YBB Capital: Thousands of pear trees are blooming, an overview of the Bitcoin ecosystem

Original author:@YBBCapital Researcher Ac-Core

Preface

2023 is an important year for the Bitcoin ecosystem to reach a new peak. In the context of both digital assets and traditional markets facing huge challenges, as the end of the year approaches, the Bitcoin-related ecosystem has ushered in a revival after being dormant. Although the popularity of Inscription has caused some people to remain opposed, it is undeniable that the market enthusiasm has also brought the return of the builder culture to Bitcoin. This development momentum has promoted the innovation wave of Bitcoin, and the most out-of-the-circle It is to draw the market’s enthusiastic narrative about inscriptions to other public chains. This article will discuss the current development direction of the Bitcoin ecosystem. It will only provide an overview of the current Bitcoin ecosystem and does not contain any investment advice.

BTC Market Hotspot Protocol

The Bitcoin asset issuance protocol has experienced rapid development in the Q1 quarter of 2023, and after one year to the Q4 quarter, the market has shown a booming scene. Especially in the Ordinals protocol ecosystem, a variety of tokens represented by BRC 20 have triggered obvious wealth effects and stimulated FOMO sentiment in the market. Even though it is only a JSON script file added to the Bitcoin blockchain, it is still The popularity of the market has convinced people. Over time, more notable protocols emerged, including Ordinals, Atomics, Taproot Assets, Runes, and PIPE. This trend clearly shows that the Bitcoin ecosystem is developing in a more diversified and innovative direction, and various asset issuance protocols provide the market with a wider range of choices and richer development opportunities.

Ordinals Protocol (BRC-20)

Source: Hiro

In January 2023, Bitcoin developer Casey Rodarmor released the Ordinals protocol, an asset issuance protocol based on Bitcoin that contains two core components: Ordinals ordinal theory and Inscription. Casey, the author of the Ordinals protocol, carries the content on UTXO through inscription, and the ordinal number assigns a unique identifier to the smallest unit of Bitcoin - 2100 trillion Satoshis. Inscription is the process of associating content with unspent transaction outputs (UTXOs). The asset issuance process of the Ordinals protocol is like writing information into the witness data and recording the token information in JSON format in the form of BRC 20.

BRC-20 Token

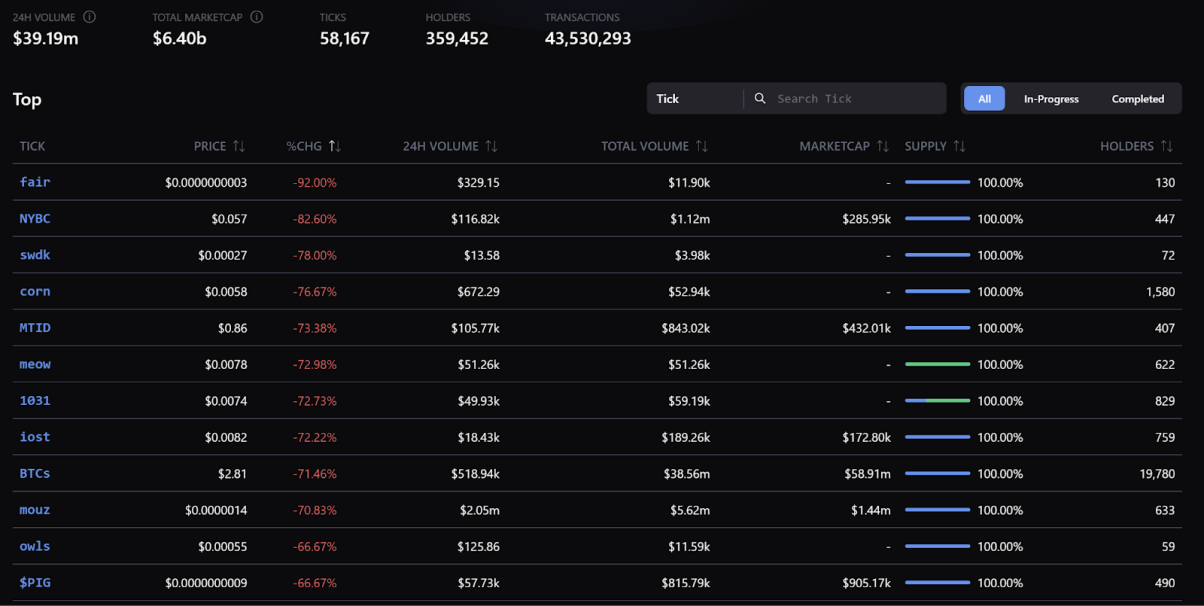

BRC-20 is a Bitcoin experimental token standard created by Domo on March 8, 2023. Its core concept is to utilize JSON data in Ordinal Inscriptions. Through the BRC-20 standard, users can easily implement key functions such as the creation of Token contracts (Deploy), the casting of Tokens (Mint), and the transfer of Tokens (Transfer). Statistics as of December 18, 2023 show that the total market value of the BRC-20 track has reached US$640 million, highlighting the important position of this token standard in the Bitcoin ecosystem and opening up new opportunities for the development of digital assets. New possibilities.

BRC-20 trading volume data source: GeniiData

BRC-100

BRC-100 is a Bitcoin DeFi protocol built on Ordinals. In addition to its own token attributes, BRC-100 is also an application protocol. Developers can also design DeFi and other application products based on the BRC-100 protocol. According to developer MikaelBTC, BRC-100 introduces protocol inheritance, application nesting, state machine models and decentralized governance, bringing computing power to the Bitcoin blockchain, making it possible to build AMM DEX, lending and other Bitcoin-native solutions. Centralized applications are possible.

Ordinals NFT

Software engineer Casey Rodarmor launched the Ordinals NFT protocol on the Bitcoin blockchain, which has officially gone live. Now, users can create and own their own NFTs on Satoshi (Sat), the smallest unit of Bitcoin, using a random but logical ordering system that makes each Satoshi unique. According to reports, there are three main differences between Ordinals NFT and Ethereum NFT:

Relevant data are stored in the Bitcoin network and do not rely on external storage such as IPFS and AWS S 3;

Permissionless: Transactions can be completed in a decentralized manner through PSBT without the need for authorization;

The cost of minting coins is directly proportional to the transaction volume.

BRC-420

According to the RCSV official Gitbook, BRC-420 focuses on modularizing on-chain inscriptions, including the two key parts of the Metaverse Standard and the Royalty Standard, which respectively define an open and flexible format for assets in the Metaverse and a set of standards for creators. The economy sets specific on-chain protocols. Different from Ordinals other protocols which are all single inscriptions, the BRC-420 protocol uses multi-inscription recursive combination.

Atomics Protocol (ARC-20)

Source: Atomics Guidebook

Atomics, also known as Atomic Protocol, covers multiple asset types, including the fungible token ARC 20 standard, NFTs, Realms, and Collection Containers. As a blockchain asset issuance protocol based on the UTXO type, Atomics provides two casting methods, namely decentralized casting and direct casting. The decentralized minting method introduces Bitwork Mining, a minting method based on the PoW (Proof of Work) model. The protocol uses Satoshi, the smallest unit of Bitcoin, as the smallest unit of issued assets. The current minimum divisible unit of ATOM is 546, and a minimum of 546 ATOM can be sold or transferred.

The difference between the Atomics protocol and Ordinals in terms of asset transaction ordering is that it does not rely on third-party orderers and can be used to create (mint), transfer and upgrade various digital items, including native NFTs, games, digital identities, domain names and social networks . In addition, the protocol also supports the creation of fungible tokens with the token name ATOM (different from Cosmos’ ATOM, only with the same name).

Recently, founder Arthur shared his views on Meta-Protocols in an interview on December 13. He sees meta-protocols as a completely new approach that allows developers to create their own data structures and rules without being restricted to using pre-existing strict structures. Protocols that represent meta-protocols, such as the Atomics Protocol, are constantly emerging, providing developers with the opportunity to create entirely new structures using smart contracts. This trend allows creators to focus their efforts more specifically on the Atomicals Virtual Machine (AVM). The launch of this virtual machine enables developers to build smart contract programs on the Bitcoin network, giving them unprecedented ways to create experiences. This means that creators can focus more on implementing smart contracts in the Bitcoin ecosystem and promoting the process of digital innovation.

Atomics asset types:

ARC 20 :It is a token format standard similar to BRC 20 on Ordinals;

Realm:The new concept proposed by Atomics aims to subvert traditional domain names and will be used as prefixes;

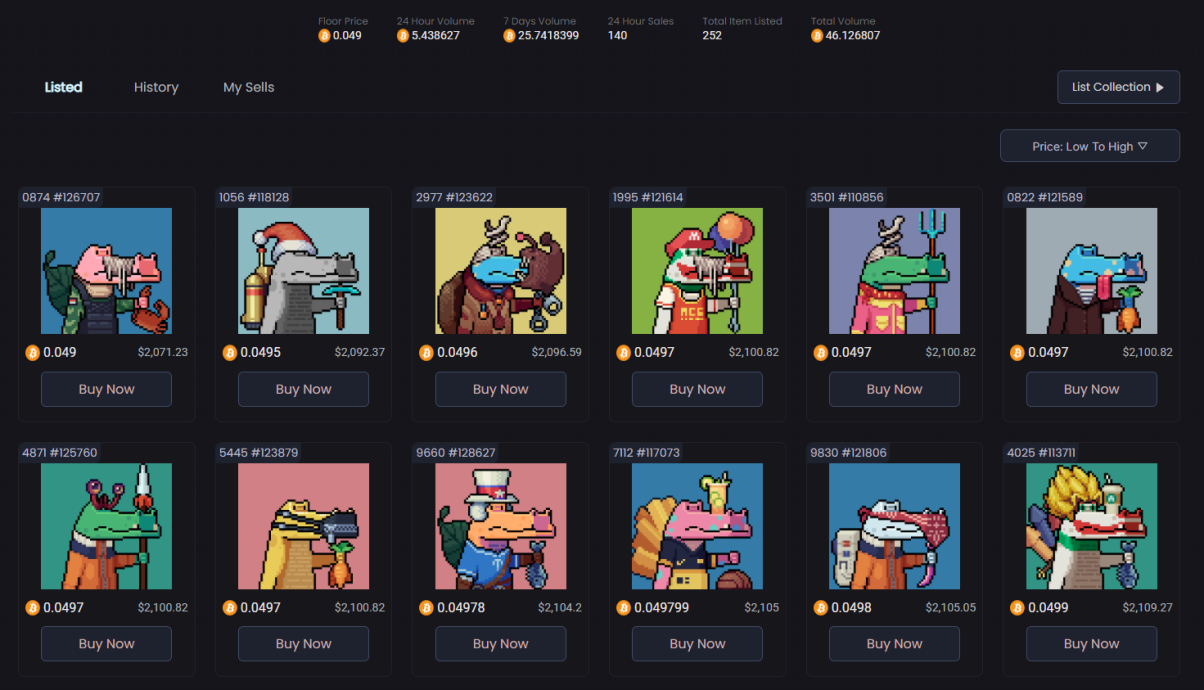

Collection Containers:This is a data type used to define NFT Collections, mainly used to store readable NFTs and related metadata. According to data on December 20, TOOTHY, which currently ranks first in terms of market value, has a total market value of 46.12 BTC and a seven-day trading volume of 25.74 BTC.

Source: Atomic Market

ARC-20 AVM

In an interview on December 13, Atomics founder Arthur said that meta-protocols are a new way for developers to create their own data structures and rules without being restricted by existing strict structures. Meta-protocols such as the Atomics Protocol are emerging to enable developers to create entirely new structures using smart contracts. This allows creators to focus on the Atomicals Virtual Machine (AVM), which enables developers to build smart contract programs on the Bitcoin network.

Runes Protocol (Rune)

Runes was proposed by Ordinals protocol creator Casey Rodarmor to solve the efficiency problems of BRC-20. Unlike the complexity of some protocols, Runes design is simple and elegant. By using OP_RETURN in a transaction, Runes cause tokens to be allocated to a specific UTXO, with output index, token amount, and token ID.

The Runes protocol is a Fungible Token protocol based on the Bitcoin UTXO model, managed and transferred through simple tuples (ID, OUTPUT, AMOUNT) and OP_RETURN operations. Its main feature is that the protocol is simple, can support some operations without additional off-chain data or native tokens, and optimizes the use of on-chain data.

The Runes protocol was proposed due to Ordinals protocol developer Caseys dissatisfaction with BRC 20s use of the Ordinals protocol to create a large number of UTXOs, so he proposed a homogeneous token protocol based on the Bitcoin UTXO model. For now, Runes Protocol remains an idea of Caseys and does not yet have a full client and development tools, although it is controversial in some areas.

PIPE protocol

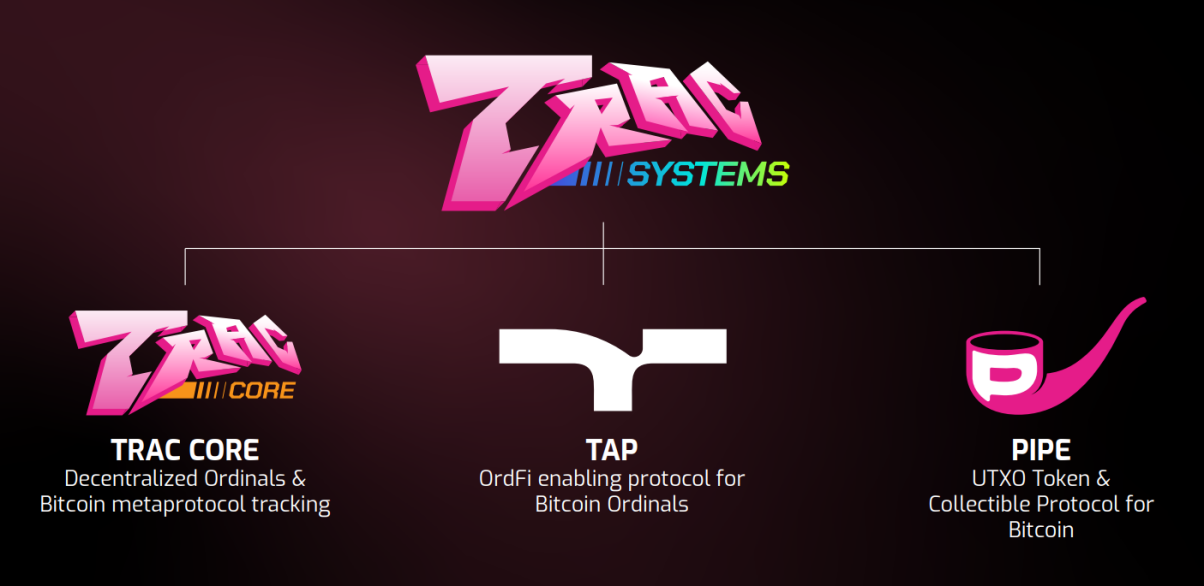

Source: Trac official

The PIPE protocol is an asset issuance protocol developed by developer Benny after being inspired by the Runes protocol designed by Casey and the Ordinals-based BRC-20 standard proposed by Domo. The PIPE protocol cleverly combines the characteristics of the Runes protocol and these two protocol standards, and has launched three protocols in the BTC ecosystem: Trac Core, Tap, and Pipe (referred to as TTP, collectively known as Trac Systems).

The main functions of the PIPE protocol include Deploy, Mint and Transfer, referred to as DMT. These features allow PIPE protocol assets to be easily created, distributed, and transferred within the Bitcoin network. In addition to supporting fungible tokens, the PIPE protocol also provides a complete data structure and standard for non-fungible tokens.

Trac Core:Bitcoin Inscription’s oracle and decentralized indexer;

Tap:It is an extension of the Ordinals protocol rather than a fork, so it can be seamlessly compatible with BRC 20;

Pipe:It is a new protocol for Ordinals fork, but the actual process requires recasting liquidity;

Trac Token:Deployed on the Ordinals-BRC 20 protocol and later used as the governance token of the Tap protocol;

TAP Token:Deployed on Ordinals-Tap protocol.

Stamps(SRC-20)

On December 6, Bitcoin Core developer Luke Dashjr revealed on social platforms that Inscriptions was exploiting a vulnerability in the Bitcoin Core client to send spam information to the blockchain. This vulnerability allowed users to set additional data size limits on transactions when forwarding or mining, and Inscription circumvented this limit by disguising its data as program code. Dashjr said it will fix this vulnerability when v2 7 is released next year. However, he later claimed in response to questions from Ordinals that the inscription itself did not exist and was a hoax.

This comment poured cold water on the Ordinals ecosystem, causing the price of BRC-20 tokens to fluctuate violently, with the price of ORDI falling by more than 25% in a single day. Critics of Dashjr argue that the Bitcoin network belongs to the community and that developers have no right to decide the fate of the Ordinals protocol based on personal preferences. Even if Dashjr completes the update to the Bitcoin program, as long as miners do not adopt the updated program, the entire Bitcoin network will not be able to complete the upgrade.

Although the controversy over inscriptions has not yet been finalized, the controversy has triggered people to reflect on the nature of Ordinals and blockchain, while also drawing attention to another token standard SRC-20 and the Bitcoin Stamps protocol. The Ordinals protocol is a derivative protocol that uses Bitcoin UTXO as a data storage medium and stores arbitrary data through Bitcoins OP_RETURN function. The protocol results in larger Bitcoin blocks, which introduces centralization risks and increases the cost of running the network. The Bitcoin Stamps protocol was created by Mike In Space and is based on the Counterparty (XCP) protocol. It is the first NFT token protocol standard on the Bitcoin chain. Stamps encode image data into Base 64 strings and store them in Bitcoin UTXO. Compared with Ordinals, Stamps pays more attention to the reliability of data and cannot be permanently removed from the Bitcoin public ledger.

The controversy prompted thinking about Ordinals and the nature of blockchain, and raised concerns about the SRC-20 standard and the Bitcoin Stamps protocol. The SRC-20 is similar to the BRC-20 but avoids the controversy brought by Ordinals. Bitcoin Stamps uses the method of directly writing image data into Bitcoin UTXO, emphasizing the reliability of the data and the fact that it cannot be removed.

An extension to Turing completeness:

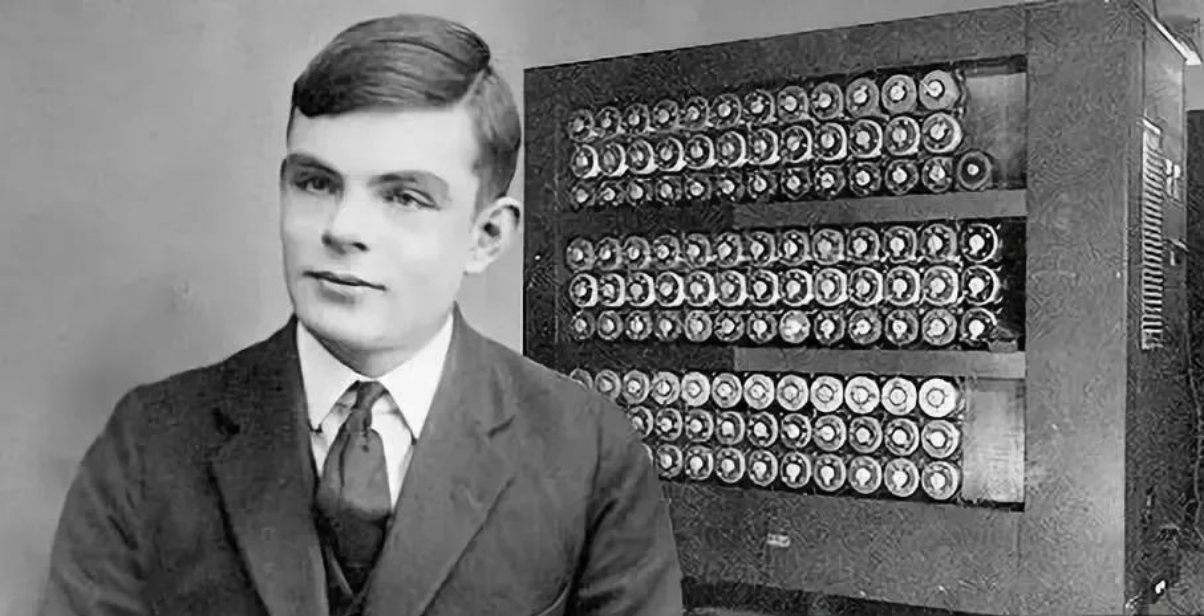

Alan Turing

A graph machine is an abstract computing model proposed by Alan Turing in 1936 to define the concept of computability. Turing completeness is a concept related to computing theory. It refers to whether a computing system can simulate the calculation process of any Turing machine. The key point is that if a computing system is Turing complete, then it has the ability to perform any Turing machine calculation. process capabilities. It is worth noting that the Bitcoin blockchain itself does not possess Turing completeness. In the impossible triangle of blockchain, decentralization and security are achieved by completely abandoning scalability. So this design choice helps prevent malicious code from running on the Bitcoin network, thus ensuring the security and stability of the network.

BitVM

On October 9, ZeroSync project leader Robin Linus published a white paper titled BitVM: Compute Anything On Bitcoin, which triggered everyones thinking about improving the programmability of Bitcoin. BitVM is the Bitcoin Virtual Machine Abbreviation for Machine. It proposes a Turing-complete Bitcoin contract solution without changing the Bitcoin network consensus, allowing any computable function to be verified on Bitcoin, allowing developers to run on Bitcoin Complex contracts without changing the fundamental rules of Bitcoin.

BitVM is a new Optimistic Rollup + Fraudproof + Taproot Leaf + Bitcoin Script computing paradigm. It is Bitcoin Virtual Machine"abbreviation of. This allows developers to simulate program behavior without imposing any load or changes on the actual Bitcoin network. BitVM uses its unique solution to do this extension. Its main roles are:

● Prover and verifier: The former will use information input from a certain system to create a proof, while the latter needs to verify the calculation results of this proof, but cannot know the specific content of the information to ensure that the calculation results are accurate;

● Off-chain calculations and on-chain proofs: Without changing the Bitcoin consensus, BitVM undoubtedly needs to transfer a large amount of calculations and expansions off-chain to improve flexibility.

RGB

RGB is the LNP/BP Standard Association (Lightning Network Protocol/Bitcoin Protocol: Bitcoin Protocol/Lightning Network Protocol). The association is a non-profit organization that oversees the development of all layers of Bitcoin, covering the Bitcoin Protocol, Lightning Network Protocol and RGB Wait for smart contracts. The RGB protocol is suitable for scalable and private Bitcoin and Lightning Network smart contract systems. Its purpose is to run complex smart contracts on UTXO and introduce it into the Bitcoin ecosystem. The official description is: A scalable and confidential smart contract protocol suite for Bitcoin and the Lightning Network that can be used to issue and transfer assets and rights more generally.

Layer 2 expansion plan:

Image source: Bitcoin Layer 2: Your Complete Guide

Stacks

Stacks is Bitcoin Layer 2 that can use smart contracts. It aims to link itself with the Bitcoin chain through its unique Proof of Transfer consensus mechanism Proof of Transfer (PoX), thereby achieving a high degree of decentralization and scalability. And without adding additional environmental impact. Stacks is an open source Bitcoin second-layer blockchain that introduces smart contracts and decentralized applications to Bitcoin. Stacks was originally named Blockstack, and its basic work began as early as 2013. Stacks’ technical architecture includes a core layer and a subnet. Developers and users can choose between the two. The difference is that the mainnet is highly decentralized but has low throughput, while the subnet is less decentralized but has higher throughput. high. The Nakamoto upgrade by Stacks will improve network performance across the board and introduce an important product - SBTC.

● Stacks has updated a version called Nakamoto, which allows Stacks to not only settle Bitcoin transactions, but also upgrade to 100% resistance to Bitcoin reorganization, and increase the speed of the stack, allowing the estimated block time to be 5 seconds;

● SBTC introduces a decentralized and native anchoring method to increase the total locked value (TVL) and the number of users of the Stacks network by issuing stablecoins based on SBTC.

Lightning Network

The Lightning Network is a second-layer scaling solution for the Bitcoin network, designed to solve the scalability and transaction speed issues of the Bitcoin network. It is a smart contract-based payment protocol that allows participants to make fast, low-cost micropayments without having to record every transaction on the Bitcoin blockchain.

In the Lightning Network, participants can open a multi-signature payment channel, which enables almost instant payments and avoids the need to conduct each transaction on the Bitcoin main chain by conducting transactions directly within the channel. Actual settlement with the Bitcoin main chain only occurs when channels are opened and closed. This allows the Lightning Network to greatly increase the processing power of the Bitcoin network, reduce transaction fees, and speed up transaction confirmation.

The Lightning Network uses a delivery method similar to that in the network, passing payments from one node to another through multiple payment channels, thus forming a payment network covering the entire network. This design allows participants to make cross-node and cross-channel payments through links, thereby achieving a high degree of interconnectivity. Its core features include:

●Issue stable currency: Use the value of Bitcoin to provide users with stable currency in a borderless financial world. For example, you can use it to create a new stable currency taUSD, and you can use a single Bitcoin transaction to transfer BTC and taUSD to the Lightning Network channel. , to perform DeFi operations;

● Multiple universe mode: Universes are repositories that hold all the information needed to initialize the Taproot Asset wallet and synchronize the state of a specific Taproot Asset;

● Asset issuance and redemption API: It is as easy for users to trade various assets on Bitcoin as investing in stocks and bonds in the real world, thus mapping to the issuance of assets in the real world;

● Asynchronous reception function: Provides developers with tools to add Uniform Resource Identifiers (URI) to on-chain addresses;

● Scalability: New function build-loadtest command to allow developers to stress test software.

MVC

MVC is a revolutionary public chain that integrates multiple innovations. On December 8, Jason Kwok, chief operating officer of Bitcoin sidechain MVC, announced MVC’s roadmap for the first quarter of next year and said that the development of a Bitcoin cross-chain bridge will be completed. MVC is based on UTXO and PoW models, achieving breakthrough high performance, low cost and powerful decentralization features. With the help of Layer 1 DID and smart contract technology, it provides the Bitcoin virtual machine MVC, and its goal is to become the top blockchain that leads 8 billion users into the Web3 era.

MVC has updated 9 major sections in its roadmap for the first quarter of next year: building a trustless asset bridge; releasing two Bitcoin-compatible wallets; launching a new block browser; built-in support for Ordinals and BRC-20; Metacontract integrated development environment; MetaID Bitcoin version; MVC/BTC is compatible with DEX Orders.Exchange; the first phase of Proof of Building is launched; and MVC node V 0.2 is launched.

BEVM

BEVM is a completely decentralized BTC Layer 2 project that realizes BTC decentralization and cross-chain to BTC Layer 2 through Musig 2 aggregation multi-signature technology and Bitcoin light nodes. By being compatible with EVM to expand the smart contract scenario of Bitcoin, BTC can get rid of the limitations of the Bitcoin blockchain that is not Turing complete and does not support smart contracts, and can build decentralized applications that use BTC as native gas.

Based on the Schnorr signature and Mast contract brought by Taproot upgrade, BEVM has implemented decentralized BTC cross-chain with 1000+ Bitcoin light nodes. In its network, BTC can circulate freely between L1 and L2 without trust. At the same time, BTC is used as Gas and is compatible with EVM. It is quickly supported by the Bitcoin community and attracts the participation of developers and users to the greatest extent, thereby quickly realizing the implementation of BTC. L2’s business closed loop.

Since BEVM is Layer 2 compatible with EVM, various decentralized applications that can be deployed on ETH EVM can also be deployed on BEVM. The only difference is that BTC Layer 2 uses BTC as Gas. Every transaction on BTC Layer 2 will be packaged into BTC Layer 1 in the form of a sequencer at a ratio of 10:1 to achieve the security of BTC Layer 2 shared by BTC Layer 1. In the long term, BEVMs BTC Layer 2 solution will enhance Bitcoins scalability, reduce fees, and cultivate a more secure and decentralized financial ecosystem, which is of great significance to the long-term development of Bitcoin.

Side chain expansion solution

Image source: DCX Learn: What is a Sidechain

RSK

RSK is the first EVM-compatible sidechain on the Bitcoin network, a stateful smart contract platform guaranteed by Bitcoin miners. Miners receive rewards through joint mining, allowing them to actively participate in the smart contract revolution. RSKs goal is to enable smart contracts, instant payments, and greater scalability to enhance value and utility for the Bitcoin ecosystem. A distinctive feature of the RSK smart contract is the use of Bitcoin’s mining mechanism to maintain its network and security. This means that the RSK smart contract blockchain is more secure and decentralized than Ethereum, while avoiding some of the scalability and performance issues in the Ethereum network.

RIF is a network based on RSK smart contracts. It provides a series of infrastructure services (DeFi, storage, domain name services, payment solutions) to solve the technical complexity faced by the second-layer network, insufficient user experience, insufficient security, and There are many problems such as the lack of a unified standard ecosystem.

Spiderchains

Spacechain is the latest proposal for Bitcoin sidechain design that incorporates mining, requiring miners to run both the Bitcoin node and the sidechain node they want to mine. The transaction chain starts with a UTXO, and each transaction creates two outputs. The first output is a token UTXO, indicating that this transaction chain is related to a certain Spacechain; while the second output is a small denomination UTXO that anyone can spend, although due to its small denomination, additional inputs and outputs are required. Starting with the second transaction of the chain, anyone can spend the second output from the Spacechain transaction chain and use it to commit their own sidechain block header. Spiderchain, meanwhile, sits on top of the main chain base layer and was created by Botanix Labs in September this year to port the Ethereum Virtual Machine to a platform anchored to the Bitcoin network. It is unique in that it does not directly involve the role of miners in the consensus, nor does it use any form of merged mining. Spiderchain uses multi-signature and escrow margins to create a second layer of proof-of-stake system on top of Bitcoin and can be deployed without any changes to Bitcoin.

Softchains

Ruben Somsen proposed a sidechain mechanism called Softchain in January 2021. This concept originated from Somsens earlier proposal"PoW fraud proof"The original intention of the proposal is to improve the security of Simple Payment Verification (SPV). In Softchain, the main chain node needs to download and verify the block header of each Softchain side chain. When a chain split occurs, main chain nodes must download the relevant blocks and verify these blocks using UTXO set commitments, which form the basis of the two-way anchoring mechanism.

Other agreements:

Image source: What is a Network Protocol and How Does it Work

Omni (stablecoin)

The Omni protocol, proposed by JR Willett in January 2012, is a digital currency and communication protocol based on the Bitcoin blockchain. It uses the Bitcoin blockchain to implement functions such as smart contracts, user assets, and decentralized peer-to-peer exchange. In 2014, USDT was first issued on the Bitcoin blockchain based on the Omni Layer protocol. Since then, it has gained the first-mover advantage and captured most of the cryptocurrency stablecoin market in one round. It is Omni-USDT based on the Bitcoin network. The deposit address is a BTC address, and deposits and withdrawals are made through the BTC network;

Colored coins (asset issuance)

Chia is a more efficient and environmentally friendly cryptocurrency platform powered by Bram Cohen, founder of the BitTorrent protocol. Chia introduces a new consensus mechanism called Proof of Space and Time (PoST), which is an alternative to the traditional Proof of Work (PoW) consensus mechanism. The script protocol that has been hot in the market recently has the concept of using Bitcoin for asset issuance as early as 2012.

DLCs (scalable smart contracts)

On November 4, according to official news, DLC.Link announced the launch of dlcBTC, an innovative solution designed to safely enable Bitcoin for DeFi operations on Ethereum. It is reported that dIcBTC is scheduled to be released in February 2024, which will allow Bitcoin holders to seamlessly participate in DeFi protocols like Curve and AAVE without the need for a custodian or third party.

Ethscriptions (the inscription protocol for creating and transferring content on Ethereum)

The earliest Ethscriptions protocol was created in 2016, but Tom Lehman only developed related products for the protocol on June 17 this year. Ethscriptions is a protocol created on Ethereum using transaction call data (Call Data). Inscription protocol for transferring digital content, which bypasses the use of smart contract storage and execution to implement deterministic protocol rules applied to Ethereum calling data to calculate state, enabling trust in each other without informing oracles and trusting third parties The result of the contract.

Multibit (cross-chain bridge)

It is designed to complete the bridge between the Bitcoin network and the Ethereum Virtual Machine (EVM) network through the Multibit cross-chain bridge. It is currently used between the three networks of ETH, BNB and BTC. Its main purpose is to provide BRC-20 assets. Provide DeFi services.

Conclusion:

2023 can be said to be the pioneering year of the Bitcoin ecosystem. Although its ecological development is difficult due to its natural lack of Turing completeness, the emergence of Inscription not only shifts the markets attention to the Bitcoin ecosystem but also At the same time, it attracted many developers to join. Perhaps we are on the eve of an ecological explosion, and just like the last round of public chain disputes in early 2021, a hundred flowers bloom situation will erupt.

The protocols that can stand out under the current situation are also worthy of our expectation and discussion. The circulation and delivery of digital gold are still to be continued.