Ethereum Gas hits a three-year low. A quick look at the mainnet value interaction and ETH's future trend

Original | Odaily Planet Daily

Author | Nanzhi

Today, the average Ethereum Gas fee fell below 4 gwei, hitting a three-year low. Does the bottoming out of Gas mean the bottoming out of the market? What impact will it have on the ecosystem and users? Odaily will analyze this in this article.

Market Trend Contact

The Ethereum mainnet Gas surges high, often when the market is hot or star projects are launched, such as the DeFi bull market, otherdeed launch, etc. Is the low mainnet Gas a signal that the market has bottomed out and is about to rebound?

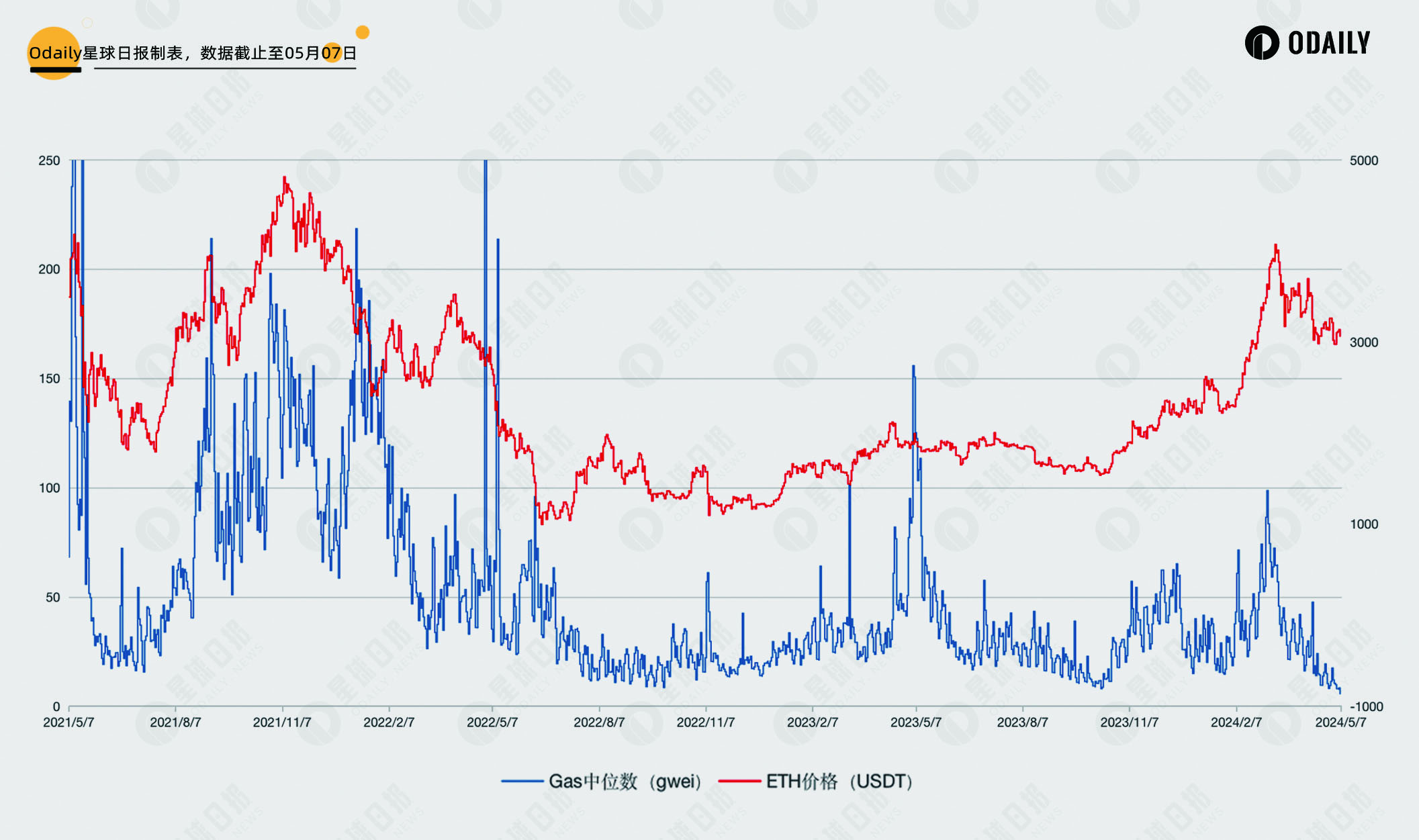

Odaily has counted the average daily mainnet gas fee for the three years from May 7, 2021 to the present. There were only 16 days and three periods of time when the mainnet's average daily gas fee was lower than 10 gwei, namely at the end of September 2022, early to mid-October 2023, and since April 20 this year (also since the Bitcoin halving).

The lowest points of ETH in the past three years were June 19, 2022 (995 USDT), January 1, 2023 (1196 USDT), and January 4, 2024 (2211 USDT). The trend charts of the two are shown below, from which we can draw the first conclusion:

The low Ethereum Gas price is the result of the downward market trend, but it is not the direct driving force for the market reversal and has no necessary connection with the absolute bottom.

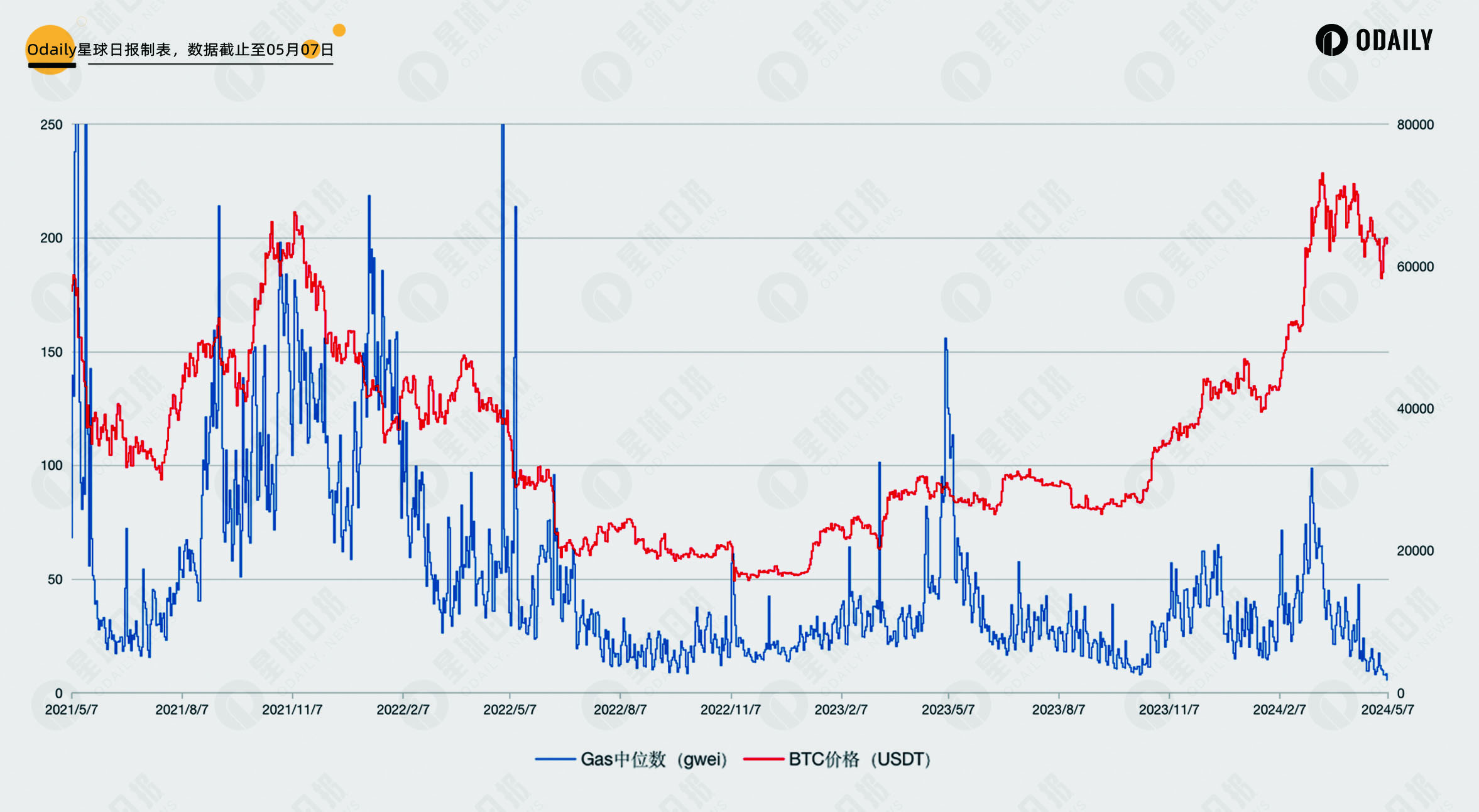

If we link Ethereum Gas fee and BTC market together, are the conclusions consistent? The trend charts of the two are shown below. Although Bitcoin’s bottom appeared much later than ETH in November 22, it is still not in the same range as the Gas bottom, and the above conclusion still holds true.

But there is another rule in the graph: the trend of Gas and the trend of price develop in the same direction . When the market falls, Gas often falls synchronously, and vice versa. For example, the bottom of Gas in October 2023 was also the extreme price in the previous and next few months. The downward trend of prices in April this year was also accompanied by the downward trend of Gas.

This means that although it is not equivalent to an absolute bottom, the bottoming of Gas increases the possibility of an upward reversal trend , which is one of the potential conditions. Readers can use the Gas trend as a reference for the market and pay attention to when the Gas trend will reverse and form an upward trend .

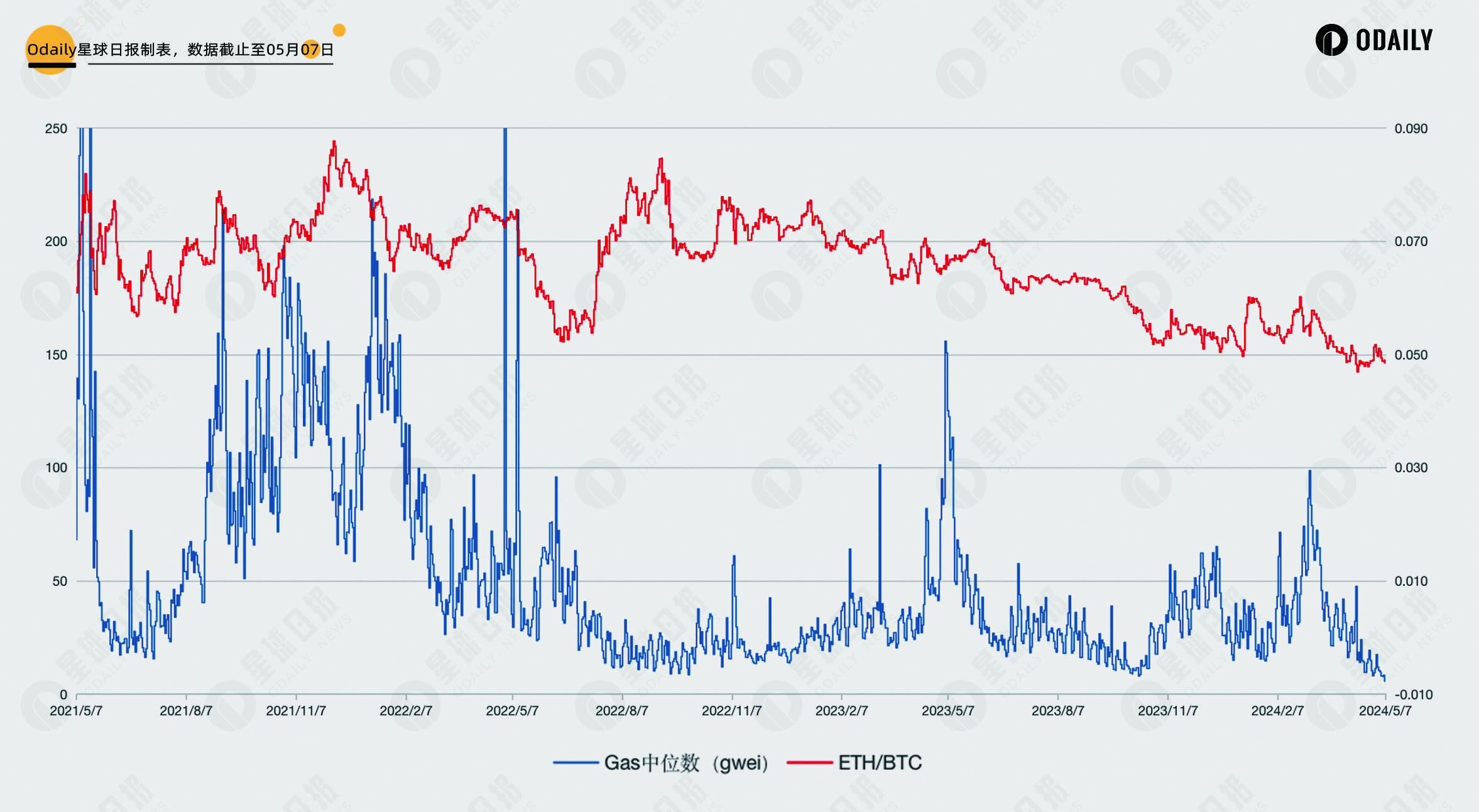

Finally, the ETH/BTC exchange rate is compared with the Gas trend as shown below. The exchange rate has been declining for more than a year. If the mainnet Gas fee is understood as the prosperity of the Ethereum mainnet, no matter how high or low it is, it cannot reverse the exchange rate trend. It can be seen that the decline of the mainnet is difficult to reverse .

Ethereum Mainnet Interaction

For users, the low gas of the main network also provides an excellent opportunity for some operations. Odaily summarizes some common operations as follows:

L2 Mainnet Cross-chain

Based on past experience, the official cross-chain bridge between the Ethereum mainnet and L2 will be used as one of the calculation standards for airdrops. Currently, the mainstream projects that have not yet issued coins include zkSync, Linea and Scroll. The links are as follows:

zkSync: https://portal.zksync.io/bridge

Linea: https://bridge.linea.build

Scroll: https://scroll.io/bridge

(Note: Whether there will be a token airdrop and whether the airdrop will consider the official bridge has not yet been determined. This is only for reference.)

Register/Renew ENS domain name

The one-year fee for an ENS domain name is 0.016 ETH. Based on the 7 gwei at the time of posting, the network fee is about 0.0029 ETH, which is a big discount compared to normal times. If you choose to register for a 5-year term, the network fee will only account for 26% of the total fee. If you operate at a price of 5 gwei, the network fee will only be 0.0022 ETH.

Cleaning up low value tokens

Calculated at 5 gwei at the time of writing, the fee for authorizing a token transaction on Uniswap is 1 USDT, and the fee for performing a swap is approximately 5 USDT. Users can choose whether to clear the token based on its value.

Gas related tools

This section will list some Gas-related tools as a reference for users who are not familiar with on-chain interactions.

The first is the most common tool Etherscan , which can be used as the most accurate data source for Gas levels and supports plug-in installation in the browser. However, it is worth noting that the operation fee estimates provided by this tool, such as Uniswap Swap operations, are often too high . Users are advised to check other sites.

Websites that support more accurate operation fee estimation include Cointool and MCT . Browser plug-ins can also be installed and support Gas queries for multiple chains.

In addition, Odaily has produced Dune query code and data panels for Ethereum's historical Gas trends for readers' reference.

in conclusion

For users, low gas fees allow them to participate more fully in various projects in the ecosystem, but it essentially means a decline in the prosperity of the ecosystem. EIP-1559 gives ETH the self-feedback feature, and after the Cancun upgrade, the transaction fees contributed by each L2 to the Ethereum mainnet have dropped significantly, and the Restaking narrative is close to landing. Ethereum and ETH are in urgent need of a new development direction to rebuild the growth flywheel of price and value.