Celestia: Ethereum DA’s biggest competitor? Can EigenLayer come back?

Original author: YBB Capital Researcher Ac-Core

Preface

According to the definition of the Ethereum Foundation, Ethereum’s Layer 2 = Rollup. According to Vitaliks recent new point of view, if other EVM chains use non-Ethereum as DA (Data Availability), then it is Ethereum Validium (moving the data availability layer of the blockchain outside the chain, using valid proofs to ensure the chain integrity of external transactions). Although there is still a certain degree of controversy over the precise definition of Layer 2 due to DA issues, the upgrade route of Ethereum is still centered on Rollup, and DA is responsible for saving or uploading Rollup transaction data during the Ethereum upgrade. important role. Whether Optimistic Rollup and ZK Rollup can access relevant data through DA will affect their own security to a certain extent, even if their dependence levels are different. Faced with the innovation of Cosmos shared security and Celestias DA penetration, as well as the market makers drive, can EigenLayer, which draws lessons from native Ethereum, regain the market by upgrading middleware to Ethereum-level security narratives? sovereignty?

EigenLayer

Image source: EigenLayer white paper

Image source: EigenLayer white paper

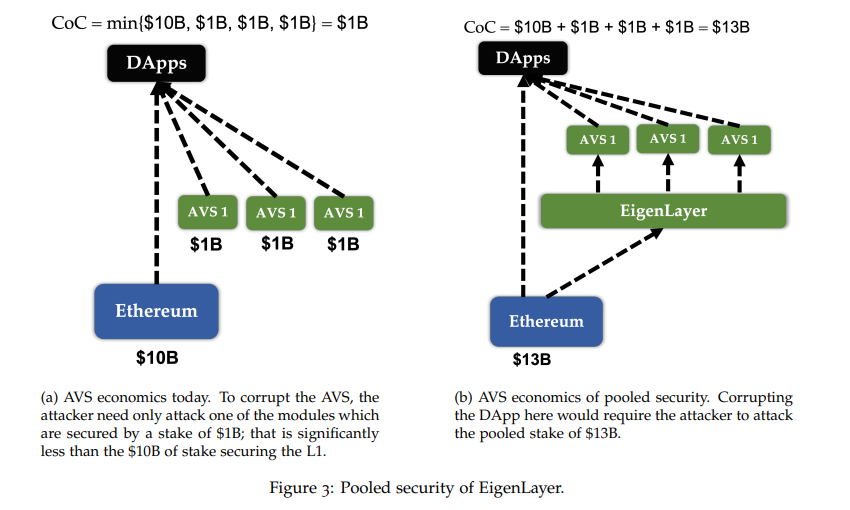

To simply understand, EigenLayer is a re-staking protocol based on Ethereum, which provides Ethereum-level security for the entire Ethereum cryptoeconomic system in the future. It allows users to re-pledge native ETH, LSDETH and LP Token through the EigenLayer smart contract and receive verification rewards, allowing third-party projects to enjoy the security of the ETH main network while also receiving more reward income, thereby achieving a win-win situation.

The reason why Ethereum is able to attract a large amount of transaction volume and liquidity is that it is currently recognized by most people as the most secure first-layer blockchain besides Bitcoin. EigenLayer directly connects the security and liquidity of Ethereum through Actively Validated Services (AVS). Its essence is to directly entrust the security verification of its token model to Ethereum nodes (which can be simply understood as node operations). business), this process is called “Re-staking”. This article only gives examples of the first AVS project developed by the EigenLayer team: EigenDA.

EigenDA: Rollup data availability

Image source: EigenDA official

Image source: EigenDA official

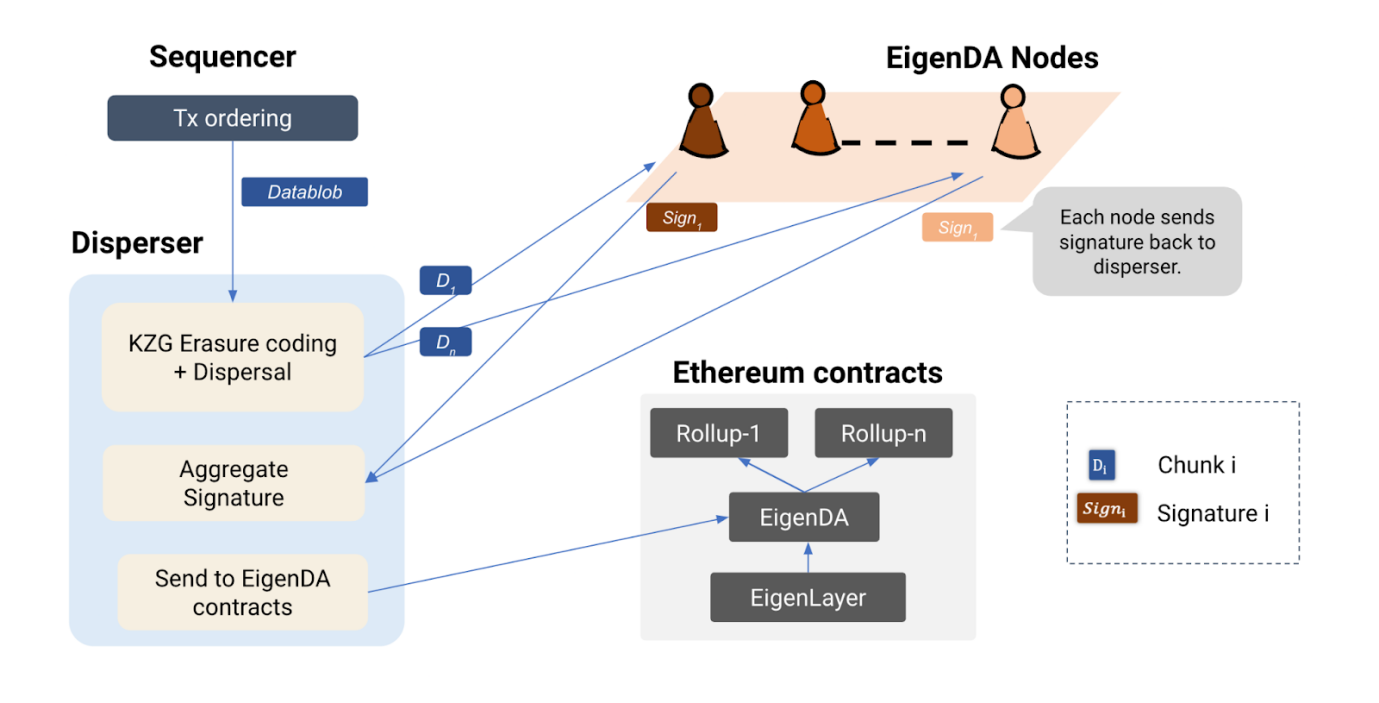

According to the official explanation and introduction (no actual relevant data to support it yet), EigenDA is a decentralized data availability (DA) service built on Ethereum using EigenLayer Restaking, and will be the first active verification service on EigenLayer ( AVS). Among them, Restakers can entrust the pledge to the executing EigenDA and the node operator that performs the verification task, and receive service fees in return, and Rollups can publish data to EigenDA, thereby reducing transaction fee costs, obtaining higher transaction throughput and improving the entire Security of the EigenLayer ecosystem. Security and transaction throughput in this development process will expand with the overall development of staking volume, related ecological protocols, and operators.

EigenDA aims to provide innovative DA solutions for Rollups, allowing Ethereum stakers and verifiers to improve security by connecting to each other, achieving the purpose of reducing costs while increasing throughput. Among them, the EigenLayer shared security system ensures decentralization. The degree of optimization will adopt a multi-node approach. According to EigenDA’s tweet, its currently integrated Layer 2 solutions include Celo, which transitions from L1 to Ethereum L2; Mantle and its supporting products outside the BitDAO ecosystem; Fluent, which provides the zkWASM execution layer; Offshore, which provides the Move execution layer. And the OP Stack in Optimism (currently used in the EigenDA test network).

EigenDA is a secure, high-throughput and decentralized data availability (DA) service built on Ethereum, developed based on EigenLayer Restaking. Here are some of the key features and benefits EigenDA is designed to achieve:

characteristic:

Sharing security:EigenDA utilizes EigenLayers shared security model to enable validators (Restakers) to participate in the verification process by contributing ETH to improve the overall security of the network;

Data availability:The main goal of EigenDA is to ensure data availability on Layer 2 networks. It uses validators to verify and ensure the data validity of the Rollup network, prevent bad behavior and ensure the normal operation of the network;

Decentralized sorting:EigenDA utilizes EigenLayers decentralized sorting mechanism to ensure that transactions in the Rollup network are executed in the correct order, thereby maintaining the correctness and consistency of the entire system;

flexibility:The design of EigenDA allows L2 developers to adjust various parameters as needed, including the trade-off between security and activity, the mode of staking tokens, erasure coding ratio, etc., to adapt to different scenarios and needs.

Advantage:

Economic benefits:EigenDA implements the shared security of ETH through EigenLayer, thereby reducing potential staking costs. It reduces the operating cost of each operator by decentralizing data verification work and provides a more cost-effective verification service;

High throughput:EigenDA is designed to scale horizontally, with its throughput increasing as more operators join the network. In private testing, EigenDA has demonstrated throughput of up to 10 MBps, with a roadmap for expansion to 1 GBps, providing the possibility to support applications with high bandwidth requirements, such as multiplayer games and video streaming;

Security mechanism:EigenDA uses multi-layer security mechanisms, including EigenLayers shared security, Proof of Custody mechanism, and Dual Quorum, to ensure the security, decentralization, and censorship resistance of the network;

Customizability:EigenDA offers a flexible design that allows L2 developers to adjust various parameters based on their specific needs and use cases to find a balance between security and performance.

Re-pledge mode

Image source: Delphi Digital

Image source: Delphi Digital

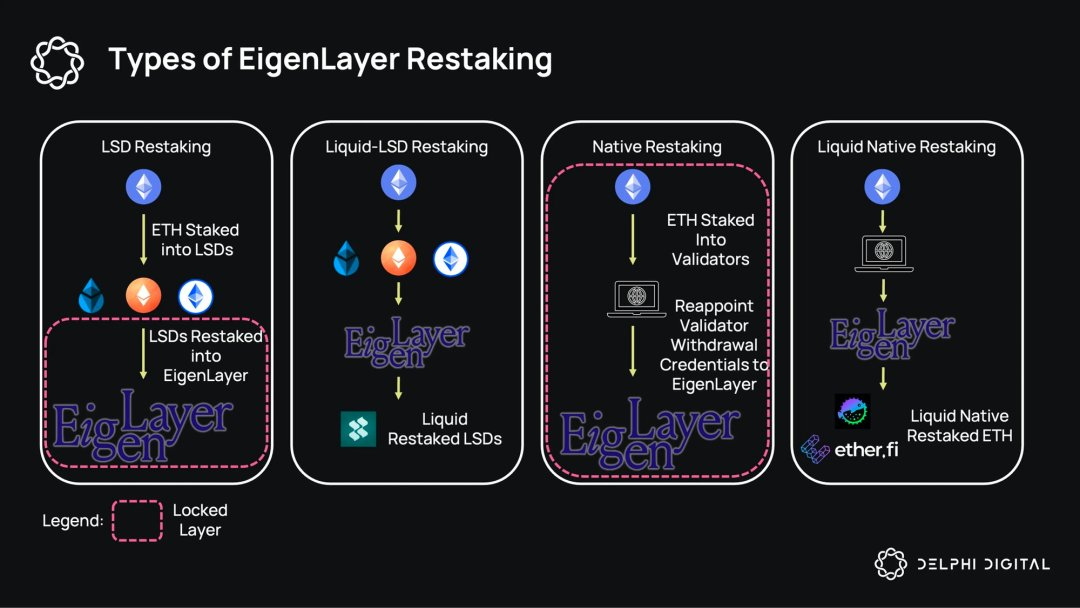

Native ETH re-pledge:

Applicable to independent ETH pledgers, they can point their pledged ETH to the EigenLayer smart contract through withdrawal certificates to re-pledge and obtain additional income. If an independent pledger commits misconduct, EigenLayer can directly confiscate its withdrawal certificate;

LST re-staking:

LST (Liquid Staking Token) is the abbreviation of Liquid Staking Token. Ordinary investors, even if they do not have 32 ETH, can carpool through liquidity staking protocols such as Lido and Rocket Pool, deposit ETH into the pledge pool, and receive LST representing their ETH and their claim rights to pledge income. Users who have pledged ETH in Lido and Rocket Pool can transfer their LST holdings to the EigenLayer smart contract and re-stake to obtain additional income;

LP Token re-pledge:

LP Token re-pledge is divided into ETH LP re-pledge and LST LP re-pledge.

ETH LP re-pledge: Users can re-pledge a pair of DeFi protocol LP Tokens including ETH to EigenLayer.

LST LP re-pledge: Users can re-pledge a pair of DeFi protocol LP Tokens containing lsdETH to EigenLayer. For example, the stETH-ETH LP Token of the Curve protocol can be pledged to EigenLayer again.

Celestia in Cosmos

Source: Celestia official

At present, no blockchain can truly solve the impossible triangle problem of decentralization, security and scalability. Cosmos believes that only a multi-chain design architecture can overcome the trade-offs between them to a certain extent. . Before discussing Celestia, let’s briefly review Cosmos, where blockchains achieve interoperability through the IBC (Inter-Blockchain Communication) protocol. Here is a detailed discussion of security between Cosmos chains:

IBC Protocol Security: IBC is the protocol in the Cosmos network that ensures communication between chains. It ensures the confidentiality and integrity of messages by using mechanisms such as encryption and signatures. The IBC protocol includes a series of verification steps to ensure the trustworthiness of cross-chain communications. Through IBC, the Cosmos chain can securely transmit messages and assets to prevent fraud and tampering;

Consensus mechanism security: Various blockchains in the Cosmos ecosystem may adopt different consensus mechanisms, the most common of which is Tendermint. The Tendermint consensus algorithm ensures consistency between nodes through Byzantine Fault Tolerance (BFT). This means that the system can still function normally in the presence of a certain number of malicious nodes. The security of the consensus mechanism is crucial to the stability and security of the entire network;

Hub security: There is a centralized blockchain called Hub in the Cosmos network, which serves as a bridge between different chains. The security of the Hub plays a key role in the stability of the entire ecosystem. If the Hub is not secure, it can cause problems for the entire network. Therefore, ensuring the security of the Hub is an important task in the Cosmos ecosystem, involving strict control of its consensus mechanism and node management;

Asset Security: Since assets can be transferred between Cosmos chains, it is crucial to ensure the security of assets. By using cryptography, the Cosmos chain is protected against malicious activities such as double-spend attacks. At the same time, the design of the IBC protocol makes the cross-chain transmission of assets more secure and reliable;

Smart contracts and application layer security: The Cosmos network allows the development of smart contracts and distributed applications. Ensuring this level of security is achieved by ensuring code quality, auditing, and bug fixes for smart contracts and applications running on the blockchain.

Celestia achieves scalability and flexibility through a modular design that separates consensus and execution, promoting a customizable ecosystem for a variety of blockchain solutions. In contrast, Cosmos promotes blockchain collaboration with an ecosystem-neutral approach, emphasizing the interconnectivity between independent blockchains, and uses Tendermint to integrate consensus and execution, providing a cohesive environment that brings The intuitive negative impact is the loss of its own flexibility. Celestias modular approach provides enhanced scalability and development flexibility, and provides customized solutions to meet different application needs. There are even calls that Celestia+Cosmos is the ultimate form of future application chains.

Celestias ICS and EigenLayers EigenDA

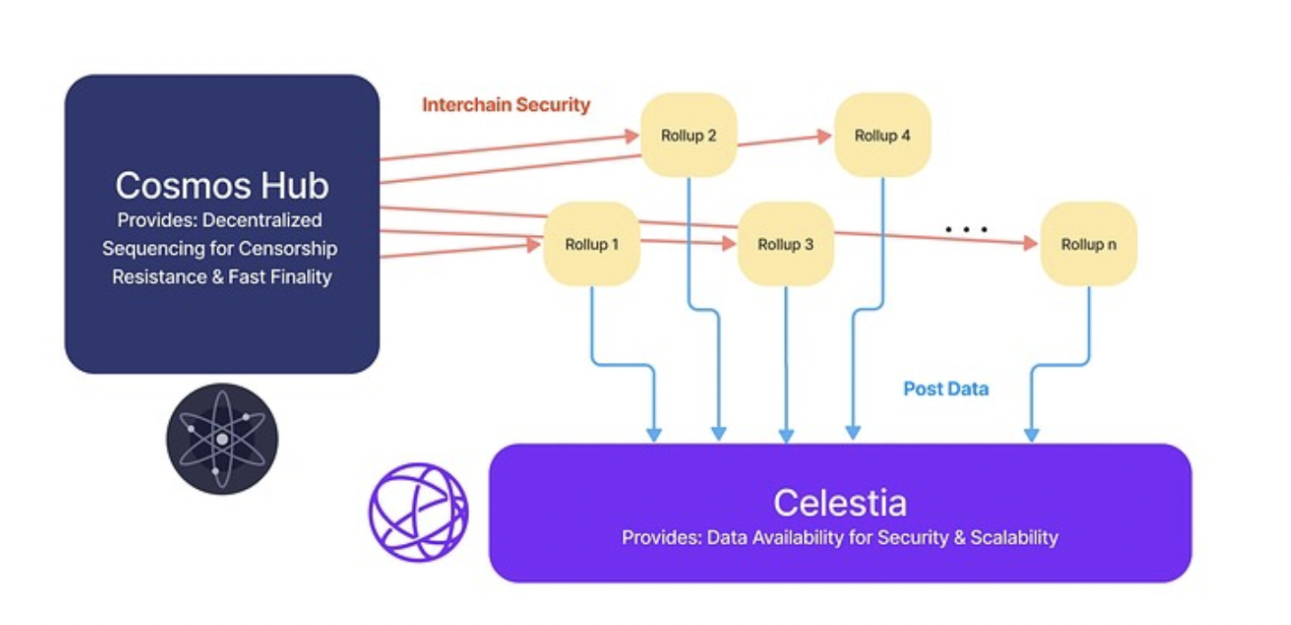

Picture source author X: @_Gods_ 1

Picture source author X: @_Gods_ 1

But what deserves attention is the ICS (Interchain Security) mentioned in Celestia’s proposal recently. The difference is that EigenLayer is a data availability layer built on Ethereum. By comparing ICS with EigenLayer, we can learn from the following To understand the relationship between them:

Sharing security:Celestia’s proposal discusses the possibility of using ICS to use validators from the Cosmos ecosystem (such as the Cosmos Hub’s validators) as Celestia’s rollup orderers. This approach allows multiple Rollup networks to share the same set of validators to achieve shared security. This idea is somewhat similar to the concept of shared security in EigenLayer, which provides security by leveraging the validators of the underlying blockchain network. The difference is that ICS uses Cosmos Hubs validator to provide verification services for connected blockchains, improving the security of the entire ecosystem through a shared security model, while EigenDA provides verification services through EigenLayer on Ethereum, using ETHs verification Restakers to verify the data availability of the Rollup network;

Decentralized sorter:The concept of decentralized sorters mentioned by Celestia leverages the ICS approach. This is somewhat similar to using EigenLayers Restaking Primitive (re-pledge mechanism) to build a decentralized sorter. Both attempt to achieve a more decentralized sorting mechanism through the characteristics of the underlying protocol;

Rollups composability:Celestia mentioned that composability across Rollups could be achieved by using the same sequencer in multiple Rollup networks (possibly via ICS). This is somewhat similar to the goal mentioned in EigenLayer of having multiple AVS (Active Verification Services) collaborate with each other in the EigenLayer ecosystem to achieve a higher level of composability and interoperability;

economics:Putting aside the technical topics of Celestia and EigenLayer, from a market perspective, what users are more concerned about is their own income. EigenLayer’s layer-by-level income stacking for LST, etc., and the airdrop expectations for the entire EigenLayer ecosystem in the future. The value is slightly stronger than Celestias.

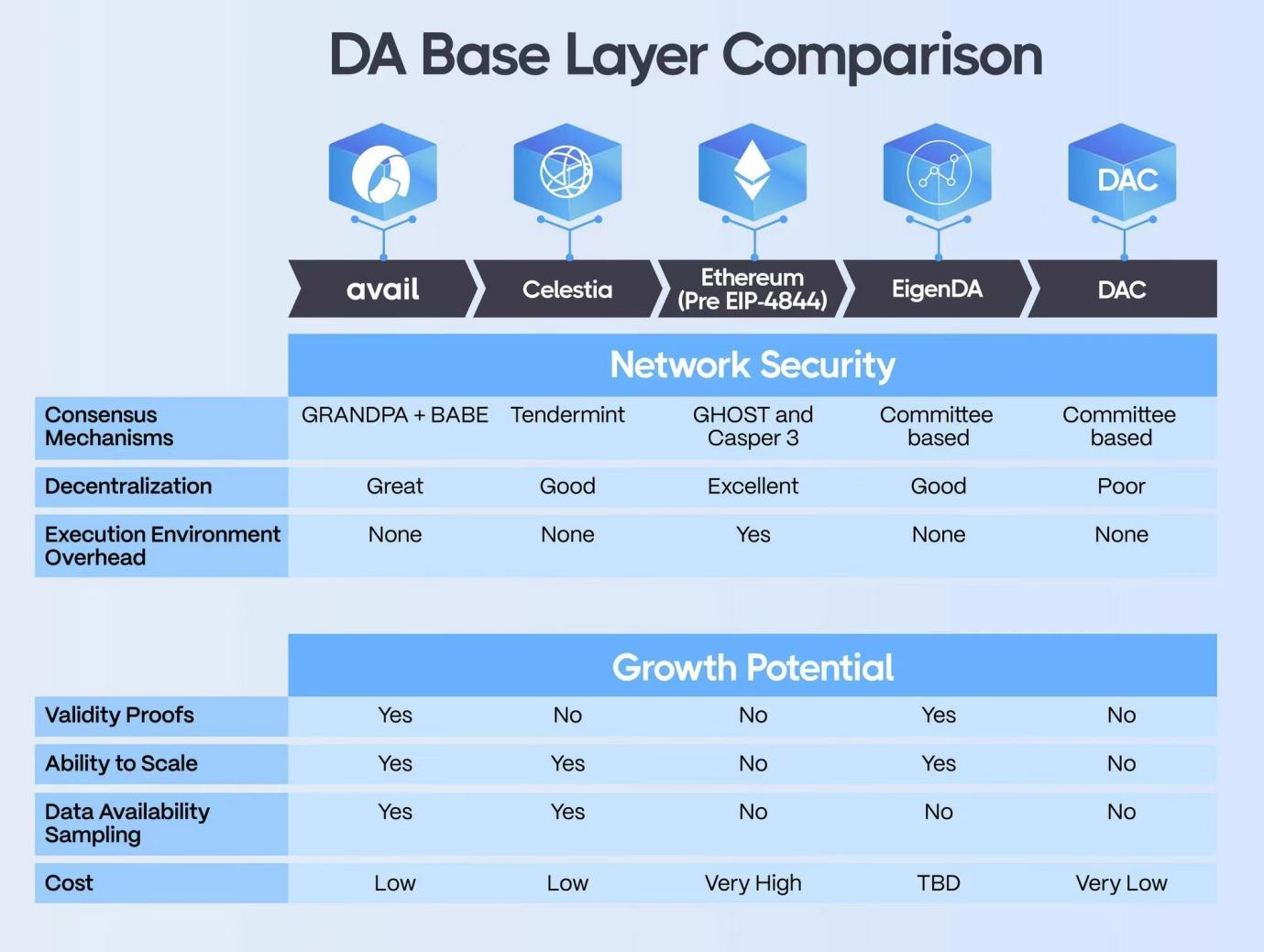

Comparison between DA layers

Image source: Researcher@likebeckett

Image source: Researcher@likebeckett

Data Availability is referred to as DA. Currently, the upgrade route of Ethereum is mainly based on Rollup. The role of DA in the process is to save or upload all transaction data of the entire Rollup. The emergence of Rollup is to solve the scalability problem of Layer 1, but actually accessing Layer 2 data through DA will affect the overall security and TPS level. In order for Layer 2 to inherit the security of Ethereum, Ethereum needs to be able to pass optimization The entire protocol security mechanism is used to upload large amounts of Layer 2 data.

In the consensus mechanism, there is a fundamental dilemma, namely effectiveness and security. The former ensures the rapid processing of transactions, and the latter ensures the accuracy and security of transactions. For this purpose, different blockchain systems will do Choose different options to achieve a balance that meets your actual needs. Among them, Ethereum, Celestia, EigenLayer and Avail solutions are all designed to provide scalable data availability for Rollup. Based on the relevant data officially provided by Researcher@likebeckett and Avail, I made the following summary.

Image source: Avail Team official

Image source: Avail Team official

Celestia:

Decentralized sorter proposal:Celestia discussed a proposal proposed by COO Nick White to use Interchain Security (ICS) from the Cosmos ecosystem to implement Celestias decentralized orderer, thereby leveraging the Cosmos Hubs validators through ICS as the DA layer Provide shared security;

Atomic cross-Rollup composability:Celestia improves composability by leveraging ICS to enable atomic transactions between multiple Rollup networks. The same sorter enables multiple Rollup networks to work together to solve the problems of liquidity fragmentation and reduced composability;

Multiple Rollup interoperability:Leveraging the same sequencer, Celestia can facilitate interoperability between multiple Rollup networks, enabling better liquidity and data availability.

EigenLayer and EigenDA:

Data availability services for shared security:EigenLayer provides data availability services through EigenDA, which is different from the traditional blockchain, but a set of smart contracts built on Ethereum, taking full advantage of the concept of shared security. EigenDA can provide efficient, secure, and scalable data availability as part of the Celestia ecosystem;

Decentralized sorting:EigenLayer emphasizes its decentralized sorting mechanism, which essentially adds ETH tokens and slashing conditions to the PoS process of the Rollup sorter to provide higher security for the Layer 2 network. Through this mechanism, EigenLayer implements an efficient sorting process;

Data availability services:EigenDA focuses on providing data availability services for Layer 2 networks, providing high-performance data transmission for on-chain applications through EigenLayer shared security and decentralized sorting.

Avail:

Data availability design:Avail focuses on the design of data availability and introduces data availability sampling technology. This technology improves the scalability of the network by allowing light nodes to verify data availability by downloading only a small portion of a block, rather than relying entirely on full nodes to obtain data;

Interoperability between blockchains:Avail is designed to increase inter-blockchain interactivity. Light nodes that support data availability sampling make increasing block size more flexible and improve overall throughput;

EIP 4844 Adaptability:Avail is actively involved in the implementation of Ethereums EIP 4844 and is an important part of Polygons modular blockchain vision, a proposal to increase block sizes and lay the foundation for the implementation of Danksharding, which allows Avail to adapt to upgrades in the Ethereum ecosystem.

Conclusion

For Rollup, in addition to the deterministic narrative brought by the Cancun upgrade in 24 years, the debate on the DA issue also brought about the issue of the precise positioning of Layer 2. For the time being, we put aside the legitimacy and security that Ethereum DA actually faces. Regardless of the issues of safety and cost, this debate between Celestia and EigenDA can easily lead to a question: whether the confrontation between the Ether Killer and the Ether Wall will trigger more market competition in the direction of composable modules in the future. Let Ethereum’s expansion methods see a new round of blooming.

Although the blockchain itself has many limitations, from the perspective of financial markets, most of the rising momentum of all markets comes from the imaginary space, and there must always be fresh stories to feed. As for innovation itself, in addition to maintaining its own correctness,"Sidetrack"It is also a narrative direction that breaks out of the original framework.