Footprint: Exploring the potential and risks of Coinbase’s second-layer chain Base

Original author: lesley@footprint.network

Coinbase has established itself as the leading centralized exchange (CEX) in the ever-changing cryptocurrency landscape. However, Coinbase firmly believes that decentralization is the key to creating an open, globally accessible crypto economy for everyone, and in 2016 released their “secret master plan, plan to achieve their goals by launching a Dapp. In August 2023, Coinbase took an important step towards realizing this vision and officially launched the Base chain.

Base Chain is Coinbase’s new layer 2 blockchain network designed to enhance the performance of the Ethereum mainnet, increase transaction speed, reduce costs, and broaden functionality.

Coinbase’s multiple initiatives further demonstrate their commitment to openness and collaboration. Coinbase has been working with Optimism for more than a year and contributed to the development of EIP-4844 (also known as Proto-danksharding), which aims to reduce fees and increase transaction throughput. To ensure the decentralization of the ecosystem, Coinbase has institutedfive key principles, to create a level playing field where users can participate and thrive without bias or barriers.

With its strong user base, Coinbase is entering the competitive space of layer 2 blockchain solutions. Through Base Chain, Coinbase aims to introduce more than 1 billion users to the global crypto economy.

Base leads the new development pattern in the Layer 2 field

Currently, Layer 2 networks play a role in different fields, including Web3 games, NFT and SocialFi, etc., all of which have ushered in a wide range of applications. Many well-known companies, such as BitDAO (Mantle Network), Consensys (Linea), Kraken, etc., have also entered the highly competitive Layer 2 market.

With the emergence of various decentralized applications, Layer 2 has become an indispensable infrastructure in the Ethereum ecosystem. It not only significantly reduces transaction costs, but also improves user experience.

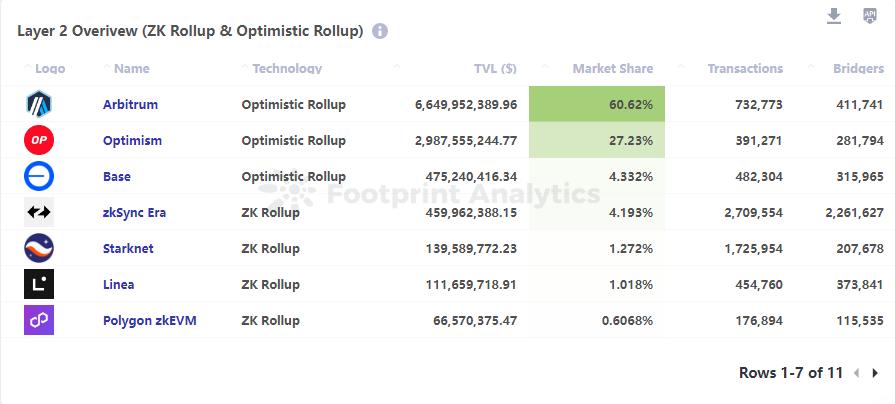

Layer 2 Overview

According to data from Footprint Analytics, Base ranks third in market share in the Layer 2 field, behind established second-layer chains such as Arbitrum and Optimism. Among emerging public chains, Base’s performance is impressive.

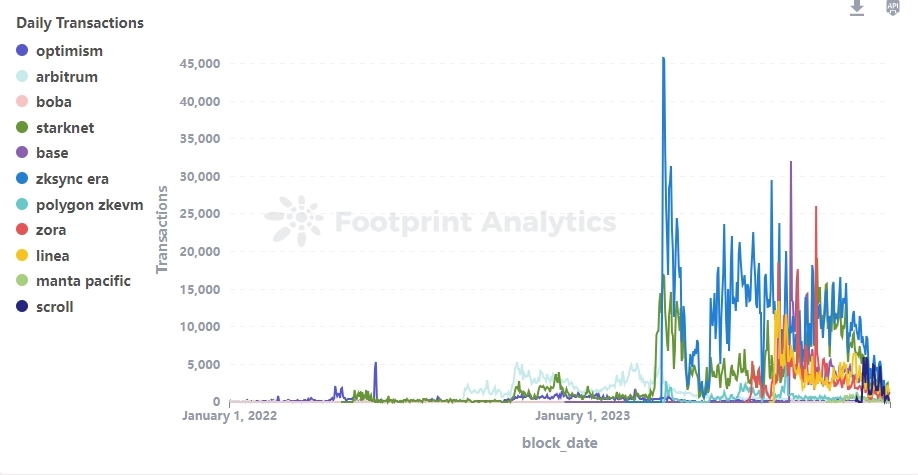

Layer 2 Daily Bridged Transactions

In the following sections, we will review Bases growth trajectory and analyze the key factors in its rise. If you want to know more about Layer 2, please check out our previousanalysis report。

Features of Base

Layer 2 public chain based on Ethereum: Base takes full advantage of the security, stability and scalability of Ethereum and incorporates Coinbase’s best practices to ensure that developers benefit from Coinbase, Ethereum Layer 1 and other interoperable The blockchain was successfully added to the Base chain.

Seamless integration with Coinbase: Base is seamlessly integrated with Coinbases products, users and tools, giving developers access to the Coinbase ecosystem of more than 110 million verified users and $80 billion in assets. This integration not only enhances the user experience but also accelerates the widespread adoption of blockchain.

Powerful and affordable: Base provides EVM-compatible services at extremely low cost, uses a simple API to set up fee transactions for account abstraction for decentralized applications, and uses easy-to-use bridges to securely build multi-chain applications program.

Open source, powered by Optimism: Base adheres to the principles of decentralization and openness and welcomes all visionary creators. It is built on Optimisms open source OP Stack, ensuring a permissionless, innovation-inclusive environment.

Despite its promising prospects, Base still faces some challenges.

The technology is not yet mature: Layer 2 technology is still in its early stages, meaning it requires extensive development and testing efforts to ensure its security and stability. Base is working to address this challenge by working with Paradigm and developing the Breath client, as well as by creating open source monitoring tools like Pessimism to increase technology maturity.

Policy and regulatory issues: Coinbase, as a centralized company, faces an unclear regulatory environment in the cryptocurrency space, which poses challenges to its business. But Coinbase has taken a proactive approach and strives to be a leader in solving regulatory challenges.

Security issues: As an open blockchain, Base hosts many protocols that have not been fully reviewed, resulting in frequent security incidents after Base was officially released because users lack the ability to review technical details.

The world of Layer 2 stacks continues to grow, and Polygon released its Layer 2 stack, Polygon CDK, in September.

Polygon CDK and Optimisms OP Stack have similar design concepts, aiming to lower the threshold for developers through modularity and composability, and build an Ethereum-centered L2 interoperability network to build Ethereum by parallelizing specific application chains. Layer 2 multi-chain interactive network centered on Fang.

However, there are some differences between them:

This universal chain architecture design method is undoubtedly one of the current development trends in the Layer 2 field. Polygon and Optimism are leading this design trend, featuring excellent scalability and developer-friendly support. This design is expected to gain advantages while attracting developers, thereby driving the rapid growth of Layer 2 technology. However, the performance and long-term sustainability of Layer 2 solutions require in-depth observation and verification in actual market operations.

The development history of Base chain

Base chain is a vital part of Coinbases vision of building a global open financial system. It has attracted much attention since the launch of the testnet in February this year.

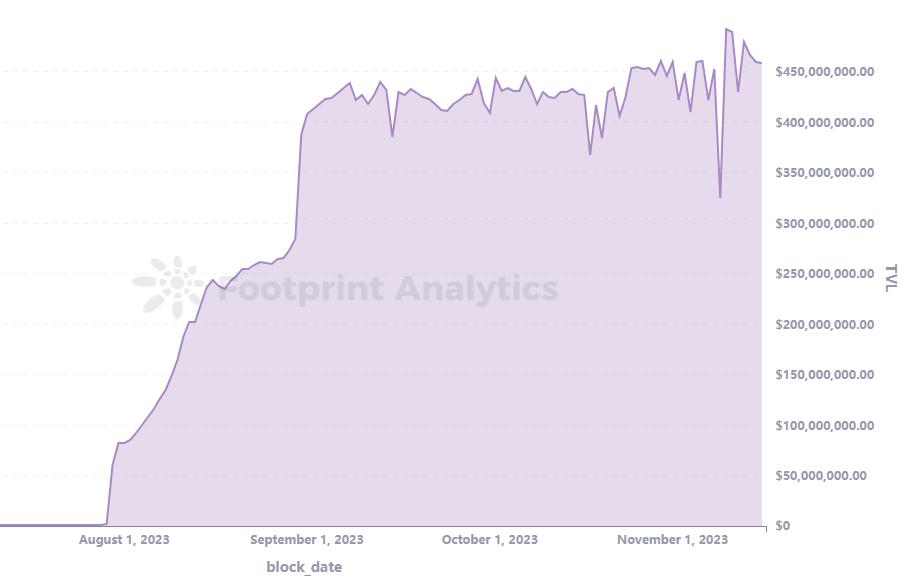

TVL with the Base chain exceeded $148 million on launch day and had grown to $459 million as of early December, according to Footprint Analytics.

Attention via $BALD

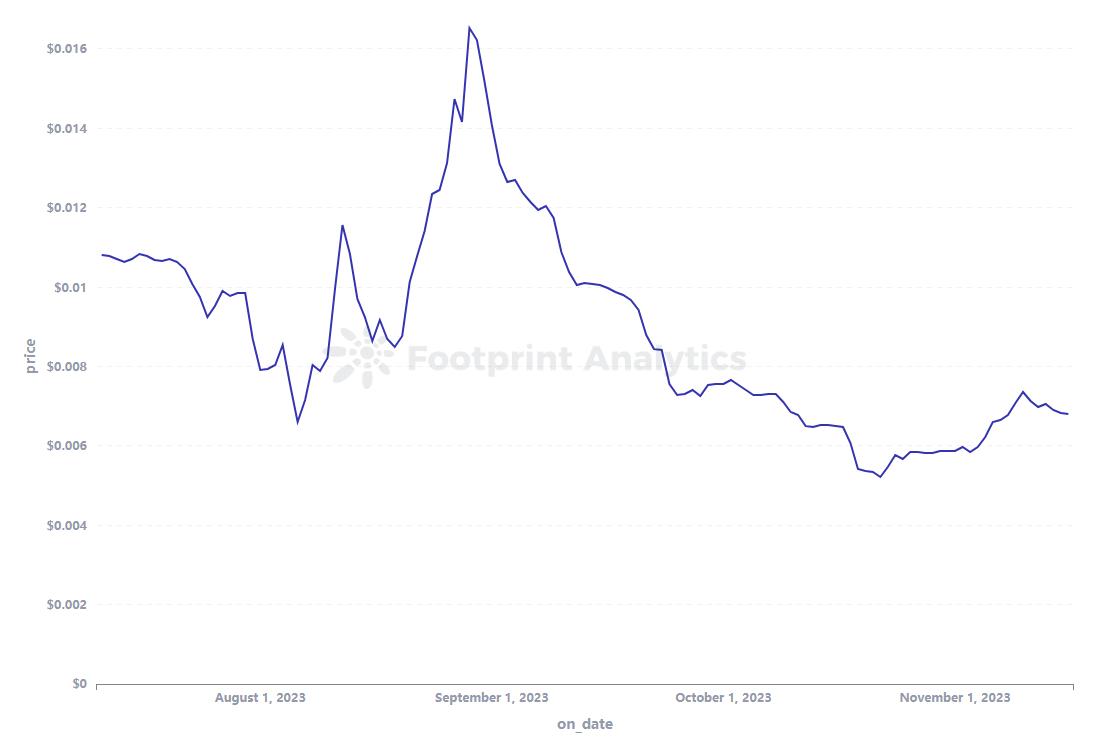

$BALD launched on July 30, immediately with massive capital backing and generating early buzz due to an interesting connection to Coinbase CEO Brian Armstrong, known for his iconic bald image. discussion. There is even speculation that $BALD may be the official token of Coinbase.

The $BALD hype gained momentum, pushing the market capitalization to over $100 million in just two days. However, this enthusiasm did not last. The developer of $BALD BaldBaseBald initiated a malicious exit operation and withdrew more than 10,500 ETH (approximately $20 million) from the liquidity pool. This behavior seriously affected the liquidity of $BALD. And caused the TVL (total locked value) of the Base chain to drop sharply. Coinbases Jesse Pollak responded to the storm on August 14, saying that the Base chain is a permissionless system, so it cannot control such events.

Shake up the market with friend.tech

friend.tech is a social media decentralized application (DApp) built on the Base chain, an Ethereum second-layer blockchain incubated by Coinbase. This innovative platform cleverly combines the concepts of fan economy and on-chain gaming to create a unique synergy.

The public launch of friend.tech on August 10, 2023 coincides with the debut of Base, and its precise timing has shown remarkable results. friend.tech’s success stems not just from its carefully planned timing, but also from its innovative concept, revenue sharing model, and strong influencer effect. These factors jointly promoted the rapid growth of friend.tech into a phenomenal application, attracting widespread user participation and recognition. The popularity of friend.tech has not only won success for itself, but has also significantly increased the overall usage and popularity of the Base blockchain.

Achieve excellence with Aerodrom Finance

On August 31, Velodrome, the largest DEX protocol on Optimism, launched a forked DEX project called Aerodrome on the Base network. In less than 2 days, Aerodromes total lock-in value (TVL) once reached $200 million, accounting for 50% of Bases total TVL.

Aerodrome strategically releases 7% of veAERO to the AERO-USDC LP pool, attracting liquidity providers to purchase AERO that is scarce in the market because the rewards for providing liquidity are very attractive. This scarcity drives up the price of AERO, increasing the revenue of providers, creating a positive feedback loop. However, there are doubts about whether this cycle is sustainable.

status quo

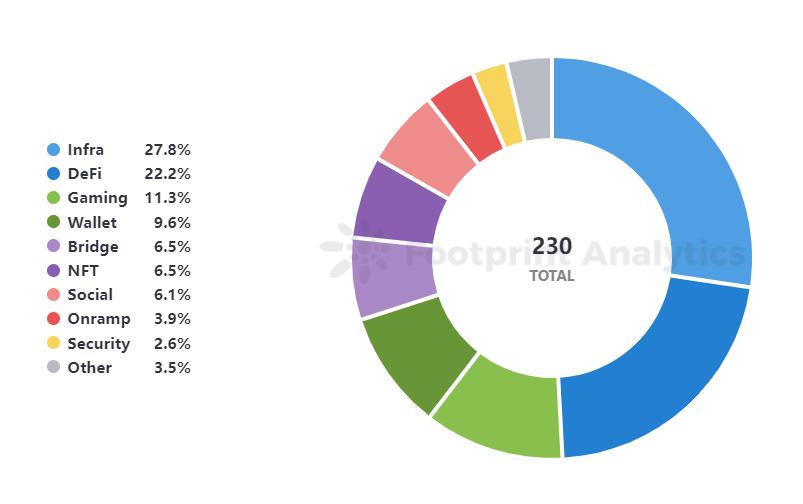

With the support of Coinbase and the blessing of traffic project Friend.Tech, coupled with Bases own active funding of development work, Base has experienced rapid growth in just a few months and has evolved into a powerful ecosystem. As of November 15, the ecosystem has more than 230 projects, with the most important categories including infrastructure (64), DeFi (51), and games (26). The surge in the number of projects shows that Base attracts diverse projects and promotes the vigorous development of the ecosystem.

Base Ecosystem Project Distribution

The diversity of various project types shows that Base is not just a hub for decentralized finance (DeFi), but also a platform with a wide range of project types, suitable for different fields, from infrastructure to games, demonstrating its emergence as a broad application The potential of comprehensive blockchain solutions.

Ethereum and other leading DeFi protocols on the chain are actively expanding to Base, adding vitality to the DeFi ecosystem. As of November 15, there are 51 DeFi projects on Base. Major lending protocols such as Aave and Compound are already deployed on Base. DEX projects such as Uniswap, SushiSwap and Balancer provide decentralized trading on Base. Revenue aggregators like Beefy.Finance enable revenue optimization across multiple protocols.

Base also integrates NFT infrastructure such as OpenSea, ZORA and Manifold to support digital collectibles and NFT markets. It is working with game studios such as Animoca Brands to develop blockchain-based games.

With the continued expansion of developer tools, wallets, oracles, and node services, Base is building a solid infrastructure foundation to support various dApps and services on its network. The flourishing ecosystem shows Bases strong development momentum and is expected to become a leading Layer 2 scaling solution.

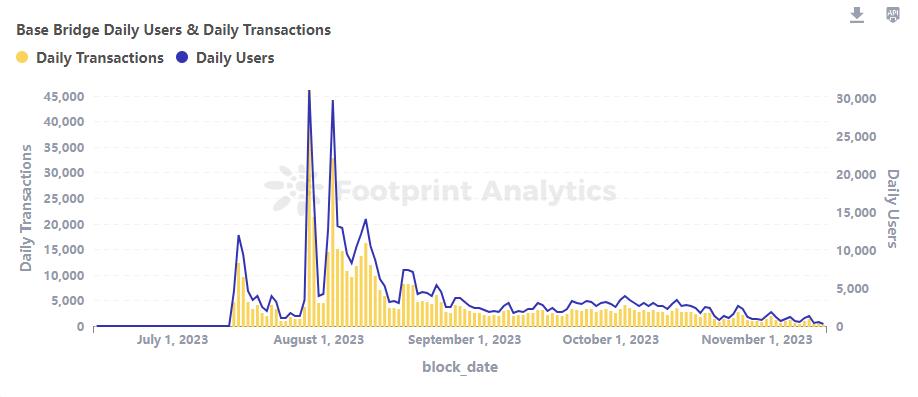

Base Bridge Daily Users & Daily Transactions

However, the market has had its ups and downs, and Bases sustainability has become a matter of concern.

While its fame and influence continues to grow, the Base ecosystem has also experienced a number of security incidents. Starting with the $BALD incident, then in August the SwirlLend team walked away with $460,000. Approximately 10 days later, the Magnate Finance team withdrew nearly $6.5 million worth of crypto assets from the platform. Security incidents also occur frequently on Base. In August, hackers targeted the decentralized exchange (DEX) RocketSwap and stole more than 472 ETH (approximately $869,000). LeetSwap DEX suspended trading on Base on August 1 due to potential vulnerabilities.

summary

In just a few months, Base has experienced rapid growth, demonstrating the potential to attract a variety of applications. Although the industry faces challenges such as immature technology and an uncertain regulatory environment, Base has attracted widespread market attention. The addition of traffic projects like friend.tech has significantly promoted the development of the ecosystem.

Looking forward to the future, Coinbase plans to introduce more than 1 billion users to the encryption market through Base, which is worth looking forward to. However, investors should still exercise caution and be aware of potential risks in the development of the ecosystem.

About Footprint Analytics

Footprint AnalyticsIs a blockchain data solutions provider. With the help of cutting-edge artificial intelligence technology, we provide the first code-free data analysis platform and unified data API in the Crypto field, allowing users to quickly retrieve NFT, Game and wallet address fund flow tracking data of more than 30 public chain ecosystems.

Footprint Website: https://www.footprint.network

Discord:https://discord.gg/3HYaR6USM7

Twitter:https://twitter.com/Footprint_Data

Telegram:https://t.me/Footprint_Analytics