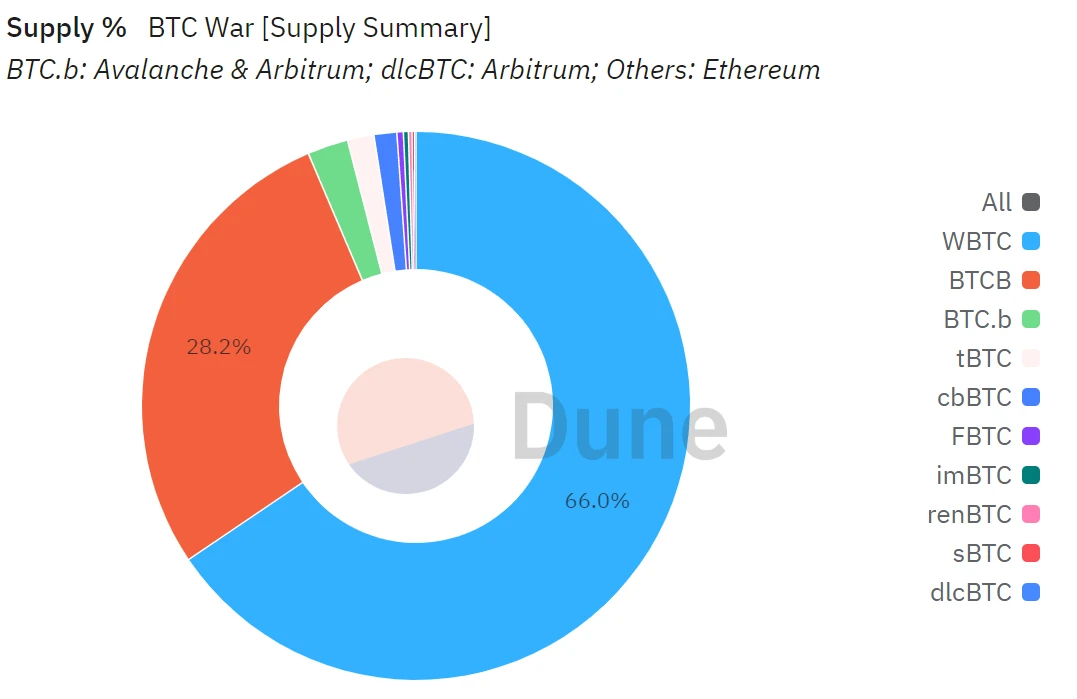

Recently, CryptoQuant, an authoritative foreign industry research platform, released an analysis report on the current status of the packaged Bitcoin market. The report pointed out that the packaged Bitcoin market is welcoming many newcomers, including Coinbases issuance of cbBTC on September 12, but BitGos first packaged Bitcoin WBTC launched in 2019 still occupies a dominant position, accounting for 66%, with a supply of 153,000 pieces, far ahead of its competitors.

66% of supply WBTC dominates

Cointelegraph, an authoritative media in the crypto industry, quoted the report in its report, saying that cbBTC has become the third largest wrapped Bitcoin in seven days. In contrast, BitGos first wrapped Bitcoin WBTC, launched in 2019, took more than a year to achieve similar results. But at present, WBTC still dominates the wrapped Bitcoin market, with a circulation of about 153,000 pieces, far behind its closest competitor tBTC (about 3,400 pieces).

Data website Dune shows that WBTC accounts for 66% of the wrapped BTC market supply share

The fierce competition in the wrapped token market has prompted BitGo to work hard in recent weeks to expand the WBTC token to more networks and regions. Earlier this month, the company began adopting LayerZero’s Omnichain Fungible Token (OFT) standard on Avalanche and BNB Chain, making WBTC usable across multiple blockchain networks.

In addition, BitGo recently announced a joint venture with BitGlobal, a regulated custody platform based in Hong Kong, to further deepen its presence in the Asian market.

Competition in the BTC packaging market intensifies; cbBTC is questioned for lack of transparency

Foreign industry media Cryptopotato. pointed out in its analysis of the report that Coinbase launched cbBTC on September 12, becoming the third largest packaged Bitcoin on the market. Currently, the total circulation of packaged Bitcoin launched by Coinbase is about 1,670 cbBTC (worth $101 million). Although cbBTC provides Bitcoin users with the opportunity to trade, borrow and participate in mining on decentralized exchanges, it also faces criticism and questioning from the community.

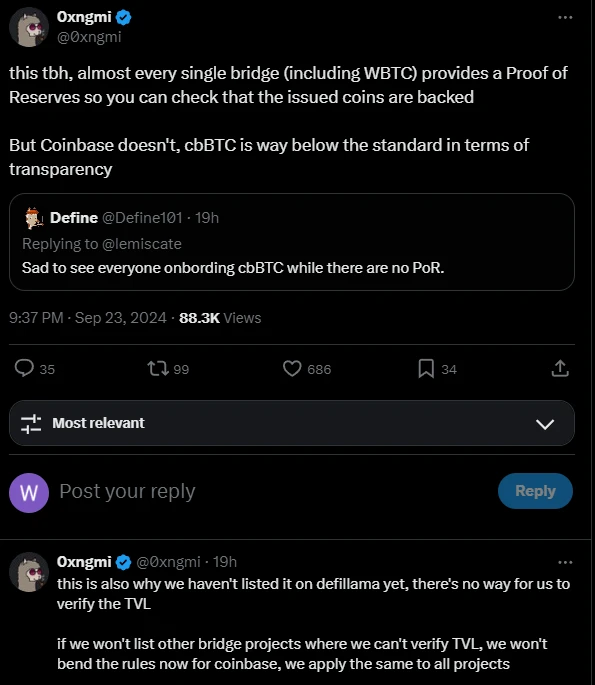

Coinbase refused to disclose the reserve address of cbBTC in the Bitcoin network, which made it impossible for users to remotely verify whether cbBTCs Bitcoin reserves actually exist on the blockchain. In sharp contrast, BitGo chose to proactively disclose the reserve address of its WBTC in the Bitcoin network.

“Some critics have pointed out that the administrator of the cbBTC smart contract can blacklist certain addresses, prohibiting these addresses from transferring, minting, or destroying cbBTC, which means that cbBTC users may have their assets frozen,” CryptoQuant said.

0x ngmi, founder of DefiLlama, one of the largest data sites in the crypto industry, posted on the X platform that cbBTC was not listed on the platform because it lacked transparency and did not provide proof of reserve (PoR), and emphasized that DefiLlama treats all projects equally and will not make an exception for CoinBase. Almost every cross-chain product (including WBTC) provides proof of reserve, but Coinbase does not, and cbBTC is far below the standard in terms of transparency. 0x ngmi pointed out directly.

As other wrapped BTC projects are trying to enter the track to challenge WBTC’s dominance, false rumors have been circulating about DeFi platforms stripping WBTC. On September 20, Aave co-founder Stani Kulechov responded to the false rumors, saying, “This is incorrect. Aave is not eliminating WBTC. This is a proposal by one of the risk providers to restrict WBTC. The proposal does not mean an exit decision, and this particular proposal is not about an exit.”

Another key figure of Aave, ACI founder Zeller, and some community representatives also expressed opposition to this radical proposal. They called for a more cautious response. At present, Aave has not taken any WBTC-related parameters offline or adjusted them.