BRC20 VS Runes, a battle igniting the Bitcoin ecosystem?

Original|Odaily

Author|Lucaskog

Recently, the BRC 20 protocol is about to be upgraded, coinciding with the upcoming launch of the Runes protocol. The two have re-attracted the markets attention to the Bitcoin ecosystem. Also as a homogeneous token distribution scheme based on the Ordinals protocol, as Bitcoin is about to be halved, who will detonate the Bitcoin ecosystem, Inscription or Rune? Is Runes founder Casey’s claim of a $1 billion market in a month exaggerated? This article explores where the new round of Bitcoin ecological bull market starts by comparatively analyzing the similarities and differences between BRC 20 and Runes protocol.

What are the BRC 20 protocol and the Runes protocol, and what is their relationship?

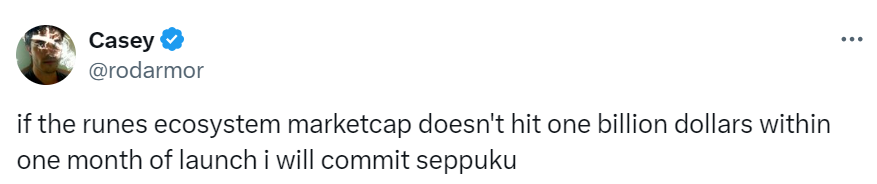

Both BRC 20 and Runes protocols are homogeneous token distribution protocols based on the Ordinals protocol. Since the release of the BRC 20 protocol, many BRC 20 tokens have been produced, including the famous ORDI, SATS, etc. However, due to the limitations of the protocol itself nature, a large number of UTXO sets are generated, too much information is stored on the chain, causing congestion in the Bitcoin memory pool, and the gas continues to increase. The behavior of engraving tokens also has a backlash against the normal operation of the Bitcoin ecosystem. The founder of the Oridnals protocol has publicly expressed dissatisfaction with the BRC 20 protocol and hopes that the community will stop minting BRC 20 tokens.

In order to solve the shortcomings of the BRC 20 protocol, the Runes protocol, which is said to be more concise, announced that it will officially launch the RUNE rune protocol based on the UTXO model after the Bitcoin halving. The Runes protocol differs from the BRC 20 protocol in that all rune balances will be held in unspent UTXOs, so nicelySolve the problem of useless UTXO expanding and spreading, and because it is based on the UTXO model, on the one handCompatible with Lightning Network,on the other handLess reliance on off-chain centralized indexing,betterGuaranteed safety. In fact, compared to the BRC 20 protocol, the Runes protocol has obvious advantages in technology.

Is Runes sure of achieving its ambition of reaching a $1 billion market within a month?

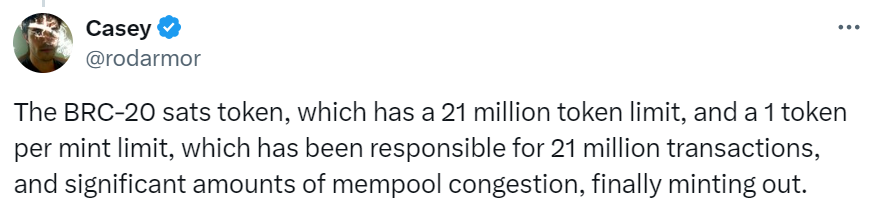

Casey said on social platforms: If the market value of the Rune ecosystem does not reach 1 billion US dollars within one month after launch, I will commit suicide by committing seppuku. Is it likely that this 1 billion US dollar goal will be achieved?

Upgraded BRC 20

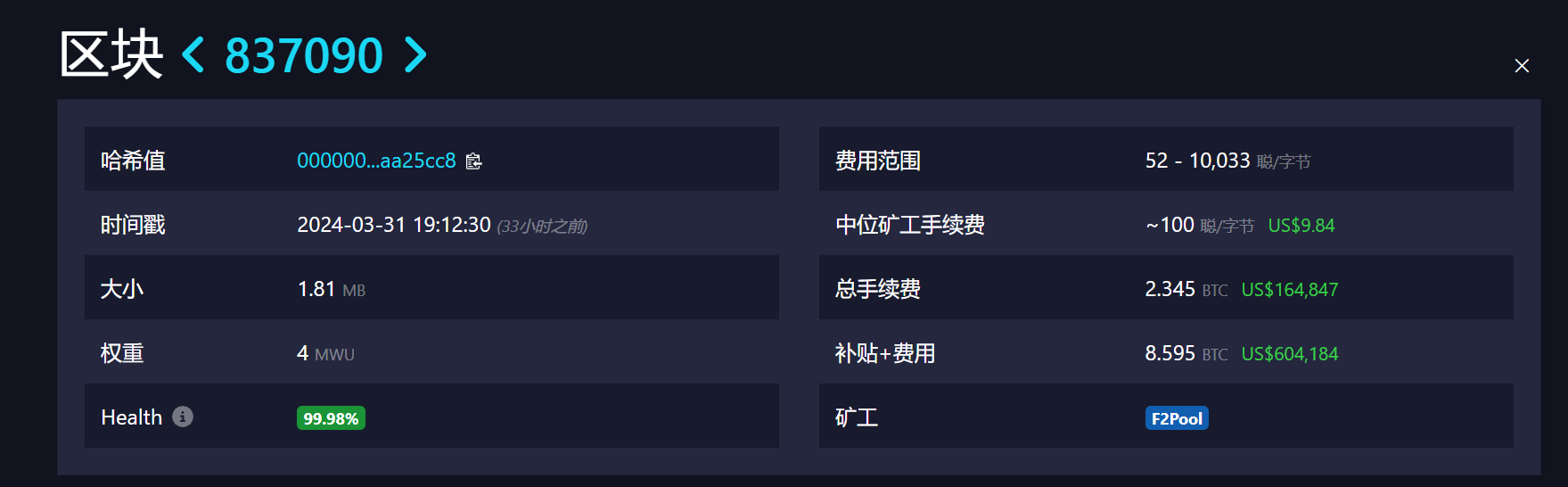

The BRC 20 protocol chooses to upgrade at a time when Runes is about to be launched. Whether it is intentional by the founder domo or not, it means that there will be fierce competition between the two. domo has currently demonstrated updated content in relevant documents, including the introduction of a self-issuing mechanism, modification of deployment inscriptions, adoption of 5-byte code, and establishment of a consensus on the destruction method of BRC-20 assets. This upgrade is currently at block height 837090 Activation, due to the introduction of the self-issuance mechanism, the deployer can choose to complete the mint by himself before deciding how to distribute it to other users, so that the first batch of enthusiasts vying to deploy the five-character token even raised the gas cost to the top Thousand dollars.

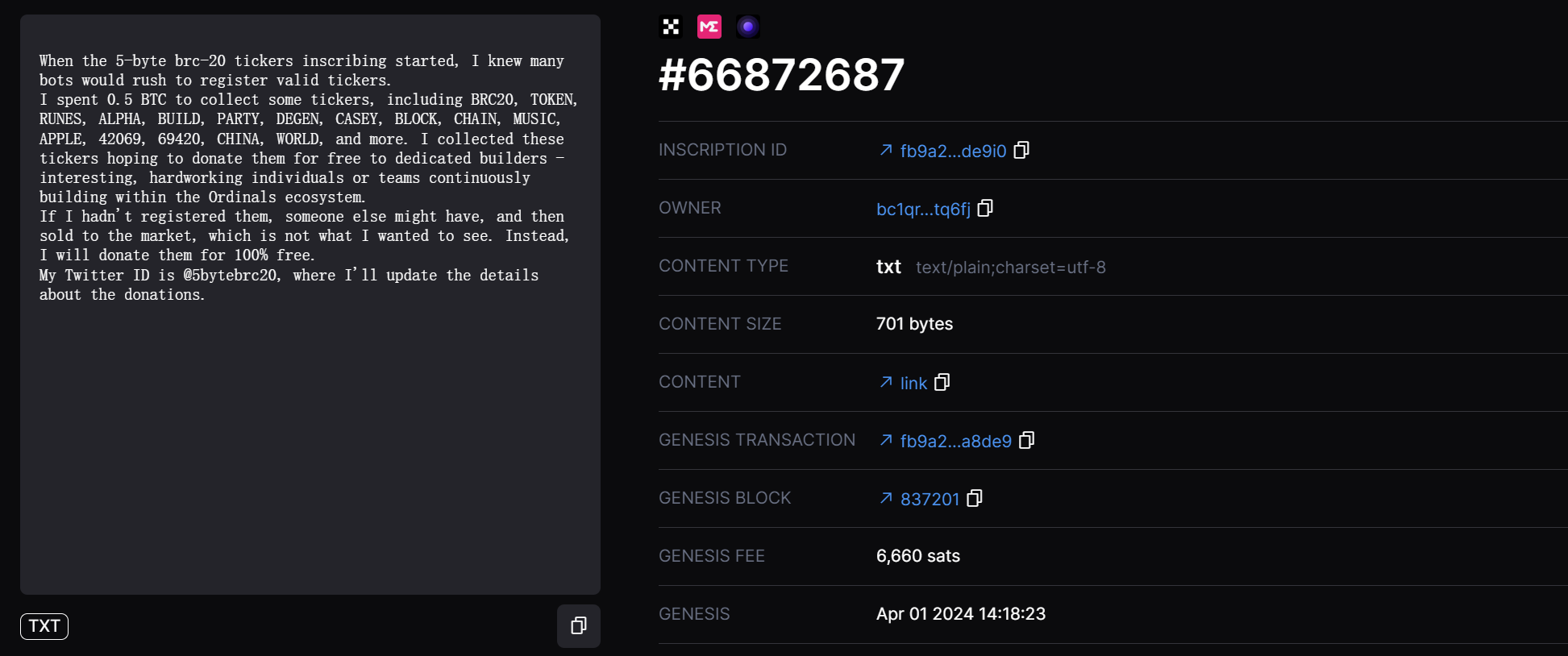

More attentive people discovered that a friend who was rushing to grab chips had engraved in his wallet address The purpose of collecting these tickers is to donate them for free to dedicated builders - interesting and interesting projects that are constantly being built in the Ordinals ecosystem. Hard-working individual or team.” inscription.

However, judging from the current market reaction, except for the competition among the first batch of deployers, there has not yet been a phenomenon-level token similar to ORDI, which means that the performance of the BRC 20 token after this upgrade is temporary. Not as eye-catching as expected.

Runes protocol related projects

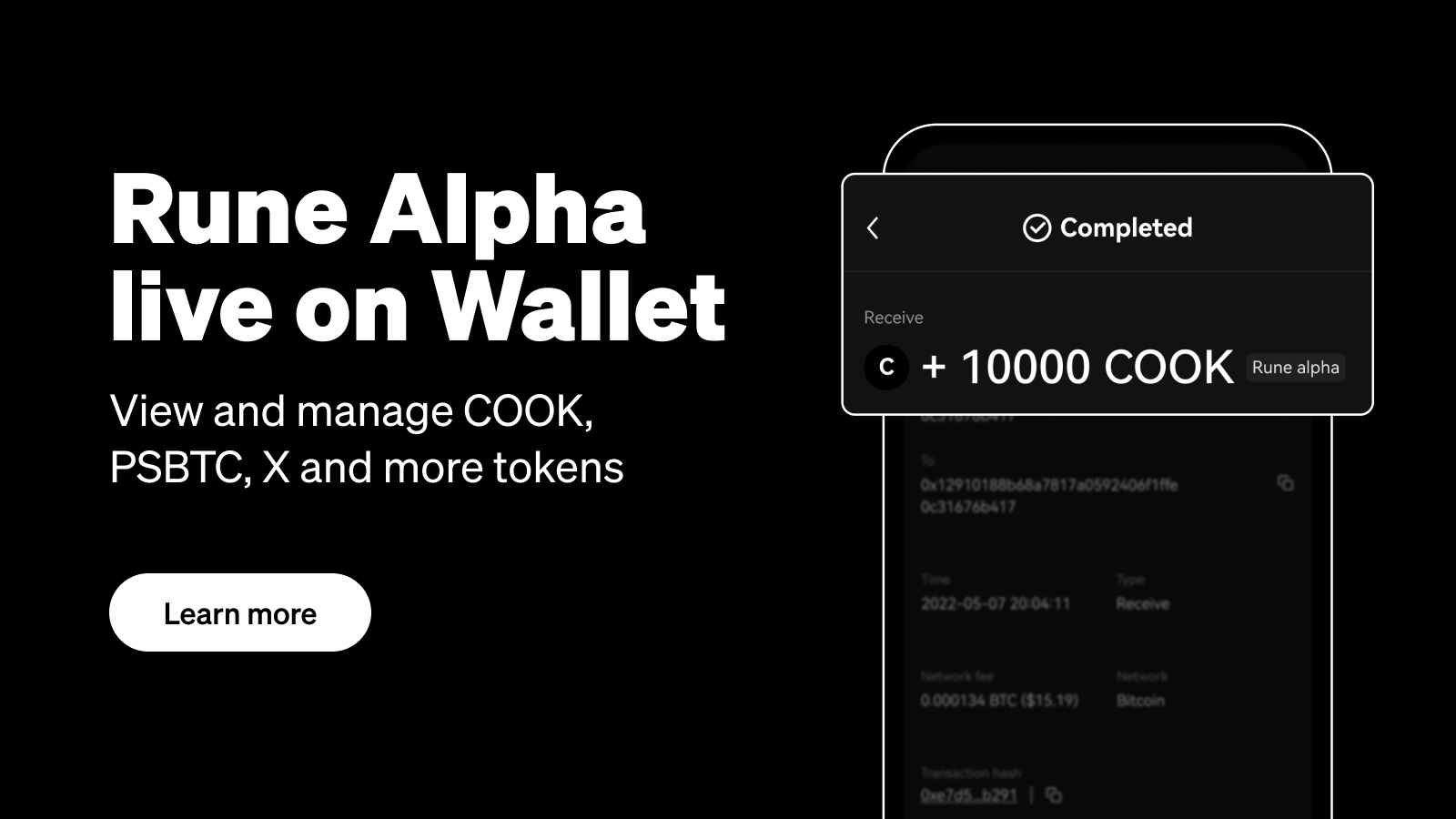

The Runes protocol is expected to be activated at block height 840,000, but before that, a large number of projects related to the Runes protocol have appeared, among which the larger ones include RuneAlpha, Runecoin, Runestone, etc.

This type of project itself is not built based on Runes. For example, RuneAlpha plans to airdrop NFT to users holding $cook tokens after the launch of the Runes protocol; Runecoin uses a rune mining machine method to hold its RISC Rune users will automatically generate points and redeem runes according to the corresponding ratio after the protocol is activated; Runestone is the largest airdrop project since the birth of the Ordinals protocol. It has now become the leader in the rune sector recognized by the community. After going online, the floor price once dropped from 0.012 BTC rose to a maximum of 0.047 BTC, which will also be exchanged for corresponding rune tokens after the protocol is launched.

For now, it seems likely that Caseys seemingly arrogant remarks will come true more than expected. Among them, the market value of Runestone alone has even reached 300 million U.S. dollars. The market value of RuneAlpha’s first token COOK remains above 20 million U.S. dollars. It is also supported by OKX’s public release. The market value of rune mining machine RISC is also more than 10 million U.S. dollars.

It is not difficult to see from the above examples that the market itself has very high expectations for the Runes protocol. When the Runes protocol is officially launched, its simpler, more elegant, and more secure design than the BRC 20 protocol, coupled with the arrival of the Bitcoin halving, the superposition of many factors may trigger a new round of fomo sentiment. If the above phenomenon really occurs, it is likely to lead to an outflow of BRC 20 market funds, making it difficult for the overall BRC 20 market to recover for a long time, except for individual phenomenal BRC 20 tokens.

Can Runes and BRC 20 lead the Bitcoin ecosystem to prosperity?

After the Runes protocol is activated, it is indeed easy to attract some funds to invest in the rune concept in the early stage, creating a prosperous scene in the short term. However, the amount of sparks generated by the collision of inscriptions and runes is not enough to ignite the entire Bitcoin ecosystem. There are many phenomenal memes in the ecosystem such as Solana and Base, which have caused a large part of the funds in the market to be dispersed. It is difficult to support the concept of sustained prosperity solely by relying on the flow of funds within the Bitcoin ecosystem and the entry of a small amount of external investment.

Why do we say that? Let’s look back at several major events that have happened in the Bitcoin ecosystem in recent years. In 2019, Segregated Witness (SegWit) was upgraded to improve transaction speed and effective storage capacity; in 2021, Taproot was upgraded to improve privacy, scalability and security. sex. These two key upgrades paved the way for the arrival of Inscription. When the time comes to 2023, the Ordinals ecology explodes, and the so-called first wave of inscriptions officially begins. Zooming out, we find that besides Ordinals, countless protocols have sprung up. Although the levels vary, there are many such as the Atomics protocol, known as the second protocol of Bitcoin, and the first issuance of tokens based on digital matter theory. (nat) Tap protocol and so on. Each of these protocols has its own understanding of the Bitcoin ecosystem. It is worth mentioning that the Runes protocol was proposed 5 days after the release of the Atomics protocol, and both are built on the UTXO model. Recently, Athur, the founder of Atomics, also said that he will release AVM (Atomic Virtual Machine) around April, aiming to build Bitcoin-native smart contracts, which also has huge competitive potential.

In addition, there are Bitcoin second-layer solutions B² Network, BEVM, etc. The Merlin project has pledged assets worth approximately US$3.5 billion. The Bitcoin ecosystem is developing towards the unprecedented trend of a hundred schools of thought contending. So will there be new protocols that will burst out with power in the future? Will the L2 narrative ultimately fit into the Bitcoin ecosystem? These questions will be answered by time.