YBB Capital: The key to the interconnection of all chains, the full-chain interoperability protocol

Original author: YBB Capital Researcher Zeke

Preface

Since the birth of blockchain, there have been constant disputes."electronic payment system"from the original intention to world computer, high-speed parallelism, and game/financial application chain. Different values and technical differences have evolved hundreds of public chains, and due to its basic characteristics of decentralization, the blockchain itself is a relatively closed and isolated system, unable to perceive the outside world and cannot communicate with the outside world. Chains are like islands and cannot be interconnected. Nowadays, the mainstream narrative of public chains is moving towards a multi-level modularization process. In addition to the execution layer such as Layer 2, we also have the DA layer, the settlement layer, and even the execution layer above the execution layer. Fragmented liquidity and fragmented experience will continue to intensify, and traditional cross-chain bridge solutions are full of hidden dangers.

From the perspective of an ordinary user, the transfer of assets between chains through cross-chain bridges is cumbersome and lengthy. In addition, it may also face the incompatibility of assets, hacker attacks, surge in gas fees, and shortage of liquidity in the target chain. and many other situations. The lack of interoperability between chains not only hinders the large-scale adoption of blockchain, but also makes each public chain more like a hostile tribe or country for many years. The underlying public chains are still making decisions in the triangular problem Disputes continued, and chatter between different levels began over the merits of various plans. As multi-chain and multi-layer parallel development intensifies, traditional cross-chain bridges can no longer meet industry needs, and Web3s demand for full-chain interconnection is imminent. So where has today’s full-chain interoperability protocol developed? How far are we from the next billion users?

What is full-chain interoperability?

In the traditional Internet, it is difficult for us to feel the separation in operating experience. As far as payment scenarios are concerned, we can basically complete payment requests on all web pages using Alipay or WeChat. But in the world of Web3, there are natural barriers between public chains, and the full-chain interoperability protocol is simply a hammer to break down these barriers. Through cross-chain communication solutions, assets and information can be stored in multiple public chains. The purpose is to achieve a seamless experience close to the Web2 level mentioned above, and ultimately achieve the ultimate goal of chain-free or even Intent-Centric (intention).

The realization of full-chain interoperability involves several key challenges, including communication issues between non-homogeneous smart contract chains, non-Wrap method transfer issues of cross-chain assets, etc. In order to solve these challenges, some projects and protocols have proposed innovative solutions, such as LayerZero and Wormhole. We will also analyze these projects below, but before that we also need to understand the specific differences between full chain and cross-chain bridges. Some of the problems of the chain are related to the current cross-chain method.

What has changed across the chain?

Different from transferring assets on a third-party bridge in the past, users need to lock the assets on the source chain and pay Gas. After a long wait, they can receive a wrapped asset (Wrapped Token) on the target chain. Full-chain interoperability protocol It is a new paradigm based on cross-chain technology. It is a communication center that transfers everything including assets through information. This enables interoperability between chains. Take Sushi, which integrates Stargate in exchange routing, as an example. Seamless asset exchange between the source chain and the target chain can be achieved only within Sushi, optimizing the users cross-chain experience to the greatest extent. In the future A more exaggerated use case can also be seamless interoperability in different Dapps on different chains.

Triangle selection and three types of verification

The world of blockchain is always full of choices. Just like the most famous public chain trilemma, cross-chain solutions also have interoperability trilemma. Due to technical and security limitations, cross-chain protocols can only be as follows: Choose two of three key attributes to optimize:

Trustlessness: It does not need to rely on any centralized trust entity and can provide the same level of security as the underlying blockchain. Users and participants do not need to trust any intermediary or third party to ensure the security and correct execution of transactions;

Extensibility: The protocol can be easily adapted to any blockchain platform or network and is not restricted by specific technical architecture or rules. This allows interoperability solutions to support a broad blockchain ecosystem rather than just a few specific networks;

Generalizability: The protocol can handle any type of cross-domain data or asset transfer, not just limited to specific transaction types or assets. This means that through this bridge, different blockchains can exchange various types of information and values, including but not limited to cryptocurrencies, smart contract calls, and other arbitrary data.

The early classification of cross-chain bridges was generally based on Vitalik and others. They divided cross-chain technologies into three categories: hash time lock, witness verification, and relay verification (light client verification). However, later according to Connext founder Arjun According to Bhuptanis division, cross-chain solutions can be divided into native verification (no trust + scalability), external verification (scalability + versatility), and native verification (no trust + versatility). These verification methods are based on different trust models and technology implementations to meet different security and interoperability requirements.

Natively Verified:

The local verification bridge relies on the consensus mechanism of the source chain and the target chain itself to directly verify the validity of the transaction. This approach does not require additional layers of verification or intermediaries. For example, some bridges might leverage smart contracts to create verification logic directly between two blockchains, allowing the two chains to confirm transactions through their own consensus mechanisms. The advantage of this approach is increased security, as it relies directly on the inherent security mechanisms of the participating chains. However, this approach can be more technically complex to implement, and not all blockchains support direct local verification.

Externally Verified:

Externally validated bridges use a third-party validator or cluster of validators to confirm the validity of transactions. These validators may be independent nodes, consortium members, or some other form of participants that operate outside of the source and target chains. This approach typically involves cross-chain messaging and verification logic that is performed by external entities rather than being handled directly by the participating blockchains themselves. External verification allows for wider interoperability and flexibility because it is not restricted to a specific chain, but it also introduces an additional layer of trust and potential security risks. (Although there is a huge risk of centralization, external verification is the most mainstream cross-chain method. In addition to being flexible and efficient, it is also low-cost.)

Locally Verified:

Native verification refers to the target chain verifying the status of the source chain in cross-chain interactions to confirm transactions and execute subsequent transactions locally. Common practice is to run the light client on the source chain of the target chain VM, or both in parallel. Native verification requires an honest minority or synchronization assumption, at least one honest relayer on the committee (i.e. an honest minority), or if the committee cannot function properly, users must transmit transactions themselves (i.e. a synchronization assumption). Native verification is the cross-chain communication method with the highest degree of trust minimization, but it is also very costly, has low development flexibility, and is more suitable for blockchains with high state machine similarity, such as Ethereum and L2 networks. between, or between blockchains developed based on Cosmos SDK.

different types of solutions

As one of the most important infrastructures in the Web3 world, the design of cross-chain solutions has always been a thorny issue, which has led to the emergence of different types of solutions. Judging from the current solutions, they can actually be classified into five categories, each of which adopts a unique approach. To realize asset exchange, transfer and contract call. 1

Token exchange: allows users to trade an asset on one blockchain and receive another asset of equal value on another chain. By utilizing technologies such as atomic swaps and cross-chain market makers (AMM), liquidity pools can be created on different chains to realize exchanges between different assets;

Asset Bridge: This method involves locking or destroying assets through smart contracts on the source chain, and unlocking or creating new assets through corresponding smart contracts on the target chain. This technology can be further divided into three types based on how the asset is processed:

Locking/minting mode: In this mode, the assets on the source chain are locked, and equivalent bridging assets are minted on the target chain. When the reverse operation is performed, the bridging assets on the target chain are destroyed to unlock the source chain. the original assets;

Destruction/minting mode: In this mode, the assets on the source chain are destroyed, and the same amount of the same assets is minted on the target chain;

Lock/unlock model: This method involves locking an asset on the source chain and then unlocking the equivalent asset in a liquidity pool on the target chain. Such asset bridges often attract liquidity by offering incentives such as revenue sharing;

Native payment: allows applications on the source chain to trigger payment operations using native assets on the target chain, and can also trigger cross-chain payments on another chain based on data on one chain. This method is mainly used for settlement, which can be based on blockchain data or external events;

Smart contract interoperability: allows smart contracts on the source chain to call smart contract functions on the target chain based on local data to implement complex cross-chain applications, including asset exchange and bridging operations;

Programmable Bridge: This is an advanced interoperability solution that combines asset bridging and messaging capabilities. When assets are transferred from the source chain to the target chain, contract calls on the target chain can be immediately triggered to implement a variety of cross-chain functions, such as equity pledge, asset exchange, or storing assets in smart contracts on the target chain.

Layer Zero

As the most famous project in the full-chain interoperability protocol, Layer Zero has attracted many well-known crypto capitals such as a16z, Sequoia Capital, Coinbase Ventures, Binance Labs and Multicoin Capital, and completed three rounds of financing totaling US$315 million. . In addition to the attractiveness of the project itself, it is not difficult to see the important position of the full-chain track in the minds of top capital. But aside from these auras, Layer Zero has been a highly controversial project in the past. It has often been criticized by people around the issues of centralized evil and ecological defects. But let’s put aside these halos and prejudices today and analyze whether Layer Zero’s architecture has the potential to open up the entire chain.

Cross-chain without trust: As mentioned above, the most mainstream cross-chain bridge solutions in the past used pure external verification. However, since trust will be transferred to off-chain verification, security will be greatly reduced (most of the thunder cases Multi-signature bridges are all for this reason, hackers only need to target the place where the assets are kept). In contrast, LayerZero transforms the verification architecture into two independent entities - oracles and repeaters, to make up for the shortcomings of external verification in the simplest way. The independence between the two should theoretically provide a completely trustless and secure cross-chain communication environment, but the problem is that hackers can also target oracles and relays to do evil. In addition, oracles and Relayers also have the possibility of centralized cooperation to cause evil, so Layer Zero’s so-called trustless cross-chain seems to still have many logical loopholes in the V1 version. However, decentralized verification networks (DVNs) will be introduced in the V2 version to improve the verification method, which we will mention below.

LayerZero endpoint: The LayerZero endpoint is a key element of the overall protocol functionality. While oracles and relays in V1 and DVNs in V2 are primarily responsible for message verification and fraud prevention, the endpoints are smart contracts that enable the actual exchange of messages between the native environments of the two blockchains. Each endpoint on a participating blockchain consists of four modules: Communicators, Validators, Networks, and Libraries. The first three modules enable the core functionality of the protocol, while the Libraries module allows developers of the protocol to extend its core functionality and add blockchain-specific custom functions. These custom libraries allow LayerZero to adapt to diverse blockchains with different architectures and virtual machine environments. For example, LayerZero is able to support EVM-compatible networks and non-EVM chains.

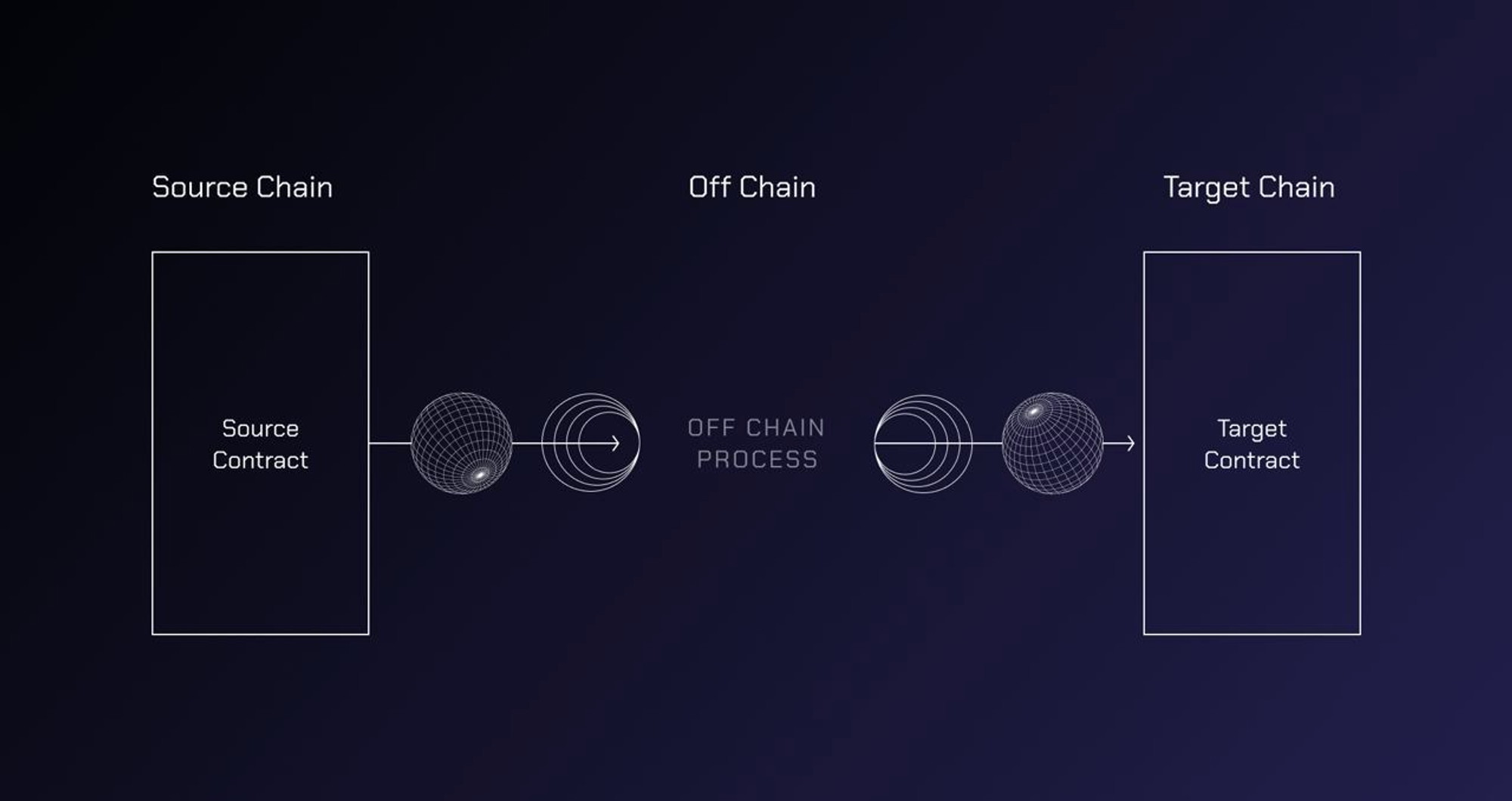

Working principle: The core of the LayerZero communication system relies on endpoints. Through the first three modules above, it forms the infrastructure for cross-chain messaging. The process starts with an application on one blockchain (Chain A) sending a message and involves passing the transaction details, target chain identifier, payload and payment information to the communicator. The communicator then compiles this information into a packet and forwards it to the validator along with other data. At this point, the validator cooperates with the network to initiate the transfer of the block header of chain A to the target chain (chain B), while instructing the relay to obtain the transaction proof in advance to ensure the authenticity of the transaction. The oracle and relayer are responsible for retrieving the block header and transaction proof respectively, and then transmit this information to the Network contract of chain B, which in turn passes the block hash to the validator. After verifying that the packet and transaction proof provided by the relay are correct, it forwards the message to the communicator of chain B. Finally, the smart contract delivers the message to the target application on chain B, completing the entire cross-chain communication process.

In LayerZero V2, oracles will be replaced by decentralized verification networks (DVNs), which has solved the criticized problems of off-chain entity centralization and insecurity. At the same time, relays are replaced by executors, whose role is limited to only executing transactions and is not responsible for verification.

Modular and extensible: Developers can extend LayerZero’s core functionality on the blockchain using Libraries modules, which are part of the protocol’s set of smart contracts. Libraries allow new functionality to be implemented in a blockchain-specific manner without modifying the core LayerZero code. The protocol is also highly scalable as it uses a lightweight messaging setup for cross-chain communication. Simple User Experience A key feature of LayerZero is its user-friendliness. Cross-chain operations using this protocol can be performed as a single transaction, eliminating the need for token wrapping and unpacking procedures typically associated with traditional crypto bridge asset transfers. Therefore, the user experience is similar to exchanging or transferring tokens on the same chain.

LayerZero Scan: Given the nearly 50 public chains and Layer 2 supported by LayerZero, tracking messaging activity on LayerZero is no easy task. This is where LayerZero Scan comes in handy. This cross-chain browser application allows you to see protocol message exchanges on all participating chains. The browser allows you to view message activity by source chain and target chain separately. You can also explore transaction activity by each DApp using LayerZero.

OFT (Omnichain Fungible Token): OFT (Omnichain Fungible Token) standard, which allows developers to create tokens with native-level functionality across multiple chains. The OFT standard involves burning tokens on one chain while simultaneously minting a copy of the token on the target chain. Meanwhile, the original OFT token standard can only be used with EVM-compatible chains. LayerZero extended the standard in the latest version of OFT V2 to support non-EVM platforms.

ONFT (full chain non-fungible token): ONFT is a non-fungible version of the OFT standard. NFTs created based on the ONFT standard can be transferred and stored on a native level between chains that support the standard.

Wormhole

Wormhole, like Layer Zero, is a member of the full-chain protocol track and has begun to show its prowess in recent airdrop activities. The protocol was first launched in October 2020 and has currently shifted from the V1 version of the two-way token bridge. It is now possible to build native cross-chain applications covering multiple chains. The most famous incident in the early days of the protocol was that the protocol suffered a hacker attack on February 3, 2022, resulting in the theft of $360 million in ETH, but Wormhole replenished the funds in less than 24 hours (source unknown), Recently, it announced a financing of up to US$225 million. So what is the magic power of Wormhole that makes it so popular with capital?

Precision Hits: Wormholes targets are not primarily EVM-types, but non-EVM-types. Wormhole is the only mainstream full-chain protocol that supports heterogeneous public chains such as Solana and Move series (APT, SUI). With the continuous recovery and explosion of the two ecosystems, it is inevitable for Wormhole to stand out.

Working principle: The core of Wormhole is the Verifiable Action Approval (VAA) cross-chain protocol and 19 Guardian nodes (Wormhole chooses well-known institutions in the industry as guardian nodes, but it is often criticized for this), and through each chain The Wormhole Core Contract converts the request into VAA to complete the cross-chain. The specific process is as follows:

Event occurrence and message creation: Specific events (such as asset transfer requests) that occur on the source chain are captured and encapsulated into a message. This message details what happened and what action needs to be taken;

Guardian node monitoring and signature: The 19 Guardian nodes in the Wormhole network are responsible for monitoring cross-chain events. When these nodes detect events on the source chain, they verify the event information. After the verification is passed, each Guardian node uses its own private key to sign the message, indicating verification and approval of the event (two-thirds of the nodes need to agree);

Generate Verifiable Action Approval (VAA): Once a sufficient number of Guardian nodes sign a message, these signatures are collected and packaged into a VAA. VAA is a verifiable approval of the occurrence of an event and its cross-chain request, containing the details of the original event and the signature certificate of the Guardian node;

Cross-chain transfer of VAA: VAA is then sent to the target chain. On the target chain, Wormhole Core Contract is responsible for verifying the authenticity of VAA. This includes checking the Guardian node signatures included in the VAA to ensure they were generated by a trusted node and that the message has not been tampered with;

Perform cross-chain operations: Once the Wormhole contract on the target chain verifies the validity of the VAA, it will perform the corresponding operations according to the instructions in the VAA. This may include creating new tokens, transferring assets, performing smart contract calls, or other custom operations. In this way, events on the source chain can trigger corresponding reactions on the target chain.

Security Modules: Wormhole is developing three main internal security features: supervision, accounting, and emergency shutdown, all in a public environment to provide insight into how they will ultimately be implemented. These features are awaiting completion of development and adoption by guardians. 2

Supervision: This function is implemented at the guardian/oracle level, allowing the guardian to monitor the value flow on any regulated chain within a certain time window. The guardian sets an acceptable flow limit for each chain. Once this limit is exceeded, excess asset flow will be blocked;

Accounting: This function is implemented by guardians or oracles, which maintain their own blockchain (aka wormchain) as a cross-chain ledger between different chains. This ledger not only makes the guardian an on-chain validator, but also acts as an accounting plug-in. The guardian can reject cross-chain transactions where the original chain has insufficient funds (this verification is independent of the smart contract logic);

Shutdown: This feature is implemented on-chain and allows guardians to suspend the flow of assets on the bridge through consensus when they perceive a potential threat to the cross-chain bridge. The current implementation is implemented through on-chain function calls.

Fast integration: Wormholes Connect product provides a simple bridging tool for applications that can integrate the Wormhole protocol to achieve cross-chain functionality with just a few lines of code. The main function of Connect is to provide developers with a set of simplified integration tools, allowing developers to integrate Wormholes encapsulation and native asset bridging functions into their own applications with just a few lines of code. For example, an NFT marketplace wants to bridge its NFTs from Ethereum to Solana. Using Connect, the marketplace can provide its users with a simple and fast bridging tool within its app, allowing them to freely move their NFTs between the two chains.

Messaging: In a diverse blockchain ecosystem, messaging has become a core requirement. Wormholes Messaging product provides a decentralized solution that allows different blockchain networks to exchange information and value safely and easily. The core function of Messaging is cross-chain information transfer, and it is equipped with a simplified integration method to accelerate the growth of users and liquidity, and has a high degree of security and decentralization. For example, lets say a DeFi project runs on Ethereum but wants to be able to interact with another project on Solana. Through Wormholes Messaging, the two projects can easily exchange information and value without complex intermediate steps or third-party intervention.

NTT Framework: NTT Framework (Native Token Transfers) provides an innovative and comprehensive solution for transferring native Tokens and NFTs across blockchains through Wormhole. NTT allows tokens to retain their inherent properties during cross-chain transfers, and supports direct cross-chain transfer of tokens without going through a liquidity pool, thus avoiding LP fees, slippage or MEV risks. In addition to integration with any token contract or standard and protocol governance process, project teams can maintain ownership, upgrade rights, and customizability of their tokens.

Conclusion

Although the full-chain interoperability protocol is still in its early stages, the overall implementation process faces risks of security and centralization, and the user experience cannot be compared with the Internet ecosystem of Web2. However, compared with the early cross-chain bridge technology, the current solution has made significant progress. In the long run, the full-chain interoperability protocol is a grand narrative that integrates thousands of chain islands. Especially in the modular era that pursues extreme speed and cost-effectiveness, the full-chain protocol is undoubtedly a key link between the past and the future, and it is also our A track that must be focused on.

references

1. Understand blockchain interoperability in one article:https://blog.chain.link/blockchain-interoperability-zh/

2. Potential analysis of new cross-chain force-wormhole:https://www.binance.com/zh-TC/feed/post/4142724308034

3. Learn about the general cross-chain information transfer protocol Wormhole in one article:https://wormholechina.medium.com/ One article to learn about the universal cross-chain information transfer protocol-wormhole-c 88 ffd 14540 c

4.Wormhole introduces native token transfer (NTT):https://wormholechina.medium.com/wormhole - Introducing native token transfers - ntt - A new open framework - for making any token native multi-chain - 7 a 2c bb 20 bee 6

5.Sushi’s cross-chain swap:https://www.sushi.com/blog/sushi-xswap-a-crosschain-dex

6.What Is LayerZero: Revolutionizing Omnichain Interoperability:https://learn.bybit.com/blockchain/what-is-layerzero/

7. The future of cross-chain bridges: Full-chain interoperability has become inevitable, and liquidity bridges will decline:https://medium.com/@eternal1 997 L/The future of cross-chain bridges-Full-chain interoperability is inevitable-Liquidity bridges will decline-abf 6 b 9 b 55 fbc

8. The disadvantages behind the LayerZero airdrop craze:https://www.chaincatcher.com/article/2091995