Lazy Financial Management Guide | Resolv airdrop requires timely registration; Backpack introduces treasury bond income (May 13)

Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

This column aims to cover the low-risk return strategies based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be ruled out) to help users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Resolv launches airdrop, please register in time

The interest-bearing stablecoin protocol Resolv (portal: https://app.resolv.xyz ), which has been mentioned many times before, has announced the economic model and airdrop plan of the RESOLV token.

The total supply of RESOLV is 1 billion: 10% is allocated to the first season of airdrops (unlocked at TGE, top addresses need to lock up for a short period of time); 40.9% is allocated to the ecosystem and community (10% is unlocked at TGE, and the rest is unlocked in 24 months); 26.7% is allocated to the team and contributors (locked for 1 year, unlocked linearly in 30 months); 22.4% is allocated to investors (locked for 1 year, unlocked linearly in 24 months).

Registration for the RESOLV airdrop started on May 9th and the deadline is 7:59 am Beijing time on May 17th. Users who have not completed the registration process must register in time, otherwise they will lose their airdrop qualifications - unclaimed airdrops will enter the second season airdrop prize pool.

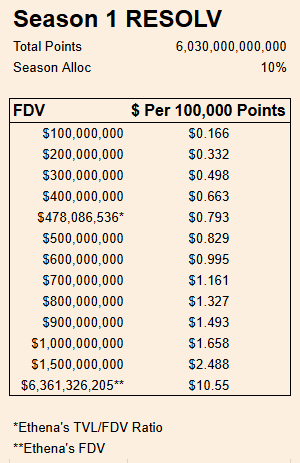

In addition, the Pendle community has estimated the integral value of Resolv under different valuation conditions. The following figure is for reference only.

Considering that Resolv has recently expanded to the BSC ecosystem, I would guess that RESOLV may follow the Binance Wallet IPO route (pure speculation, please refer to official information).

Backpack introduces 4% Treasury yield

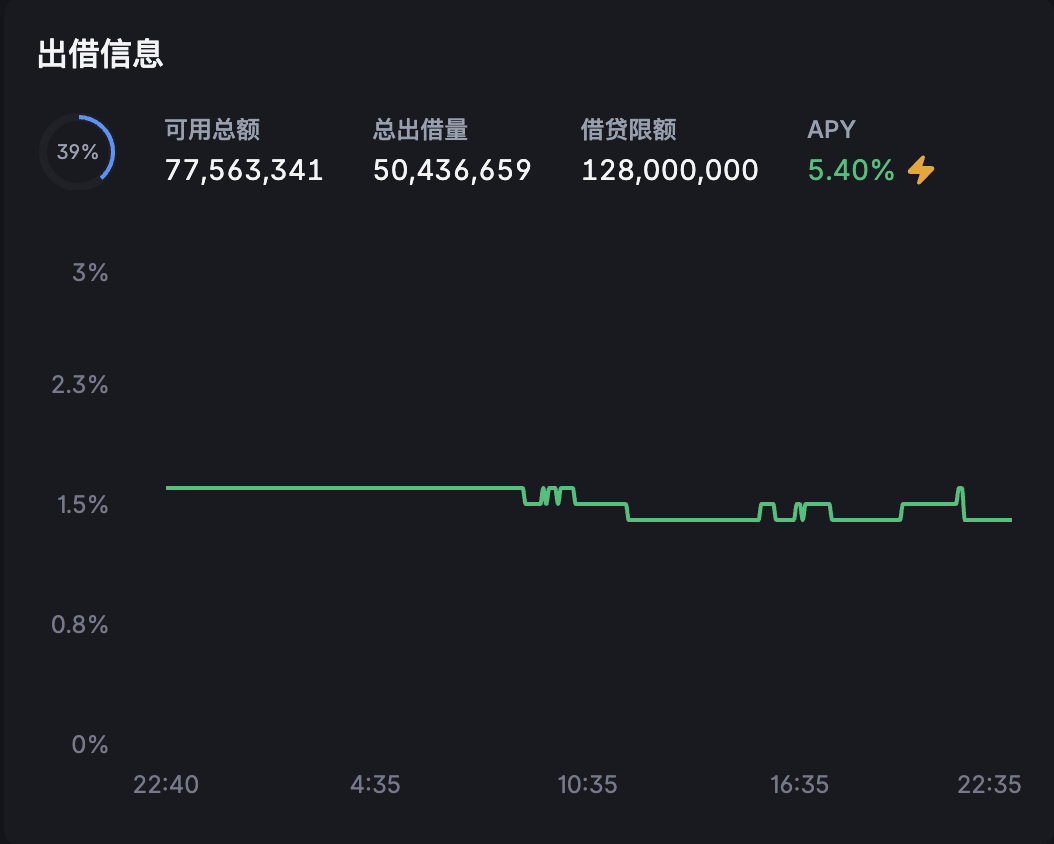

Backpack (portal: https://backpack.exchange ) has recently integrated a stablecoin system into its platform. Currently, stablecoins such as USDC deposited in the platform will be converted into USD by default. Borrowing USD can earn an additional 4% treasury bond yield in addition to the basic lending yield (currently reported: 1.4% + 4% = 5.4%).

We have previously shared how to use Backpack for spot-futures arbitrage (looking for currencies with higher funding rates, buying spot currencies and opening equal short orders at the same time to receive funding rate compensation). This allows you to accumulate Backpack points while earning certain returns. The introduction of treasury bond yields has further enriched the income path within Backpack, so it is still recommended to participate.

Aave & Pendle PT revolving loan demand is hot

Aave officially supported Pendle PT assets last month. The pools currently online include eUSDe PT and sUSDE PT. The limits of the two pools are US$400 million and US$240 million, respectively, and both are currently full.

Considering the security of Aave itself and the liquidity of USDe assets, this is basically the safest leveraged financial management on the market, and is more suitable for users with large funds and seeking clear returns. There are too many people and too little meat. Interested users can pay attention to the pool limit and new pool related dynamics in real time.

Berachian pre-deposit unlocked, don’t forget to withdraw

Another key event in the financial management track this week is that the funds that participated in the Berachian pre-deposit a few months ago have been unlocked, such as the USDe assets deposited through Concrete. Different pre-deposit channels will have different unlocking requirements, but the general cycle takes several days. Users who have participated in related activities should not forget to withdraw money. After all, idle funds are essentially a waste of opportunity.