Summary of Messari report on Covalent (CQT) data availability

Core summary

Covalent provides a unified API that allows developers to reuse queries on multiple public chains.

The project has already provided data to many cryptocurrency companies, covering a wide range of use cases, including Consensys (investor dashboard), CoinGecko (cryptocurrency market data aggregation platform), Rotki (tax tool), NFTX (NFT gallery) and Rainbow (Consumer Wallet).

As of December 2023, Covalent supports over 210 blockchains and plans to support over 1,000 blockchains by the end of 2024.

The Covalent network has been launched and plays two key roles: block specimen generator and block result generator.

The Graph is currently suitable for projects that require specialized datasets, while Covalent is currently best suited for serving applications that require general, broadly applicable data.

Introduction

Messari’s summary of Covalent’s (CQT) report highlights the project’s massive data availability, with billions of pieces of data.

Although blockchain data is public and accessible, it is often difficult to obtain. The problem becomes even more complex when applications such as wallets and NFT marketplaces need to obtain data from multiple blockchains, and those blockchains have different output formats. Covalent built a protocol that standardizes data from more than 210 blockchains; its unified API allows developers to reuse queries across supported networks.

APIs (Application Programming Interfaces) transfer data between two parties: the client and the server. Using APIs, servers can control their systems and respond to client requests. Users (such as application developers or analytics companies) extract data from it via APIs, while data providers retain ownership. While many companies have built server-side infrastructure to provide access to blockchain data, most are limited to the RPC layer. These traditional methods often only obtain the surface-level data required to be formatted into the requested blockchain.

Covalents protocol goes deeper than traditional approaches: it extracts data from various blockchains, uploads the data to storage instances, indexes and transforms the stored data objects, and loads the data into a local data warehouse for API users Inquire. Throughout the process, it sends proofs to the Moonbeam network to verify the work completed at each step. In short, Covalent cryptographically and securely standardizes all extracted blockchain data so that developers can query from any chain in a unified way, which is where the Unified API comes in.

Covalent Overview

Progressive Decentralization with Covalent

Covalent started as a hackathon project in 2017. Since its inception, it has been building an indexing engine capable of providing deep metrics from the blockchain. Examples of these deep metrics include getting token holders for any block height or getting log events emitted by a specific smart contract address.

In October 2020, Covalent only supported Ethereum. But as of December 2023, Covalent already supports more than 210 growing blockchain networks that API users can query. Additionally, in 2022, Covalent became the first blockchain data provider to index app chains.

Before undertaking progressive decentralization, Covalent sought product market fit for its indexing engine. In addition to parties supporting and interested in Covalent, the project also generates revenue from clients in the cryptocurrency industry such as ConsenSys, CoinGecko, and Rainbow. Covalent told Messari that years of delivering business campaigns to enterprise customers confirmed market demand, laying the groundwork for the types of data that can be queried from its unified API.

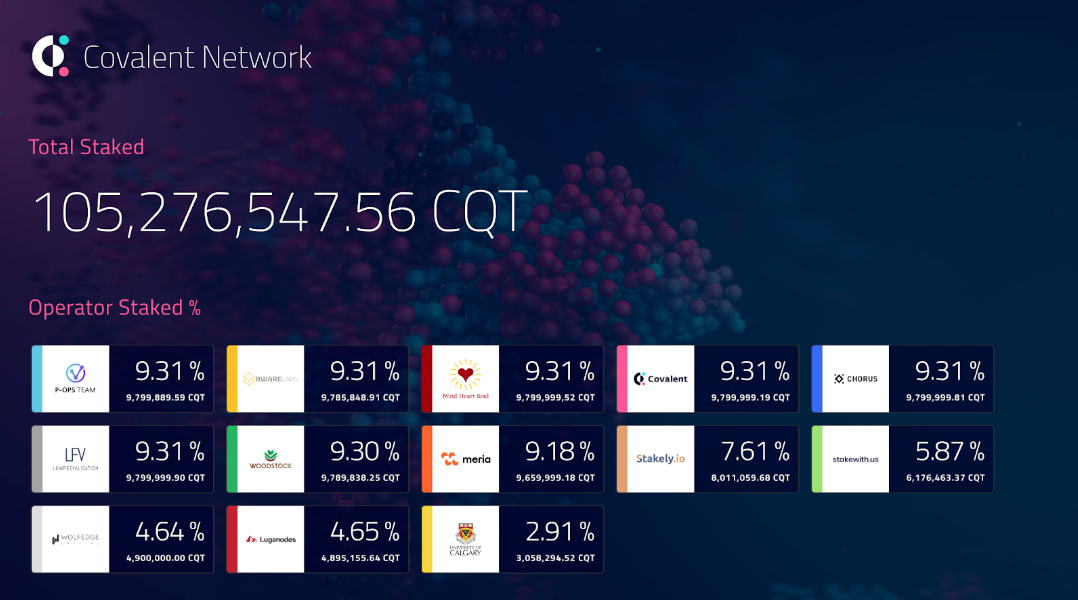

network participants

Covalent’s decentralized protocol will have multiple network participants called “operators.” Currently, two network operator roles exist alongside the staking functionality. They areblock specimen generatorandrefiner”. As of December 2023, Covalent has15 Block Specimen Producers (BSP), which includes well-known operators such as Chorus One, Woodstock, StakeWithUs and Meria. However, as Covalents decentralization process continues to evolve, this role will require permission.

Block specimen producers extract the raw blockchain data and create a"block specimen"data object. The Block Exemplar Producers commitment to standards enables blockchain data to be composed and reused outside of the execution environment. The block specimen producer then uploads the block specimen to the storage instance, creates a hash (or proof) of the stored block specimen, and publishes the proof into the Covalent ProofChain smart contract on Moonbeam. Once proven on Moonbeam, other network nodes can verify the work of the block specimen producer.

Staking CQT as of December 2023

at the same time,"refiner"is a processing framework designed for scalable and verifiable data transformation. Block Result is one of many possible outputs. It is a one-to-one representation of the block data returned by the blockchain node through RPC calls, with optional additional information fields. Like block specimen producers, extractors employ encryption techniques to ensure efficient conversions.

Others not yet onlineNetwork operator roleIncludes query operators, auditors, and storage operators.

The query operator loads the transformed data into the local data warehouse before responding to the API query.

Each network operator is paid after auditors confirm each certification for a specific period. Before payment is made, a group of auditors are randomly selected from all network operators to serve as auditors for the audited time period.

When block specimen producers upload data to a storage instance, they can either run the instance locally or pay a storage operator to run the instance. Storage operators should load and store proofs locally via IPFS, thus increasing the data availability of the proofs.

Covalent is currently managing these roles and working to open them up to entities eager to participate.

Covalent told Messari that it plans to have all network operator roles live by 2024. As the Covalent protocol decentralizes, the growth and activity of network participants such as block specimen producers, refiners, and query operators will reveal the overall effect of its decentralization.

Covalent has raised approximately $15.71 million in a private seed round, two strategic private placements, and a public placement.Private Placement Participants in 2020Includes Woodstock Fund, 1kx Capital, Mechanism Capital, AU 21 Capital, Brilliance Ventures, TRG Capital and CoinGecko.Private Placement Participants in 2021These include Hashed, Binance Labs, Coinbase Ventures, Delphi Ventures, Hypersphere Ventures, and the entities behind Avalanche, NEAR Protocol, Elrond, and Moonbeam.

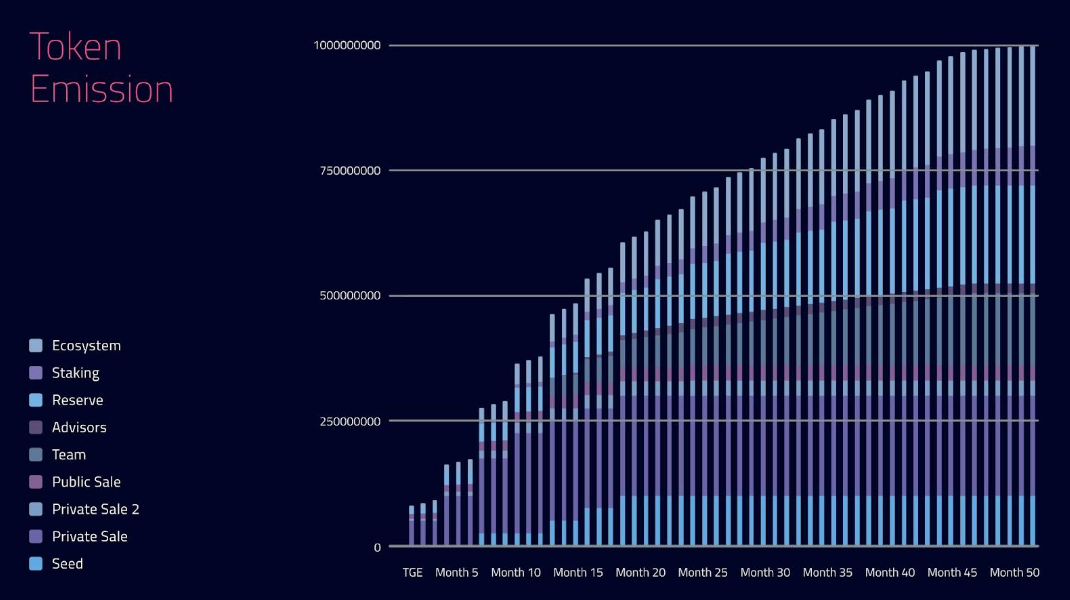

Covalent Query Token (CQT) launched on Ethereum with a maximum supply of 1 billion, with differentUnlock plan. Of this supply, approximately 33.3% (333 million CQT) were allocated to the private sale participants mentioned above. Teams and advisors are allocated approximately 16.4% (164 million CQT) of the maximum supply. The remaining allocation (public sale, staking, reserves, and ecosystem) represents approximately 50.3% of the maximum supply (503 million CQT). Currently, all private and public investor tokens are unlocked.

CQT is a governance token also used for staking and settlement payments with network operators. As Covalent progresses toward decentralization, governance is still in its early stages and requires manual intervention from the team. While community members generate improvement proposals on forums and Discord, the team decides whether to move proposals to Snapshot for final off-chain voting based on feedback and rough consensus. Adopted proposals are then implemented by the Covalent team. As of December 2023, Covalent has been voted on Snapshot four times, the most recent of which was in September 2023.

While governance uses CQT on Ethereum, staking and payment settlement are via CQT bridged with Moonbeam. CQT uses a method called"Stake to gain access"(Stake-for-Access,SFA)’s token model requires network operators to stake CQT to perform network duties and subsequently receive compensation. Network operators participate by pledging CQT, and there is a risk that the pledged assets will be reduced due to negligence or malicious behavior - however, as of December 2023,The reduction has not yet taken effect。

Due to the termination period, the CQT held by the network operator is at leastWithin 180 daysNot for sale. The value of CQT will be driven by the mechanism that connects API demand to network data supply. Tentatively starting from the second quarter of 2024, the stable

Coin progresspay, the stablecoin will be used in the market to purchase CQT to reward operators. Unbonding periods and market buying features may benefit asset prices as selling pressure decreases and buying pressure increases. However, liabilities and infrastructure overhead may be paid in another currency, which may pose challenges for network operators as newly awarded CQTs may face selling pressure.

Holders who choose not to run operating nodes can delegate CQT to network operators. In return, they will receive variable returns based on the amount of CQT staked and commissions charged by network operators. Earnings come from inflationary staking rewards (used as incentives tostart upNetwork operator activities), these rewards will supplement network rewards for up to four years. In the case of ongoing activity, rewards will come from fees paid to the protocol for queries to the Covalent API.

Competitors to watch

When seeing the keyword “API,” it’s easy to want to compare Covalent to any competitor that provides on-chain data access via APIs. However, most entities that provide API products only collect data at the RPC level. Staying only at this level would place the burden of querying and standardizing data on different blockchains on the shoulders of development teams.

Potential complementary solutions

Since Covalent provides a unified API, service providers like Infura and Alchemy can be considered complementary to Covalent. Covalent told Messari that its network operators actually pull data from sources like Infura and CoinGecko and then package the data so it can be pulled from Covalent’s unified API. This flexibility becomes very important in a multi-chain world where the data retrieved from the RPC layer may be different from the data of other chains.

The Graph

While Alchemy and Infura employ centralized structures, The Graph is an indexing protocol where network participants are incentivized to earn rewards for performing critical operational tasks. In contrast to Covalent, all network participant roles in The Graph are real-time. The Graph is planned to meet specificExit criteria and indexer readyDriven by this, graduallystopIts services are hosted on-chain to achieve complete decentralization.

However, Covalent and The Graph do not compete directly as market indexers. Applications using Covalent tend to require general, broadly applicable data rather than the highly specialized datasets built by subgraph developers. Applications in areas such as wallets, NFT markets, and tax services are more likely to use Covalent. By curating indices based on queryable data types, Covalent currently chooses to forego indexing community-created datasets. In the future, it plans to introduce a community-maintained API endpoint calledClass C terminal。

For development, The Graph relies on independent developers or teams to create subgraphs (open APIs that contain on-chain data). Considering that subplot development requires a high degree of expertise, most meaningful subplots are created by something likeMessariorBuilt by a highly organized entity like Uniswap Labs. The Graph compensates for the lack of market-derived broad data provision by providing development tools to help independent entities build subgraphs.

While outsourcing development can result in building overly specialized subgraphs, these APIs often contain deeper access to information than protocols focused on standardization. Covalent plans to increase support forcommunity maintenanceSupport for API endpoints, similar to subgraphs. The competition with The Graph is not head-to-head, and the two protocols can exist side by side by providing support for various projects.

Thoughts at the end of the article

When building applications that use on-chain data, projects should choose their providers based on the following four factors:

The number of chains supported by the provider.

The types of data that can be extracted.

Data security/accuracy.

Latency (the number of blocks the provider is lagging behind).

After years of serving the elite companies in crypto such as ConsenSys, CoinGecko, and Rainbow, Covalent has iterated on its unified API to provide a powerful set of fine-grained data with measurable performance for over 210 supported blockchains. market demand. Covalent publishes proofs at every step of its data flow while maintaining a two-block latency for every blockchain it supports. As the world moves towards a multi-chain future, Covalent will play an important role in the field of on-chain data indexers. It will provide users with a secure, fast and unified way to query data from parallel networks.