Detailed explanation of "BLOG": How to use DeFi to reshape the economic model of encrypted games?

Original post by Kydo, Llama & Aiko, Folius Ventures

Original compilation: TechFlow

Thanks to Nat and Nicolas (Crypto Raiders), Nate (Bancor), Jason (Folius), Jerry (Stepn), TY (Cradlesio), PhABC and Salvator (Horizon), Bailey (Defiance), Cyn Bahati (moongateguild), and Raymond Chng

introduction

introduction

All economies cannot succeed without a balanced and sustainable monetary system.However, the game economy has not yet found a balance between its currency supply and demand - in-game currencies are extremely volatile, which poses great challenges for all stakeholders.

The currency price in the game can be abstracted as the game relationship between burning and casting. Burning is driven by consumption in the game, such as upgrading, advancing, breeding and trading; casting is driven by in-game activities, such as tasks and PvP. While most of the attention has been focused on adjusting the complex balance between burning (demand generation) and minting (supply generation), little thought has been given to the financial nature of these systems.

first level title

The Dilemma of the Cryptocurrency Game

The old monetization model is not sustainable. Gold diggers (miners) keep moving from one game to another, creating false prosperity and leaving a volatile situation.

Even with the Ronin public chain and the new Axie game, the price of RON has been halved, and SLP has not seen any upward momentum. Therefore, scholars had to leave this overcultivated land and migrate to other places, such as Avalanche and Polygon.

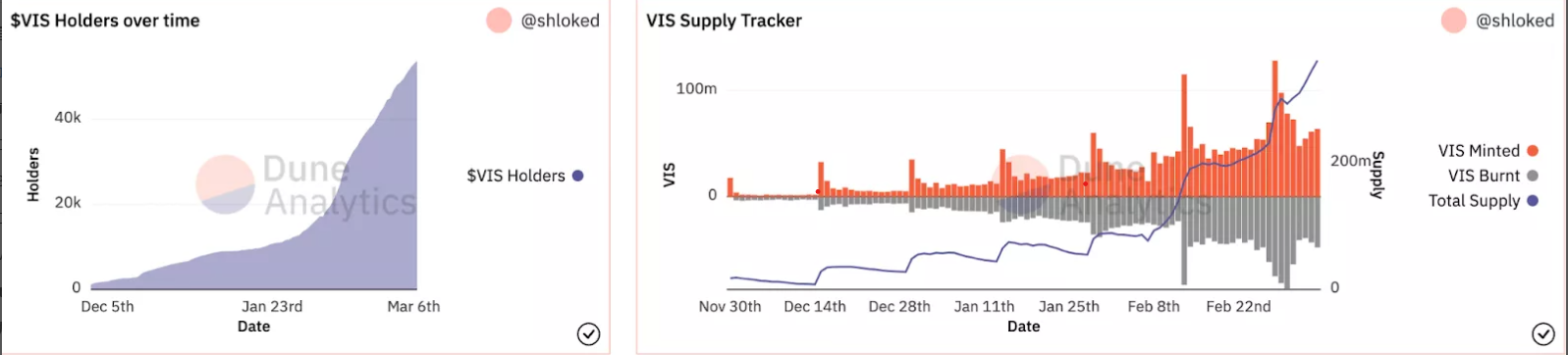

image description

image description

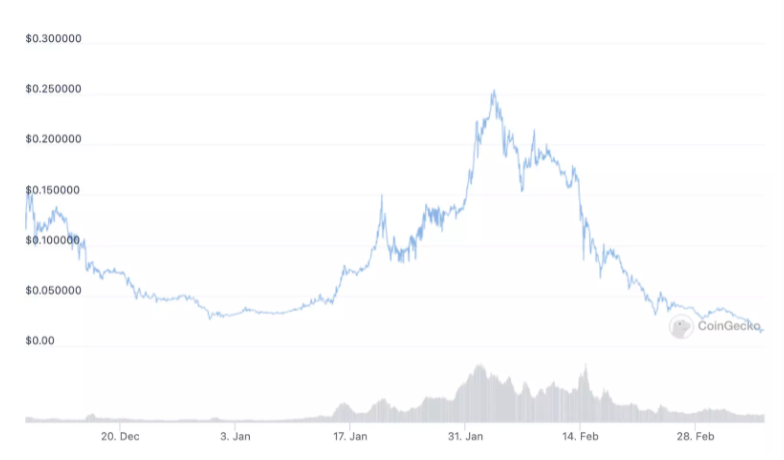

$VIS Price Performance

In order to alleviate the large-scale devaluation of tokens, some game teams have implemented some preventive measures, but the effect is mediocre.These inefficient measures are often cumbersome designs for developers.

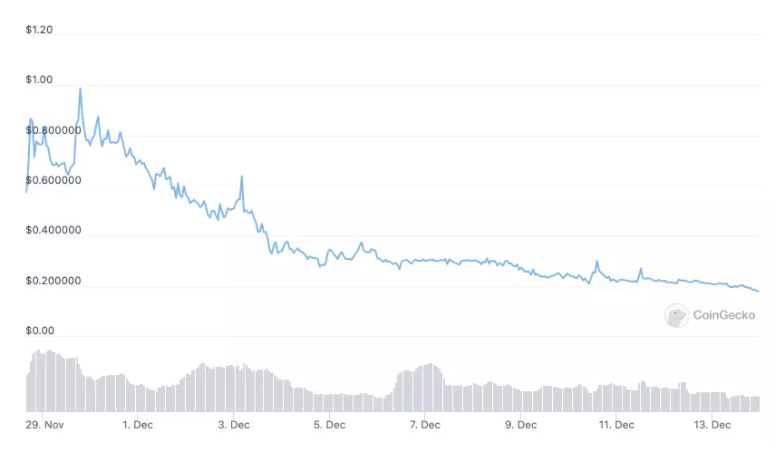

For example, Thetan Arena, a MOBA game with high replayability, has previously found success in the mobile app market with eight million players and is one of the most popular cryptocurrency games.

It is currently valued at $151 million. While it implemented gold sinking (an economic process by which a video game's in-game currency, or any item that can be valued on it, is removed) and combat limits to reduce inflation, it did not prevent scholars from constantly Squeeze $THC and cash out all.

image description

$THC Price Performance

The financialization of game experience has caused the backlash of the system.A lot of attention and asset appreciation attracts new players to buy the asset and try out the game, or use it as an investment opportunity and earn tokens in return. Regardless of their motivations, when token prices suddenly drop, there will be massive price rallies as these players will scramble to get out of the system first.

Strong playability is essential, but we also need certain safeguards to curb the backlash of these systems. Most developers still try to follow the traditional way of tackling inflation with gold sinking.

first level title

current innovation

secondary title

Crypto Raiders' Commodities AMM

Crypto Raiders is a P2E game launched last year on the Polygon website. The most interesting addition to Crypto Raiders is the external AMM. This AMM is the most basic commodity trading platform in the game. At a higher level, this design attempts to eliminate counterparties in any transaction.

Relying on existing decentralized exchanges, we can create highly liquid instant settlement trading markets for in-game assets, which did not exist in past games. WoW or Runescape needs someone on the other side of the deal. In cryptocurrencies, with automated market makers, you don't. — Nat Eliasson

secondary title

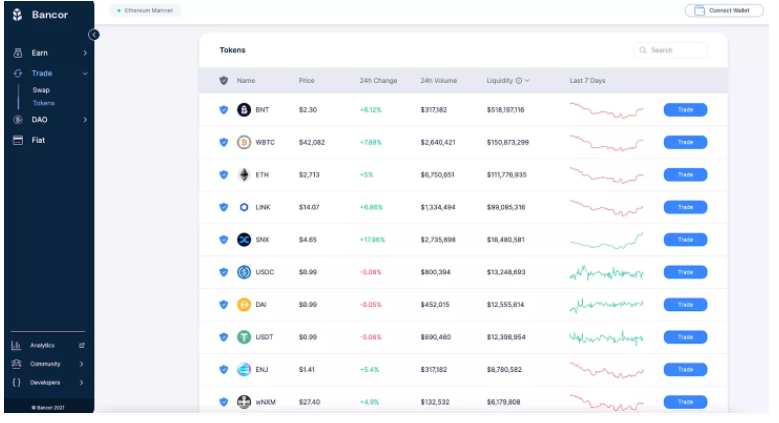

Bancor V3

Launched in mid-2017, Bancor was the first AMM project and one of the least visible in the entire DeFi space. Unlike most AMMs which can create pools between any token,image description

2022 Bancor website

The name "Bancor" comes from the currency concept of the famous economist John Maynard Keynes, called "International Settlements Union (ICU)" - the basic economic unit of all settlements and valuations. While the original idea did not materialize in the Ethereum world, the parallel between Bancor's vision and the game economy is evident.

In the game, the basic economic unit is determined by the agreement. In Axie it's $SLP, in Crypto Raiders it's $AURUM. So perhaps Bancor's design philosophy is most applicable to the in-game economy.

secondary title

Omnipool AMM

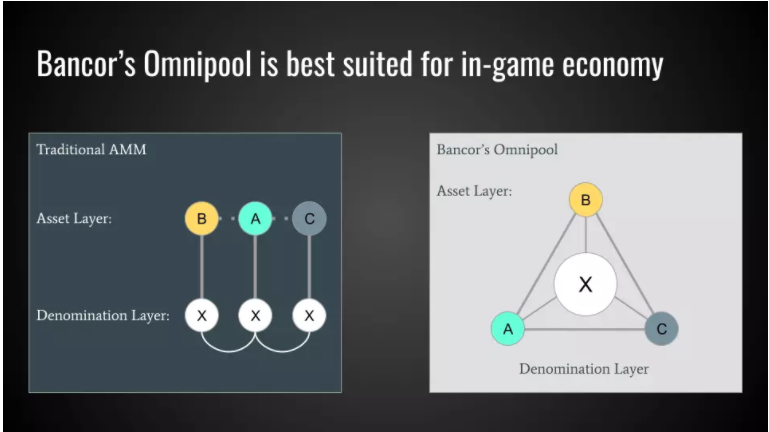

Bancor's Omnipool AMM allows trading against a central liquidity pool.In the traditional AMM model, all liquidity is decentralized, so there is no common face value (numeraire). In the example below, Token A has a deeply liquid pair to Token X, but only moderately liquid pairs to Token B and Token C (a visual example: Token X = ETH, Token A = Any token, Token B = USDC, Token C = USDT), this design introduces composability but adds complexity, resulting in fragmented liquidity for different pairs.

secondary title

Vortex

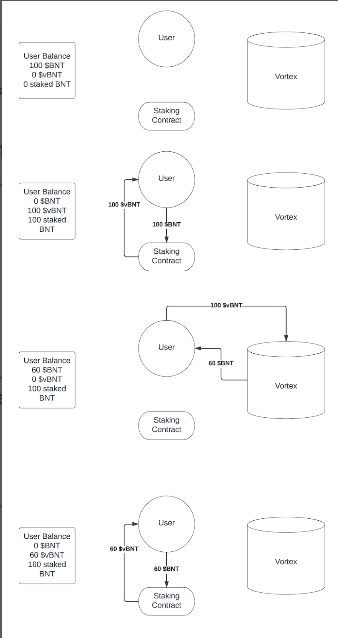

Vortex is an innovation that enables highly efficient token buybacks.

A common way for protocols to support token prices is through token buybacks. The protocol will use a portion of its revenue to buy back through the open market. Repurchased tokens are typically distributed to token holders or burned.

Bancor's Vortex system is designed to buy back tokens at a discount. To achieve such a feat, Bancor provides users with liquid staking. After BNT is staked into the system, bettors can exchange their vBNT (betted BNT) into BNT through the Vortex system.

image description

Process Flow of vBNT Staking and Vortex

secondary title

Vote-escrow and ve(3,3)

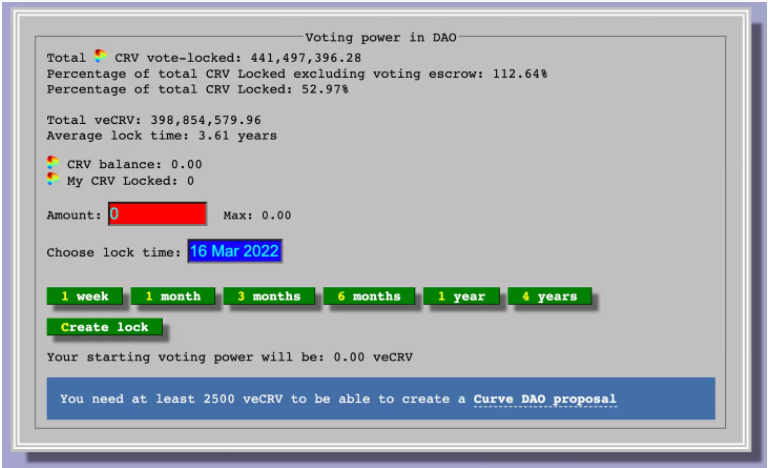

ve(3,image description

Curve DAO's governance page

In the traditional ve model, token holders can lock their CRV (Curve's native token) in exchange for veCRV. veCRV is the governance token of Curve DAO, which is used to determine future liquidity rewards. The exchange rate between veCRV and CRV is a linear function based on time. When the lock-in period is 4 years, 1 CRV = 1 veCRV; when the lock-in period is 1 year, 1 CRV = 0.25 veCRV.

veCRV holders receive platform transaction fees from the protocol. For example, if on a given day, Curve generated $1 million in transaction fees on the protocol, and there is a supply of 1 million veCRV tokens, you will be rewarded $1 for every 1 veCRV you hold. (actual figures and percentages will vary).

first level title

The Avengers Assemble!

Now, how do we respond to these innovations?

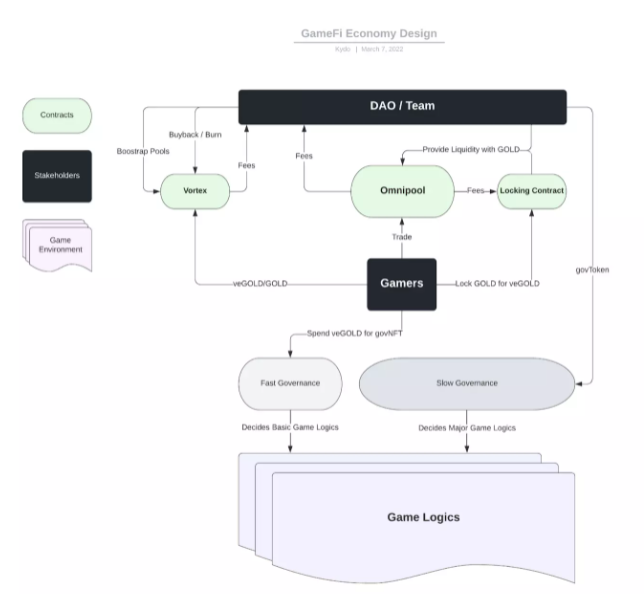

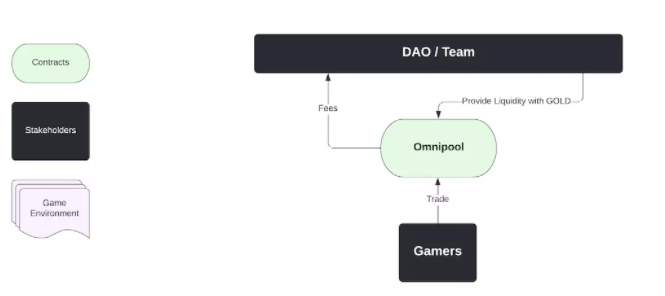

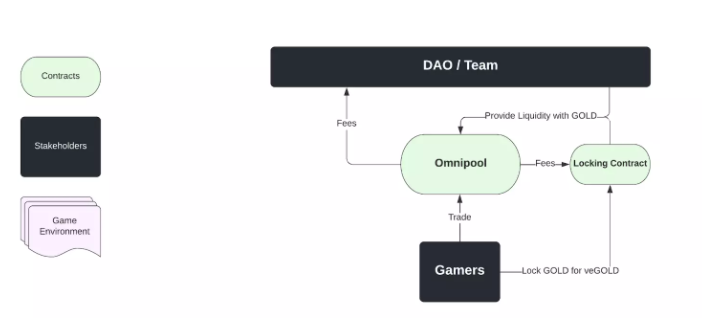

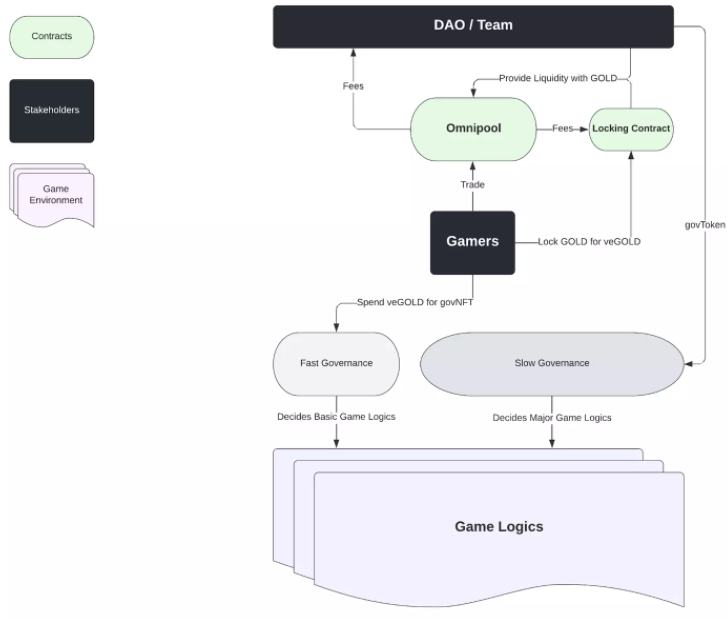

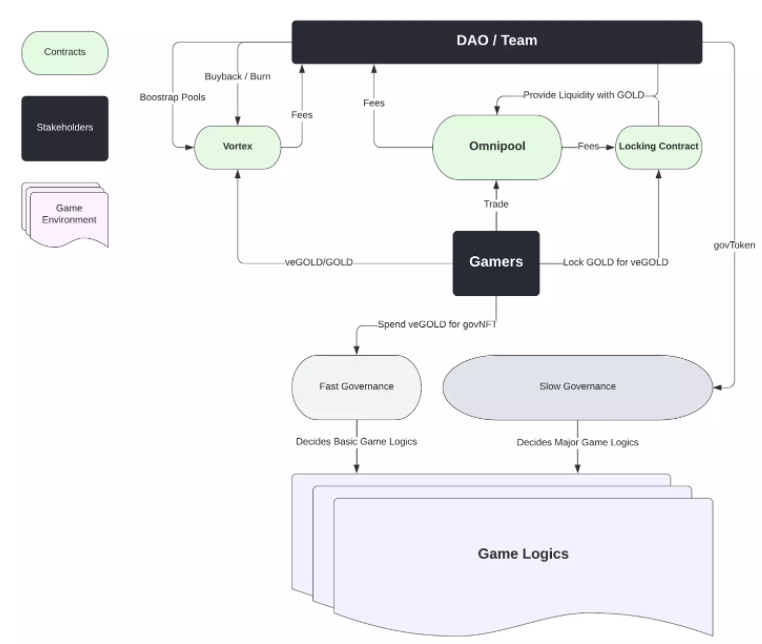

image description

Flowchart of all interactions within the blog

In this design, my goals are:

1) Increase the trading experience through an all-encompassing AMM,

2) Reduce token selling pressure through long-term lockup,

3) Increase the utility of locked tokens through governance control,

4) Increased token purchases through active buybacks.

For gamers, this design is very simple and easy to understand:

Game players trade items with instant settlement under the same user interface;

Gamers lock their GOLD in the bank (lock-up contract) to get veGOLD and earn passive income. like depositing money in a bank;

Gamers spend their veGOLD to buy Titles of Honor (govNFT) (after meeting some non-financial requirements) for cosmetic items (and/or status boosts) and governance powers;

Gamers can (via Vortex) sell their veGOLD (locked GOLD) for GOLD.

first level title

Trading experience

Not all items in the game should be NFTs.In traditional cryptocurrency game projects, the most important asset is NFT. For example, Axies from Axie Infinity, Pega from Pegaxy, Crab from Crabada, and Raiders from Crypto Raider.

However, not everything in the game should be NFT (ERC721). For example, let's imagine a traditional fighting RPG game. In this simple game, the player has a sword and a shield. Each item has its unique properties. Therefore, they should belong to NFT, because they are not replaceable. Your sword is not mine. No problem here. When the player goes out into the wild to fight monsters, he collects different drops. These drops can be meat, bones, gems, etc. The items are no longer unique, they are interchangeable. All meat is equal, all gems are equal, and so on. Some MMORPG players might be thinking, "but what about the different gems? They're not interchangeable". That's right, among gems, strength gems and speed gems are not the same. However, you can design the Strength Gem to be an ERC20 and the Speed Gem to be another ERC20. They are not interchangeable with each other, but are interchangeable within each other - my power gems are equal to your power gems (internal interchangeable), my speed gems are not my power gems (not interchangeable). The same concept can be extended to the gem level as well.

Thinking about the cryptocurrency game in terms of "fungible assets", we can leverage Bancor's Omnipool AMM to facilitate a better trading experience. From now on, I will refer to these replaceable items as "commodities". In both traditional games and current cryptocurrency games, all items are traded through order books. An order book is where buyers and sellers post prices for items they want to sell or buy.

For low-liquidity commodities, this may not be the best approach. If I want to sell some gems I collected a few days ago, I have to post a sell order on the order book and then wait for an unknown amount of time until someone else places an order. With the Omnipool AMM, I can instantly trade any amount of gems, like I would normally sell my $MATIC or $ETH on Uniswap. The same is true if I am a buyer and want to buy something. Omnipool realizes that the presence of opponents is no longer required in all transactions, making commodity transactions in the game a better experience.

With Omnipool, the protocol can also have more fine-grained control over the price of goods. In the order book model, liquidity consists of different players buying and selling these items. When we change it to the Omnipool model, the protocol can guide the pool with a certain amount of liquidity to better control the price changes of its commodities. This change is achieved by marking the sides of the boot pool and gaining liquidity.

For example, going back to fighting games, the protocol wants to introduce gems into the game. The protocol can guide the GEM/GOLD pair with 100,000GEM and 1,000,000GOLD, the implied price (1GEM=10GOLD). If the protocol is going to send out 1000-2000 gems in the next month based on user activity, they can calculate a minimum price for gems by assuming everyone converts their gems to gold. This information can help the team build stronger models for the in-game economy.

By controlling liquidity, protocols can even deploy a more granular approach. Another example: when there is a sudden influx of players needing gems, this can cause the price of gems to skyrocket. To curb sudden price increases, protocols can increase the depth of liquidity pools by tokenizing and adding parties to the Omnipool. The same method can also be applied when the price plummets.

first level title

long-term lock

A long-term lock is an excellent way to reduce selling pressure. Many DeFi projects have adopted such a design to suppress issuance and increase long-term value docking between token holders and the protocol. One of the main criticisms of locking is that it imposes illiquidity on tokens. This is the case for many DeFi tokens, but it is less of an issue for in-game tokens. In-game tokens are highly inflationary and liquid by nature, so locking will also be more valuable and constructive.

In [BLOG], gamers can lock their GOLD in exchange for veGOLD by locking contracts. The exchange rate can be determined as a function of time. For example, players can set the lock-up period of GOLD to be one year, and then get 0.5veGOLD, or lock it for two years, and get 1veGOLD. The longer a player locks in, the more rewards and governance he/she gets.

To leverage GOLD in contracts, protocols can channel it into their Omnipool as liquidity to earn transaction fees. In this way, there is a native benefit of locking GOLD without requiring the protocol to mark more tokens to the system. However, for various reasons (IL and low APR), this may not be sufficient. Protocols can then increase the locked APR through traditional liquidity rewards (with or without special protection rights).

first level title

Locked Tokens and Governance in Crypto Games

One of the main reasons for locking tokens in DeFi protocols is to ensure long-term value adjustments. Therefore, most governance decisions are made by locked token holders. In the context of cryptocurrency gaming, this is impossible for two reasons. First, most games already have a two-player token system. Second, and more importantly, the token balance of governance is not the most suitable form for the game. Gamers should not think about detailed, large numbers when playing games. Therefore, for these reasons, I introduce govNFT to solve these problems.

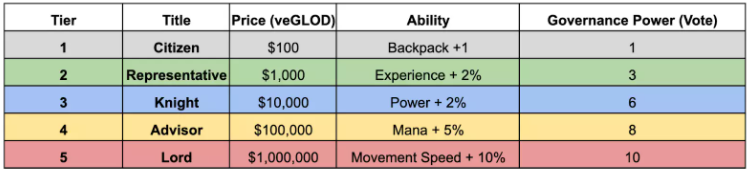

After receiving veGOLD, gamers can use it to purchase these govNFTs. These govNFTs, depending on their level, can give players different cosmetic effects, abilities, and governance powers to make simple governance decisions.

These governance decisions can be really interesting, and I can give you an example of what might happen.

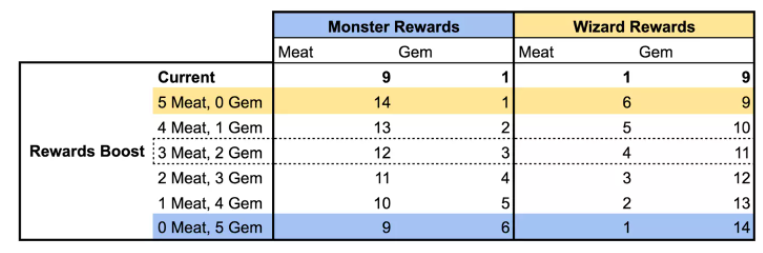

After a while, the game has matured and there are different clans and guilds in the game. Clan A is made up of warriors. Warriors can easily kill monsters, but are weak against another enemy - wizards. For every monster killed, the game player gets 9 pieces of meat and 1 piece of gem. So fighters have much less gems. Clan B, on the other hand, is made up of mages. Mages can kill wizards very easily, but are weak against monsters. For each wizard killed, the player gets 9 gems and 1 piece of meat. Since each clan has a surplus of resources on one side, transactions can be conducted between the two clans to ensure an efficient exchange of resources.

Now we introduce a simple governance structure: every week, the game increases the kill reward by 5, and it resets every month. These 5 rewards may all be meat - (monster kill = 14 meat + 1 gem) (wizard kill = 9 gem + 6 meat), or they may all be gems (monster kill = 9 meat + 6 gem) (wizard kill = 14 gems + 1 meat). For a complete breakdown, see the table below.

The final distribution of rewards will be determined by voting. If 80% of people voted for gems and 20% for meat, then the reward would add 4 gems and 1 piece of meat to all kills. If 40% of people voted for gems and 60% for meat, then the reward would increase by 2 gems and 3 meat. The yellow row represents the mage's target, and the blue row represents the fighter's target.

With this simple governance structure, the game suddenly has an interesting game theory dynamic. Warriors want a reward of 5 gems and 0 meat, while mages want a reward of 0 gems and 5 meat. Every clan wants their income not to be diluted by rewards. This competition increases the need for governance rights. Where does governance come from? It comes from govNFT, govNFT comes from veGOLD, and veGOLD comes from GOLD.

If you’re a DeFi native, you might recognize this design from Curve’s meter design, which enables veCRV holders to direct liquidity rewards to different pools. In the [BLOG] design, I gamified the entire voting process, allowing gamers to decide according to their interests.

first level title

Efficient Token Buyback

In order to draw a perfect end to the whole [BLOG] design, I introduced the Vortex system to achieve efficient token repurchase.

Token buybacks are a way to increase buying pressure on native tokens by exchanging protocol revenue for native tokens. However, this design is powerless in the field of cryptocurrency games. Each game can be an independent system. The closed system design presents a barrier to token buybacks for cryptocurrency games. If all the income in my example game is generated through GOLD (or other commodities), all I can do is burn it. So for an income of 1 GOLD, I can burn 1 GOLD from the supply. This is not unrealistic. If you are familiar with time discounts, then you will understand better. Don't worry if you're not familiar with it.

That's what Vortex does.

For gamers, after GOLD is locked in the bank, they can 1) hold veGOLD to earn interest, or 2) use it to buy govNFT. Now with Vortex, they can sell their veGOLD for GOLD. This is useful for gamers who may need GOLD for more other gaming purposes. The veGOLD/GOLD Vortex system can be seen as a Uniswap v2 liquidity pair, so users can unload their veGOLD at any time according to market demand and supply.

write at the end

write at the end

The economy of crypto games is an emerging field that has the potential to get the first billion users on board with cryptocurrencies.I don't want their first experience in cryptocurrency to be like mine - watching their portfolio drop 50% in a week. If we can't immediately eliminate these risks, we need a stronger in-game system to mitigate them.

In this post, we present BLOG: A New Economic Model for Cryptocurrency Games, including AMM, Token Locking, Governance and Buyback. This general framework, while very effective, should be tailored to each project's goals during implementation. Due to its modular design structure, projects can also use only a subset of the entire design.I hope this design will work for cryptocurrency game projects, and let's work together to help the next batch of hundreds of millions of users enter it.