SignalPlus Macro Analysis Special Edition: Deal No Deal

After announcing the suspension of additional tariffs on China, President Trump suddenly posted on social media that the EU trade negotiations "have made no progress," so he "recommends imposing a 50% tariff directly on the EU starting June 1, 2025." Trump pointed out that the EU has "strong trade barriers, value-added taxes, ridiculous corporate fines, non-monetary trade barriers, currency manipulation, and unfair and unreasonable lawsuits against American companies," and believes that these measures have led to an "unacceptable" trade deficit of more than $250 billion a year in the United States.

Just as the market was preparing for retaliation from the EU, Trump quickly changed his stance after a call with the President of the European Commission and announced that the implementation date of tariffs would be postponed to July 9. Now we are back to square one, but the dollar is already under more pressure to open the week.

To simplify the overall logic, if the US goal is to eliminate trade deficits with its trading partners, it is essentially asking the EU to pay about $200 billion a year as an "entrance fee" to enter the US market, which is obviously an unacceptable price for most people.

In fact, according to Citi's analysis, under the framework of game theory, the final result of the "Nash Equilibrium" reached by the United States and Europe is likely to be a 50% tariff on each other.

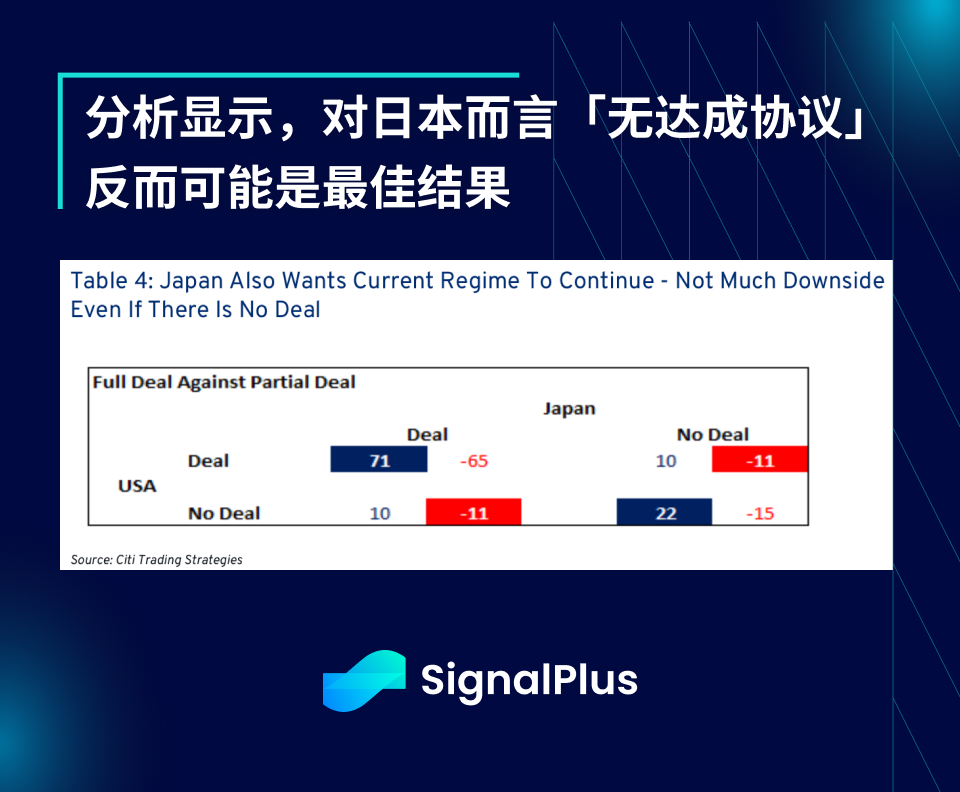

As for Japan, according to the same analysis, a "no deal" situation may be the most beneficial to Japan, considering the extremely limited impact on its net exports. Ironically, reaching a "comprehensive agreement" with the United States under current conditions may be the worst outcome, so it would not be surprising if future negotiations between the two sides reach a deadlock.

Of course, there are many dynamic factors that the market and economists have not grasped (such as dependence on rare earths, etc.), and just like the case of China, the United States seems to have chosen to make comprehensive concessions in the end and accepted a less than ideal result. Similar to Japan, economists generally believe that China is likely to reach a comprehensive agreement with the United States, and the best approach is to delay the negotiation process to obtain more concessions from the United States, which is indeed happening.

For the global macro market, this is also the "optimal solution": the United States withdraws its policy of forcing a synchronized slowdown in the global economy, and the US dollar becomes the main target of pressure, while the strong performance of overseas stock markets offsets the impact to a certain extent.

Back to the market level, apart from the US dollar, the biggest loser is global fixed income assets. Recent credit rating downgrades, disappointing budget results, and a series of weak US Treasury auctions have caused bond yields to return to the highs of the range.

The double whammy of surging bond yields and fiscal budget concerns caused the SPX to underperform other global markets and macro asset classes, suffering its biggest weekly drop since early April (-1.6%), with all sectors experiencing selling pressure.

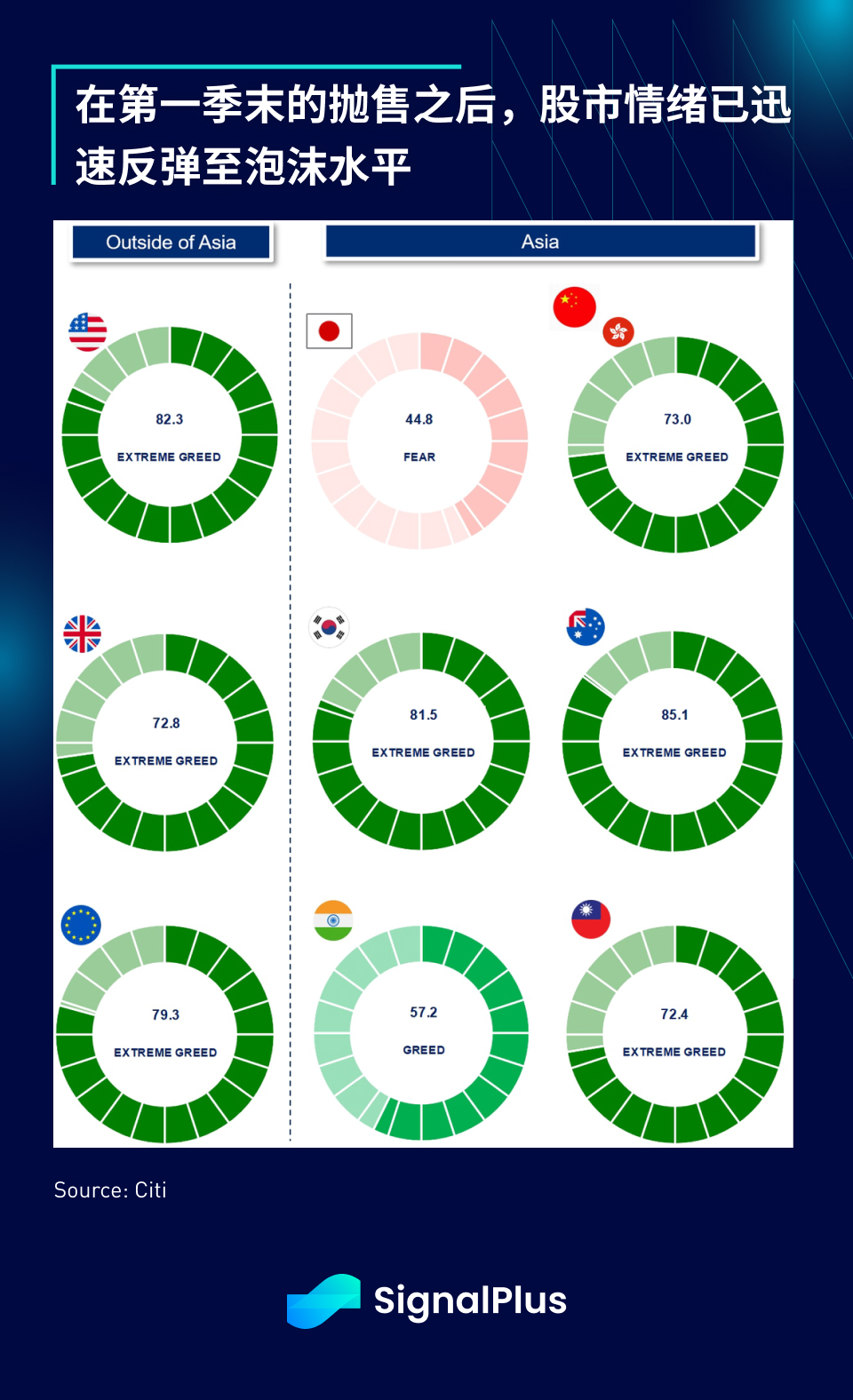

The recent pullback in U.S. stocks comes at a time when overall stock market sentiment has risen back to overheated levels, especially in the U.S., Chinese and European markets.

While growth stocks and real estate are most sensitive to yields, higher term premiums have also dragged down spot gold prices as geopolitical and recession tail risks have gradually faded over the past month.

In the short term, we believe that the current market concerns about the US budget and spending issues may be over-exaggerated, just like the previous fear of recession. As the government's tariff measures are gradually implemented, it is expected to bring considerable revenue to the fiscal budget in the future, which should offset some short-term deficit pressure.

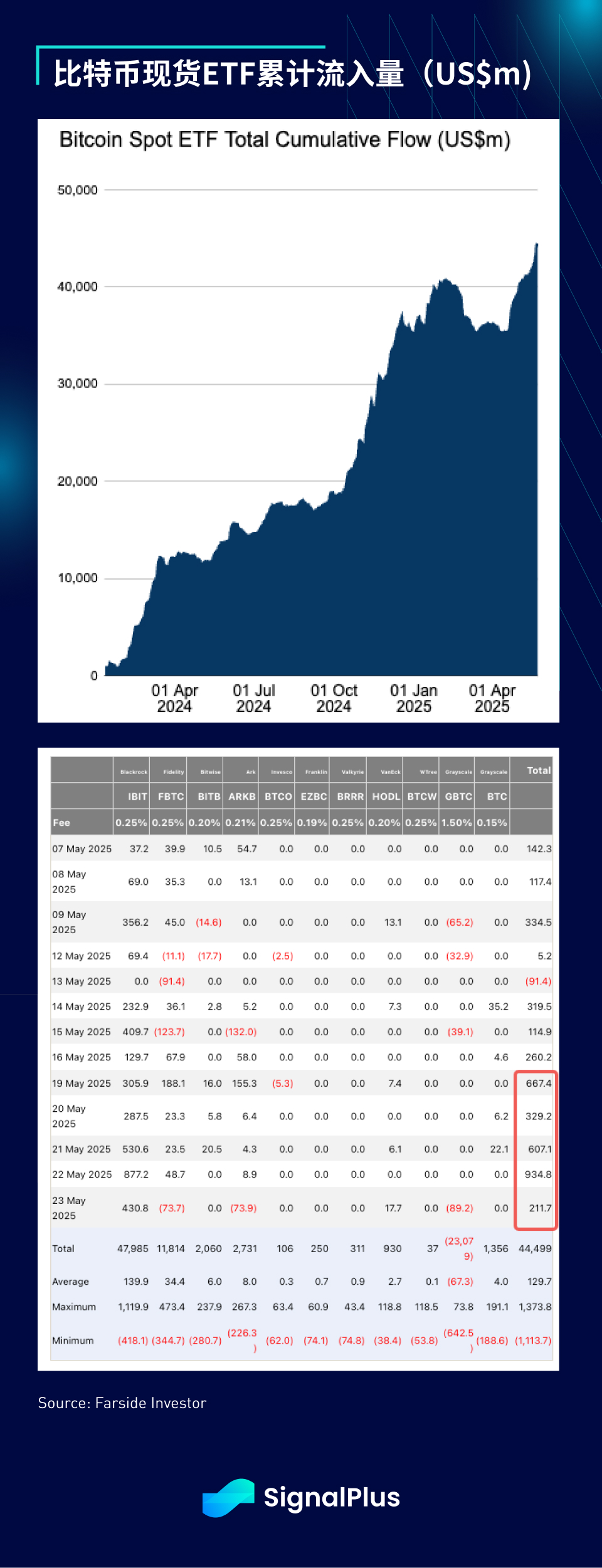

In contrast, cryptocurrencies have shown great resilience in the past two weeks, with BTC prices outperforming U.S. stocks and bonds by about 15% in the past three weeks.

In terms of ETF fund flows, the net inflow reached US$2.75 billion in a single week, the third highest in history, of which ETH also attracted a net inflow of US$248 million.

The passage of the GENIUS Stablecoin Act is widely seen as a major milestone in the development of the cryptocurrency industry, although it comes at the cost of increased monitoring and regulatory intervention by institutions, moving further away from the original cryptocurrency concept that emphasized the spirit of decentralization.

The volatility skew for BTC and ETH has returned to more normal levels, leaning to the upside, and overall implied volatility has also rebounded, indicating that investors are no longer shorting rallies, but instead turning to positioning for a more sustained upward breakout.

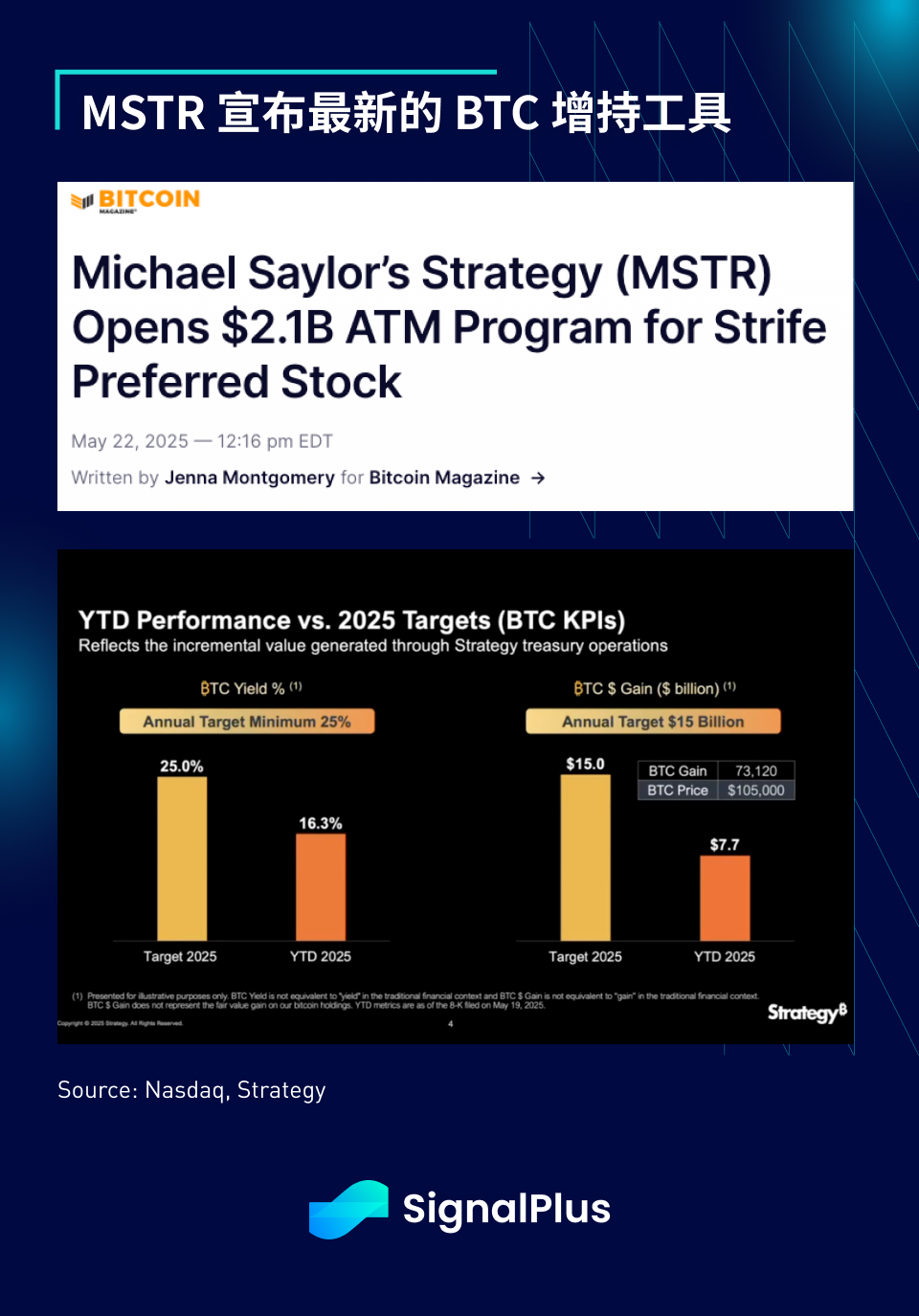

At the same time, MicroStrategy announced the launch of the latest round of $2.1 billion preferred stock issuance plan at market price to increase its holdings of BTC. The current macro environment still constitutes a tailwind, and the momentum seems to be biased towards the cryptocurrency side. In addition, the recent price trend is structurally healthier, and the sentiment of chasing highs has significantly weakened, which is conducive to the continued upward breakthrough of prices and setting new highs in the coming weeks.

I wish you all good luck and smooth trading!

You can use the SignalPlus trading vane function for free at t.signalplus.com/news , which integrates market information through AI and makes market sentiment clear at a glance. If you want to receive our updates in real time, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com