Key Takeaways

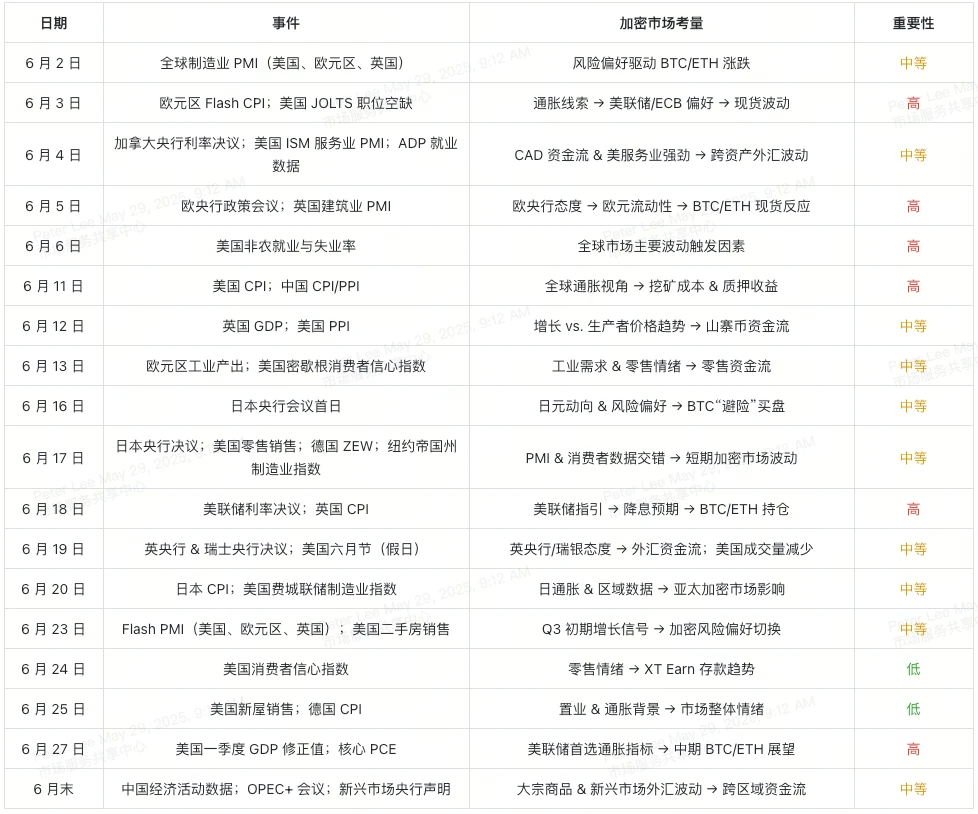

June’s macro calendar is packed: from PMI and CPI data to FOMC and ECB meetings, all will trigger violent fluctuations in the Bitcoin (BTC) and Ethereum (ETH) markets.

High-impact events (such as US non-farm payrolls, US CPI, ECB and Federal Reserve decisions) require priority attention for hedging and position planning of BTC Spot, ETH Spot and staking strategies.

Medium-importance releases (manufacturing PMI, Bank of Canada/Bank of Japan/Bank of England/Swiss National Bank meetings and various regional surveys) will affect cross-asset fund flows and indicate a switch in risk appetite (risk-on/risk-off), and are particularly sensitive to staking returns on platforms such as XT Earn.

Rigorous operation manual: pre-checklists, response templates and strict leverage control can help traders effectively manage the downside risks of spot, derivatives and pledged positions while grasping the macro-driven market.

June is crucial for crypto traders. The global economic calendar is packed with news from PMI and CPI data to central bank decisions, which often trigger large fluctuations in Bitcoin (BTC) , Ethereum (ETH) and other digital assets. As these macroeconomic data and events are revealed, they will reshape market risk appetite and capital flows, thereby affecting the prices of BTC and ETH. For investors who participate in both BTC spot and ETH spot trading, accurately grasping the time and potential impact of each data release often determines the success or failure of profits and losses.

This article will sort out the key events in June for you on a weekly basis, interpret the macro and geopolitical themes worthy of attention, and provide practical strategies for the crypto market, including BTC staking , ETH staking , and opportunities on the XT Earn platform.

Table of contents

How to Read the Economic Calendar as a Crypto Trader

View June calendar overview by week

Week 1 (June 1 – 7)

Week 2 (June 8 – 14)

Week 3 (June 15 – 21)

Week 4 (June 22 – 30)

Exclusive influence and strategies for the crypto market

How to Read the Economic Calendar as a Crypto Trader

Key data types:

PMI (Purchasing Managers Index): A measure of the health of the manufacturing and service industries. A rise in PMI tends to boost risk appetite, pushing up BTC and stocks in tandem.

CPI/PPI (Citizen/Producer Price Index): reflects the inflation trend. Higher-than-expected inflation data usually prompts central banks to be hawkish, putting pressure on the prices of Bitcoin and Ethereum .

Employment reports (such as US non-farm payrolls): Influence the Federal Reserve’s interest rate decision. Stronger-than-expected employment data may trigger sharp fluctuations in the BTC spot and ETH spot markets.

Central bank meetings (Fed, ECB, BOJ, etc.): Setting policy interest rates, either dovish or hawkish, will directly impact market liquidity and risky assets, including cryptocurrencies.

Leading vs. Lagging Indicators:

Leading indicators: PMI, initial jobless claims, etc., can provide early warning of economic trends.

Lagging indicators: GDP revised values, PPI, etc., are mostly used to confirm trends.

Volatility expectations:

– High-impact data releases (such as non-farm payrolls, CPI, central bank decisions) can cause fluctuations of 5-10% in BTC and ETH, especially when leverage is used or derivatives expire.

View June calendar overview by week

Week 1 (June 1 – 7)

June 2 – Global Manufacturing PMI (US, Eurozone, UK) [Medium]

The estimated manufacturing PMI for May indicates growth in the second quarter. Stronger-than-expected data can boost risk appetite and drive up BTC and ETH prices ; if it is lower than expected, it may trigger profit-taking in the BTC spot and ETH spot markets and drive inflows of stablecoins.

Image Credit: Trading Economics

June 3 – Eurozone Flash CPI US JOLTS Job Vacancies [High]

The Eurozone Flash CPI is used to measure potential inflation trends and is crucial to ECB policy; higher-than-expected inflation will weaken the liquidity of risky assets. The US JOLTS job vacancy data shows a stronger labor market. The unexpected data will strengthen the Feds hawkish stance, depress BTC staking returns and drag down BTC/ETH performance.

Image Credit: Trading Economics ( EU CPI US JOLTS )

June 4 – Bank of Canada decision US ISM services PMI / ADP employment data [Medium]

A dovish or neutral decision by the Bank of Canada is good for commodity currencies and risk asset liquidity, thus supporting the crypto market. The US ISM service PMI and ADP employment data reflect the health of the service industry. If the data is strong, it usually triggers a new round of selling pressure in the crypto market.

June 5 – ECB policy meeting UK construction PMI [high]

The ECB will discuss whether to continue raising interest rates or keep it on hold for now; dovish signals usually release liquidity and drive a rebound in BTC/ETH, while hawkish comments may trigger a pullback. As a supplementary data, the UK construction industry PMI, if lower than expected, will correspondingly weaken the market gains brought about by the ECBs positive news.

Image Credit: Trading Economics

June 6 – US non-farm payrolls unemployment rate [high]

The non-farm payrolls report is the ballast stone of market fluctuations. If the number of new jobs is lower than expected or the unemployment rate rises, it will strengthen the markets expectations of the Feds interest rate cuts, thereby triggering a sharp rebound in BTC and ETH; on the contrary, stronger-than-expected data usually leads to a rapid sell-off in the spot and derivatives markets.

Image Credit: Trading Economics ( US NFP Unemployment Rate )

Week 2 (June 8 – 14)

June 11 – US CPI China CPI/PPI [High]

The US CPI is the main indicator used by the Federal Reserve to measure inflation; if the data is higher than expected, it tends to push up US Treasury yields, which in turn triggers a correction in the crypto market. Chinas CPI and PPI data determine the costs and economics of miners computing power - rising producer prices will compress Bitcoin staking yields and drag down BTC prices .

Image Credit: Trading Economics

June 12 – UK GDP US PPI [Medium]

The UK GDP growth rate reflects the flow of sterling funds and risk appetite across assets: when growth exceeds expectations, crypto assets tend to strengthen; when it falls short of expectations, it is easy to trigger risk aversion and lead to selling. The US PPI usually leads the CPI. When producer prices unexpectedly rise, it will push real yields higher, creating downward pressure on Ethereum prices .

June 13 – Eurozone Industrial Output US Michigan Consumer Confidence [Moderate]

The growth of industrial output in the Eurozone reflects the vitality of the real economy. When the data is strong, risk assets in both traditional and crypto markets are more popular. The University of Michigans consumer confidence index measures retail sentiment. When the confidence index rises, more users tend to deposit funds into XT Earn for Bitcoin and Ethereum staking .

Week 3 (June 15 – 21)

June 16-17 – Bank of Japan meeting US retail sales [Moderate]

The Bank of Japan meeting and any tweaks to its yield curve control could change yen flows and global risk appetite. A dovish surprise could boost crypto markets, while a hawkish hint could trigger a pullback. U.S. retail sales reflect consumer spending; weak data tends to boost BTC prices as markets expect the Fed to remain dovish .

June 17 – German ZEW Confidence Index New York Empire State Manufacturing Index [Moderate]

Germanys ZEW investor confidence survey shows the outlook for Europes largest economy, and rising values usually boost global risk assets, including cryptocurrencies. The New York Empire State Manufacturing Index provides information on the health of the U.S. manufacturing sector; if the data is strong, it is often accompanied by a rise in the stock market and drives BTC and ETH higher simultaneously.

June 18 – Fed rate decision UK CPI [High]

The June FOMC rate decision and updated “dot plot” are the second major events of this month. Dovish guidance is expected to bring about a broad increase in risk appetite (pushing up BTC/ETH), while hawkish signals may trigger a rapid sell-off. As a global inflation reference, the UK CPI will also affect the liquidity expectations of the crypto market.

Image Credit: Trading Economics

June 19 – Bank of England Swiss National Bank decisions (US Juneteenth holiday) [Medium]

Policy announcements from the Bank of England and the Swiss National Bank will affect the flow of funds in both the pound and the Swiss franc. If both central banks release dovish or neutral signals, it will promote cross-asset liquidity, which will benefit the crypto market; if there is a hawkish surprise, it will tighten market conditions. Low trading volumes during the Juneteenth holiday in the United States may amplify intraday volatility.

June 20 – Japan CPI US Philadelphia Fed Manufacturing Index [Medium]

Japans CPI provides the latest clues to domestic inflationary pressures. If it rises beyond expectations, it may prompt the Bank of Japan to reassess its monetary policy, which in turn affects the yen and market sentiment. The Philadelphia Fed Manufacturing Index measures the intensity of regional factory activity in the United States; stronger data usually boosts risky assets, thereby driving up BTC and ETH.

Week 4 (June 22 – 30)

June 23 – Flash PMI US Existing Home Sales [Moderate]

Flash PMIs in the United States, Eurozone, and the United Kingdom provide a preview of economic growth: when data is better than expected, it usually boosts risk appetite and pushes BTC/ETH upward; if it is lower than expected, it may trigger a sell-off. Although U.S. second-hand home sales are also an economic reference, they have less direct impact on the crypto market.

June 24 – US Consumer Confidence Index [Low]

The consumer confidence index reflects the optimism of the retail end: if it is significantly better than expected, it may bring more funds into the crypto market; if it is lower than expected, it will suppress risk appetite. However, such data generally does not cause drastic fluctuations.

June 25 – US New Home Sales German CPI [Low]

U.S. new home sales and German CPI provide background information on the housing market and inflation: even if unexpected fluctuations occur, they will only affect risky assets for a short period of time and have limited impact on the continued trend of Bitcoin and Ethereum.

June 27 – US Q1 GDP Revised Core PCE [High]

The revised first-quarter GDP and core PCE (the Federal Reserve’s preferred inflation indicator) will reshape market expectations for the timing of rate cuts: if the data is still on the high side, it may bring downward pressure on BTC/ETH; if the data is on the low side, it is expected to trigger a sustainable crypto market rebound.

Image Credit: Trading Economics

End of June – China economic activity data, OPEC+ meeting emerging market central bank statements [Medium]

During the month-end, various economic activity data from China, OPEC+’s decision to cut or increase production, and statements from emerging market central banks will affect commodity prices and emerging market currencies. The resulting cross-regional capital flows can bring intermittent volatility to the crypto market.

Macro and Geopolitical Focus

Inflation trends:

The June CPI/PPI data for the United States and the Eurozone are crucial. If inflation continues to rise, the Federal Reserve and the European Central Bank may maintain a hawkish stance, which will put pressure on BTC and ETH prices ; conversely, a cooling of inflation may trigger a rebound in the risk appetite of BTC spot , ETH spot and altcoins.

Central bank turning signal:

Traders should carefully study the FOMC meeting minutes and ECB press conferences to capture clues about the timing of rate cuts. If there are early hints of a shift, it may drive funds from fixed income to BTC staking , XT Earn and ETH staking , narrowing the spread between staking yields and government bond yields.

Trade war hot spots:

Potential tariff announcements or escalations between the United States, China, and the European Union often trigger cryptocurrency sell-offs in sync with the stock market. Take advantage of the safe haven demand brought about by major macro data releases to hedge risks through stablecoins or shorting altcoins.

Global risk events:

The ongoing conflict in Ukraine and the tension in the Taiwan Strait will stimulate the demand for safe havens. Although gold is usually the preferred safe haven asset, Bitcoin also exhibits the attributes of digital gold; when geopolitical risks intensify, it is recommended to pay attention to the performance of these two types of assets at the same time.

Crypto Market Exclusive Impact and Strategies

Event-driven volatility management:

Use the calendar to adjust positions in advance: Consider reducing leverage or tightening stop loss 1-2 hours before major events such as non-agricultural, CPI, FOMC, etc. After the event is released, observe the initial high and fall of BTC/ETH before opening a position.

Hedging strategies:

When holding a large spot position, you can hedge BTC spot through futures or options.

On XT Earn , you can flexibly switch between Bitcoin staking income and stablecoin income to manage risks. Similarly, ETH staking can also be used as a defensive tool in a down market to lock in stable income.

Dependency Monitoring:

Track the correlation coefficients between Bitcoin, Ethereum and major stock indices in real time; if the correlation coefficient soars (>0.8), it means that crypto assets may be linked to stocks, and strategies should be adjusted accordingly, such as preferring directional trades rather than long combinations.

Altcoin rotation:

In the risk-on phase after dovish data is released, some funds can be transferred from BTC/ETH to high-beta altcoins or DeFi tokens. When macro uncertainty rises, retrace to BTC spot and ETH spot , as they are generally more resilient during a broad market sell-off.

Leverage risk control:

– Avoid using too high leverage before major events. The crypto market itself is extremely volatile, and short-term sharp fluctuations driven by events may quickly trigger forced liquidation. Keep leverage ≤ 3 × to cope with price fluctuations within 5%.

Summary: June Trading Example Manual

Preparation checklist:

Confirm current positions in BTC spot , ETH spot or derivatives markets.

Check the open interest of major futures contracts to gauge market heat.

Set price alerts for key price points to ensure timely follow-up.

Response template:

If CPI exceeds expectations: Reduce BTC/ETH long positions by 20% and transfer 10% of funds to stablecoins or XT Earn .

If CPI is lower than expected: increase funds, buy an additional 10% of BTC spot , and increase the ETH pledge ratio.

Risk management rules:

Each trading position shall not exceed 2% of the portfolio.

Use a trailing stop loss of 3% for BTC and 5% for altcoins.

Closely monitor margin ratios and maintain a reserve margin of at least 30% for leveraged positions.

Final summary

For crypto traders, it is crucial to master the June economic calendar, which connects macro data and digital asset fluctuations. Synchronize BTC spot and ETH spot strategies with PMI, CPI, and major central bank events, and make full use of the Bitcoin and Ethereum staking tools on XT Earn , so that you can more accurately time your entry and exit, effectively manage risks, and seize opportunities brought by market fluctuations. Remember to set calendar reminders, practice multiple response plans in advance, and stay flexible in mid-June. As macro forces and geopolitical trends jointly drive traditional and crypto markets, disciplined preparation will help you move forward steadily in the third quarter and beyond.

Frequently asked questions

What is the Economic Calendar and Why Is It Important for Crypto Traders?

The economic calendar lists the release dates of key macroeconomic data and central bank decisions (such as CPI, PMI, etc.). Tracking these events can help traders predict market fluctuations in advance and arrange entry and exit and hedging strategies reasonably.

How does the interest rate decision affect Bitcoin and Ethereum?

Raising interest rates usually tightens market liquidity and puts pressure on non-yielding assets such as Bitcoin and Ethereum; while dovish stances of keeping policy unchanged or cutting interest rates will release liquidity, often triggering a rebound in cryptocurrency prices.

Should I close my positions before a major data release?

This depends on personal risk appetite. Many traders will reduce leverage or reduce positions 1-2 hours before high-impact events (such as non-agricultural, FOMC) to avoid sudden and drastic fluctuations.

How to Hedge Crypto Exposure During Macro Events?

You can short BTC/ETH through futures or options, or allocate funds to stablecoins. On platforms such as XT Earn, flexibly switching between Bitcoin/Ethereum staking and stablecoin income is also an effective way to manage risks.

What is the difference between the High, Medium, and Low importance labels?

– High: Highly likely to cause significant volatility in the crypto market (such as US CPI, FOMC).

– Medium: has a significant impact on risk appetite and market direction (e.g. national PMIs, regional surveys).

– Low: Provides context but typically has limited direct impact on prices (e.g. new home sales).

How can I apply this calendar to my daily trading?

Sync major event times to your calendar, set price alerts for BTC and ETH, prepare response templates, and check your playbook before daily trading so that your position strategy is consistent with the days events.

Quick Links

$500,000 incentive kicks off a trading carnival: MNT × XT Carnival full guide

A must-see calendar of economic events in May for crypto traders

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading , and contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.