Stablecoin Regulation and the GENIUS Act: The Necessity of Formal Verification

As Web3[1] applications continue to accelerate, more and more central banks and institutions are developing digital asset products, with stablecoins being one of the key directions. Stablecoins combine the efficiency and transparency of blockchain with the stability of traditional finance, and will become a key factor in reshaping the global payment system and financial infrastructure. However, in order to promote the mainstream adoption of stablecoins[2], a solid foundation must still be laid in terms of user trust, regulatory compliance, and compatibility with existing Web3 systems.

Under a strict compliance framework, formal verification is considered to be a promising methodology that can help build reliable stablecoin contracts while verifying key compliance requirements. This article will focus on the following directions:

A comprehensive understanding of the regulatory requirements for stablecoins is critical for all stablecoin issuers;

When launching a stablecoin project in the United States, the GENIUS Act is an indispensable and important basis for assessing compliance risks;

Formal verification can help stablecoin projects more effectively meet the compliance requirements of the GENIUS Act.

Overview of the Stablecoin Regulatory Landscape

Since the launch of the first crypto stablecoin projects in 2014[3], stablecoins have been seen as a bridge between the traditional financial system and the Web3 world. The traditional financial system generally has problems such as high latency, lack of transparency, and high costs. In order to improve these shortcomings, stablecoins have introduced:

Real-time settlement

Unalterable records

Smart contracts that can automatically verify rules or redirect foreign exchange routes

Wider financial inclusion, allowing anyone to participate easily

The E-Money regulatory framework[4], introduced as early as 2009, was not initially designed for Web3 scenarios, but has now been gradually extended to cover Web3-compatible solutions including stablecoins.

At present, central banks of many regulatory agencies, including the Abu Dhabi Global Market (ADGM) and the Hong Kong Monetary Authority (HKMA), have been testing relevant plans. The US Congress passed the GENIUS Act, outlining a regulatory roadmap for the compliant development of stablecoins.

GENIUS Act

The GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act), introduced in June 2025, establishes a mandatory compliance framework for stablecoin payments in the United States:

Some legal provisions of the GENIUS Act

Some legal provisions in Chinese are as follows:

Why is the GENIUS Act important?

The bill establishes a unified federal-level "certification" for stablecoins, which helps reduce regulatory fragmentation and provides clear institutional guidance for product design, risk management, and audit preparation. Complying with the regulations in the GENIUS Act is not only a basic requirement for compliance, but also a key guarantee for improving the security of user asset transactions.

As a formal verification research team at CertiK, we hope to introduce formal verification methodology to help prove the key properties of stablecoin smart contracts. We use rigorous mathematical derivation and machine-checkable logical arguments to ensure that the code meets compliance and security requirements under arbitrary boundary conditions.

From legal provisions to formal verification lemmas

Formal verification expresses each compliance requirement as an invariant or liveness on the chain. Taking the GENIUS Act as an example, the above legal provisions can be formally expressed as the following lemma:

Furthermore, the technical invariants of certain stablecoins should be rigorously proven to ensure that specific legal requirements are met.

Stablecoin technical invariants:

These formalized lemmas will become Proof Obligations in your chosen verification framework (TLA⁺, Coq, K, Isabelle, or Why 3).

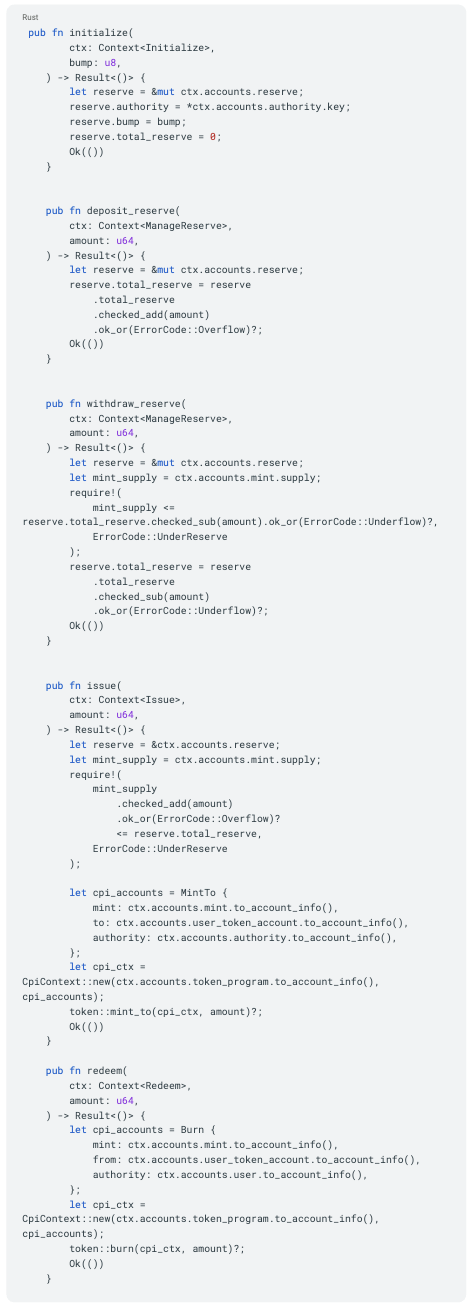

However, only some of these specifications are relevant to the formal verification process at the smart contract stage. In the following example, we built a case based on the Solana stablecoin system and formally verified its specifications.

Solana Stablecoin Program Example: How to Implement the GENIUS Act’s Invariance Requirements

Here’s a stripped-down version of the Solana stablecoin program we built, showing how all operations on the chain satisfy its core invariants:

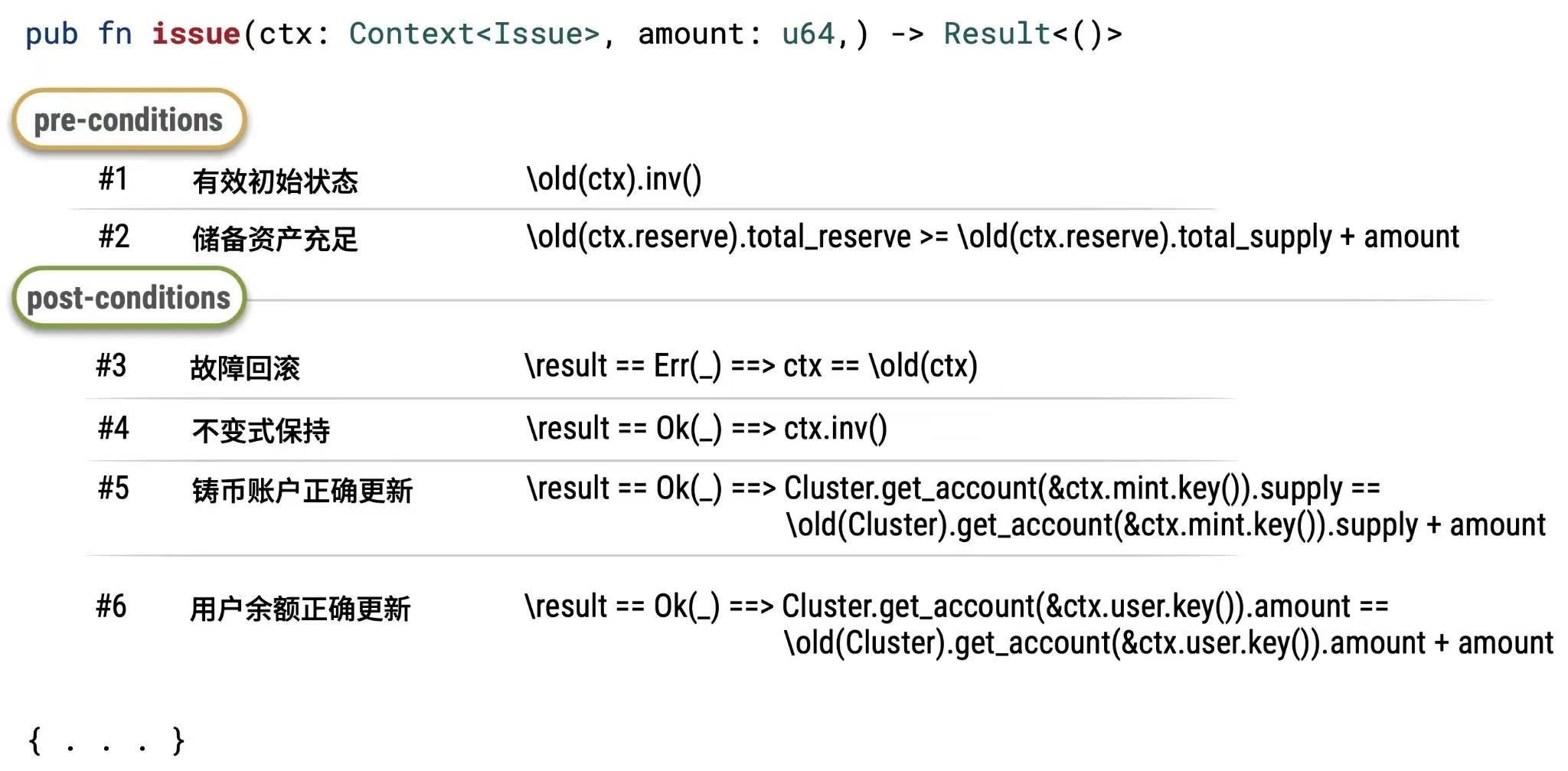

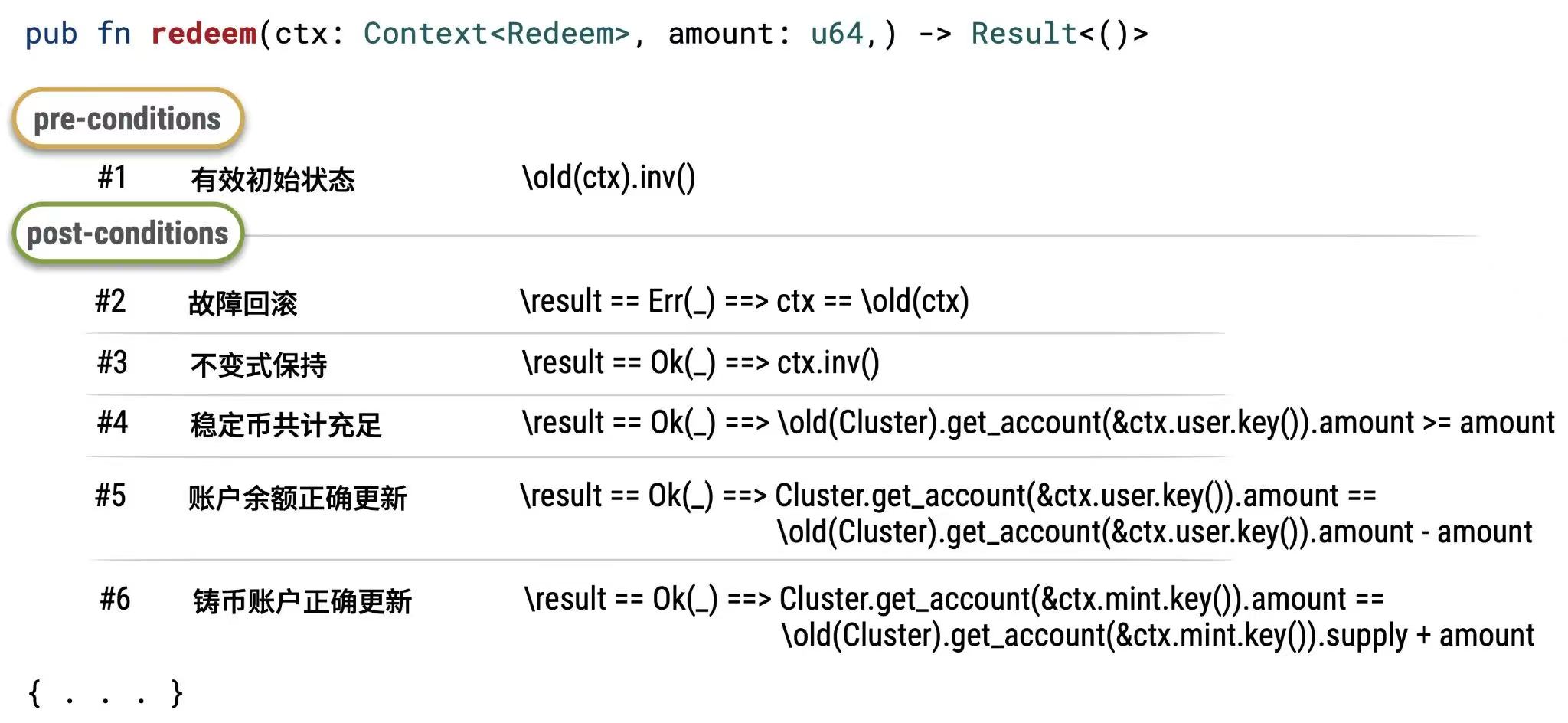

Example output from the formal verification of the Solana stablecoin program

Here’s a stripped-down version of the Solana stablecoin program example to show how core invariants are enforced on-chain:

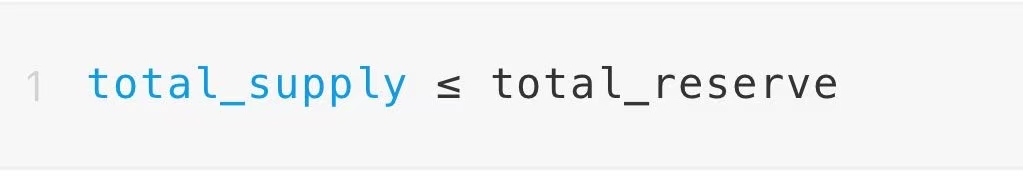

In the full result, we are able to successfully formalize the invariant: Total Supply ≤ Total Reserve, where

Total supply (total_supply) = ∑i Account[i].amount

Total reserve (total_reserve) = ∑k Bank[k].reserve

Core invariants:

Once all proof obligations have been met, the above Solana stablecoin program example can be mathematically proven to strictly meet the "one-to-one reserve backing" compliance requirements of Section 4(a)(1)(A) of the GENIUS Act.

Once all proof obligations have been met, the above Solana stablecoin program example can be mathematically proven to strictly meet the "one-to-one reserve backing" compliance requirements of Section 4(a)(1)(A) of the GENIUS Act.

Why Formal Verification Is Not Just a Nice-to-Have, But a Must-Have for Compliance

Formal verification is not a "nice to have" feature. For stablecoin compliance, it is essential to protect the funds and confidence of every participant. Once there are any vulnerabilities in the actual code implementation, it may lead to serious asset losses, regulatory penalties, and even long-term negative impact on the brand.

Following formal verification best practices will bring additional advantages to stablecoin protocols:

1. Gaining regulatory trust: Instead of reviewing reams of legal documents or audit reports, regulators can refer directly to machine-verified proof of compliance.

2. Reduce risks: When the code is iterated, its handler contract will automatically generate proofs to avoid potential risks caused by regression issues.

3. Improve audit efficiency: Since financial and technical proofs are checked at the same time, security audits and CPA audits can be conducted simultaneously.

4. Achieve market differentiation: The “provable compliance” statement can effectively enhance the trust of partners such as banks, merchants and DeFi platforms, and become an important fulcrum for brand reputation and cooperation expansion.

Additionally, when pitching your stablecoin to a board, community, or regulator, being able to say: “Our protocol has been formally verified in accordance with the requirements of the GENIUS Act with no outstanding proof obligations” turns compliance risk into a competitive advantage.

This not only increases project confidence, but also significantly accelerates several key processes, including:

Regulatory approval timeline (approval, entry into regulatory sandbox)

Enterprise-grade integration (proven integrity required by banks and payment service providers)

DeFi partnerships (oracles and lending platforms prefer to trust mathematically proven protocols)

Next step: Collaborating with CertiK to launch more securely and quickly

As global regulators continue to pay more attention to stablecoins, compliance and security[5] have become core challenges facing issuers. Whether it is to meet the requirements of the GENIUS Act or plan to expand globally, stablecoin projects need to build a reliable security foundation from the bottom up.

CertiK’s self-developed formal verification framework is built for real blockchain application scenarios. Our approach breaks through the abstract model at the academic level and can generate machine-verifiable security proofs on the chain, directly corresponding to compliance requirements. This is not a theoretical exploration, but a reliable guarantee for actual production environments.

As the largest security company in Web3, CertiK has always been committed to the mission of "full-line protection, extraordinary achievement". Whether you are trying to meet the compliance requirements of the GENIUS Act or aim to build a trusted stablecoin for the world, CertiK can escort your project and help it go online safely and efficiently.

We offer:

Customized formal verification framework, tailored to your system architecture;

Compliance advisory services for the GENIUS Act, ADGM, MAS, HKMA and other regulations;

End-to-end security audit, covering threat modeling, penetration testing, on-chain formal verification, etc.

Regulatory communication services to help you smoothly deal with OCC, Federal Reserve and state regulatory reviews.

How is CertiK different from traditional formal verification products?

Implementation-level verification: ensuring that the source code complies with the specification, not just the abstract hierarchical model of the protocol.

Proprietary property verification: Unique properties of custom codes can be verified, beyond the regular generic properties.

Complex reasoning capabilities: Through automated reasoning, arbitrarily complex code and properties can be verified, far exceeding the level that developers, auditors, and even formal verification engineers can achieve through manual reasoning.

Production-oriented: Code that is suitable for actual production environments and can be verified without large-scale refactoring, as opposed to formal verification schemes that are limited to prototypes or academic research.

As a leader in formal verification and blockchain security, CertiK has safeguarded over 5,000 blockchain projects with experience in securing more than $530 billion in digital assets, laying a solid foundation for the compliance and security of stablecoin projects.

We welcome further communication and can arrange a technical seminar on proof-of-concept audit for you to explore how to help your stablecoin project achieve compliance and high-reliability online operation through a systematic and provably secure approach.

[ 1 ] Web3: https://www.certik.com/resources/blog/Web3

[2] Stablecoins: https://www.certik.com/resources/blog/the-rise-of-stablecoins-in-unstable-times

[3] Since the launch of the first stablecoin projects in 2014: https://blog.bitmex.com/a-brief-history-of-stablecoins-part-1/?utm_source=chatgpt.com

[4] The regulatory framework for electronic money (E-Money) introduced in 2009: https://finance.ec.europa.eu/consumer-finance-and-payments/payment-services/e-money_en

[5] Security: https://www.certik.com/resources/blog/security-risks-of-stablecoins