LD Capital Macro Weekly Report (12.3): Retail investors’ bullish sentiment is high, deviating from economic fundamentals for the first time in three years

Main points

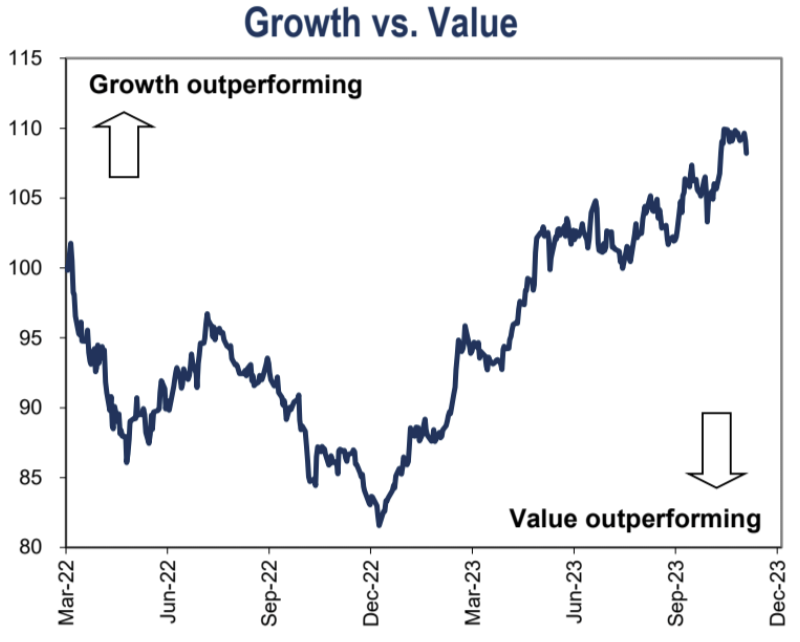

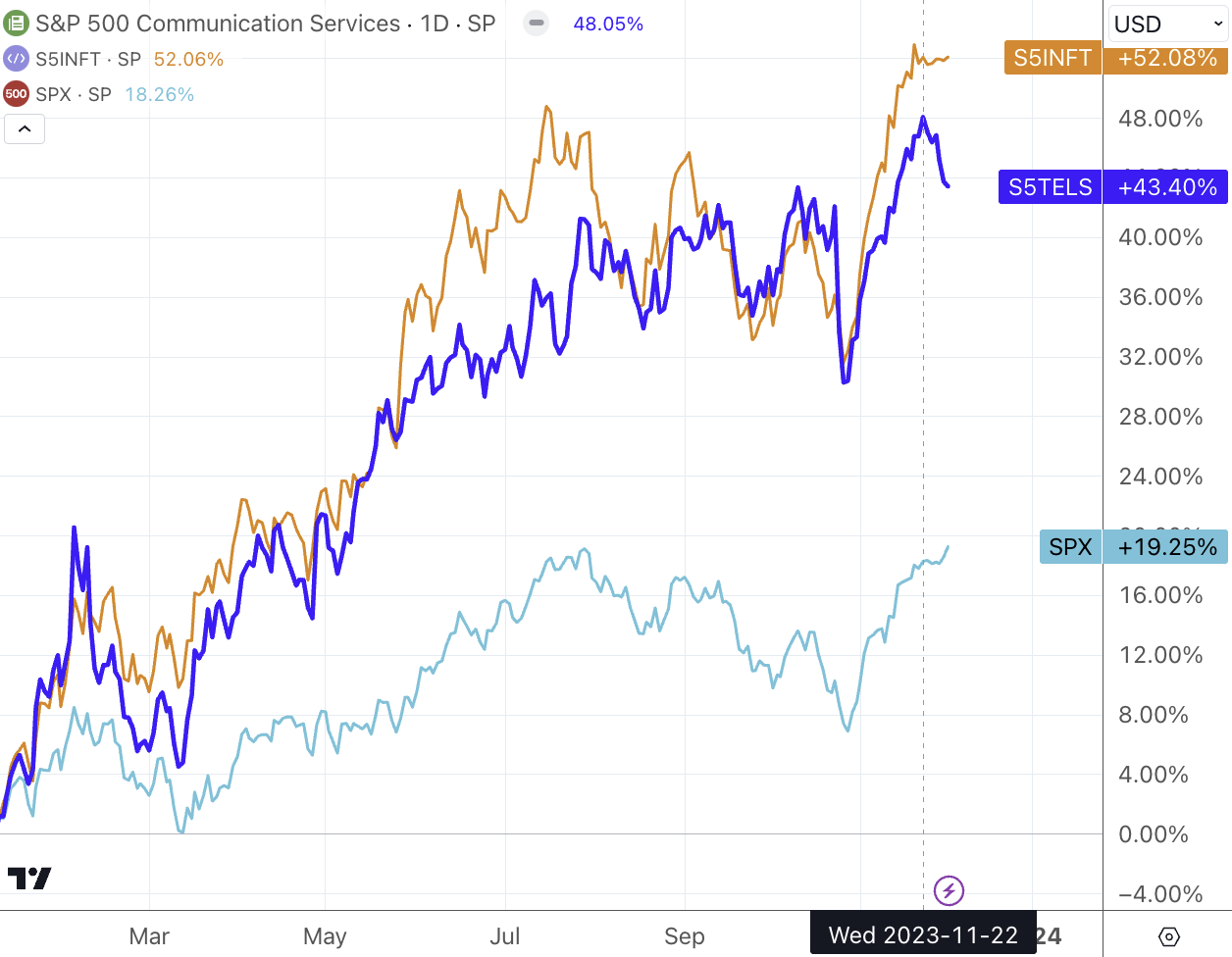

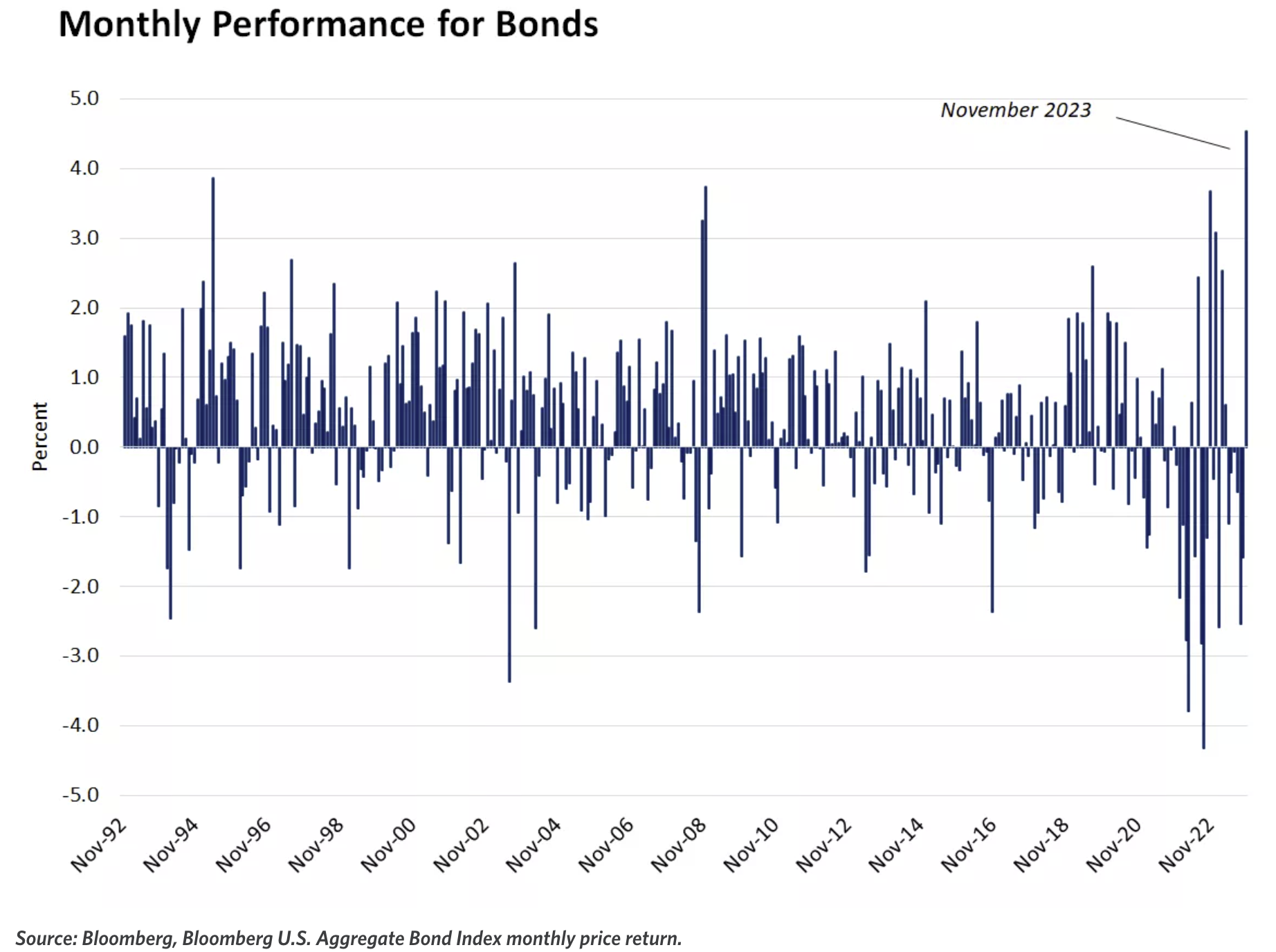

The industries most sensitive to falling interest rates continued to lead last week, with the technology and communications sectors, which once rose more than 50% this year, performing the worst. The bond market recorded its best monthly return in the past 30 years;

In terms of data, U.S. and global GDP growth slowed, and U.S. manufacturing momentum deteriorated slightly, but consumer spending continued to grow;

The Feds Waller issued a reminder to cut interest rates in advance, the Feds mouthpiece Timiraos issued a statement saying that the Feds interest rate hikes may be over, and Powell continued to be hard-talking but the market did not buy it;

OPEC+ expanded production cuts, but oil prices fell sharply mainly because this meeting is likely to be the limit of OPECs self-restriction, and there will not be another production cut. The market is worried that a battle for market share may break out next year;

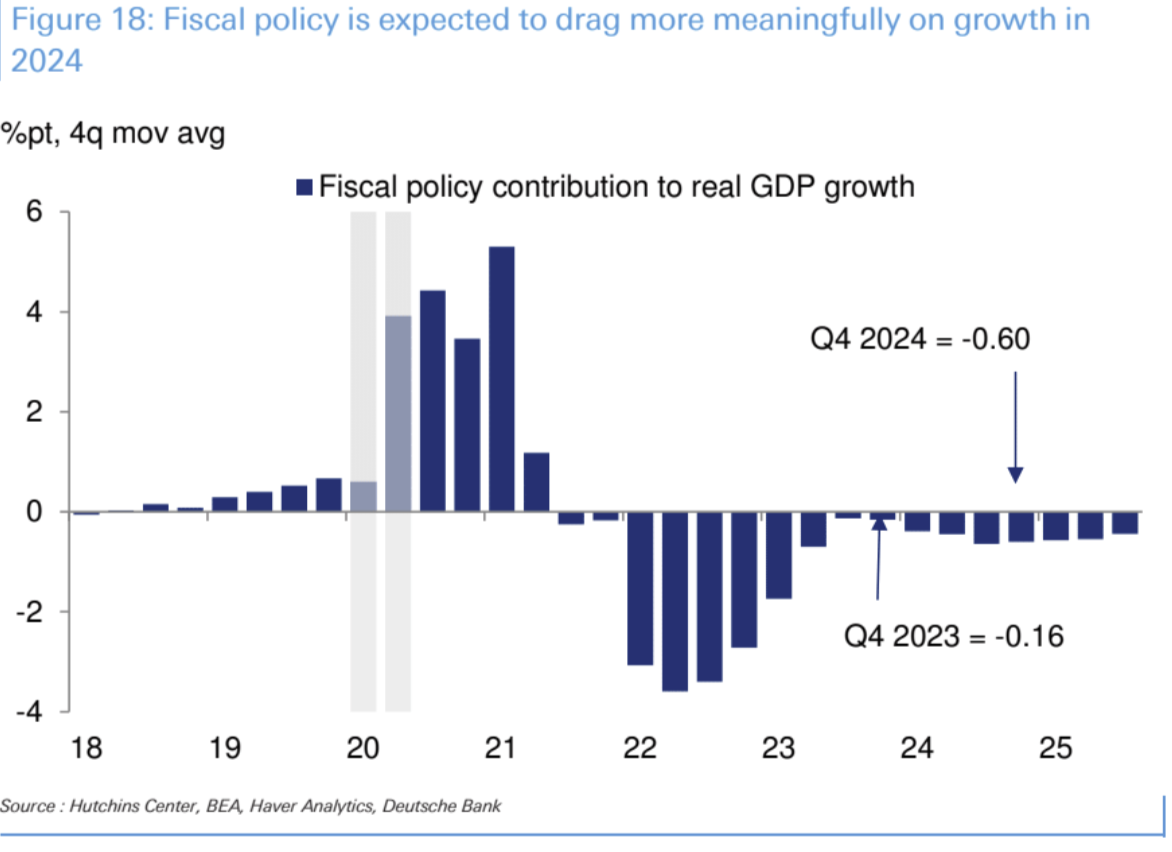

Compared with 2023, fiscal policy in 2024 should have a greater drag on the U.S. economy. DB forecasts a drag on nominal GDP growth of about 0.8%;

Entry into the cryptocurrency market is currently not strictly restricted. The penetration rate in the United States has reached 20%, almost the same as stocks. Even if the ETF is approved, the increase it can bring should be limited; regardless of the failure or success of the Bitcoin ETF in January, it may All mean the emergence of a short-term top.

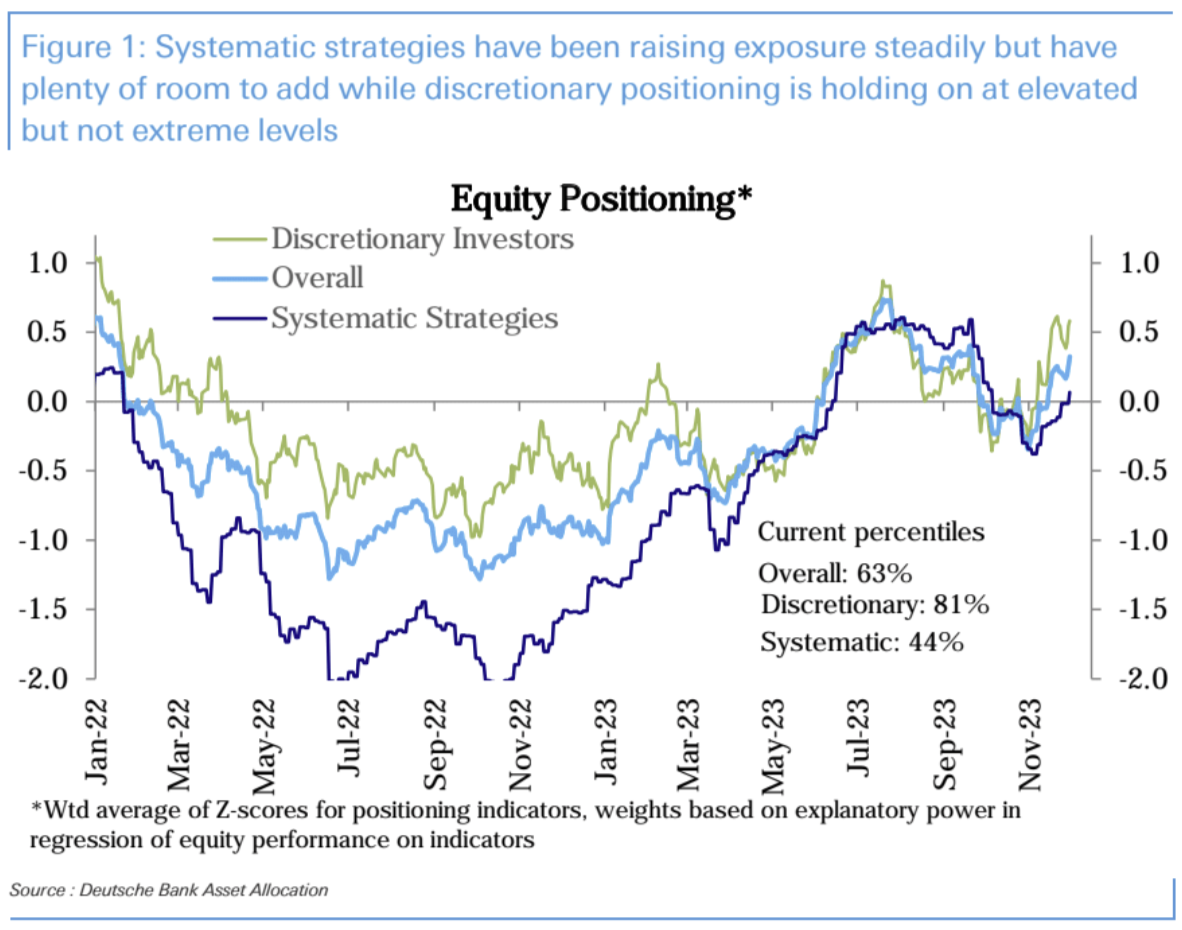

The total stock position increased further this week to the 63rd percentile, with systematic investors’ neutral positions and subjective investors’ positions on the high side;

In the futures market, net long positions in U.S. stocks rose for the third consecutive week, but the serious deviation from economic fundamentals also occurred for the first time since the end of 2019;

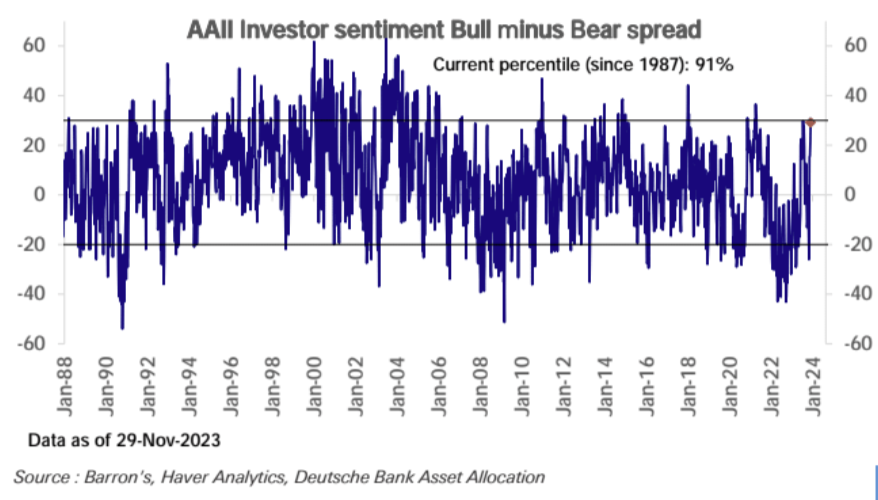

The AAII survey showed high retail investor sentiment, with the bullish-short differential reaching the 91st percentile historically;

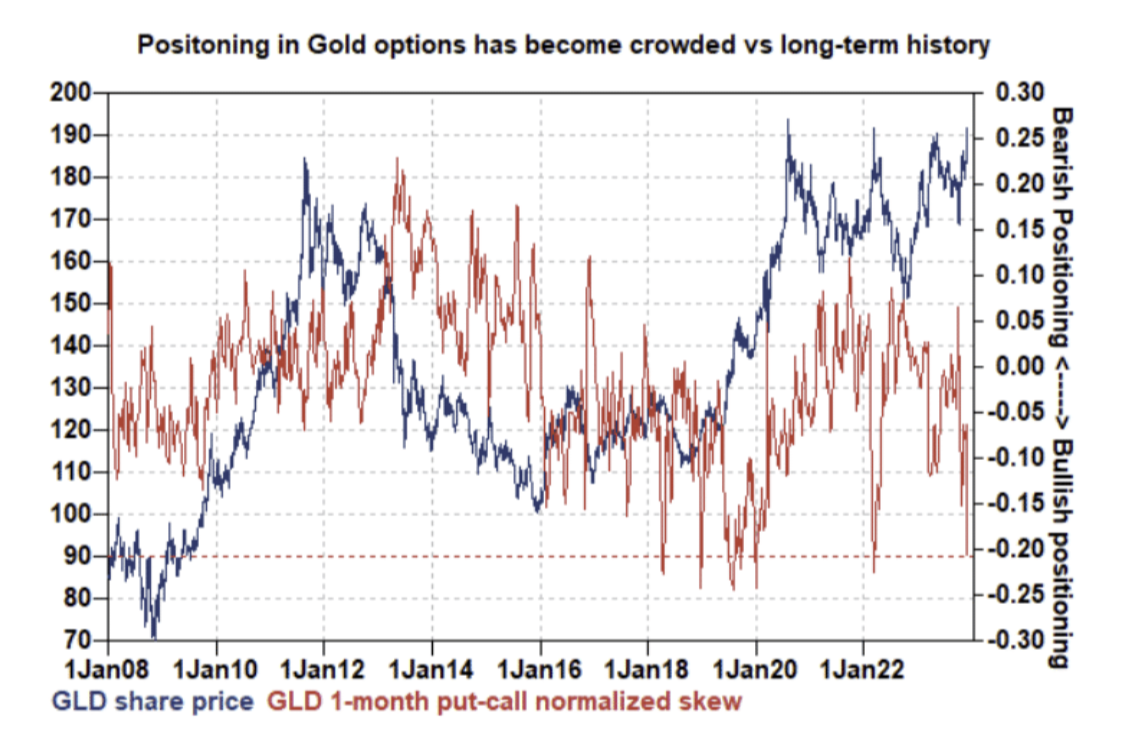

Gold’s call options demand is unusually high and put-call skew is near historical extremes;

Pay attention to the non-farm employment data this week. Considering that there will be seasonal factors and the return of strikes in November, the number of 175,000 is not expected to be high. A slightly lower than expected number may trigger further market associations with interest rate cuts. A slightly higher than expected number is also sufficient for the market. Reasons to convince yourself.

Market and data review

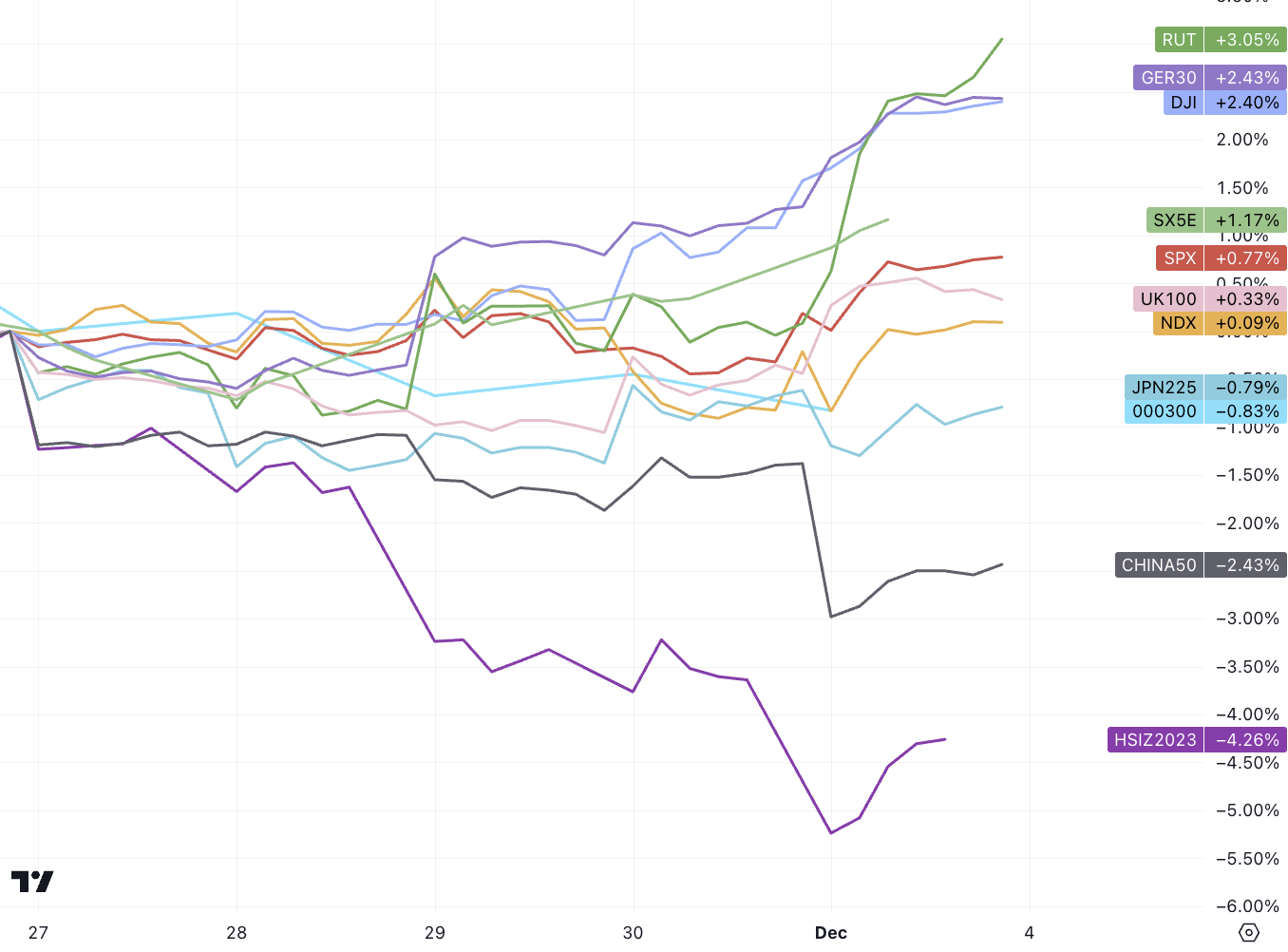

In the past week, the market was led by cyclical industries and small-cap stocks. Generally speaking, industries most sensitive to falling interest rates have performed well, including cryptocurrencies, industrial metals, and gold. The weekly performance of the major stock indexes below shows that the small-cap stock index Russel l2 000 (RUT) accelerated its gains in the second half of last week.

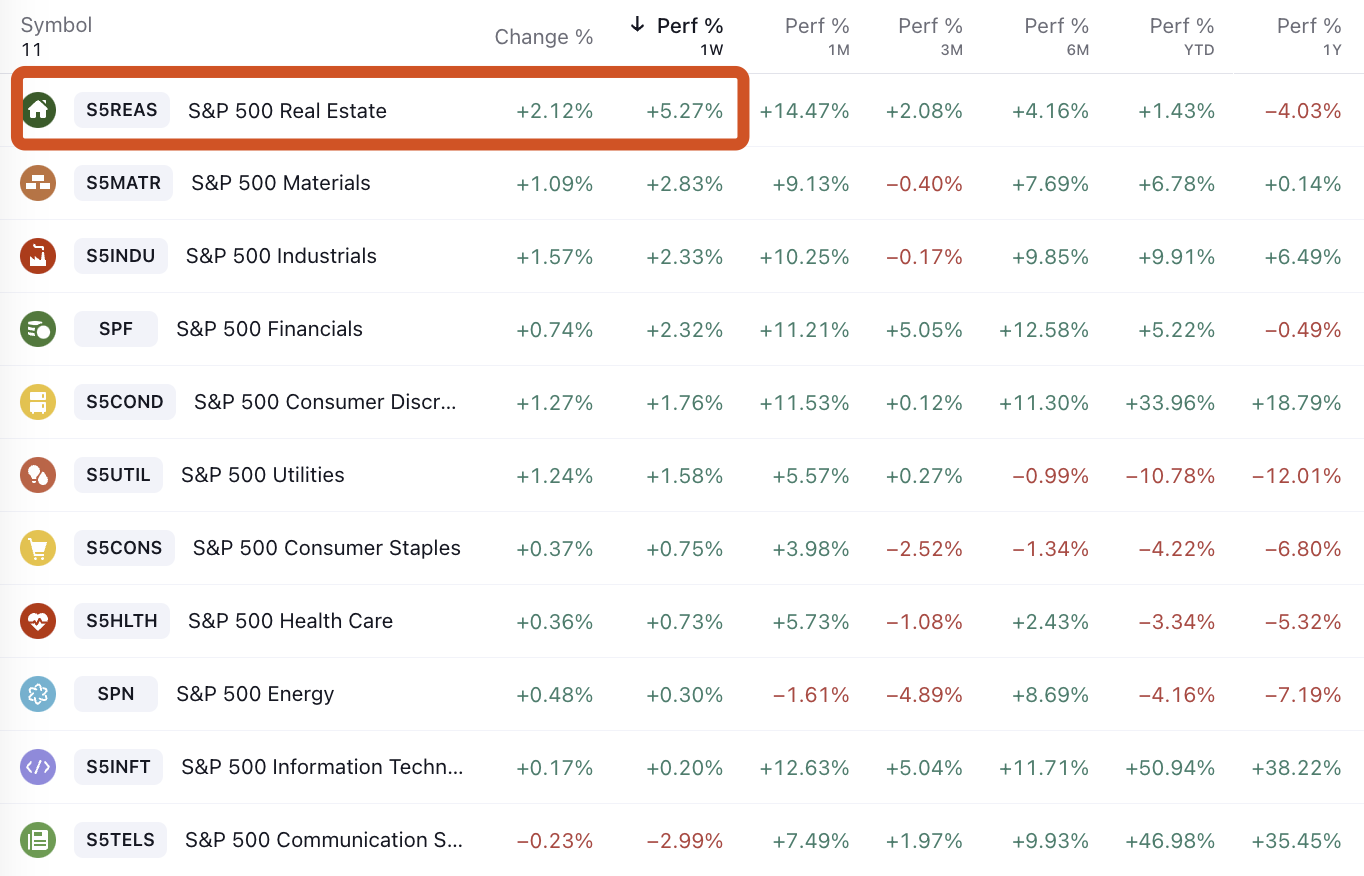

Typical industries that are sensitive to interest rates include real estate. The sector has also risen by more than 5% in a single week. It is the best performer in the SP industry index. It has risen by 14.5% in the past month. Other industries including financial services and consumer discretionary goods have also risen in the past month. rose more than 11%. The technology and communications sectors, which have performed best this year, have performed the worst. Communications even fell 3% last week and became the only sector to fall:

The communications sector (S 5 TELS) has bucked the trend recently and has pulled back, while the technology sector (S 5 INFT) has stagnated, but it still maintains a gain of more than 2 times the market this year:

The bond market posted its best monthly returns in the past 30 years:

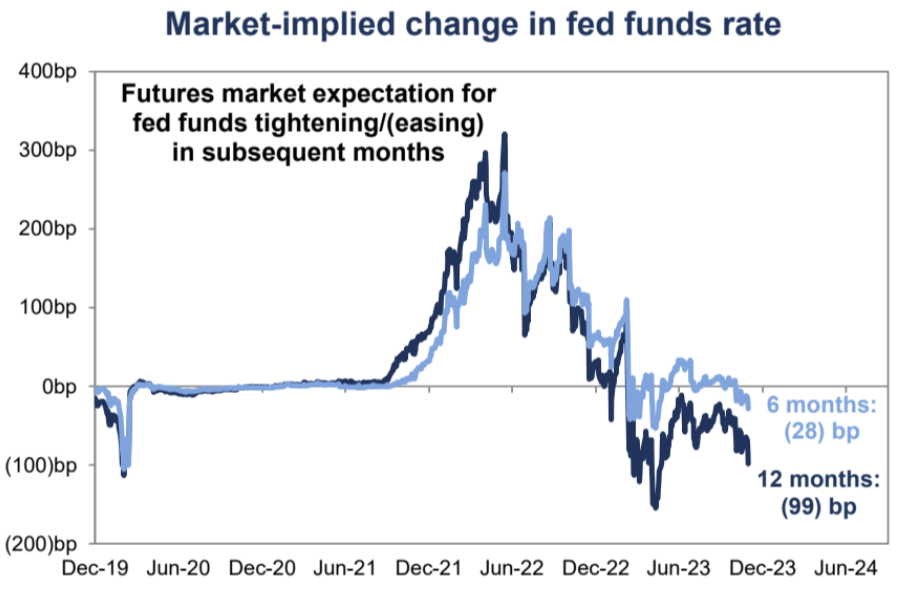

The current interest rate futures market is implicitly pricing in an interest rate cut of 28 bp in the next six months, which means that there will be one rate cut before May, and a 99 bp rate cut in 12 months, which means that there will be almost four rate cuts next year. It is relatively ahead of its time. We believe that the Fed will at least verbally suppress it in the future. The possibility of such an expectation exists (after the December meeting). Although some officials have begun to switch gears, it is difficult to expect officials to unanimously promote this expectation:

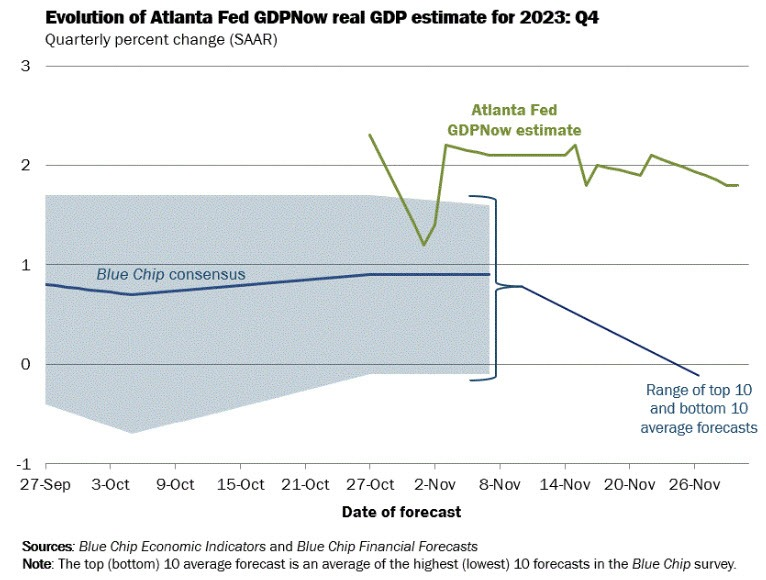

From a data point of view, the growth of US and global GDP has slowed down, and the momentum of US manufacturing has deteriorated slightly, but consumer spending continues to grow; US core inflation and GDP growth have both declined. Since the market pays more attention to the former, it still supports the central bank and the market for the time being. Optimism.

The Atlanta Feds GDPNow forecast for fourth-quarter growth fell last week from 2.1% to 1.8%:

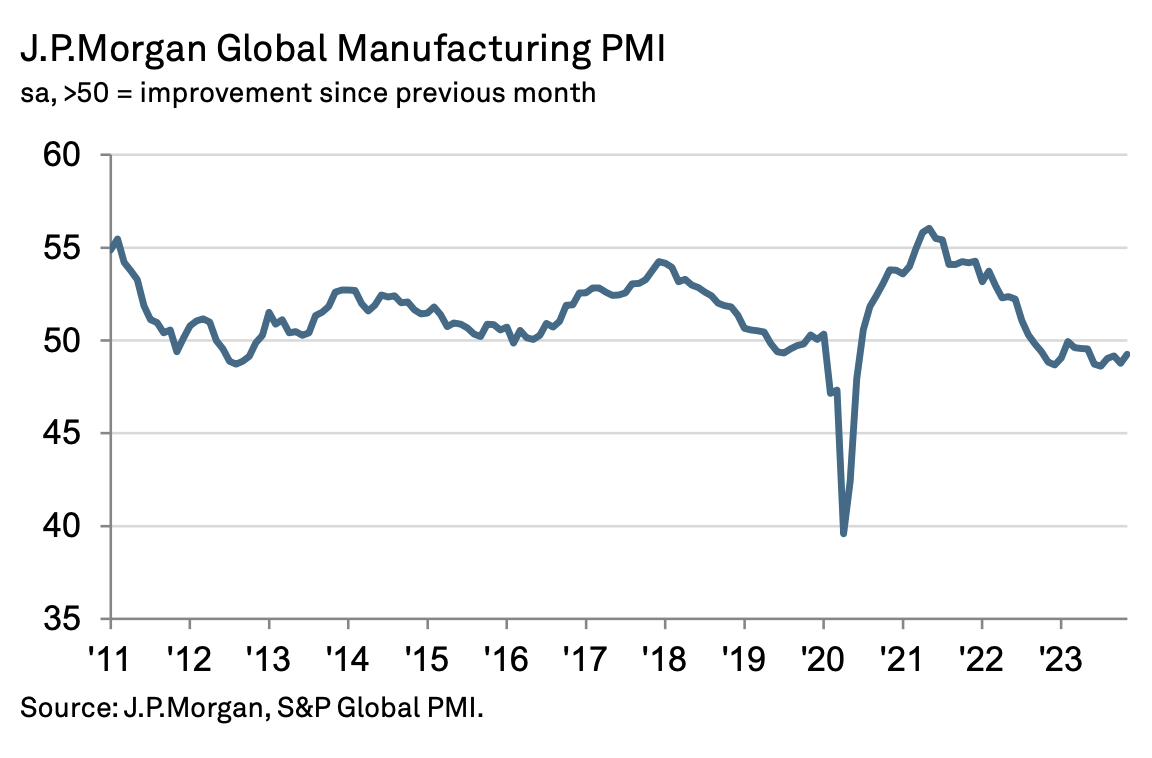

Although the global manufacturing PMI index rose to 49.3 in November, the highest in six months, the global PMI has been below 50 for 15 consecutive months, creating the longest contraction period since the 2008 financial crisis:

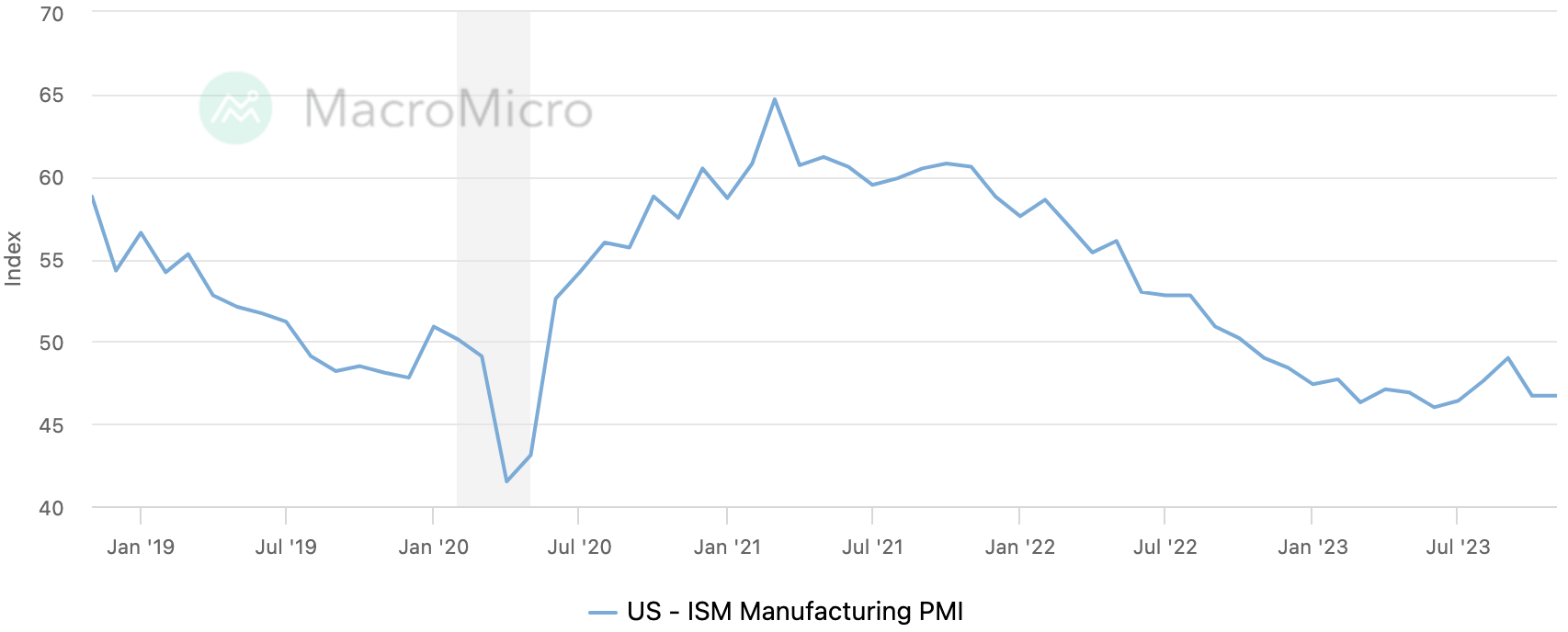

The U.S. manufacturing PMI has shrunk (below 50) for 13 consecutive months, marking the longest contraction cycle in the past 20 years since the outbreak of the Internet bubble crisis:

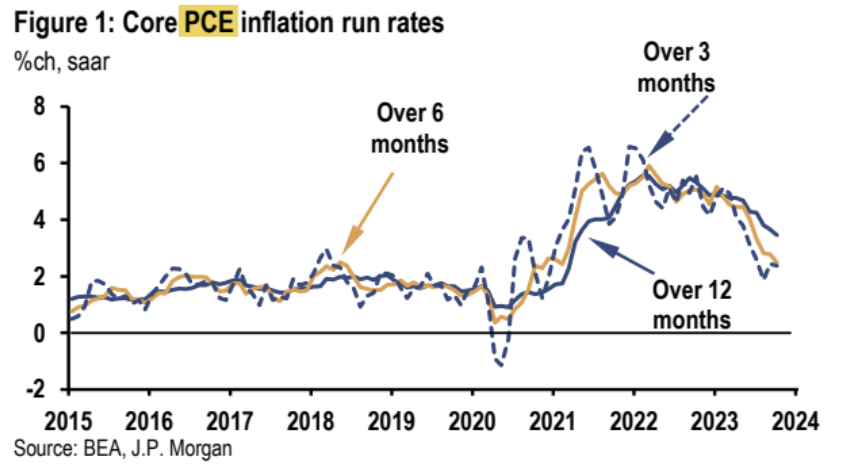

Overall, underlying inflationary pressures in the United States continue to ease, and the market generally expects inflation to continue to moderate in the coming months, although it will not fall linearly. The PCE core inflation index released last week continued to decline, rising 3.5% year-on-year, getting closer to the Feds 2% target. Annualized core inflation in the last three months and six months was 2.4% and 2.5% respectively, significantly below the highs earlier this year:

Personal consumption slowed to 0.2% month-on-month from 0.7% in September. However, annualized growth was about 5.2%, the same as in the previous three months.

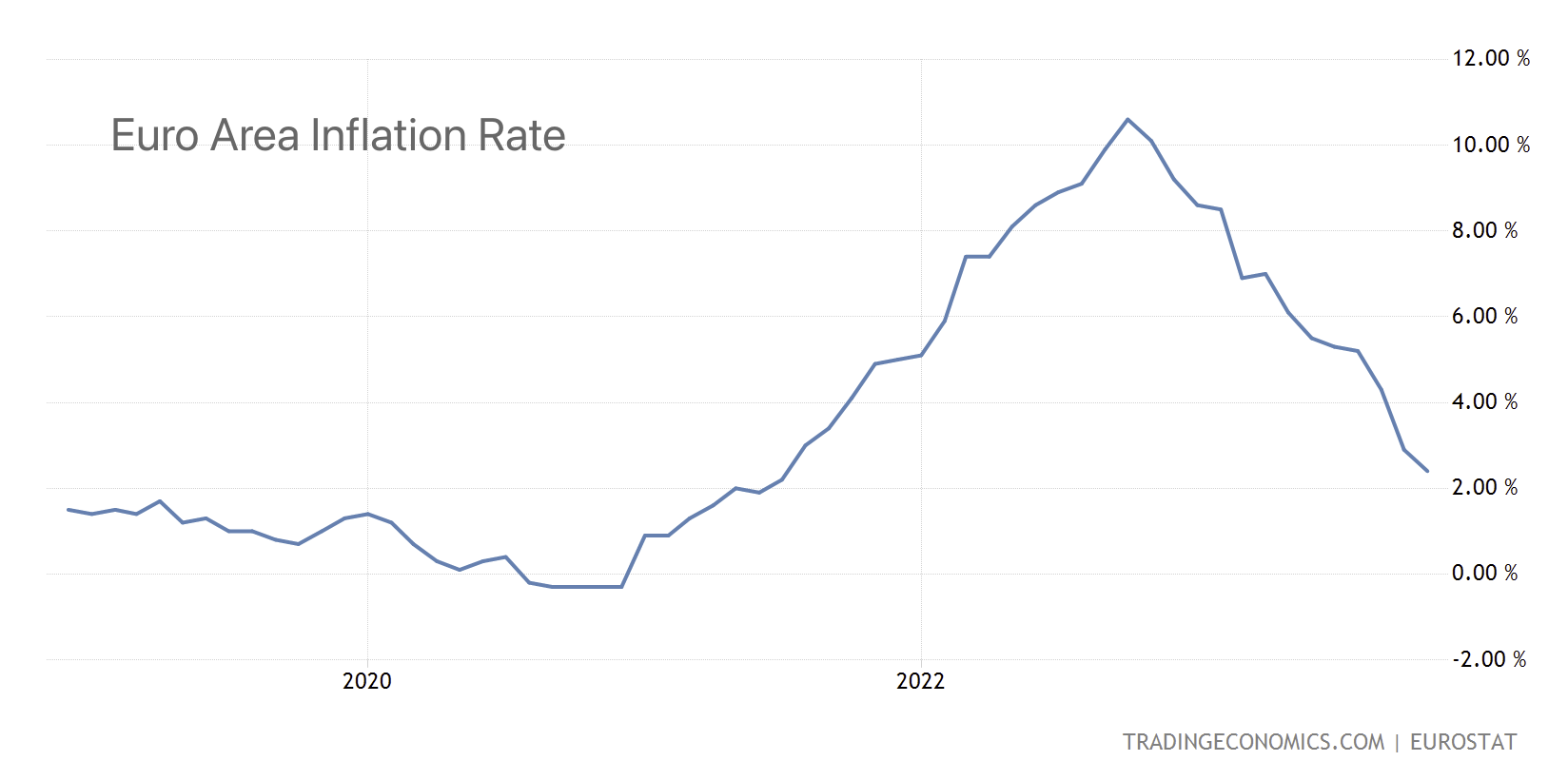

Eurozone nominal inflation fell to 2.4% in November, well below its peak of 10.6%, a decline that exceeded market consensus:

More tips on rate cuts

Fed Waller said last week that if progress continues to curb inflation in the coming months, it may be reasonable to start cutting interest rates in the first half of 2024. These remarks were in stark contrast to Chairman Powells response to a question about a rate cut at the November FMC meeting, when he emphasized: In fact, the committee is not considering a rate cut at all now.

Timiraos, the Fed’s mouthpiece, also wrote last week that the Fed’s interest rate hikes may be over, but officials are reluctant to say so. The Federal Reserve will extend its pause on interest rate hikes until January next year. This means that the Fed’s December 12-13 meeting will focus on how long it is still possible to send a signal to raise interest rates. Officials are unlikely to eliminate this so-called tightening bias at this meeting, which would be a necessary first step before considering whether to cut interest rates. This is an early warning that the December meeting will continue to remain on hold, but the tone is hawkish.

According to current market forecasts, by June next year, the year-on-year core PCE inflation rate should have dropped convincingly to below 3%, and the unemployment rate will climb to close to 4.5%. This is a mild recession environment, and the Fed does not have much reason to continue persist in.

On Friday, Powell poured cold water on interest rate cuts, saying it was too early to judge when to ease and to prepare for further tightening if necessary. However, he also mentioned that the impact of monetary policy on economic conditions has a lag, and the Feds monetary tightening policy may not yet have a full impact. The market apparently ignored his hard words and paid more attention to the pressure on the Fed to shift policies brought by the weakening economy. In terms of market performance, U.S. bond prices rebounded sharply during the session on Friday and yields plunged.

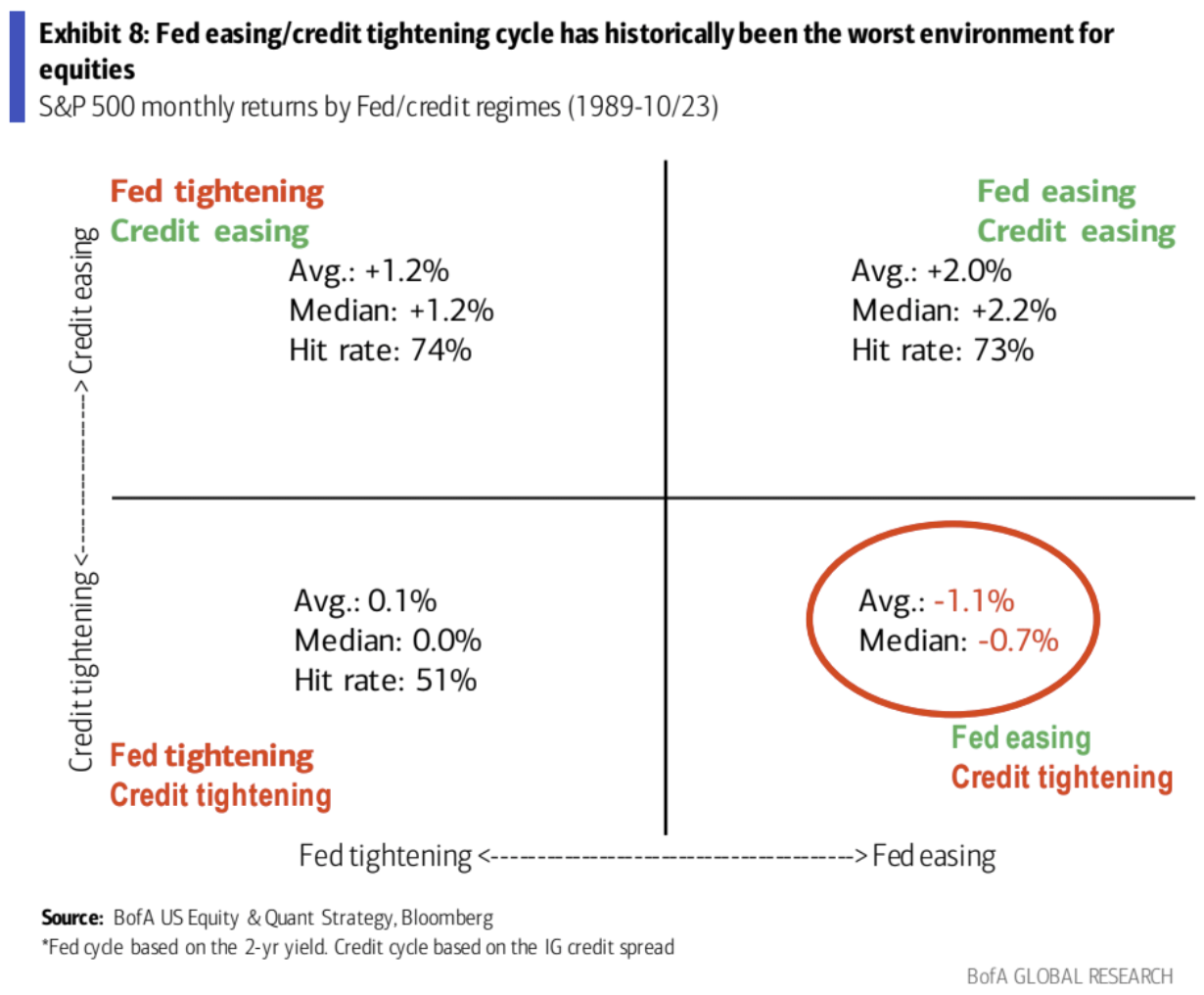

It is best if the Fed is not forced to ease due to the economic downturn. Although many believe that the Feds easing cycle will be the catalyst for the next wave of stock market gains, history shows that an environment in which the Feds easing cycle and investment-grade credit spreads widen simultaneously are most beneficial to stocks. Bad, that is, a recessionary environment. Bulls should hope for an improving economy, leading to easier credit conditions, rather than easing led by a dovish Fed because of a weak economy.

Fiscal drag grows

Deutsche Bank: Given the current highly uncertain political environment, the forecast range for the fiscal year 2024 deficit is very wide, between US$1.6 trillion and US$1.9 trillion. The base forecast is about US$1.7 trillion, compared with a deficit of US$337 billion this year. Narrow. Compared with 2023, fiscal policy should have a greater drag on the economy in 2024. We forecast a drag on nominal GDP growth of about 80 basis points.

BTC approaches $40,000

Expectations for the approval of a spot BTC ETF, combined with a weakening U.S. dollar and U.S. Treasury yields, pushed BTC close to the $40,000 mark last week. The market is now very optimistic that the ETF could be approved in early January. However, we have analyzed before and do not believe that entry into the cryptocurrency market is currently strictly restricted, whether it is Coinbase or already listed crypto ETPs such as BITO and GBTC, or the Bitcoin and Ethereum futures markets.

According to a Coinbase survey in February 2023, 20% of Americans own cryptocurrencies, compared to 21% of Americans who hold stocks directly, showing that the penetration rate of cryptocurrencies in the United States is already high (if the CB survey data does not As for too outrageous), there is limited room for further expansion.

So we tend to think that whether the Bitcoin ETF fails or succeeds again in January, it may mean the emergence of a short-term top.

OPEC+ expands production cuts, oil prices plummet

After tough negotiations, OPEC+ reached an agreement on oil supplies last Thursday. OPEC+ agreed to further cut supply by 1 million barrels per day. At the same time, Saudi Arabia will extend an additional 1 million barrels per day of voluntary production cuts it already has in place. But oil prices fell nearly 5% (83 – 79) after the meeting.

Some analysts believe that because the production cuts are voluntary, they are worried that they will not be strictly enforced. In addition, the target of reducing production by 1 million barrels is also set. This time it is just barely achieved. The relevant production reduction has already been included in the oil price, and this is likely to become the limit of OPECs self-restriction. There will not be another production reduction, and the market share may even explode next year. The battle has caused oil prices to fall to around $40. OPEC+ currently has about 5 million barrels per day of spare capacity, and there is no sign that U.S. production growth will slow down (the U.S. added five more oil rigs last Friday). It had been hoped that demand growth next year would absorb OPECs spare capacity, but OPEC itself only forecast demand growth of 2.5 million barrels per day; therefore, it will take at least another year for the market to tighten. These may be the reasons why oil prices first rose and then fell sharply.

Positions and Fund Flow

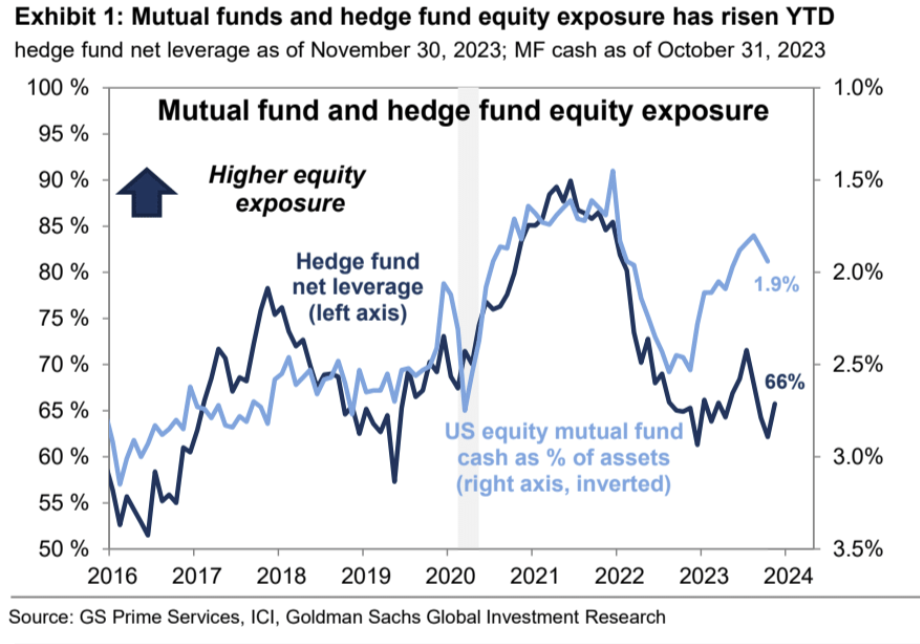

According to Goldman Sachs PrimeBook data, hedge funds and public funds have increased their stock exposure throughout the year. Hedge funds’ net positions increased from 61% to 66% in 2023, but it is still lower than the long-term average of 70%. However, because hedge funds also Long and short positions have been added, and overall leverage is now at an all-time high. This means that the ratio of hedge funds investment scale relative to capital has increased, but the risk exposure is still relatively conservative, and everyone still seems to be afraid of a sharp retracement or that the animal spirits have not yet been released:

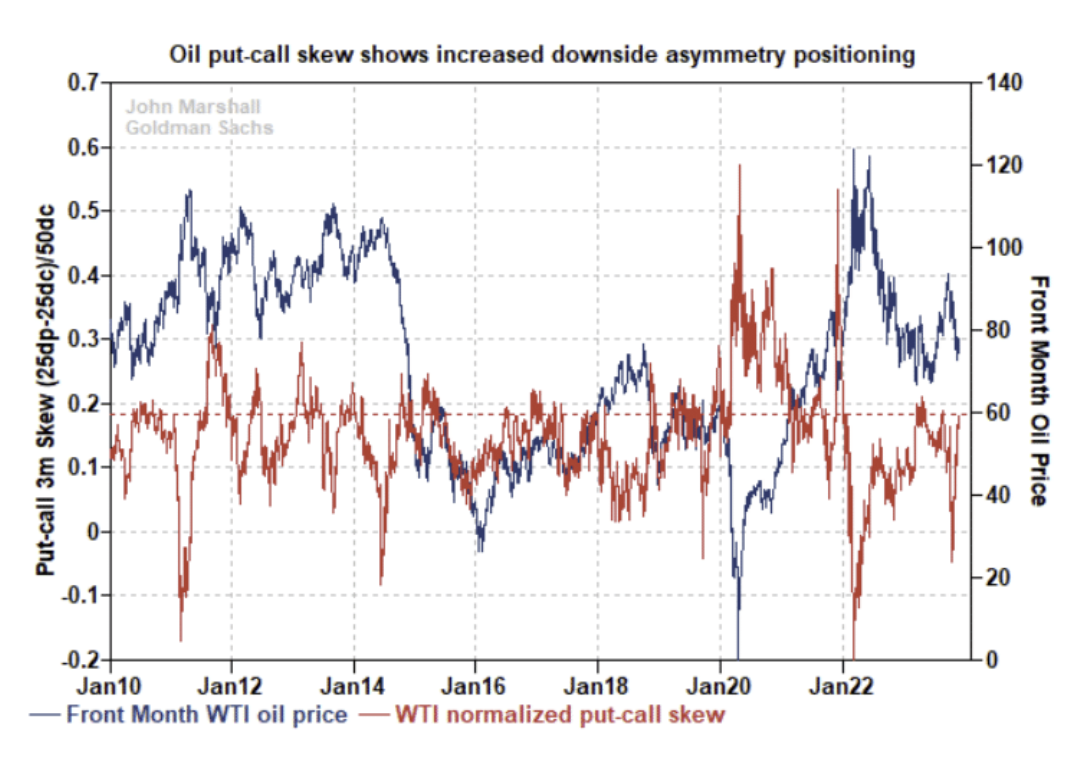

The demand for golds call options is unusually high and the put-call skew is close to the historical extreme, indicating that the market is extremely optimistic about golds recent asymmetric rise expectations. This may be a sign of the main rise and may also indicate that the market needs to adjust (note the price blue Comparison between the extreme value of the line and the skew red line):

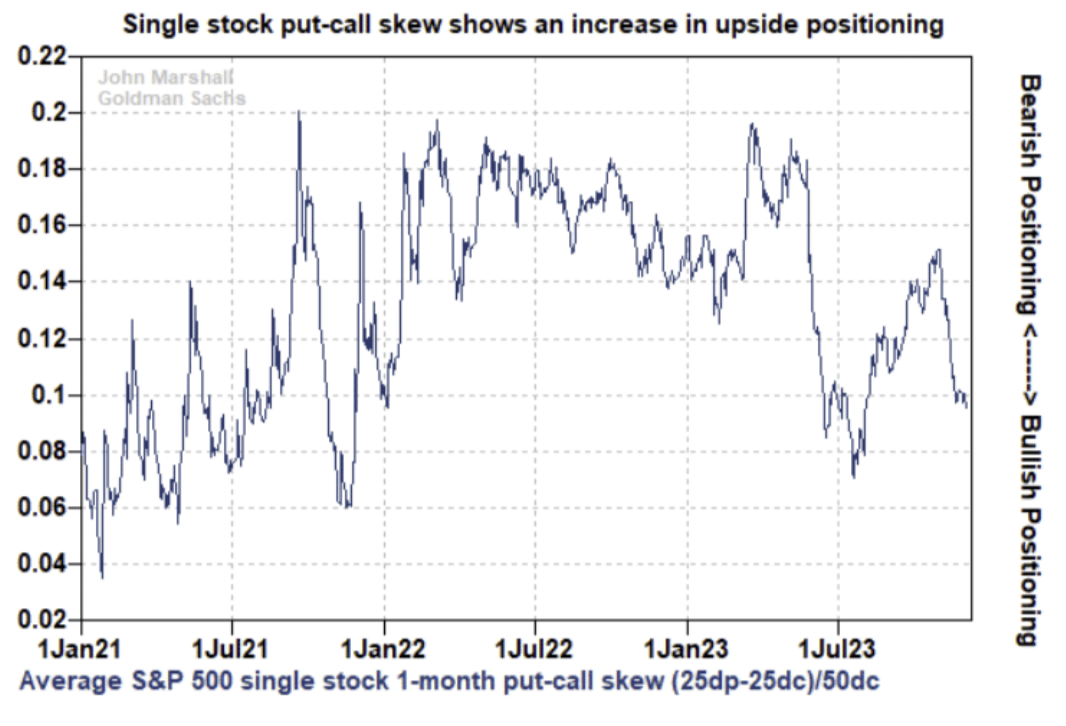

The put-call spread of individual stocks is also falling and is currently only at the 25th percentile of history, indicating that the level of bullishness among professional investors is high but not yet at an extreme level. If there is a further increase in bullish demand, it will constitute a warning signal for the stock market:

The demand for crude oil put options increases (the skew moves upward), and investors expectations and fears about falling crude oil prices are increasing. This is also a contrarian indicator, and buying crude oil call options to hedge against inflation and geopolitical risks would be a good opportunity if it moves higher.

Total equity positions measured by Deutsche Bank increased further this week (63rd percentile), with systematic strategies adding positions from just below neutral to just above neutral (44th percentile), although they have significantly Bullish on large-cap U.S. indices, but their positions on small-cap, European and emerging market indices remain lower on the way up. At the same time, the positions of independent investors have further increased to the overweight area (81st percentile), which is high but not extreme:

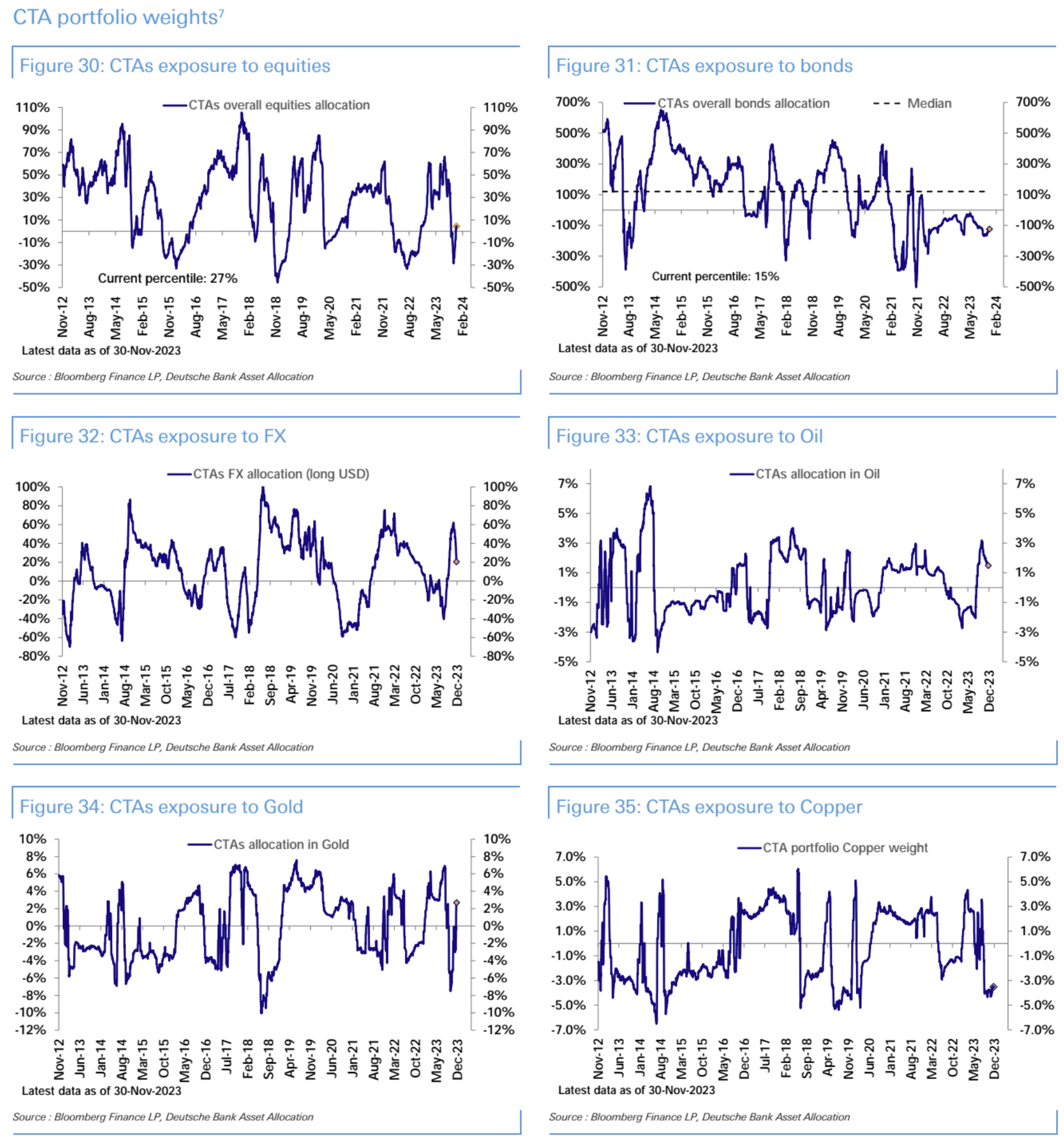

CTA positions have increased for three weeks in a row, with equity allocation turning bullish but still historically relatively low (27th percentile); short exposure to bonds appears to be in the early stages of narrowing (15th percentile):

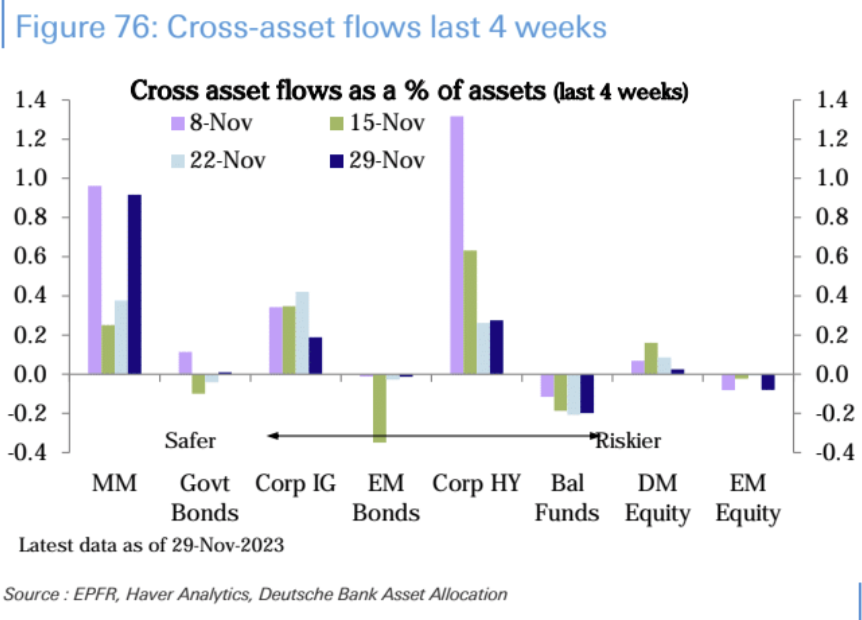

U.S. equity funds ($8.3 billion) continued to see steady net inflows, while the rest of the world (-$5.7 billion) saw net outflows; money market funds received significant net inflows ($75.6 billion), totaling nearly $1.7 billion over the past six weeks. 300 billion U.S. dollars, a record year-to-date total of 1.29 trillion U.S. dollars; the pace of bond fund inflows slowed last week, but the corporate bond sector still has significant inflows, and emerging market stocks and bonds both committed outflows:

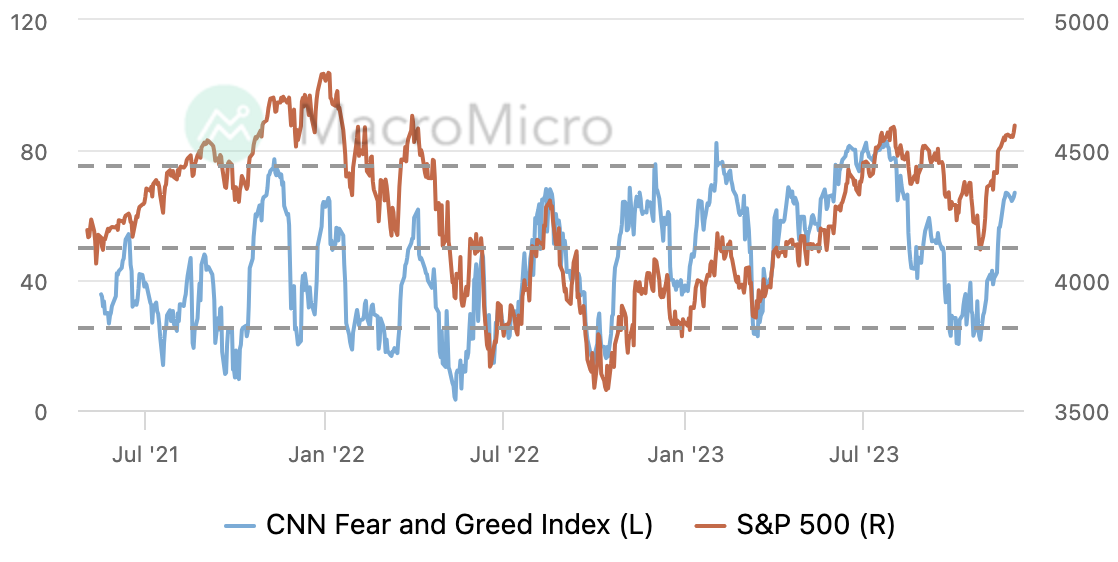

In the futures market, the net long position in U.S. stocks rose for the third consecutive week, but the serious deviation from economic fundamentals also occurred for the first time since the end of 2019:

market sentiment

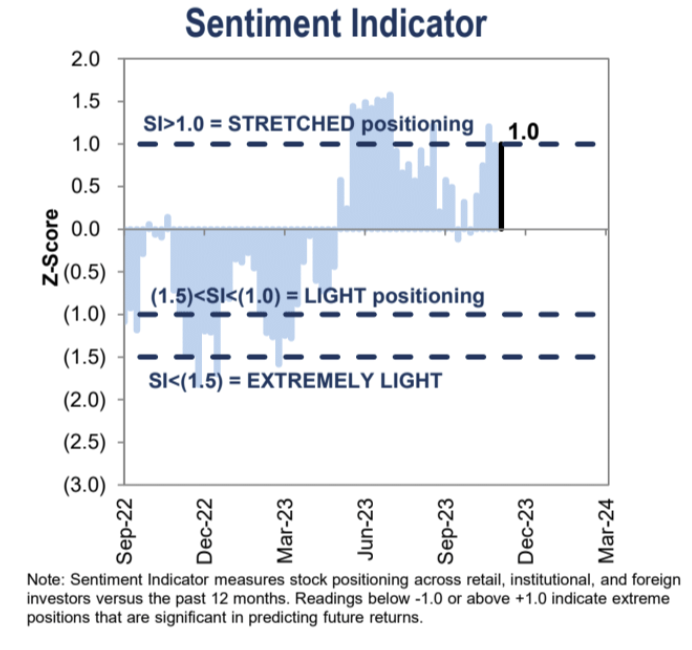

The Goldman Sachs institutional sentiment indicator returned to 1.0, which is the excessive range, reflecting that the current sentiment is relatively optimistic:

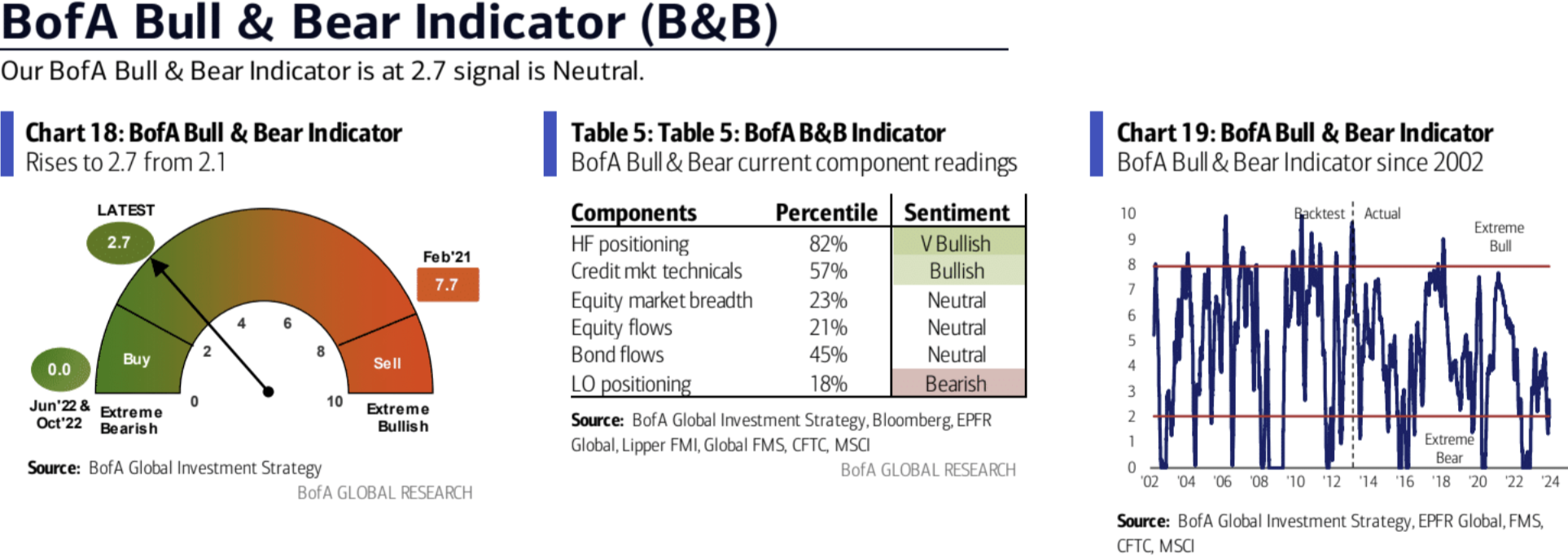

The Bank of America sentiment indicator rebounded from 2.1 to 2.7, which is in the neutral range:

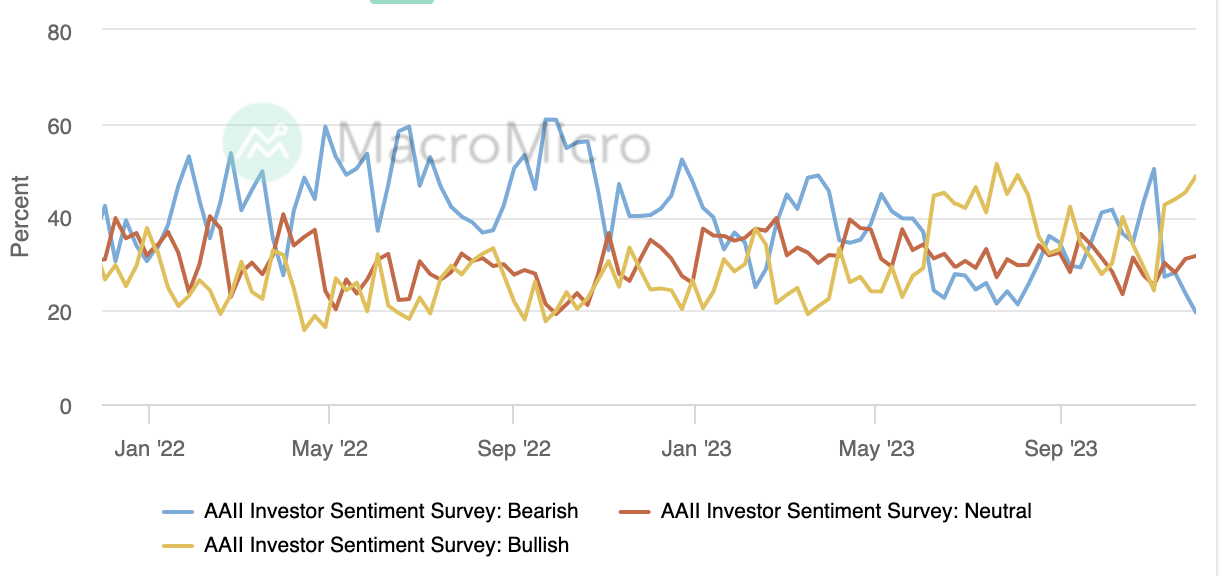

The proportion of bullish views in the AAII survey rose to 48.76%, and the long-short difference remained the same as in July this year, reaching the 91st percentile in history:

The CNN Fear and Greed Index is on the positive side and has not yet reached excessive greed:

Follow this week

There are no more than four things that can reverse the current momentum in the future: changes in Fed policy expectations, panic about economic growth, political/fiscal uncertainty, and geopolitical uncertainty.

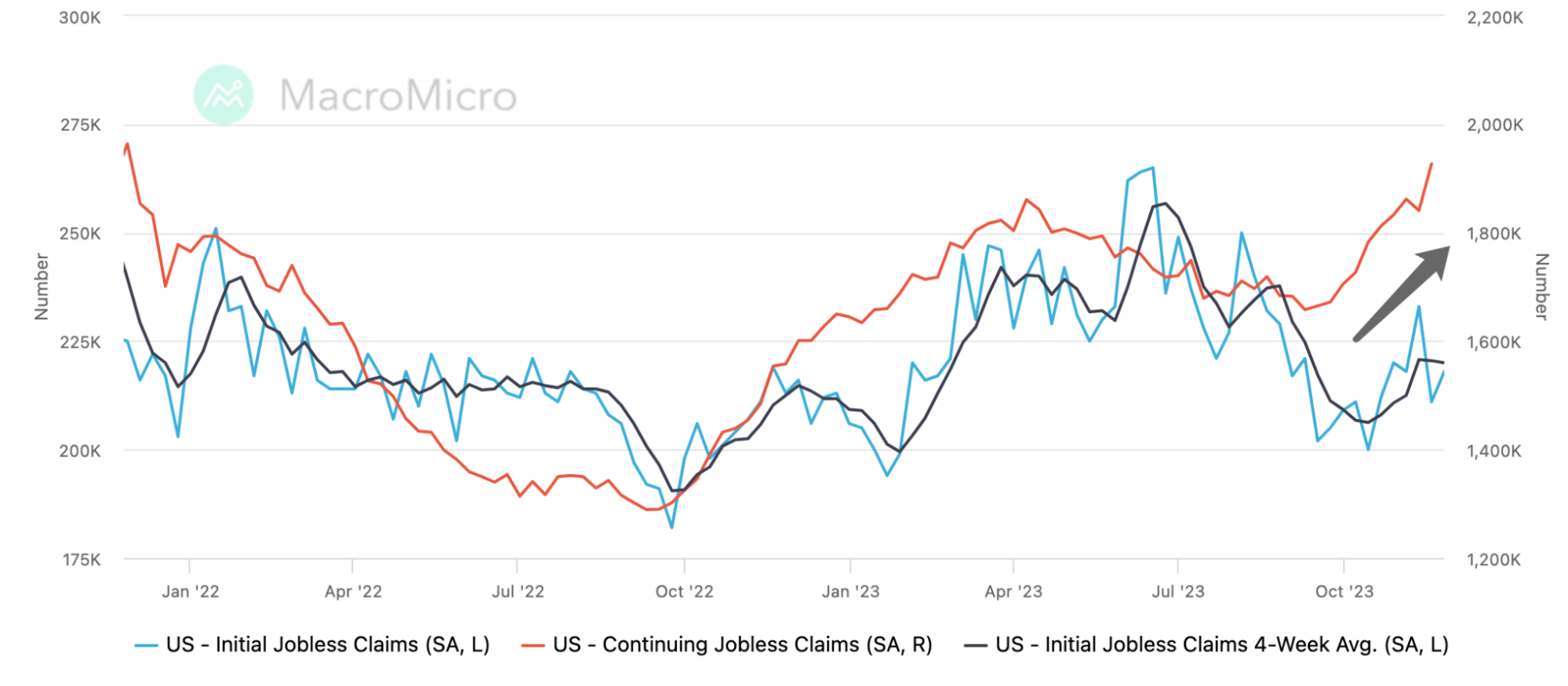

The latest turning point may be Fridays non-farm payrolls report. The market expects 175,000, a slight increase from Octobers 150,000. This may be due to the return of workers on strike in some industries in November, and seasonal factors during the November holidays are expected. The number of hirings (such as retail, logistics) may increase during the holiday season, so such a move may interfere with the employment trend. It should be realized that even strong data in November cannot conceal the weakening trend of the overall job market. High-frequency weekly unemployment benefits data This can also be confirmed by:

Since the non-farm payrolls figure is not expected to be high, a slightly lower than expected figure may trigger further market speculation about interest rate cuts. A slightly higher than expected figure also allows bulls to find reasons to convince themselves; but if it is significantly lower than expected, it may trigger Recession conjecture. In addition, the market predicts that the unemployment rate will remain unchanged at 3.9% between October and November; average hourly earnings are expected to increase by 0.3% in November, exceeding the previous value of 0.2%, but the year-on-year growth rate will continue to decline to 4.0%. Value 4.1%.

Earlier on Tuesday, there was US job vacancy data, which is expected to drop from the previous 9.553 million to 9.35 million. Although job vacancies fluctuate greatly, the turning trend is obvious. This data has had an impact on the market in the past two months. The impact is obvious.