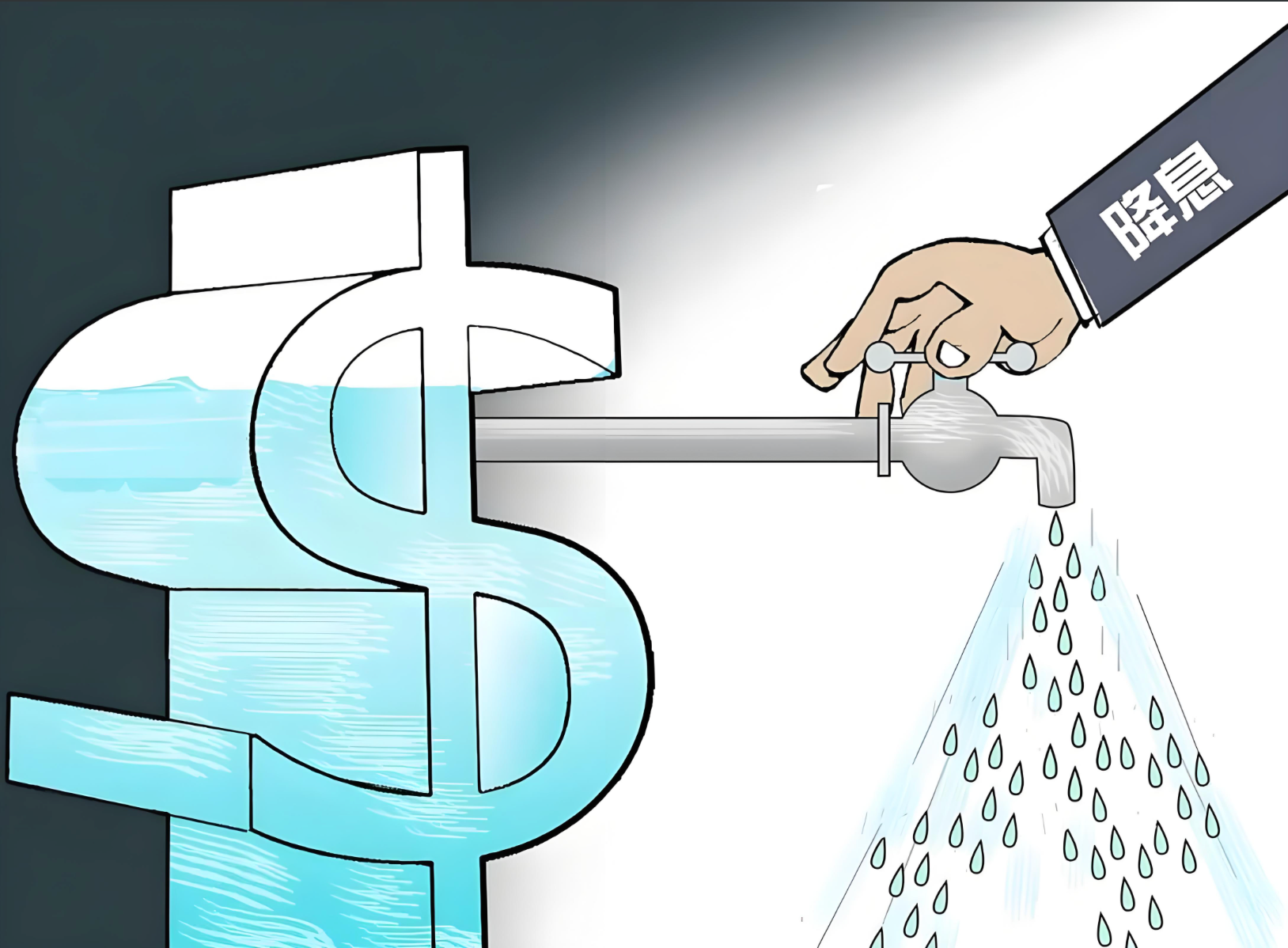

The Fed cuts interest rates by 50bp: Golden investment opportunities and potential risks in the crypto market

This article Hash ( SHA1 ): b7909e85230c846f01fdf480d00fe25080ede1dc

No.: PandaLY Security Knowledge No.033

On September 18, 2024, the Federal Reserve announced a 50 basis point (bp) cut in the benchmark interest rate, a decision that has attracted widespread attention in the global financial market. Behind this rate cut is the dual pressure of falling inflation and slowing economic growth. In the past two years, the Federal Reserve has repeatedly raised interest rates to curb inflation, but with the changes in the macroeconomic environment, loose monetary policy has once again become an important tool for dealing with financial market fluctuations.

The impact of interest rate cuts is not limited to traditional financial markets, but also has a significant impact on mainstream assets in the cryptocurrency field, such as Bitcoin, Ethereum, and cryptocurrency exchange-traded funds (ETFs). These first-tier crypto assets, as the focus of the market, may receive direct capital inflows. However, along with this opportunity, there is also potential for market volatility and increased speculative risks. In contrast, derivatives such as decentralized finance (DeFi) will also gain some room for development against the backdrop of interest rate cuts.

1. Background and impact of the Fed’s interest rate cut

Background of the Fed’s rate cut

The Fed's interest rate cut is one of the important tools of macroeconomic policy, usually used to respond to economic slowdown or financial market turmoil. By lowering the benchmark interest rate, the Fed hopes to stimulate borrowing and consumption behavior of businesses and consumers, thereby promoting economic recovery. On September 18, 2024, the Fed decided to lower the benchmark interest rate by 50 basis points (bp), marking an important monetary policy shift.

Inflationary pressure: High inflation around the world prompted the Federal Reserve to take aggressive interest rate hikes during 2022-2023. However, as the economy slowed, monetary policy began to pull back.

Financial market volatility: The interest rate hike has led to a liquidity crunch in the market, and the prices of high-risk assets such as cryptocurrencies have fluctuated sharply. The Fed’s interest rate cut is an attempt to ease this situation and restore market confidence.

Changes in the global economic environment: Against the backdrop of international trade uncertainties and geopolitical tensions, global economic growth has slowed down, and the Fed’s policies are also closely related to the global economic situation.

The broad impact of rate cuts on financial markets

The impact of interest rate cuts on financial markets is widespread, especially through the following channels:

Lower borrowing costs: Businesses and consumers have easier access to cheap credit, which leads to increased investment and consumption, thus boosting the overall economy.

Currency depreciation pressure: Interest rate cuts are often accompanied by the depreciation of currencies such as the US dollar, which may cause investors holding US dollars to shift funds to other safe-haven or high-return assets, such as cryptocurrencies.

Stock market rebound and capital inflows: News of rate cuts usually stimulates stock market rebounds and attracts more funds into high-risk, high-return markets such as technology stocks and crypto markets.

Potential impact of rate cuts on the crypto market

Like traditional financial markets, the cryptocurrency market will also react to the Fed’s rate cuts. In particular:

Funds flow into the crypto market: In a low-interest environment, more investors may choose to invest their capital in high-return crypto assets, especially those with rapid growth potential.

Increased volatility: As more funds flow into the cryptocurrency market, it may drive short-term price increases. However, the resulting price fluctuations will also lead to more instability in the market.

Mainstream assets benefit: Mainstream assets such as Bitcoin, Ethereum, and cryptocurrency ETFs will directly benefit from rate cuts as investors may turn to these assets to hedge against inflation and seek high returns. In contrast, the returns on traditional financial assets may decline.

2. Crypto market reaction and opportunities and risks of mainstream assets

How interest rate cuts drive money into mainstream crypto assets

After the rate cut, the low interest rate environment increased liquidity in the market. Low returns in the traditional financial system prompted investors to seek higher yield opportunities, which brought capital inflows to mainstream crypto assets such as Bitcoin, Ethereum and cryptocurrency ETFs.

Income opportunities for Bitcoin and Ethereum: In a low-interest environment, Bitcoin and Ethereum, as major crypto assets, usually attract more capital inflows. This process may further enhance the liquidity of these mainstream assets and drive up their prices.

The attractiveness of cryptocurrency ETFs: As a compliant investment tool, cryptocurrency ETFs provide investors with a new way to access the crypto market. Against the backdrop of interest rate cuts, the attractiveness of cryptocurrency ETFs may increase, attracting more investors to participate.

Opportunities from increased market liquidity

Interest rate cuts usually mean that more capital will flow into high-growth areas in a short period of time, which may bring a series of opportunities for mainstream crypto assets:

Capital investment in the market: More capital inflows can drive the construction of market infrastructure for mainstream crypto assets, such as technological upgrades and security enhancements of trading platforms.

Asset innovation and application: Abundant funds can promote the innovative application of assets such as Bitcoin and Ethereum, and enhance the market’s ecological diversity and user experience.

Risks from increased market speculation

However, increased market liquidity also comes with certain risks:

Speculative capital flows: A large amount of capital flowing into the mainstream crypto market may lead to short-term price increases, but it will also increase market speculation. When the Fed tightens monetary policy again, funds may withdraw quickly, leading to increased market volatility.

Bubble risk: As more funds flow into crypto assets, some immature projects may be over-hyped, forming a price bubble, which will ultimately have a greater impact on the market.

3. Security challenges brought about by interest rate cuts

Increase in on-chain attacks:

Increased market liquidity and active capital will bring more opportunities for on-chain attacks, especially on the Web3 platform. The following are the main security challenges:

Price manipulation attacks: DeFi protocols are particularly vulnerable to price manipulation attacks when prices fluctuate drastically. Attackers manipulate price oracles to cause smart contracts to trigger incorrect price judgments, thereby conducting arbitrage or attacks.

Liquidation attacks: During the market volatility caused by interest rate cuts, the collateral involved in the DeFi protocol may be frequently liquidated. Hackers may deliberately trigger large-scale liquidation events by designing complex liquidation strategies, affecting the normal operation of the platform.

Liquidity pool and asset freezing risks:

As capital inflows intensify, liquidity pools in Web3 platforms may face higher pressure. Rapid inflows and outflows of funds in liquidity pools may lead to the following risks:

Liquidity depletion: In a volatile market, the risk of liquidity pool funds running out increases. The platform may freeze the user's assets due to insufficient liquidity, making it impossible for the user to withdraw funds in time.

Smart contract vulnerabilities are magnified: With the concentration of market funds, once there are vulnerabilities in the smart contracts on the platform, attackers may use the influx of large amounts of funds to launch large-scale attacks, causing huge losses.

The rise in cryptocurrency scams:

The market boom brought about by the interest rate cut has also attracted more cryptocurrency scams. The following are common types of scams:

Fake airdrops and investment platforms: Scammers may take advantage of the market’s optimism and impersonate well-known projects to conduct fake airdrop activities to attract investors to transfer funds into the scam.

Phishing attacks: When users are eager to participate in the market, they are easily trapped by phishing websites or fake trading platforms, which may lead to the disclosure of private keys or wallet information, resulting in the theft of funds.

Case Study: Bitcoin Price Fluctuation Events in 2023

The Bitcoin market experienced dramatic price fluctuations in 2023. When the Federal Reserve announced a rate cut, the price of Bitcoin rose sharply, attracting a large amount of funds into the market. However, the rapid rise of the market also brought about dramatic price fluctuations and related security challenges. Some trading platforms froze user assets due to liquidity pressure, while phishing attacks and fake investment platforms also increased, causing many investors to suffer losses.

This risk also applies to the current market, especially when a large amount of funds are pouring into mainstream crypto assets. Immature technology and excessive hype may lead to project bubbles, and as monetary policy changes, the bubble will have a significant impact on the market when it bursts.

4. Increase in fraud and phishing and strategies to address them

Scams caused by market sentiment fluctuations:

When the market is in the context of increased liquidity and rising prices, investors are prone to make irrational investment decisions due to **panic of missing out (FOMO)**. This provides opportunities for scammers to:

Disguised as a popular project: Scammers may disguise themselves as a popular project related to the positive impact of interest rate cuts, using high returns as bait to attract investors to participate in fake DeFi or NFT projects.

Fake social media campaigns: Using social media to spread fake giveaways or fake airdrop information, scammers lure investors by impersonating well-known figures (such as Justin Sun, the founder of Tron).

How to deal with scams and phishing?

To combat this phenomenon, Web3 users should take the following measures:

Enhance security awareness: Users must be more vigilant against fraudulent activities and avoid participating in any activities that require transferring funds or sharing private keys, especially fake airdrop activities on social media.

Enable multi-factor authentication: Users should enable two-factor authentication (2FA) for their cryptocurrency accounts to increase the security of their accounts.

Use secure Web3 wallets and browser extensions: Choose well-known and verified wallets and browser extensions, such as MetaMask, and avoid using tools from unknown sources.

Case Study:

After the Fed's interest rate cut was announced, the liquidity of the crypto market increased, and several fake projects took advantage of the opportunity to rise. A scam project called "BitProfit" quickly expanded on social media. They claimed to cooperate with a well-known Bitcoin investment platform to launch a high-yield investment plan related to the interest rate cut, promising users an annualized return rate of up to 25%. The scammers disguised themselves as a popular Bitcoin investment platform linked to the interest rate cut, and even forged the social media account of Ethereum founder Vitalik Buterin, and released a fake airdrop event to induce investors to transfer funds to the wallet address controlled by them.

In just two weeks, the scammers attracted more than 200 investors to participate and defrauded more than hundreds of thousands of dollars in Bitcoin and Ethereum. Once the funds entered the address controlled by the scammers, the users could no longer retrieve the funds. The scammers then destroyed all social media accounts related to them, and the project quickly disappeared.

5. Response strategies of Web3 developers and enterprises

Security upgrade of smart contracts:

As funds flow into the Web3 ecosystem, Web3 developers need to conduct comprehensive smart contract security upgrades. In addition to regular code audits, developers should use more diverse tools for dynamic monitoring and testing to promptly fix vulnerabilities that may be exploited. For example, enhance the security protection of Oracle to prevent oracle manipulation and reduce the risk of malicious contract triggering. Use automated tools to detect malicious behavior and abnormal fund flows to ensure that contracts remain secure and stable despite the influx of large amounts of funds.

Strengthening security infrastructure:

In the context of rapid capital flows and market fluctuations, Web3 platforms must invest in security infrastructure to deal with potential on-chain attacks and speculation. First, platforms should strengthen on-chain monitoring, track capital flows in real time, and prevent possible attacks. Second, enhance distributed protection measures, such as distributed node protection, to reduce the risk of attacks caused by single point failures. In addition, Web3 projects should cooperate with third-party security companies to reduce the attack surface through timely vulnerability fixes and smart contract upgrades.

6. Global policies and the long-term development of Web3

1. Compliance and regulatory pressure

As the liquidity increases due to the Fed’s interest rate cut, global regulators may further strengthen their supervision of the Web3 ecosystem. This intensified supervision is mainly reflected in the following aspects:

Strengthening compliance requirements

In response to the risks brought by increased liquidity, regulators may introduce stricter compliance requirements. Especially for KYC (know your customer) and AML (anti-money laundering) measures, these will become standard compliance configurations for platforms. Platforms must establish a comprehensive customer identity authentication system to ensure the authenticity of user identities and monitor trading activities to prevent illegal capital inflows.

International regulatory challenges

Differences in regulatory policies between countries and regions will be one of the main challenges facing global Web3 projects. For example, the EU may implement strict data protection regulations, while other countries may focus on taxation and anti-fraud measures. Developers and companies should pay close attention to these policy changes and make corresponding adjustments based on local regulations. Achieving cross-border compliance requires not only technical support, but also legal expertise.

Optimization of compliance processes

In order to adapt to the ever-changing compliance requirements, Web3 platforms need to continuously optimize their compliance processes. This includes implementing a real-time compliance monitoring system, enhancing data transparency and tracking capabilities, and conducting regular compliance audits. This will help identify potential compliance issues in a timely manner and avoid penalties for violations.

2. Long-term policy trends and Web3 security challenges

Although the Fed’s rate cuts have brought short-term capital inflow opportunities, macroeconomic uncertainty may still pose a threat to the Web3 ecosystem in the long run:

Macroeconomic uncertainty

Long-term macroeconomic uncertainty may lead to frequent adjustments in monetary policy, such as possible interest rate hikes in the future. Such economic fluctuations will affect the liquidity of capital, thus affecting the financing and operation of Web3 projects. Platforms need to develop emergency plans to ensure that they can maintain stable business operations in the event of liquidity tightening.

The persistence of Web3 security challenges

As regulatory pressure and hacker attacks intensify, the security challenges faced by Web3 platforms will become more complex. Regulators are increasingly demanding data privacy and security, and platforms need to continuously upgrade their security measures to resist various cyber attacks. At the same time, the continuous evolution of hacker methods also requires platforms to strengthen the monitoring and repair of potential vulnerabilities.

Improve security protection capabilities

In order to cope with these security challenges, Web3 platforms and users need to continuously improve their security protection capabilities. Platforms can enhance their security by implementing multi-layered security measures, such as smart contract audits, real-time monitoring systems, and user education. At the same time, users should also be vigilant, update passwords regularly, and use two-factor authentication and other measures to protect personal assets.

Prediction of future policy direction

Looking ahead, policy trends will have a profound impact on the development of Web3. Developers and companies need to pay close attention to policy dynamics and plan ahead so that they can quickly adjust their strategies when policies change. In addition, communication with policymakers and industry associations will also help grasp policy trends and promote the formulation of regulations that are conducive to the development of Web3.

In general, changes in global policies and economic environments have a significant impact on the development of Web3. Web3 projects and users need to be fully prepared in terms of compliance, regulation, economic fluctuations, and security to ensure sustainable development in a complex environment.

Conclusion

The Fed's 50 bp rate cut has not only had a profound impact on the traditional financial market, but also brought new opportunities and risks to the Web3 ecosystem. In this context, Web3 platforms, developers, investors, and users must maintain a high level of security awareness, especially when market volatility intensifies and capital flows accelerate. By improving contract security, strengthening infrastructure construction, and paying close attention to global policy changes, the Web3 ecosystem can maintain steady development and respond to potential challenges in the ever-changing macroeconomic environment.

Lianyuan Technology is a company focused on blockchain security. Our core work includes blockchain security research, on-chain data analysis, and asset and contract vulnerability rescue. We have successfully recovered many stolen digital assets for individuals and institutions. At the same time, we are committed to providing project security analysis reports, on-chain traceability, and technical consulting/support services to industry organizations.

Thank you for your reading. We will continue to focus on and share blockchain security content.