具有2-5倍增长潜能的Tribe被低估了

本文来自 Banklesshq,原文作者:Ben Giove,由 Odaily 星球日报译者 Katie 辜编译。

几个月前,Fei Protocol和Rari Capital将价值数十亿美元的协议合并为Tribe DAO。这次合并为DeFi协议在未来如何完成合并创造了先例。协议似乎采取了一种垂直集成的方法,而Tribe DAO想要拥有整个DeFi堆栈。

Tribe现在有去中心化的稳定币、一个创新的贷款市场,以及一个将其它游戏项目纳入其麾下的计划,同时坐拥数亿美元的加密资产,只剩下DEX领域还未“染指”。

但Tribe在加密市场的关注度并不高,我不禁想问;“Tribe被低估了吗?”

合并的力量

尽管DeFi代币的价格已经大幅下降,但由于控制了多样化的资产储备,许多协议通过牢固的竞争定位和影响力,改善了波动情况。

符合这一要求的项目包括Tribe DAO。Tribe DAO诞生于Fei Protocol和Rari Capital的合并,它代表着一个新的“协议黑手党”,并迅速成为DeFi的巨头。

Tribe坐拥超过6亿美元的资金,在将Fei Protocol的稳定币与Rari的独立贷款市场结合起来后,它将成为DeFi内部的一支力量。此外,每个协议在早期都经受住了重要测试,如Fei发行后的脱钩和Rari开发情况,都证明了它们具有韧性和能力,能够承受DeFi的严酷考验。

那管理这样一个体量资金的项目代币值多少钱?

Tribe DAO概述

我将分开介绍Tribe DAO中的四个子DAO。

1. Fei Protocol

Tribe DAO的第一个项目是Fei Protocol。它是FEI稳定币的发行者,这是市值第11大的稳定币,供应量超过5.58亿美元。

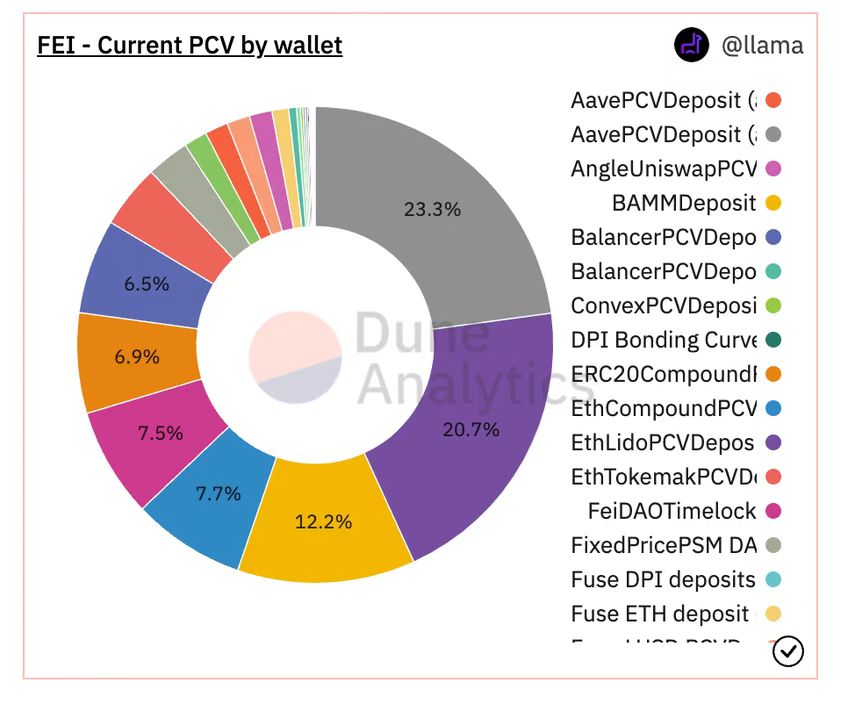

FEI是一种与美元挂钩的、过度担保的稳定币,由一系列资产(即协议控制价值(protocol-controlled value,PCV)支持。Fei已经将其PCV部署到各种不同的DeFi协议中,如Lido、Convex和Fuse,由此产生收益和引导流动性。

PCV的一个关键特征是它完全由去中心化资产组成,由ETH、非中心化稳定币和DeFi治理代币组成。

来源:Dune Analytics

尽管最初Fei Protocol利用直接激励等机制来实现稳定,但Fei在推出后大幅度打破了挂钩美元的机制。这促使Fei的设计发生了重大变化,比如取消了直接激励措施,并最终推出了Fei V2。

Fei V2包括了几个关键的升级,比如Fei和其基础抵押品之间的1:1可赎回性,以及利用完成Balancer V2用算法管理PCV的计划。

Fei提供的另一项服务是流动资金服务(LAAS)。LAAS与Ondo Finance合作,通过为DAO提供租赁代币的能力,帮助他们降低流动性成本,因为将原生代币存入Ondo的LP(流动性提供者)库的DAO将看到其匹配等量的Fei。Fei根据提供的流动性数额获得固定的费用,而受益DAO则有权获得所有的交易费用,并承担暂时的损失风险。

2. Rari Capital

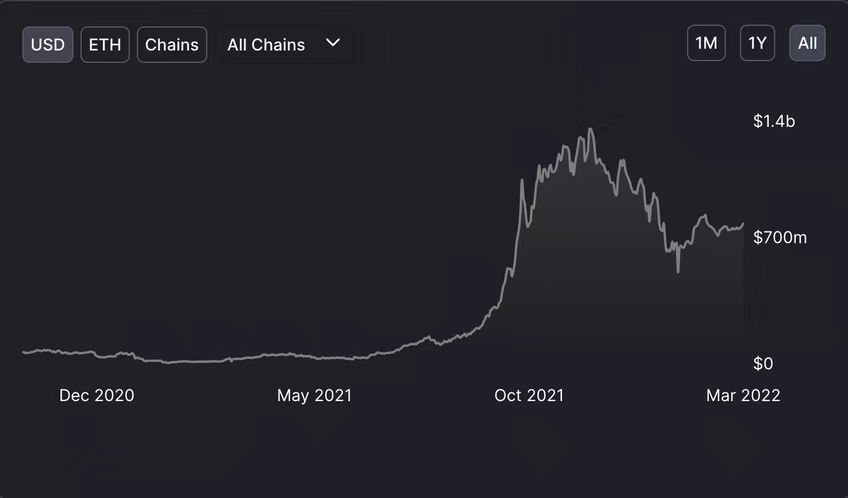

Tribe中第二个主要的子Dao是Rari Capital。Rari最著名的业务是Fuse,让任何人创建自己的独立借贷市场。Fuse是以太坊的第三大货币市场协议,拥有超过7.89亿美元的TVL(总锁值)。

来源:DeFi Llama TVL 数据板

Fuse具有高度可塑性,并且相对于现有协议具有更多的功能。例如,管理员可以改变大量的矿池参数,例如选择自己的预言机提供商,而Dao可以通过使用一个称为飞轮的特性,从Fuse矿池中启动流动性挖掘程序,允许用户在赚取奖励的同时,以他们的LP(流动性提供商)头寸为抵押进行贷款。

如前所述,Rari通过与Fei的合并推动了Tribe DAO的创建。这是DeFi历史上规模最大的一笔此类交易。交易的执行方式是让Rari的本地治理代币RGT的持有者能够以每RGT约26.7个Tribe的汇率将其资产交易到Tribe。虽然最初一些社区成员最初感到担忧,但合并得到了压倒性的链上支持。

合并带来的协同效应已经开始显现出来,许多Fuse矿池已经植入了Fei的流动性,而即将推出的Tribe Turbo将充分利用Fei和Fuse的能力。

3&4. Volt Protocol和Midas Capital

除了Fei和Rari,Tribe DAO最近也加入了两个新协议,有极大可能性通过Tribe Launch来跟进,这是一个旨在将新的DAO加入Tribe生态系统的程序。

第一个是Volt Protocol,它正在开发一种稳定币Volt,跟踪CPI(加密价格指数,又叫加密世界的道琼斯指数)的增长。该协议在其设计和发布机制中利用了Fei和Fuse,并将由VCON代币管理,其供应的25%将由Tribe DAO拥有。

第二个是Midas Capital,其目标是帮助将Fuse扩展并部署到EVM兼容的链上。虽然Fuse已经被Rari团队部署到Arbitrum,但Midas应该会帮助Rari抓住新兴市场的机遇,即在非以太坊L1、EVM链上拥有400亿美元以上的TVL。

Tribe的竞争优势在哪里?

1. 协议控制价值(PCV)储存资产

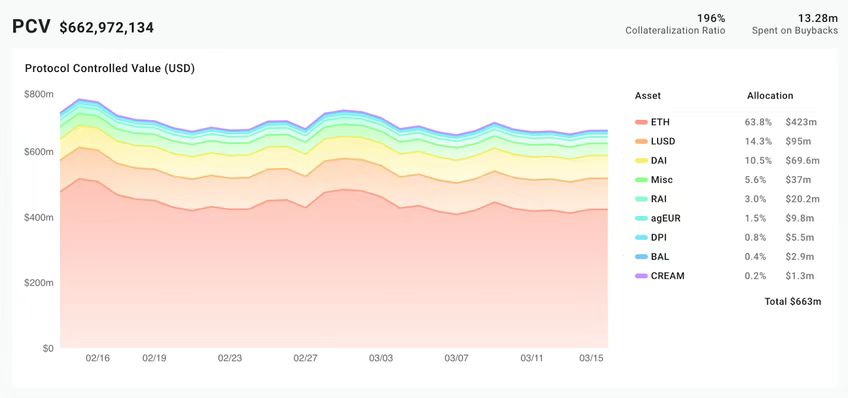

来源:Fei Analytics

Tribe DAO的一个主要竞争优势是它通过PCV储存资产。

Tribe DAO可以部署它的PCV来赚取收益,也可以使用它来创建Fei,称为协议拥有的Fei(POF)。

与PCV一样,POF可以以对DAO具有战略利益的方式进行部署,例如通过赚取额外收益来产生现金流,并在不同的Fuse矿池和AMM矿池之间从战略上引导流动性。

来源:Fei Analytics

尽管低于2021年11月的高点,但PCV目前的价值为6.62亿美元。

深入其构成,我们可以看到93.8%的PCV是由ETH和稳定资产组成的。这意味着PCV应该能够在看跌的市场条件下保持其价值的稳健部分,就像2022年初所看到的那样,允许Tribe在未来很长一段时间内保持良好的资金状况。

此外,对这些资产的重视也可以提高PCV的效用和获得收益的机会,因为这两组资产是整个DeFi协议中集成最广泛的。

这个庞大且不断增长的储存资产将有助于Tribe DAO成为DeFi的王者,并允许它们对收益率和流动性流动施加重大影响。

2. 垂直整合

Fei-Rari合并的一个重要好处是它通过为Tribe DAO提供一个稳定币和借贷市场,帮助他们垂直整合了Tribe DAO。这是三种主要协议类型中的两种,第三种是AMM(自动做市商),DAO需要AMM来控制DeFi堆栈的所有层。

本质上,“控制堆栈”意味着DeFi协议,或DAO 黑手党可以影响利率、流动性流动,并创建自己的自主金融系统,而不依赖任何第三方协议。在竞争日益激烈和快速变化的DeFi环境中,这可以极大地增加Dao的长期生存机会,并极大地改善它们的竞争定位。

虽然Tribe DAO目前还没有拥有自己的AMM,但是通过与Balancer的紧密联系与一个AMM建立了紧密的联系。除了计划利用DEX来管理协议控制值(PCV)外,Tribe DAO和Balancer于2021年11月执行了900万美元的代币交易。在可预见的未来,这很可能使两种协议保持紧密联系,帮助填补Tribe DAO的“AMM缺口”。

3. 人才资本

Tribe DAO由非常有才华的开发人员、贡献者和社区成员组成。

在合并之前,Fei和Rari都成功地建立了产品和市场的匹配关系,Fei的市值达到7.56亿美元,是2021年7月创下的历史最低纪录的两倍多,而Rari的TVL在收购提议提出时为11.6亿美元。这表明了两个团队强大的开发、业务和社区建设能力。

此外,考虑到Fei和Fuse带来的创新,以及这两个团队在不断发布新特性和产品方面的能力,DAO和社区似乎很有可能能够适应快速、不断变化的DeFi环境。

4. 合作关系和协作性

Fei和Rari的团队都展示了杰出的业务发展技能。

超过20家Dao已经或计划推出Fuse矿池,而Fei已经与Index Coop、Angle Protocol以及上文提到的Balancer等多个项目合作。

这表明Tribe DAO具有高度的协作性,能够在DeFi内部形成战略互惠的伙伴关系。考虑到DAO-to-DAO合作关系中所看到的不断增长的价值,以及其中一个核心的DeFi价值主张是可组合性,Tribe处于不利的地位的可能性较低。

代币经济

正如传统股票市场里说的“股票不是业务”,加密市场中的“代币不是协议”。

正如过去一年所看到的,许多基础设施强劲的DeFi项目的表现远远落后于市场指数和基准,这在很大程度上是由于代币经济设计的糟糕。

让我们一起了解Tribe的代币经济,看看它是否能够避免类似的命运。

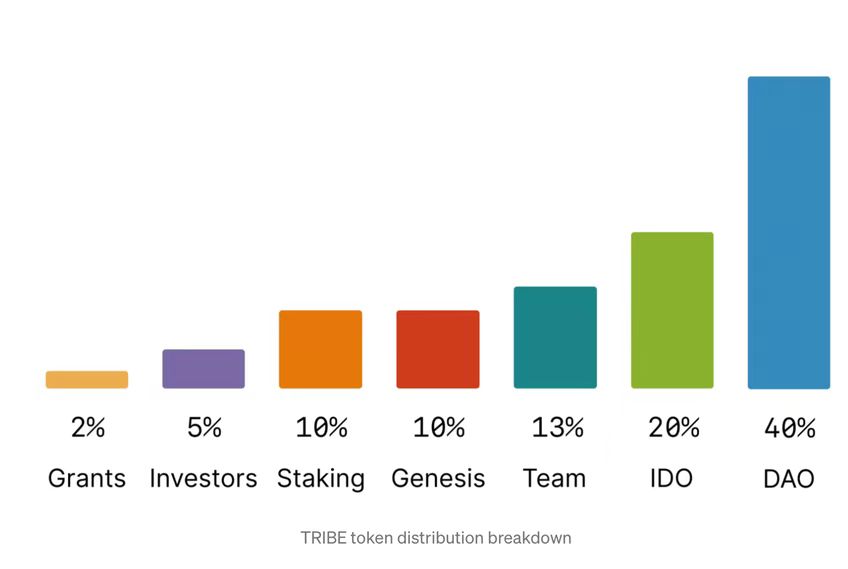

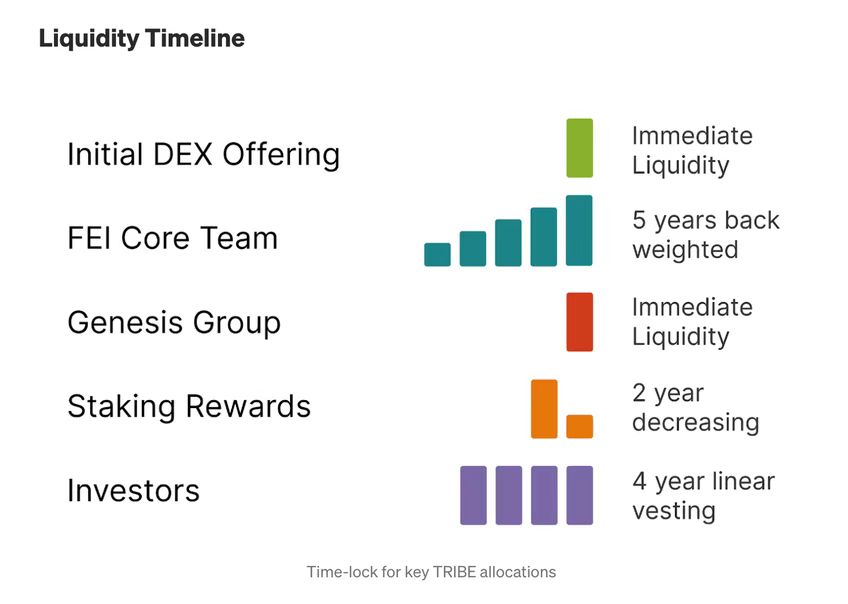

代币分发机制

来源:Medium的Tribe分发机制文章

正如我们所看到的,Tribe的初始分配是高度去中心化的,只有18%流向团队和早期投资者。这两组之间的分配明显低于许多其它DeFi协议,仅Genesis参与者获得的分配就比私人轮投资者多两倍。

来源:Medium的Tribe分发机制文章

此外,Tribe受益于过长的兑现期的先决条件,投资者和团队代币的兑现期分别超过4年和5年。此外,团队分配是反向加权的,这意味着代币持有者将不得不在协议的早期承受初期的通货膨胀。

这种更公平的代币分配和更长的兑现时间的结合表明,Tribe DAO是一个高度长期导向的,并且可能会做出强调长期稳定性和可持续性的决策。

代币使用情况

Tribe在Tribe DAO和Fei协议中都扮演着两个关键角色:

治理的权利

协议支持

与大多数DeFi代币一样,Tribe作为一个整体用于DAO内部的治理,持有者能够对各种项目(如PCV分配)进行投票。然而,Tribe也对DAO资金库或PCV中持有的资产持有微治理权,AAVE、ANGLE、BAL、COMP、CRV、CVX、INDEX和TOKE构成可以行使这些权利的代币。

Tribe DAO是DeFi微治理的先驱之一,因为它们以利用INDEX微治理来帮助达到让Fei在Aave上上线的门槛而闻名。尽管相对于ETH和稳定资产,这些代币只占协议控制值(PCV)的一小部分,但Tribe广泛的微治理权在未来可能对Dao有价值,增加了代币在这类买家中的吸引力。

Tribe的第二个主要用途是为FEI提供协议支持。类似于MKR在MakerDAO中的角色,如果Fei的担保不足,则会铸造Tribe,从PCV中赎回,并重新担保协议。

供需动态

Tribe的主要需求驱动因素和价值增值机制是回购,因为20%的“协议股权”,即PCV的价值,如果所有的Fei都被赎回为其基础质押品,将被分配给每周购买的Tribe,这些Tribe再分配回协议库。

除了有助于激励PCV的增长和管理责任心之外,这些回购应该促成Tribe收购压力来源。截止目前,已经执行了价值超过1328万美元的回购。

虽然如果Fei的担保不足,会有永久的重大通胀冲击的风险,但Tribe目前只是通过“Fei-Rari”的流动性挖矿释放出来,“FeiRari”是一个由Tribe DAO运营的Fuse矿池。尽管这可能会给代币带来销售压力,因为它是由产矿工挖矿得到的。但从长远来看,由于协议控制值(PCV)的大小,该协议很好地定位,以避免依赖,并可能完全消除排放。

就目前来看,Tribe的代币经济似乎对投资者非常有利,尤其是与DeFi中疯狂的通胀代币经济相比。

最后,Fei Protocol联合创始人Joey Santoro提出了一项代币经济改进方案,该方案有可能进一步改善供需动态。

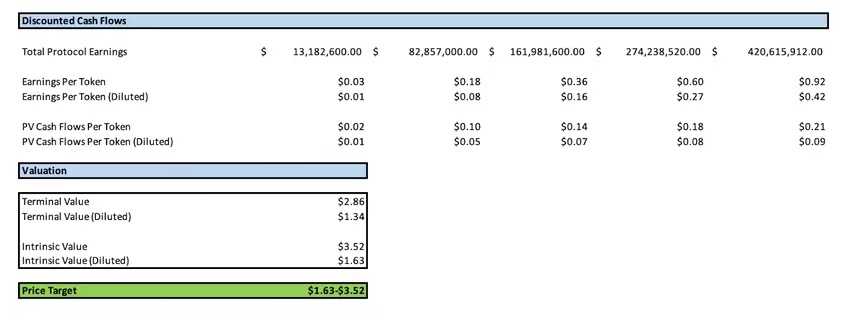

现金流折现估值(DCF Valuation)

现在我们了解了Tribe DAO的产品、竞争优势和代币经济,让我们来看看Tribe DAO的财务状况,并尝试使用现金流折现(DCF)模型对其进行估值。

Tribe DAO的现金流主要有三种来源:

跨DeFi协议分配Fei所获得的协议拥有的Fei(POF)收益。

通过类似地将这些资产部署到各种DeFi协议中,获得协议控制值(PCV)的收益。

从Fuse获得的平台费,是通过从支付给存款人和贷款人的利差中抽成而产生的。

该模型试图预测Fei稳定币和Fuse的增长,作为估算这三个来源产生的现金流的一种手段。

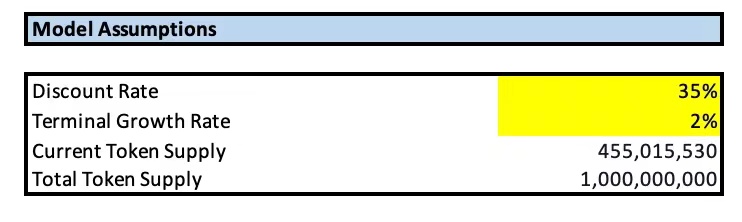

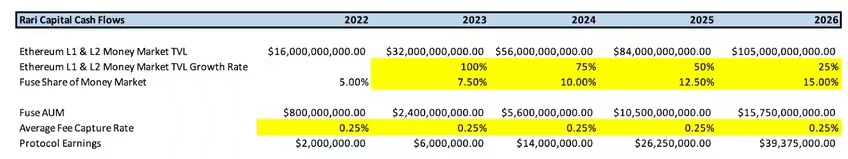

该模型采用了35%的折现率,这个数字与风投资本家对初创企业进行估值的平均范围一致。此外,该模型还采用了2%的最终增长率,以跟踪全球的预期增长率。

该模型假设稳定币市场在未来五年将以越来越慢的速度增长227%。考虑到之前提到的竞争优势,Fei公司是受益者,预计未来四年,随着PCV的规模成比例增长,其市场份额将不断增长。

该模型还预测,通过部署到AMM、借贷市场和流动性质押服务,DAO将能够在协议拥有的Fei上获得5%的初始收益率,在PCV上获得3%的收益率,而该收益率预计将随着协议规模的扩大而下降。

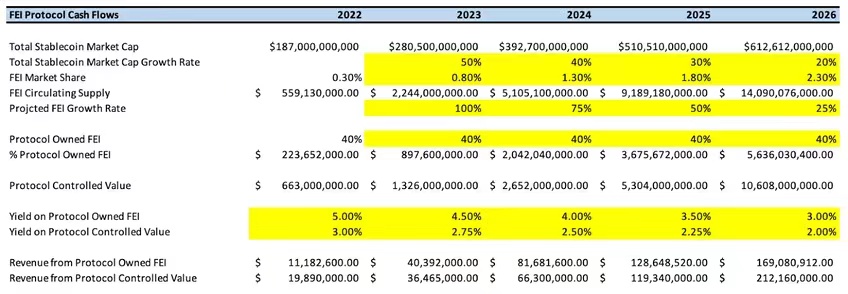

该模型预计,以太坊L1和L2的借贷部门在未来五年将以每年放缓的速度增长556%。考虑到DeFi所有资产的潜在市场,Fuse预计将在该行业占据越来越大的市场份额(该模型没有考虑Midas Capital的资本部署)。

尽管不同矿池的利用率和因此获得的利息差异很大,但模型预测Rari将获得基于AUM(资产管理规模)的0.25%的总体利用率。

通过将两种协议产生的总现金流相加,并将其折现到目前,我们计算出Tribe的公平价值在1.63- 3.52美元之间。

以目前0.58美元的价格计算,这意味着上涨了207%-564%。

风险评估

1. 竞争力

稳定币领域的竞争非常激烈,24家公司的市值超过1亿美元,9家公司的市值超过10亿美元。考虑到该领域庞大的潜在市场,在可预见的未来,竞争力不太可能削弱。

在孤立的借贷市场中,竞争同样激烈,Euler Finance和Silo Finance等新兴协议看到了投资者的兴趣所在。此外,最近推出的Aave v3还包括一些独立的贷款功能,进一步搅浑了这片竞争水域。

2. 协议控制价值风险(PCV Risk)

如前所述,Fei的PCV(协议控制价值)是通过各种不同的协议存储的。虽然风险分布在这些协议,如果一个或多个协议被利用,或者DeFi遭受重大系统性事件,很大一部分的PCV可能会失去,使Fei及其存放的多个Fuse矿池处于抵押不足的风险。

3. 排放

尽管持续存在回购,但仍有活跃的Tribe排放,使代币成为矿工的目标,潜在地给Tribe价格带来下行压力。此外,考虑到反向加权股权和价格大幅升值的可能性,反向加权股权可能会带来团队和核心贡献者未来大量销售的风险。

4. 监管方面的担忧

稳定币发行者以及整个DeFi可能面临监管机构的打击。尽管Tribe DAO采用了完全去中心化的链上治理,但它仍然面临着被希望控制DeFi的政府机构审查的风险。

总结

有了两个创新的协议产品Volt Protocol和Midas Capital,巨大的协议控制价值(PCV)储存资产,并由一群强大的贡献者领导,进行不断建造、发行和交易,Tribe DAO似乎准备成为一个DeFi黑手党,从这个熊市中脱颖而出。

尽管该协议面临着几个重要的风险来源,但凭借强大的代币经济,且估值暗示着当前价格有强大的上行潜力,但当投资者看到Tribe时,我们不应因一颗树而放弃整片森林。

免责声明:这个模型是一个评估Tribe潜在价值的框架,而不是对其价值的最终判断。