Gryphsis加密货币周报:自比特币ETF通过后,BTC价格下跌超15%

Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMedium, for deeper research and insights.

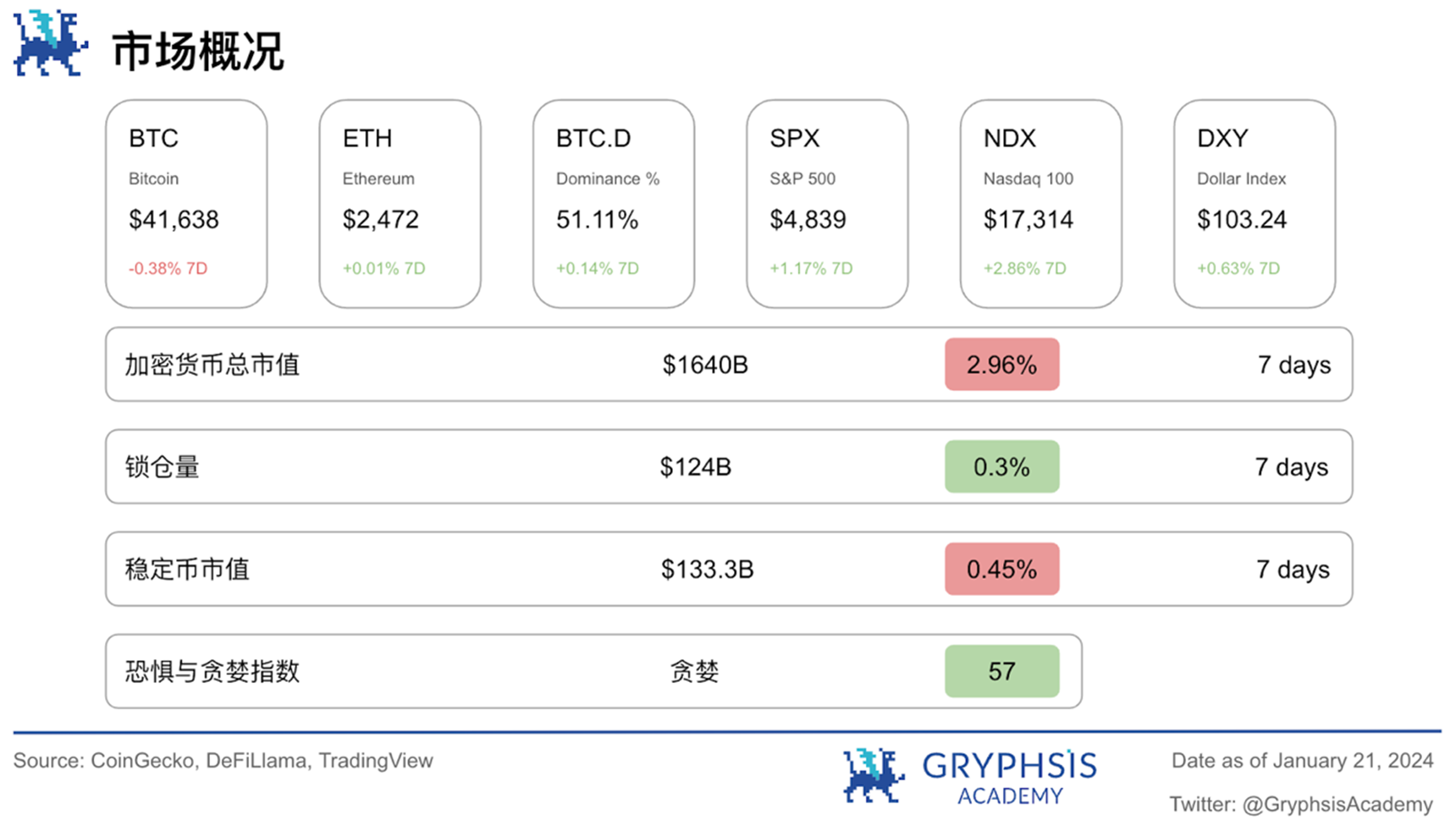

Market and industry snapshots

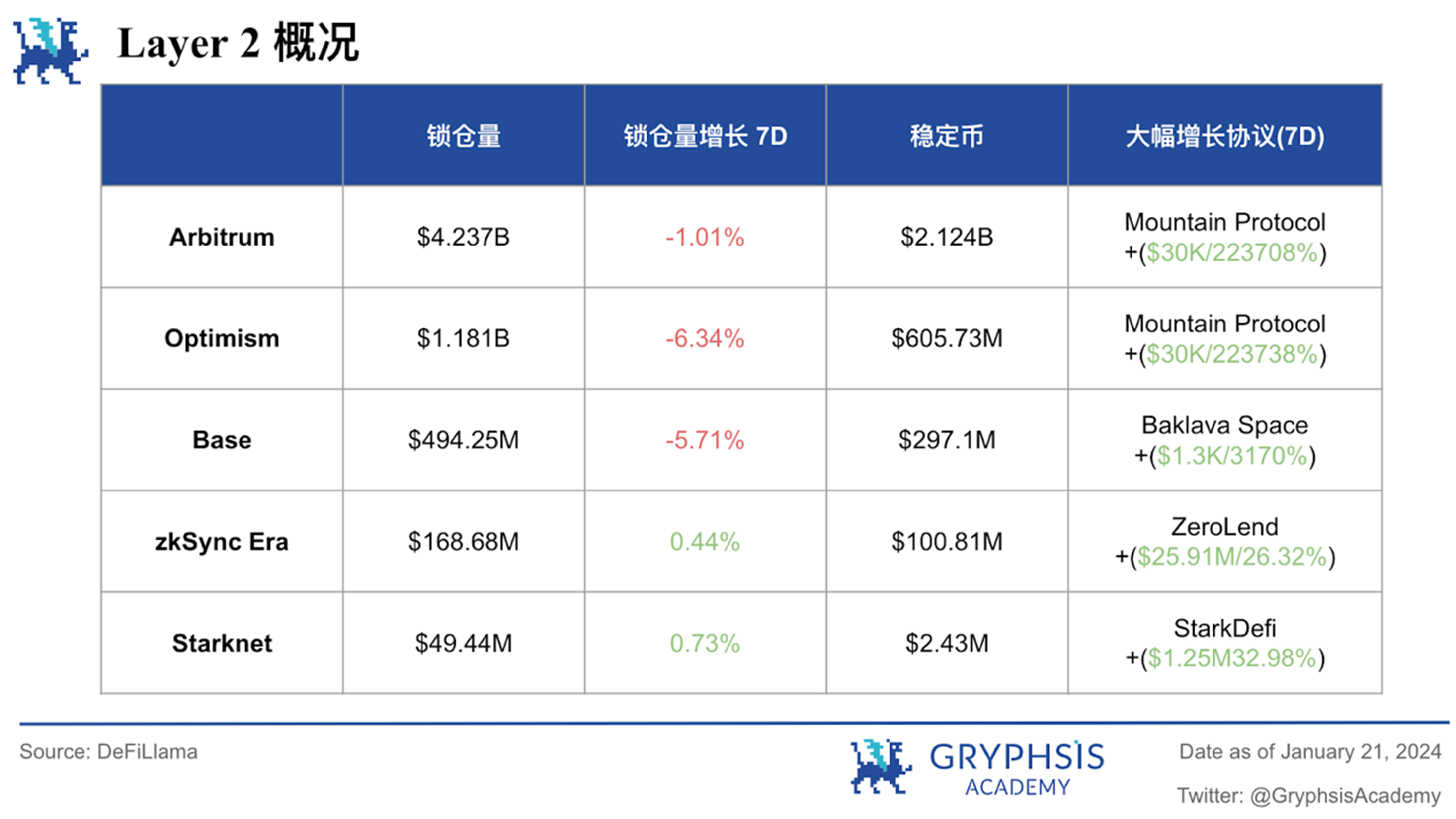

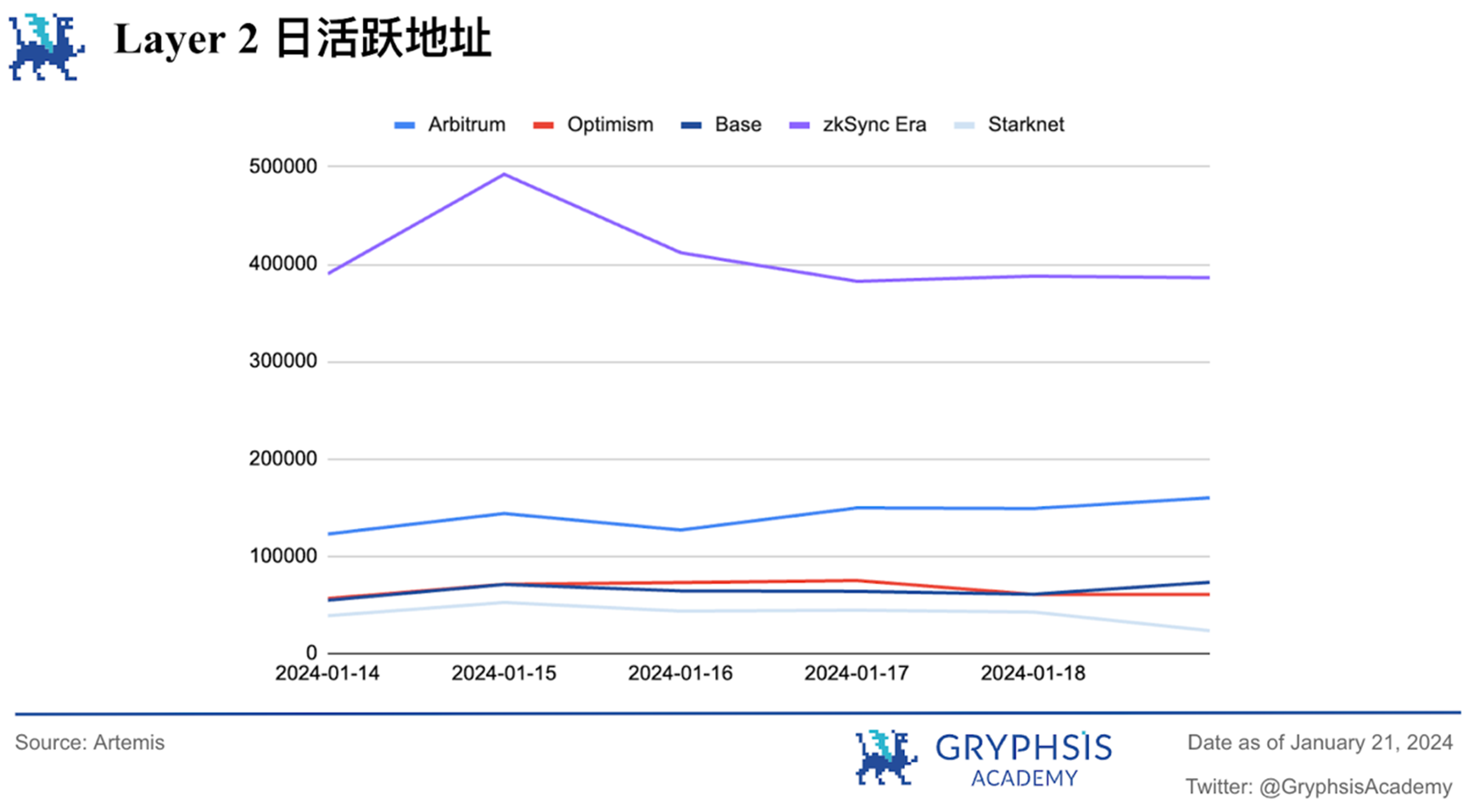

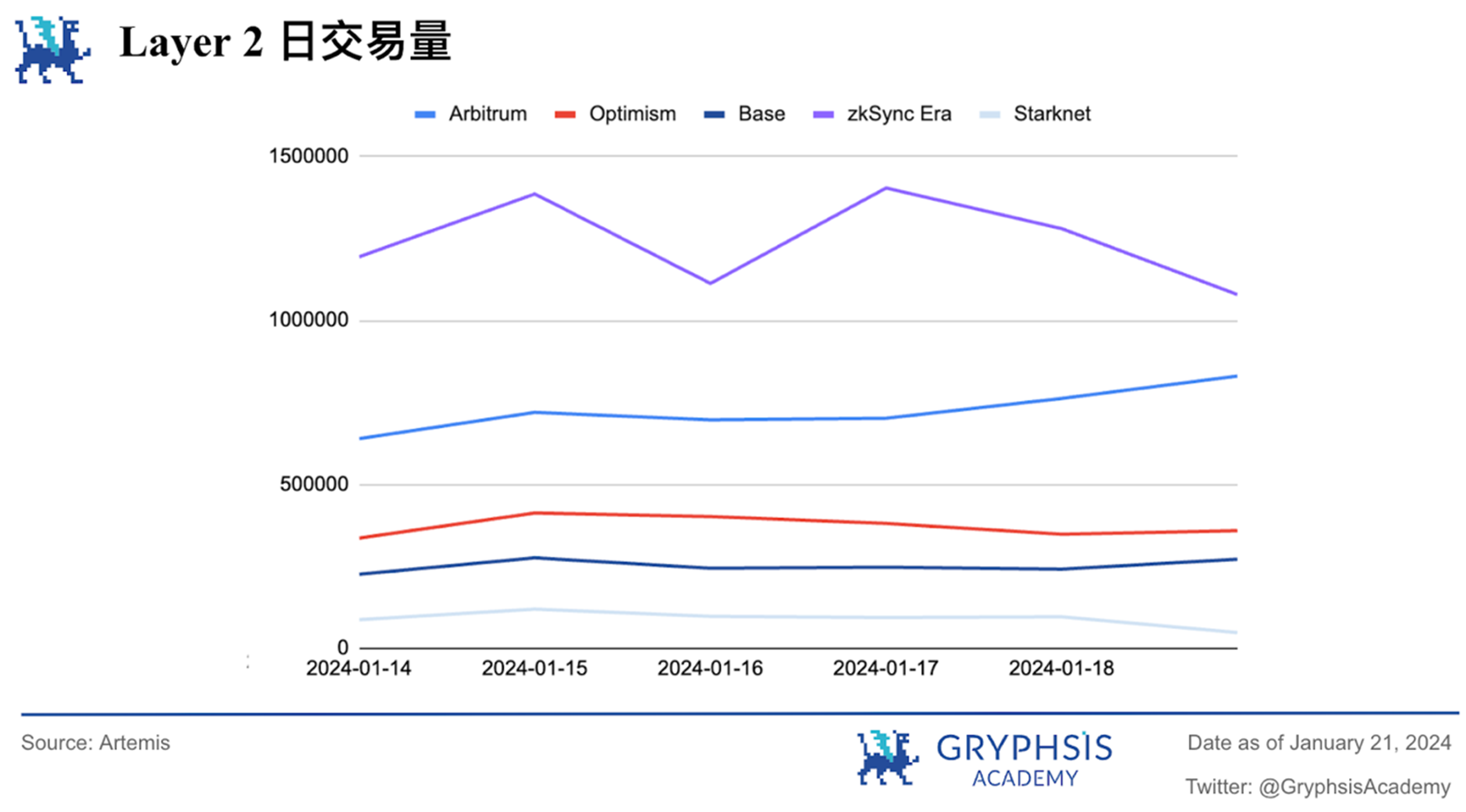

Layer 2 Overview:

Last week, Layer 2 showed a downward trend except for zkSync Era and Starknet, but the increase in both was not obvious. Protocols like Mountain Protocol, Baklava Space, ZeroLend, and StarkDefi have demonstrated noteworthy TVL growth rates.

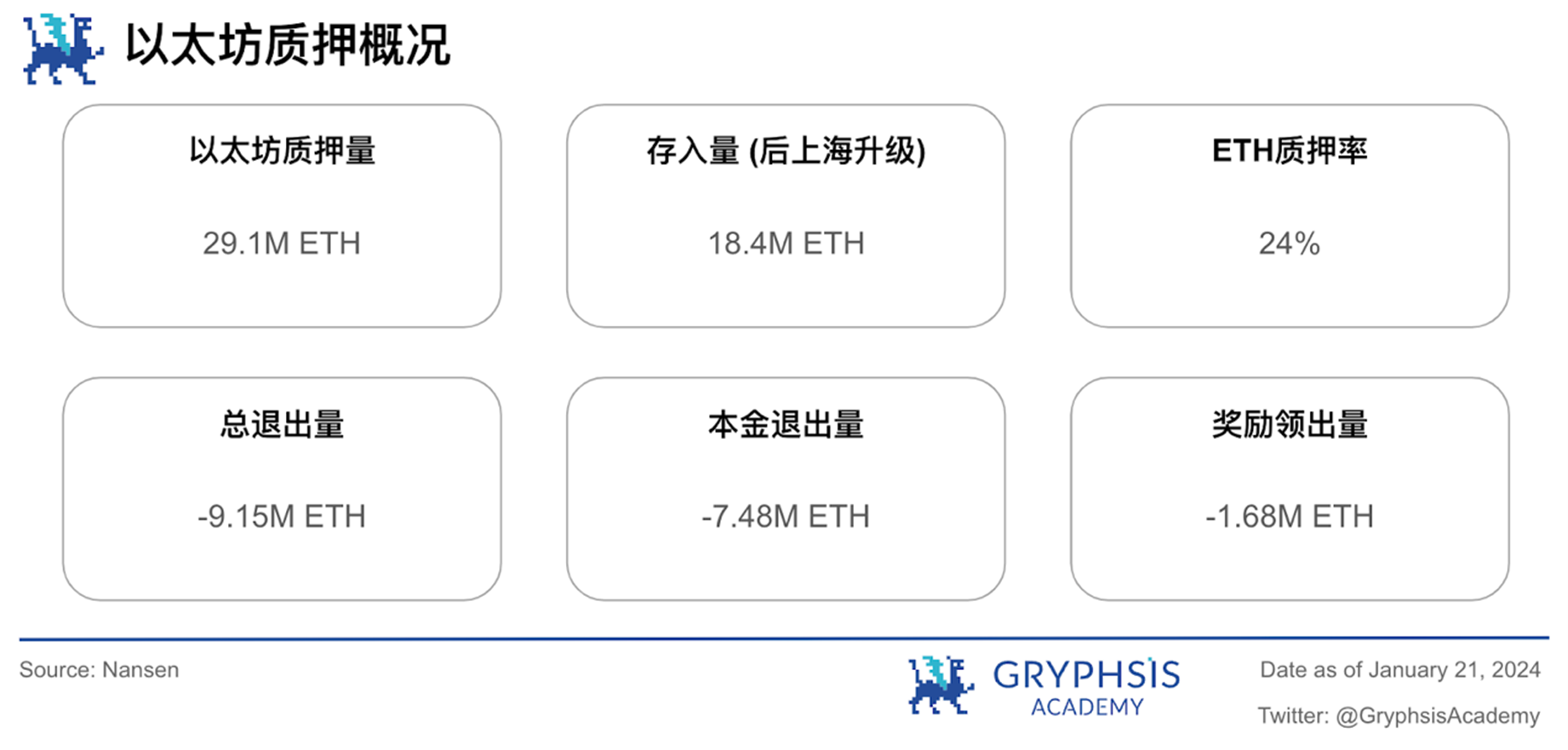

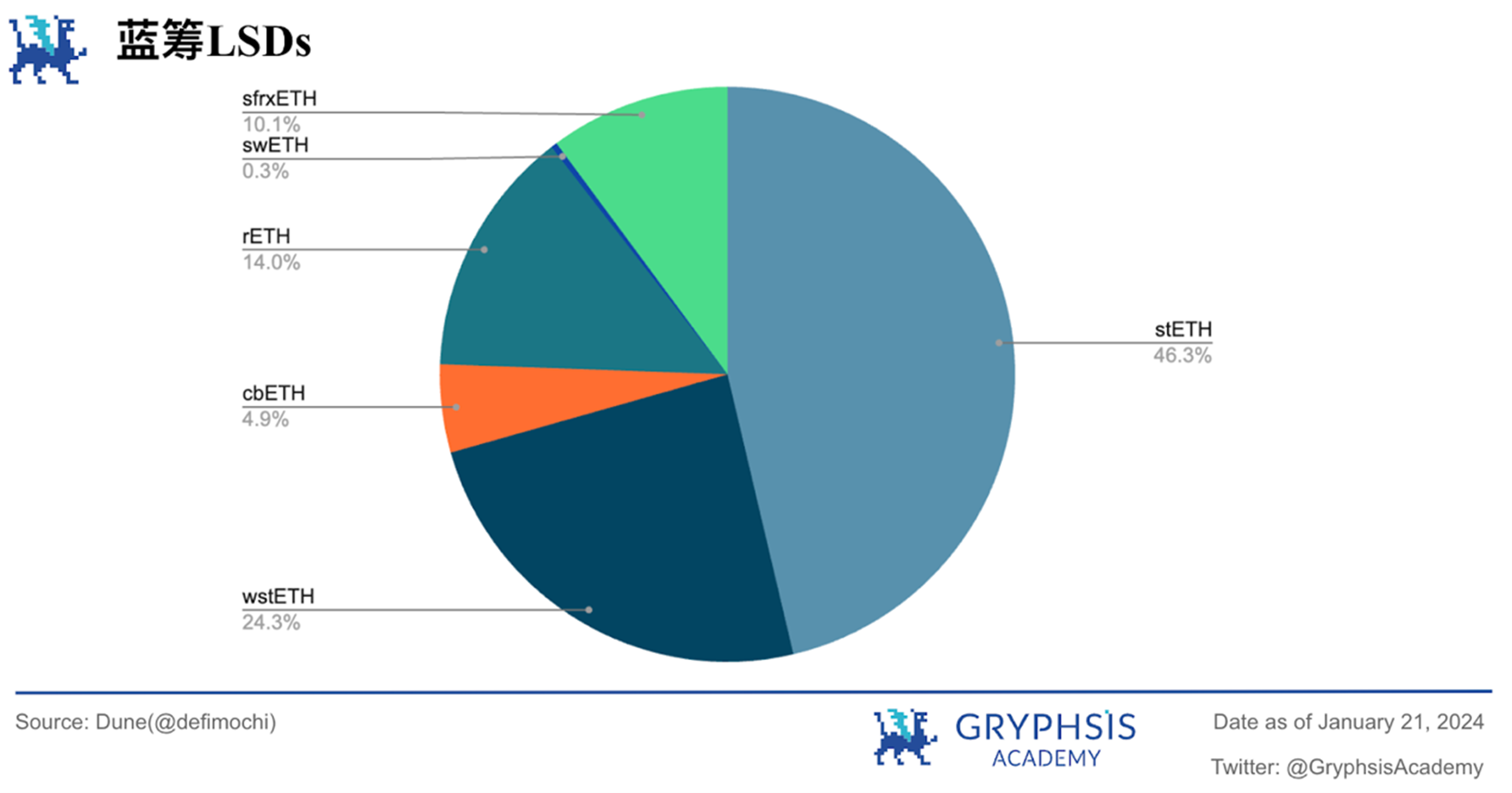

LSD Sector Overview:

In the LSD field, both Ethereum deposits and total withdrawals have increased, but the withdrawals are relatively more obvious. In terms of market share, all blue-chip LSDs declined except for sfrxETH, which gained 4.25% this week.

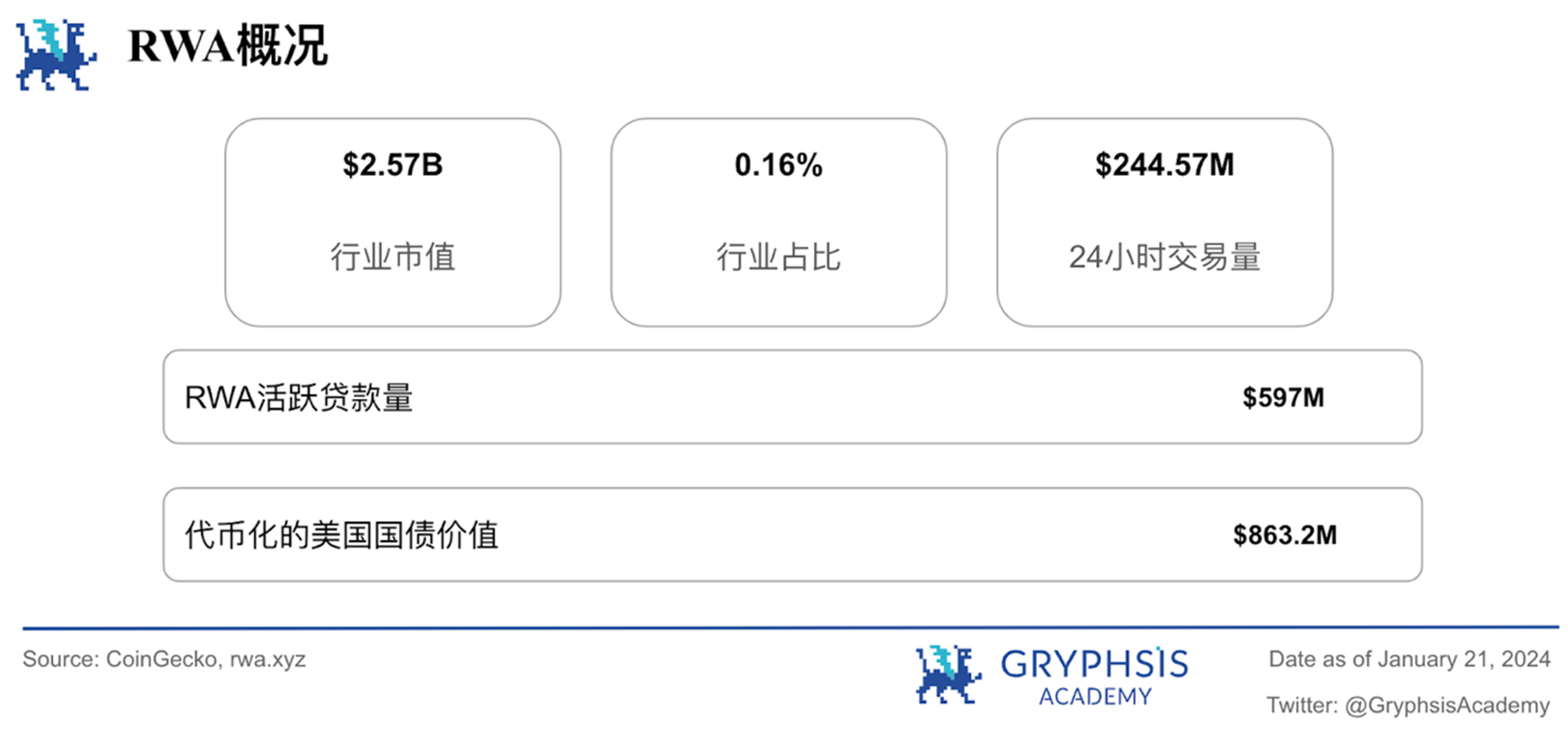

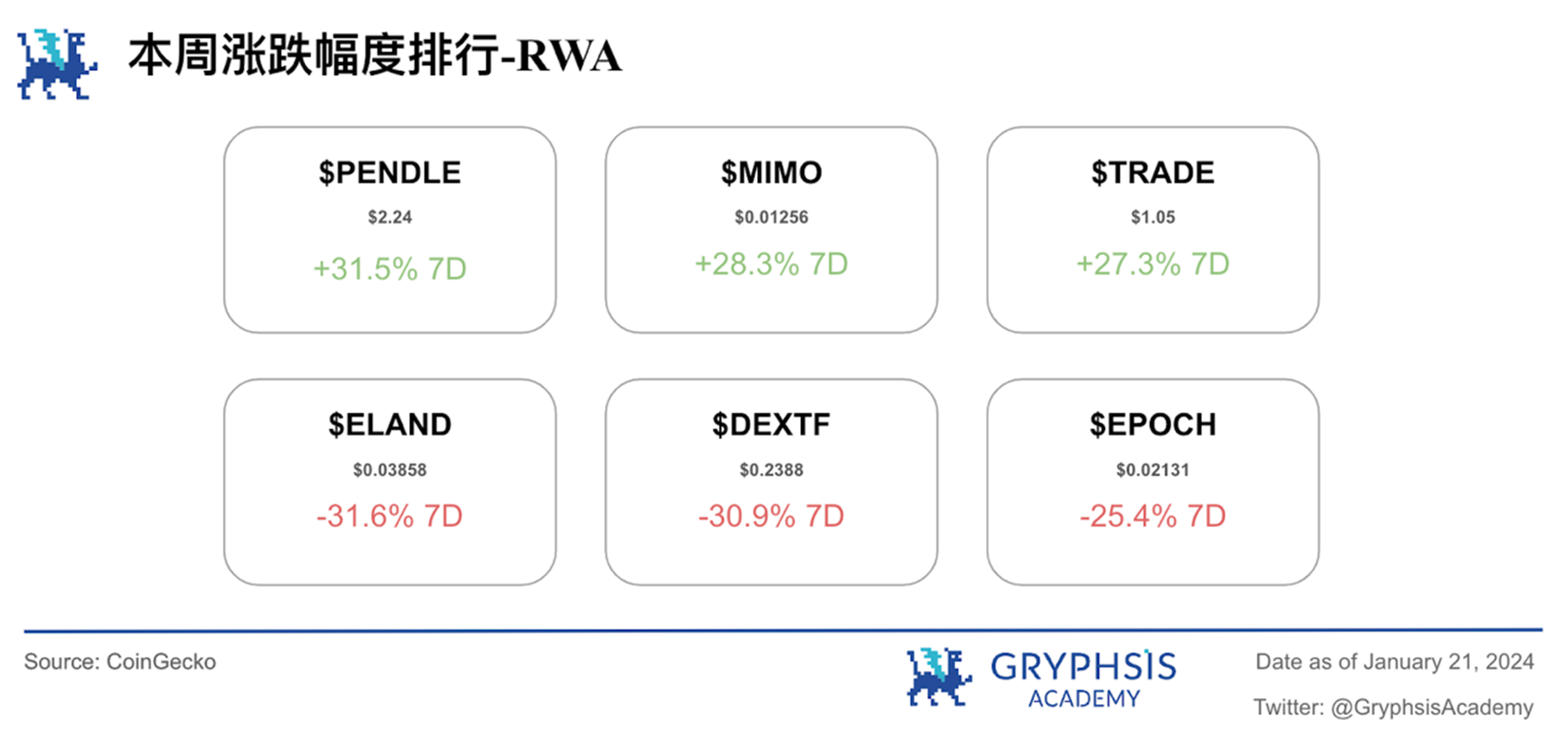

RWA Sector Overview:

Last week, the worlds real asset market capitalization increased by 15.25%, but the 24-hour volume increase was significantly 111.02%. RWA tokenized treasury gains and tokenized U.S. Treasury bond values both rose slightly. Notable growth tokens include $PENDLE, $MIMO and $TRADE, with tokens like $ELAND, $DEXTF and $EPOCH experiencing larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

BTC Price Drops Over 15% Following ETF Approval

Weekly Agreement Recommendations:

B² Network

Weekly VC Investing Spotlight:

WOO Network($ 9 M)

Fetcch($ 1.5 M)

DIMO($ 11.5 M)

Twitter Alpha:

@TheDefiDog on $ARB

@wacy_time 1 on $SAVM

@stacy_muur on AI

@Vaultkaofficial on GLM

@zerokn 0 wledge_ on Eigenlayer

Macro overview

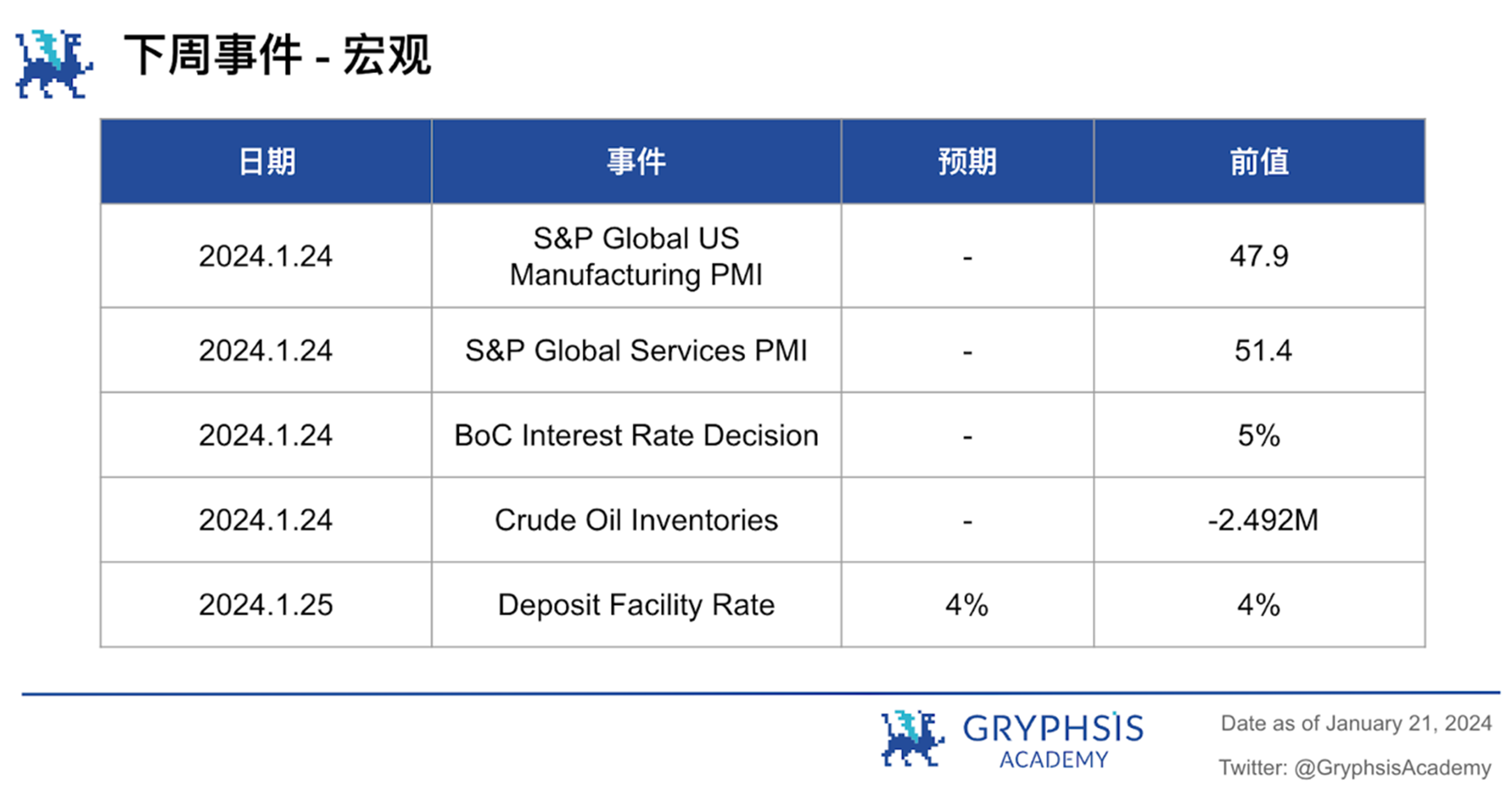

This week, the stock market has seen stronger changes than the crypto industry, with SPX and NASDAQ increasing by 1.17% and 2.86% respectively. In the coming week, pay attention to major events such as the core SP Global U.S. Manufacturing Purchasing Managers Index, the Bank of Canadas interest rate decision, crude oil inventories, and deposit rates.

Big news this week

BTC Price Drops Over 15% Since BTC ETF Passed

Bitcoin (BTC) prices fell another 4.5% on Thursday, falling to a month-low $40,800 since the newly approved spot Bitcoin ETF began trading on January 11. About 13%. Additionally, financial giant JPMorgan Chase (JPM) said in a research note on Thursday that Bitcoin has fallen more than 15% since the debut of spot exchange-traded funds (ETFs) last week, while Grayscale Bitcoin Trust GBTC saw outflows $1.5 billion.

K33 research analyst Vetle Lunde said that exchange-traded products (ETPs) globally currently hold more than 864,000 Bitcoin. However, Canadian and European ETPs have also seen significant outflows over the past week as investors took profits and/or put money into cheaper U.S. ETFs.

Additionally, the ProShares Bitcoin Strategy ETF (BITO), recently surpassed $2 billion in assets under management. While this futures-based ETF holds no Bitcoin, it accounts for 36% of the open interest in CME Group’s Bitcoin contracts, according to Lunde. Futures-based Bitcoin ETFs account for 48% of all CME’s open interest in Bitcoin, he added.

The analyst team of JPMorgan Chase pointed out that GBTC investors who bought GBTC funds in the past year, they bought GBTC funds at a substantial discount to the net asset value (NAV) in anticipation of its eventual conversion to ETF, and now they have fully invested in the ETF after the conversion. To take profits, they chose to exit the Bitcoin market entirely rather than move to cheaper spot Bitcoin ETFs.

The bank warned that if GBTC loses its liquidity advantage, more funds, perhaps an additional $5 billion to $10 billion, may exit GBTC. As of Friday, GBTC was the most expensive ETF of its kind, Some charge no fees for the first six months or until certain assets under management (AUM) targets are reached.

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we chose B² Network, a ZK Rollup layer 2 network deployed on the Bitcoin network.

The B² team began participating in the cryptocurrency industry as early as 2015. After realizing the innovative mechanisms and community potential that Ordinals assets brought to the Bitcoin network, the team launched B² Network in 2022, an EVM-compatible EVM with zero-knowledge proof Rollup technology. The network also supports the second-layer network of BTC addresses and EVM addresses. In the 23-year investment annual report released by OKX, B² Network was included, but the specific financing amount is unknown.

Since Bitcoin is not Turing complete, zero-knowledge proof cannot directly perform zero-knowledge proof verification on Layer 1 (Bitcoin). Therefore, B² Network’s ZK-Rollup solution only writes the aggregate data of zero-knowledge proof and Rollup into Bitcoin through Taproot, ensuring that the ZK-Rollup data is anchored in Bitcoin and cannot be tampered with. However, it does not guarantee the validity and correctness of transactions in ZK-Rollup, nor can it leverage Bitcoins powerful consensus capabilities to ensure the security of Layer 2 ZK-Rollup. Therefore, ZK-Rollup needs to be confirmed on Bitcoin as the final settlement layer.

The following is its technical framework, which mainly includes the following parts:

Source: Official Doc

1. Rollup Layer

B² Network uses ZK-Rollup as the Rollup Layer. ZK-Rollup Layer uses the zkEVM solution, which is responsible for executing user transactions within the Layer-2 network and outputting relevant certificates. Users transactions are submitted and processed in ZK-Rollup Layer, and the status is also stored in ZK-Rollup Layer. Batch proposals and generated zero-knowledge proofs are forwarded to the data availability layer for storage and verification.

2. DA Layer (data availability layer)

The data availability layer includes decentralized storage, B² nodes and the Bitcoin network. This layer is responsible for permanently storing a copy of the Rollup data, validating the Rollup zk proof, and ultimately confirming it on Bitcoin.

3. Decentralized Storage

A key aspect of the B² Network, decentralized storage serves as a repository for ZK-Rollup user transactions and their corresponding proofs. With decentralized storage, the network inherently enhances security, reduces single points of failure, and ensures data immutability.

4. B² node

Composed of multiple modules that perform various roles. They incentivize decentralized storage through zk storage proofs and economic incentives to ensure accurate and efficient storage of B² rollup data copies. Verify zk rollup proofs and check the accuracy and efficiency of zk rollup transactions and state generation. The Bitcoin submission module of the B² node, writes data to Bitcoin via Tapscript, creates bit value commitments for zk-proof verification, and performs final confirmations on Bitcoin via a challenge-response mechanism.

The Bitcoin network is the ultimate settlement layer for the B² Network. Users can recover all B² rollup transactions via Bitcoin and verify their authenticity using zk proofs recorded on Bitcoin. B² Network uses zk proofs to verify commitments and a challenge-response mechanism for final confirmation on Bitcoin. This process is supported by Bitcoin’s powerful Proof of Work (POW) algorithm, ensuring the security of B² rollup.

Through these technical means, B² provides application scenarios for BTC and other Bitcoin-related assets, making Bitcoin not only “digital gold” but also a leader in cryptocurrency application scenarios, laying the foundation for BTC-related assets and allowing DeFi, NFTs, SocialFi and other applications can thrive.

our insights

Bitcoin was originally a value storage currency, but its network limitations led to transaction congestion and restricted ecological development. But with the explosion of asset concepts such as Ordinals assets, Inscriptions, and BRC 20, a new path seems to have been opened up. The market value and ecological activity of the Bitcoin network have led to an explosion.

Since November last year, the market value of Bitcoin has increased by 20.6%, and ecological interaction fees have increased by 32 times. More and more users and projects are pouring into the Bitcoin ecosystem. However, due to its Turing incompleteness, block size restrictions and other factors, it cannot bear the explosive network demand. More and more Bitcoin second-layer network protocols are in use. And born.

Source: Tokenterminal

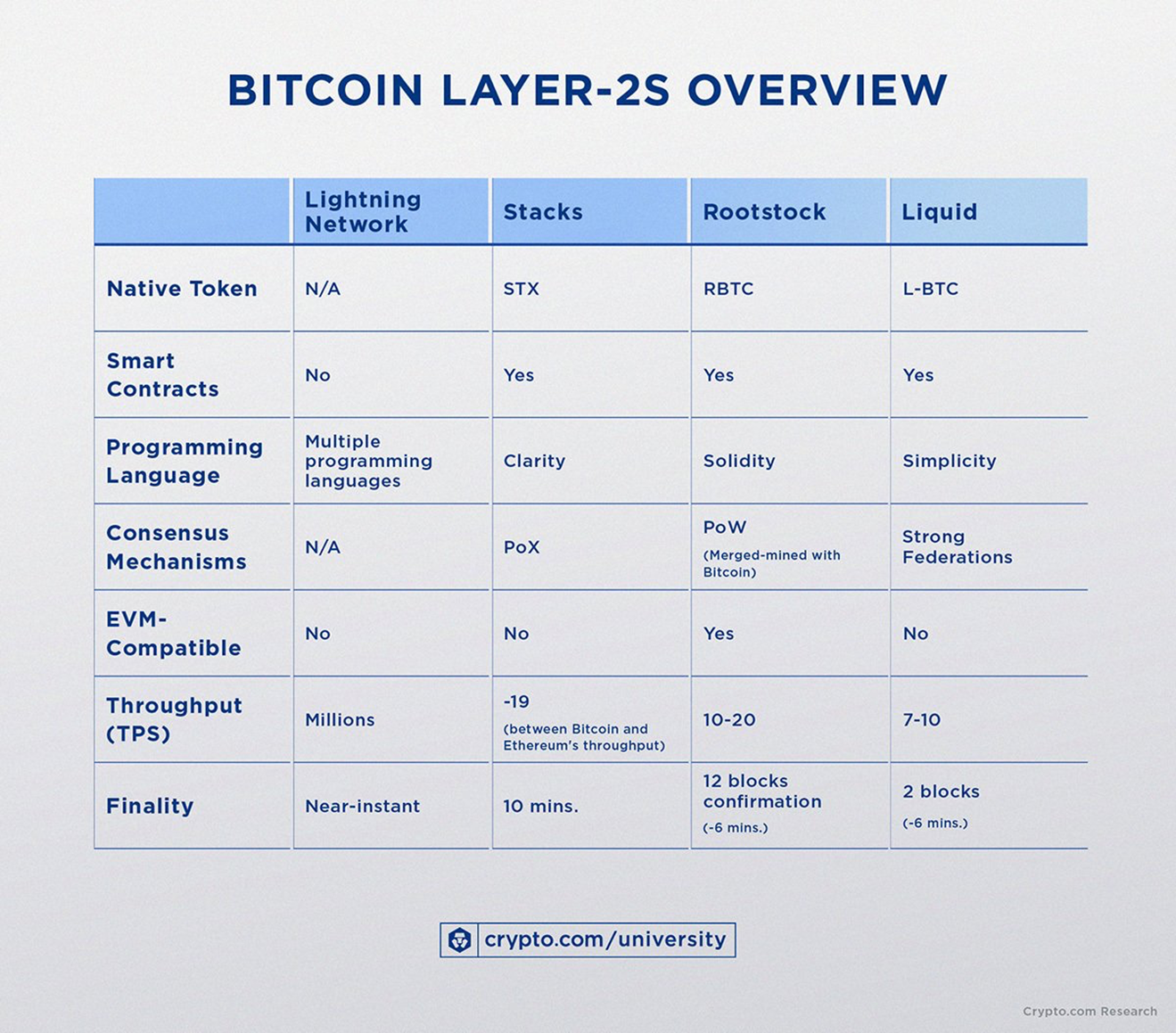

The Bitcoin second-layer network was initially dominated by Lightning Network, Stacks, Rootstock, Liquid, etc. Vitalik, the founder of Ethereum, suggested in a Twitter Space about the Bitcoin ecosystem that Bitcoin needs scaling solutions like Plasma or Rollup. This brings more possibilities to Bitcoin. More and more Layer 2 networks not only adopt Rollup, but also propose various solutions.

Source: Crypto.com

As a two-layer network using ZK Rollup technology, B² Network ensures the security of rollup transactions through the innovative introduction of zero-knowledge proofs; generates Taproot commitments based on rollup zk proof verification, and publishes them on the Bitcoin network as rollup fraud proof; through Bitcoin The challenge-response mechanism on the network confirms the evidence of fraud and ultimately ensures the security of the rollup.

Currently, B² Network has launched the Alpha test network MYTICA in December and is openly recruiting ecological developers. Partners and developers can deploy DApps on the B² Network test network. It also opened its own Odyssey and a Grant worth $1M to attract users to experience it on the test network.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

WOO Network

WOO Network connects traders, exchanges, institutions, and DeFi platforms, providing them with democratized access to optimal liquidity and trade execution at zero or low cost. It was originally incubated by Kronos Research, a large crypto quantitative trading firm. The goal of WOO Network is to reduce market inefficiencies and disrupt cryptocurrency markets by solving one of the major problems of cryptocurrencies - liquidity fragmentation.

https://x.com/WuBlockchain/status/1747909315745489071?s=20

Fetcch

Fetchch is building a new wallet with an ID protocol that enables various wallets and dApps to issue cross-chain, composable wallet IDs to their users. These IDs enable users to connect any number of addresses from any chain, enabling a single identity across chains. Fetcch hopes to simplify payments and improve the connection between wallets and blockchains, allowing dApps to create a simple onboarding experience for users.

https://x.com/FetcchX/status/1747581921801163229?s=20

DIMO

DIMO is a decentralized software and hardware Internet of Things (IoT) platform that enables users to create authenticated vehicle data streams for private sharing with applications. This allows users to negotiate better services such as car financing and insurance.

https://www.theblock.co/post/272456/decentralized-infrastructure-11-5-million-series-a-coinfund

protocol event

Bungee protocol exploited as funds worth at least $ 3.3 million appear to be stolen

Chainlink integrates with Circle’s CCTP protocol for cross-chain USDC transfers

Jupiter, the Solana DEX aggregator confirms token release date

OP Crypto Rebrands as Inception Capital: A Name That Embodies Vision And Multicultural Strength

Solana Mobile unveils cheaper Saga crypto phone successor

Industry updates

South Korea weighs crypto tax abolition amid new income tax regime

EU provisionally agrees on stricter due diligence rules for crypto firms

Coinbase takes its turn in court, arguing the tokens it listed are not securities

Cumulative spot bitcoin ETF volume crosses $ 11 billion on fourth day of trading

Ethereum devs implement Dencun upgrade on Goerli testnet

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/TheDefiDog/status/1748095435431145722?s=20

https://x.com/wacy_time1/status/1748164431555510368?s=20

https://x.com/stacy_muur/status/1747975954704834838?s=20

https://x.com/Vaultkaofficial/status/1747944479007662157?s=20

https://x.com/zerokn0wledge_/status/1747762080378478962?s=20

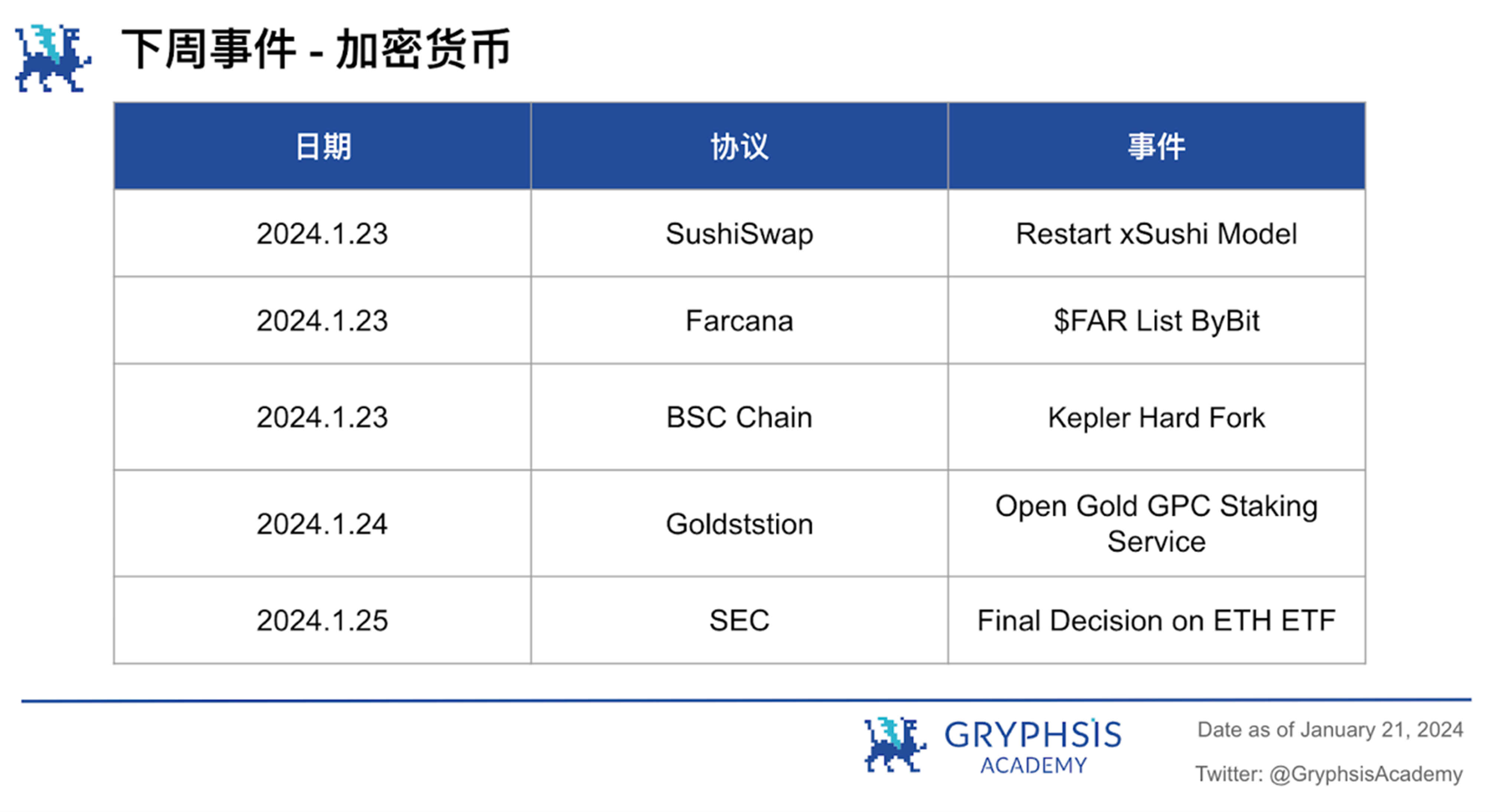

next week events

news source

https://www.theblock.co/post/273286/eu-stricter-due-diligence-crypto-firms

https://www.theblock.co/post/273050/ethereum-dencun-goerli-proto-danksharding

https://www.theblock.co/post/272827/chainlink-circle-cctp-usdc

https://www.theblock.co/post/272800/jupiter-jup-token-launch-date-memecoin-drop-planned

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.