LD Capital Macro Weekly Report (11.27): Optimistic sentiment continues to cover positions, Goldman Sachs clients quietly flee technology stocks, BTC futures players add short positions

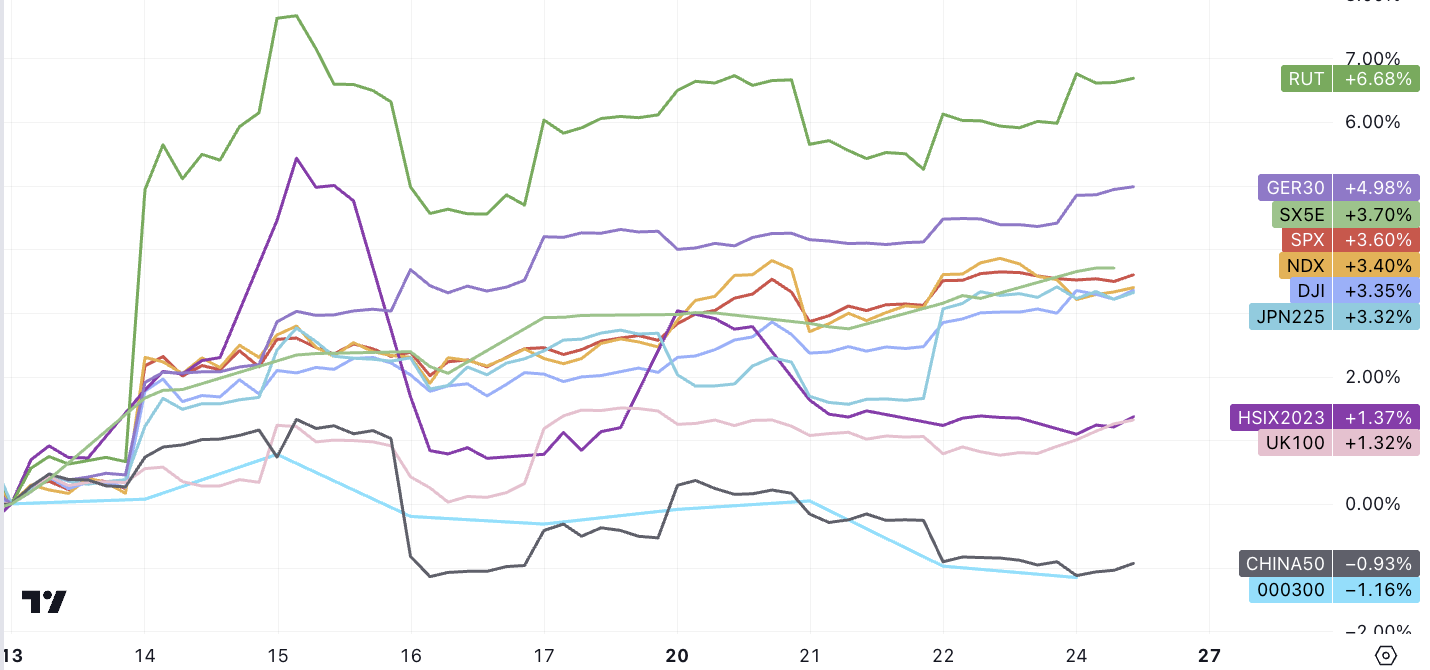

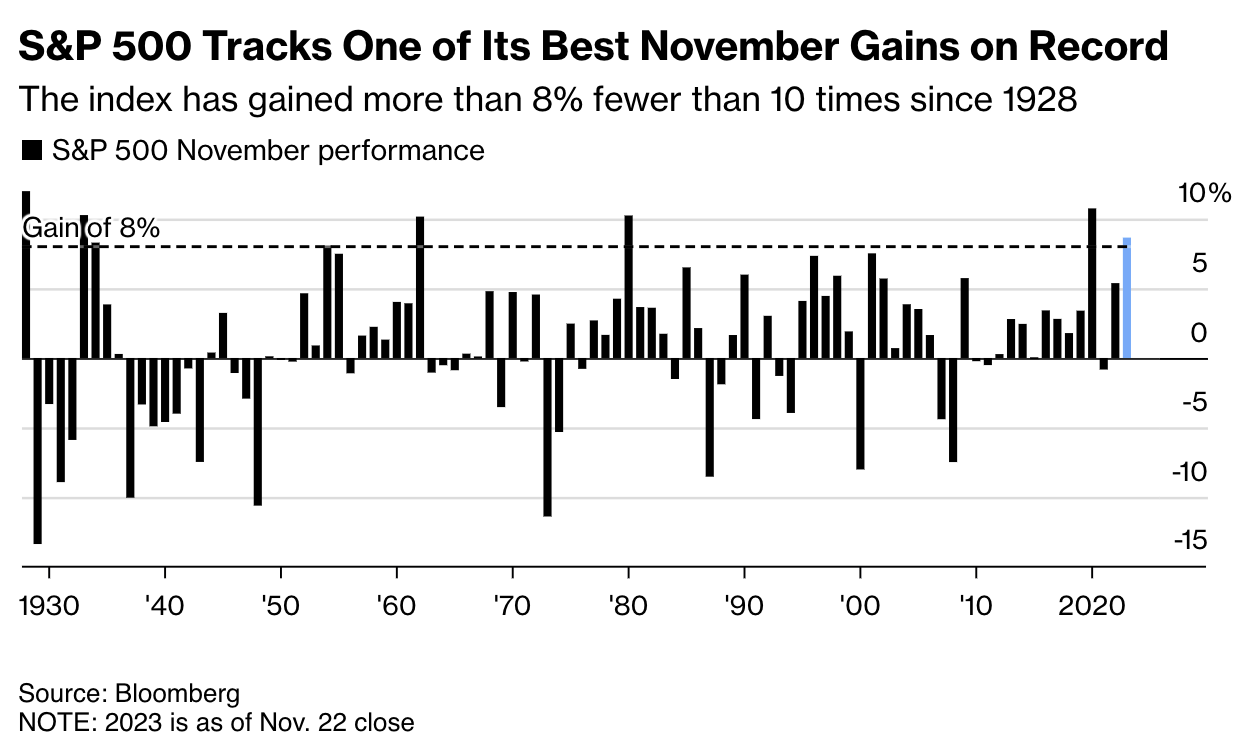

In holiday-shortened trading, U.S. stocks rose slightly, U.S. bonds fell slightly, the U.S. dollar fell, cryptocurrencies and gold rose, crude oil was basically flat, and the overall market sentiment was optimistic. The SP 500 is currently near its July high and the Nasdaq 100 is just above its July high. This rebound was mainly driven by the decline in secondary market interest rates, passive replenishment of institutional positions, and the corporate repurchase window period. The macro background is that the market has increased confidence in the peaking of interest rates, which has little to do with the improvement of the basic economic prospects or earnings growth. Changes in capital flows may lead to larger fluctuations.

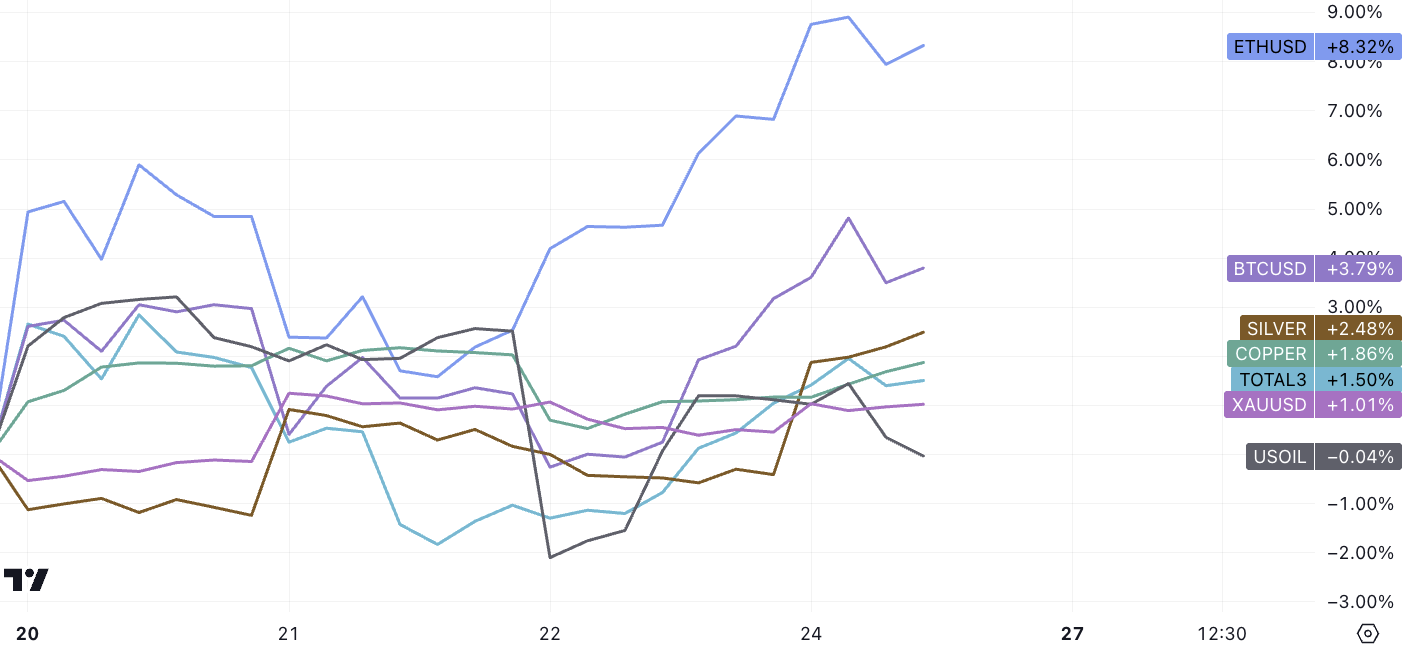

Cryptocurrencies are fluctuating at high levels, with BTC and ETH both hovering at their highest levels since April last year, and Altcoins lagging behind:

Implied volatility has fallen to historical lows again, which is often a reversal signal:

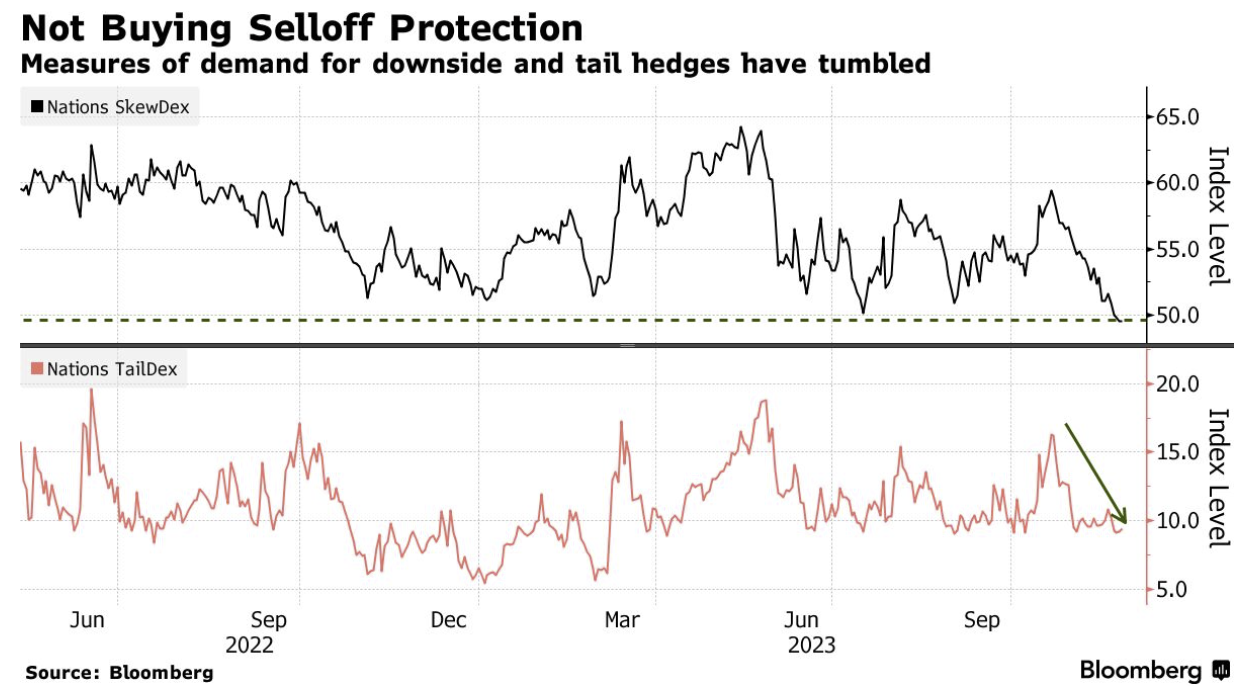

Hedging demand fell sharply, with the cost of protecting against a market sell-off falling by about 10% (one standard deviation) to the lowest level in data dating back to 2013. Demand for tail risk hedges is also hovering near its lowest level since March.

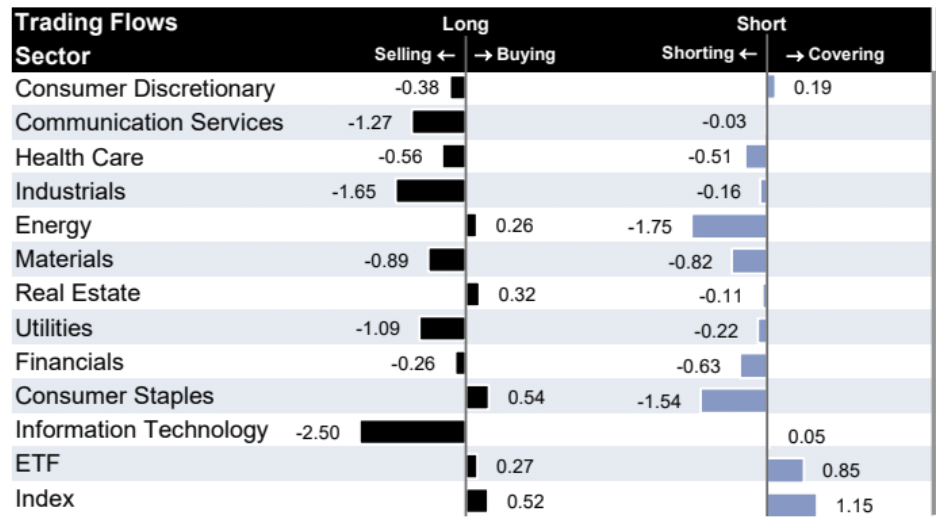

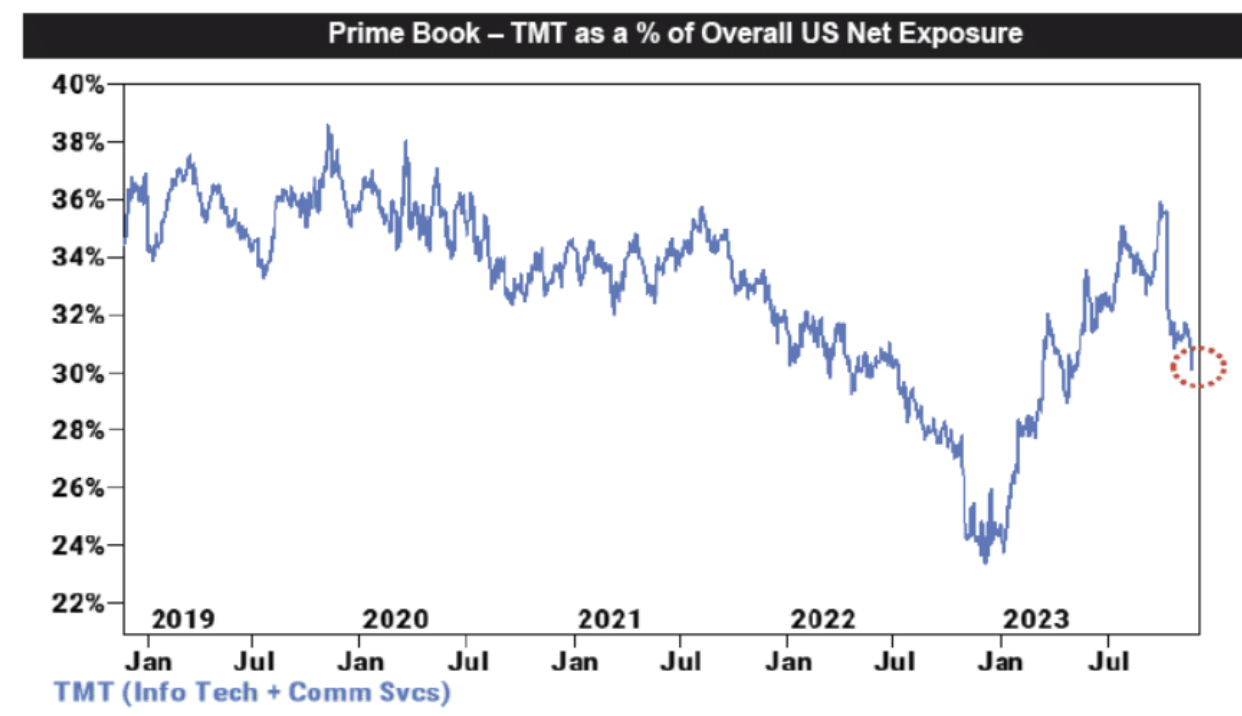

While the broader market has been rising in recent weeks, the sell-off in technology stocks is an undercurrent that cannot be ignored. According to GS Prime Book data, the net selling of U.S. technology stocks last week was the largest since July, which was mainly caused by the reduction of previously long positions, and the reduction of long positions exceeded the amount of short covering.

The proportion of technology stocks in GS Prime customers net positions has dropped to 30%, with a high of about 36% in late October. Overall, this 30% share ranks at the 36th percentile over the past year and the 36th percentile over the past five years. 16th percentile, not high.

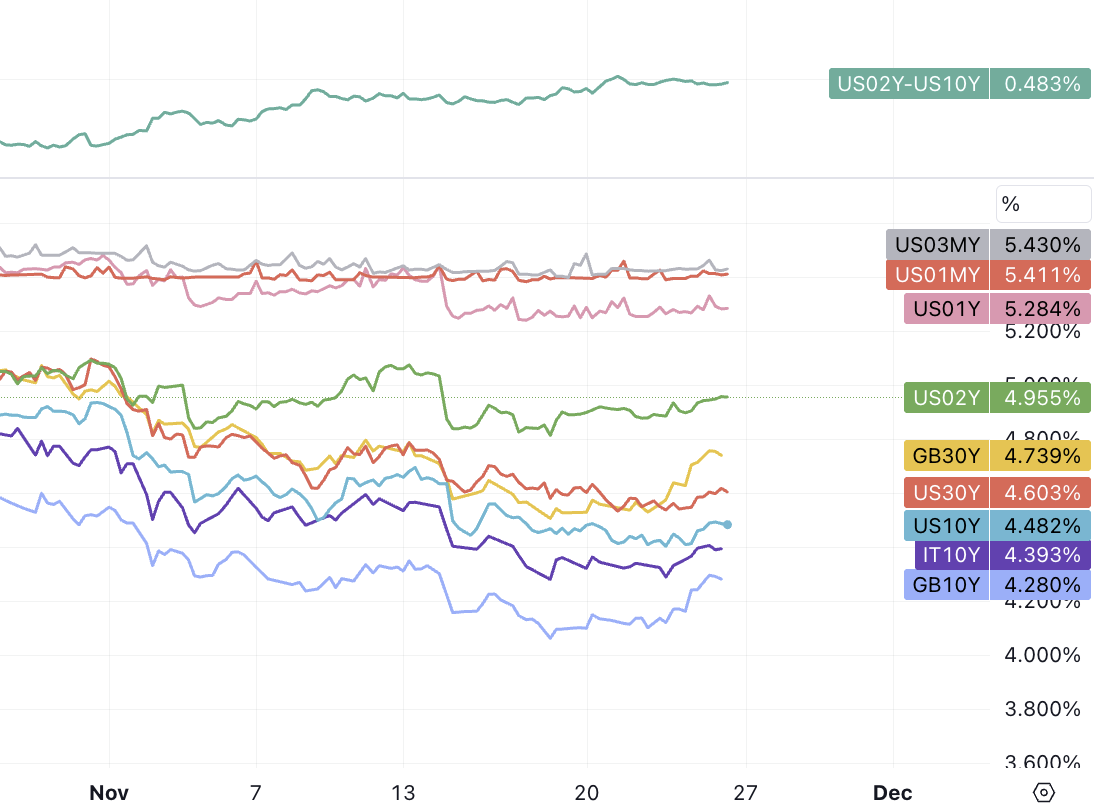

This week is another big week for bond issuance. The Treasury Department will sell US$54 billion of 2-year Treasury bonds + US$55 billion of 5-year Treasury bonds on November 27; it will sell US$39 billion of 7-year Treasury bonds on November 28. . Auctions have been an important source of volatility across the market. The results of last Wednesdays 15 billion 10 yr TIPS and 26 billion 2 yr auctions were relatively low. However, Mondays 16 billion 20 yr auction saw strong demand, so bond market interest rates showed a V-shaped trend of first falling and then rising. The overall closing prices were Higher yields, especially on the short end:

Bond markets may also see disruptions from Europe. Because the German court ruled last week to deduct 60 billion euros of expenditures from the federal budget, resulting in a 60 billion euro reduction in available funds for the German government, the German government will once again suspend its debt ceiling, which may trigger additional issuance of German debt. If it directly abandons expenditures, it may A 0.5 percentage point decrease in German GDP is not a good thing for either side, but this matter is still in its early stages. Judging from the attitude of the court ruling, it ruled that it is illegal to use 60 billion euros of epidemic aid funds to fund climate protection starting in 2021. Therefore, this raises whether the German government’s other cumulative 770 billion euros of extra-budgetary special funds may be used in the future. Illegal speculation.

Coincidentally, there was news last week that the budget deficits of the United Kingdom and Canada exceeded expectations. Taken together, the increase in global government debt supply is an inevitable trend. I don’t know when it will become the subject of speculation again.

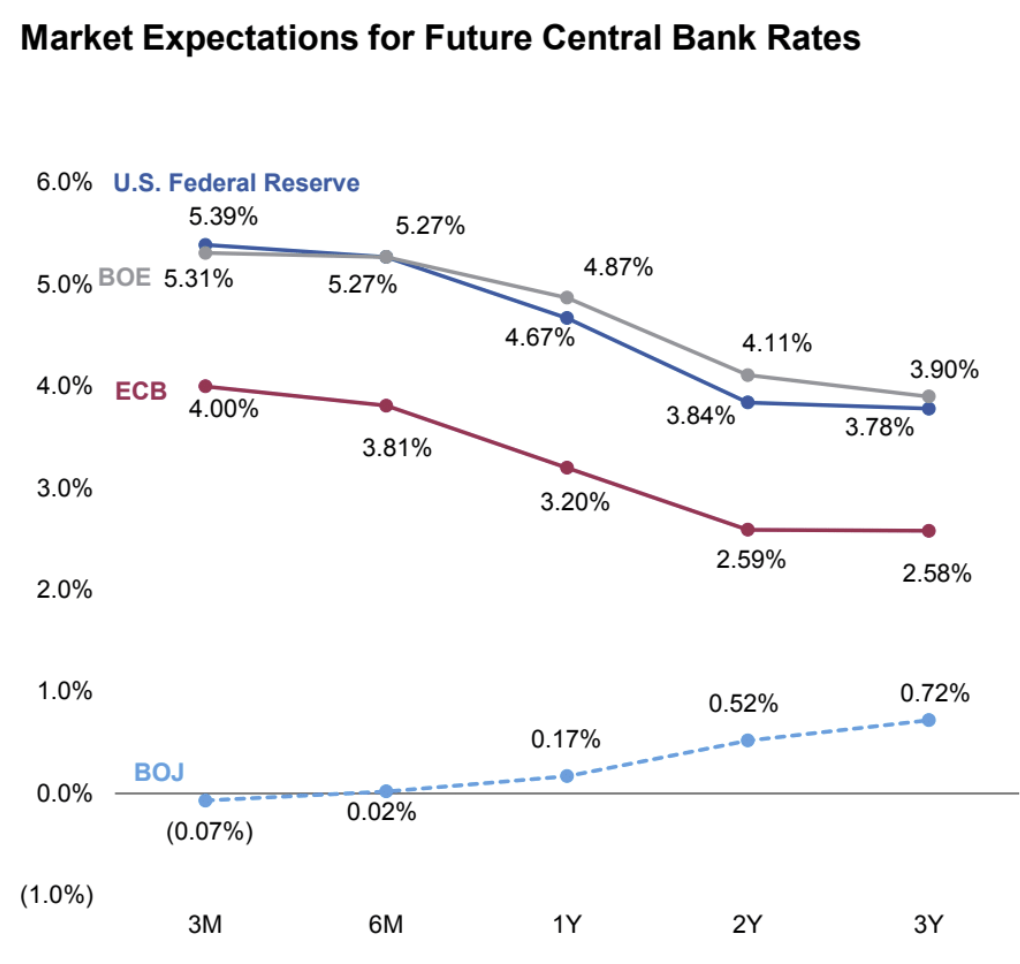

Both Powell and the Fed meeting minutes mentioned that continued tightening of financial conditions may replace raising interest rates. However, financial conditions have not remained tense, and policy levels have fallen by 50% since October:

But because maintaining employment is also one of the Feds two core goals, if the labor market softens further, that could prompt the Fed to start cutting interest rates even if inflation remains above target.

A drop in bond yields from 5% to 4% means a soft landing, which should be bullish, but if the yield drops from 4% to 3%, the market is worried about recession, and risk assets have a bearish risk, so the best case scenario is bond market returns As long as the rate remains at the current level, it should not continue to fall too much.

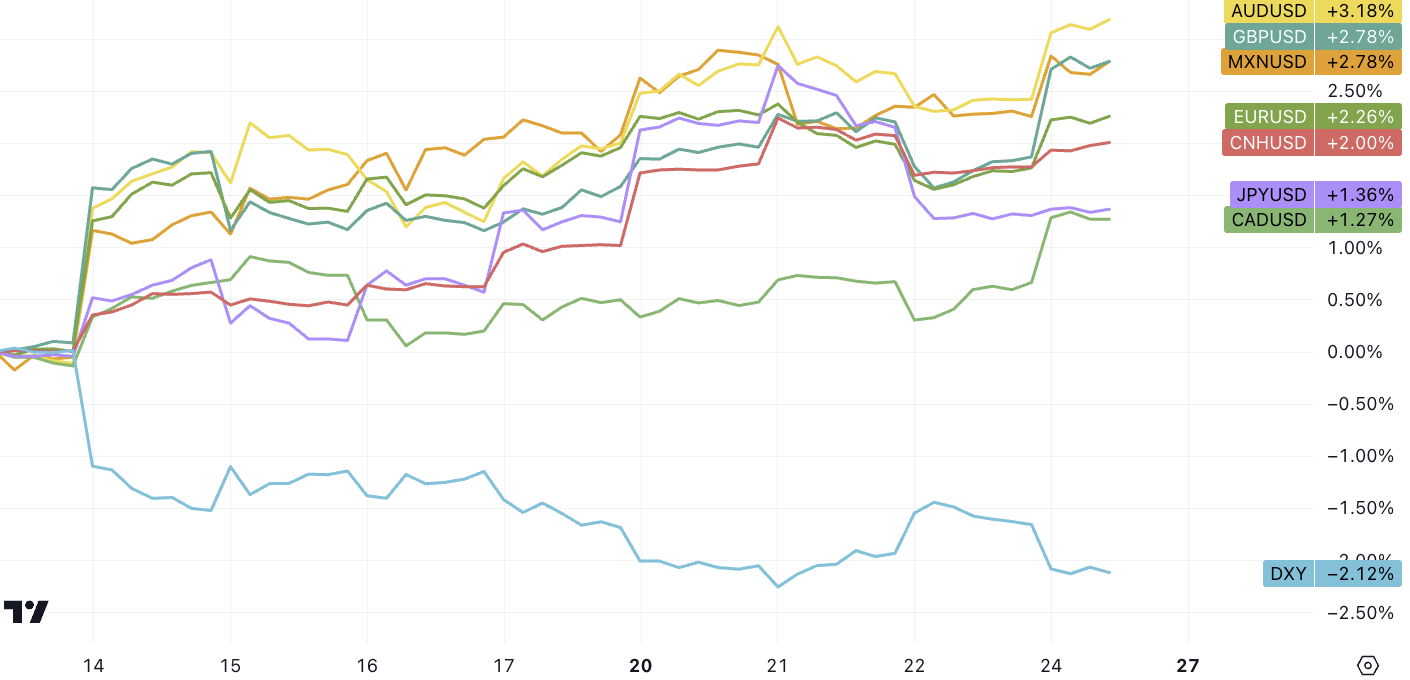

In terms of exchange rates, the U.S. dollar continued to fall last week, but the decline narrowed. A weaker U.S. dollar is good for commodity assets. The yuan has risen 2% against the US dollar in the past two weeks, to a range of 7.14 ~ 15, but the rebound has not led major currencies:

NV financial report beats expectations

In the third quarter, revenue tripled year-on-year and EPS profit increased nearly six-fold, both significantly exceeding Wall Street expectations:

Revenue in the third quarter was US$18.12 billion, a year-on-year increase of 206%. Analysts expected a growth of 171% to US$16.09 billion, nearly 13% higher than expected, and far exceeding Nvidias own guidance range of US$15.68 billion to US$16.32 billion. In the second quarter of the previous quarter Revenue increased by 101% year-on-year.

Adjusted EPS on a non-GAAP basis in the third quarter was US$4.02, a year-on-year increase of 593%. Analysts expected a 479% increase to US$3.36, nearly 20% higher than expected, and a year-on-year increase of 429% in the second quarter.

The non-GAAP adjusted gross profit margin in the third quarter was 75.0%, an increase of 18.9 percentage points year-on-year, higher than analysts’ expectations of 72.5%, and higher than Nvidia’s guidance range of 72% to 73%, an increase of 3.8 percentage points from the second quarter.

However, the strong financial report failed to bring about a further rise in the stock price as usual. NV stock price closed down 3.5% for the whole week, which shows that investors are generally holding heavy positions. When the stock price has risen by 240% this year, they are reducing their holdings on the rise. ; Investors hope to see that the current extremely high growth rate can be maintained for several years. Even if there are signs of weakening, capital will be cashed out. Some people think it is the impact of the U.S. government’s export restrictions on new products from China, but nv itself believes that the overall demand is strong enough to make up for the gap in China’s GPU sales. Overall, it can be seen from the current market performance that the market is not buying it. The stock price continued to fall on Friday after NV postponed the launch of a new AI chip for China that complies with the latest US export restrictions the next day.

NV has been a reliable leading indicator for much of the year when it comes to tech stocks, and bucking the trend now is not a good sign.

From a valuation point of view, if the earnings forecast of US$16.6 per share for fiscal year 25 is used, the price-to-earnings ratio of NVs current price of 480 is only 30 times. In fact, it is not an exaggeration. For example, AMD is also trading at about 32 times PE. There are two main long-term challenges facing NV: First, many customers or competitors, including Microsoft and Intel, have been developing their own AI chips to reduce their dependence on NV chips. The second is that if the artificial intelligence bubble bursts, demand for its data center chips may also disappear.

Opec+ meeting postponed

Due to disagreements among member countries over the extent of production cuts, the market is paying attention to this weeks postponement of the OPEC+ meeting. Rescheduling a meeting of this level is a big deal and is rare. The main contradictions focus on the production cutters led by Saudi Arabia and Russia demanding that other members The country further cuts production. Crude oil futures were volatile last week due to the unexpected postponement of the meeting, falling more than 10% in the past six weeks. The meeting is significant as crude oil prices are key to interest rates and market performance next year. On the other hand, the US election is approaching. Former Republican President Trump, who is leading the polls, has stated that if elected, he will repeal Bidens climate bill and maximize fossil energy production.

Argentina’s “Comprehensive Dollarization”

Milei, the candidate of the far-right electoral alliance Freedom Forward, won the Argentine presidential election. Milei advocated a series of measures such as comprehensive dollarization, closing the Argentine central bank, and cutting social welfare. Argentina is currently one of the countries with the highest inflation in the world (140%). Milei hopes that dollarization can boost confidence and curb currency devaluation. In the eyes of many people, Milei is Argentinas savior. After the election results came out, Musk also gained popularity , commented that “Argentina’s prosperity is coming.” However, Argentina’s net foreign exchange reserves are negative. At least in the short term, the central bank cannot raise enough U.S. dollars for market exchange, and the local currency still faces the risk of continued sharp depreciation. Additionally, Milei “sees Bitcoin as a key tool to combat the inefficiencies and corruption of the centralized financial system” and as a “viable alternative to traditional economic structures,” and his election is seen by crypto players as wider acceptance and integration into the Argentine economy. The beginning of cryptocurrencies, offering potential solutions to the problems of inflation and financial instability.

However, Mileis post-confirmation speech did not live up to the promise of his campaign speeches, requiring us to dial back on the pricing of his radical policies.

Judging from the results of the experiment in El Salvador, the first country to adopt cryptocurrencies as legal tender, there is very little private use (according to data from the Central Bank of El Salvador, in the first six months of 2023, only about 1% of remittances received were Bitcoin Bitcoin; the transaction speed and cost of Bitcoin are not suitable for daily payments, but it has a huge cost advantage for cross-border remittances. The World Bank will calculate that the average fee for cross-border remittances of US$200 is 6%), but it has promoted the rebound of El Salvador’s national debt ( 0.26 – 0.8). The good performance of Bitcoin price this year is an important reason behind it. It is somewhat similar to Microstrategy. In short, Bitcoin has not become a currency, but it has become a reserve that outperforms the US dollar.

The exact number of Bitcoins owned by El Salvador is unknown as there are no public government records. If we go according to the previous plan, it is estimated that as of November 14, El Salvador’s holdings will reach 2,744 Bitcoins (current value of 100 million US dollars), and the average purchase price will be approximately 41,800 US dollars. Calculated based on the current Bitcoin price, there is still A loss of over ten million dollars.

Palestinian-Israeli ceasefire

A temporary ceasefire agreement between Israel and Hamas came into effect on Friday, which calls for a cessation of hostilities for at least four days, during which the two sides will exchange hostages and increase humanitarian aid to Gaza. Since the truce was only a brief one and had little impact on financial markets, gold ended last week back above $2,000.

Thanksgiving consumption is booming

Consumers have been surprisingly resilient this year, as their spending has been unaffected by inflation, soaring interest rates and resumption of student loan payments. According to Adobe statistics, U.S. consumers spent a record $5.6 billion online on Thanksgiving Day, a year-on-year increase of 5.5%, and spent $9.6 billion on Black Friday the next day, a year-on-year increase of 6%. According to the National Retail Federation, more than 182 million people are expected to shop during Black Friday sales, a 9% increase from last year and a new high since tracking began in 2017. Deloitte estimates that their average spending during Black Friday sales will be 13% higher than last year, reaching $567 per person. According to estimates from the National Retail Federation, Americans will spend between $957.3 billion and $966.6 billion during Thanksgiving, Christmas and New Years Day, an increase of at least 3% over last year, but this number may only be in line with inflation. , confirming that recent price cuts have offset growing demand.

UBS: The Fed’s interest rate cut coupled with a sharp drop in real interest rates has led to a new high in gold prices next year.

UBS Joni Teves analyst team pointed out in the latest precious metals annual outlook that investors currently have low positions in gold, and they have eliminated most of their positions in gold as the global economy continues to recover from the COVID-19 epidemic. , but as the cycle matures and policies turn, their attitude towards gold will change accordingly.

UBS expects the Fed to cut rates in the first quarter of 2024, and a pause in rate increases in December would continue to confirm the Feds preference for a rate cut around six months after the last increase.

Looking at the performance of gold after previous interest rate hike cycles by the Federal Reserve, UBS found that gold prices tended to fall by 2% about 3 months after the end of previous interest rate hike cycles, but rose by 7% in the next 6 months.

UBS expects gold to reach new highs in 2024 and 2025 as the U.S. economy enters recession, the U.S. dollar weakens as the Federal Reserve cuts interest rates, and the real yield on the 10-year U.S. Treasury note falls 160 basis points from its 2023 high.

According to UBSs baseline forecast, the gold price will be US$2,000 per ounce by the end of this year, US$2,200 in 2024, and will fall back to US$2,100 in 2025 but remain high.

(Much of the market’s optimism about gold can also be applied to Bitcoin, and alternative allocations can prepare for lower interest rates in the future.)

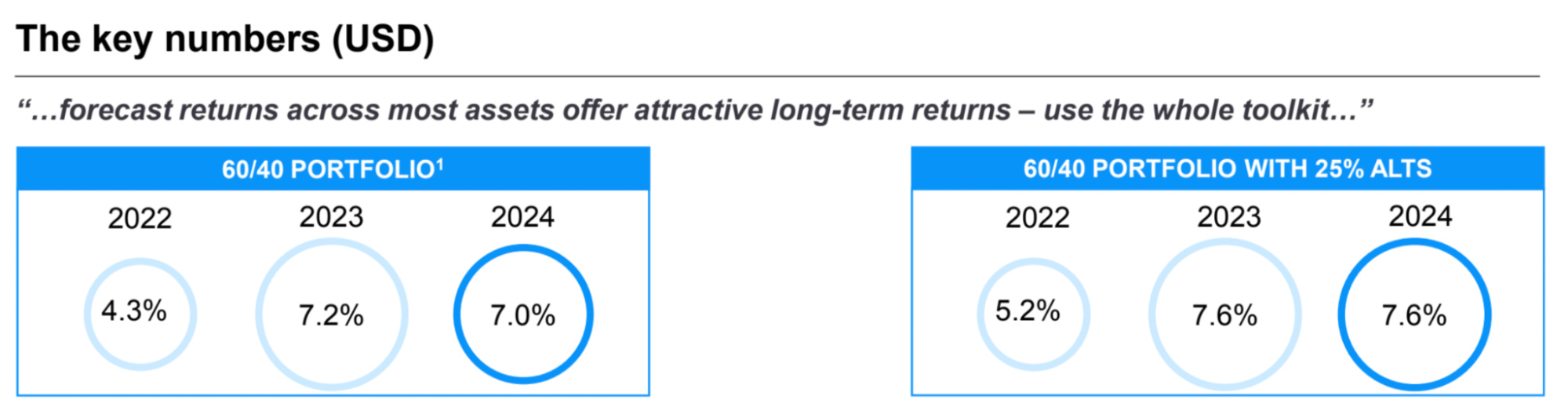

JPM Asset Management: Alternative asset allocation will be important next year

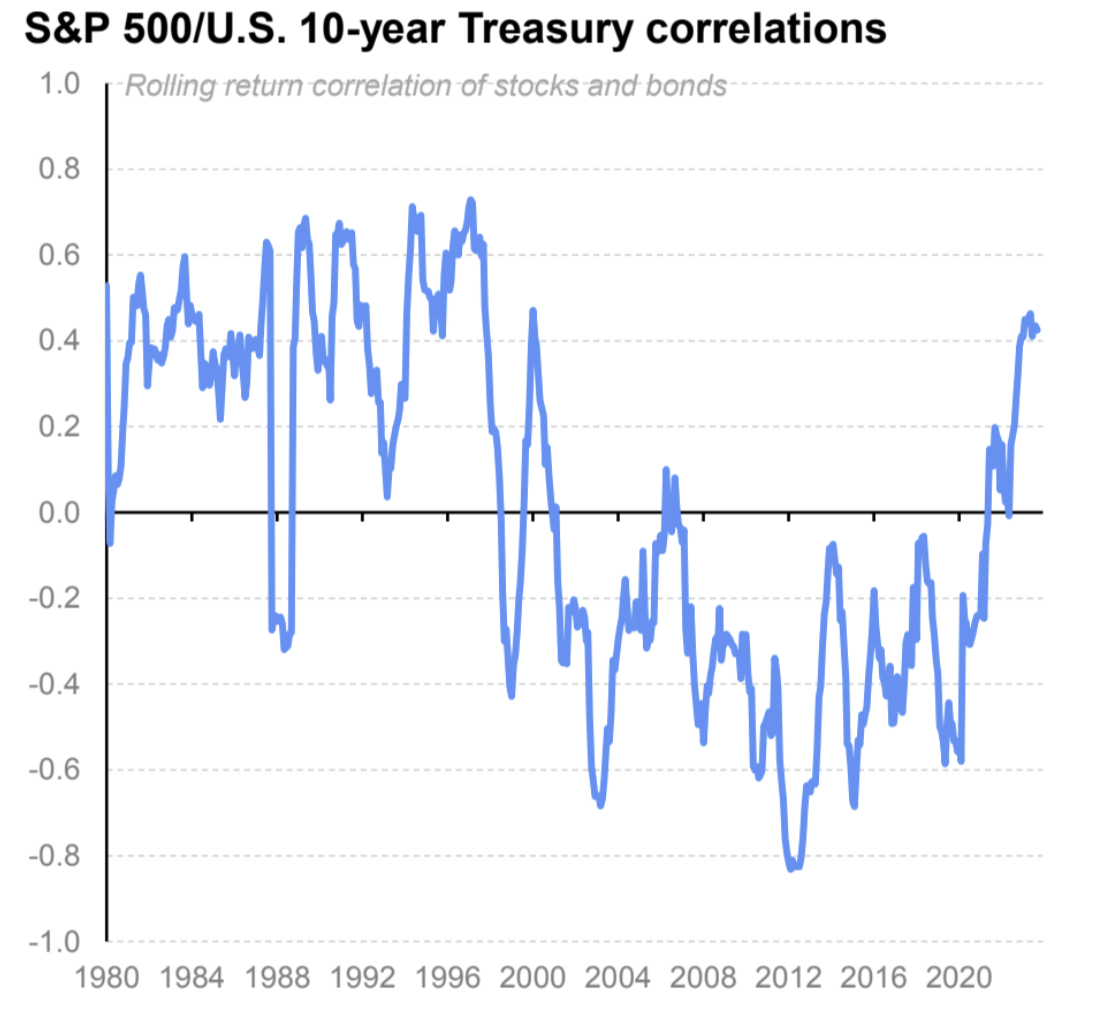

The correlation between stock and bond prices is expected to remain in a high range in the future as inflation pressure eases and economic growth slows. The higher correlation makes the diversification effect of alternative investments more prominent, as alternative assets have higher expected returns. Can provide a yield premium to a portfolio.

(This logic is also applicable in the cryptocurrency market. Take BTC as an example. Regardless of whether you agree with its valuation logic or not, its price history Sharpe and Sortino ratio are higher than Nasdaq 100. When a large amount of funds are used to select alternative assets, It’s hard to jump out of it)

Chinese real estate stocks and bonds rise

China is increasing pressure on banks to support struggling property developers, such as by allowing them to provide unsecured short-term loans to qualified developers. People familiar with the matter said at the time that authorities were finalizing a draft list of 50 developers eligible to receive financial assistance. Chinese developer stocks and bonds rose last week. For example, Country Garden’s stock price soared 20%, and its bond prices soared 50%. Sino-Ocean Groups share price soared 50%, CIFI Holdings soared 50%, MSCI China Real Estate ETF rose 10% last week, and the CSI 300 Real Estate Index rose 2 to 3%. Most developers in China face a liquidity crisis rather than a solvency crisis, meaning they can survive if the government provides sufficient financing cash flow. If left unchecked, developers will default on their debts and the situation of unfinished buildings across the country will worsen, which will only create a vicious cycle in the market. Since the funds required to ensure delivery may be as high as 3 trillion yuan, it is unlikely to rely on market takeover, and debt monetization may be the only solution.

Positions and Fund Flow

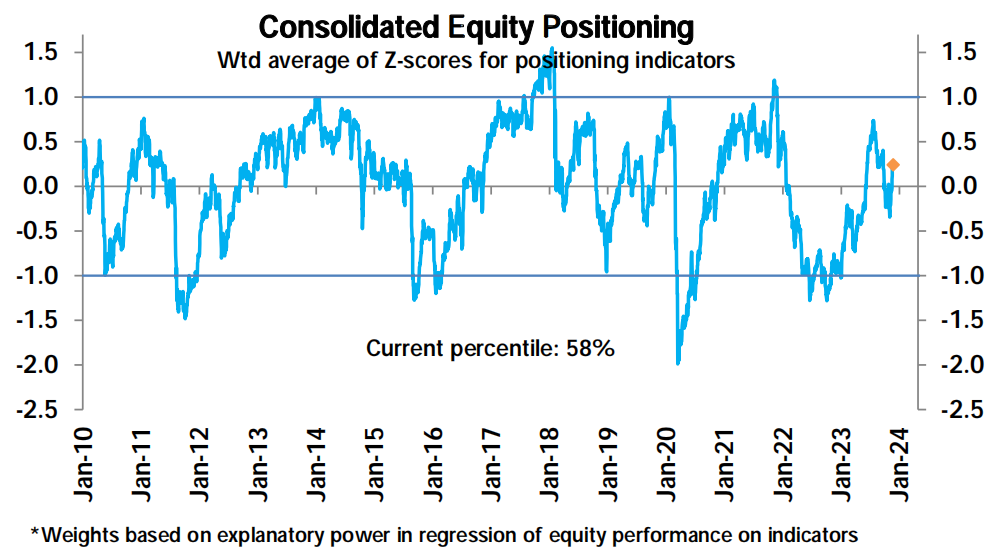

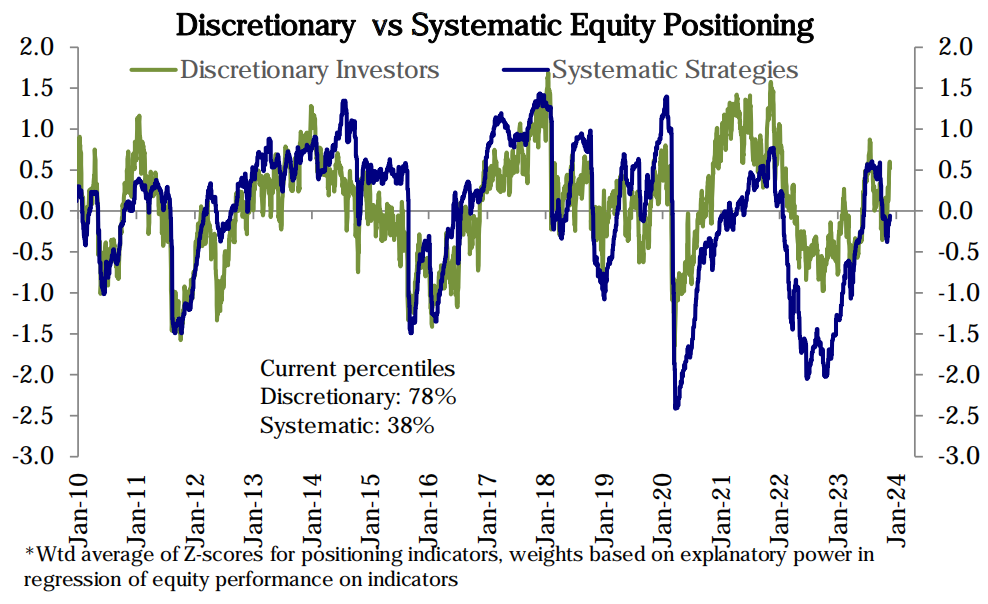

The measure of overall equity positioning rose further this week, reaching moderately overweight territory (58th percentile), and positions among independent investors in particular continued to rise sharply, reaching their highest level since late July (78th percentile) , but not yet to the extreme. Positioning in systematic strategies continues to rise slightly and remains just below neutral (percentile 38):

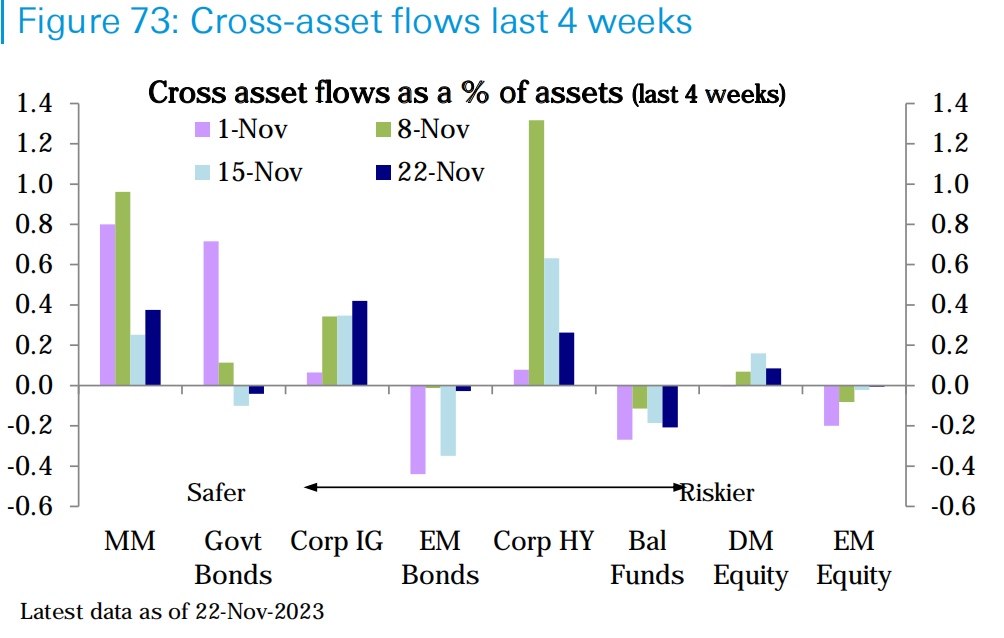

Equity funds received inflows ($13.1 billion) for the third consecutive week, with the United States ($12.4 billion) once again receiving the bulk of the funds. Inflows into bond funds ($6.7 billion) accelerated, with investment-grade bonds ($4.1 billion) recording the largest weekly inflows since early April. Money market funds enjoyed a fifth straight week of inflows ($30.9 billion), bringing total inflows to more than $222 billion during the period.

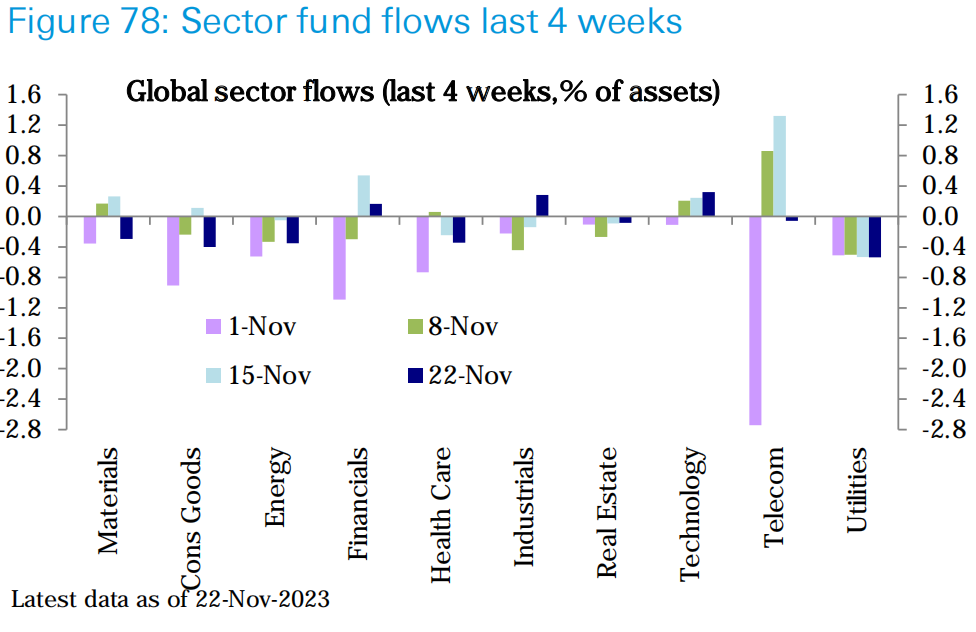

In terms of industries, the inflows in the past two weeks have been obvious in telecommunications, technology and finance, while utilities, healthcare, and energy have seen obvious outflows:

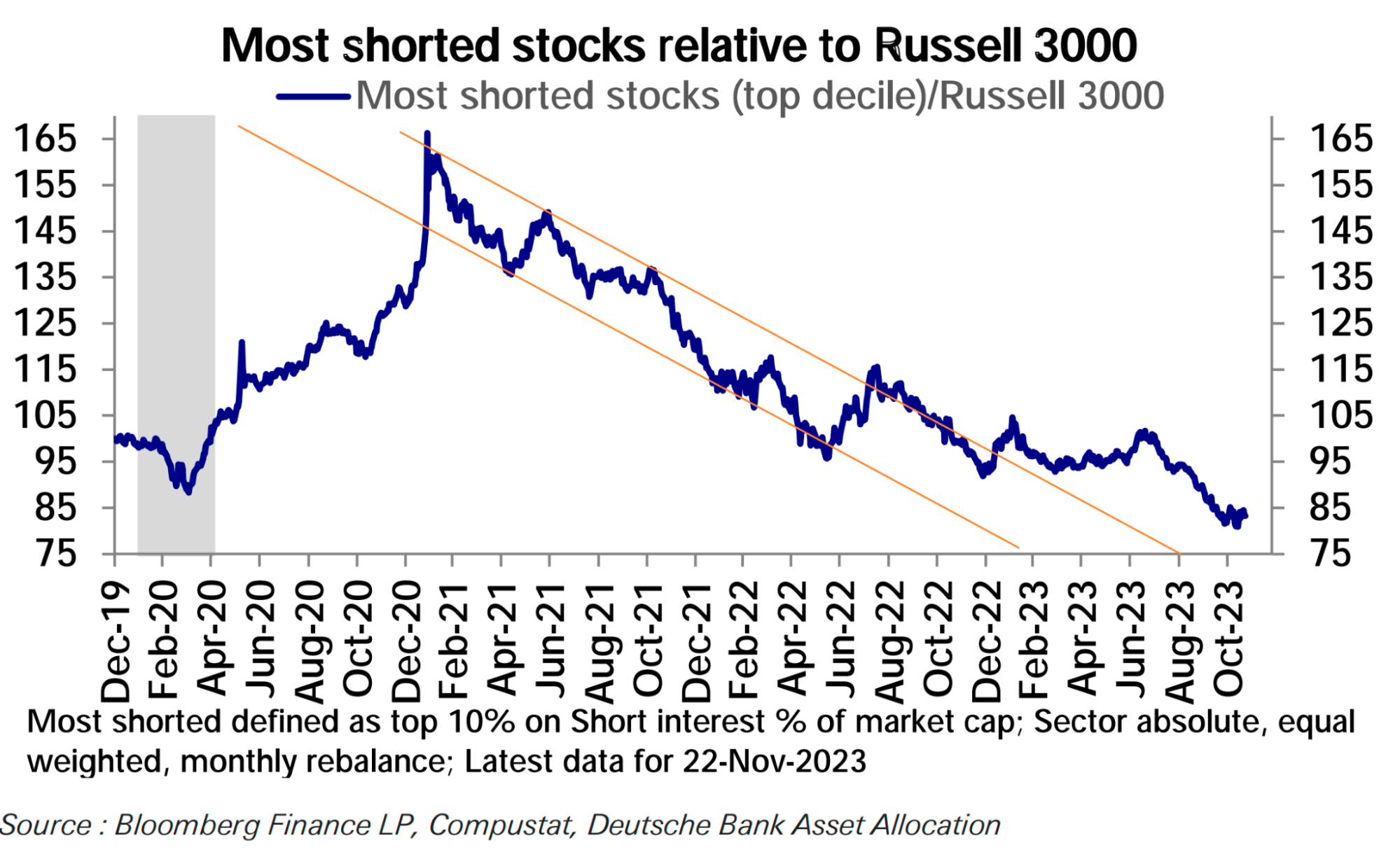

Since October, the performance of stocks with the largest proportion of short sellers (top 10%) has caught up with the market:

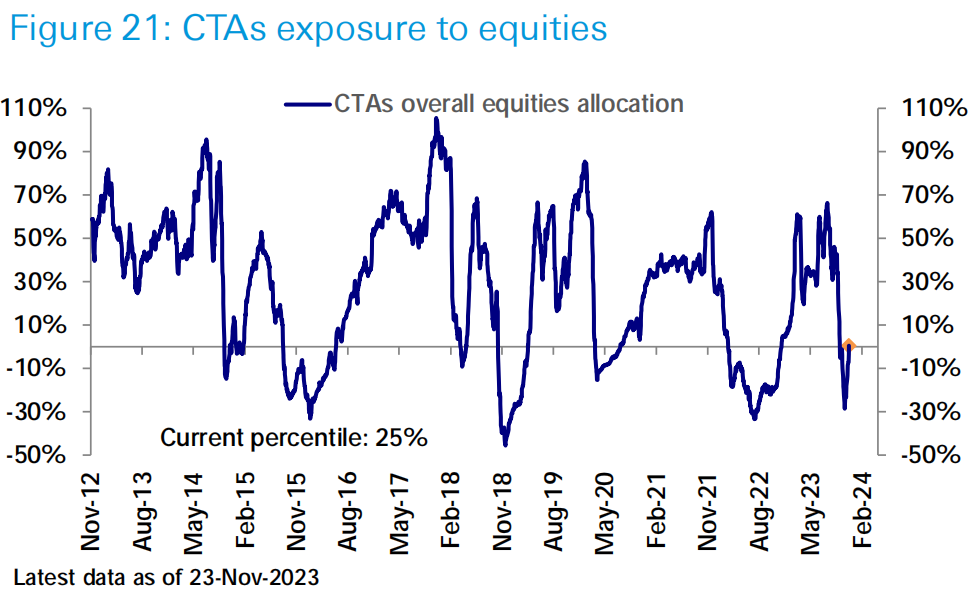

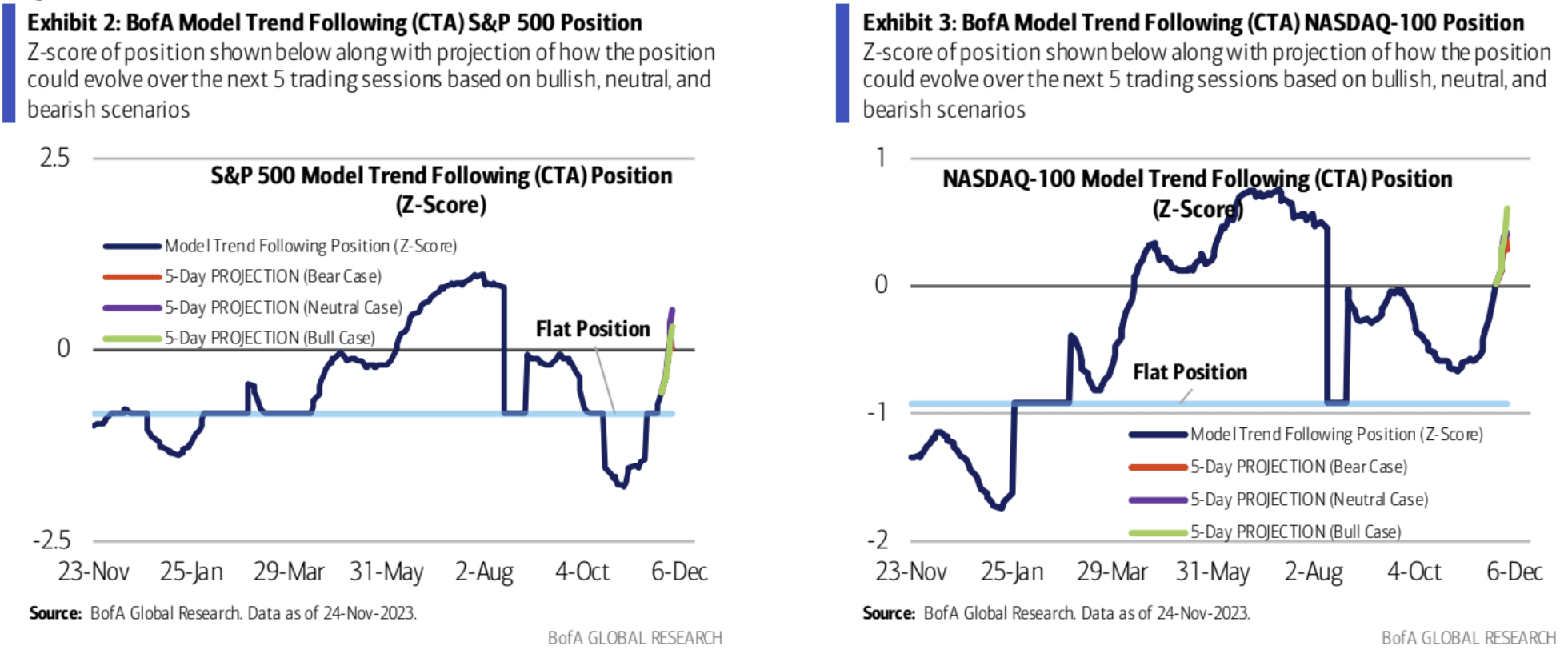

CTAs significantly increased their equity allocation to Neutral (25th percentile):

According to BoA’s forecast, CTA will continue to be a big buyer in the market this week:

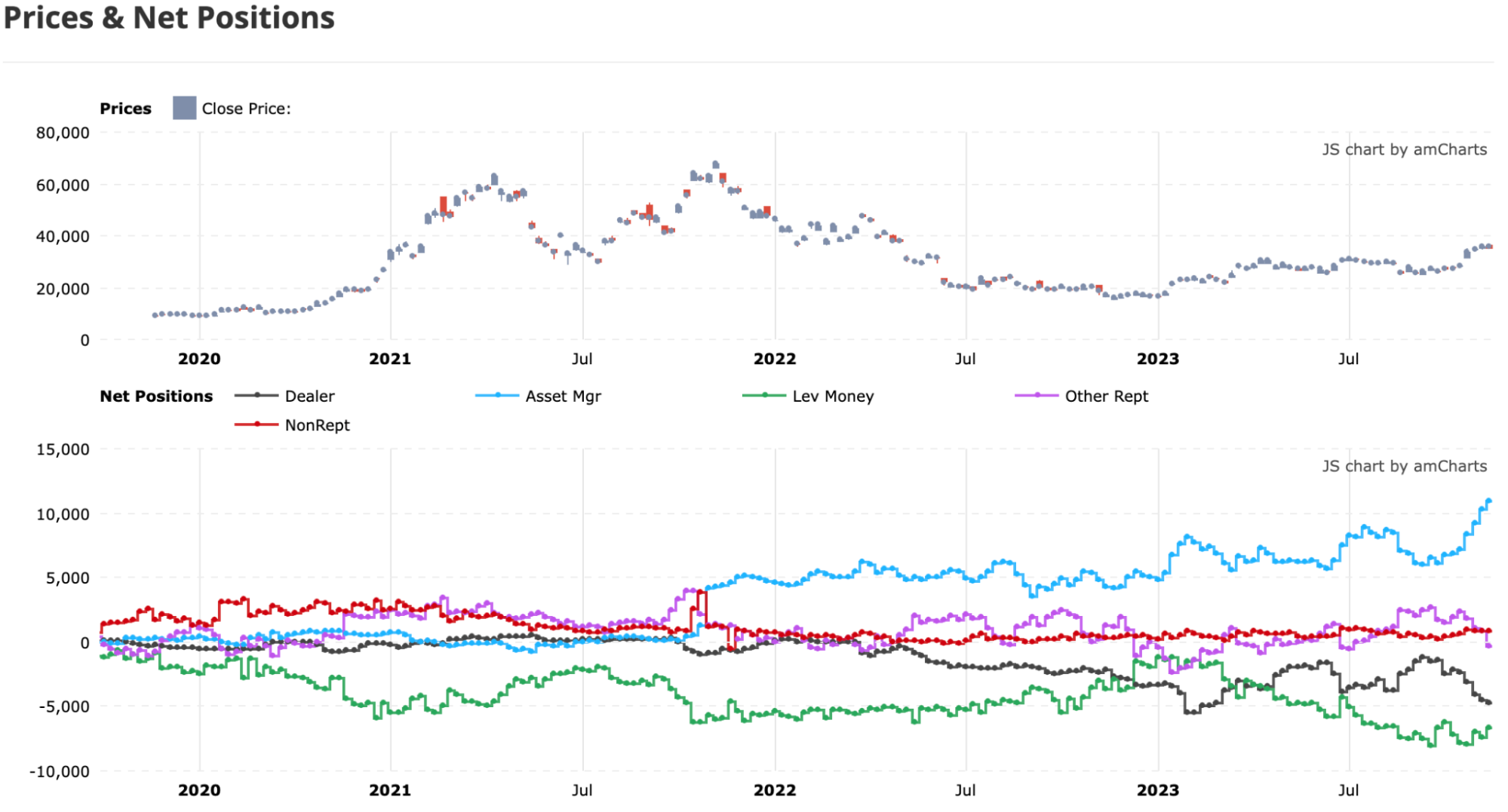

In terms of BTC futures, asset management (blue) positions continue to hit record highs, retail investors (purple + red) have turned net short last week, market makers (gray) have net short positions hitting a new high since February this year, and leverage funds (green) have net short positions. The head count has decreased but remains at a high level. We have previously analyzed that most of the increase in asset management positions was contributed by BTC futures ETFs, so it can be seen that players in the futures market other than ETFs are not actively long BTC. Historically, the behavior pattern of leveraged funds operating against the trend is very obvious. They always reduce their positions when they rise and increase their positions when they fall. Since players outside of ETFs are clearly short, you could on the one hand understand that these people think the market may have peaked. But if their judgment is wrong, the motivation for subsequent short covering is bound to be stronger.

sentiment indicator

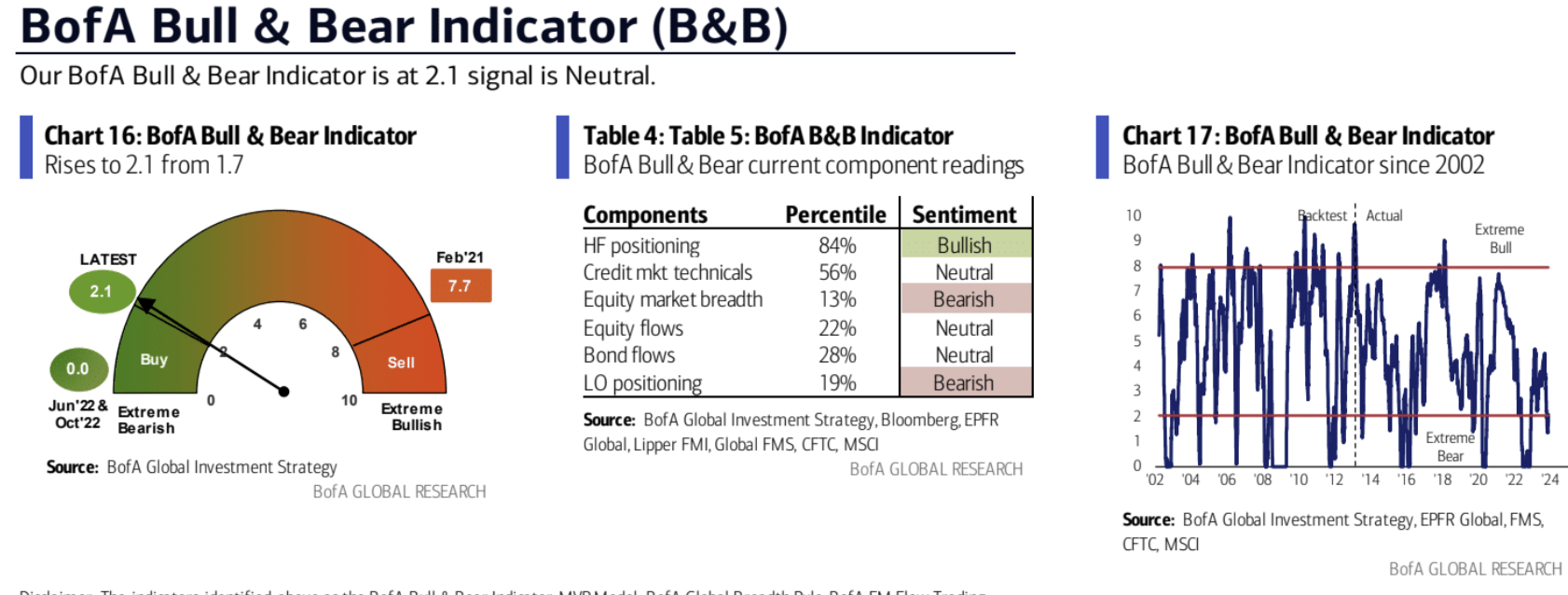

The BofA Bull-Bear Indicator rose to 2.1, signaling a shift in investor sentiment from extreme pessimism to neutral, with the bank recommending a cautiously optimistic approach:

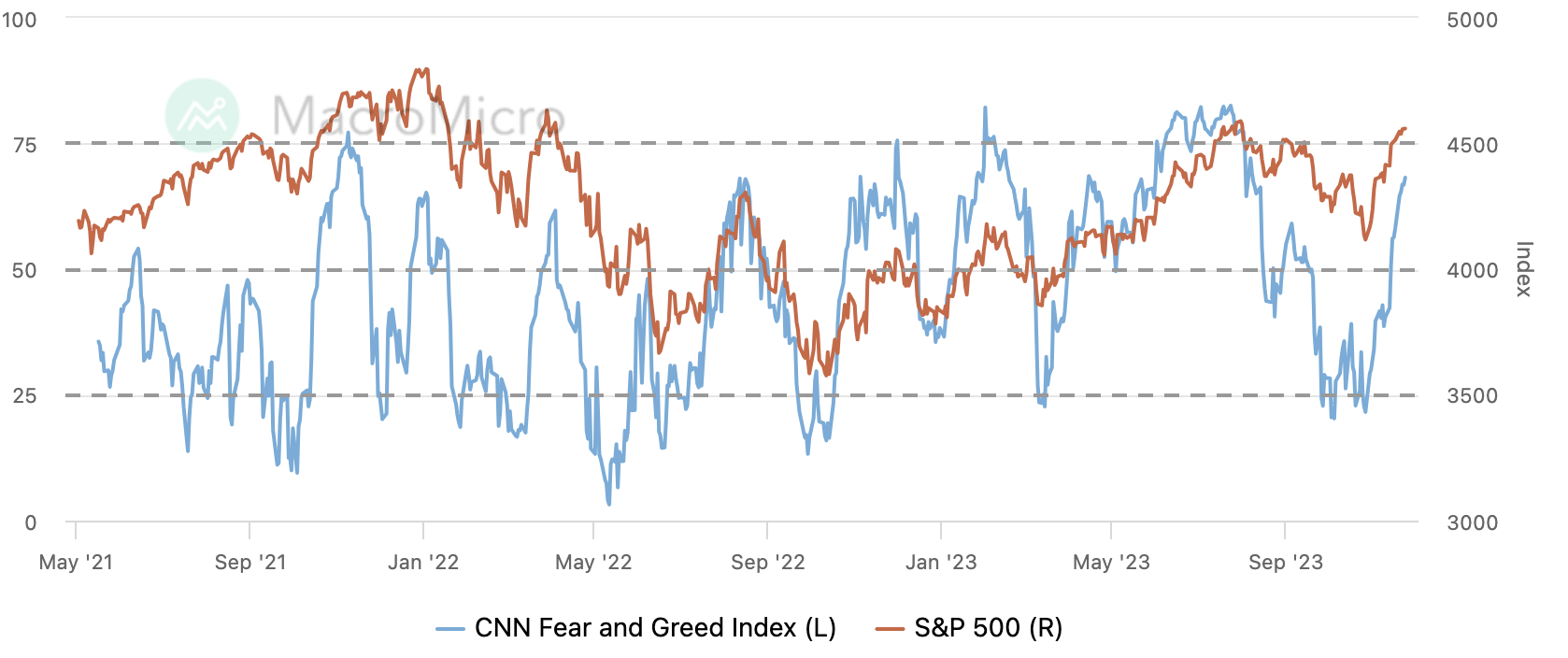

The CNN Fear and Greed Index jumped sharply to the greed range:

Sentiment indicators from AAII and Goldman Sachs were not updated this week.