详解40家顶级加密风投VC年度报告,告诉你谁最值得跟投

原文作者:吴卓铖

原文编辑:Colin Wu

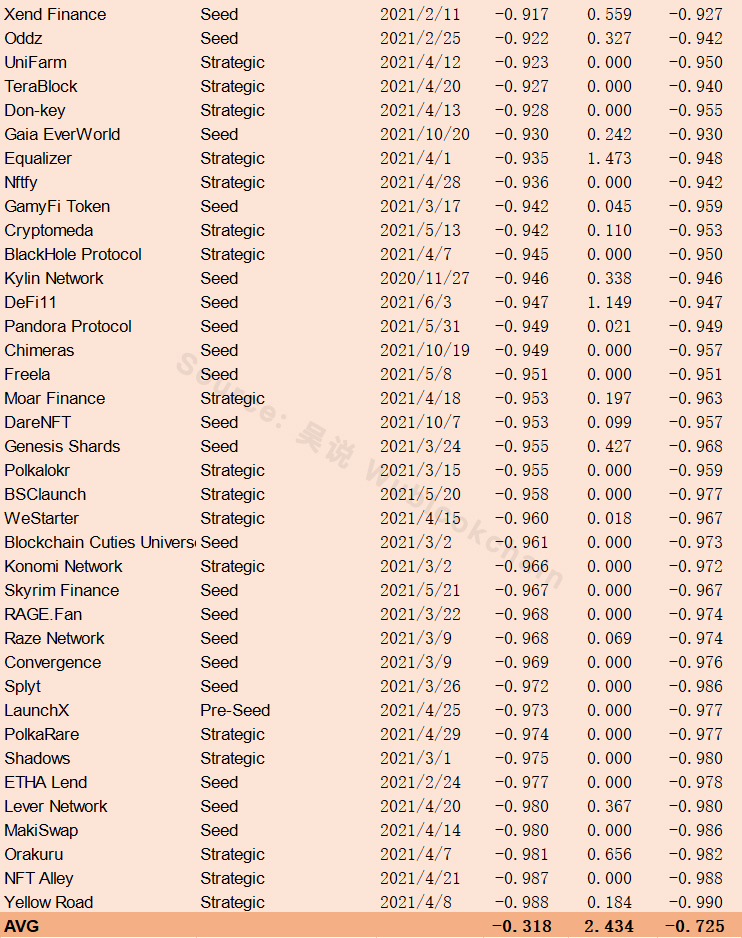

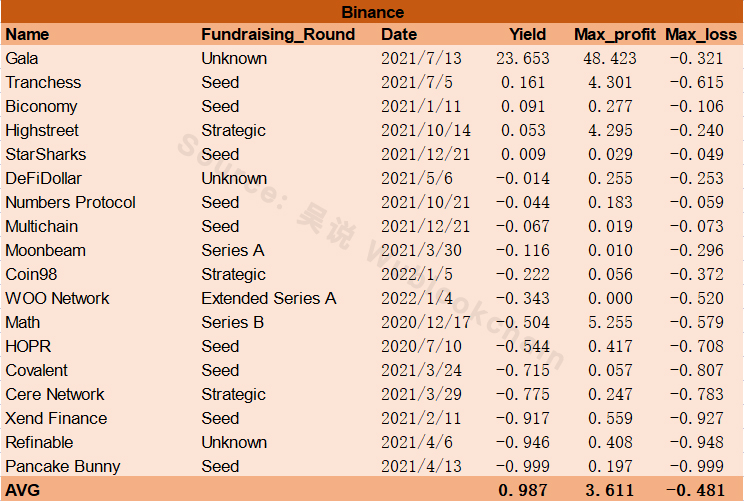

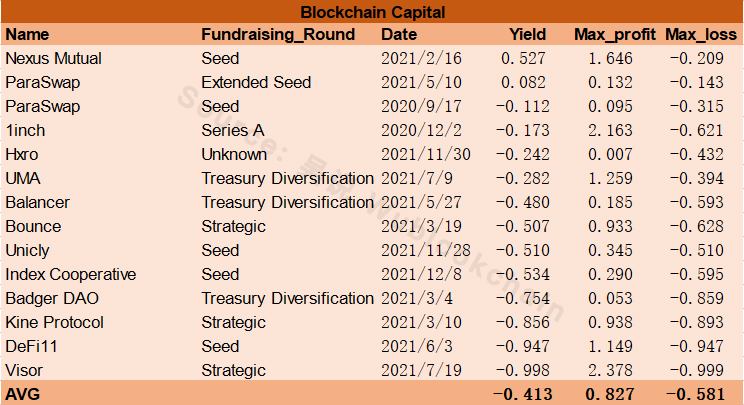

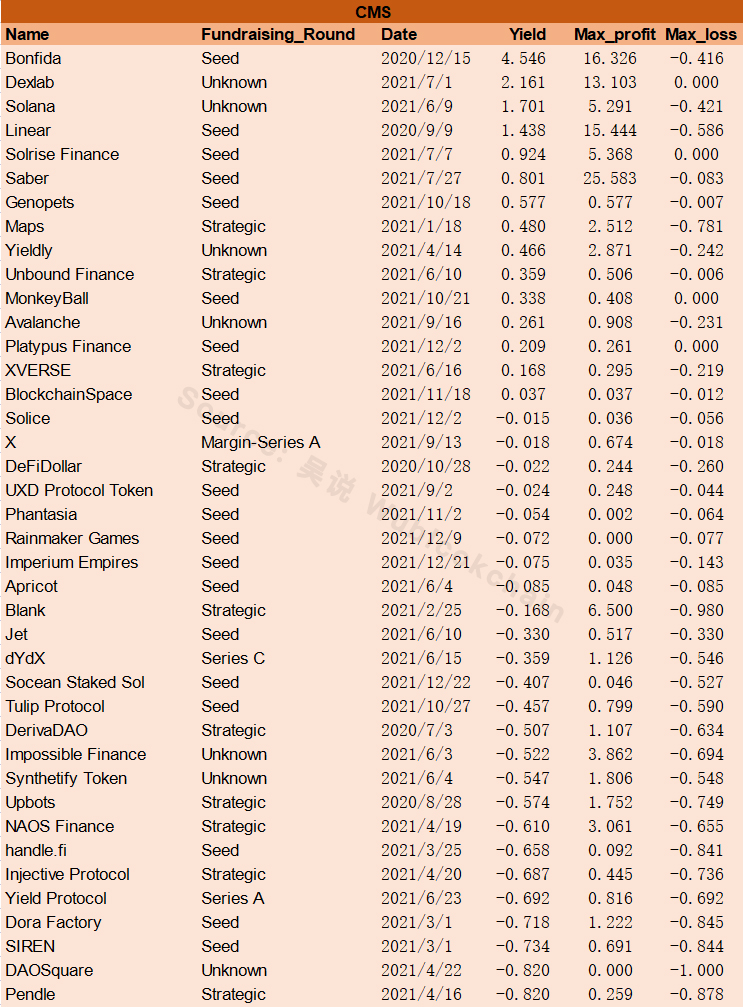

多数投资者喜欢追踪项目的融资信息,以此作为项目资质的评判标准。本文详细统计了自 2020 年 7 月以来(主要为2021年)的 590 个已发 Token 项目的融资信息,计算自融资信息公布以来的收益率(当前价格/公布日价格)、最大收益(公布以来最高价/公布日价格)和最大亏损(公布以来最低价/公布日价格)。

从两个角度呈现 VC 对投资者的借鉴意义。第一,从 VC 角度出发,列举 40 家知名 VC 的投资情况,计算其损益。第二,从项目角度出发,筛选业绩表现较好的项目,挖掘其背后的 VC(除去那 40 家)。之所以不统计 2020 年 7 月以前的数据,是因为当时的融资信息比较凌乱,大部分都没有披露。

本报告存在很大的局限性,需要读者注意:

非常重要的一点是,项目 token 的损益不是从发行日开始算起,而是从融资信息公布日开始算。以 Axie Infinity 为例,该项目发行至今上涨了超过 300 倍,a16z 与 Paradigm 等一众知名 VC 都参与了其 B 轮融资,但如果按发行以来的收益率计算就会高估他们的实际收益率。事实上,B 轮融资是去年 10 月公布的,而 Axie 的暴涨发生在去年夏天,如果只计算 10 月以来收益率,那么真实数字为 -50%。

那么 VC 的真实收益率就是 -50%?也不尽然!我们不知道他们的成本价(尤其是私募轮的价格),更不知道他们的退出价(不同项目不同轮次的锁仓退出周期均不同),也无法知道在不同项目的金额分配。因此用这种方式衡量 VC 的投资能力过于想当然了。

本文计算的所有收益率均不代表 VC 投资业绩,只是衡量融资信息对于投资者的参考价值。部分项目存在多轮融资,上述 590 个项目共有 685 条融资数据。所有融资数据均来自 Dove Metrics(难免会有不少遗漏),价格数据均来自 CoinGecko,数据截至 2022 年 2 月 10 日。

此外需要注意的是,对于顶级VC来说,投资收益曲线拉长,例如它们在2020年7月以前投资的一些项目,也会在这之后获得高额回报,本文没有进行相关统计。

知名 VC

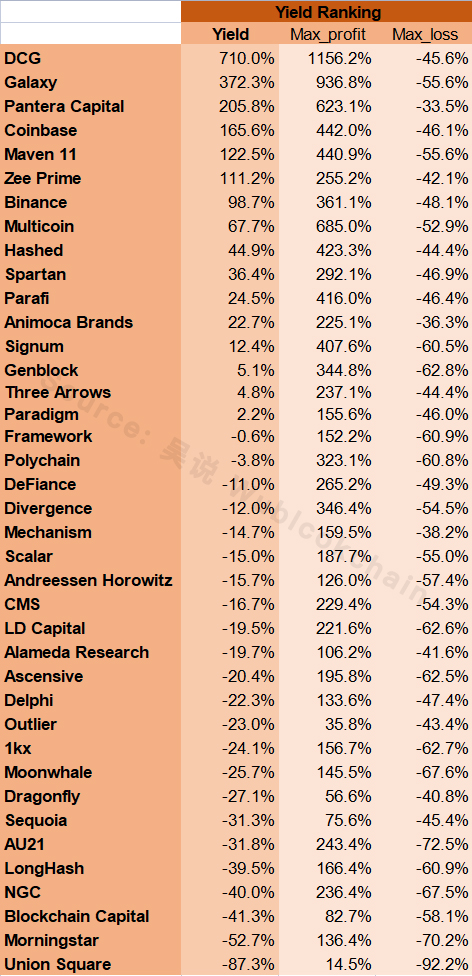

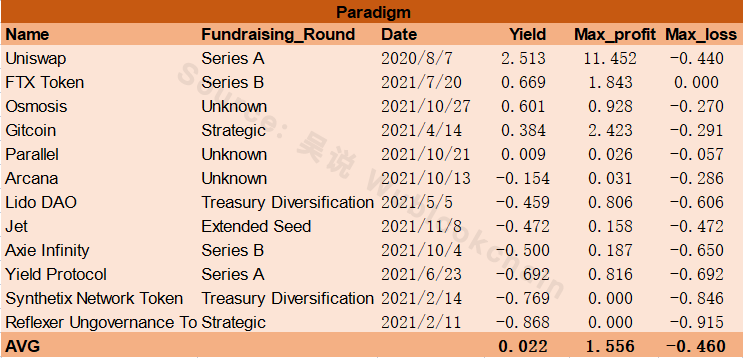

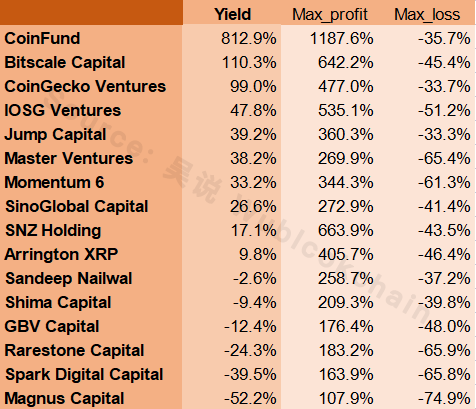

40 家 VC 按照投资信息公布以来的收益率排序:

以上三个收益率均为平均收益率,其数值被部分“百倍币”拉高,实际情况大部分都是亏损的。但一级市场就是如此,高风险高收益,因此,平均数比中位数更具参考价值。其中,有 23 家 VC 的收益率为负。其余 17 家中,有 1 家最大收益小于两倍,有 2 家最大亏损大于 60%。最大收益较低意味着,即使每个项目都在最高点抛出,平均收益也并不优秀;而最大亏损较高则意味着,在价格下行期间须承受极大浮亏。

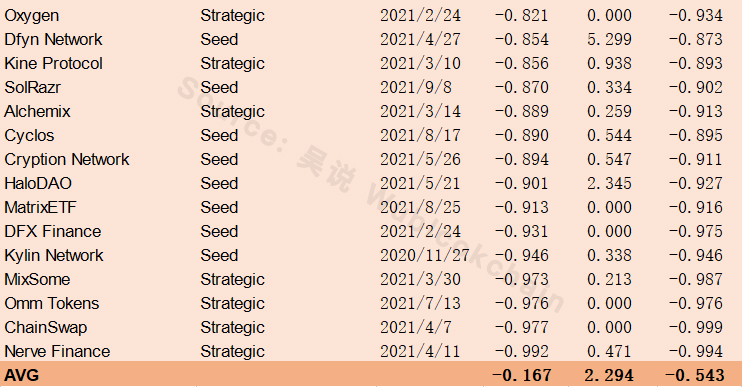

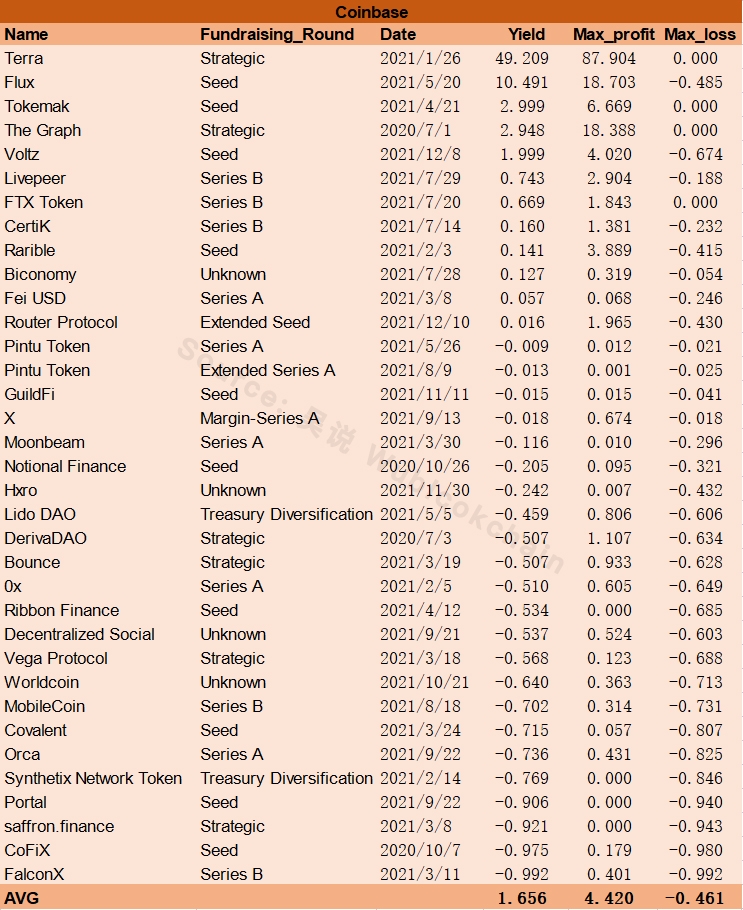

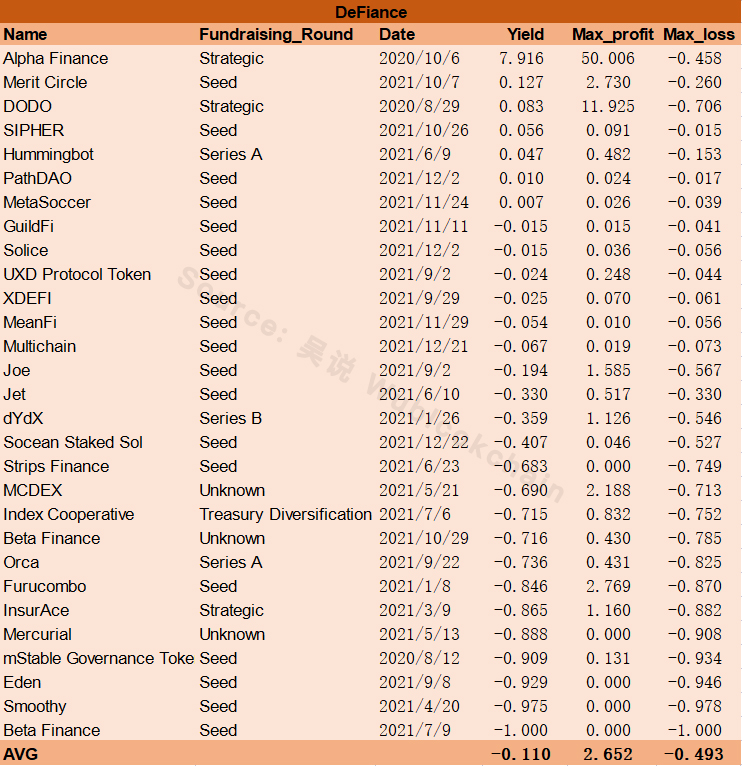

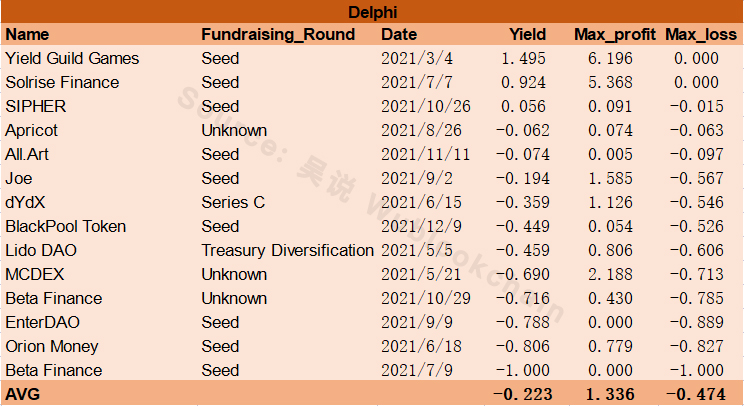

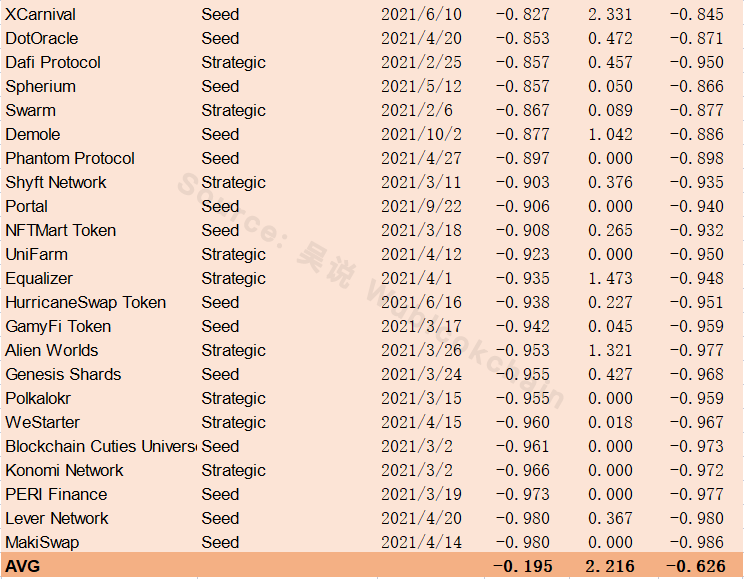

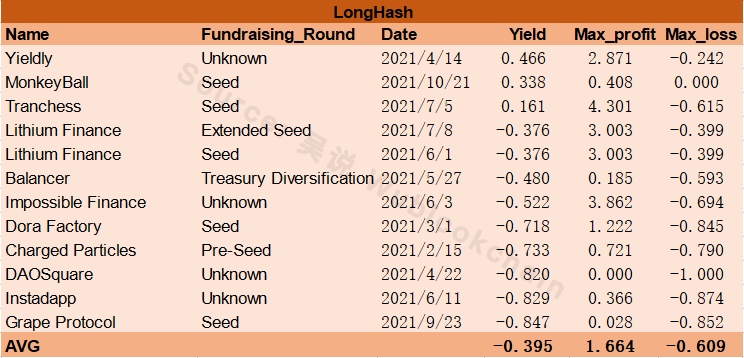

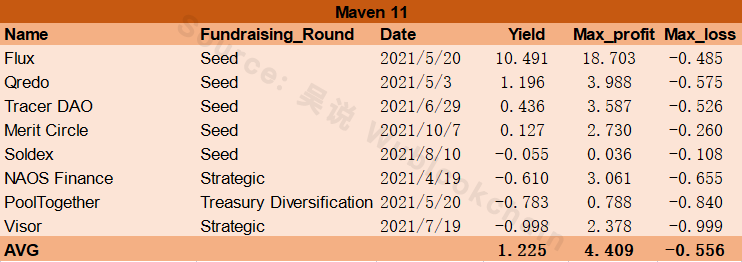

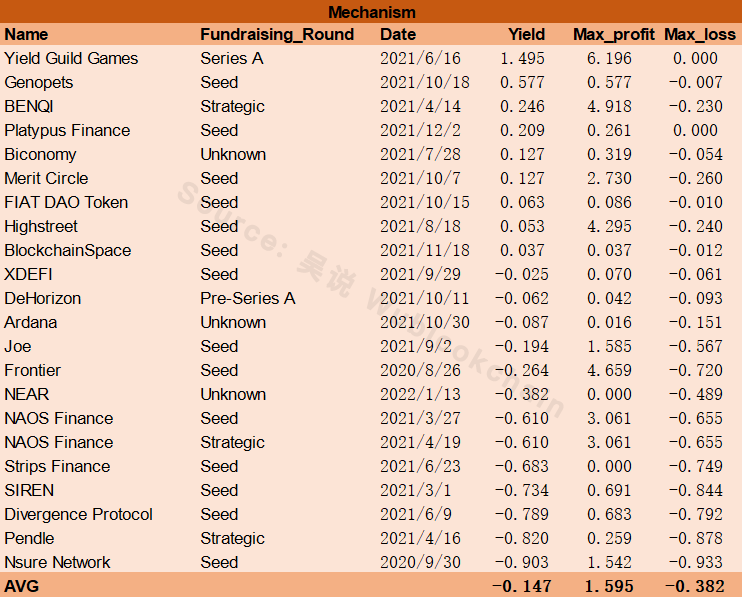

以下为 40 家 VC 的具体情况,按首字母排序。

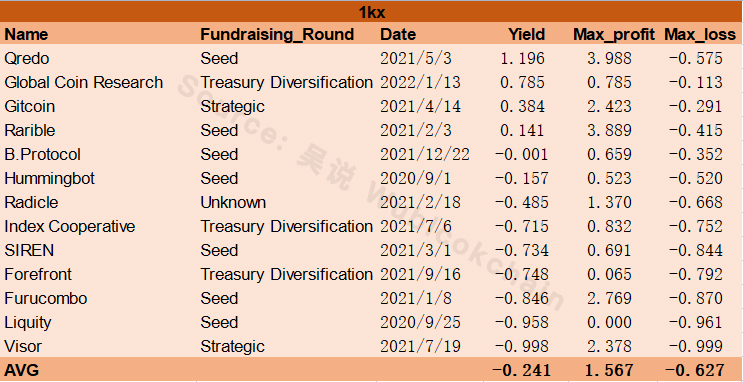

1kx

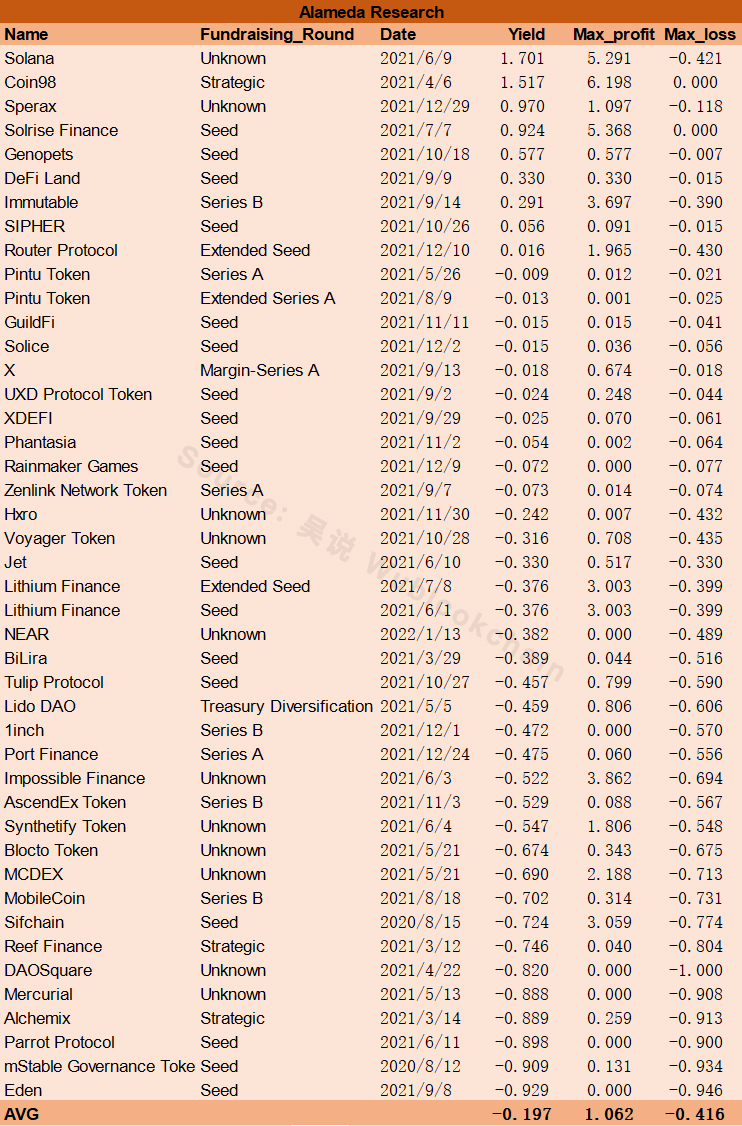

Alameda Research

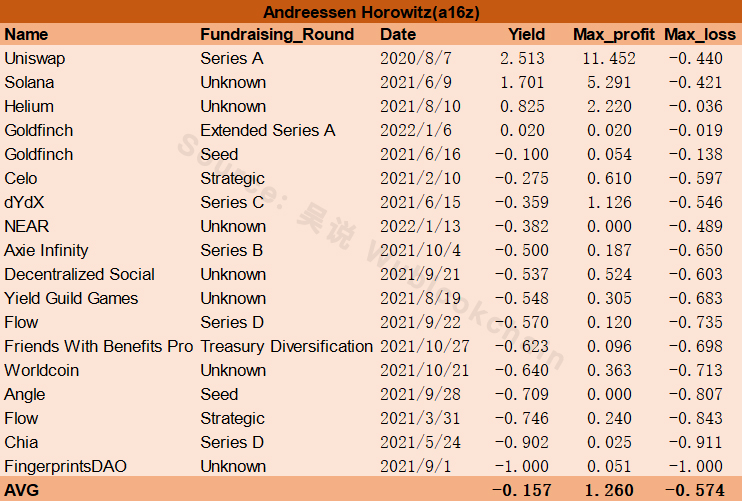

Andreessen Horowitz(a16z)

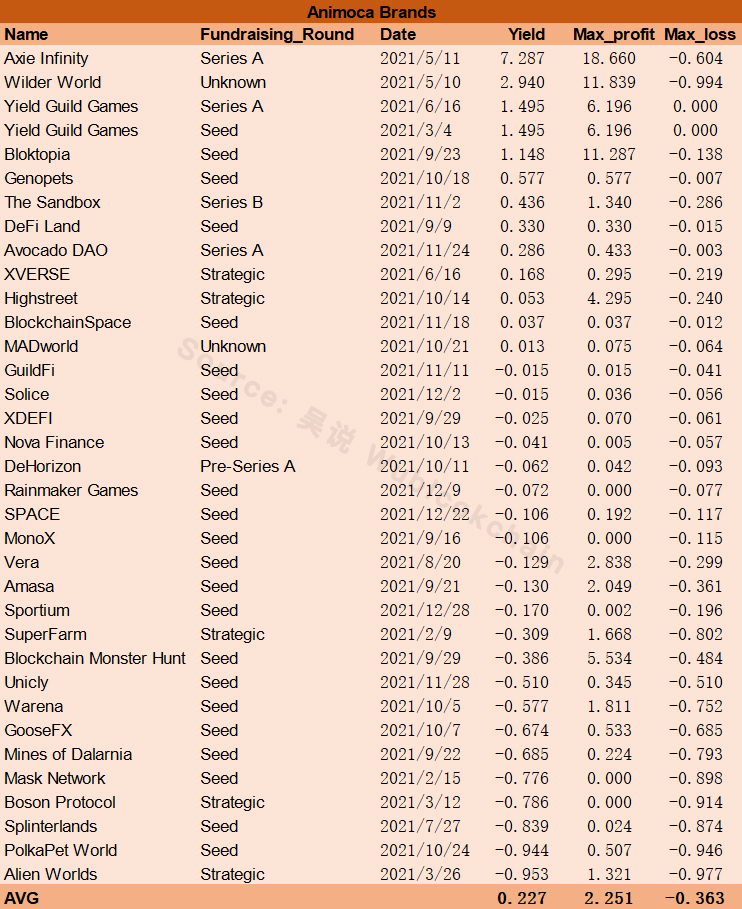

Animoca Brands

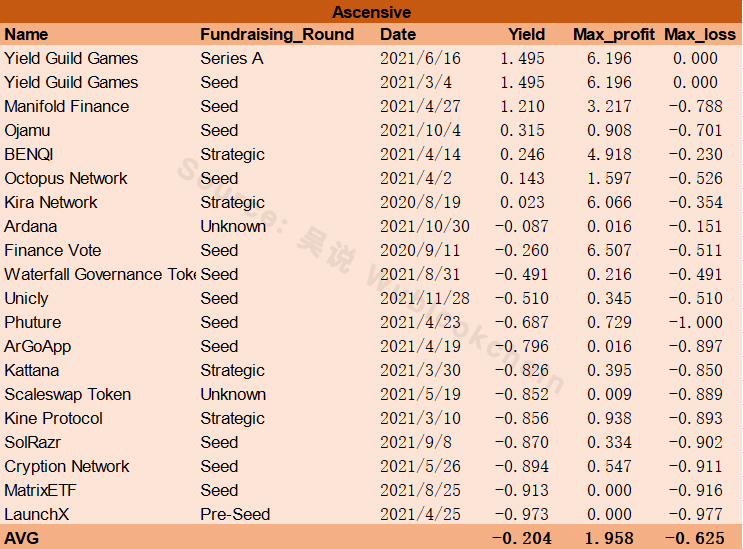

Ascensive

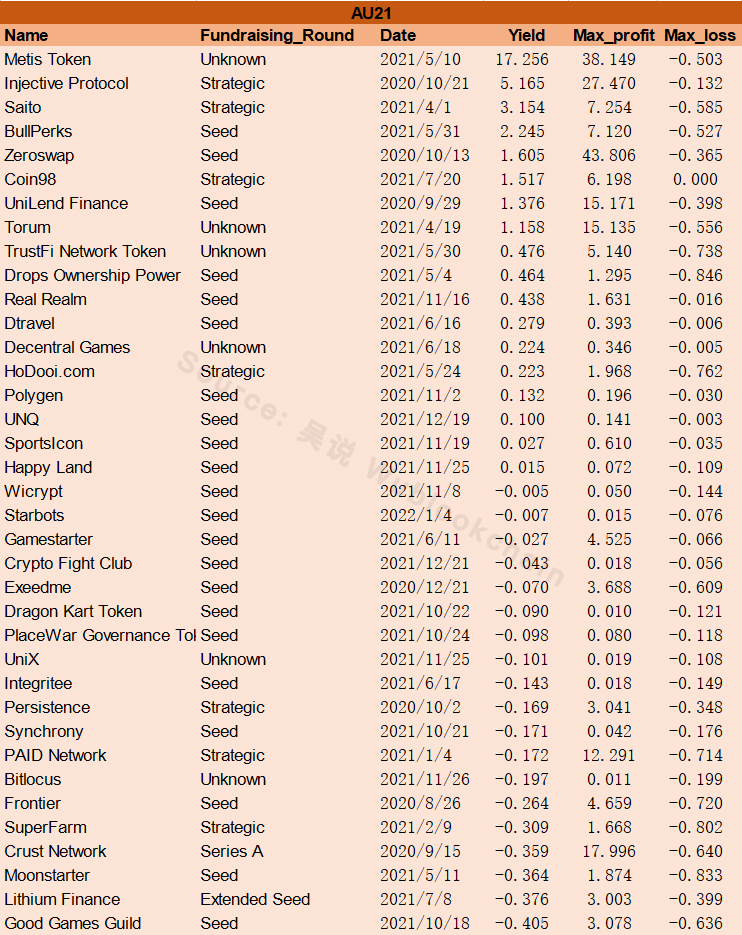

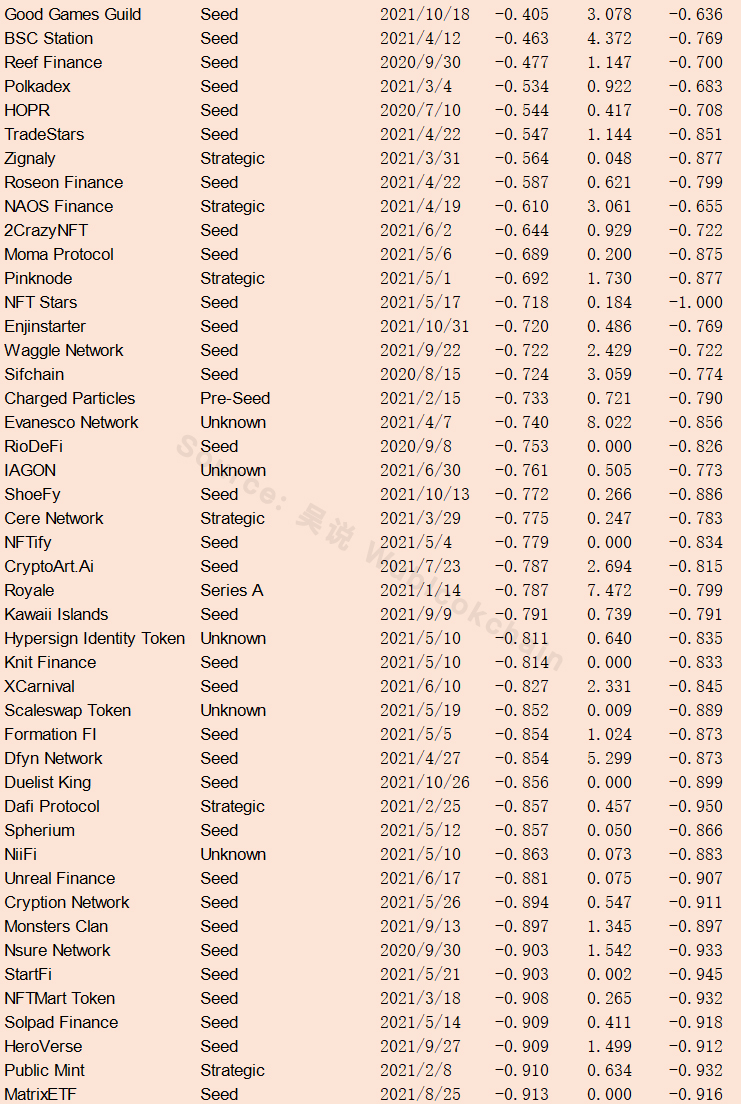

AU21

Binance

Blockchain Capital

CMS

Coinbase

DeFiance

Delphi

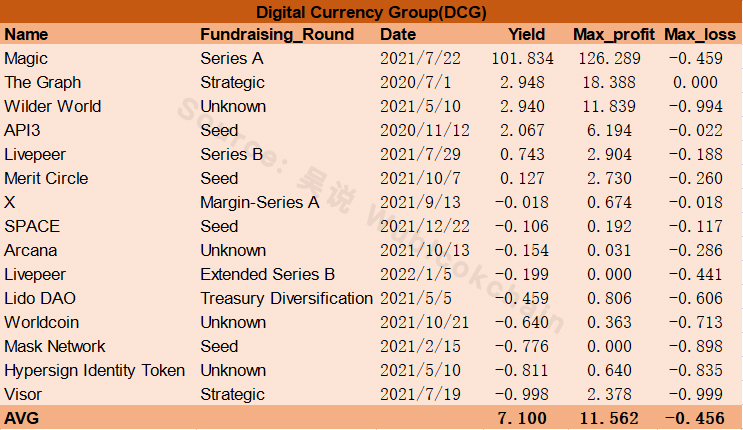

Digital Currency Group

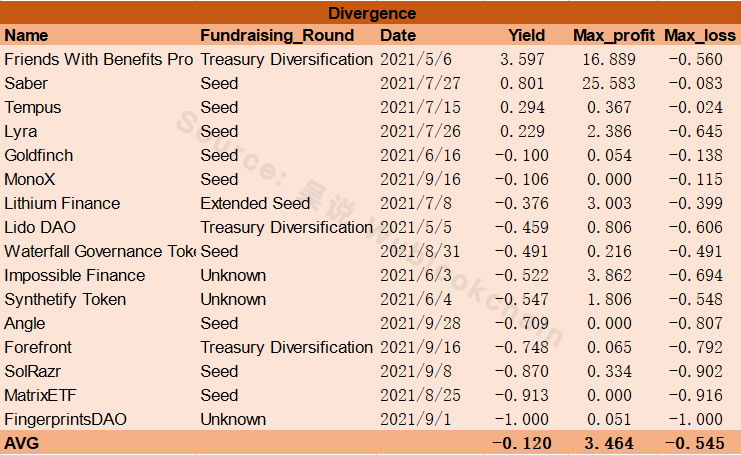

Divergence

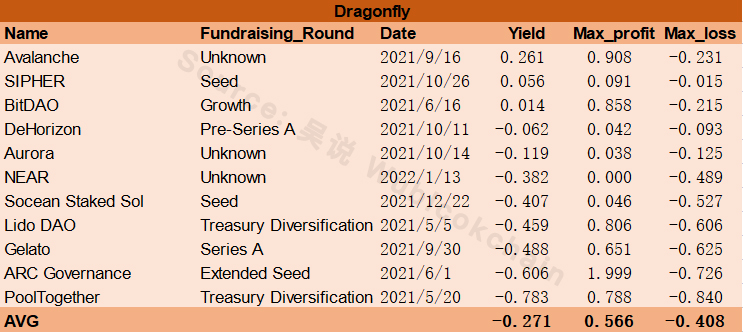

Dragonfly

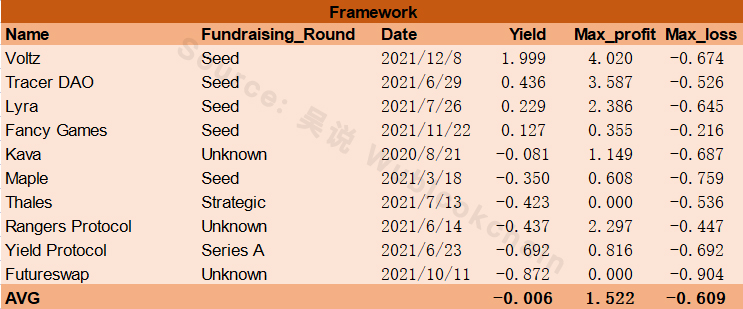

Framework

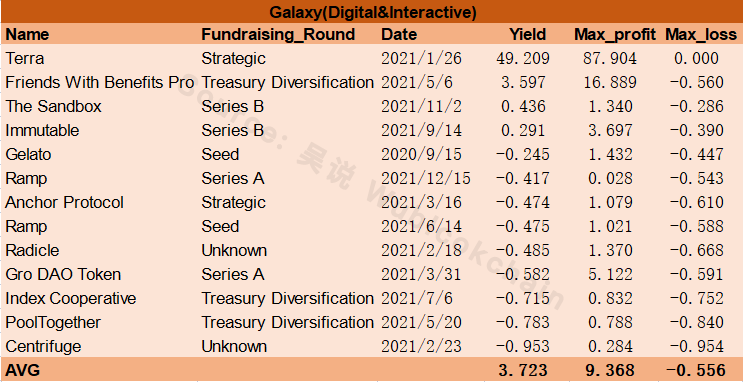

Galaxy(Digital&Interactive)

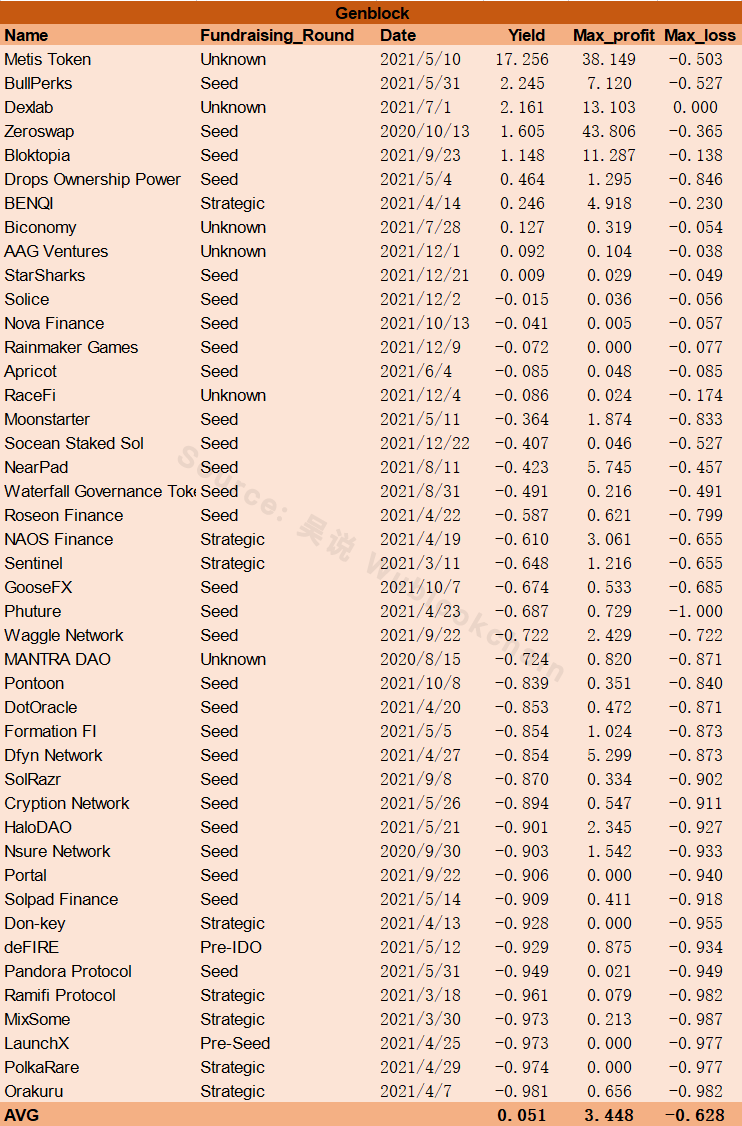

Genblock

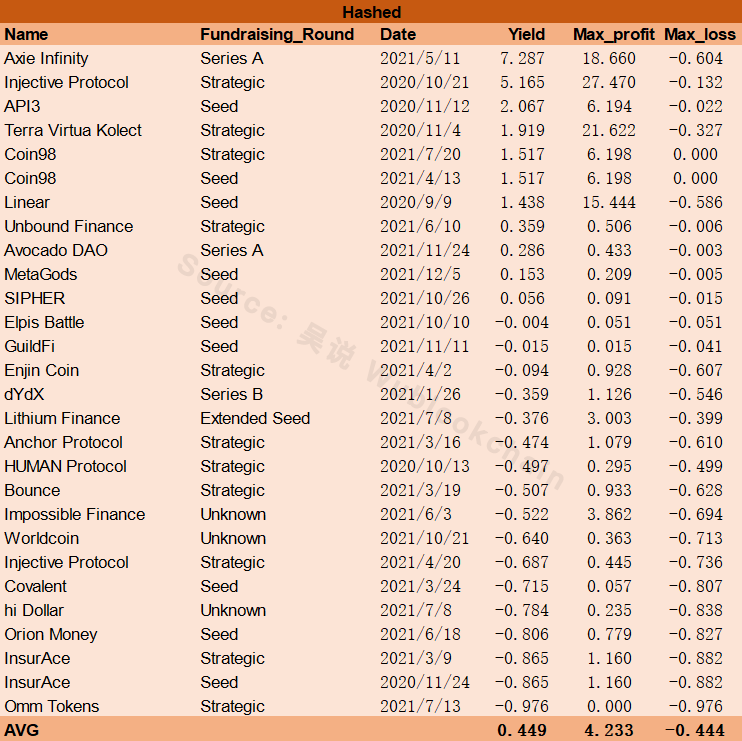

Hashed

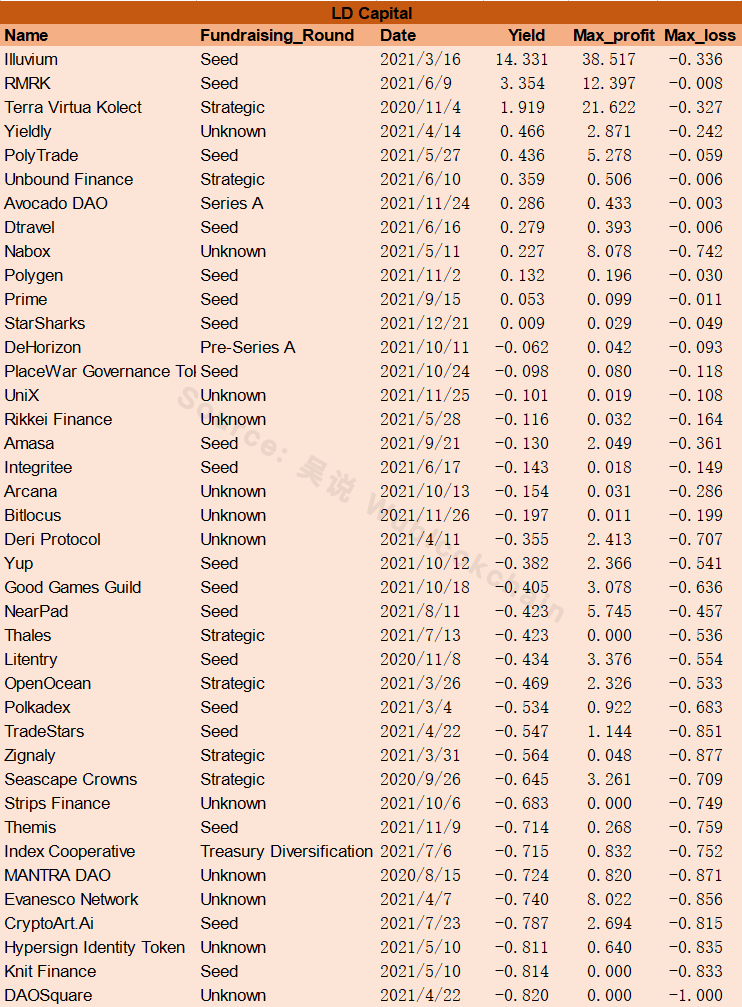

LD Capital

LongHash

Maven 11

Mechanism

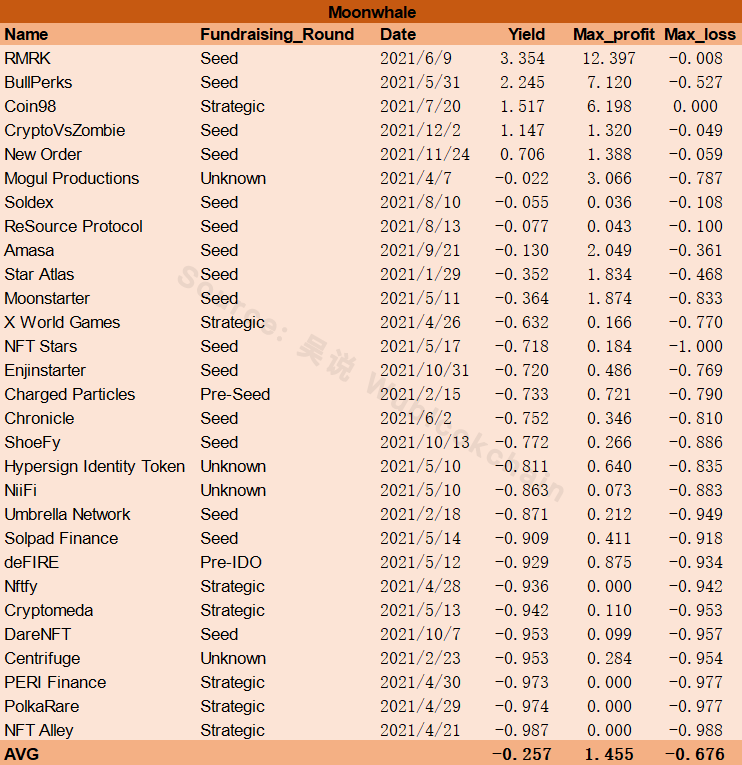

Moonwhale

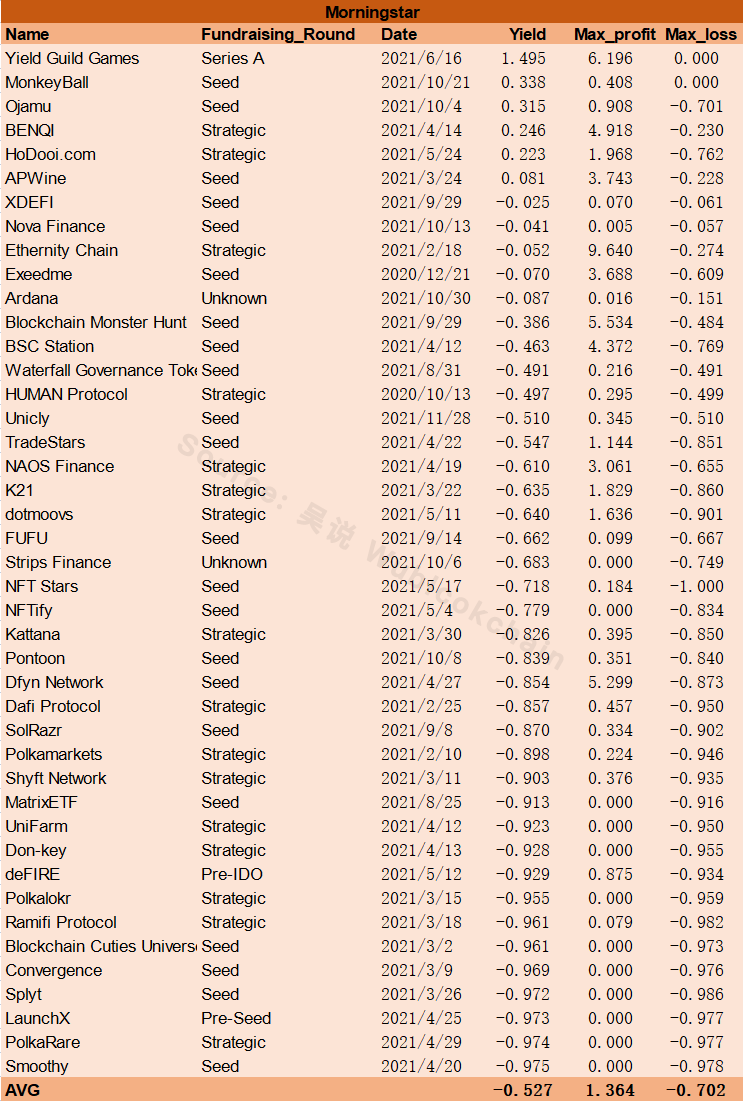

Morningstar

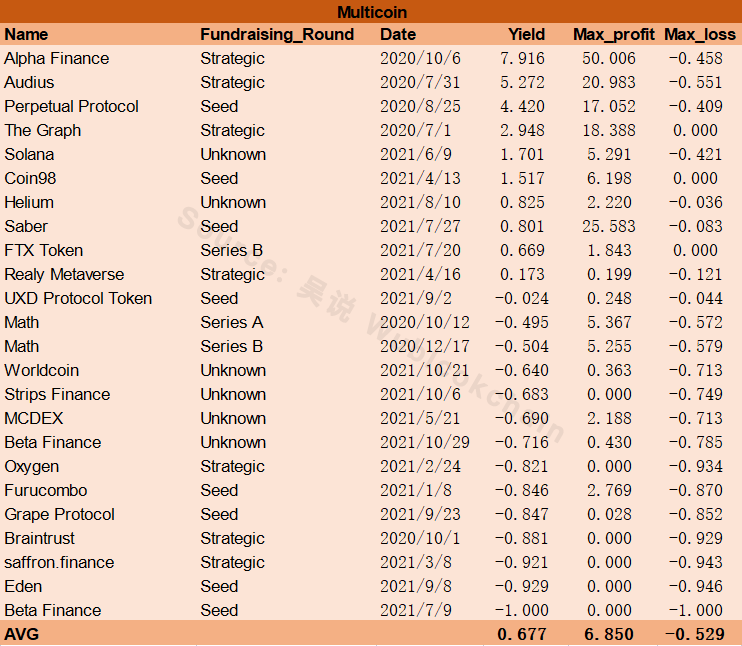

Multicoin

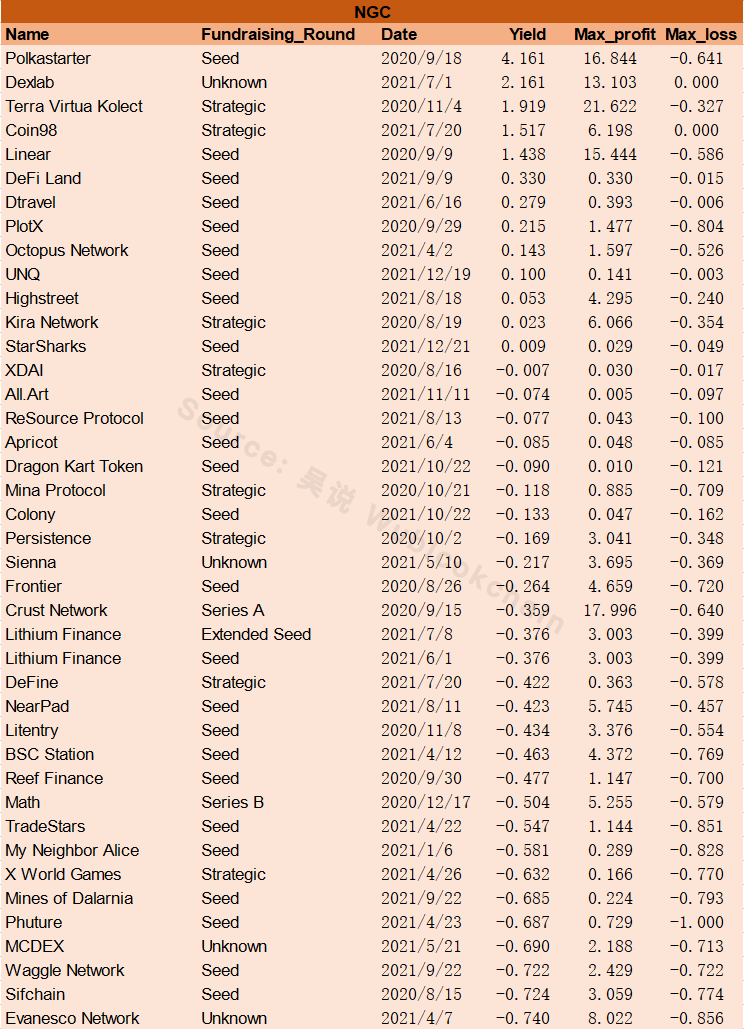

NGC

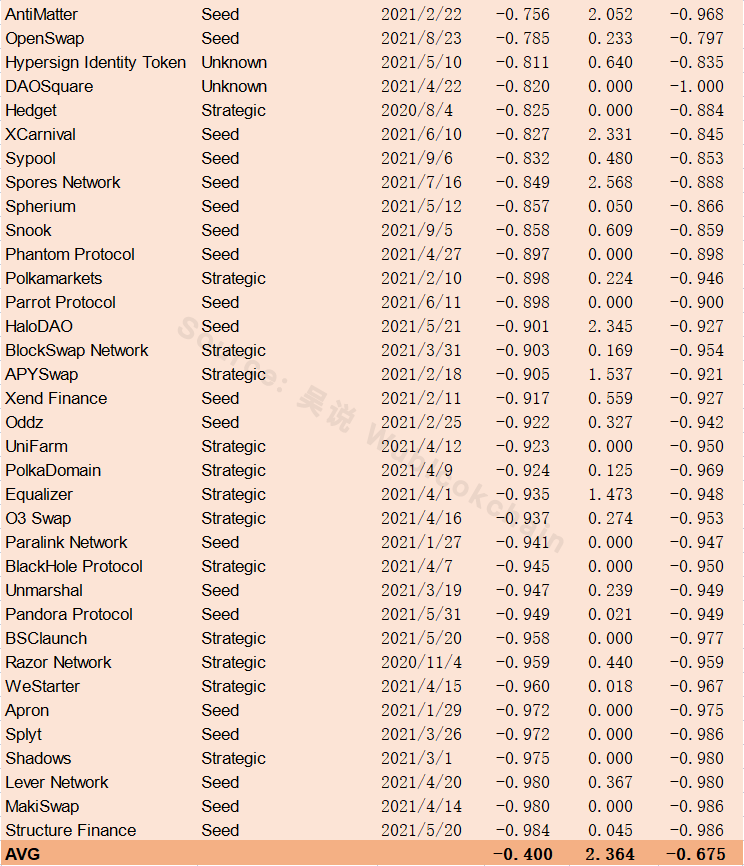

Outlier

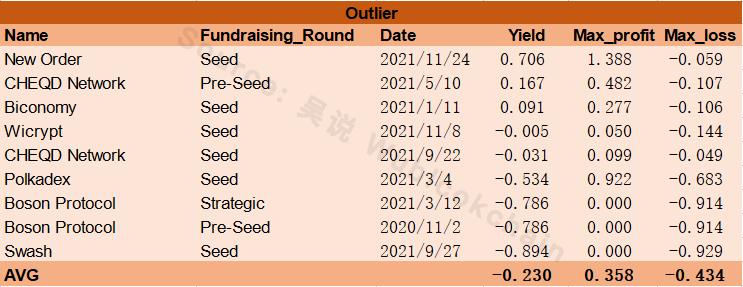

Pantera Capital

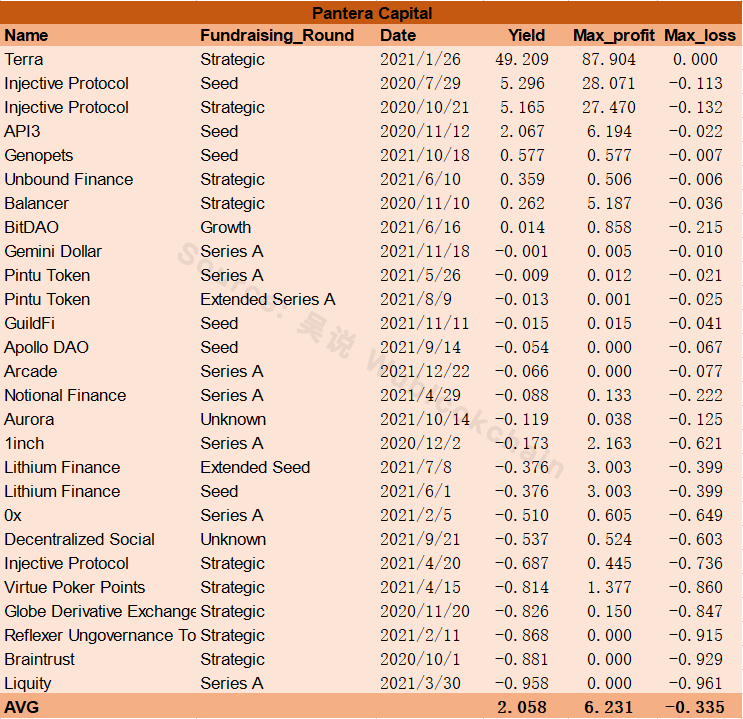

Paradigm

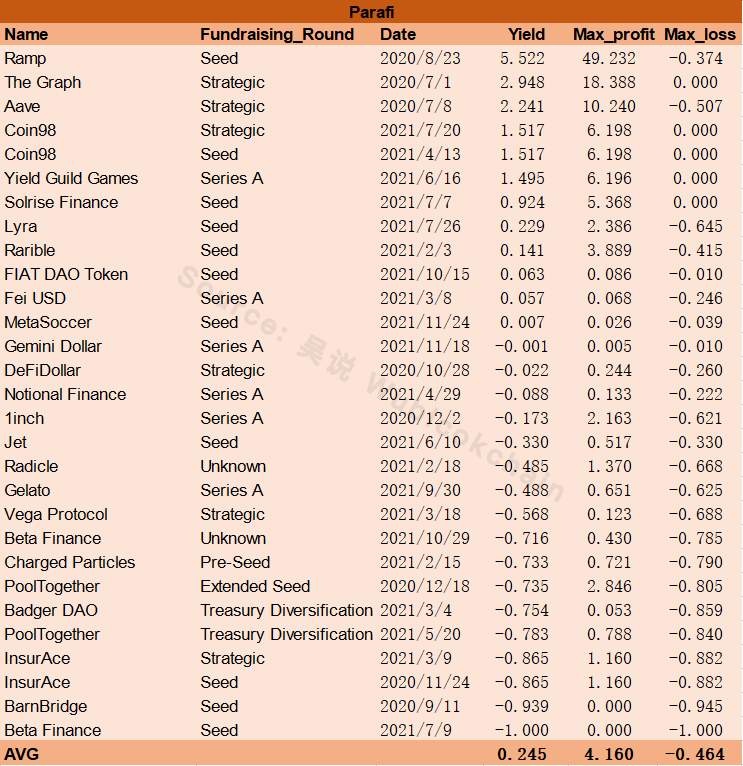

Parafi

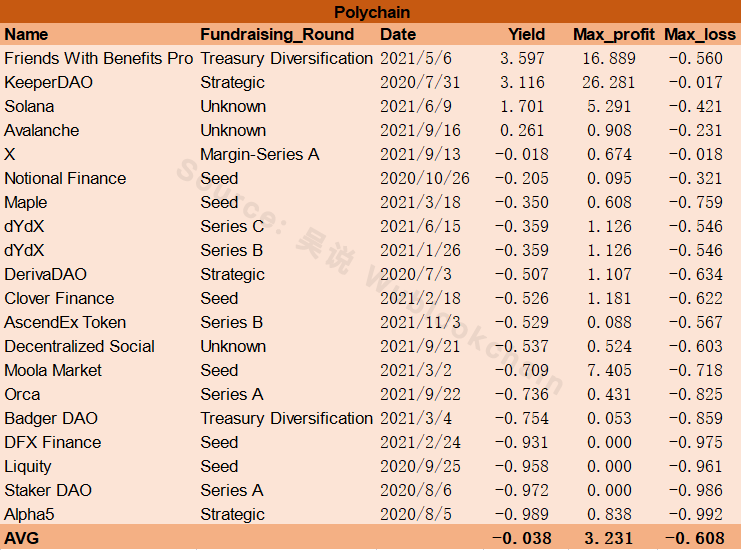

Polychain

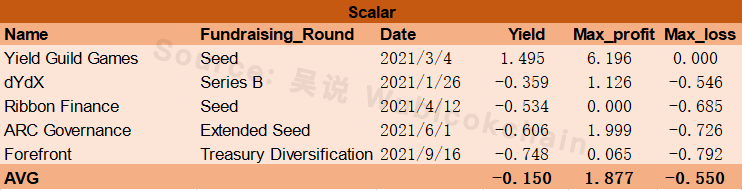

Scalar

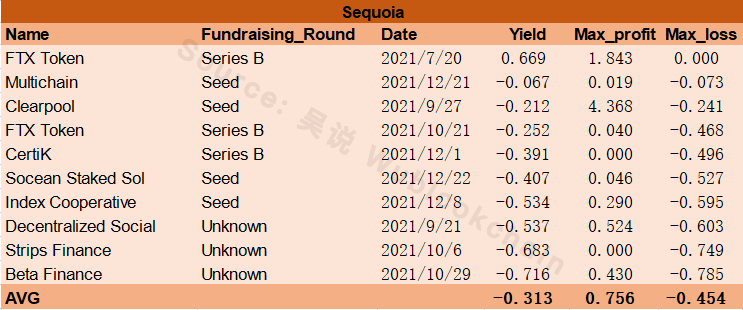

Sequoia

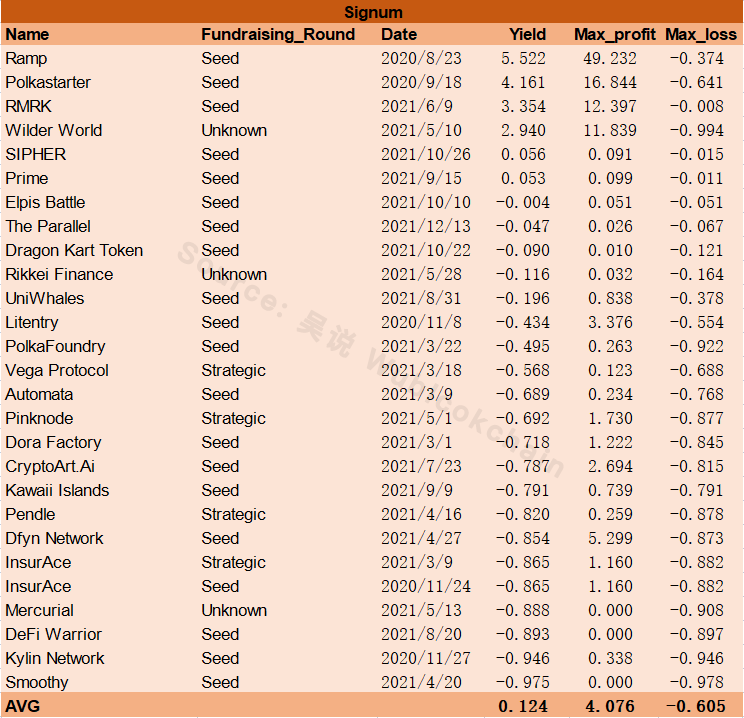

Signum

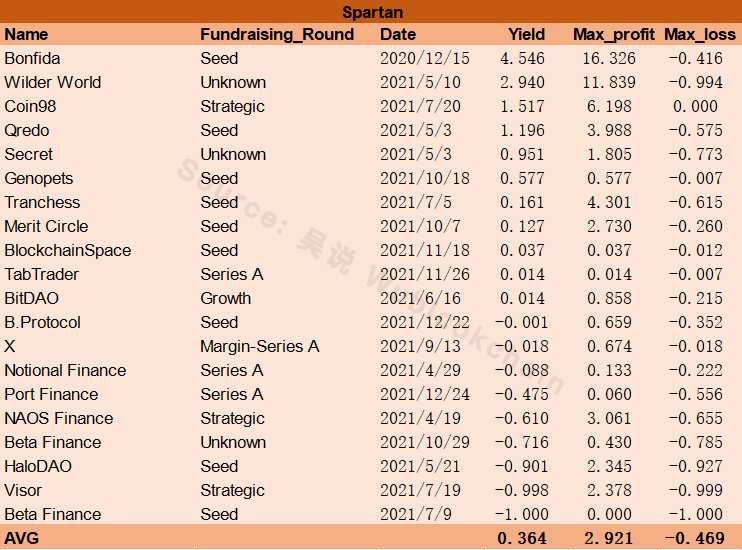

Spartan

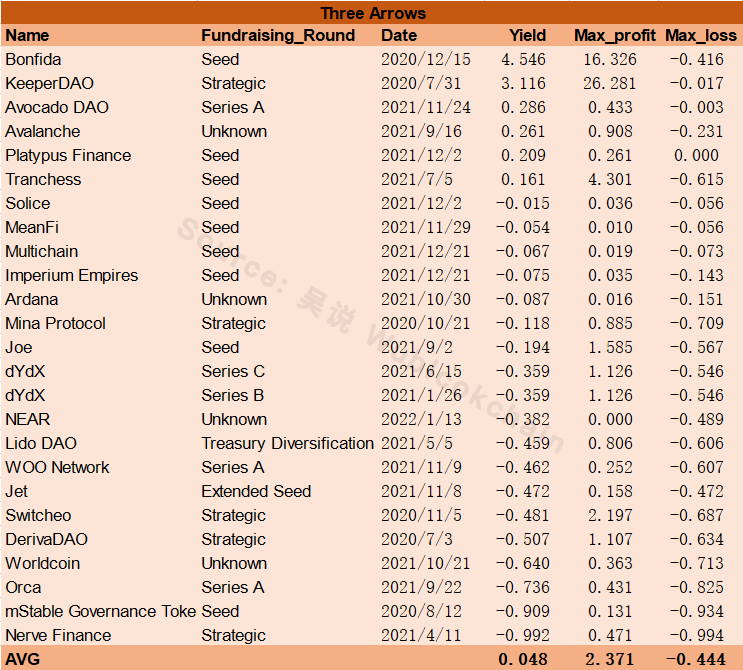

Three Arrows

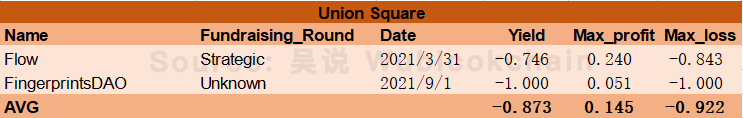

Union Square

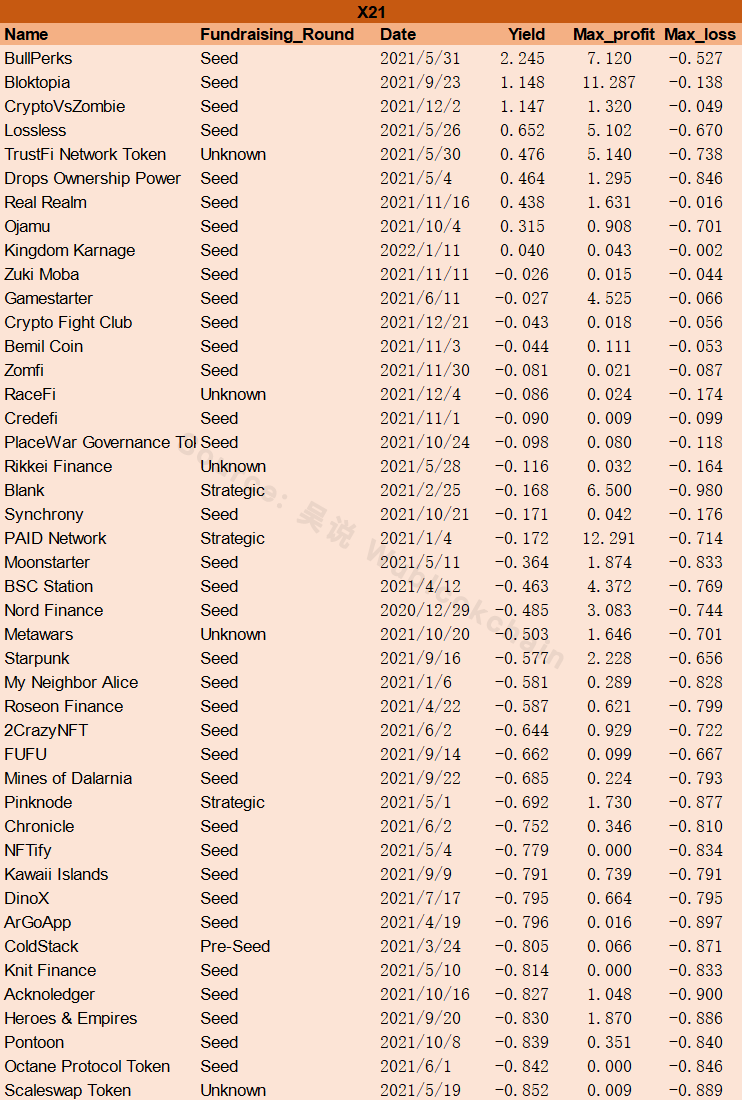

X21

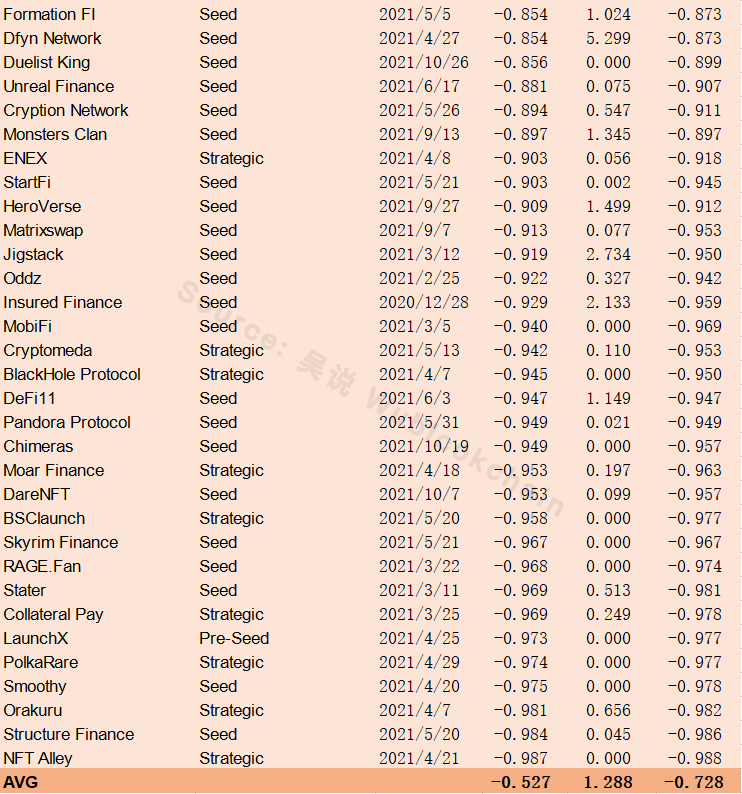

Zee Prime

其他 VC

筛选步骤如下:

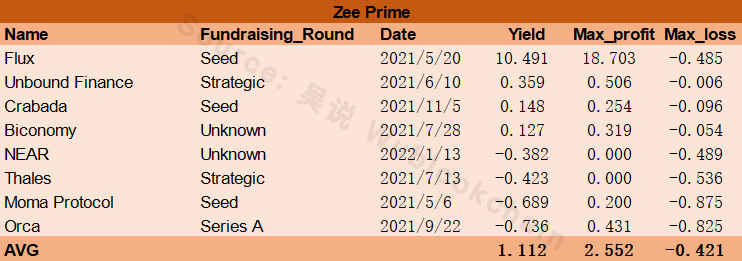

首先,将2020年7月以后 685 条数据分别按照融资公布以来收益率、最大收益、最大亏损降序排列。然后筛选出在每项收益排名中均有 3 个及以上项目进入前 100 名的 VC。

最终得到 16 家 VC(除上述 40 家外):

以 GBV 为例,收益率进前 100 的项目有 6 个,最大收益进前 100 的有 4 个,最大亏损进前 100 的有 8 个。这其中有些 VC 投资项目繁多,投中 3 个以上收益率进入前 100 的项目自然不难。因此我们需要对这 16 家 VC 进一步筛选。

通过比较我们发现,这 16 家 VC 整体表现要好于上述 40 家。呈亏损状态的 VC 仅 6 家,出现大幅回撤的仅 5 家,且大部分最大收益超过 2 倍。

总结

重申,以上所有收益率均不代表 VC 投资业绩,只是衡量融资信息对于投资者的参考意义。投资者可以将融资背景作为项目优劣的评判标准之一,但不适合跟投,毕竟我们不知道 VC 的真实成本价和退出价。

个人更喜欢将上述收益率当做“反向指标”来参考,即收益率较高的 VC 不一定能让我为某个项目加分,但收益率较低的 VC 一定能让我为其以后投资的项目减分。

吴说:独立可信的报道者 欢迎在这里关注我们

中文推特 https://twitter.com/wublockchain12

电报Telegram中文频道 https://t.me/wublock

官方网站 https://www.wu-talk.com/

根据央行等部门发布“关于进一步防范和处置虚拟货币交易炒作风险的通知”,本文内容仅用于信息分享,不对任何经营与投资行为进行推广与背书,请读者严格遵守所在地区法律法规,不参与任何非法金融行为。吴说内容未经许可,禁止进行转载、复制等,违者将追究法律责任。