US$1 billion of institutional funds poured into the crypto market. How will the Bitcoin halving affect subsequent investments?

More and more institutional investors are attracted to Bitcoin, with more than $1 billion injected into Bitcoin in just two months. This can be said to be a bellwether for the recovery of cryptocurrency, indicating the expected development trajectory of the market in 2023 and beyond. Bitcoin is gradually gaining recognition from institutional investors and is viewed as a legitimate asset class with considerable long-term growth potential. Additionally, the combination of Bitcoin’s limited supply and the upcoming halving event enhances its appeal, especially for investors seeking scarcity, along with the launch of a potential Bitcoin ETF.

Institutional investment in Bitcoin exceeds $1 billion

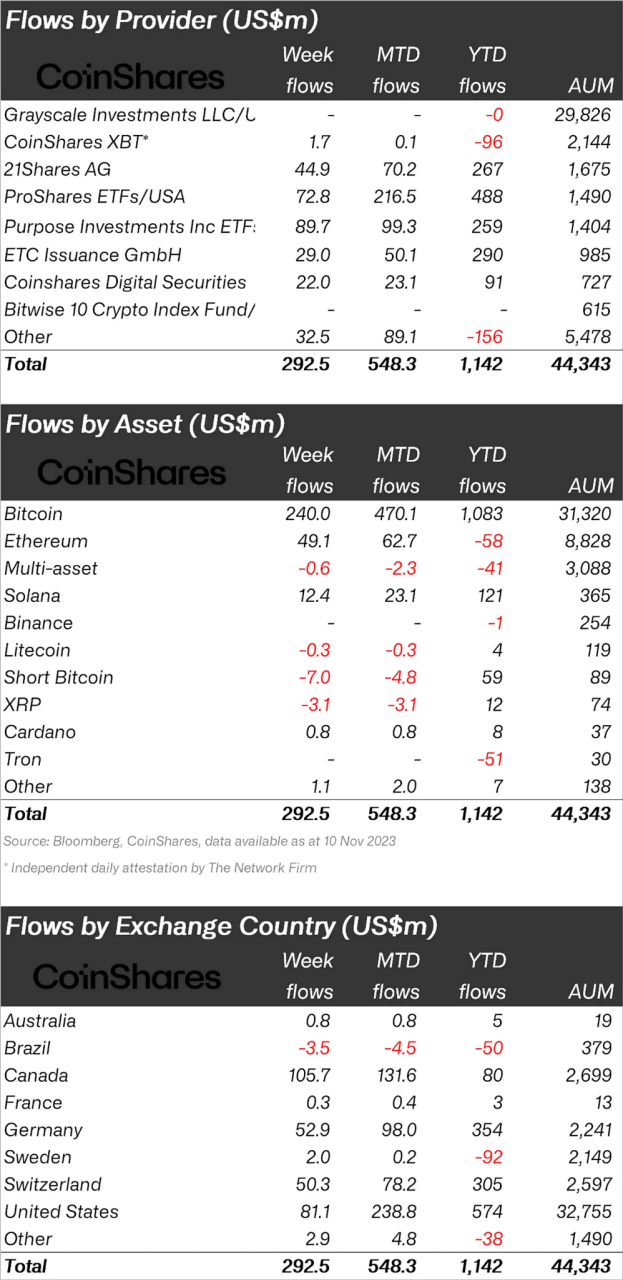

CoinShares released its latest weekly report* on November 13, highlighting the narrative of renewed capital inflows into Bitcoin and altcoins. Bitcoin, ethereum and some major altcoins are experiencing price gains as excitement builds over the potential approval of the first U.S. ETF.

According to TradingView, the entire cryptocurrency market capitalization has increased by $600 billion since November 2022. As detailed in the CoinShares report, funding for cryptocurrency investment products has increased significantly over the past two months. The report disclosed: “Inflows into digital asset investment products last week totaled $293 million, pushing seven-week inflows past the $1 billion mark. Year-to-date inflows totaled $1.14 billion, marking the first time on record Three high annual inflows.”

A striking statistic highlights crypto’s resurgence in 2023: Cryptocurrency exchange-traded products (ETPs) assets under management (AUM), which have nearly doubled since the start of the year, increased in the last week alone Nearly 10%.

CoinShares highlighted: “Total AUM now reaches $44.3 billion, the highest level since the collapse of a major cryptocurrency fund in May 2022.” The report also revealed that Bitcoin bulls dominated trading volume. The report states, “Bitcoin last week saw inflows totaling $240 million, pushing total year-to-date inflows to $1.08 billion, while short Bitcoin saw outflows of $7 million, indicating that the market remains bullish.”

Bitcoin Scaling to Meet Evolving Demand

As the crypto market continues to grow, Ordinals are also extremely popular. A previous article by veDAO Research Institute mentioned the network congestion caused by the surge in Ordinals transactions. As peoples interest in BRC-20 tokens grows, Bitcoin transaction fees also rise. After weeks of accumulation, average transaction fees have surged since late October, reaching a six-month peak of over $16 on November 9. Thankfully, the growing ecosystem of Bitcoin sidechains and scaling protocols promises to simplify Ordinals transactions and return fees to more manageable levels.

In the 14 years since Bitcoin’s birth, the volume of transaction data has exploded, and the emergence of Ordinals is just the latest trend to put pressure on the limited throughput of blockchains. As researchers began focusing on Bitcoins scalability challenges in the mid-2010s, the initial focus was on enabling faster and cheaper transactions. For example, the Lightning Network was launched in 2019 as a dedicated Layer 2 network designed to support peer-to-peer Bitcoin micropayments.

In the context of Ordinals, connecting BRC-20 tokens to more efficient sidechains can significantly reduce fees and create a smoother trading environment. For example, Bioniq uses Internet Computer Protocol (ICP) to encapsulate Ordinals, which users can then trade without incurring transaction fees. Ditto for Bitmos, a private blockchain network built on Cosmos that aims to improve the scalability of the Ordinals project. The platform is scheduled to launch next year and the cross-chain bridge will allow users to create BRC-20 tokens that can be freely moved between Cosmos chains.

As Ordinals develop, bridging and scaling solutions may power new, more complex use cases for Bitcoin-based assets. And this will also be reflected in Bitcoin’s supply dynamics.

A Reassessment of Bitcoin Supply Dynamics

In response to the growing interest, on-chain analytics firm Glassnode has delved into reassessing Bitcoin supply dynamics. According to Glassnodes latest weekly report The Week On-Chain.*, with only five months left before the next block halving, the number of Bitcoins used for storage has now exceeded the amount mined by 2.4 times. The upcoming fourth halving event has important fundamental and technical implications for Bitcoin. Glassnode notes that this is an extremely attractive event for investors given the significant returns seen in previous cycles.

The weekly report includes multiple charts, the above one showing Bitcoin supply storage by long-term holders (LTH), entities that hold the token for 155 days or more. Philip Swift, founder of the statistics platform Look Into Bitcoin, emphasized that the presence of wallet entities, regardless of size, is constantly increasing, and tweeted on the 13th, “This is what adoption looks like.”

How will the halving impact investing in 2024?

The next Bitcoin halving event will occur in April 2024. During the halving event, the number of Bitcoins awarded to miners will be halved. The event is expected to further reduce the supply of Bitcoin, which could make the asset more attractive to investors.

Over the past few Bitcoin halvings, we can observe some meaningful trends. First, after every halving, the price of Bitcoin goes through a period of increase. Whether this trend will continue until the next halving is unknown. Historically, Bitcoin’s halving events have exacerbated the cryptocurrency’s market scarcity, leading to upward price pressure, which explains the bull runs that have followed each halving event.

After the crypto winter of 2022 and the economic downturn of 2023, Bitcoin’s 2024 halving schedule is crucial. By slowing down the creation of Bitcoin, it limits the supply of Bitcoin over time, and gold-like scarcity also applies here. Bitcoin’s halving promotes innovation and resilience in its native cryptocurrency, setting it apart from fiat currencies. The Bitcoin halving in 2024 will affect how quickly new Bitcoins enter the market. The event will cause the reward to be reduced from 6.25 BTC to 3.125 BTC. In order to maintain profitability, miners must find ways to optimize their operations as the reward decreases. This may prompt miners to become more efficient.

In addition, we can also look at this issue from a longer time line. In the early stages of Bitcoin, its price was relatively low and volatile. However, as time passed and Bitcoin became more popular, its price began to gradually increase. This means that while the halving event may have a certain impact on the price of Bitcoin, the long-term trend may depend more on other factors such as market supply and demand, the macroeconomic environment, and the development of the Bitcoin ecosystem.

Conclusion

Overall, the increase in institutional exposure to Bitcoin is a positive sign for the crypto industry, indicating that institutional investors are increasingly accepting Bitcoin and viewing it as a legitimate asset class. The next halving event may also have a positive impact on Bitcoin price, attracting more investors to invest in the asset.

references:

https://blog.coinshares.com/volume-157-digital-asset-fund-flows-weekly-report-a8be1d5b3f85?gi=c9b0a4dc3b18

https://insights.glassnode.com/the-week-onchain-week-46-2023/

Follow us

veDAO is an AI-driven web3 trend tracking intelligent trading one-stop platform

Website: http://www.vedao.com/

Investment is risky, the project is for reference only, please bear the risk at your own risk