Original author:Zach Pandl, Grayscale

Original compilation: Felix, PANews

Key points:

ETH’s growth in 2023 is still good, but still lagging behind that of Bitcoin and some other public chains. Grayscale believes this can be attributed to positive factors unique to Bitcoin this year, as well as a slow recovery in activity on the Ethereum chain.

Although ETH has not risen as much as Bitcoin, ETH has still outperformed traditional assets this year in absolute terms and on a risk-adjusted basis. Ethereum’s growing L2 ecosystem may attract new users and support the token’s valuation in 2024.

It’s rare to say that an asset rising 82% is “underperforming,” but that’s what ETH is facing in 2023. The second-largest crypto asset has seen decent gains this year (with relatively low price volatility), but is still well behind BTC, which is on track to gain 162% this year. The ETH/BTC ratio declined throughout the year, reaching its lowest level since mid-2021 (Figure 1). Grayscale Research believes that ETH will “underperform” in 2023 for the following reasons.

Chart 1: ETH/BTC ratio trending downward in 2023

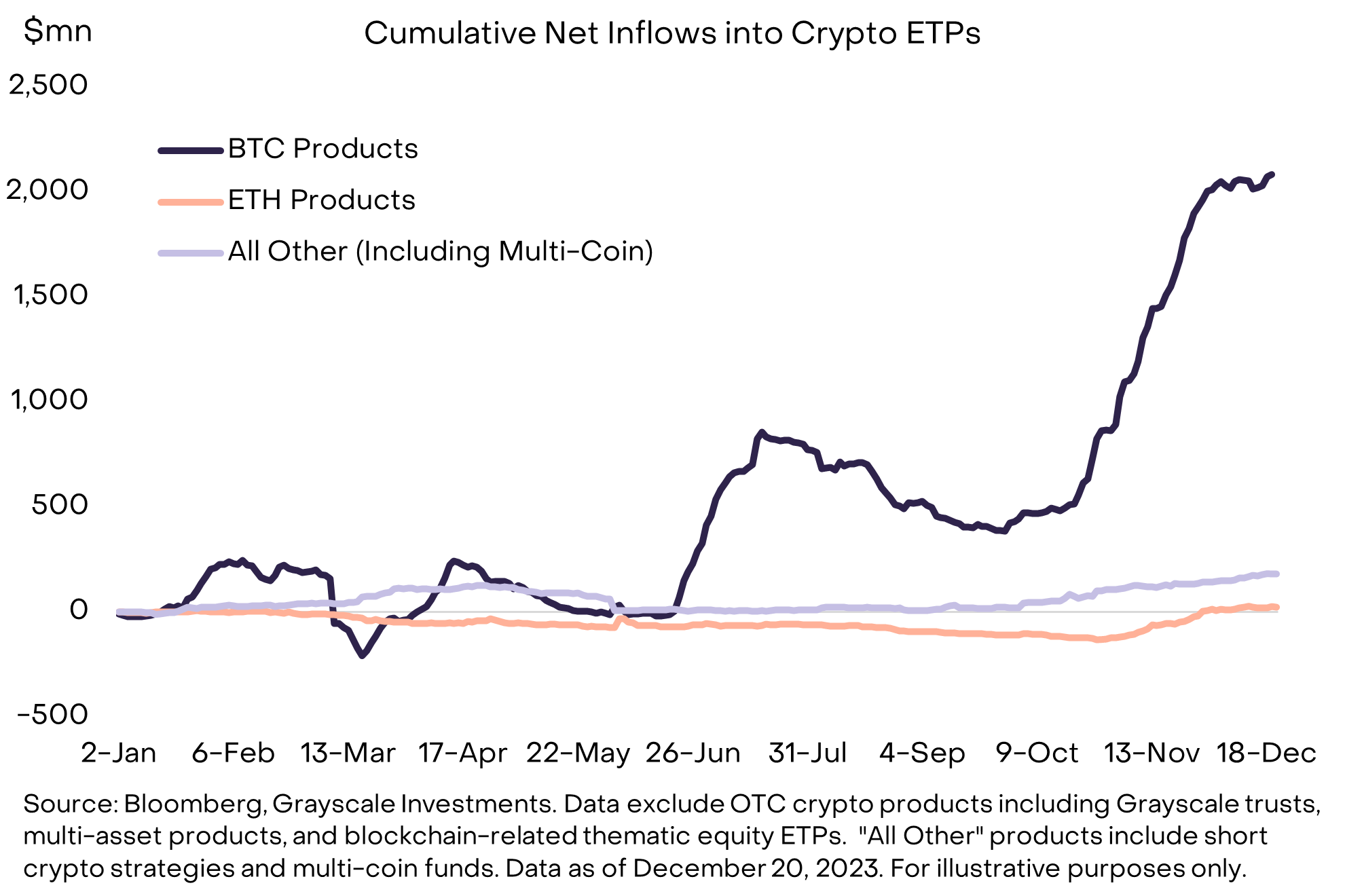

First, there are several Bitcoin-specific positives in 2023, including substantial progress on a potential Bitcoin spot ETF and instability in U.S. regional banks, highlighting Bitcoin’s role as an alternative to the traditional monetary system. These events appear to be driving inflows into Bitcoin-focused crypto investment products in 2023, sending Bitcoin higher this year. For example, Grayscale Research estimates that Bitcoin-focused exchange-traded products (ETPs), including futures products in the United States and spot products overseas, will see net inflows of approximately $2 billion in 2023. In comparison, ETH-focused ETPs saw net inflows of just $24 million during the same period (Figure 2).

Chart 2: Bitcoin-specific positives appear to be driving more ETP inflows

Second, most smart contract platform tokens have risen less than Bitcoin this year, with ETH largely in line. As shown in Chart 3, the FTSE Grayscale Smart Contract Platform Crypto Industry Index is up approximately 94% in 2023, just slightly ahead of ETH. ETH outperformed other coins in the year to October, but others have caught up recently (standout performers being AVAX and SOL). Throughout the year, ETH has performed near the middle of the pack among the 40 tokens on the Smart Contract Platform Crypto Industry Index.

Chart 3: Ethereum’s performance is consistent with the Smart Contract Platform Crypto Industry Index

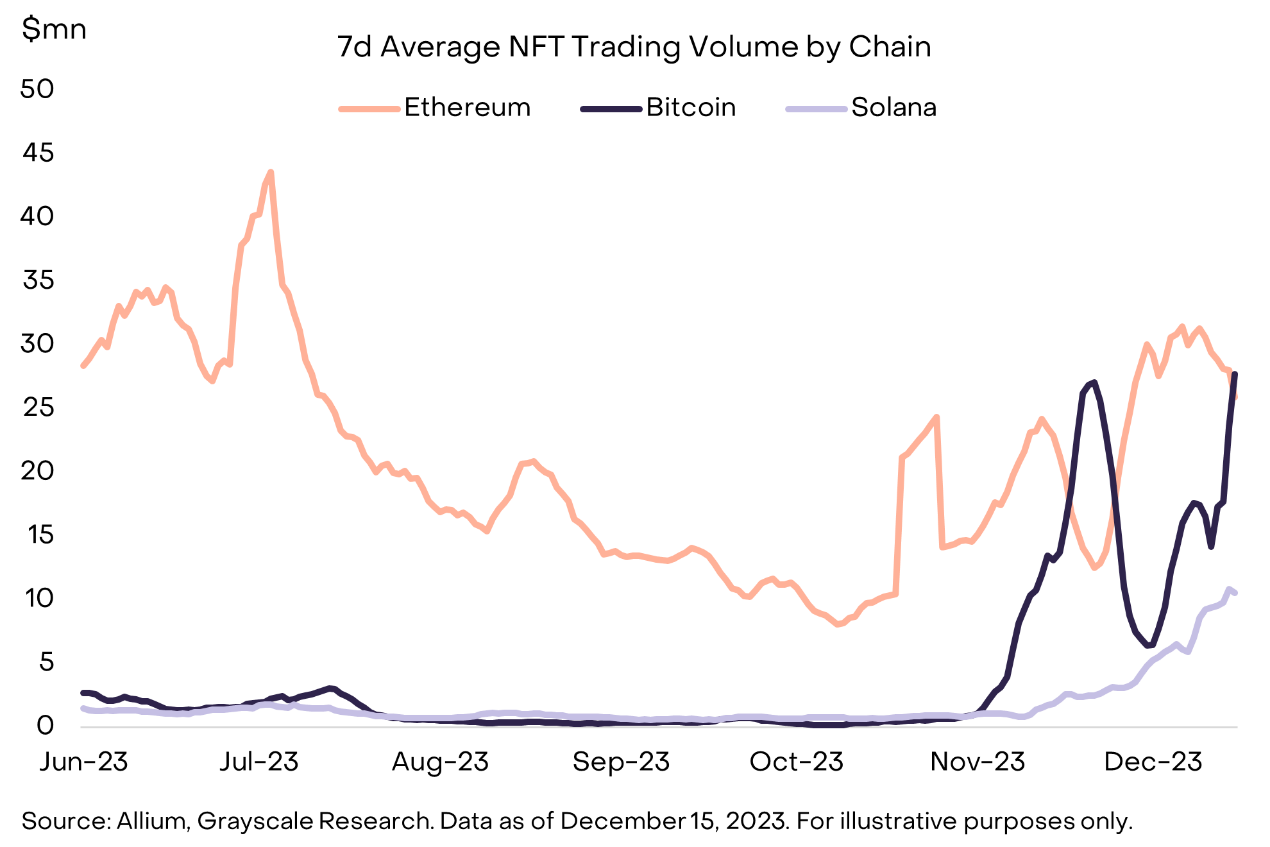

Third, on-chain activity (in some categories) on the Ethereum mainnet has been slower to resume compared to other public chains. For example, Solana ecosystem NFT transaction volume has grown faster than Ethereum ecosystem NFT transaction volume since the start of the quarter. Digital collection transactions on Bitcoin have also grown significantly due to the rise of Ordinals (Figure 4); in late December, the Bitcoin network’s single-day transaction fees even exceeded those of Ethereum due to the large number of Ordinals transactions. While Grayscale Research believes Ethereum’s NFT ecosystem remains constructive, Solana and the Bitcoin network have recently captured the majority of market share in on-chain activity in this space.

Chart 4: Increasing NFT activity on Bitcoin and Solana chains

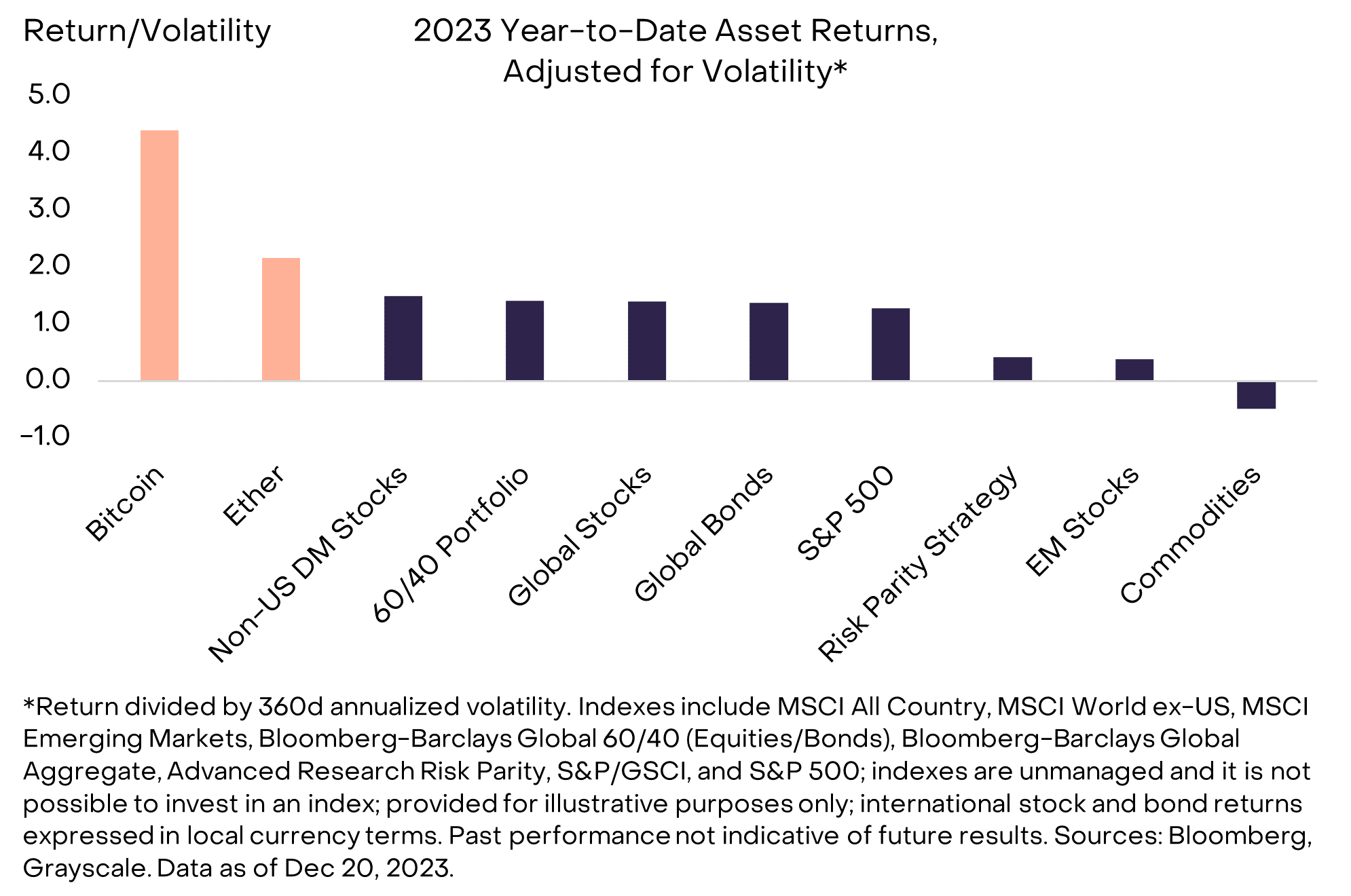

Looking at the broader picture, while ETH has lagged Bitcoin and certain other cryptoassets this year, ETH has significantly outperformed traditional assets in both absolute terms and risk-adjusted returns (Table 5). So while the price of ETH is up “only” 82% this year, this increase should be seen as evidence of the crypto market’s ongoing recovery.

Exhibit 5: Risk-adjusted Ethereum returns outperform traditional assets

While other blockchains are in the spotlight in 2023, Ethereum’s future still looks bright. On top of that, Ethereum has historically benefited from the deepest network effects in the industry, having the most decentralized applications (DApps), the most developers, and the highest revenue. Ethereum is pursuing a “modular” development approach, where an ecosystem of Layer 2 blockchains will be built on Layer 1 chains to allow activities to scale. This is still a work in progress and should make it 10-100x cheaper for Layer 2 scaling solutions to confirm transactions on Ethereum via the EIP-4844 upgrade next year. This will help reduce costs for Ethereum Layer 2 users.

Ethereum could return to the center of the crypto stage in 2024 if it can attract new users to its growing Layer 2 ecosystem. Therefore, the smart contract platform track may face the fiercest competition.

Low-cost “monolithic” blockchains like Solana can provide a “silky-smooth” experience to new users, especially when combined with wallets and other ecosystem dApps. In comparison, Ethereums modular environment can be more cumbersome to use, as users need to actively bridge assets between the mainnet and L2s. However, the development of these networks is still in its early stages, and it remains to be seen which blockchains will be able to design the best product/market fit and accumulate the most value for their native tokens over time. Once end users are finished interacting with applications, the shortcomings of the current Ethereum user experience should be less severe, and other Ethereum features, such as trusted decentralization, may attract developers and ultimately support token valuation. value. For investors unsure of how competition between smart contract platforms will play out, diversifying into investments may be worth exploring.