1Confirmation合伙人:2022年加密领域值得关注的三个产品趋势

原文作者:Richard Chen,风险投资公司1Confirmation合伙人、OpenSea早期投资者

原文编辑:元宇宙之道

去年年底,我写了一篇关于2021年三个不引人注目的产品趋势的文章。在我对2022年做出三个预测之前,让我们回顾一下我的表现。

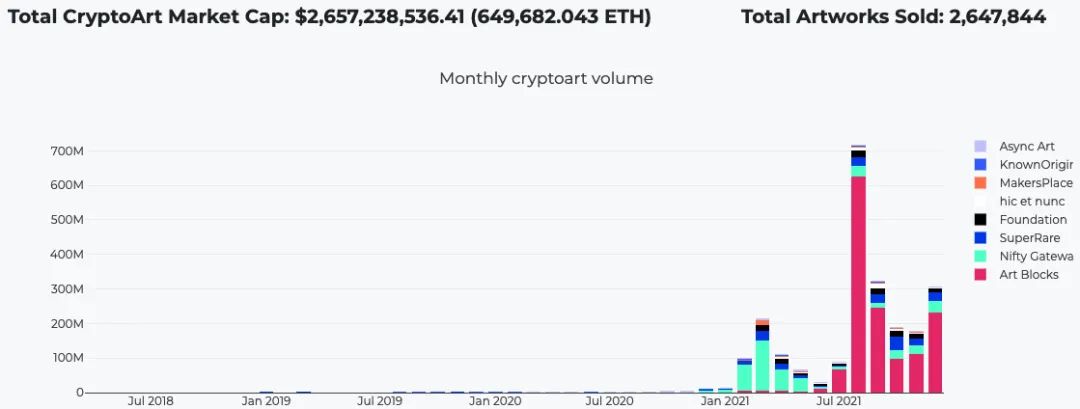

1. 加密艺术

结论:正确

虽然今年已经有很多关于NFT和加密艺术的文章,但这张图完美地总结了这方面的内容。

来源:https://cryptoart.io/data

我将回顾一下我在2021年预测中写的两句话:

“DeFi最高主义者目前将NFT视为玩具,这让人想起BTC最高主义者在2018年时对dApps的否定。” ——那些一年前公开非常看空NFT的DeFi推特影响者突然来了个180度的大转变,开始推销和炒作PFP,甚至筹集NFT资金。“目前有三位艺术家的作品总价值超过100万美元,43位艺术家的作品总价值超过10万美元。我预计在2021年底会看到远远超过这个数字。” ——如今,艺术品总价值超过1亿美元的艺术家有4位,超过1000万美元的有46位,超过100万美元的有268位,超过10万美元的有1283位。

2. 预测市场(Prediction markets)

结论:不清楚

从2020年美国总统大选到就职典礼之间,Polymarket在一月份的交易量激增。相信#stopthesteal的特朗普支持者继续以1美元兑10美分的价格购买特朗普的股票,给那些相信其他的人提供了10%的“arb(套利)”机会。但除了像现实世界的重大政治这样的一次性事件之外,预测市场很难维持交易量。我认为预测市场和去中心化社交网络是加密货币的两个杀手级用例,但产品市场的时机到来仍然比我最初想象的还要遥远。

3. DeFi衍生品

结论:正确

我在推特上发表了我的热门观点,即2021 DeFi已经达到了增加功能改进的程度(例如更好的稳定币代替原来的稳定币),或将以太坊上的工作复制到其他L1上。

今年我们在DeFi看到的少数0到1的创新都以衍生品为中心。Index Coop和Ribbon构建了结构性产品,提供指数和收益策略的风险敞口。Notional启动了固定利率借贷。但更重要的是,今年DeFi的两大重磅创新Uniswap v3和Primitive。

Uniswap v3重新重新定义了流动性提供商的含义,重新考虑将资本效率而不是总价值锁定作为DeFi项目的KPI,并启动了一个结构性产品生态系统,例如Gamma在Uniswap之上构建做市策略。从v3发布开始,Uniswap的DEX市场份额从45%增加到75%(Sushi则从24%减少到12%),因为交易量汇聚到了执行最佳的AMM。

Primitive也是第一个实施复制做市商的项目。给定特定金融衍生品(例如期权、掉期)的预期收益,可以构建一个结合曲线函数,在AMM现货市场上复制这种衍生品。这对DeFi期权来说是件大事,因为期权是DeFi中最后一个没有明确市场领导者的类别——由于gas和流动性分散等原因,很难在链上复制tradfi期权。展望未来,我相信Primitive会像Uniswap对之前的订单簿DEX(如EtherDelta和Radar Relay)那样,对现有的期权项目进行改造。

2022年三个不引人注目的产品趋势的看法

1. 垂直特定的NFT市场

OpenSea显然是我们投资组合中最大的赢家。虽然它将继续成为一个具有时代性公司和在NFT二级市场占据主导地位,但我相信,由于更好的UI/UX以及搜索和发现功能,垂直特定市场将开辟出利基市场。SuperRare是高端1/1加密艺术的一个成功例子,但还有其他类别,如摄影(例如Sloika)、元宇宙土地(例如Metahood)和音乐(例如Catalog)。

Craigslist信息图的拆分,web2 VC喜欢用它来引导思想。

我将特别强调音乐NFT。与美术、收藏品和游戏等其他类别不同,音乐NFT出乎意料地尚未爆炸式增长,但我觉得收藏者的品味正在迅速改变。领先的音乐NFT市场Catalog在10月份迎来了突破月份,成交量图很容易让我联想到,我在2020年初加密艺术爆发前在SuperRare看到的情况。对于音乐来说,这只是一个“何时”而不是“是否”的问题。

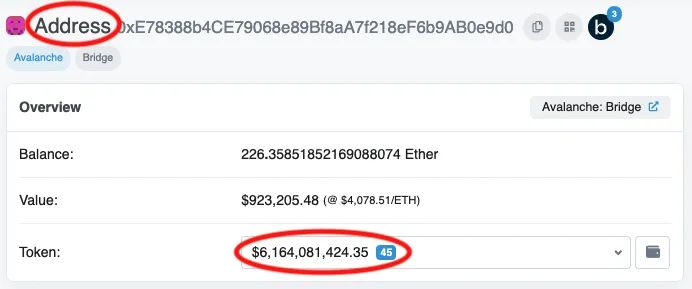

2. 信任最小化的跨链桥

现在几乎所有的跨链桥都是可信多重签名的变体。特别是Ethereum到Avalanche的桥,它是一个外部以太坊地址账户(EOA),其私钥被分散在四个受信任的英特尔SGX签名者之间,而且它持有超过60亿美元的用户资金。

这些桥是巨大的蜜罐,我预测跨链桥黑客将成为新的CEX和DeFi黑客。6.11亿美元的Poly Network黑客事件只是未来的冰山一角。

幸运的是,更多的信任最小化的桥接产品正在进入市场。Hop是目前领先的信任最小化桥接产品,它使用债券商和稳定币交换AMMs来重新平衡桥接双方的资金。虽然迄今为止桥梁的重点一直是代币转移,但现在的圣杯和一个活跃的研究领域是如何以无信任的方式进行跨链信息传递。这种跨链的可组合性将实现大量的新用例。以太坊L1上的DeFi项目智能合约将能够调用L2或侧链上的智能合约功能。

3. 投资DAO

我喜欢将投资DAO视为对收藏家而不是艺术品进行细分。我所看到的将NFT细分化的问题是,碎片化代币(ERC-20s)不基于基础NFT(ERC-721s 或 ERC-1155s)进行交易,因为如果它们的价格出现重大偏差,就没有办法套利。因此,将持有碎片化代币作为特定蓝筹股NFT(如CryptoPunks)的廉价指数敞口是没有意义的。

FlamingoDAO是迄今为止最成功的投资DAO,我们也看到DAO开始用于大型团体购买,例如美国宪法和Ross Ulbricht的艺术品等。今天的过程涉及部署Gnosis Safe,但我希望看到更好的工具,如Koop,促进更容易的团体购买昂贵的NFTs。99%的NFT不会长期保值,而昂贵的蓝筹NFT(CryptoPunks、Bored Apes等)将保持最佳价值,这是一个公开的秘密。投资DAO是让大众更好地接触到高端NFT的最干净的方式。