Original - Odaily

Author - Azuma

Yesterday evening, meow, the co-founder of Jupiter, the leading transaction aggregation protocol in Solana ecosystem, updated the latest progress of the Jupuary plan on the 23:00).

As another popular project in the Solana ecosystem, Jupiters airdrop has been warmed up since the Breakpoint period in early November last year. Today, it has experienced a collective surge in the Solana ecosystem, as well as Jito, which officially announced its airdrop plan in the same period but implemented it earlier ( JTO)s miracle of creating wealth, community users expectations for JUPs airdrop are also constantly rising.

So, can JUP repeat the story of JTO? We can make some simple speculations based on some existing public data.

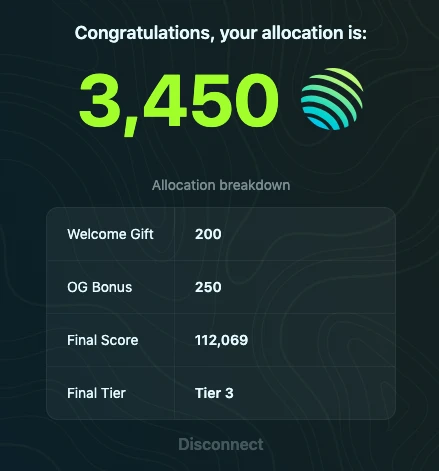

In early December last year, Jupiter launched the JUP airdrop quota query website (https://airdrop.jup.ag/) in advance. Users who have interacted with the agreement in the past can now check the JUP airdrop amount they can obtain through the website. According to feedback from community users, addresses that have basically interacted with the Jupiter protocol can receive a minimum guarantee reward of 200 JUP. Some users who have interacted more often reported receiving airdrop credits of thousands of JUP.

According to Jupiters disclosed token economic model design, the total supply of JUP is 10 billion.

Previously, meow had initially disclosed JUP’s TGE mechanism. The tentative plan is as follows:

First mint 10 billion JUP;

Divide 10 billion JUP equally into two cold wallets (belonging to the team and the community respectively) in a ratio of 50:50;

Withdraw 10% from the team wallet to provide liquidity;

Withdraw 15% from the community wallet for the first airdrop and early community activity needs.

Meow added that it is expected that the team wallet will initially use 5% of the share to build initial liquidity, and the use of the remaining shares has not yet been determined, but 1-2% of the share may be increased in terms of liquidity on the first day. All in all, it is expected that 15% -17.5% of JUPs tokens will enter circulation on the first day of TGE, 10% -7.5% of the tokens will be in hot wallet storage, and 75% of the tokens will be in cold wallet storage.

Now let’s excerpt the key information:The total supply of JUP is 10 billion, with an initial circulation of 1.5 billion to 1.75 billion.

Currently, Aevo has launched JUPs pre-lanuch contract trading, and the price is temporarily quoted at US$0.64. In the past month, it has reached a high of US$0.85 and a low of US$0.48.

Odaily Note: The pre-lanuch contract on Aevo has large fluctuations and small trading volume. It has certain reference significance, but it cannot fully represent the real market price after TGE.

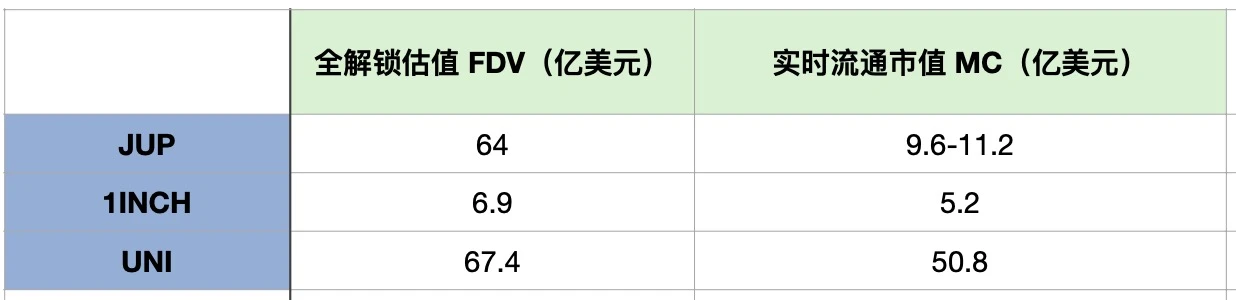

Calculated based on Aevo’s real-time contract quotes,JUPs fully unlocked valuation (FDV) after the currency issuance is approximately US$6.4 billion, and its real-time circulating market value (MC) is approximately US$960 million to US$1.12 billion.

Next, we can compare the above data with the same type of header protocols in Ethereum. It should be noted that, combined with Jupiter’s existing business layout (aggregation + contract + DCA, etc.), it is difficult to find a complete set of its business types. Consistent projects, so we decided to compare 1inch (1INCH) and Uniswap (UNI) based on their main business (transaction aggregation) and track positioning (DeFi services).

CoinGecko data shows,1INCHs FDV is US$690 million and MC is US$520 million; UNIs FDV is US$6.74 billion and MC is US$5.08 billion.

From the above comparison, it can be seen that from the perspective of FDV, JUP has approached UNI, far exceeding 1INCH, which may mean that its current contract price of $0.64 is somewhat overvalued. However, considering that JTO has previously counterattacked Lido (LDO), the LSD leader of the Ethereum ecosystem, in terms of FDV, and the circulation ratios of JUP and JTO in the initial period of currency issuance are also quite close, so the current quotation of JUP is only from the perspective of MC. There seems to be some reasonableness.

Based on the differences in valuation logic, JUP airdrop users seem to be able to perform different operations - users who believe that JUP still has room for appreciation can continue to hold it after the airdrop, while users who believe that JUP has been overvalued can choose to hold it on Aevo Short-selling hedging (there is a risk of liquidation) and locking in the airdrop value in advance.

The last thing that needs to be reminded is that in addition to JUPs own TGE, while updating the progress of Jupuary, meow also mentioned that two test currency issuance experiments will be conducted before JUP, one is mockJUP that will be released tomorrow, and the other It is a meme coin that will be released next week (meow specifically emphasized that it will be a real meme coin).

This may be another opportunity outside of JUP.