Original author: Alex Liu, Foresight News

Will Sui usher in airdrop season?

Announcing airdrop news at ecological conferences may be a new trend in project marketing. Jupiter, which announced at Solana Breakpoint last year that it would airdrop JUP tokens, has earned plenty of buzz and attention.

Various recent signs indicate that many Sui projects may replicate Jupiters operations, making the Sui Basecamp conference to be held in Paris, France from April 10th to 11th the beginning of a new airdrop season for Sui.

Hints from Lianchuang

Adeniyi is the CPO and Lianchuang of Mysten Labs (Sui development company). A few days ago, he retweeted a picture with the comment: Tell me what you saw :-). There are many patterns of parachutes 🪂 on this picture and related images of different projects on Sui - the recognizable images include Fuddies and DeSuiLabs (NFT on Sui), Tails by Typus (NFT, option agreement on Sui), Aftermath Eggs (trading aggregator, DEX on Sui), FUD the Pug (meme coin on Sui), etc.

Relevant tweets and comments retweeted by Adeniyi

When DeepBook, the order book liquidity protocol on Sui, tweeted to announce the airdrop on March 29, he even retweeted and commented, Check your wallet 🪂, this is just the beginning of an interesting season. It seemed to also hint that something was about to come. Come airdrop season.

Relevant tweets and comments retweeted by Adeniyi

It seems that the airdrop expectations of the Sui ecological project are indeed not low. Let’s analyze several specific projects below.

Suilend

Airdrop clues

Suilend is a new lending project founded on Sui by 0x Rooter, the founder of Solend, the lending protocol on Solana. In addition to the confirmed airdrop to Solend users, there is a high probability that it will also be airdropped to Sui users. On April 7, its official Twitter posted a picture with only the date 4.8 in it, which seemed to imply that important news would be announced on that day. Adeniyi reposted this post with a 🌧️raining cloud emoji, possibly hinting at an airdrop.

Relevant tweets and comments retweeted by Adeniyi

Participation Guide

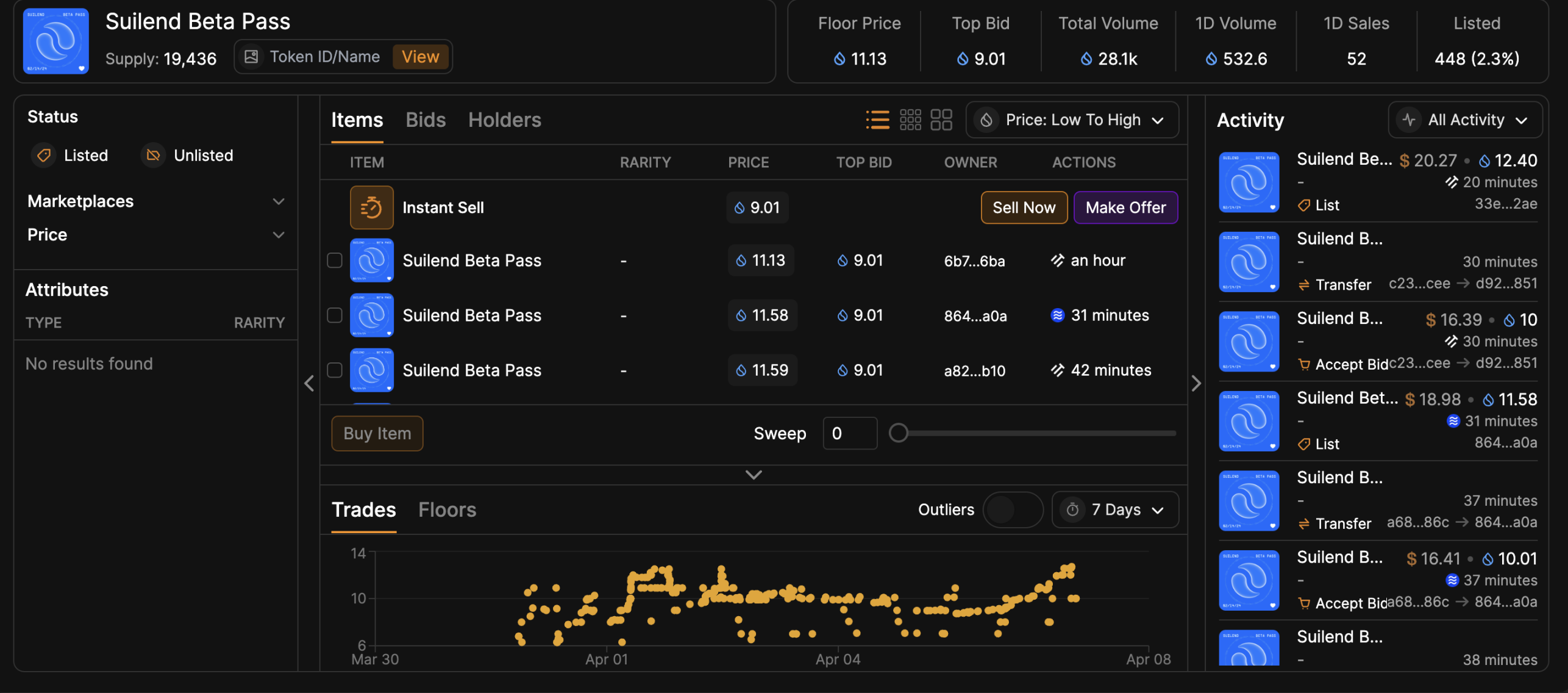

To obtain the Lending Protocol airdrop, deposits and borrowing are essential. But unlike other permissionless lending protocols, if you want to participate in Suilend at this stage, users need to hold a Suilend Beta Pass, an NFT pass. In addition to being available at events held by Suilend and its partners from time to time, this NFT can also be purchased through NFT markets such as tradeport. The current floor price is around 11 SUI.

Suilend Beta Pass related interface on tradeport

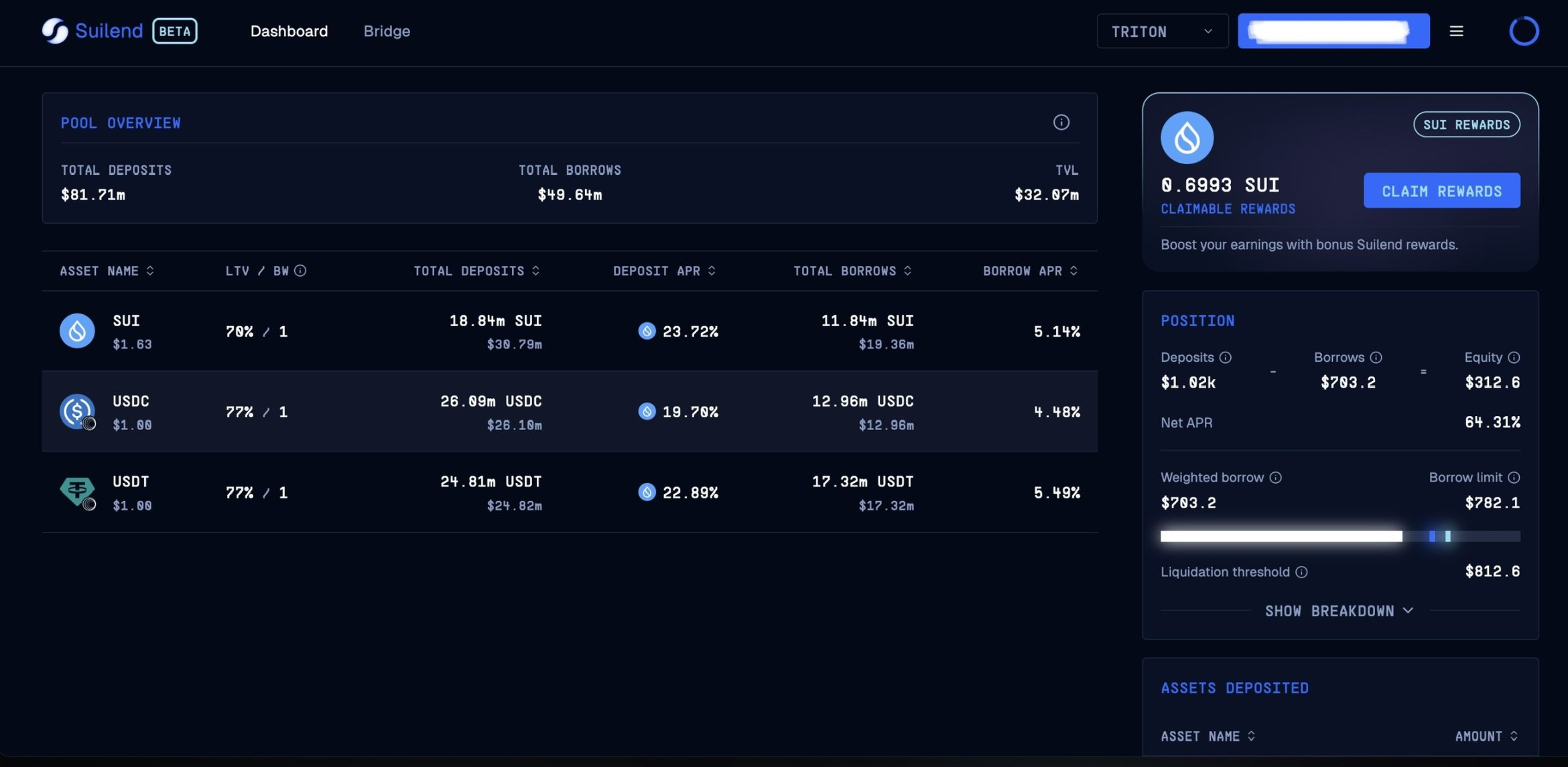

After you have the Suilend Beta Pass, you can go to the Suilend official website to deposit and borrow. Due to the Sui Foundations SUI token incentives, the interest rates on DeFi on Sui are quite impressive. It should be noted that borrowing on Suilend will charge a one-time borrowing fee of 0.3%. If you perform operations such as revolving loans, it will take a long time to recover the cost.

Suilend official dApp related interface

SuiNS

Airdrop clues

SuiNS is an address domain name service on Sui, which was acquired by Mysten Labs last year. In January this year, Adeniyi conducted a questionnaire on

Related Tweets

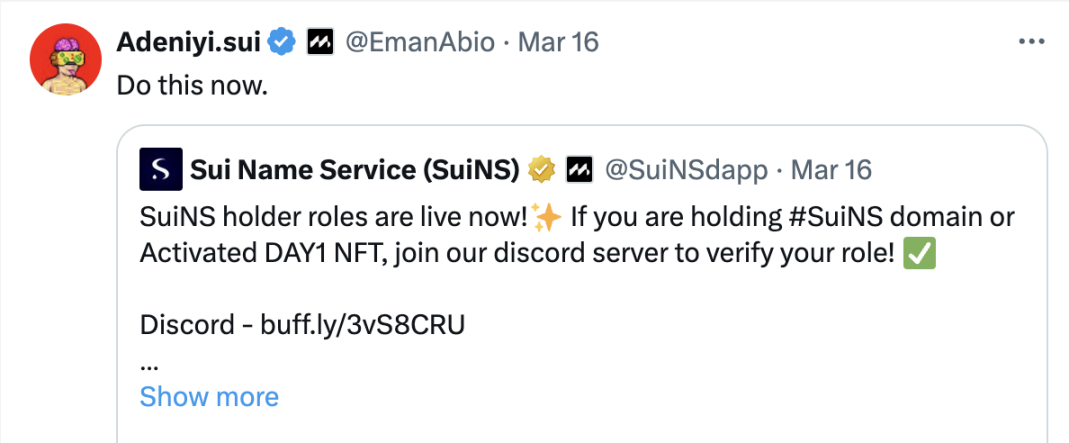

The core projects of Mysten Labs mainly include Sui Network, Sui Explorer, zkSend and zkLogin products that have been announced to be shut down, Sui Wallet, and SuiNS. SuiNS is the project that seems to have the highest probability of issuing coins and airdrops. Adeniyi retweeted a tweet from the project on March 16 that allows domain name holders to enter Discord to get verified roles, and commented: Do it now.

Relevant tweets and comments retweeted by Adeniyi

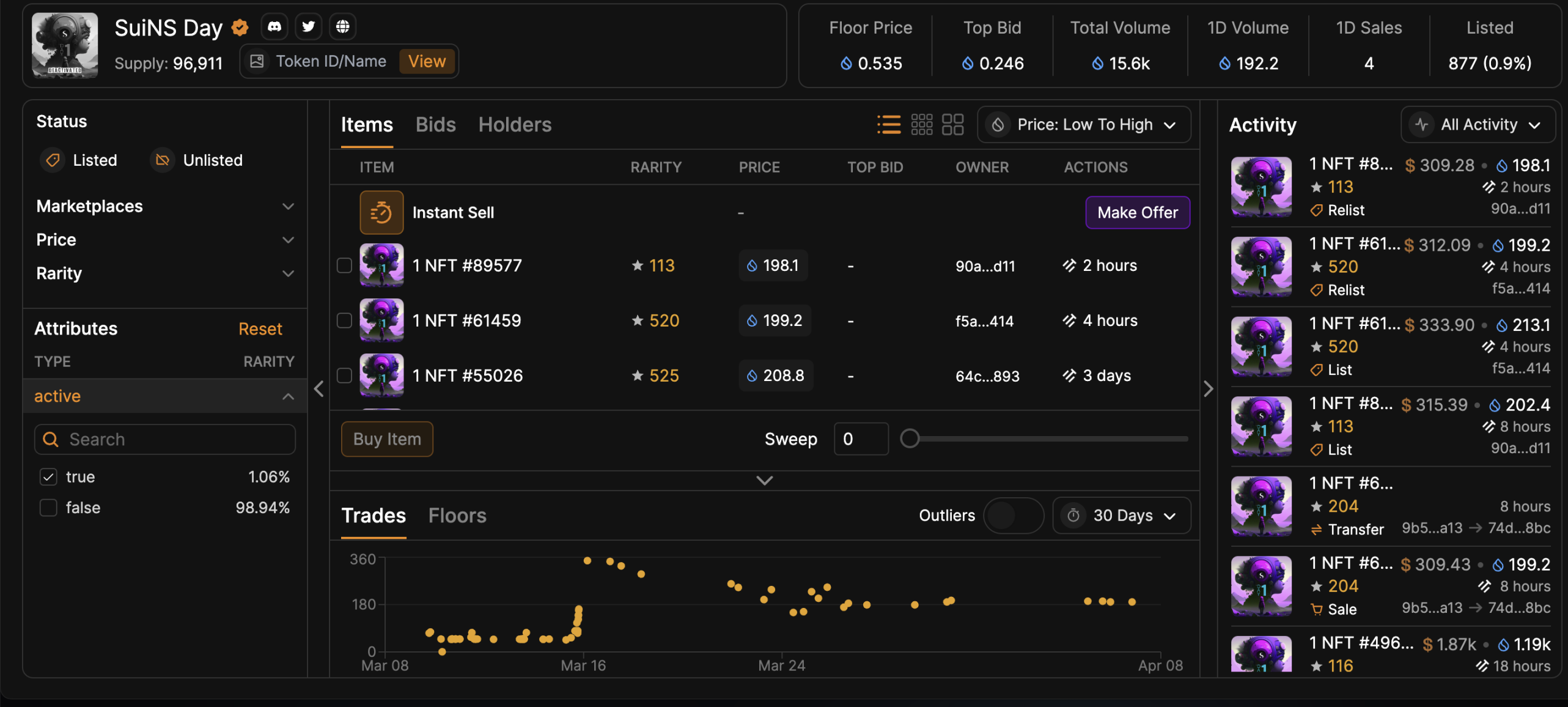

This has once again raised peoples expectations for the SuiNS airdrop. The floor price of activated SuiNS Day NFT, which can obtain the exclusive character of Activated Day 1 NFT in the SuiNS Discord, has soared from less than 50 SUI to nearly 200 SUI.

Related pages of SuiNS Day NFT on tradeport, below is the transaction price trend

Participation Guide

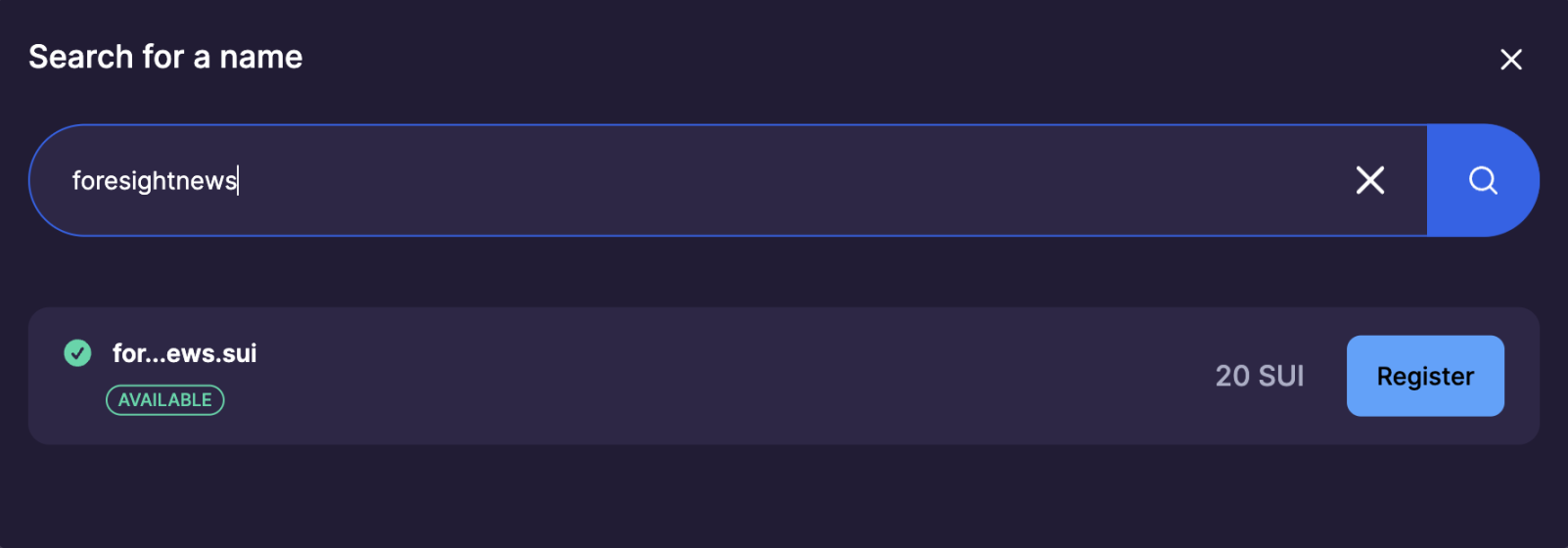

The overall steps are to first become a SuiNS domain name holder, and then enter its Discord for verification.

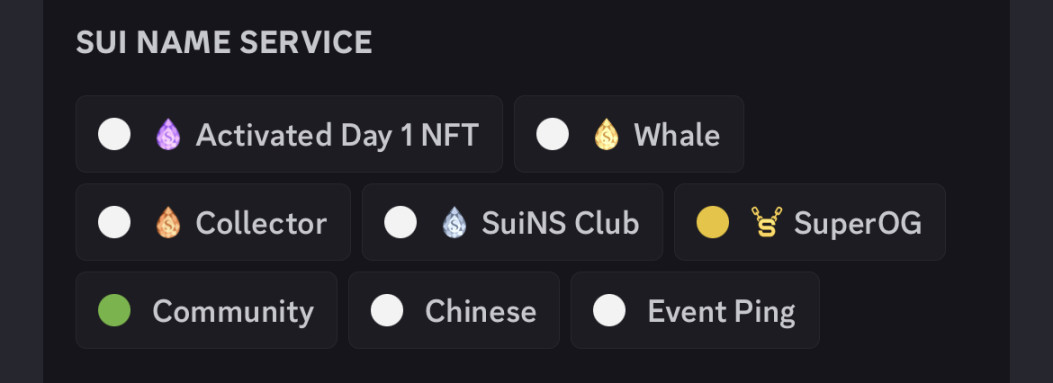

There are 5 types of DC character groups available, including the Activated Day 1 NFT character obtained by holding activated SuiNS Day NFT, the Whale character holding 10 or more domain names, and the Collector holding 5 to 9 domain names. holder role, and the most basic SuiNS Club domain name holder role.

SuiNS Discord role acquisition rules

It should be noted that to become a domain name holder, you do not have to go to the SuiNS official website to register a domain name at a price starting from 20 SUI a year. You can go to NFT trading platforms such as tradeport to buy it at a cheaper price.

Official website price for domain name acquisition

The floor price of domain names in the secondary market

To obtain the Activated Day 1 NFT character, you can purchase the activated SuiNS Day NFT in the NFT market. It should be noted that although unactivated SuiNS Day NFTs are cheaper than activated ones, they are worthless and cannot be activated again. You can set the active feature to true in the market to filter activated NFTs.

After obtaining these domain names and NFTs, enter the SuiNS Discord, verify them in the domain-verify channel, and wait until the corresponding characters successfully appear on the profile page, and youre done.

Role displayed on Discord profile page

Navi

Airdrop clues

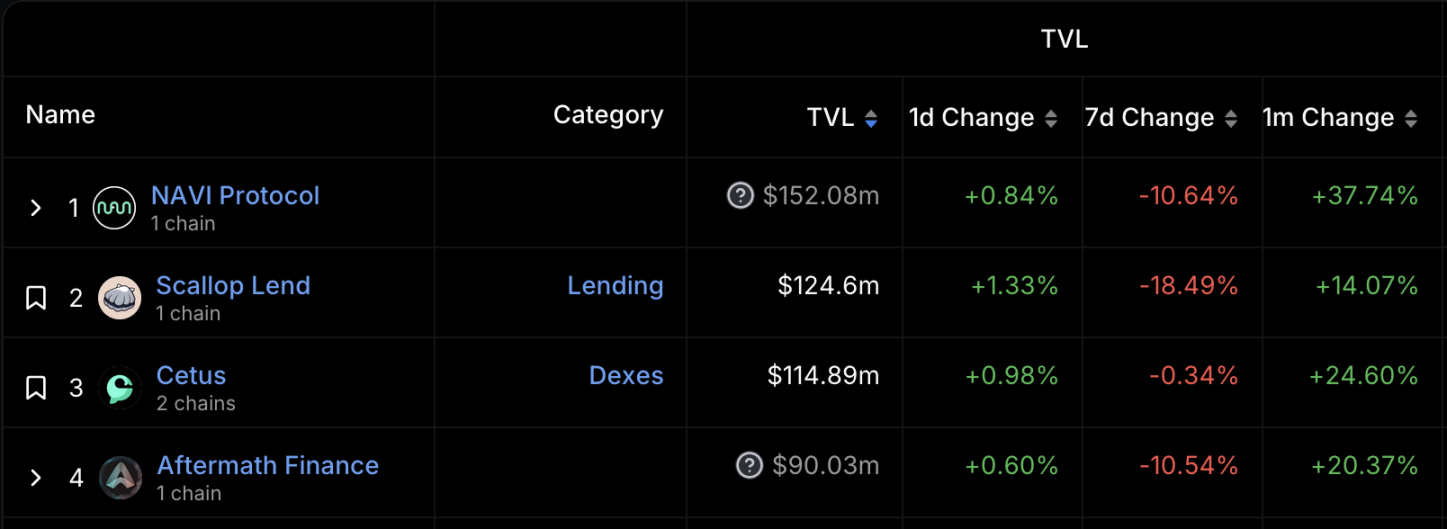

Navi is the largest TVL protocol on Sui, and its main business is lending. Tokens have been issued through IDO on Cetus before, but there has been no token airdrop for users.

Sui Ecological Protocol TVL Ranking on DefiLlama

When the user Wen Daily, his Discord administrator said that there will be a conference in April and there may be big moves.

Navi has an ongoing points system, and its documentation states that points will play a key role in the upcoming and upcoming airdrops.

Participation Guide

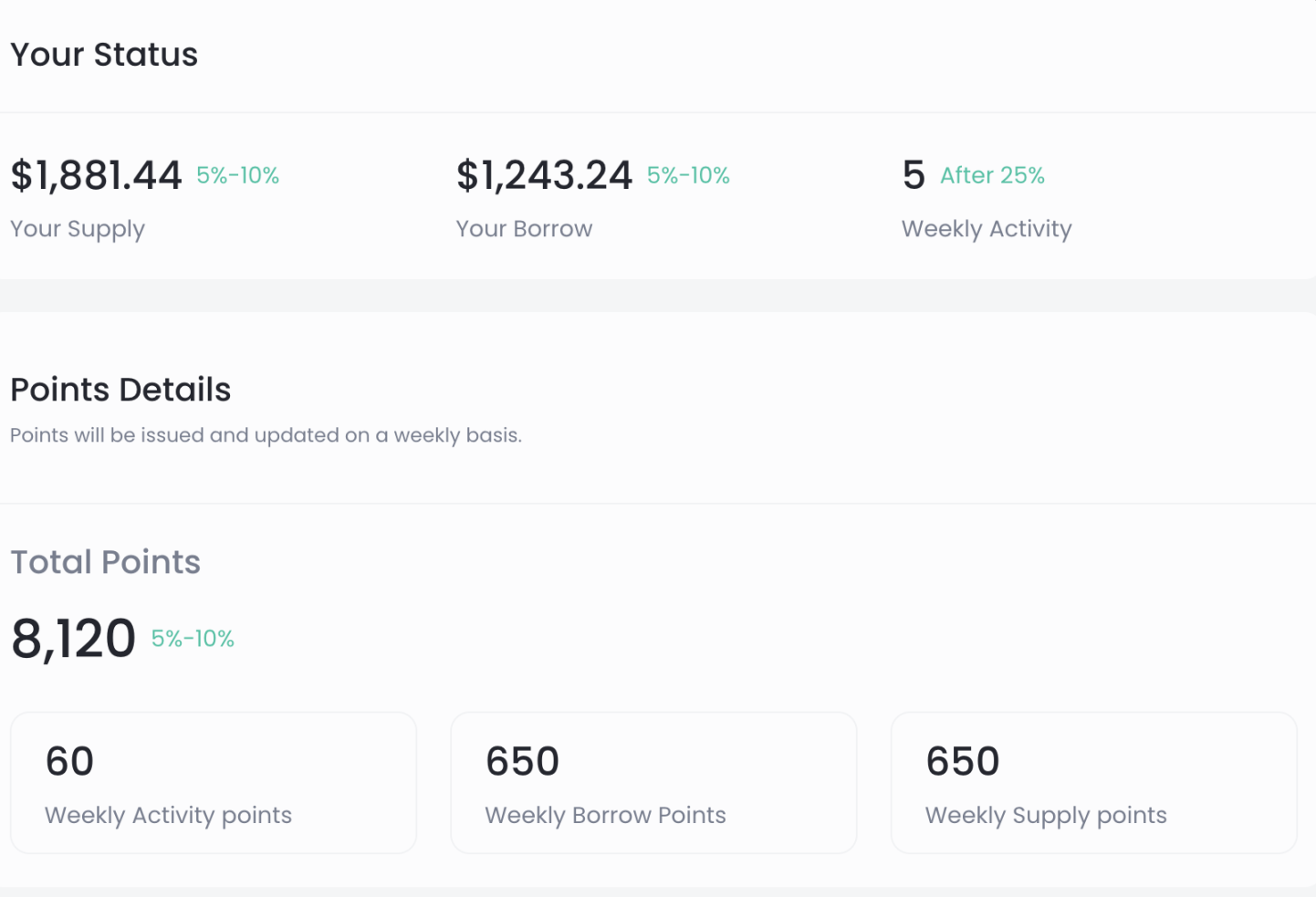

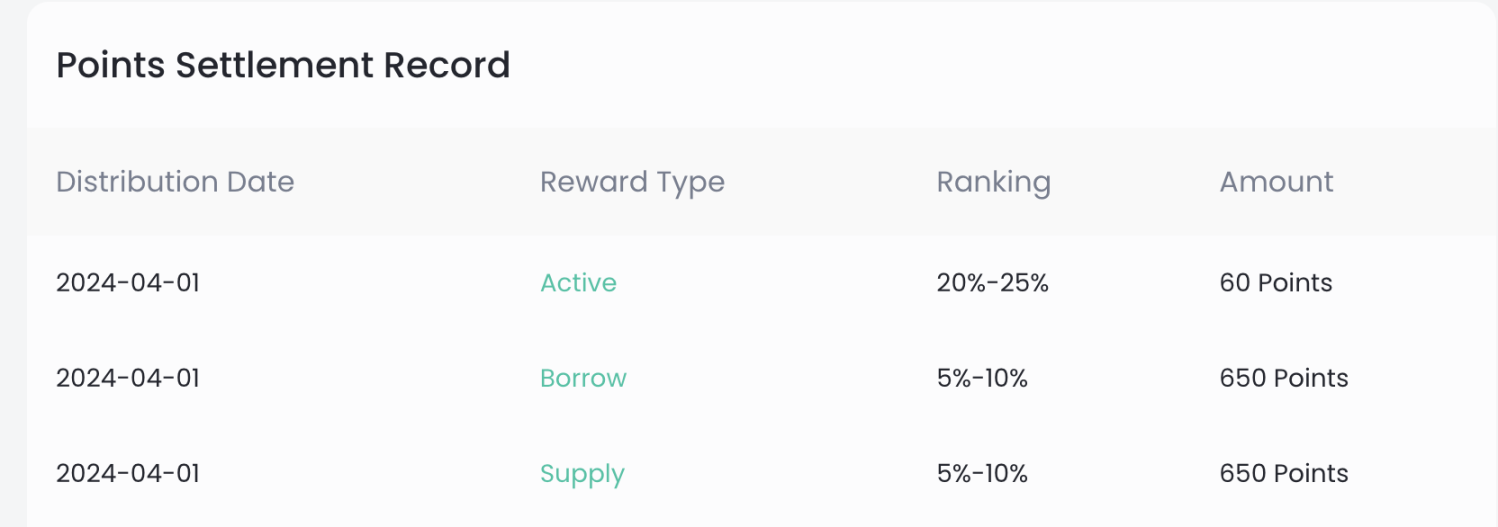

Go to the Navi official website to deposit and borrow. Points will be settled every Monday based on the relative ranking of the deposit and borrowing amounts. The weekly deposit and loan scores are capped at 1,000 points, and the scores are reduced for lower rankings. For example, if you rank between 5% and 10%, you will get 650 points. In addition to depositing and borrowing, there are also active points capped at 200 points per week.

Navis score panel

Navi weekly score settlement

Tip: There are no one-time fees for Navi loans. Smart revolving loans can generate higher points with lower capital. At the same time, the 200 active points every week are easy to obtain. You can get most of the points by collecting deposit rewards in time every day.