LD Capital Track Weekly Report (2023/11/28)

DeFi Lending

MakerDAO

Blast, the L2 network launched by the original team of Blur, has currently deposited 35.22 million USDC into the Maker PSM module. Maker PSM currently has a total of 350 million USDC locked, accounting for about 10%. The rapid growth of Blast TVL is also beneficial to the development of Maker to a certain extent.

Compound

A new round of Compound Grants will launch on November 30 with a budget of $1 million to fund high-quality builders or projects and further Compound’s mission.

Aave

The giant whale 0xa72e purchased a total of 2 million LDOs at a price of $1.79. Currently, he has deposited all the LDOs into Aave and borrowed approximately 1.56 million USDT to continue purchasing LDOs.

LSD

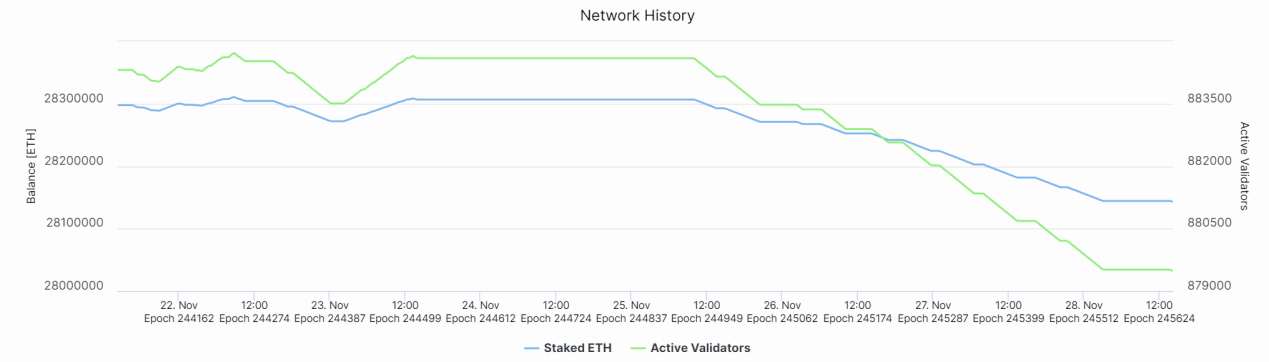

Last week, 28.72 million ETH were locked in the beacon chain, corresponding to a pledge rate of 23.88%, a month-on-month increase of 0.07%; of which there were 879,500 active verification nodes, a month-on-month decrease of 0.69% (the first decrease since the Shanghai upgrade). This week’s ETH staking return was 3.72%, and ETH’s annualized inflation was -0.3%; Uniswap, Maestro and BananaGun are the top three Defi that burns gas.

ETH pledges fell by 0.3% month-on-month this week

Source: Beaconcha.in, LD Capital

This week’s ETH staking yield is 3.72%

Source: LD Capital

ETH annualized inflation remains -0.3%

Source: ultrasound, LD Capital

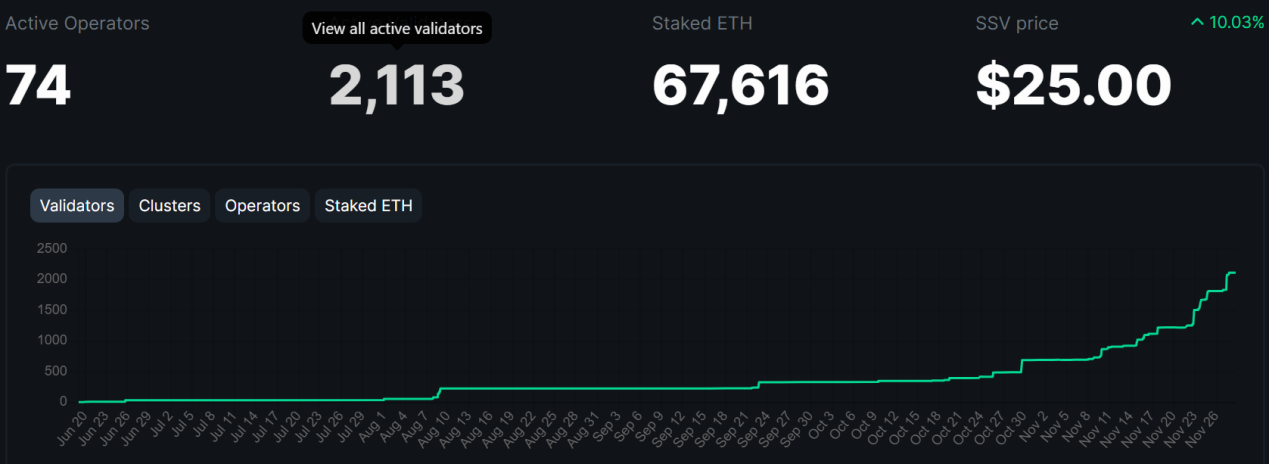

Among the three major LSD protocols, in terms of price performance, LDO fell by 4% in the week, RPL fell by 3.9%, and FXS fell by 0.1%; from the perspective of ETH pledge volume, Lido rose by 2.58% in the week, Rocket Pool rose by 0.65%, and Frax rose by 0.69%; Last week, the highly popular L2 Blast launched the ETH pledge airdrop activity. Since it uses Lido as the underlying protocol for ETH pledge, it has brought a significant increase in pledges to Lido; Lido has approved the deployment of the DVT pledge module, which will Use SSV and Obol as DVT solutions; SSV’s permissionless mainnet upgrade is currently voting, ending on December 1st, and has been unanimously approved; SSV TVL growth has accelerated, with an increase of 29,000 ETH last week. Pay attention to the TVL after the SSV mainnet goes online Growth; Rocket Pool’s current deposit pool balance is 18,027 ETH, RPL pledge rate is 50.89%, a slight decrease, and the effective pledge rate is 92.1%; last week FrxETH began to support redemption. Due to the popularity of Blast, attention is paid to the interest-bearing L2, which is also based on LSD Frax Chain’s launch plan.

SSV TVL accelerated last week

Source: SSV Scan, LD Capital

NFTFi

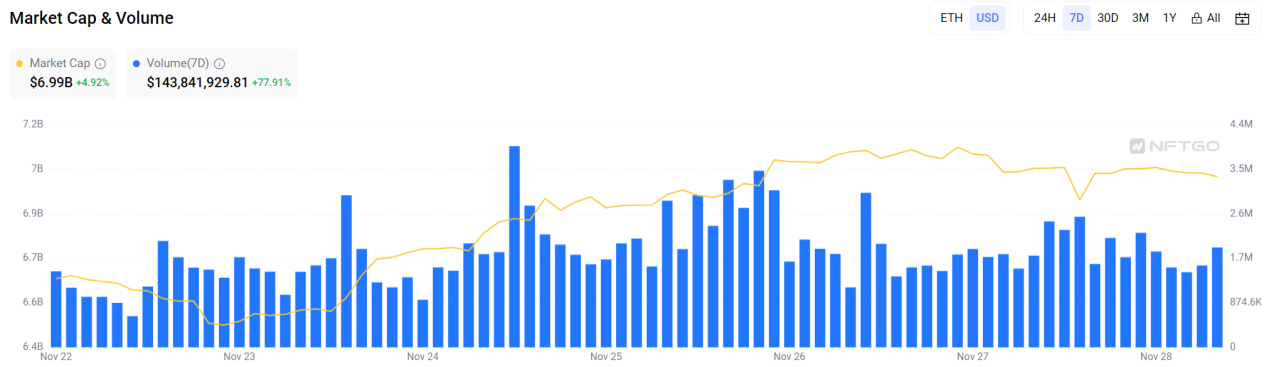

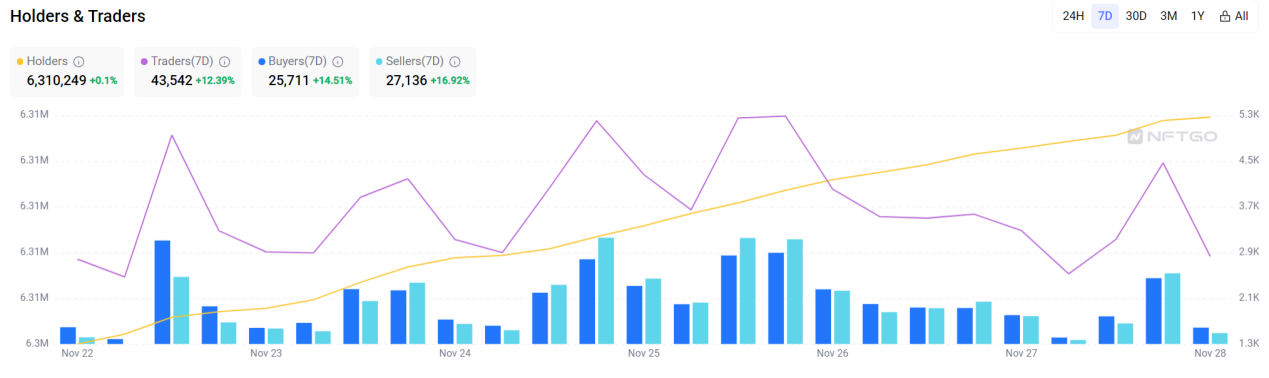

Last week, the total NFT market trading volume was US$144 million, a month-on-month increase of 77.91%; the total market value was US$6.99 billion, a month-on-month increase of 4.92%; NFT holders were 6.31 million, a month-on-month increase of 0.1%; NFT traders were 44,000, a month-on-month increase of 12.4%.

Source: NFTGo, LD Capital

Source: NFTGo, LD Capital

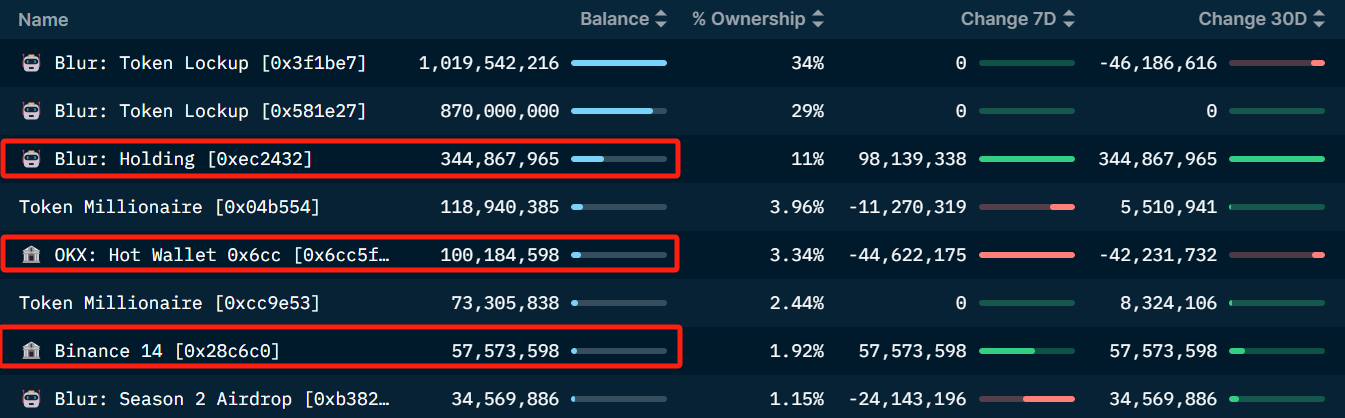

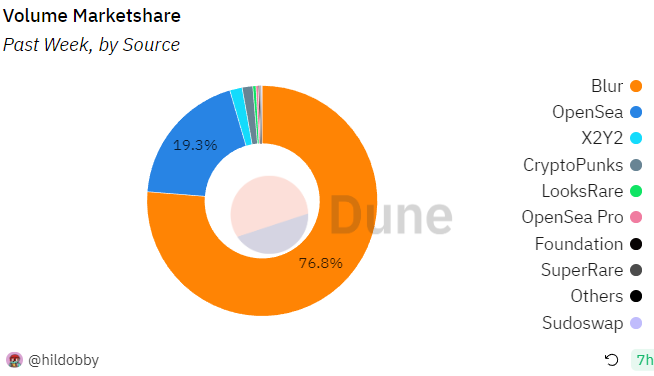

The price of Blur increased by 62% last week. The Blur team launched the interest-bearing L2 Blast. By staking BLUR, you can accumulate points to receive airdrops in the future. There are currently 34.57 million BLUR left in the second quarter airdrop, 345 million Blur has been pledged, OK Exchange holds approximately 100 million BLUR, and Binance Exchange holds approximately 57.57 million BLUR; Blur’s trading volume last week was 1.09 billion, a month-on-month increase of 98%, and the market share increased to 76.8%. TV L278 million, a month-on-month increase of 162%.

Source: Nansen, LD Capital

BLUR’s market share increased to 76.8%

Source: Dune, LD Capital

BendDAOs current TV L106 million, a month-on-month increase of 6.7%, including 17,700 ETH deposits, a utilization rate of 15.53%, a deposit interest rate of 6.9%, a borrowing interest rate of 0.45% (paid to the borrower, and the arbitrage space is basically eliminated), BEND pledge interest rate 5.5%.

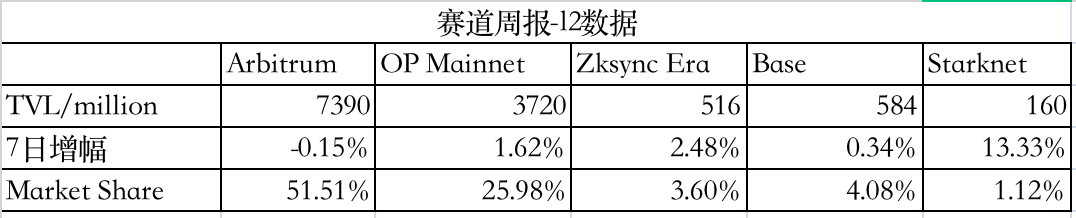

Ethereum L2

TVL

The total amount of Layer 2 TVL is US$14.34 billion, and the overall TVL has increased by 3.58% in the past 7 days.

Source: L 2b eat, LD Captial

Optimism

At 12:00 on November 30, 24.16 million OP Optimism tokens (approximately US$43.73 million) will be unlocked, accounting for 2.74% of the circulating supply.

Arbitrum

1. In the past week, the total amount of USDT and USDC minted was 1.27 billion, of which 100 million were bridged to Arbitrum.

USDT: 1.1 billion coins minted, 70 million of which are bridged to Arbitrum;

USDC: 170 million coins minted, 30 million of which are bridged to Arbitrum

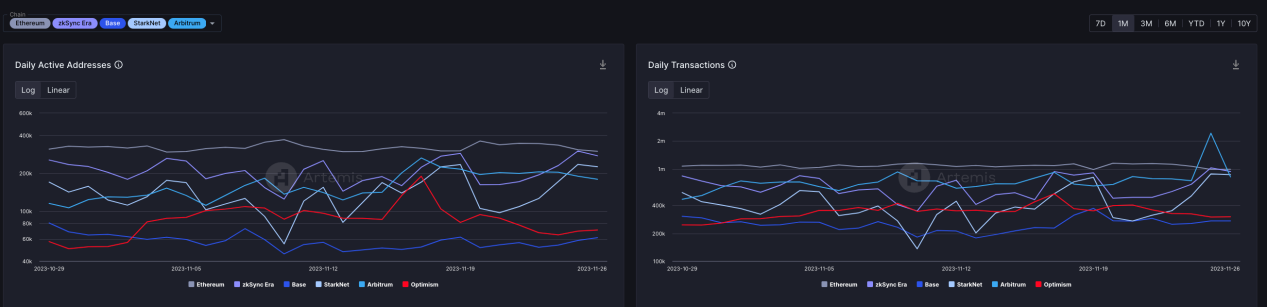

On-chain activity

Source: Artemis

AI

OpenAI

After OpenAI founder Sam announced that he would join Microsoft, OpenAI issued a document on November 22 stating that it had reached an agreement in principle. Sam Altman will return to OpenAI as CEO and form a new board of directors, including Bret Taylor (Chairman), Larry Summers and Adam DAngelo.

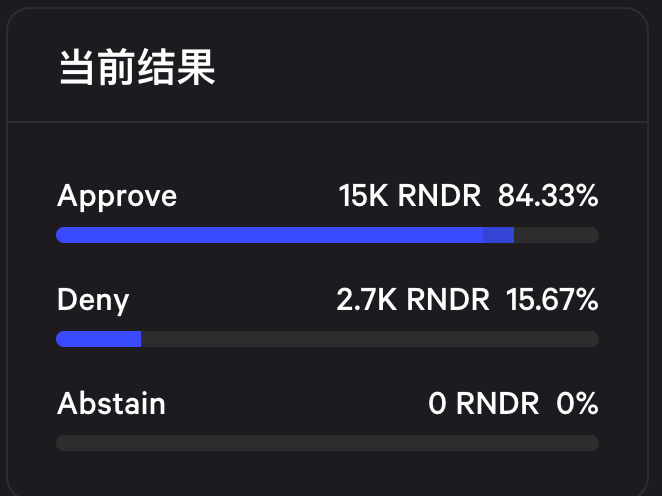

RNDR

On November 22, two important proposals of RNDR reached the final voting stage, namely RNP-006 and RNP-007. These two proposals will enable the Render Network to migrate to the Solana blockchain network and expand the AI computing power business. The current two proposals The approval rate of the proposals exceeded 80%

AGIX

1. On November 24, AI track tokens AGIX and FET were listed on the OKX exchange.

2. At 08:00 on November 28, 9.39 million SingularityNET tokens AGIX will be unlocked (approximately US$2.9 million), accounting for 0.76% of the circulating supply - unlocked monthly

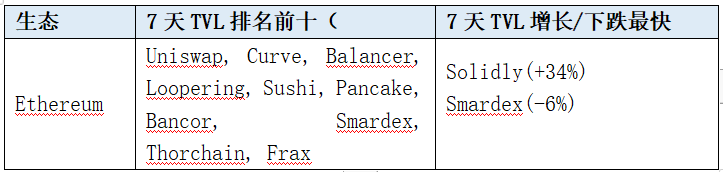

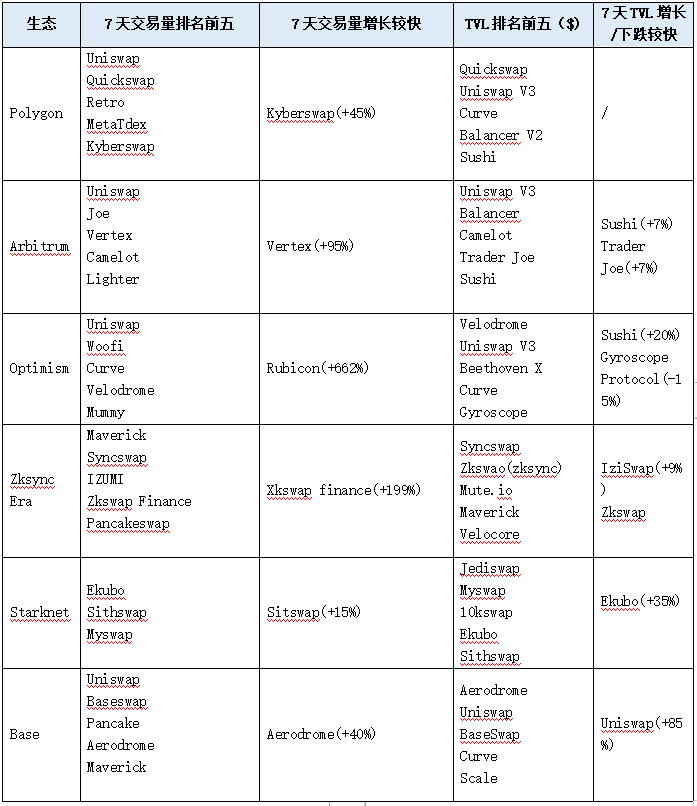

DEX

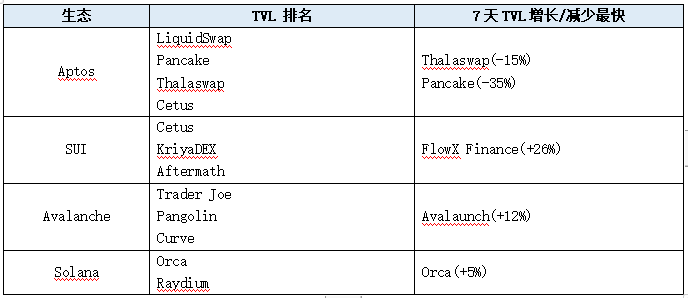

Dex combined TVL 12.68 billion,A decrease of 0.1 billion from last week. Dex’s 24-hour trading volume was 2.95 billion, and its 7-day trading volume was 2.2 billion, a decrease of 5 billion from last week.

Ethereum

ETH L2/sidechain

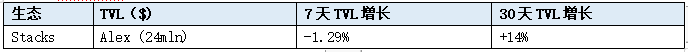

BTC L2/Sidechain

Alt L1

Cosmos

The top ten projects with net inflows from IBC volume this week are: Osmosis, Cosmos hub, Axelar, Celestia, Kujira, Neutron, Stride, Akash and Terra.

ATOM performed better after the COSMOS hub proposal 848 was passed this week. With the announcement of founder Jae’s fork plan, the currency price fell back. For ATOM, reducing the inflation rate is a long-term positive, and investors do not like high-inflation tokens. For a long time, Atom itself has lacked the ability to capture value, and excessive inflation is one of the reasons for its continued low price. Interest in APR is also one of the few use cases for Atom.

The counter-argument is to reduce the staking reward from nearly 19% to 13%. A large APR drop could dissuade many stakers, posing a threat to the security of the network. Therefore, they argue that the inflation rate should not be suddenly halved in order to maintain a high level of safety.

Therefore, inflation has dropped but staking rewards have also decreased, network security is not protected to the greatest extent, and the community is divided. Cosmos co-founder Jae Kwon plans to fork Cosmos Hub after the community passes Proposal 848.

The fork will result in a new network, AtomOne, and the corresponding token ATOM 1. The launch plan includes releasing a large portion of the Genesis supply to those who oppose the proposal. Meanwhile, those who voted for the proposals will face cuts. Approximately 10% of the tokens will be pre-mined for various purposes, as Kwon stated in a document. Interchain Foundation will not be included in the airdrop.

The hard fork is expected to result in the largest airdrop of ATOM and could result in a significant increase in trading volume for ATOM and ATOM 1 tokens.

“Jae calls the new chain AtomOne (ATOM 1). Most of the allocation of ATOM 1 will be distributed proportionally to ATOM holders, it is unclear whether liquid ATOM is included.”

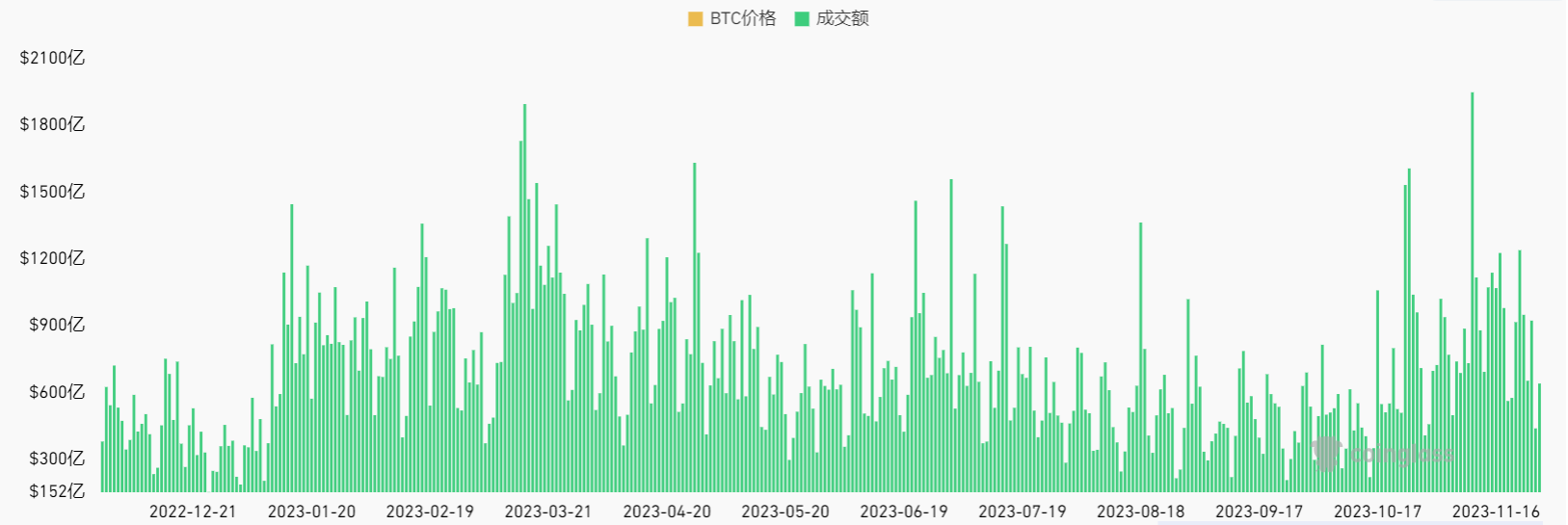

Derivatives DEX

BTC maintained a wide range of fluctuations between 35,500 and 38,000 last week. This position has been oscillating for about two weeks, and spot trading volume is in a reduced state. Contract open interest fluctuated around $34 billion.

source:coinglass

Over the past week, the contract still maintained high trading volume, but it was down from the previous week. Altcoins have retraced significantly, and contract trading sentiment has declined.

source:coinglass

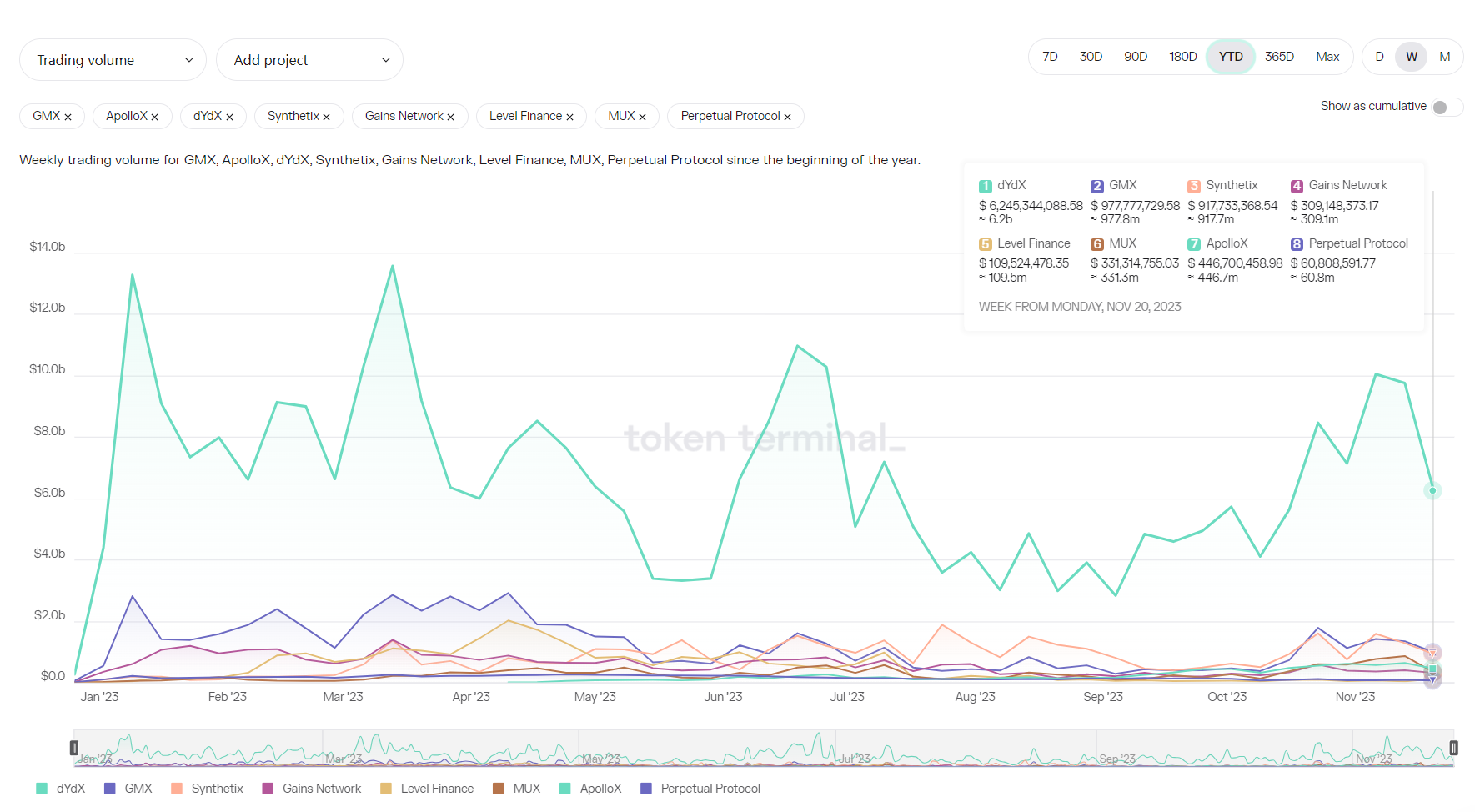

Along with the recovery of contract positions and trading volume, the trading volume of derivatives DEX has also recovered significantly. In the first two weeks of November 2023, the trading volume of derivatives DEX reached the fourth peak period in 2023, which was equivalent to the end of January, end of March, and early July of 2023. The weekly trading volume of DYDX exceeds US$10 billion, the second-tier GMX and Synthetix are about US$1.5 billion, and the third-tier ApolloX and MUX exceed US$500 million. During the week of November 20th to November 27th, transaction volume dropped significantly. The weekly trading volume of DYDX is approximately $6.2 billion, and that of GMX and Synthetix is approximately $900 million.

It can be seen that DYDX is still the leader in the derivatives DEX track, and GMX and Synthetix are in the second echelon. This pattern is relatively stable and no new strong competitors have emerged yet.

source:token terminal

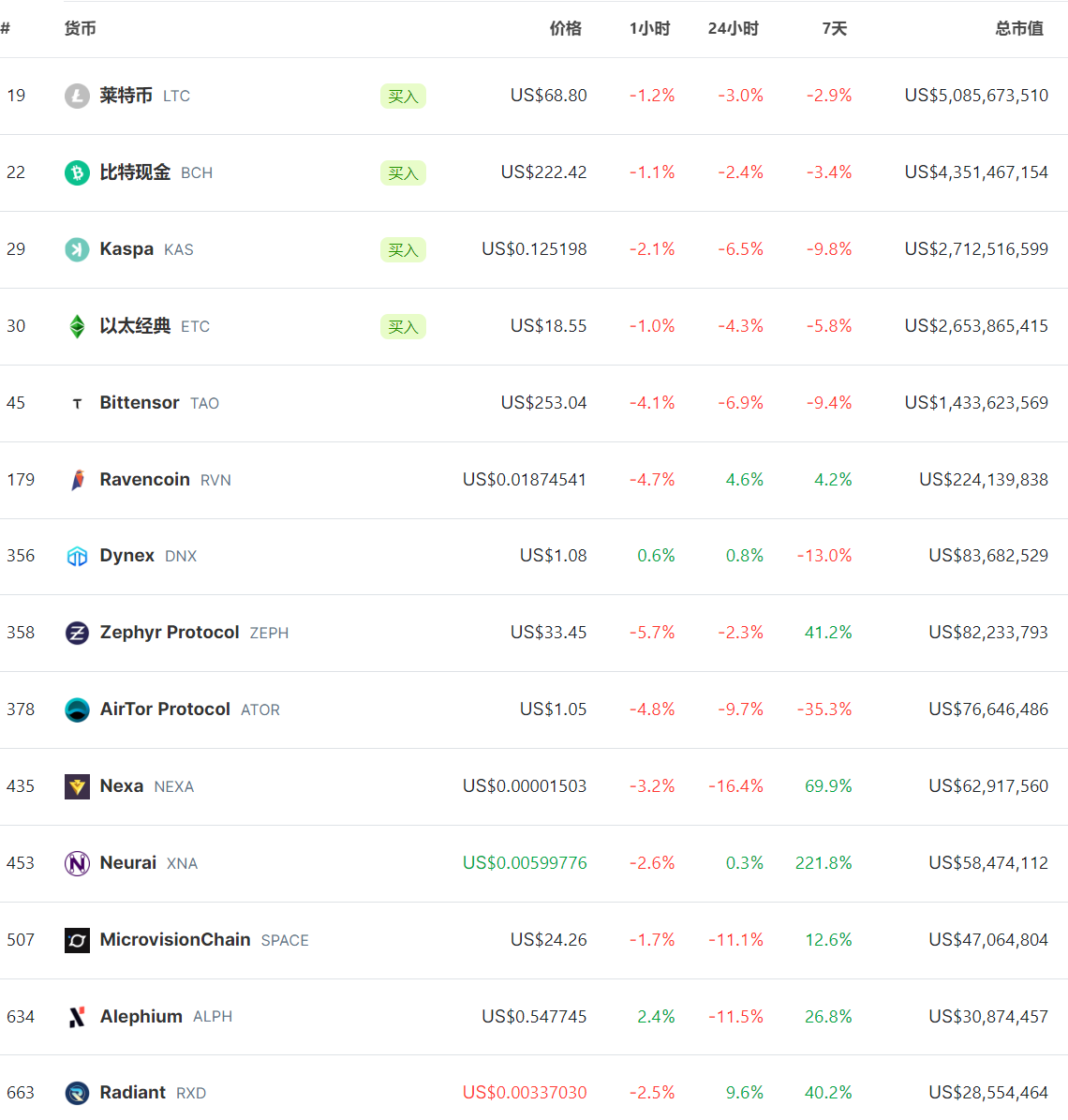

POW

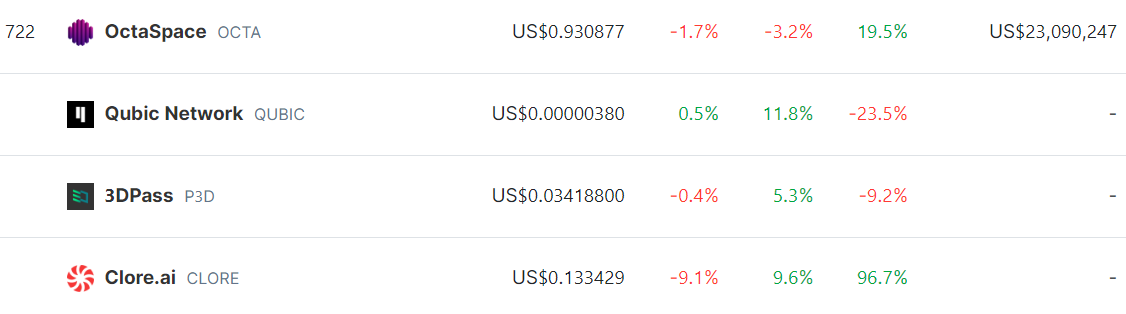

After experiencing rapid growth in the past two weeks, POW new concept coins have experienced a correction. Most POW tokens are in the early stages of development, with a market value of less than $50 million, and are traded on smaller exchanges, with larger rises and falls.

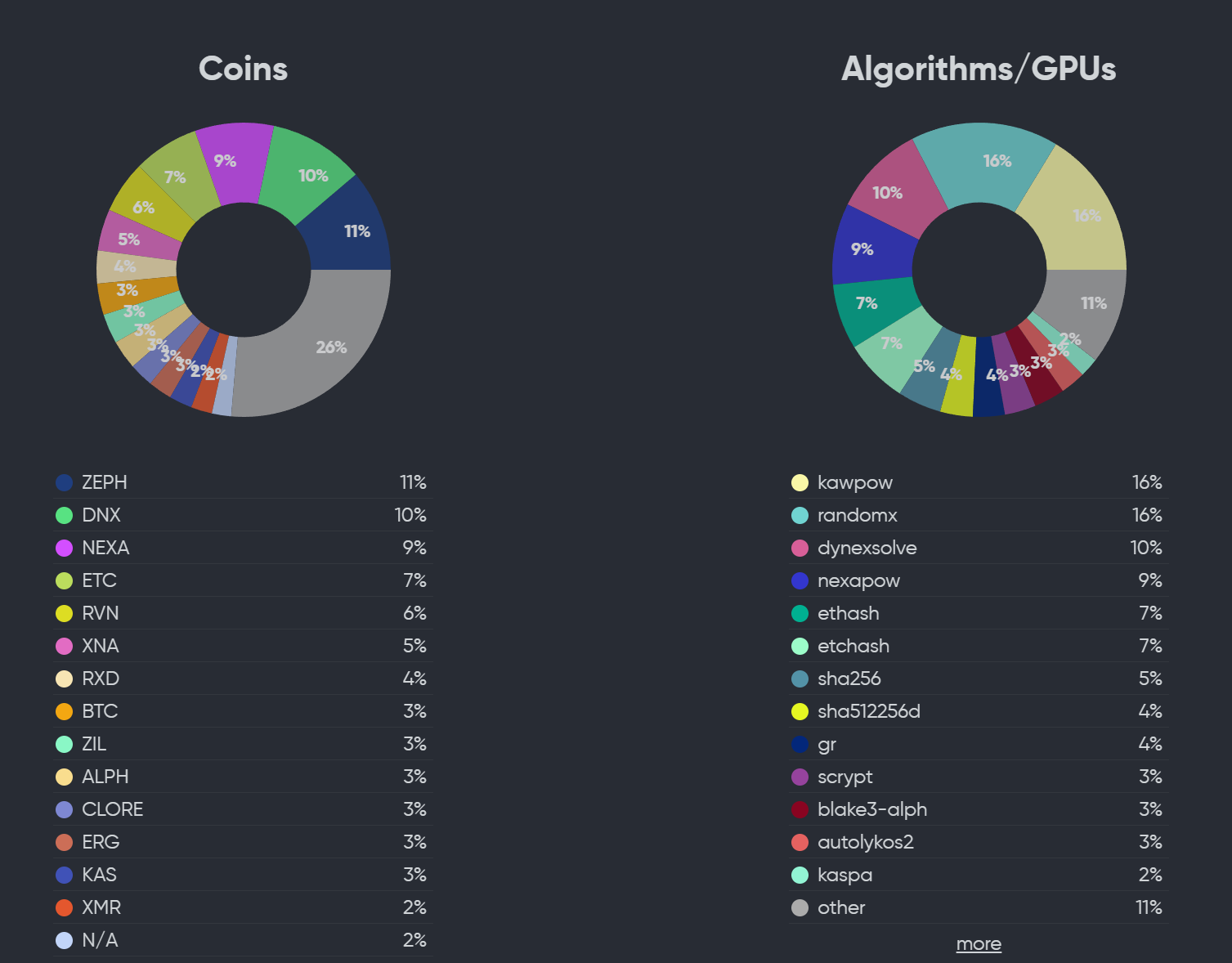

From the perspective of GPU/CPU computing power, due to large price fluctuations, computing power also fluctuates significantly. The tokens with the fastest price increases gain more computing power. ZEPH currently has more computing power than DNX and ranks first. NEXA surpassed ETC and RVN to become third. The computing power of XNA, RXD, ALPH, and CLORE projects has also increased rapidly.

NEXA and RXD focus on faster POW public chains, mainly driven by BCH community miners. XNA belongs to the AI+Internet of Things concept and has gained more than 5 times in the past week. ALPH is also a POW public chain. CLORE is a computing power rental platform, and its services include mining, rendering, and AI computing power.

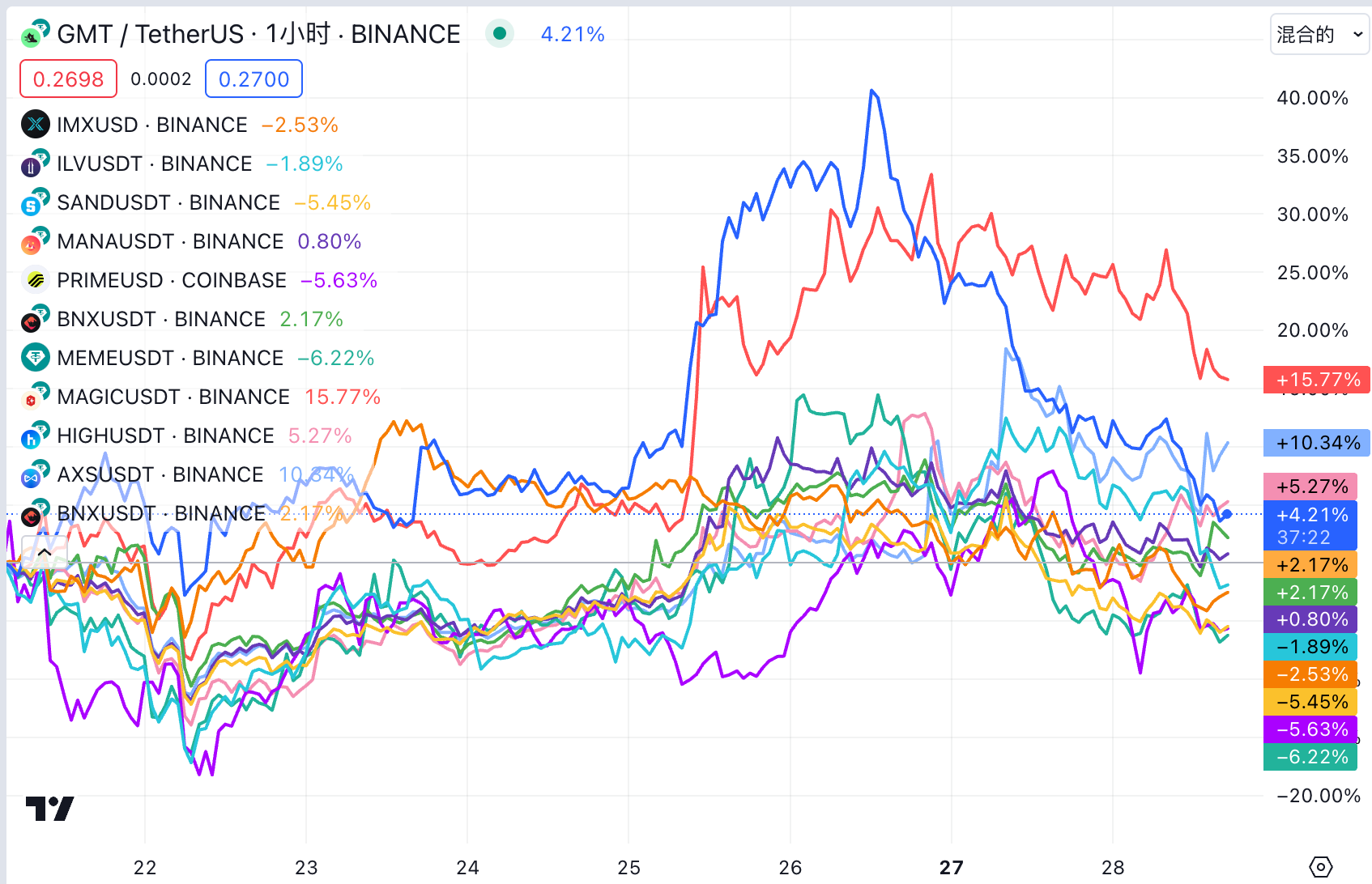

Gamefi

From November 21st to 28th, the target with the highest price increase in the Gamefi sector was MAGIC. (Note: Due to too many Gamefi projects, only some projects are included.) Affected by the broader market this week, GMT retracement was large. Recently, the Gamefi sector seems to have started a trend of new games referencing old tokens.

BinaryX

BinaryX announced the official launch of version 1.0 of the AI game AI Hero. After the game is released, participating players will be able to mint NFT heroes, which can be used to participate in new competitive modes and obtain mining rewards. Players can earn hero NFTs as they play, or use BNX to recruit on the market, or hold a certain amount of BNX to unlock NFT minting for free.

TreasureDAO

TreasureDAO co-founder Karel Vuong revealed that TreasureDAO is building a game chain and plans to use MAGIC as a Gas token. This information was further confirmed in Karel Vuong’s Twitter reply.