SoSo Value: Dozens of crypto institutions’ annual reports summarize the “eight new narratives” of the 2024 bull market

Introduction

In 2023, the total market value of cryptocurrencies has rebounded significantly, growing from US$1 trillion at the beginning of 2023 to more than US$1.6 trillion by the end of the year. This is also regarded as a clear signal that the encryption market is emerging from the cryptocurrency winter. In addition to the significant rebound in overall data, including market capitalization, there are different bright spots in each track of the encryption industry.

Looking back on 2023, the global macro background and the Web3 field are both a year full of variables. Although the encryption market has recovered slightly, the global macro economy is still under downward pressure, wars have broken out in regional areas, and aspects such as culture and consumption have also There is nothing to be said about it. Traditional industries have been impacted to varying degrees. Looking at the macro-connected Web3 field, the BTC spot ETF process is accelerating. Major events such as the resignation of CZ and the conviction of SBF under US supervision have broken the old and established the new. AI technology represented by ChatGPT has begun commercial use.

Narrative is a main thread driving the encryption industry. Investment institutions and markets create new narratives, and investors question and understand the narratives. Looking forward to 2024, looking at the annual reports released by dozens of top encryption institutions, most institutions are optimistic about the encryption market in 2024.

By interpreting these dozens of reports, SoSo Value starts from understanding the narrative and combines its own insights to summarize the eight key narrative keywords you should know to help you layout the branded bull market expected by the institution. At the same time, it is hoped that readers can avoid The investment traps brought about by the uncertainty and reflexivity of the market.

The annual reports and articles selected in this report come from: a16z, Coinbase, Messari, Hashed, Matrixport, Spartan, Binance, Delphi Digital, Pantera and other institutions...

(Comparison of Crypto’s total market capitalization and SP 500 market capitalization | Data from: https://alpha.sosovalue.xyz/)

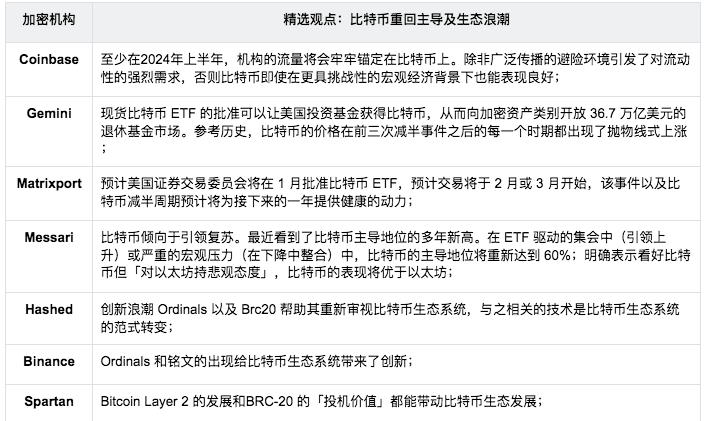

One of the narrative keywords: Bitcoin’s return to dominance and ecological wave

Placeholder institutions: Coinbase, Messari, Gemini, Hashed, Matrixport, Spartan…

Overall argument: With the support of policies and regulations, Bitcoin is increasingly favored by retail investors and institutions, and will lead the market recovery and return to dominance. The approval of Bitcoin ETFs and the Bitcoin halving cycle will provide impetus for price increases. , Innovation Wave Ordinals and BRC-20 will reshape the Bitcoin ecosystem.

The core narrative of 2024 must be around Bitcoin, the core asset in the encryption field. Most institutions have devoted a lot of space to predicting the development of Bitcoin in the new year. The US-compliant crypto exchange Coinbase stated in its year-end report that Bitcoin will regain its dominance in the crypto market in 2023. This shift shows that retail and institutional investors are increasingly favoring Bitcoin;

1/ About Bitcoin Spot ETF:In 2023, several well-known financial giants applied for spot Bitcoin ETFs in the United States. Coinbase believes that the participation of financial giants in this field will help validate and enhance the prospects of cryptocurrency as an emerging asset class. At least in the first half of 2024, institutional traffic will be firmly anchored in Bitcoin.

2/ The impact of the overall macro environment on Bitcoin:Unless a widespread risk-off environment triggers strong demand for liquidity, Bitcoin will perform well even in a more challenging macroeconomic backdrop.

Similar to Coinbases view, the exchange Gemini also stated in a research report that after the ETF is approved, a large inflow of capital into crypto is expected to drive up prices. Meanwhile, approval of a spot Bitcoin ETF could give U.S. investment funds access to Bitcoin, opening the $36.7 trillion retirement fund market to the crypto asset class.Regarding the time and location of the halving, the halving market will arrive in April 2024. Referring to history, the price of Bitcoin has experienced a parabolic rise in each period after the previous three halving events.

Also holding the same view is the crypto financial institution Matrixport, which mentioned ETFs and Bitcoin halving in its report predicting market trends in the first half of 2024. The institution expects that the U.S. Securities and Exchange Commission will approve a Bitcoin ETF in January. Trading will begin in February or March, and this event, along with the Bitcoin halving cycle, is expected to provide healthy momentum for the coming year.

Regarding Bitcoin price and market capitalization ratio, crypto investment analysis agency Messari predicts that although it is difficult to predict Bitcoin’s trading position in the short term, its attractiveness is almost indisputable from a longer time scale. The long-term argument for Bitcoin is straightforward. Everything is going digital. Bitcoin tends to lead the recovery. Bitcoin dominance has recently seen new multi-year highs.The agency’s bet is that Bitcoin dominance will return to 60% in an ETF-driven rally (leading the way up) or severe macro stress (consolidating on the way down);

Regarding the latest Brc 20 ecological wave,Crypto exchange Binance mentioned in its year-end report that the emergence of Ordinals and inscriptions has brought innovation to the Bitcoin ecosystem.Crypto investment institution Hashed conducted a more specific analysis of this field, The innovation wave Ordinals and Brc 20 help it re-examine the Bitcoin ecosystem. The related technologies are a paradigm shift in the Bitcoin ecosystem, demonstrating the most dominant, The long-term sustainable potential of a widely accepted and most secure blockchain.

Hashed said that he foresees that the Bitcoin ecological field will unfold like Ethereum decentralized finance in 2020. Ecosystem infrastructure includes lending markets, decentralized exchanges, bridges, aggregators, portfolio management, development tools, tracking infrastructure, and more. Startups or protocols that help build tools for secure and flexible programming of Bitcoin, develop independent indexing infrastructure or wallets, aggregation systems, or even create native Bitcoin metaverses or NFT markets could have a huge impact in 2024; for Brc 20 Regarding related technical doubts, the encryption investment institution Spartan stated in the report,The development of Bitcoin Layer 2 and the speculative value of BRC-20 can both drive the development of the Bitcoin ecosystem.

It is worth mentioning that the crypto investment analysis agency Messari clearly stated that it is optimistic about Bitcoin but pessimistic about Ethereum. Although it likes Ethereum and everything derived from it, in the long run, the investment case for ETH is more like Its Visa or JPMorgan Chase. Bitcoin has outperformed Ethereum as a digital currency due to institutional allocators’ interest in the “pure play” of digital gold.

(Comparison of Crypto’s total market capitalization and Bitcoin market capitalization | Data from: https://alpha.sosovalue.xyz/)

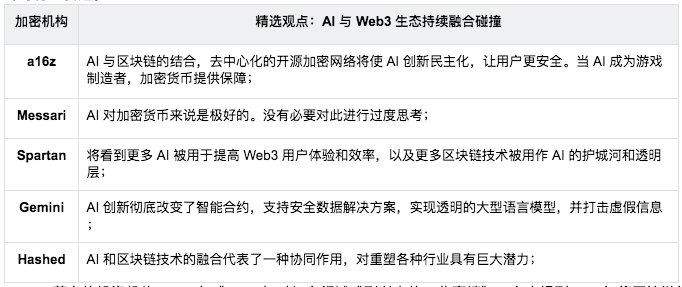

Narrative Keyword Two: The continued integration and collision of AI and Web3 ecology

Placeholders: a16z, Messari, Spartan Group, Gemini

Overall argument: AI technology represented by ChatGPT will begin large-scale commercial use in 2023. What impact will this have on the cryptocurrency field? Most institutions believe that AI will bring a better user experience to Web3 users and change smart contracts, payment, code auditing and other industry tracks.

The well-known investment institution a16z mentioned in the article Some Things to be Excited about the Encryption Field in 2024 that the combination of AI and blockchain, decentralized open source encryption network will democratize AI innovation and make users safer . At the same time, when AI becomes the game maker, cryptocurrency provides protection. For example, AI generates legends, terrain, narratives and logic for the game, while Crypto provides the ability to understand, diagnose and punish when AI encounters problems. Crypto investment institution Spartan Group also stated that it will see more AI being used to improve Web3 user experience and efficiency, and more blockchain technology being used as a moat and transparent layer for AI;

Messari, a crypto investment analysis agency, is optimistic about the impact of AI on the cryptocurrency field and said there is no need to overthink it. “AI is great for cryptocurrency. There is no need to overthink it, but Arthur Hayes (BitMEX founder) published an article on this topic this summer. The two most critical elements for any artificial intelligence are data and computing power. Therefore, it seems that artificial intelligence will trade a kind of data that persists over time Its energy purchasing power is reasonable, which perfectly describes Bitcoin;

In terms of predicting the changes that AI will bring to technology and different track areas, crypto exchange Gemini said in a report, “AI innovation has revolutionized smart contracts, supported secure data solutions, enabled transparent large-scale language models, and combated falsehoods. Information, specifically expressed as:

1/ Content creation: The asymmetric ability of AI to create content exceeds human processing capabilities. Soon people will default to assuming that the content is false and rely on on-chain proofs for verification;

2/ Payment: In the near future, most payments will be made on the chain by AI Agents on behalf of people;

3/ Code audit: Code audit companies will develop copilot versions for smart contract writers, so AI can assist in verifying the quality of smart contract code during creation (not just after creation);

It is worth noting that crypto investment institution Hashed believes that the integration of AI and blockchain technology represents a synergy that has great potential to reshape various industries. Regarding the content creation industry, the agency gave the example that deep learning models such as Midjourney and Stable Diffusion may become protocols similar to the media version of ChatGPT, where original content and IP holders can pledge their assets (NFTs, game items, photos, papers, Iconic designs, etc.) to prove ownership and originality, a portion of the revenue generated by the product can be distributed as loyalty compensation. This will ease IP ownership issues for content generated by AI engines and open up new markets for content creators.

(List of some tokens in the AI field|Data from: https://alpha.sosovalue.xyz/)

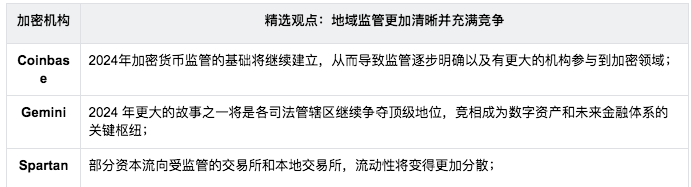

Narrative Keyword Three: Regional supervision is clearer and full of competition

Placeholder institutions: Coinbase, Gemini, Spartan

Overall Tone: The foundation for cryptocurrency regulation will continue to be established in 2024, leading to regulatory clarity and greater institutional involvement in the crypto space. One of the bigger stories in 2024 will be that jurisdictions will continue to compete for top spot in the regulatory landscape.

Coinbase, a U.S.-based crypto exchange, has always been at the forefront of U.S. regulation and therefore has deep insights into regulation. The agency believes that the foundation for cryptocurrency regulation will continue to be established in 2024, leading to gradual regulatory clarity and greater institutional involvement in the crypto space. However, it analyzes both negative and positive aspects of U.S. regulation. On the one hand, the agency believes that uncertainty in the United States is contributing to missed opportunities. On the positive side, the U.S. approval of Bitcoin spot ETFs may increase the number of cryptocurrencies. Access expands to new investor categories and reshapes markets like never before.

Not only has the foundation for regulation been established, but the global regulatory field will also be full of competition. The crypto exchange Gemini said in the report, One of the bigger stories in 2024 will be that jurisdictions continue to compete for top status and compete to become digital assets. and a key hub for the future financial system. Countries including the United Kingdom, the European Union, the United Arab Emirates, Japan, Hong Kong, Singapore and other countries have seen this and are continuing to compete to have the most credible regulatory framework to attract business growth and innovation. ;

Will regulation also have a negative impact? Crypto investment institution Spartan is worried that regional regulation will have an impact on the overall crypto market liquidity. Some capital will flow to regulated exchanges and local exchanges, and liquidity will become more dispersed.

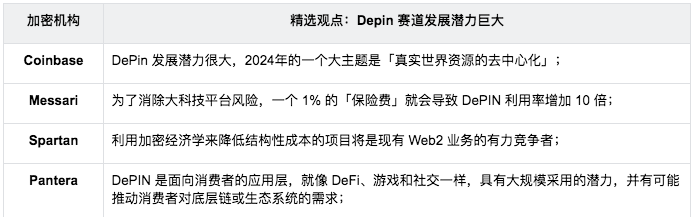

Narrative Keyword No. 4: DePIN has huge development potential

Placeholder institutions: Coinbase, Messari, Spartan, Pantera

Overall argument: DePIN is one of the potential tracks that several encryption institutions are optimistic about. First, they believe that DePIN has the potential for large-scale adoption; second, they believe that projects that use cryptoeconomics to reduce structural costs will be existing Web2 businesses. A strong competitor.

Paul Veradittakit, a partner at crypto investment institution Pantera, wrote in an article discussing the Depin track that the development of DePIN in the past year has had considerable impact and significance on the entire blockchain ecosystem. One of the most important reasons is that “DePIN is a consumer-facing application layer, just like DeFi, gaming, and social, with the potential for mass adoption and the potential to drive consumer demand for the underlying chain or ecosystem.” .

From the perspective of the larger industry background, Coinbase believes that DePIN has great development potential, and blockchain technology will play a core role in managing and allocating actual resources in the future. A big theme in 2024 is decentralization of real-world resources.

Among them, Coinbase specifically mentioned the concept of DeComp (distributed computing) in the report. DeComp is a specific extension of DePIN that relies on a distributed computer network to complete specific tasks. And predicting that the concept will be revitalized by the mass adoption of generative artificial intelligence (AI), training AI models can be computationally expensive, and the industry is exploring whether there are opportunities to alleviate this problem through decentralized solutions.

When it comes to DePIN, we have to mention the traditional cloud infrastructure field. Messari said that cloud infrastructure services are a US$5 trillion market value industry in the traditional market, and DePIN only accounts for 0.1% of it. Even assuming that 0% of online services use DePIN as their primary stack, the need for decentralized redundancy alone could lead to a surge in demand. In order to eliminate the risk of big technology platforms, an insurance premium of 1% will lead to a 10-fold increase in DePIN utilization. It doesn’t take much to make a difference, especially with the demand for GPU and computing resources driven by artificial intelligence.

Similar views include Spartan, which believes that “projects that use cryptoeconomics to reduce structural costs will be strong competitors to existing Web2 businesses.”

(List of some tokens in the DePIN field|Data comes from: https://alpha.sosovalue.xyz/)

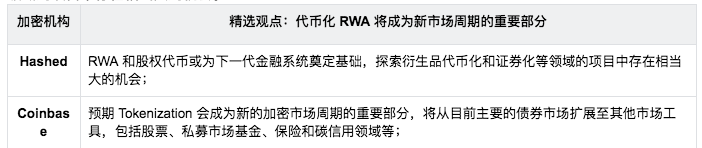

Narrative Keyword 5: Tokenized RWA will become an important part of the new market cycle

Placeholder institutions: Coinbase, Hashed

Overall tone: Tokenization is expected to become an important part of the new encryption market cycle. In 2024, it will expand from the current main bond market to other market instruments, including stocks, private market funds, insurance and carbon credit fields, and explore derivative tokens. Considerable opportunities exist in projects in areas such as securitization and securitization.

Crypto investment institution Hashed believes in a report that RWA and equity tokens may lay the foundation for the next generation of financial systems. The agency stated that the current market is mainly focused on products related to U.S. Treasury bonds and the tokenization of basic assets, however there are considerable opportunities in projects exploring areas such as derivative tokenization and securitization.

Regarding investment concepts in this field, Hashed said that the evaluation of relevant projects will also include regulatory elements such as compliance, risk management and due diligence, as well as operational elements such as efficient deposit and withdrawal processes, market accessibility and scalability. Tokenized RWA is critical to bridging the gap between decentralized finance and traditional finance, laying the foundation for a more integrated and resilient financial ecosystem.

Crypto exchange Coinbase will discuss the meaning of tokenization, category expansion, and developments in conjunction with regulation in the report:

1/ Tokenization is an important use for traditional financial institutions, and it is expected to become an important part of the new encryption market cycle;

2/ Category expansion: In 2024, we may see tokenization expand to other market instruments (currently mainly in the bond market), including equities, private market funds, insurance and carbon credits, due to customer demand for high-yield products and The need for diversified sources of income is increasing;

3/ Integration with regulation: It is worth watching the regulatory progress made by jurisdictions like Singapore, the EU and the UK. The Monetary Authority of Singapore sponsors “Project Guardian,” which has produced dozens of proof-of-concept tokenization projects on public and private blockchains for Tier 1 financial institutions around the world. The EU’s DLT pilot regime has developed a framework for enabling multilateral trading facilities to utilize a blockchain for trade execution and settlement, rather than through a central securities depository. The UK has also launched a pilot regime seeking to provide a more advanced framework for the issuance of tokenized assets on public networks;

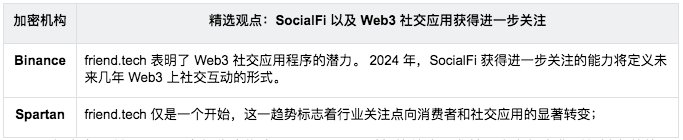

Narrative Keyword Six: SocialFi and Web3 social applications gain further attention

Placeholder institutions: Binance, Spartan

Overall tone: The emergence of friend.tech in 2023 has attracted industry attention. Encryption agencies predict that this is just the beginning. SocialFi, represented by the potential of Web3 social applications, will gain further attention, marking the shift of industry attention to consumers and social applications. significant transformation.

Crypto exchange Binance pointed out in the report that the attention generated by friend.tech, especially from influencers outside the cryptocurrency field, shows the potential of Web3 social applications. SocialFis ability to gain further traction in 2024 will define what social interaction will look like on Web3 for years to come. Crypto agency Spartan also talked about the explosion of friend.tech, coupled with the airdrop that may occur in the coming year, which has triggered a surge in imitation projects. “This is just the beginning. This trend marks the industry’s focus on consumers and social media. Significant changes in applications.

(List of some tokens in the SocialFi field|Data comes from: https://alpha.sosovalue.xyz/)

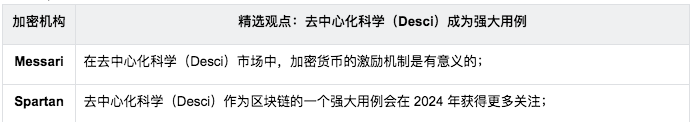

Narrative Keyword No. 7: Decentralized Science (Desci) becomes a powerful use case

Placeholder agencies: Spartan, Messari

Overall tone: Decentralized science (Desci) will gain more attention in 2024 as a powerful use case for blockchain, and in this market, the incentive mechanism of cryptocurrency makes sense.

Encryption agency Messari mentioned decentralized science (Desci) in the last paragraph of its year-end report and stated that the projects covered by this concept are still in their early stages, and 50% of the DeSci projects it tracks were established within the past year. In this market, cryptocurrency incentives make sense. To scale, token sales and DAOs aim to revolutionize the way people conduct research, and interest in longevity, rare disease treatments, and space exploration is large enough to drive growth in the field. At the same time, encryption agency Spartan predicts that decentralized science (Desci) will gain more attention in 2024 as a powerful use case of blockchain. Its significance lies in using Web3 technology to establish a secure and durable record of scientific contributions to achieve fair credit. Distribute, simplify transactions, allow global resource sharing and overcome economic barriers

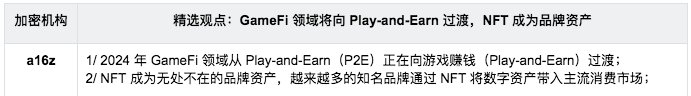

Narrative Keyword Eight: The GameFi field will transition to Play-and-Earn, and NFT will become a brand asset

Placeholder: a16z

Overall argument: Regarding the GameFi field, a16z’s narrative prediction is the most noteworthy. The agency stated that in 2024, the GameFi field will be transitioning from Play-and-Earn (P2E) to making money from games (Play-and-Earn), and at the same time, NFT will become a brand asset. More and more well-known brands are bringing digital assets into the mainstream consumer market through NFT.

Among a16zs nine major predictions for the encryption market in 2024, predictions in the GameFi field were mentioned. The once popular concept Play to earn became Play and earn. a16z believes that what the gaming industry really needs is games that can both attract players and allow players to get more value. The transition from Play-and-Earn (P2E) to gaming to make money (Play-and-Earn) is underway, establishing a significant distinction between gaming and work (gold). In addition, Messari also stated in the report that the current market size of the gaming industry is approximately US$250 billion and is expected to grow significantly. For the gaming industry, the value-add of leveraging web3 architecture is the potential for improved user acquisition and retention, but so far this remains an unproven argument.

a16z also mentioned predictions about the NFT field in the report, NFT has become a ubiquitous brand asset, and more and more well-known brands are bringing digital assets into the mainstream consumer market through NFT. With custodial wallets and L2 networks with low transaction costs, the conditions are being created for widespread adoption of NFTs as digital brand assets for wider companies and communities.

(List of some tokens in the GameFi field|Data from: https://alpha.sosovalue.xyz/)

Reference report

https://coinbase.bynder.com/m/c8c6fdc663f44b5/original/2024-Crypto-Market-Outlook-V3.pdf

https://mp.weixin.qq.com/s/z2dbV7Rt-ZXQ9hYoIcynkw

https://resources.messari.io/pdf/crypto-theses-for-2024.pdf

https://www.gemini.com/trend-re port-2024

https://medium.com/the-spartan-group/9-things-that-excite-us-in-web3-in-2024-c 0 ac 6 f 029 bcf