In the chaotic era of encrypted payment cards, is this a business that is difficult to sustain?

Written by: Web3 farmer Frank

How many "U cards" do you have now?

From the early Dupay and OneKey Card, to the Card launched by exchanges Bitget and Bybit, to the encrypted payment card services of Infini, Morph and SafePal, and even Coinbase and MetaMask have entered the market. Since this year, encrypted payment cards (U cards) targeting the PayFi narrative have almost become the standard for Web3 project parties.

As a new round of players rush to grab market share, promotional tweets and review information for various U cards are overwhelming, which reminds people of the colorful shared bicycles that filled the streets. The dazzling array of options has also shifted the market's focus from availability to comparisons of registration/usage thresholds, rates and other dimensions, trying to find the most cost-effective king in the "sea of cards".

However, if we observe over a longer period of time, we will find that the U card market is prosperous on the surface, but it still cannot cover up its underlying fragility. To put it bluntly, the life cycle of a U card is sometimes not necessarily longer than that of some meme coins: there are countless cases of running away, shutting down, and card replacement. Most of the crypto payment card players in the last wave have long disappeared.

The reason is simple. Security and compliance are always the sword of Damocles hanging over all U cards. In addition to being highly dependent on the compliance willingness of the channel bank for encryption business, the U card itself also has a natural structural flaw - the custody of the fund pool is in the hands of the service provider, which is a great test of operational capabilities and moral standards. If there is a problem with any of the cooperative banks and service providers, users may become innocent cannon fodder...

As for the current "Hundred Regiments War", the underlying fee costs of U cards are mostly similar, and user experience often relies on subsidies, high interest rates and other measures. However, these short-term incentives obviously cannot build real long-term competitiveness. Once subsidies decline, facing homogeneous card-binding consumption services, it is difficult to say which brand users will have long-term loyalty to.

Therefore, as the traditional U card model gradually exposes its ceiling, some encrypted payment card services have begun to emerge with new variables, and some interesting attempts have been made from multiple dimensions such as financial management and bank accounts:

For example, the "card + financial management" form of the star project Infini provides custodial interest-bearing income for users' deposited Crypto assets through on-chain DeFi configuration; the "card + bank account" form of the old wallet SafePal allows users to truly hold a personal real-name Swiss bank account, and realize the overseas brokerage/CEX deposit and withdrawal experience under the Euro/Swiss franc framework.

Objectively speaking, whether the broader "card +" services in the future can truly break out of the cycle and become an exception still needs further market testing, but what is certain is that only those encrypted payment card projects that can strike a balance in security, compliance and user experience may be able to break the curse of "short life" in this "era of chaos."

Crypto payment cards are not an evergreen

Why have U cards transformed from a niche market into a popular commodity that everyone is vying for?

There are only two core reasons behind this.

First of all, in the context of a bear market (it was a "bear market" when I wrote this article, a "bull market" when I published it, and a "bull market" when I saw this article?), encrypted payment cards are actually a good business that can both attract attention and generate traffic: not only do they have a clear profit model and stable cash flow, but they can also significantly increase user activity and community stickiness.

After all, one of the biggest pain points for Web3 players, especially those in mainland China, is deposits and withdrawals: how to use the Crypto in hand directly for daily consumption payments, and how to convert the Fiat in hand into Crypto in a compliant and convenient manner, has always been a natural landing scenario with strong demand.

Therefore, for Web3 projects that are in urgent need of expanding their business boundaries, regardless of whether they are originally strongly related to the PayFi track, they are almost all willing to enter this track. This also makes U card a rare "deterministic business" and the best business expansion opportunity in the eyes of a number of Web3 projects.

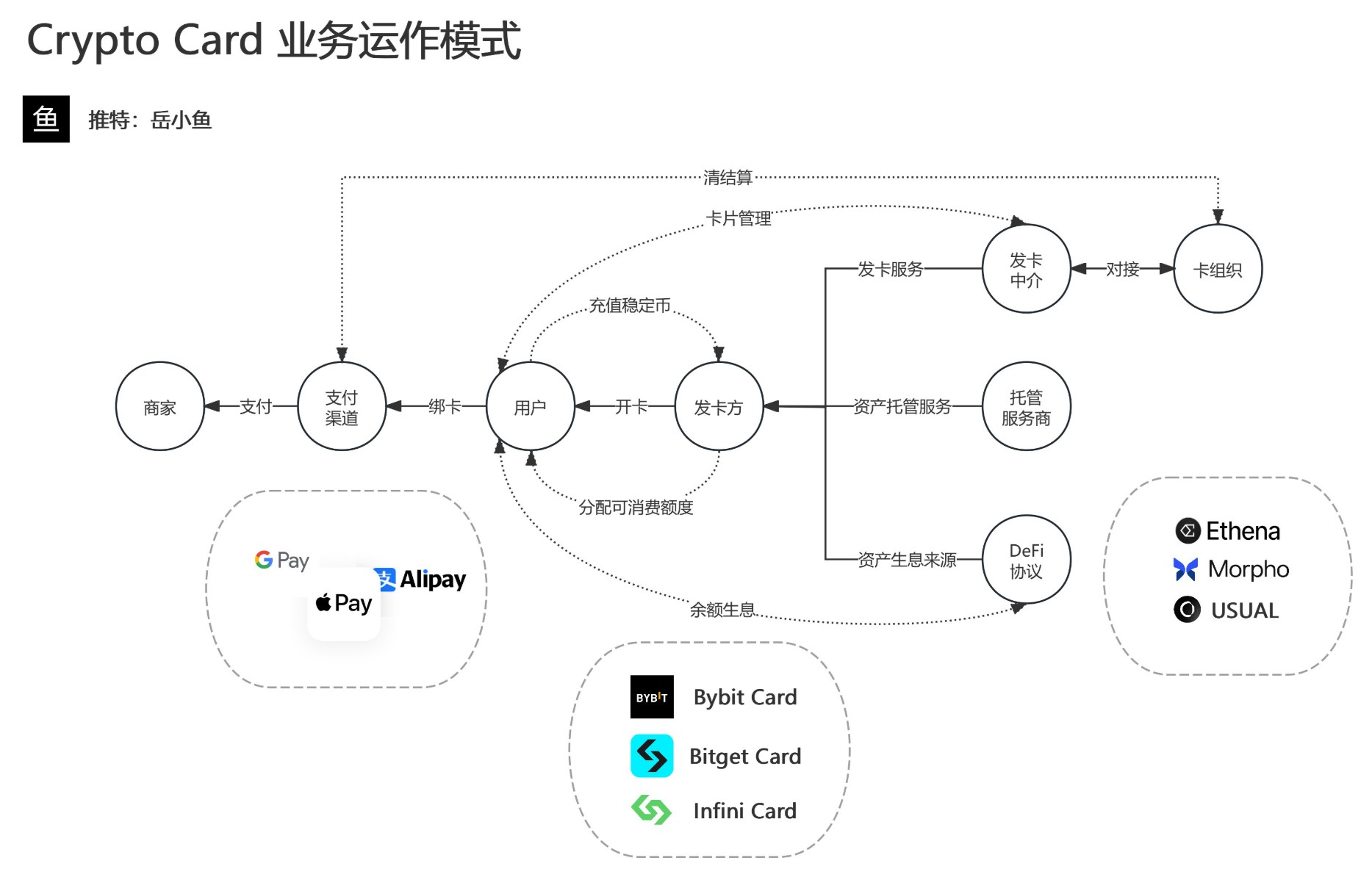

Secondly, in addition to market demand, the low entry threshold for issuing encrypted payment cards is also an important factor that attracts many project parties. They are usually issued by Web3 project parties (such as Infini and Bybit mentioned at the beginning of the article) in cooperation with traditional financial institutions (banks and other card issuers), presenting a three-level architecture of "card organization-card issuer-Web3 project".

Source: @yuexiaoyu 111

Take the commonly used MasterCard U card on the market as an example:

Card organization: MasterCard. The card BIN number segment (the first six digits of the bank card) allocated by it is the core resource of the payment system and is directly authorized by the card organization to the first-level card issuers (such as licensed banks and electronic money institutions);

Tier 1 card issuers: licensed financial institutions such as DCS Bank (DeCard) in Singapore, responsible for compliance-level fund custody and card BIN management;

Web3 project parties: As secondary card issuers, they cannot directly obtain card BINs. They can only cooperate with primary institutions to obtain technical authorization and be responsible for user-side product design and operation.

Among them, the first-level card issuers play a key role in the entire chain. They are responsible for connecting with the card organizations, mastering consumption data, and handling risk control matters such as freezing and blocking cards. The Web3 project party focuses on brand building and user operations, and builds a business model of traffic conversion.

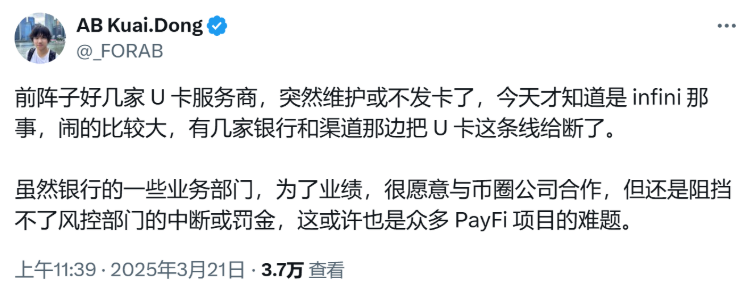

However, this is also the risk point. Once a secondary card issuer is reported to have violated regulations (such as money laundering, unknown fund flows, etc.), the card organization or regulatory agency may impose direct penalties. Even if there is no direct violation, some banks may tighten cooperation due to regulatory pressure or risk control considerations.

This means that related U card services are at risk of being shut down at any time, and also explains why among so many emerging "U card" projects, only a few can survive a year or two.

Of course, there is a deeper problem, which is the risk of fund security. Because under this structure, most U cards are essentially prepaid cards that require recharge before consumption. Users first recharge funds to the project party, and what they get is only the "consumption limit" based on the recharge record, rather than independent custody of real assets.

This is no different from the gym cards and supermarket recharge cards we are familiar with. For example, if you spend 5,000 yuan to apply for a stored-value card at a gym, the funds will go directly into the gym's bank account. The gym promises that the balance on the card will be deducted for each of your purchases, but there is no independent 5,000 yuan in cash stored in the card. Instead, the card forms a "fund pool" together with the recharge funds of other members.

The gym may use the money from this fund pool to pay rent, purchase equipment, or even invest in other branches. However, if the gym goes bankrupt due to poor management one day, or the owner absconds with the money, the balance on your stored-value card will become "waste paper" because you have never truly owned "your own 5,000 yuan", but only a "debt claim" to the gym.

The same is true for U cards. When you recharge 100 USDT/USDC, it is directly transferred to the unified on-chain fund pool controlled by the secondary card issuer. The U card "fiat currency quota" obtained by each user is just a sub-account under the company account opened by the project party at the issuing institution based on the recharge situation. It is only used for payment and settlement, and there is no actual fiat currency deposit in the card - you can use it for consumption, but you cannot transfer it freely.

In other words, most of the Crypto assets recharged by users flow directly into the project party's on-chain account rather than the real bank account system. The corresponding fiat currency side does not open an independent account with the same name for the user, but only allocates the consumption limit through a unified account. Your "limit" is essentially just a string of numbers. Whether it can be redeemed depends entirely on the platform's viability and willingness to redeem.

This model means that the security and stability of the entire system depends almost entirely on the project party's ethical standards and risk control capabilities.

When the deposited user funds reach a certain scale, if the project party encounters moral risks (such as misappropriation of funds, running away with funds), or risk control fails (broken capital chain, hacker attack, inability to cope with large-scale bank runs), user assets will face the risk of loss or even irrecoverable losses (there are endless cases of U card running away online).

Currently on the market, whether it is the U card products launched by exchanges or the encrypted payment cards of star reputation projects, most of them are prepaid cards, so it is difficult to do long-term business. Of course, U cards issued by platforms with good reputation and compliance capabilities can reduce risks to a certain extent.

“Card+” service: a new variable for crypto payment cards?

Because of this, more and more project parties are no longer satisfied with the single U card service, but are actively seeking to transform towards more financial attributes and long-term value.

For example, Bitget and SafePal no longer focus on the simple "U card" business by investing in crypto-friendly banks with financial licenses (such as DCS and Fiat 24). Instead, they are working on building a comprehensive financial service system of "card + bank account", breaking out of the business scope of a single consumption tool.

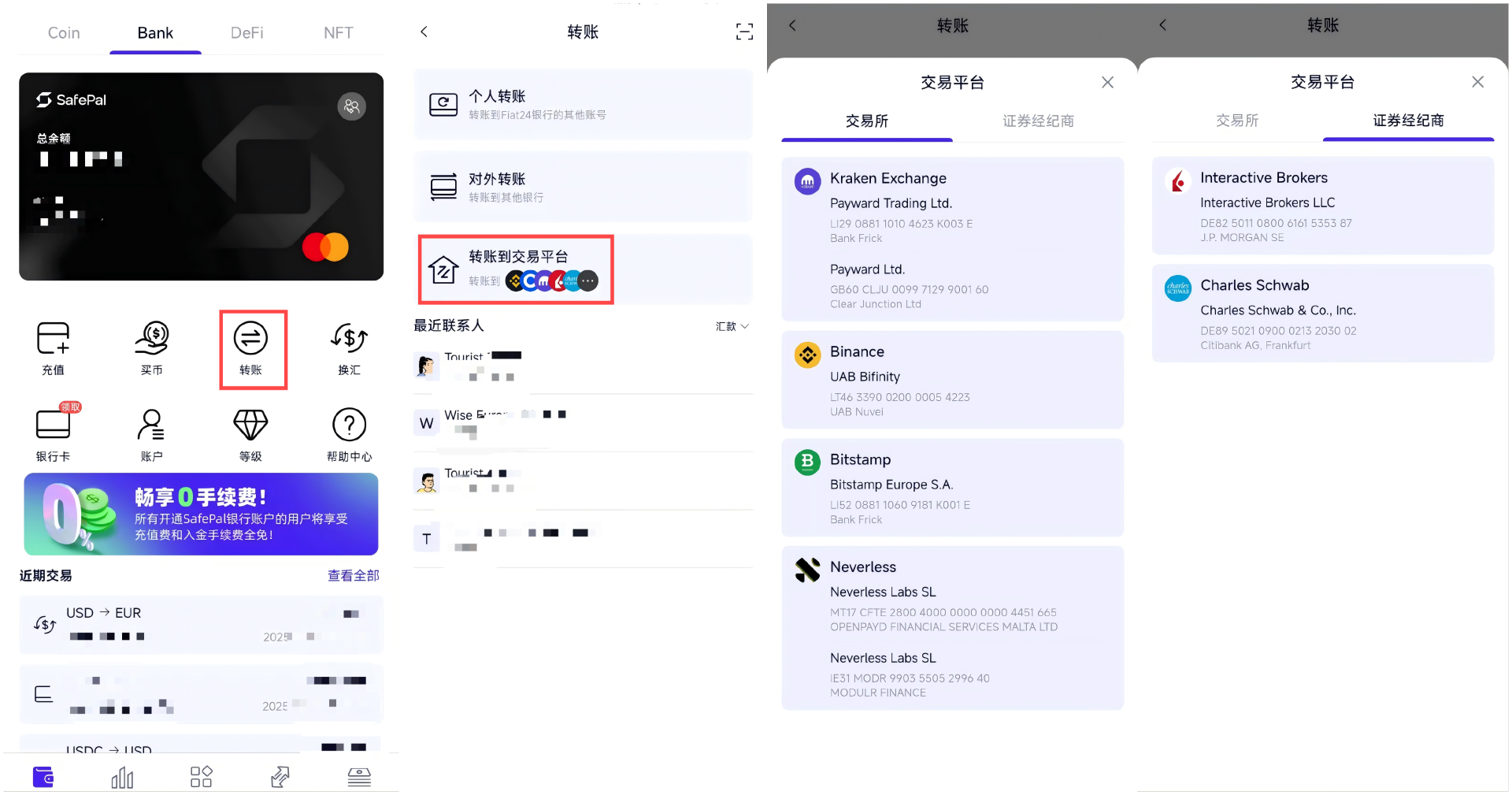

Taking SafePal as an example, it disclosed a strategic investment in the Swiss compliant bank Fiat 24 in early 2024, and officially launched personal Swiss bank accounts and co-branded Mastercard services for users including mainland China at the end of last year. The author has also tested and experienced this "above U card" service model.

Simply put, the biggest advantage of this "non-U card" model is that it fundamentally solves the problem of fund security in traditional U cards - users directly hold bank accounts with the same name, and funds enter the real banking system rather than being deposited in the project party's fund pool, effectively reducing the risks of running away, bank runs and redemption.

Even if problems arise in the Web3 project itself under extreme circumstances, users can still withdraw funds independently through the banking system. This kind of fund independence and security is unmatched by the traditional U card model.

More importantly, this model opens up a wider range of deposit and withdrawal channels, and in a sense realizes the seamless connection between the TradFi and Crypto worlds: taking the bank account service of SafePal & Fiat 24 as an example, users can not only complete free deposits and withdrawals of overseas brokerages (such as Interactive Brokers, Charles Schwab) and CEX through personal bank accounts, but also transfer funds back to Alipay/WeChat or domestic banks through channels such as Wise (Euro SEPA transfer), thus realizing a closed-loop asset flow on and off the chain (further reading " SafePal Practical Manual: The Most Complete Guide to Connecting Crypto and TradFi ").

In contrast, most U card products are still at the stage of subsidy and rate competition. Take Bybit as an example. It attracts users through a high cashback strategy, but 10% or even higher cashback means that the rate competition is close to the limit. Once the subsidy is reduced, the highly homogenized product experience cannot retain users, let alone build real brand loyalty.

This structural contradiction makes it difficult for most pure U card products to survive the cycle, and the broader "card + bank account" model may be the direction for a few projects to break through.

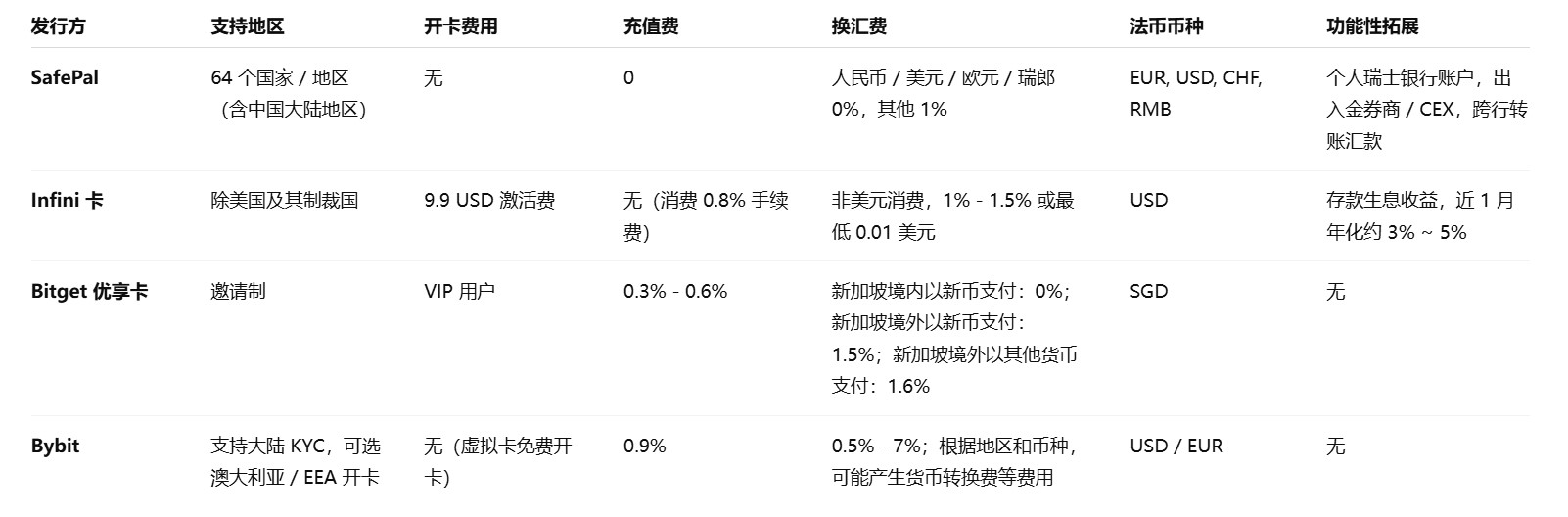

The author also sorted out the crypto payment card products with good reputation in the current market, and made a rough comparison of the account opening and registration threshold, fee structure and compliance functionality in actual use:

From this comparison, it can be seen intuitively that the "card + bank account" model currently adopted by SafePal has significant advantages in fund security, fees and functionality, especially in terms of compliance and support capabilities for actual deposit and withdrawal scenarios, building a competitive barrier that is difficult to simply copy.

On the surface, crypto payment cards compete for rate subsidies, but in reality they compete for who can control the truly scarce compliance resources and financial infrastructure. Only players who have licenses and bank-level resources will have the last laugh in this chaotic era.

A new narrative curve from "U card" to "card + bank account"

Starting in 2025, Web3 payment has reached its narrative turning point to some extent.

The biggest difference is that in the past, the entire track was mostly focused on encrypted payment solutions for 2B enterprise services. Now, more and more leading institutions are beginning to enter the 2C consumer scenarios. The most representative case is OKX's newly launched OKX Pay, which also directly cuts into the personal payment market and opens up the mass market with its own traffic and ecological advantages.

Judging from the development trend, it is only a matter of time before the "pure U card" model is eliminated. The market has gradually evolved from a single payment tool to a comprehensive asset management tool. After all, the U card only achieves "consumer terminal access" but cannot build a complete ecological closed loop for capital circulation - for example, when users need to transfer funds to Interactive Brokers, 99% of U cards can only remain silent.

Therefore, only by going beyond the simple consumer card positioning and integrating functions such as savings, investment, and remittance can we seize the new narrative curve.

Just like the way SafePal & Fiat 24 works, it allows users to directly deposit funds into Interactive Brokers for stock trading through their Euro accounts, and they can also freely transfer funds to Alipay with the help of tools such as Wise, thus achieving the free flow of funds on and off the chain, making Crypto wallets almost as capable as fully functional commercial bank accounts.

From this perspective, Web3 wallets naturally have the ability to manage encrypted assets and are the most ideal PayFi service carrier. This is also the fundamental reason why OKX Pay and SafePal are accelerating the "card + bank account" model. They are trying to provide a new asset management experience that combines the convenience of virtual cards, the security of compliant bank accounts, and the characteristics of decentralization:

Users can enjoy the decentralized nature through non-custodial wallets, and can also make global consumer payments with the help of Visa and MasterCard networks. At the same time, they can enjoy financial services close to traditional banks (transfers, remittances, deposits and withdrawals), while still retaining the flexibility of encrypted assets.

In the future, when crypto assets are further integrated into the global financial system, this model may be the ultimate solution to achieve large-scale user growth.

The evolution from "U card" to "card + bank account" has clearly demonstrated the breakthrough path of encrypted payment cards - finding a new narrative curve, from a single consumption tool to a comprehensive asset management portal.

The future competition will no longer be about who gives more cashback, but who can truly open up the last mile between Crypto and TradFi. This market ultimately belongs to those long-termists who can build financial infrastructure and have compliant resources, rather than traffic players who seek short-term arbitrage.

Last words

Back to the original question: Can crypto payment cards become a sustainable business?

The so-called "short life" essentially reflects the inherent defects of the business model - over-reliance on subsidies, lack of compliance moat and real user stickiness. When subsidies ebb and supervision becomes stricter, this seemingly lively game will naturally come to an end.

But that doesn't mean the story ends here.

In other words, "short life" is not necessarily a destiny, but if you want to be "long-lasting", you must come up with a new set of business principles that conform to the essence of finance and can cross cycles.