Exclusive interview with FCM: Mobile privacy wallet launched, platform coins will be airdropped to contributing users

On July 8, FCM Group held the FCM Wallet cross-chain payment global launch conference in Hong Kong and officially launched its mobile privacy wallet product.

According to Daniil, a senior executive representative of FCM Group, FCM has undertaken 62.48 million cross-chain transactions worth US$156 million; in 2026, it plans to explore the direction of metaverse privacy assets and GameFi.

At the event, FCM Global Marketing Director Tristan Li said that privacy is the infrastructure of the next generation of financial systems and a basic right.

In 2025, when the compliance trend is becoming more obvious, as a privacy cross-chain product, how to balance regulatory requirements and privacy protection, what is the opportunity for issuing the mobile wallet this time, what are the advantages of FCM compared with its competitors, what are the data results achieved and the planned future goals, and how does the team handle the details of technical implementation? For the above questions, we interviewed Jacky, the technical consultant of FCM China, and discussed them one by one.

Q: Please give a brief introduction of yourself. What is the size and composition of the FCM team? Why did the core staff initially choose the direction of privacy wallets and cross-chain currency mixing?

I am Jacky, currently serving as the technical consultant for FCM China. Our team is located in Singapore and Russia, and has more than 30 technical staff. The core members are relatively young, and are all blockchain enthusiasts who have the dream of decentralization .

With the significant trend of decentralization, FCM's business has covered more than 20 countries around the world. Today, it officially released the on-chain privacy wallet and launched it on the mobile terminal.

Q: 18 years later, till now, the team has been mainly focusing on polishing the product?

The team started in 2018, and for many years we were lost among many acceptors; but since March 2025, we began to adjust our strategy, plan branding, increase our voice and users, and truly become known to users.

Q: Who does FCM consider its target users to be?

If divided into CeFi and DeFi, on-chain users are mainly concerned about privacy and fund security. As smart contracts drive industry development, we believe in the immutability of contracts and non-custodial methods.

Q: What are the core advantages of FCM?

Although we started late, our team has been implementing technology quickly. Compared with other general wallets, FCM pays more attention to privacy.

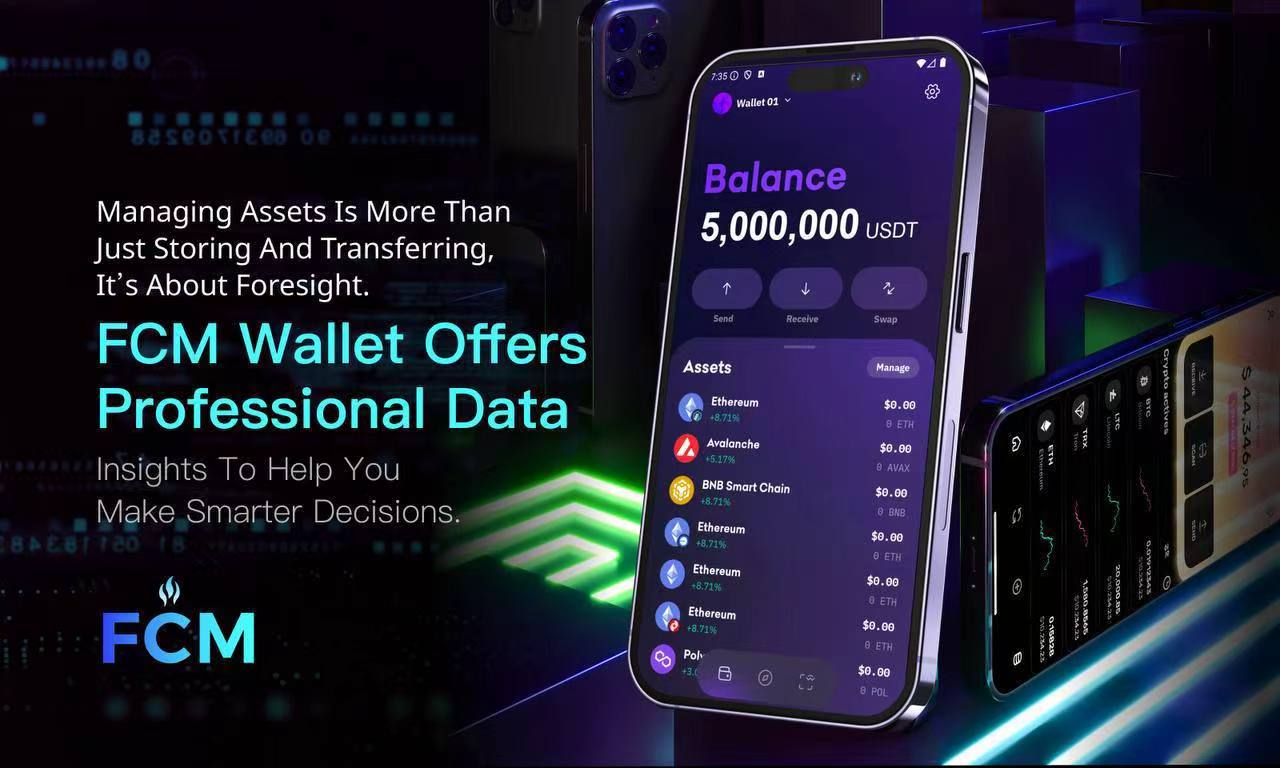

For users, FCM Wallet has three advantages:

The arrival time is fast, 0.3 seconds to 1 minute;

Low handling fees (according to the official website, the handling fees other than gas are divided into two levels: 0.5% and 1%);

The supported single cross-chain amount is high.

Q: I have tried the website version before and saw that it already has cross-chain and coin storage functions. What is the opportunity for launching the mobile wallet product this time? In what scenarios do you hope users will use it?

In the past, as a Dapp, users entered through a third-party browser, and new users often felt that this was not like a "product." This time, we passed the review and went online on the app store, which enhanced the brand and was more intuitive and obvious.

Q: What functional modules does the wallet currently implement? What are the future plans?

Currently supports cross-chain and revenue. In the future, we will continue to develop Swap, DeFi, GameFi, privacy chat, etc.

Q: Where does the profit come from?

The income comes from users providing liquidity, similar to traditional finance, where users deposit legal currency into banks to provide liquidity.

Q: Regarding technical implementation, I saw on the product page that FCM's services support cross-chain of public chains such as BTC, ETH, ERC 20, Solana, BNB Chain, TRON, etc. How does it achieve cross-chain capital transfer? Who are the service providers behind each link?

Taking Ethereum → TRON as an example, the user transfers the funds on Ethereum to the designated address. After the corresponding Ethereum address of FCM receives the funds, the liquidity pool on TRON automatically sends funds of equal value to the TRON address filled in by the user.

Q: How much funds do we need to reserve on the target chain to ensure service efficiency? What will happen if the target chain lacks liquidity?

FCM's liquidity funds are distributed across 28 public chains. Cross-chain transactions are automatically triggered by contracts, and a single cross-chain reserve pool can be up to US$50 million.

If liquidity is insufficient, assets will be stuck on the chain until the target chain’s funds are reorganized, or if they are not received for a long time, the user’s funds will be automatically returned.

Q: How much cost will the introduction of ZKP technology increase? Can't the version without ZKP also achieve privacy cross-chain?

In terms of cost considerations, we hope to be lower than traditional finance.

As technology is updated and iterated, we hope to achieve faster payment times and improve efficiency.

Q: Regarding privacy and regulation, the Crypto field has entered the compliance era in 25 years. How to balance the trend when starting a business in the privacy field?

FCM actively embraces compliance and applies to be listed on the Apple Store. The two are not in conflict, and we need to find a balance.

Q: If illegal/stolen funds utilize FCM services, how will regulatory/security requirements be addressed in terms of governance/technology, etc.?

This question involves how to define illegal funds. The regulatory authorities will mark them and require the issuer (such as Tether) to block the relevant addresses. 99% of users’ funds are fine, and the 1% with problems will be discovered by the regulators first.

If it involves hackers stealing coins, EU regulators have previously required the cessation of coin mixing products and services.

FCM has not yet encountered this situation.

Q: At the event, the guest shared that Fast Coin will be launched soon. Is it a platform coin? When will it be launched? Is there any airdrop plan?

FCM has seen a surge in traffic since March, so we are promoting APP and platform coins, encouraging users to contribute on the platform, giving coins to users, and supporting free circulation.

Q: What are the usage scenarios of FastCoin?

The on-chain gas fees of cross-chain and coin mixing services can be offset and discounted; in addition, destruction, governance, etc. will also be introduced.