On December 23, 2020, OKX announced the launch of the unified trading account system (Unified Account) and launched a global public beta.

Three years later, the established unified trading account pioneered by OKX, an established crypto exchange, still remains the industry leader. There are three main cores behind it: OKX insists on simplifying complexity in terms of product operation experience, OKX insists on starting from user needs in terms of product usage functions, and most importantly, OKX insists on continuous innovation in terms of product iteration.

The first-generation crypto exchange accounts only had simple fiat accounts and currency accounts, which could only meet the basic needs of users for deposits and withdrawals and spot transactions, and had limited functions. The second-generation crypto exchange accounts tend to be more rich and functional. Users have at least multiple independent accounts such as fiat accounts, currency accounts, margin accounts, perpetual accounts, delivery accounts, options accounts, etc., which are extremely playable. Big increase.However, because these accounts are not interoperable, users need to transfer funds back and forth to the corresponding accounts when conducting different types of transactions. Not only is the operation inefficient and cumbersome, there are financial barriers, and it is not conducive to increasing the thickness of the margin under extreme market conditions, And the capital utilization rate is also relatively low.

In order to further enhance user trading experience, OKX has begun to promote the arrival of third-generation crypto exchange accounts with its profound technology accumulation, which is of great significance to inspire the industry.

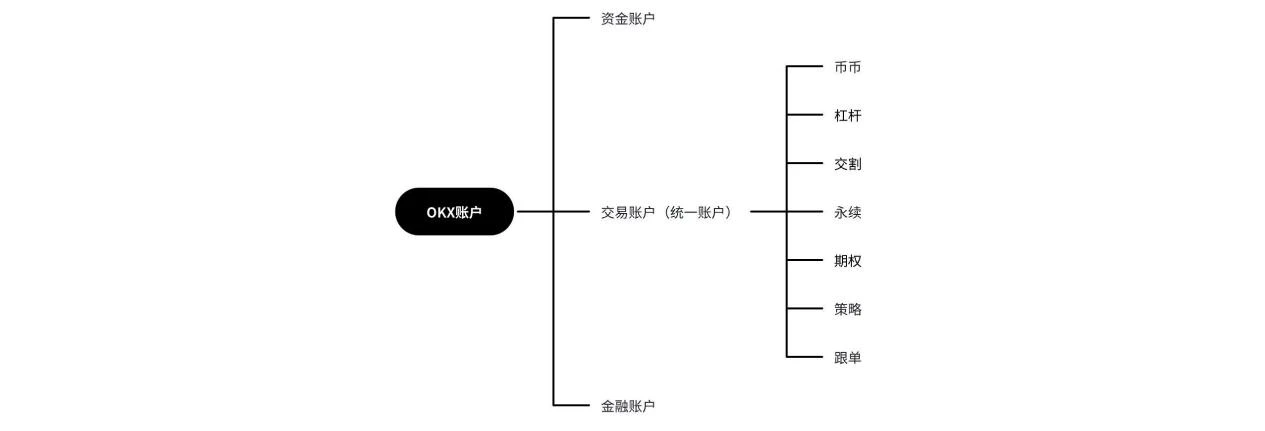

Account framework and applicable users

OKX unified trading account is a trading system that can simultaneously buy and sell multiple crypto asset derivatives settled in different currencies through one trading account. It is divided into three types: capital account, trading account and financial account. Capital account and financial account are mainly used for Savings and financial management, and the trading account is a unified trading account system. Under this account, users can conduct five major trading types and 14 trading strategies, including currency, leverage, delivery contracts, perpetual contracts, and options contracts, as well as spot contract tracking in one stop. There is no need to transfer orders back and forth, which greatly improves the convenience of transactions at the operational level.

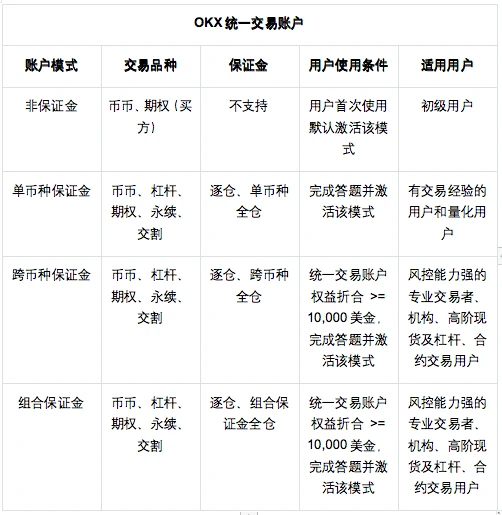

For different types of users, the OKX unified trading account provides a total of four account modes including simple trading mode, single-currency margin mode, cross-currency margin mode and combined margin mode.That is, from simple to advanced modes to accurately adapt to user trading needs.

Account advantages and usage scenarios

In the non-margin mode, users can conduct spot and options transactions at the same time in the same account, but leverage, delivery contracts, and perpetual contracts are not provided.OKXs non-margin model is based on the perspective of protecting junior users. By doing subtraction, it prevents them from directly participating in high-leverage complex derivatives transactions, thereby establishing a relatively safe and risk-controllable trading environment for junior users.

The single-currency cross-margin mode is the mode with the most users. Users can simultaneously conduct currency, leverage, options, perpetual contracts and delivery contracts in the same account, as well as derivatives hedging and arbitrage in the same settlement currency. All trading products with the same settlement currency will share margins, and trading profits and losses can offset each other. For example, two contracts that are both BTC currency-based will share margin. The positions and margins of trading products with different settlement currencies are independent, and trading profits and losses cannot be shared.Compared with the second-generation independent account model, the single-currency margin model greatly simplifies the transaction steps, isolates the risks of different currencies, and improves the utilization efficiency of account funds.

The cross-currency cross-margin model is the most representative model in the OKX unified trading account. It can trade the same types as the single-currency margin model, derivatives hedging and arbitrage in the same or different settlement currencies, and does not hold a certain currency. When buying an asset, you can also trade derivatives of that currency. But the difference is that all trading varieties share margins, and trading profits and losses can offset each other, that is, the cross-currency full margin model is supported. For example, multiple transactions such as BTC contracts and ETH contracts can share a margin, and the thickness of the margin increases.Compared with the single-currency margin mechanism, all crypto assets in this model will be converted into U based on the conversion rate and counted as margin for all positions, breaking the account restrictions between different currencies and reducing the risk of liquidation and liquidation. In the further Improve capital utilization efficiency.For example, under the previous independent mode, in the falling market, the liquidation risks of the BTC contract and the ETH contract were 20,000 U and 2,000 U respectively, but in the cross-currency cross-position mode, the liquidation points may be reduced to 10,000 U and 1,000 U. U, reduces the risk of liquidation and liquidation.

Under the combined margin full position mode, you can carry out complex hedging combinations and option combinations, hedging and arbitrage between derivatives and spot products with the same underlying, and you can also trade derivatives of a certain currency when you do not hold that currency asset.For example, you only hold BTC but can trade ETHUSDT perpetual contracts. Margins are shared among all trading varieties and the margins of derivatives under the same index can offset each other, and trading profits and losses can offset each other. This does not support risk hedging. By building a hedging portfolio of a certain size to reduce risk exposure, maintenance margin requirements can be effectively reduced and capital utilization can be further improved. For example, when the users position size is larger, the hedging structure is better, and there is an option hedging/spot hedging strategy, the margin requirements are lower.

Users can flexibly choose the four account modes of the OKX unified trading account according to their own needs, reducing the probability of liquidation under extreme market conditions and improving capital utilization efficiency.

Product Highlights and Technological Innovation

The comprehensive and advanced OKX unified trading account has many highlight features worth exploring.

Taking the combined margin full position model as an example, it mainly has three core functions: profit and loss hedging, risk hedging and transaction type hedging.Especially when users are hedging transaction types, this model not only supports hedging between derivatives, but also exclusively supports hedging between spot and derivatives.In addition, when users are hedging spot and derivatives, the spot assets of the user account are not locked and can be withdrawn flexibly.

The single-currency margin mode sets up two levels of risk verification. The first level of verification is called risk control order cancellation verification, and the second level of verification is called pre-position reduction verification. This can ensure that users can trade normally and avoid all pending orders being cancelled, positions being partially lightened or even all liquidated due to insufficient margin.

At present, many exchanges are still unable to implement a cross-currency cross-margin model. This model not only allows users to conduct currency, leverage, options, perpetual contracts and delivery contracts at the same time in the same account, as well as the same or different settlement currencies. derivatives hedging and arbitrage,And margin calculation and settlement are very fast. This is because OKX uses a large number of exclusive checksum calculation rules in the backend to realize that all crypto assets will be converted into U standard according to the conversion rate and calculated as margin for all positions.

In addition, in the cross-currency cross-margin mode, the automatic borrowing function is also supported. Users can select the Turn on currency borrowing or Close currency borrowing function in the settings according to their needs.When the borrowing mode is enabled, if the effective margin of the USD value of the account is sufficient, the user can still achieve coinless transactions even if the balance of a certain currency is insufficient, greatly improving the convenience of transactions.

For example, a user only owns SOL but wants to buy ORDI. However, since the exchange does not have a SOL/ORDI trading pair, only SOL/USDT and ORDI/USDT trading pairs, the user needs to exchange SOL for USDT and then buy ORDI. , but after turning on the currency borrowing function, users can directly use SOL to purchase ORDI. This is because the system will lend the user USDT interest-free for purchasing ORDI, which improves the user’s transaction convenience and reduces transaction fees.

Third Generation Crypto Exchange Account

As the crypto market continues to develop, the derivatives market in the crypto industry has also shown strong growth momentum, attracting more and more investors and institutional participation. Growth is expected to continue, especially against the backdrop of the gradual clarity of the regulatory environment and further maturity of the market. However, the shortcomings of the current second generation of encrypted accounts have intensified, and users have more urgent needs for efficient and simple transaction methods and experiences.

Crypto exchanges are the most important scenario for the circulation of crypto assets. OKX unified trading account overcomes the problem of calculating different businesses such as currency, leverage, options, perpetual contracts and delivery contracts in a unified trading account, and by setting a simple trading mode, There are four account modes in total: single-currency margin mode, cross-currency margin mode and combined margin mode, which can accurately adapt to different user trading needs, solve the problem of redundant and complicated second-generation accounts, and greatly improve the smoothness of transactions. and convenience, reducing the risk of liquidation through margin sharing, improving fund utilization, etc.Realizing the integration of internal financial ecology and efficient and convenient transactions of user assets, it redefines the third-generation trading account system.

As the worlds leading encryption and Web3 technology company, in recent years, OKX has not only provided high-liquidity transactions globally, but also is committed to promoting the development of financial instruments and providing users with more trading and investment options.By continuing to promote higher-end products by leading financial technology solutions, we will provide investors with more innovative financial tools including Web3 wallets, CeFi structured products, etc., thereby promoting the large-scale adoption of the encryption industry and providing opportunities for the industry. Bringing a demonstration effect, the encryption industry will continue to usher in more exciting innovations.

It is conceivable that in the future, with the emergence of various new financial instruments in the encryption industry, users will be provided with more extensive and convenient services, greatly lowering their participation threshold, and may become a new growth engine to help the encryption industry reach its next peak.