Morph: Firing the first shot at a consumer-grade public chain, why does it have the opportunity to become a super portal?

Original author: IceFrog (X: @Ice_Frog666666 )

1. From the perspective of the industry cycle, why is the consumer-grade public chain a rigid demand in this cycle?

In the past few crypto cycles, from DeFi Summer to the NFT craze, to the great leap forward in infrastructure and the outbreak of the MEME narrative, the industry has been constantly innovating itself.

But today, the increasingly rich infrastructure is in stark contrast to the shrinking liquidity and slowing user growth. This structural contradiction has become the biggest dilemma in the current industry.

Especially in the public chain track, the dominant narrative logic used to be: "faster TPS + lower gas fees + more DeFi applications". However, as the technology gap narrows and innovation converges, the model of simply relying on "hyping new public chains" is accelerating its failure, with declining investment momentum and a shift in real demand.

To put it more simply, people no longer want a "faster casino", but a "usable chain".

In this context, a new generation of public chains such as Morph, which focus on consumer scenarios, are becoming an inevitable product of the evolution of the industry cycle.

There are two deep driving logics here:

With the macro-structural changes, Web3, as the next-generation Internet infrastructure, must transition from purely financial attributes to taking on broader demands such as real consumption, social interaction, and content.

In terms of micro-evolution trends, the industry's traffic logic must be rebuilt, and the future growth engine must be experience-driven natural traffic, that is, daily high-frequency scenarios where users are willing to stay and consume.

To carry out such a transformation, traditional financial public chains (such as those that are too DeFi-oriented) are naturally unsuitable, and consumer-grade public chains will become new traffic entrances and experience bases. Morph may be in the right position at this turning point of the cycle.

2. Morph: A technological and strategic breakthrough for consumer-grade public chains

1. Core technology advantages: balance between performance and safety

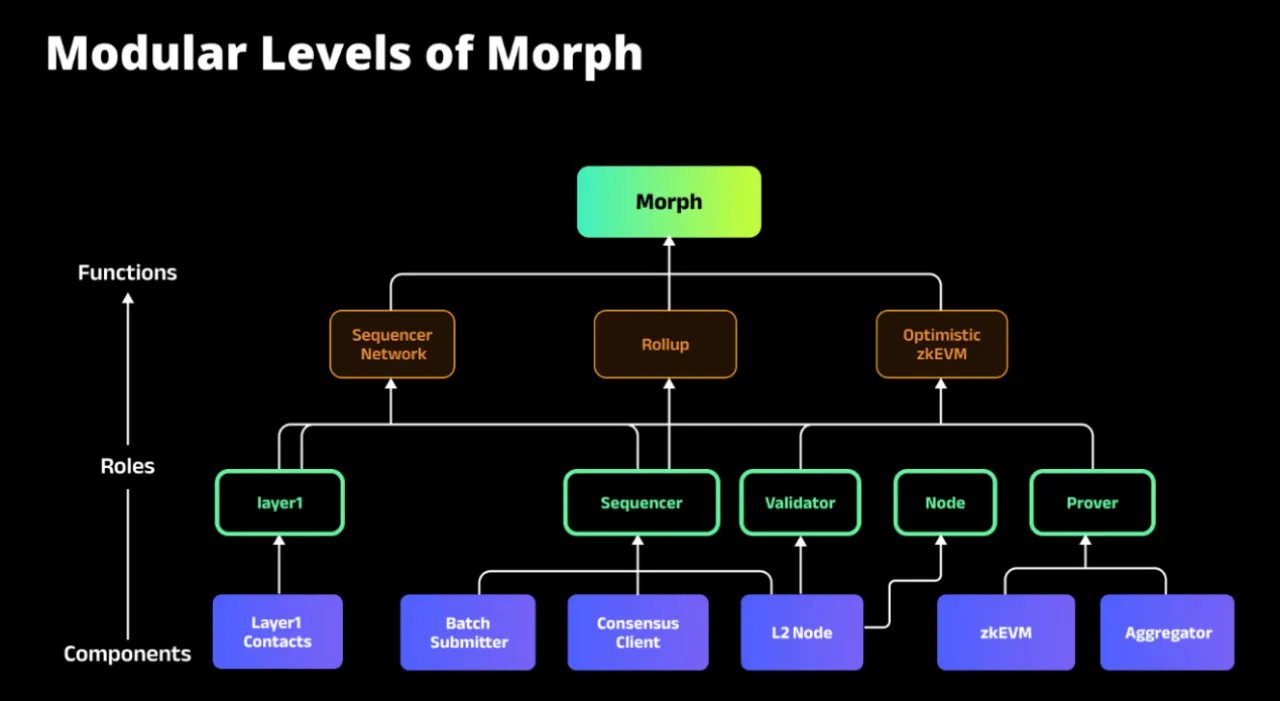

I won’t go into details about the entire architecture. In short, it is similar to other public chains, mainly using the sequencer for consensus and execution, the proof mechanism for state verification, and data availability. On top of that, the project has some innovations and optimizations of its own.

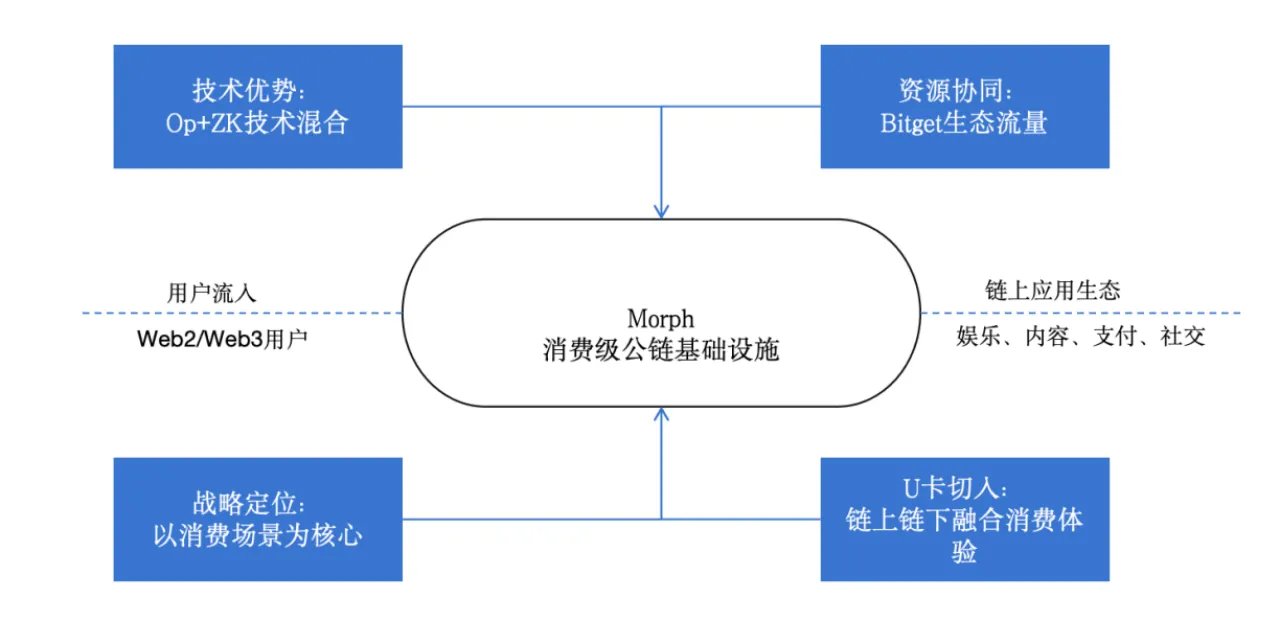

Hybrid Rollup innovation (Optimistic + ZK), Morph has created the Optimistic zkEVM + Responsive Validity Proof (RVP) mechanism, combining the low cost of Optimistic Rollup and the high security of ZK Rollup, greatly compressing the challenge window, increasing withdrawal speed and reducing overall costs.

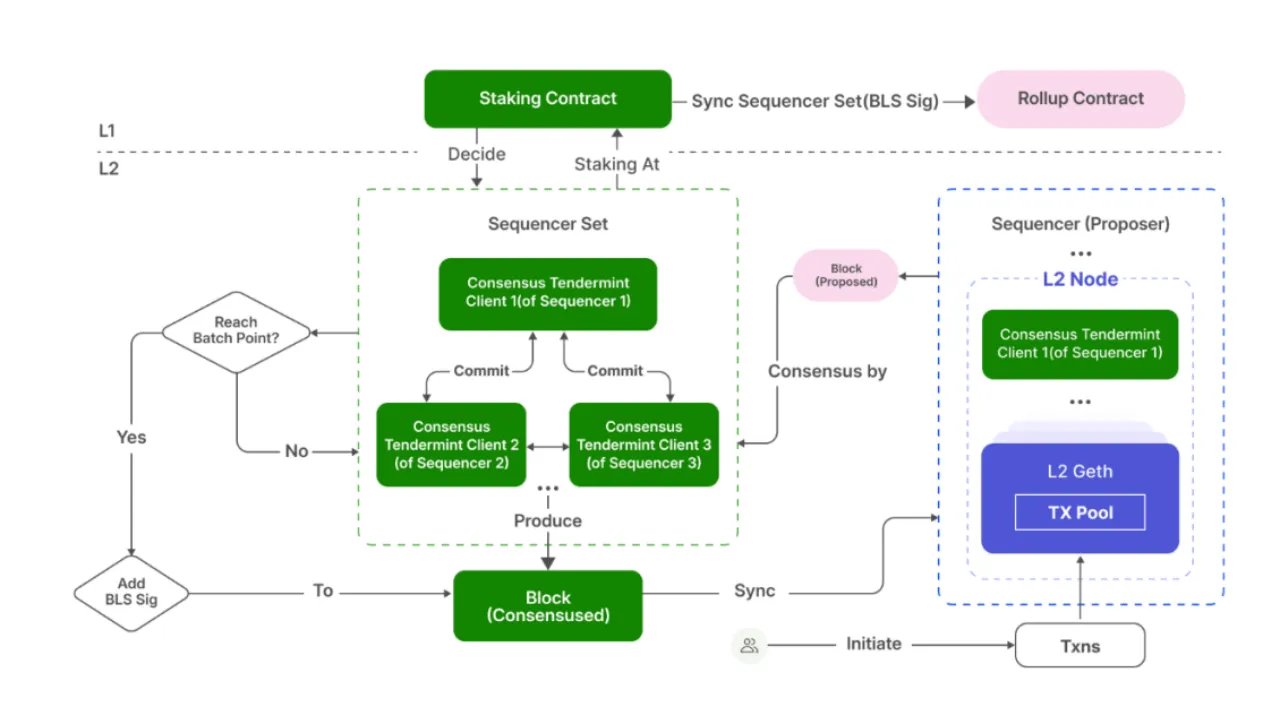

Decentralized sorters as a whole no longer rely on a single point sorting center, which completely alleviates the biggest pain points of traditional Layer 2, MEV monopoly and transaction review, and ensures the fairness and high availability of transaction processing.

Modular architecture: supports independent upgrades and evolutions of different modules, and can flexibly adapt to more new expansion requirements in the future, such as EIP-4844, SP 1 zkVM, etc., ensuring Morph's long-term technical evolution capabilities.

From a technical perspective, Morph's overall construction logic is not a single breakthrough, but a systematic integrated innovation that ensures performance, safety, and experience.

2. Strategic positioning advantage: extension from transaction to life

With "consumption scenarios" as its core, Morph is not a chain that simply talks about "TPS" or "DeFi", but is clearly positioned as an infrastructure that serves "on-chain consumer applications" (entertainment, social networking, and lifestyle). Morph focuses on on-chain content, on-chain social networking, on-chain entertainment, on-chain payment, etc. These are all scenarios that can truly activate the daily needs of hundreds of millions of users, not just a simple financial speculation cycle.

Combining strong resources and traffic with Bitget and other platforms to form potential synergy, sharing users, brands and channels, accelerating the introduction of real users and ecological cold start. In fact, for such projects, traffic barriers are extremely important in the early stages, and public chains with stable and efficient traffic diversion entrances will be easier to build early ecological potential.

3. More than just U Card, build Alipay for Web3, and continuously improve product and brand power

With the strong endorsement of Bitget and Singapore's first-tier card issuer DCS, the Morph Black Card quickly sparked heated discussions in the industry once it was launched. While sparking widespread discussion within Web3, it also successfully broke through the Web2 consumer finance system.

Although there are still some disputes over the operational details, there is one point that has almost been agreed upon: as a consumer-grade product that integrates on-chain and off-chain, the Morph Black Card has initially verified that there is a broad and real demand for high-frequency connections between on-chain financial services and real life.

What is reflected behind this is Morph's in-depth thinking and compliance layout for long-term strategy. Although its surface form is similar to the traditional "U card", in essence, it has surpassed the tool attribute and is more like a Web3 entry-level infrastructure that connects the on-chain financial account system, off-chain consumer rights, and compliant clearing network.

The Morph Black Card is issued by DCS, a local licensed bank in Singapore, and completes the entire process of card organization integration, product structure review, KYC, AML certification and risk control review under the supervision of MAS (Monetary Authority of Singapore).

In addition, Morph did not position the Black Card as just a "card swiping tool", but introduced a complete rights and interests system that can only be enjoyed by high-end credit cards in the Web2 world. This superposition of rights and interests not only makes the Black Card itself scarce, but also reflects Morph's deep thinking on the "consumer-level entrance": making the on-chain identity a credential for enjoying a distinguished experience in the real world, and making encrypted assets truly become "credit assets" that can be used in daily life.

Morph has taken great pains to adopt this strategy, which reflects that the core demand of the project as a whole for long-term development is not to make a fortune by taking advantage of the hot wind, but to consider building a compliant, secure, convenient and globally available system from the entire underlying strategy.

4. The underlying account system supports the closed ecological loop. Card issuance is not the end, but the starting point.

Morph Black Card is not an isolated financial product, but a part of the entire Morph account system. This account system not only supports card issuance and payment functions, but will also become the core infrastructure for building Web3 financial management, identity, points, and membership systems in the future: it not only supports binding of on-chain accounts to off-chain identities, but also supports encrypted asset storage, exchange, financial management and other functions, similar to the Web3 version of "Alipay"; in addition, it can also embed more Web3 applications and third-party financial tools to realize an open financial ecosystem.

On this basis, Morph is building a system where "accounts are the entrance to finance": every card and every account is not only a payment tool, but also a core identity hub that connects various Web3 services (consumption, transactions, financial management, and social networking).

3. Morph’s potential challenges and long-term value

Although consumption and applications are recognized by the industry as the next growth curve, the difficulty of cold start and the requirements for operation are far greater than those of Defi and other protocols.

First of all, from the perspective of risk, there are difficulties in terms of implementation cycle, industry competition, etc. that need to be continuously built and broken through in the future.

Challenge 1: The implementation of consumption scenarios requires continuous and solid strong operations

The previous rights and interests dispute of Morph Black Card and Platinum Card is actually a microcosm of the operational difficulties. It not only tests the project's understanding of the "card" itself, but also tests the effective design of the user experience. The essence of the product still belongs to the category of "consumer-grade financial services". Users not only pay attention to rights and interests and experience, but also make medium- and long-term choices based on factors such as service continuity, security and compliance. Although the black card has opened up a certain space, the project still needs to make users willing to use it naturally in daily life in terms of experience; and it needs to continue to educate users.

Challenge 2: Intensified competition requires faster and more effective brand building and ecosystem construction

As Morph has opened up the narrative window of “consumer-grade public chain”, it can be foreseen that more L2s and even some new L1s will quickly follow suit and layout the on-chain consumer market. Even some public chains with high TPS as their selling point have begun to tend towards the “content ecosystem” layout. Ethereum Rollup system may also join the competition for consumer narrative in the future.

In this case, how to complete the brand establishment and initial ecosystem construction before the narrative is fully involuted will directly determine Morph's position in the industry competition. This requires not only to clearly explain "what it is", but also to make users "happy to use it".

Although the cold start cycle of consumer-grade public chains is long and the operational requirements are extremely high, from Morph's current technical architecture, strategic layout to resource coordination capabilities, it has multiple potentials to overcome the early pains and move towards the next growth curve:

Value 1: The on-chainization of consumer applications is a long-term trend, and Morph is positioned to be extremely scarce

As the industry gradually moves towards stock competition, public chains that can truly connect on-chain applications with users' daily consumption scenarios are extremely scarce. From the demand side, Web3 users are no longer satisfied with DeFi speculation, but expect the chain to carry real, continuous, and high-frequency life experiences, such as payment, social networking, and entertainment content consumption.

From the supply side, most of the current L1 and L2 are still stuck in financial native applications (DEX, lending) and short-term narratives (such as MEME). There are very few projects that truly focus on the on-chain consumer experience and have the ability to be implemented.

As a first-tier consumer-grade public chain planner, Morph is expected to seize the minds of users and establish a scarce position as the "on-chain portal for daily consumption" in the next 2-3 years.

Value 2: Morph technology is highly scalable and can adapt to more narrative changes in the future

Thanks to its modular design and hybrid Rollup architecture, Morph can adapt to industry evolution very flexibly in the future. For example, with the advancement of sharding technology, Morph can quickly reduce data availability costs; through the decentralized advancement of Sequencer, it can build a more secure and censorship-resistant underlying foundation; in the future, it can also be compatible with more new on-chain consumer applications, such as on-chain advertising, on-chain subscription services and other new fields. In general, Morph is not a public chain bound to a single technical framework, but an open platform that can evolve dynamically and in sync with the industry, and has long-term technical vitality.

Value 3: Obvious advantages in resources and capital, with long-term resource synergy potential

Putting aside all the recent public opinion influences, in the medium and long term, Morph has the traffic, channels and brand resources of strong platforms such as Bitget, which can continuously inject users and funds into the on-chain consumption ecosystem; in the future, it is expected to open up the on-chain and offline consumption closed loop and form a unique user barrier; at the capital level, Morph has obtained strategic investment from many first-line funds, providing a solid resource guarantee for subsequent ecological support and application incubation.

Value 4: The account system is the foundation of the super entrance, and the system moat is solid

The core of Morph is not "how many cards are issued", but to build a super portal that can carry out asset management, identity binding, on-chain payment, points and even Web3 social networking through the account system behind the card.

In the future, all users’ on-chain behaviors can be expanded into multiple scenarios such as financial management, lending, payment, membership, etc. in the account system. This will be the infrastructure threshold for all consumer applications to grow.

For this reason, Morph's black card is not an isolated product, but an important part of its construction of "account as financial hub". In the long run, this system is the underlying moat that truly sets it apart from other Layer 2 projects.

4. Conclusion: Morph is expected to become a super portal for on-chain life infrastructure

Judging from the current industry trends, we need to admit that Web3 is undergoing a profound switch in its underlying logic. The industry is migrating from asset speculation to real consumption; evolving from financial leverage to life experience; and transforming from pure on-chain superposition to on-chain + off-chain integration.

Under this trend, Morph has provided a complete set of systematic answers in terms of technology, strategy, and resource coordination. Although its recent public opinion is not very favorable, in the long run, if it can steadily promote the implementation of applications, quickly complete cold start, and gradually expand the scale of real users, then the long-term value of Morph will not only be a public chain, but the next generation of on-chain life infrastructure, and may even become the Alipay, WeChat, or even a super portal of the Web3 world.

Overall, Morph, as a consumer-grade public chain with clear positioning, solid technology, and forward-looking strategy, has indeed hit an important node in the transformation of the industry narrative.

In the future, whether Morph can truly realize this potential will depend on its operational capabilities, its ability to occupy the minds of users and its continued construction of an ecological moat.

From an investment research perspective, if the keyword of the previous cycle was "deepness of protocol", then the keyword of the next cycle is "breadth of experience", and what Morph is trying to open up is the entire user life cycle path of "asset-identity-consumption-credit".

What we need to admit is that in a new cycle of bidding farewell to extensive growth and turning to refined operations, Morph is trying to give an answer that is closer to the real picture of the future, life on the chain, not just speculation on the chain.

And this path may be the only way for Web3 to truly become mainstream and truly change the world.

If you believe that the future of Web3 will be life-oriented and popularized, then Morph is worth your continued attention.