไม่ราบรื่น และนักลงทุนสถาบันจำนวนมากไม่เชื่อเกี่ยวกับ crypto ผู้จัดการของ LPs ขนาดใหญ่บางแห่งไม่เต็มใจที่จะเสี่ยงและชอบที่จะลงทุนในกองทุนที่มีความสัมพันธ์ทางสังคมที่มั่นคง เช่น Sequoia และแม้แต่ Paradigm แต่เมื่องานเขียนของ Kyle และ Tushar มีพลังมากขึ้นเรื่อย ๆ และเสียงของพวกเขาก็ค่อย ๆ เพิ่มขึ้นเรื่อย ๆ นักลงทุนจำนวนมากก็สังเกตเห็นพวกเขา

ตลอดปี 2018 Multicoin ได้รับรางวัล LP รุ่นหนาหลายรายการ ได้แก่ Marc Andreessen, Chris Dixon และ David Sacks (สองคนแรกคือจิตวิญญาณของ a16z, David เป็นผู้ก่อตั้ง COO ของ Paypal และเป็นผู้ก่อตั้ง Craft Ventures), Fred Wilson จาก Union Square Ventures เขาพูดอย่างตรงไปตรงมาว่าเหตุผลที่เขาเพิ่มทุนคือผู้ก่อตั้งสองคน“ไม่กลัวทำผิดต่อหน้าสาธารณชน”。

แน่นอนว่าความตรงไปตรงมาของ Multicoin ยังดึงดูดพลังการยิงจำนวนมาก ในตอนแรกพวกเขามีความอ่อนน้อมถ่อมตนอย่างมากต่อ Ethereum ซึ่งนำไปสู่การลงทุนใน EOS ซึ่งเป็น "Ethereum Killer" ที่โด่งดังครั้งหนึ่ง ซึ่งเป็นบล็อกเชนที่พยายามจัดหาทางเลือกความเร็วสูง ในสายตาของแฟน ๆ Ethereum หลายคน นี่เป็นความท้าทายโดยตรงสำหรับ Ethereum

ชื่อระดับแรก

03

Winners win big, losers average losers

เนื่องจากการจดทะเบียนโครงการที่รวดเร็วมากในตลาด cryptocurrency ในตอนแรก Multicoin จึงมีกองทุนเฮดจ์ฟันด์เพียงแห่งเดียวที่จะตามทันโครงการ ICO ที่ดี เริ่มต้นในปี 2018 ผู้คนไม่มองว่าสกุลเงินดิจิทัลเป็นแฟชั่นที่หายวับไปอีกต่อไป เริ่มติดตามอิทธิพลระยะยาว และเริ่มเปิดการออกโทเค็นส่วนตัวในช่วงแรก

Multicoin ก่อตั้งกองทุนร่วมทุนโดยเฉพาะอย่างรวดเร็ว รูปแบบกองทุนครอสโอเวอร์นี้ทำให้ Multicoin มีดุลยพินิจที่ดี: การลงทุนในระยะแรกในโครงการที่ดี ความร่วมมืออย่างใกล้ชิดกับผู้ประกอบการ และหากคุณมีความเชื่อมั่นในโครงการ คุณสามารถใช้เครื่องมือรองเพื่อลงทุนในระยะยาวเพื่อถือ

สมมติฐานของ Multicoin ในการตัดสินใจลงทุนคือลงทุนในโครงการที่พวกเขาคิดว่าสามารถถือครองได้เป็นเวลา 10 ปีนี่คือความสามารถที่เรียกว่าการเติบโตอย่างต่อเนื่องในระยะยาวและต่อเนื่อง ซึ่งเป็นแหล่งที่มาเดียวกับกลยุทธ์ Changsheng "Long the internet" โดยรวมของ Tiger เมื่อ 10 ปีที่แล้ว

Multicoin หวังที่จะแสดงวิทยานิพนธ์ที่ได้รับจากการโต้วาทีซ้ำๆ อย่างเต็มที่ และได้รับผลตอบแทนที่แข็งแกร่งที่สุดเมื่อสิ้นสุดรอบ ซึ่งต้องใช้ความเชื่อมั่นอย่างแน่วแน่และความอดทนที่เพียงพอ นี่คือเหตุผลว่าทำไมในฤดูหนาวของการเข้ารหัสลับในปี 2018 และ Black Thursday ในเดือนมีนาคม 2020 Multicoin จึงครองตำแหน่งขนาดใหญ่อย่างเช่น Solana และ Helium (ทีมเหล่านี้แทบจะหันหลังกลับไม่ได้ในเวลานั้น)

เมื่อตลาดการเข้ารหัสกำลังถดถอย Multicoin ยังยกตำแหน่งขนาดใหญ่หลายแห่งรวมถึง Solana และยังลงทุนในสื่อสตรีมมิ่งเพลงแบบกระจายอำนาจ Audius ในลักษณะ "ทวนกระแส" ร่วมกับ Livepeer และ Braintrust ในภายหลัง ได้กลายเป็นกรณีสำคัญภายใต้ บรรทัดฐานของ "อำนาจอธิปไตยทางดิจิทัลของ web3 และตรรกะของแอปพลิเคชัน"(เราจะขยายความในหัวข้อการลงทุนในช่วงครึ่งหลังของบทความนี้)

ในช่วงเวลาที่ซบเซาที่สุด Multicoin ตัดสินใจที่จะหยุดการซื้อขายและยึดติดกับการเดิมพันของเขา ในปี 2018 แม้ว่า EOS จะล้มเหลว แต่ก็ยังมีประสิทธิภาพดีกว่า Bitcoin และ Bitwise 10 (กองทุนดัชนีที่สำคัญในแวดวงคริปโต) มากกว่าครึ่ง . นี่เป็นจุดเปลี่ยนที่สำคัญสำหรับ Multicoin:ตั้งแต่นั้นมา พวกเขาไม่หมกมุ่นอยู่กับสิ่งที่เรียกว่า "จังหวะเวลาของตลาด" อีกต่อไป แต่มุ่งเน้นไปที่ขนาดและมูลค่าของโอกาสนี้มากกว่า— ดังที่ Tushar กล่าวว่า “เราตระหนักดีว่าคุณไม่สามารถทำนายเหตุการณ์หงส์ดำได้ ซึ่งจะเกิดขึ้นในเดือนมกราคม 2020 และคุณไม่สามารถคาดเดาได้ว่าจะเกิดอะไรขึ้นในเดือนมีนาคม เราตัดสินใจที่จะยึดมั่นในจุดแข็งของเรา:การเลือกเนื้อหาที่ขับเคลื่อนด้วยวิทยานิพนธ์ "

ก่อนที่จะแนะนำกลยุทธ์ที่ขับเคลื่อนด้วยวิทยานิพนธ์ในบทต่อไป ลองมายกตัวอย่าง: หลังจากที่การเดิมพันครั้งใหญ่ของ Multicoin กับ EOS ล้มเหลว “ผู้ที่เป็นศูนย์กลางของ Ethereum” ต่างก็ดูโอ้อวด อย่างไรก็ตาม ผู้ก่อตั้งทั้งสองไม่ได้ถอนความคิดก่อนหน้านี้ทั้งหมดของพวกเขาเกี่ยวกับปัญหา Ethereum: เส้นทางการขยายตัวของ Ethereum นั้นเปลี่ยนแปลงอย่างรวดเร็วแต่มีความเร็วไม่เพียงพอที่จะส่งมอบ นักพัฒนาที่มีพรสวรรค์ระดับผู้สูงอายุหลายคนจากไป Lianchuang Gavin Wood ได้ย้ายไปที่ โครงการใหม่ Polkadot และเนื่องจาก Vitalik ทำงานช้า ความแออัดของ Ethereum และปริมาณงานต่ำทำให้เป็นไปไม่ได้ที่จะเห็นอนาคตที่ดี

พวกเขาตระหนักว่าความล้มเหลวของ EOS อยู่ที่รูปแบบการจัดสรรทรัพยากรและแง่มุมอื่นๆ ไม่ใช่ว่าวิทยานิพนธ์ของพวกเขาผิด พวกเขารู้อย่างรวดเร็วว่าทำไมพวกเขาถึงเดิมพันม้าผิดตัวและยึดติดกับวิทยานิพนธ์ต้นฉบับ ในกระบวนการค้นหา "ผู้ท้าชิง Ethereum" ในที่สุดพวกเขาก็ลงคะแนนให้โครงการที่มีผลตอบแทนเป็นพันเท่าอย่าง Solana

Multicoin ไม่ต้องการเหวี่ยงตาข่าย แต่ต้องการจับปลาที่ใหญ่ที่สุดและจับมันด้วยเงินทั้งหมดเมื่อถูกถามเกี่ยวกับเลเยอร์ 2 และการยกเลิกการพิสูจน์ความรู้เป็นศูนย์ที่มีแนวโน้มมากที่สุดเมื่อเร็วๆ นี้ ไคล์พูดอย่างตรงไปตรงมาว่า "ไม่ใช่สิ่งที่เราทำ เราไม่พะวงกับการค้าขายนี้"และยอมรับว่ามีองค์ประกอบของโชคในการเดิมพัน Starkware ในตอนนั้น พวกเขาลงทุนใน Starkware ร่วมกับกองทุนชั้นนำ เช่น Paradigm และ Sequoia Multicoin ไม่ได้พูดถึงตรรกะการลงทุนซ้ำๆ การเคลื่อนไหวเหล่านี้แสดงให้เห็นอย่างตรงไปตรงมาว่าพวกเขาเชื่อมั่นและสนับสนุนสนามนี้มากแค่ไหน ปรัชญาการลงทุนที่มุ่งเน้นนี้เป็นเหตุผลว่าทำไม Multicoin สามารถมีโครงการระดับดาวหลายโครงการที่ขับเคลื่อนผลกำไรส่วนเกินจำนวนมาก

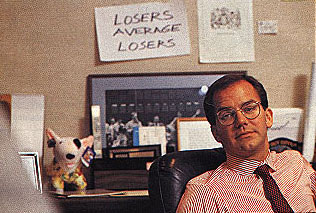

ผู้ก่อตั้งทั้งสองเห็นพ้องกันว่า Multicoin นั้นไม่ชอบความเสี่ยงมากกว่าบริษัทอื่น และเป็นหนึ่งในกองทุนคริปโตไม่กี่แห่งที่ "เลิก" จัดการความผันผวนและจัดการความเสี่ยงจากมุมมองเชิงคุณภาพ"ผู้แพ้โดยเฉลี่ย" โดย Paul Tudor Jones คือคำขวัญของพวกเขาชื่อระดับแรก

04

Maniac Deduction ที่ขับเคลื่อนด้วยวิทยานิพนธ์

การขับเคลื่อนวิทยานิพนธ์นั้นพูดง่ายกว่าทำ นักฉวยโอกาสมักมีปฏิกิริยาตอบสนองและเปิดกว้างต่อการประเมินสิ่งใหม่ๆ ที่เกิดขึ้นในโลก Tushar กล่าวอย่างตรงไปตรงมาว่าสิ่งนี้ไม่ต่างจากการปัด Tinder นักลงทุนที่ขับเคลื่อนด้วยวิทยานิพนธ์อย่างแท้จริงจะสร้างมุมมองเชิงคาดการณ์ก่อน เช่นเดียวกับแผนงานสาธารณะของโครงการ Web 3 จำนวนมาก พวกเขาจะมีภาพที่สมบูรณ์ของ

ภารกิจแรกของ Multicoin ไม่ใช่การลงทุนในโครงการที่ดี แต่เป็นการสร้างทฤษฎีการลงทุนที่ดี ปรับ "ควร" ของโลก Web 3 ใหม่ด้วยหลักการแรกล้วนๆ และเมื่อคุณตัดสินใจว่าองค์ประกอบบางอย่างจะครอบครองตำแหน่งเชิงกลยุทธ์ที่สำคัญในอนาคต คุณจะ "เดิมพัน" ทั้งหมด แม้ว่าผู้ก่อตั้งทั้งสองชอบใช้คำว่า "การพนัน" แต่ในความเป็นจริงแล้ว โครงสร้างทางทฤษฎีที่อยู่เบื้องหลังนั้นละเอียดอ่อนพอๆ กับการผ่าตัด

Tushar เผยแพร่การแลกเปลี่ยนในพื้นที่ FTX แบบกระจายอำนาจ สี่เดือนหลังจากที่พวกเขาเสนอแนวคิดของ "การกระจายอำนาจ FTX" พวกเขาพบโครงการโปรดของพวกเขา Perpetual Protocol ซึ่งให้คุณค่ากับสภาพคล่องที่ลึกและเลเวอเรจสูง ข้อโต้แย้งซ้ำ ๆ ของ "อำนาจอธิปไตยทางดิจิทัล " จากยักษ์ใหญ่ด้านเทคโนโลยีนำไปสู่การลงทุนในโครงการต่างๆ เช่น Audius และ Project Galaxy ซึ่งมอบ "IP" ของตนเองให้กับผู้ใช้โดยตรง

ในการประชุมลงคะแนนเสียง 80% ถึง 90% ของเวลาจะใช้ไปกับการอภิปรายเกี่ยวกับตลาด โดยใช้หลักการแรกในการอภิปรายปัญหาที่มีอยู่ โมเดลที่เป็นไปได้ ข้อบกพร่องของโมเดลที่มีอยู่ และนวัตกรรมทางเทคโนโลยีในอนาคต เฉพาะเมื่อคุณแยกไม่ออกเท่านั้นที่จะรู้ว่าอะไร คุณกำลังรับประกันภัยและมูลค่าที่คุณสามารถสร้างได้”

เช่นเดียวกับที่พวกเขาจงใจกระตุ้นการอภิปรายโดยการแสดงความคิดเห็นในที่สาธารณะอย่างต่อเนื่อง การลงคะแนนเสียงเป็นสถานที่สำหรับเปิดเผยการหักล้างเชิงตรรกะที่ไร้ความคิดและบอบบาง และ "การไม่ยอมรับที่เป็นนิสัยและสร้างสรรค์" นี้กลายเป็นวิธีการสื่อสารที่ Multicoin พึ่งพามากที่สุดและมีประสิทธิภาพ ในเชิงลึก"หลังจากออกจากการประชุม เราสามารถเสริมความแข็งแกร่งให้กับแนวคิดเดิมของเรา หรือเราสามารถล้มล้างความคิดเหล่านั้นและเริ่มสร้างชุดทฤษฎีใหม่ทั้งหมด"

ที่น่าสนใจคือในสิบนาทีแรกของ IC พวกเขาทั้งหมดถือคอมพิวเตอร์อย่างเงียบ ๆ และแสดงความคิดเห็นในบันทึกในเวลาเดียวกันเพื่อให้การอภิปรายประจบประแจงและทุกคนสามารถคิดได้อย่างอิสระโดยไม่มีข้อสันนิษฐานใด ๆ ลุกขึ้นและอภิปราย

Multicoin มีทีมที่ค่อนข้างสมดุล Kyle คลั่งไคล้ (ต่อไปนี้บทความก็เหมือนเขา) และ Tushar ก็สงบ บทบาทของทั้งสองคือการจัดตั้งวิทยานิพนธ์และการจัดการพอร์ตการลงทุน ไคล์พูดเร็วและมีบุคลิกการโต้วาทีตามแบบฉบับ แม้ว่าในช่วงแรก ๆ เขาจะพูดจาไม่ดีต่อสาธารณชนในบางโครงการและทำให้คนวงในไม่พอใจ แต่จะเห็นได้ว่าเขาคิดเกี่ยวกับ "อำนาจอธิปไตยของเราในโลกดิจิทัล" อย่างถี่ถ้วนแล้ว Tushar ค่อนข้างอ่อนโยน มีตรรกะที่เข้มงวดเมื่อพูด และชอบมองไปข้างหน้า เขามักพูดว่า "เราเป็นมิชชันนารีไม่ใช่ทหารรับจ้าง" และเชื่อว่าเทคโนโลยีการเข้ารหัสสามารถขยายขอบเขตของเทคโนโลยีของมนุษย์เพื่อให้ได้รับอิสรภาพในระดับที่มากขึ้น

ผู้ก่อตั้งสองคนที่หลบหนีจากวอลล์สตรีทได้รับคัดเลือกเป็นสมาชิกผู้ก่อตั้งที่สำคัญสองคนจากที่นั่นอย่างน่าอัศจรรย์: Brian Smith อดีตนักวิเคราะห์ของ Tiger Management และอดีตรองประธานฝ่ายการเงินของผู้ให้บริการซอฟต์แวร์อีคอมเมิร์ซที่จดทะเบียน ทำหน้าที่เป็น COO และ CFO Matt Shapiro มีพื้นฐานเป็นนายธนาคารและเติบโตเป็นหุ้นส่วนอย่างรวดเร็ว

ที่นี่ยังต้องพูดถึงการเพิ่ม Mable Jiang โอกาสคือเมื่อทุกคนวิจารณ์ Binance ว่าไม่มีการกระจายอำนาจเพียงพอ Multicoin จึงเข้ามามีบทบาทในการต่อต้านฉันทามติ ในเวลานั้น Kyle ตระหนักว่าเขาไม่รู้เพียงพอเกี่ยวกับตลาด crypto ในเอเชีย ดังนั้นเขาจึงย้ายไปประเทศจีนเพื่อหาข้อมูลเพิ่มเติม กว่าหนึ่งเดือนในการหาผู้รับผิดชอบ นักลงทุนในตลาดจีน เขาได้พบกับ Mable ในที่ประชุมและเชิญเธอเข้าร่วมในที่สุด (Mable เพิ่งออกจาก Multicoin เพื่อทำงานเป็นหัวหน้าเจ้าหน้าที่ฝ่ายรายได้ของ StepN ซึ่งเป็นบริษัทที่ได้รับความนิยมเมื่อเร็วๆ นี้ รับโครงการ) นอกจากนี้ เนื่องจากความหลงใหลใน Binance ร่วมกัน Sam Bankman-Fried จาก FTX จึงประสบความสำเร็จกับผู้ก่อตั้งทั้งสอง ต่อมา Multicoin ได้ซื้อ FTT มูลค่า $60 ในราคา $5 ในไตรมาสที่ 4 ปี 2019

ชื่อระดับแรก

05

“หุ้นส่วนผู้ประกอบการรายที่สาม”

และSolanaและHeliumตัวอย่างเช่น.

ผู้ก่อตั้ง Solana ดึงดูดความสนใจของ Multicoin เนื่องจากเขา "เกือบจะหมกมุ่นในการติดตามประสิทธิภาพของบล็อกเชน" หลังจากลงทุนใน Solana เป็นครั้งแรกในช่วงต้นฤดูร้อนปี 2018 Multicoin ยังคงได้รับหุ้นจากนักลงทุนที่ "ไม่เต็มใจ" บางราย เราต้องรู้ว่า Multicoin เผชิญกับความวุ่นวายเช่นเดียวกับ EOS เมื่อลงคะแนนให้ Solana แต่สิ่งนี้ไม่ได้ขัดขวาง Kyle และ Tushar จากการเข้าร่วมและเรียกร้องคำสั่งซื้อ

หนึ่งในจังหวะที่ยอดเยี่ยมอาจเป็นความร่วมมือกับ Sam Bankman-Fried: สร้าง Serum การแลกเปลี่ยนแบบกระจายอำนาจที่ด้านบนของ Solana และใช้ประสิทธิภาพของ Solana เพื่อแทรกลงในสมุดคำสั่งซื้อออนไลน์ของ Serum ซึ่งช่วยให้นักพัฒนาสามารถซื้อขายใน Solana ได้ง่ายกว่า สร้างแอปพลิเคชัน DeFi ที่ปรับขนาดได้บนอินเทอร์เน็ต สิ่งนี้กลายเป็นก้าวสำคัญสำหรับ Solana ในการสร้างระบบนิเวศที่กว้างขึ้นและกว้างขึ้น Multicoin ยังเยาะเย้ย Uniswap ตรงข้าม Serum อย่างเปิดเผย: หนังสือสั่งซื้อในห่วงโซ่ประสิทธิภาพสูงและ AMM บนห่วงโซ่ประสิทธิภาพต่ำ ประนีประนอม

ผู้ก่อตั้ง Solana มองว่า Multicoin เป็น "หุ้นส่วนผู้ประกอบการรายที่สามของเขา" และการเป็น "คนแรกที่นึกถึงเมื่อประสบปัญหา" คือขอบเขตที่นักลงทุน VC หลายคนต้องการบรรลุ

ในทำนองเดียวกัน หลังจากได้สัมผัสกับโครงการฮีเลียม Tushar และผู้ก่อตั้ง Amir ได้โทรศัพท์หลายครั้งเพื่อหารือเกี่ยวกับเศรษฐกิจโทเค็นของ Helium วิทยานิพนธ์ดั้งเดิมของ Multicoin คือ: ข้อมูลเป็นสินค้าโภคภัณฑ์ที่ใหญ่ที่สุดในโลกที่ยังไม่ได้แปลงเป็นทางการเงินอย่างสมบูรณ์ และเราต้องการวิธีที่ประหยัดมากขึ้นในการส่งข้อมูล ตามความเชื่อนี้ Multicoin มีส่วนร่วมอย่างเต็มที่ในการกำกับดูแล และการเดิมพันอย่างเข้มข้นกับฮีเลียม การใช้เงินทุนมากกว่า 11% ติดตามผ่านกองทุนเฮดจ์ฟันด์ และยังเพิ่ม HNT สำหรับการดำเนินการแยก SPV ของ LP

เพื่อเป็นการตอบแทน ทีมงานของ Helium ได้มอบหุ้นบุริมสิทธิ์ของ Multicoin รวมถึงรางวัลผู้ก่อตั้งที่กระจายตามสัดส่วนของการขยายเครือข่าย ซึ่งเกือบจะส่งรายได้ให้กับ Multicoin ในรูปแบบของเงินรายปีตลอดไป

ชื่อระดับแรก

06

ธีมการลงทุนและอนาคตของ Crypto

ชื่อเรื่องรอง

Open Finance: อุดมคติอันยิ่งใหญ่ของการบูรณาการทางการเงิน

การเงินแบบเปิดแสดงถึงอุดมคติอันยิ่งใหญ่ของผู้ก่อตั้งทั้งสอง:เพื่อให้การทำธุรกรรมในตลาดทุนทั่วโลกสามารถดำเนินการได้อย่างน่าเชื่อถือโดยไม่มีการรับประกัน ไม่จำเป็นต้องมีคนกลาง ไม่ต้องกังวลกับความเสี่ยงของคู่สัญญา สินทรัพย์ของคุณสามารถโอนระหว่างแพลตฟอร์มได้ภายในไม่กี่วินาที

ในการสนทนากับ Micky Malka ผู้ก่อตั้ง Ribbit Capital (กองทุนที่มุ่งเน้นด้านฟินเทคที่ยอดเยี่ยม) Tushar ได้พูดถึงจุดที่ได้เปรียบในการแข่งขันของ DeFi และกล่าวถึงประเด็นนี้เกี่ยวกับความสัมพันธ์กับลูกค้า: ประเด็นสำคัญอยู่ที่ว่าใครเป็นเจ้าของความสัมพันธ์กับลูกค้า มูลค่าของ Defi คือจำนวนผู้ที่เกี่ยวข้อง (นักพัฒนา ผู้บริโภค) ที่พวกเขาสามารถดึงดูดให้สะสมมูลค่าได้

Bitcoin เองจับผู้บริโภคอย่างแน่นหนาในรูปแบบของสัญญาทางสังคมหรือการจัดเก็บมูลค่า / มูลค่าเพิ่ม แต่สำหรับ Defi ผู้คนไม่ได้สร้างความรู้สึกผูกพันตามธรรมชาติและเป็นส่วนหนึ่งของข้อตกลงบางอย่าง พวกเขาต้องการเพียงอัตราที่ดีที่สุด สภาพคล่อง และประสบการณ์ . นี่คือสาเหตุที่ผู้รวบรวมบางรายกระจายคำสั่งซื้อของผู้บริโภคไปยังสถานที่ต่างๆ ของ Defi เพื่อให้ได้การกำหนดค่าที่ดีที่สุด และความสัมพันธ์ของพวกเขากับผู้บริโภคก็ดีขึ้นจริงๆ

Micky ใช้การเปรียบเทียบที่ชัดเจน ในเมืองเล็กๆ ในบ้านเกิดของเขาที่เวเนซุเอลา อาจมีร้านตัดผมเพียงแห่งเดียวและโรงแรมเพียงแห่งเดียว แต่มีธนาคารสองหรือสามแห่งอยู่เสมอ และธนาคารต่างแข่งขันกันโดยใช้อัตราดอกเบี้ยและความแตกต่างของบริการ บริการทางการเงินเป็นอุตสาหกรรมที่มีสินค้าโภคภัณฑ์สูงมาโดยตลอด และไม่มีอะไรที่ลอกเลียนแบบไม่ได้ แต่จะชนะได้อย่างไร เพียงแค่พึ่งพาแบรนด์ เพื่อให้มีความสัมพันธ์กับผู้บริโภค บางที DeFi จำเป็นต้องเดินตามเส้นทางเดิมของการเงินแบบดั้งเดิมเพื่อติดตามผลกระทบของแบรนด์และสำรวจลักษณะสำคัญของแบรนด์ที่สามารถได้รับความไว้วางใจจากผู้บริโภคในที่สุด ก่อนหน้านั้น คล้ายกับ Uniswap ทางแยกของ Sushiswap , การปรับแต่งจะไม่เปลี่ยนสถานการณ์

เมื่อมองไปยังจุดสิ้นสุด Kyle ให้การเปรียบเทียบที่สอดคล้องกับการเงินแบบดั้งเดิม: จะมี "นายหน้าซื้อขายหลักทรัพย์ชั้นนำ" "Defi-native" เพื่อรองรับเวอร์ชัน blockchain ของสัญญา Perpetual swap ——คุณสามารถแลกเปลี่ยนระหว่างสกุลเงินดิจิตอลและสกุลเงิน fiat ได้อย่างอิสระ และคุณสามารถซื้อผลิตภัณฑ์ทางการเงินจากทั่วทุกมุมโลกได้ตามต้องการในอนาคต การเงินแบบดั้งเดิมและ Defi จะอยู่ร่วมกัน แต่ค่าใช้จ่ายในการทำธุรกรรมที่ต่ำอย่างเห็นได้ชัดของ Defi จะดึงดูดผู้คนให้โอนเงินได้มากขึ้นอย่างแน่นอน

ชื่อเรื่องรอง

Web3: ทบทวนการประสานงานของกิจกรรมทางเศรษฐกิจของมนุษย์

สรุปสาระสำคัญของ Web 3 ของ Multicoin ได้ในประโยคเดียว คือ เครือข่ายที่ไม่ไว้วางใจซึ่งช่วยให้ผู้คนสามารถประสานงานกิจกรรมทางเศรษฐกิจได้อย่างอิสระและมีประสิทธิภาพมากขึ้น อันที่จริง มันขยายตรรกะของ Defi ก่อนหน้าไปยังทุกด้านนอกเหนือจากการเงิน

กล่าวโดยเจาะจงคือ กิจกรรมมากมายในสังคมสมัยใหม่อาศัยเอนทิตีแบบรวมศูนย์ในการจัดสรรทรัพยากร: AWS สำหรับการจัดเก็บ, AT&T สำหรับการสื่อสาร และ Google สำหรับการค้นหา เบื้องหลังคือต้นทุนการทำธุรกรรมที่สูงและความเสี่ยงด้านการรวมศูนย์ที่ร้ายแรง (ความเป็นส่วนตัวของข้อมูล ความล้มเหลวเพียงจุดเดียว ฯลฯ)

บางโครงการพยายามที่จะกระจายอำนาจเหล่านี้หลังจากแยกย่อยโครงสร้างพื้นฐานที่เราเคยได้รับในโลกที่ผ่านมาเป็นหน่วยที่มีค่าน้อยที่สุด ผู้อาศัยใน Web3.0 ทุกคนสามารถรับรู้ถึงทรัพยากรที่เป็นไปไม่ได้ในอดีต:เครือข่ายสังคม (SocialFi) ฮาร์ดไดรฟ์ (Arweave) แบนด์วิธเครือข่าย (Helium) และแม้กระทั่งความสนใจ (Brave)

ในหมู่พวกเขาเป็นหัวข้อย่อยที่น่าสนใจมาก: Web3 เศรษฐกิจแบ่งปัน Multicoin โหวตสำหรับโครงการเช่น Helium, The Graph, Arweave, RNDR และ Audius ภายใต้บรรทัดฐานนี้

เบื้องหลังของ Helium คือ ด้วยความนิยมของ Internet of Things และ 5G ข้อกำหนดด้านความเร็วของเครือข่ายและเลย์เอาต์จึงเพิ่มขึ้นทุกวัน และรูปแบบการสื่อสารแบบดั้งเดิมของเมืองหลวงแบบรวมศูนย์นั้นไม่ยั่งยืน ดังนั้น Helium จึงใช้แบนด์วิธร่วมกันเพื่อสร้างการสื่อสารแบบกระจายอำนาจ เครือข่าย

กราฟหวังว่าจะเป็นเครื่องมือค้นหาแบบครบวงจรสำหรับ Web 3 ทำให้ข้อมูลบล็อกเชนเข้าถึงและใช้งานได้ในระดับสากล และ Dapps ไม่จำเป็นต้องพึ่งพาผู้ให้บริการจากส่วนกลาง

Arweave ไม่เพียงแต่ขัดขวาง AWS เท่านั้น แต่ยังแก้ปัญหาที่เป็นไปไม่ได้ที่จะจัดเก็บข้อมูลทั้งหมดบนห่วงโซ่ภายใต้ข้อจำกัดความสามารถในการปรับขนาดของ Ethereum โดยใช้เครือข่ายพื้นที่จัดเก็บถาวรแบบกระจายของเครือข่ายฮาร์ดดิสก์ที่ไม่ได้ใช้งานร่วมกัน

RNDR เป็นเครือข่ายการเรนเดอร์การประมวลผล GPU แบบกระจายที่เกิดขึ้นภายใต้ข้อกำหนดการเรนเดอร์กราฟิกขนาดใหญ่และซับซ้อนที่ Metaverse นำมา

Audius คืนสิทธิ์การควบคุม ลิขสิทธิ์ และรายได้ของเพลงให้กับนักดนตรี ขจัดคนกลางระหว่างนักดนตรีและแฟนเพลง ซึ่งอาจกำหนด IP และระบบเศรษฐกิจของแฟนเพลงใหม่:

ชื่อเรื่องรอง

ห่วงโซ่สาธารณะอันยิ่งใหญ่: อนาคตที่ปราศจากสะพาน

ส่วนนี้เป็นเพียงการคาดการณ์ของ Multicoin เกี่ยวกับอนาคตของการเข้ารหัส ซึ่งต้องรวมถึงการเสริมแรงซ้ำแล้วซ้ำเล่าของการเดิมพันที่ได้วางไปแล้ว และการเรียกร้องอย่างกระตือรือร้นสำหรับการสั่งซื้อ แต่ข้อโต้แย้งของผู้ก่อตั้งทั้งสองนั้นคุ้มค่าที่จะแบ่งปัน

จากมุมมองของความเป็นไปได้ Tushar ใช้การเปรียบเทียบเพื่ออธิบายบทบาททางประวัติศาสตร์ของสะพานข้ามโซ่:ในปี 1990 ช่างเทคนิคคิดเกี่ยวกับวิธีเชื่อมต่ออินทราเน็ต (อินทราเน็ต) ของทุกคนด้วยสะพานเพื่อสร้างเครือข่าย จนกระทั่งแนวคิดของอินเทอร์เน็ต (อินเทอร์เน็ต) ปรากฏขึ้น ผู้คนพบว่าสามารถใช้เครือข่ายทั่วโลกได้ในทำนองเดียวกัน สะพานข้ามโซ่ยังเป็นรูปแบบการเปลี่ยนผ่าน เมื่อเพิ่มเลเยอร์ของโปรแกรมเลเยอร์ที่ซับซ้อนเข้าไปแล้ว ความขัดแย้งระหว่างระบบจะจัดการได้ยาก ในระยะยาว สะพานข้ามโซ่จะค่อยๆ ถอนตัว

Kyle เพิ่มจุดหนึ่งจากมุมมองของประสิทธิภาพ: สะพานข้ามโซ่จะเพิ่มความล่าช้า เพิ่มอุปสรรคในการย้ายข้อมูลและมูลค่า และการใช้ก๊าซ และการรวบรวมแอปพลิเคชันอาจมีข้อกำหนดสูงสำหรับความสอดคล้องของระบบและการทำงานร่วมกัน เราไม่ทราบ ของชิ้นไหนควรวางไว้ในเลเยอร์เดียวกัน แต่โดยทั่วไป แค่เศษเดียวก็ดีที่สุดแล้ว นี่คือเหตุผลที่เขาเชื่อว่าจะไม่มีเชนสาธารณะเฉพาะกลุ่ม เช่น เชนสาธารณะของเกม เชนสาธารณะ DeFi ฯลฯ เนื่องจากมีความต้องการสะพานข้ามโซ่มากเกินไป

ดังนั้น Multicoin จึงไม่เชื่อในความเจริญรุ่งเรืองร่วมกันของหลายเชน และเชื่อว่ามันอาจจะเป็นโลกของมัลติเชนในปีหรือสองปีหน้า แต่ในมิติเวลาที่ยาวขึ้น มันควรจะลดลงเหลือ 2-3 อันทรงพลังทั้งหมด โซ่สาธารณะเครือข่ายสาธารณะจะค่อยๆ ชะล้างทราย และจุดเปลี่ยนอาจเกิดขึ้นเมื่อยักษ์ใหญ่ด้านอินเทอร์เน็ตเลือกเครือข่ายเพื่อสร้างแอปพลิเคชันชื่อเรื่องรอง

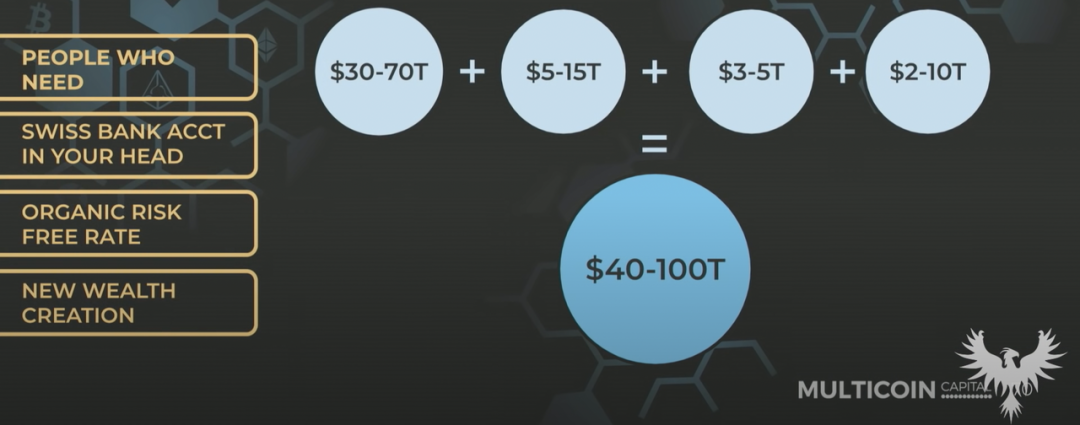

สกุลเงินดิจิทัลที่ไม่ใช่อธิปไตย: นอกเหนือไปจากระบบเศรษฐกิจที่ไว้วางใจได้

ในการประชุมสุดยอด Multicoin 2019 Kyle กล่าวถึง:เสถียรภาพของสกุลเงินตามกฎหมายขึ้นอยู่กับรัฐบาลแห่งชาติที่มีอำนาจ แต่มีคน 500 ล้านคนในโลกที่อาศัยอยู่ในสังคมที่มีอัตราเงินเฟ้อมากกว่า 10% สำหรับคนเหล่านี้หากพวกเขาไม่พบช่องทางในการรักษาทรัพย์สิน มูลค่าสุทธิประจำปีจะลดลงอย่างน้อย 10% สกุลเงินดิจิทัลอาจมีบทบาทเป็นทองคำดิจิทัลเพื่อช่วยรักษาทรัพย์สินของตน

นอกจากนี้ เขายังเชื่อว่าจากมุมมองของการแข็งค่าของสินทรัพย์ สกุลเงินดิจิทัลยังเป็นวิธีการสร้างมูลค่าเพิ่มที่ขยายตลาดได้มาก (ผู้คนสามารถแสวงหารายได้ผ่านคำมั่นสัญญาและวิธีอื่นๆ) ในที่สุด ความมั่งคั่งส่วนใหญ่ที่สร้างขึ้นในโลกคริปโตยังคงต้อง อยู่ใน Digest ในโลกนี้ (เช่น ซื้อ NFT, โทเค็นโซเชียล ฯลฯ)

Multicoin เชื่อว่า 4 จุดข้างต้นรวมกันเป็นขนาดตลาด 40-100 ล้านล้านเหรียญสหรัฐ นี่คืออนาคตของ crypto ที่พวกเขามองเห็น