YBB Capital: TVL exceeded 600 million in 9 days, the rational thinking about Blast behind the madness

Original author: @YBBCapital Researcher Ac-Core

Foreword:

With the recent launch of the Layer 2 network Blast by the founder of Blur, the market has also experienced mixed emotions in the face of strong expectations for airdrop profits. According to the official announcement, the Blast mainnet will be launched in February next year, and airdrops based on points will continue similar to Blur’s previous model. The growth rate of Blasts TVL in just a few days after the news came out has been impressive. However, Blurs raid on Layer 2 narrative will undoubtedly lead to three outcomes: triggering a new round of hot topics; laying a huge new mine. Regarding the plagiarism of related track projects, from a marketing perspective, this incident is undoubtedly a market battle between strong technology Layer 2 and strong consensus Layer 2.

Review the basic structure of Ethereum Layer 2

Image source: Top Ethereum Layer 2 Networks

After Blur puts forward its own Stake Layer 2 new narrative, we might as well understand the current basic structure type of Ethereum Layer 2 before making a judgment. That is, it is a scalable solution designed to improve transaction throughput and reduce transaction costs by introducing a second layer protocol or protocol stack on the Ethereum blockchain, which can be roughly summarized as the following types:

State Channels

Definition: State channels are a solution based on the direct exchange of signatures between partners without writing every transaction to the blockchain. The basic principle is to create an off-chain environment between participants so that transactions can occur off-chain, with the final state only being broadcast to the network when it needs to be submitted to the blockchain. This method greatly improves transaction efficiency and throughput.

How it works: In a state channel, participants can open a channel, perform multiple transactions, and then ultimately submit the final state of the channel to the blockchain. In this way, only the opening and closing of the channel require on-chain transactions, while transactions within the channel can be performed off-chain, avoiding the cost and time delay of each step of transactions on the blockchain.

Example: Lightning Network, Bitcoin’s state channel solution. Users can make fast, low-cost micropayments off-chain, with the final state only being written to the blockchain when the channel needs to be closed. On Ethereum, Raiden Network is a similar state channel solution that enables highly scalable transactions by creating a many-to-many channel network.

Sidechains

Definition: A side chain is a chain that is separate from the main blockchain but compatible with it. It can have its own consensus mechanism and block generation rules. Users can lock assets from the main chain, then conduct transactions on the side chain, and finally submit the transaction results to the main chain. This approach improves overall network performance by enabling higher throughput on sidechains. The following are several common sidechain contract bridging methods:

Pegged Bridge: It is a mechanism to achieve cross-chain interaction by anchoring or mapping assets between two chains. In this bridging method, users lock their assets on one chain, and the corresponding amount of assets will be generated on the other chain. This usually involves some trusted intermediary party responsible for overseeing the locking and releasing of assets;

Lock-and-Mint Bridge: Lock-and-Mint Bridge is a method of bridging by locking assets from one chain and then creating a corresponding number of assets on another chain. Users lock assets on the original chain, and the bridge protocol will issue a corresponding number of tokens or assets on the target chain. This approach usually requires a trusted intermediary or multi-signature contract to ensure the security of the locking and releasing process;

Cross-Chain Atomic Swap: It is a decentralized way that allows users to perform atomic-level swaps on two chains, that is, either all of them are completed or none of them are completed. This approach typically uses smart contracts and hash locking to ensure the reliability of transactions. The atomic exchange method does not involve a trusted intermediary, but involves a more complex smart contract design;

Proxy Bridge: It is a way of cross-chain interaction through an intermediate proxy. Users send assets to the bridge proxy, which performs corresponding operations on the other chain and then sends the corresponding assets to the target address. An example of this approach is executing transactions between two chains via multi-signature contracts;

Light Client Bridge: The light client bridge uses a lightweight client to track the state on the source chain, and then generates the corresponding state on the target chain. This method does not require the locking and unlocking of assets, but ensures the reliability of the interaction by verifying the status on both chains. This is common with some Layer 2 solutions on Ethereum.

Plasma

Definition: Plasma is a Layer 2 framework first proposed by Vitalik Buterin, one of the founders of Ethereum. Its design is inspired by a tree-like structure, which contains multiple independently running sub-chains. Each sub-chain can process transactions and only submit the final state to the main chain in case of dispute. Such a structure allows each sub-chain to be regarded as an independent side chain, which can operate at lower costs and higher throughput.

How it works: The key idea of Plasma is to reduce the burden on the main chain by spreading transaction processing across multiple sub-chains. This layered structure helps improve the scalability of the entire system while maintaining the security requirements of the main chain. However, Plasma also faces some challenges, such as handling exits on sub-chains and the design of dispute resolution mechanisms.

Hybrid Solutions

Definition: This is a hybrid approach adopted by some Layer 2 solutions, which combines the advantages of state channels and sidechains to provide a more flexible solution in different use cases.

How it works: State channels can be used in the system to handle certain high-frequency transactions, while side chains can be used to handle larger or less frequent transactions. Such a hybrid approach improves the flexibility of the entire network system by selecting the optimal solution based on actual needs.

Rollups

This is currently the mainstream and well-known expansion solution. It mainly adopts the method of migrating computing and storage outside the chain. As a recent report from the blockchain infrastructure department Chainstack [1] shows: Without Optimism and Arbitrum, etc. Layer 2 Rollup network, Ethereum transaction fees will be 4 times the existing price, which are currently mainly divided into two categories: Optimistic Rollup and ZK Rollup.

Optimistic Rollup: It adopts an optimistic execution approach, which assumes that the transaction is valid and will only be rolled back when there is a dispute. This reduces the burden on the main chain and increases overall throughput. However, effective dispute resolution mechanisms are needed to ensure the security of the system;

ZK Rollup: Use zero-knowledge proof to verify transactions on the side chain, thereby ensuring the validity and security of the transaction. This method takes full advantage of the power of zero-knowledge proofs and provides a high degree of privacy and security by executing transactions on the side chain and then submitting the verification data to the main chain.

Validium Chain.

Validium Chains combines the features of side chains and state channels by executing transactions outside the chain while using zero-knowledge proofs to ensure the validity of transactions. This method processes transactions off-chain, avoiding the cost of executing each step of the transaction on the main chain, but at the same time ensuring the security and verifiability of transactions. This provides a novel combination of high performance and privacy protection.

State Rent

First, let me explain that State Rent is not a Layer 2 solution, but an improved mechanism on the main chain. It reduces storage pressure on the chain by introducing rent to encourage users to release states that are no longer used. Although it does not directly improve transaction throughput, State Rent helps optimize the use of on-chain resources and improve overall network efficiency.

Back to Blast itself

Image source: Season 3 Rewards Loyalty

The different types of Layer 2 solutions mentioned above are jointly committed to solving the scalability problem of the blockchain, and each solution has its unique advantages and applicable scenarios. Choosing the appropriate method usually depends on the needs of the specific application. Security requirements and user experience considerations. What Blast itself has so far proven is that it relies on 3/5 multi-signatures to control recharge addresses. Most Layer 2 also relies on multi-signatures for management (see further reading [2]). Even though the problem of the Rollup centralized sorter is still unresolved, from the perspective of community consensus, Blast has still achieved great success in the short term.

Possible risks of Lido

Source: ASIA ARYPTO

Lido is a decentralized staking service based on Ethereum that allows users to stake their ETH tokens into the Ethereum 2.0 network, thereby powering Ethereum’s PoS (Proof of Stake) mechanism. Blasts Stake model essentially uses users ETH assets to pledge Ethereum Lido and RWA, and returns the proceeds to users and developers, with native Tokens as additional rewards. Therefore, pledging a large amount of funds in the Lido network also increases the financial security risks of the pledgers. They are faced with a certain degree of continuous centralization of the pledge method, which may be accompanied by the following risk factors that affect the Lido project:

Liquidity risk:Lido’s liquidity is one of the key factors in the project’s successful operation. If there is insufficient liquidity, users may face difficulties when they want to exit staking or withdraw funds. This situation may be affected by market factors, network congestion and other factors. Solutions to this problem may include developing more flexible exit policies, increasing the number of market participants, or partnering with other DeFi projects to increase overall liquidity.

Technology upgrade and evolution risks:The Ethereum network and blockchain technology are in a rapid development stage and may undergo upgrades and evolutions. Lido must keep up with these changes and ensure that its technology infrastructure can adapt to the latest standards and upgrades to maintain the security and availability of its systems.

Risks of over-centralization:

Node centralization: Although Lido aims to be decentralized, the actual validator nodes are still operated by specific institutions or individuals. If these nodes are subject to some form of control or collusion, it could lead to centralized control of the entire system;

Social engineering and malicious behavior: Validator node operators may be subject to social engineering attacks or other forms of malicious behavior, which may include nodes being attacked, taken offline, or maliciously manipulated;

Technical centralization: The core functions and key infrastructure of the Lido protocol may be controlled by a few technical entities, which may lead to technical centralization risks. For example: if the upgrade of the core protocol is too centralized, it may lead to too centralized control of the protocol;

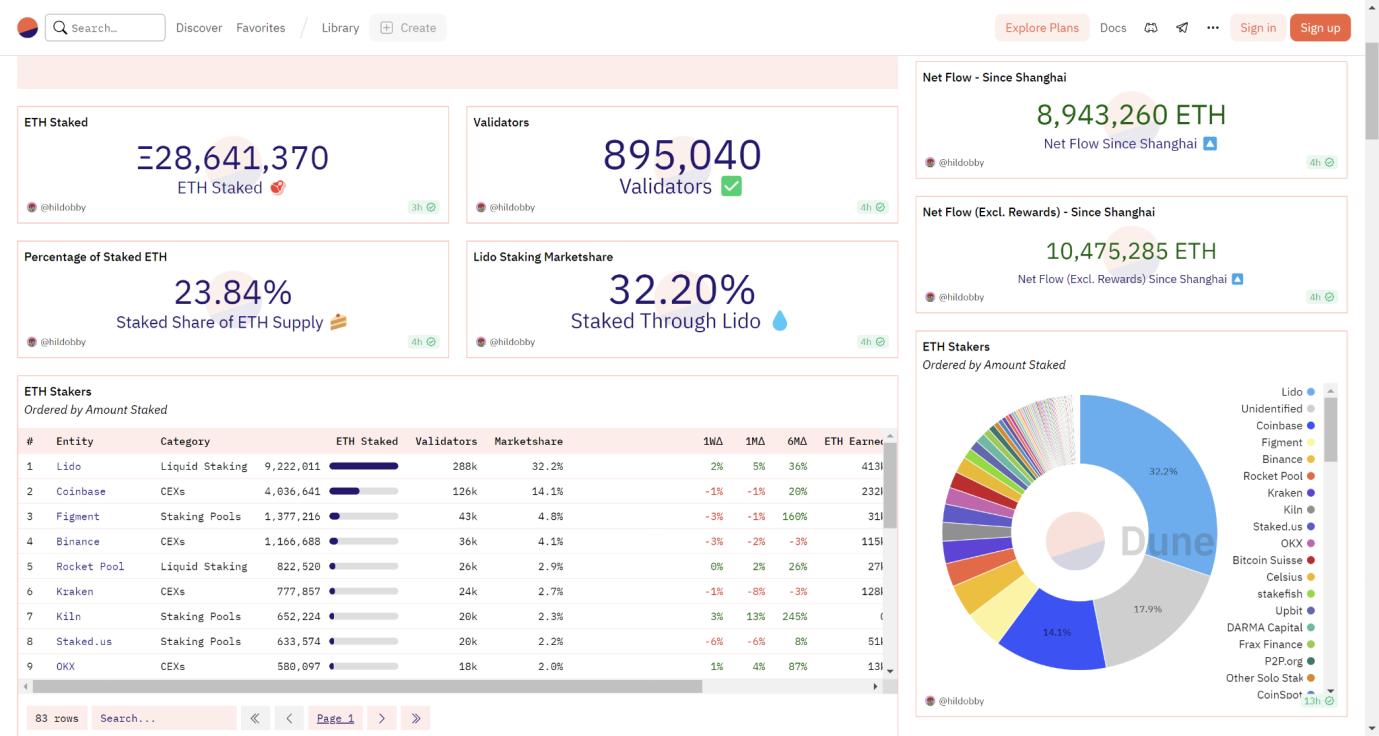

Fund centralization: Lido’s token issuance and staking may be controlled by some large holders, who may have a disproportionate impact on the protocol, as shown in the Dune data below, November 29: Ethereum Letter The total amount pledged on the standard chain exceeds 28.64 million ETH, and Lido’s market share reaches 32.20%;

Governance centralization: If the governance mechanism of the protocol is too centralized, decision-making power may be concentrated in the hands of a few entities or individuals, while ignoring the voice of the broad community;

Data source: Dune

Contract Economics Risks:Project economic incentives need to be carefully designed to ensure that the long-term interests of users and ecosystems are protected. Improper incentives can lead to loss of funds, system instability, or other negative consequences. Project teams should continually evaluate and optimize these incentive mechanisms to adapt to changing market conditions and user behavior;

Security audit risks:The security of smart contracts is the cornerstone of the success of the Lido project. If there are loopholes in the smart contract, it may lead to the loss of user funds. Therefore, it is crucial to conduct thorough and regular security audits of contracts. At the same time, the project team needs to actively adopt feedback from the security community and promptly fix the discovered vulnerabilities;

Community governance risks:The design and implementation of a community governance model may influence the direction of a project and the decision-making process. If community governance is not effective enough, it can lead to difficult decision-making and hinder project development. Therefore, the project team should maintain close cooperation with the community, establish a transparent governance mechanism, and encourage extensive community participation;

Black swan event:Unpredictable events can have a significant impact on Lido. Project teams need to establish flexible risk management strategies to deal with emergencies and ensure that the system is sufficiently resilient to risks.

Thoughts and influences on Blast

Image source: Blast official

Pacman announced that it has raised $40 million in funding for the Blur ecosystem, with participation from Paradigm, Standard Crypto Investment, Lido consultant Hasu, The Block CEO Larry and other Nogan angel investors. The birth of Blast comes with the aura of Blur and financing from Paradigm Blessing has attracted a lot of attention since its appearance. Especially recently, with the blessing of new narratives, it cant help but give us a lot to think about.

1.Where does the native interest rate provided by Layer 2 Blast come from?

When users deposit tokens into the Blast (L2) network, they actually lock tokens of equal value. Blast puts these assets into Lido and RWA for pledge. Blast distributes the income to users and also distributes the original Points are distributed to users, which also brings two direct problems:

Depositing a large amount of user assets into Lido has once again increased the centralization of the staking track to a certain extent. For users, users not only need to consider the operational security of Blast, but also the operational security of Lido. Assuming that both of them are safe, if TVL continues to maintain its current upward momentum, and due to the uncertainty caused by secondary market prices, multiple factors will, to a certain extent, bring more volatility to the entire Ethereum. Uncertain risks;

If Blast is regarded as a new Stake Layer 2, when users lock up a large amount of ETH assets to gain income, they also lock up a large amount of liquidity. How do Dapp applications in the Blast ecosystem obtain liquidity and how do they describe new developments? Coin expectations are also a question worth thinking about.

2. Technology and consensus, which direction of Layer 2 is more likely to be paid for by the market?

First of all, the main goal of the blockchain is to solve the trust and security issues in transactions. Once the information is confirmed and added to the blockchain, it will be stored permanently unless there is the ability to control more than 51% of the nodes in the system at the same time. , otherwise a single node cannot modify the data. The development of the industry is inseparable from technological progress. From a technical perspective, Blast does not innovate, it just opens up new paths. Even strictly speaking, Blast does not belong to Layer 2.

However, the strongest essence of blockchain is still finance. Technology relies more on mathematics and code, while finance is mixed with more psychological expectations. The most successful part of Blast is that it relies on the strong traffic of itself and Paradigm. It directly addresses users airdrop expectations for the project in a straightforward manner. To a certain extent, compared with other rollups with strong technology, it is undoubtedly the way in which they earn profit from the price difference through Gas and distribute it to users as a result of Stake. The flow Sex is the soul of all public chain systems, and Blast has achieved a strong consensus in the short term through the anticipation of airdrops. In the short term, strong consensus will still be paid for by the market, but long-term maintenance requires more opportunities.

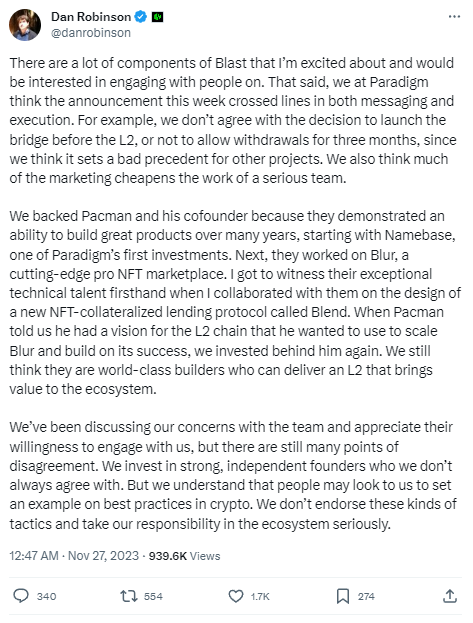

3. What is the hint from Dan Robinson, research director of investment institution Paradigm?

Source: X (Twitter) @danrobinson

Disagreement with Blast project decisions:

Order of bridging vs. L2: Paradigm mentioned that they disagree with the decision to start bridging before L2. This may indicate that they believe that rolling out the bridge before the L2 (Layer 2) solution is ready may be risky and may affect the stability and security of the project;

Not allowing withdrawals for three months: Similarly, for the decision to not allow withdrawals for three months, Paradigm may believe that this sets a precedent that is not conducive to users and may cause concern and dissatisfaction among users.

Concerns about marketing methods:

The article mentions dissatisfaction with the way the Blast project is marketed, pointing out that these methods may reduce the image of a serious team. Specifically, it may refer to issues with the way a project or technology is promoted, perhaps in an exaggerated or inaccurate manner.

Past support for Pacman and team:

Paradigm reflects on their support of past work by Pacman and its partners, from Namebase to Blur to Blend. This shows that Paradigm has a level of trust in this team, based on their demonstrated technical prowess and track record of building great products over the past many years.

Support for L2 Vision:

Paradigm stated that they invested in the Blast team because Pacman proposed a vision for the L2 chain and hoped to use it to expand the success of the Blur project. This demonstrates Paradigm’s belief that the Blast team is capable of delivering a valuable L2 solution that positively contributes to the entire ecosystem.

Discussion with the team:

Paradigm stressed that they have had discussions with the Blast team to express their concerns, and the team has shown a willingness to communicate with them. This shows that when difficulties or disagreements arise, both parties are willing to resolve them through dialogue.

Responsibilities and role models:

Paradigm emphasized their sense of responsibility in the crypto space, saying they realize people may value their practices in the space. They made it clear that they do not support certain strategies, emphasizing that they take their responsibilities in the ecosystem seriously.

Overall, the passage reflected some of Paradigm’s specific objections to the Blast project’s decisions, but also expressed their support for the Blast team’s past work and emphasized their sense of responsibility in the crypto ecosystem, which was subsequently followed by Wu Block According to chain news, Pacman also tweeted that he had made several necessary clarifications:

The high income provided by Blast is not a Ponzi scheme. Its income comes from Lido and MakerDAO, which are based on Ethereums staking income and on-chain T-Bills respectively. These incomes are a core component of the on-chain and off-chain economy and are sustainable. ;

Market strategy (GTM) has nothing to do with Paradigm. Although Paradigm provides consultation on technical L2 design, GTM is entirely determined internally by Blast;

Blasts invitation system is not a new mechanism. The invitation system has existed for a long time. This mechanism is designed to reward users who contribute to the L2 ecosystem and is a feedback to the communitys support. This is why invitation rewards exist.

Note: The analysis in this paragraph only represents the authors personal views and does not involve guidance. If you have any objections, you can ignore them.

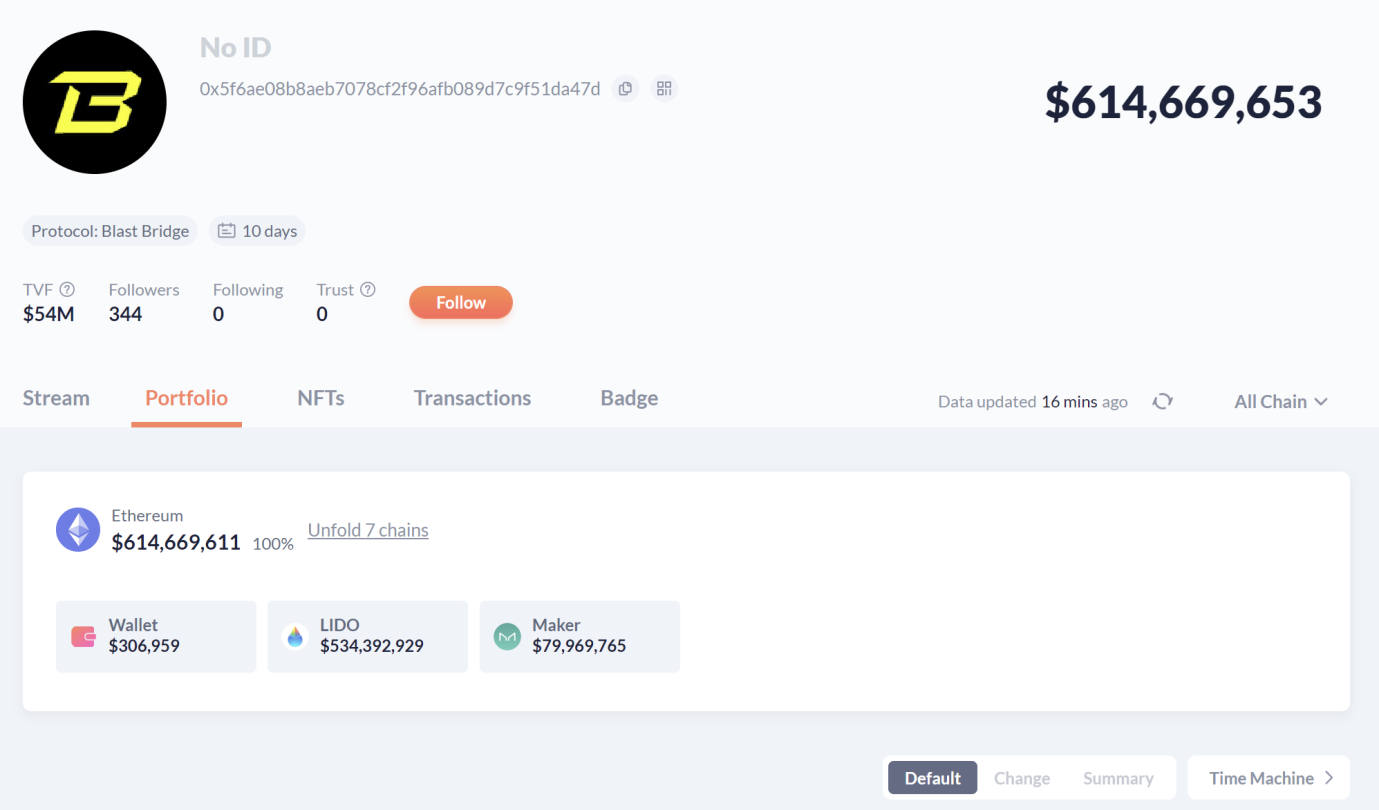

4. Rapidly growing TVL market exceeding US$600 million

Data source: DeBank

Since Blur founder Pacman announced the newly launched project Blast on November 21, as of November 29, the total cryptocurrency locked value (TVL) of Blast has reached US$614 million in just one week, triggering a short-term stir in the industry. The overall discussion hotspot, this Layer 2 with Stack as the core has undoubtedly achieved great success in terms of market consensus.

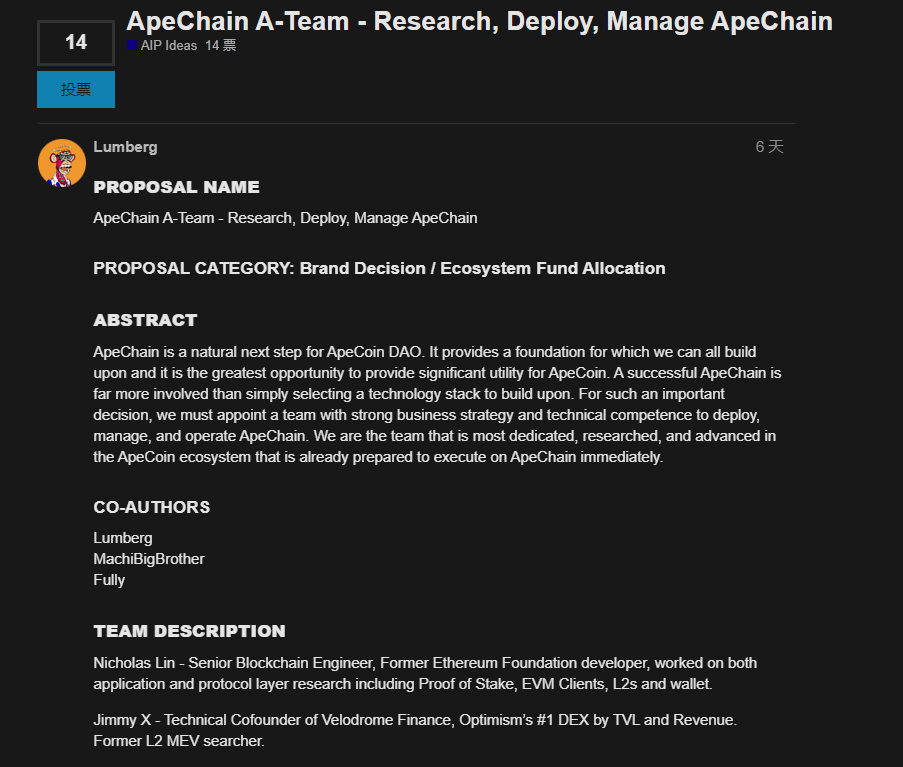

5. “New Job” from ApeCoin

Image source: ApeCoin official

The original article mentioned a person named"ApeChain"The proposal aims to promote the research, deployment and management of ApeChain in the ApeCoin DAO ecosystem (see extended link [3] for the original text). The article states that the team met with multiple technology solution partners and discussed the strengths and weaknesses of each technology solution to seek support from each partner. After careful consideration by the project team, we chose to support Layer 2 Rollups to better attract developers to build on ApeChain.

This makes us wonder whether ApeCoin intends to catch up with the Blast craze as soon as possible?

Its future development will be compatible with the Optimism Superchain ecosystem and promises to provide it with basic token grants to help ApeCoin DAO participate in Superchain governance. Will this remind us that Ape has relied on Blasts TVL siphon effect to quickly Catch a hot spot? The specific contents of DAO include: infrastructure, business operations, developer relations and ecosystem development.

The infrastructure includes:

Block explorers such as: Blockscout, Etherscan or the open source alternative Otterscan;

Oracle: Chainlink, Pyth or Redstone;

Layer 1 data publishing fees in ETH;

Sequencer related operations.

Two ways to handle expenses during the discussion phase:

Directly launch ApeChain (AC) tokens without DAO having to bear any costs;

The team will raise funds for the operation and development of ApeChain, and governance tokens will be distributed to ApeCoin supporters in the future.

Finally, regarding Blur’s launch of Blast, it is undoubtedly a hugely successful attempt from a marketing perspective. It uses its own industry influence to straightforwardly explain the airdrop rules of the point method, attracting a large amount of funds to pledge in a short period of time, and inspiring The new round of Staking enthusiasm in the market, and its TVL that has raised more than 600 million US dollars in a short period of time, has also attracted the attention of other Layer 2 and Ape communities. However, it should be noted that it has associated uncertain risks, which still deserves our caution.

Extension link:

【 1 】https://blockworks.co/news/ethereum-rollups-save-gas-fees

【2】https://twitter.com/eternal1 997 L/status/1729128004239216863

【 3 】https://forum.apecoin.com/t/apechain-a-team-research-deploy-manage-apechain/20163