OKX researcher: Taking the cycle as a guide, the “knowledge” and “action” of leading institutions in the encryption industry

The U.S. federal funds rate remains at the highest level since 2022, between 5.25% and 5.50%. However, boosted by the Federal Reserves suspension of interest rate hikes and the expectation of the approval of the Bitcoin spot ETF, on- and off-site funds have combined to help Bitcoin return to its rise. aisle. At the end of October this year, with a monthly increase of over 26%, BTC broke through the 30,000 suppression level that had lasted for nearly half a year, leading the crypto market to rebound across the board.

However, it is not easy to repair the market this time. Since BTC hit a new high of $69,000 in 2021, the industry has entered a long bear market that lasted more than 2 years. As of early October this year, crypto industry data have fallen to the freezing point. For example, NFT market transactions hit a new low in two years, the ETH/BTC exchange rate hit a new low in 15 months, the total financing of Q3 encryption companies hit a new low since Q4 in 2020, DEX The transaction volume continued to hit a new low since January 2021, and the Bitcoin balance on the trading platform hit a new low in the past five years. Funds continued to flee, and the market fell into mourning.

At this darkest moment, the spark represented by Bitcoin Ordinals is gradually gaining momentum, the address on the Bitcoin chain has reached a record high, the bullish forces on the market are actively taking action, and the market sentiment has reached an inflection point. Subsequently, with the inflow of 900 million stablecoins, the crypto market swept away the gloom and ushered in a major reversal. Those project parties and institutions that actively deployed in the bear market began to receive rewards.

This article aims to understand the market from their perspective and explore their knowledge and action in the bear market through dialogue with high-quality industry projects and institutions such as dappOS, Taiko, Celestia and OKX Ventures that have successfully survived this bear market cycle. Finding the key to future industry development does not constitute any investment advice.

Looking back at the past three bull-bear cycles

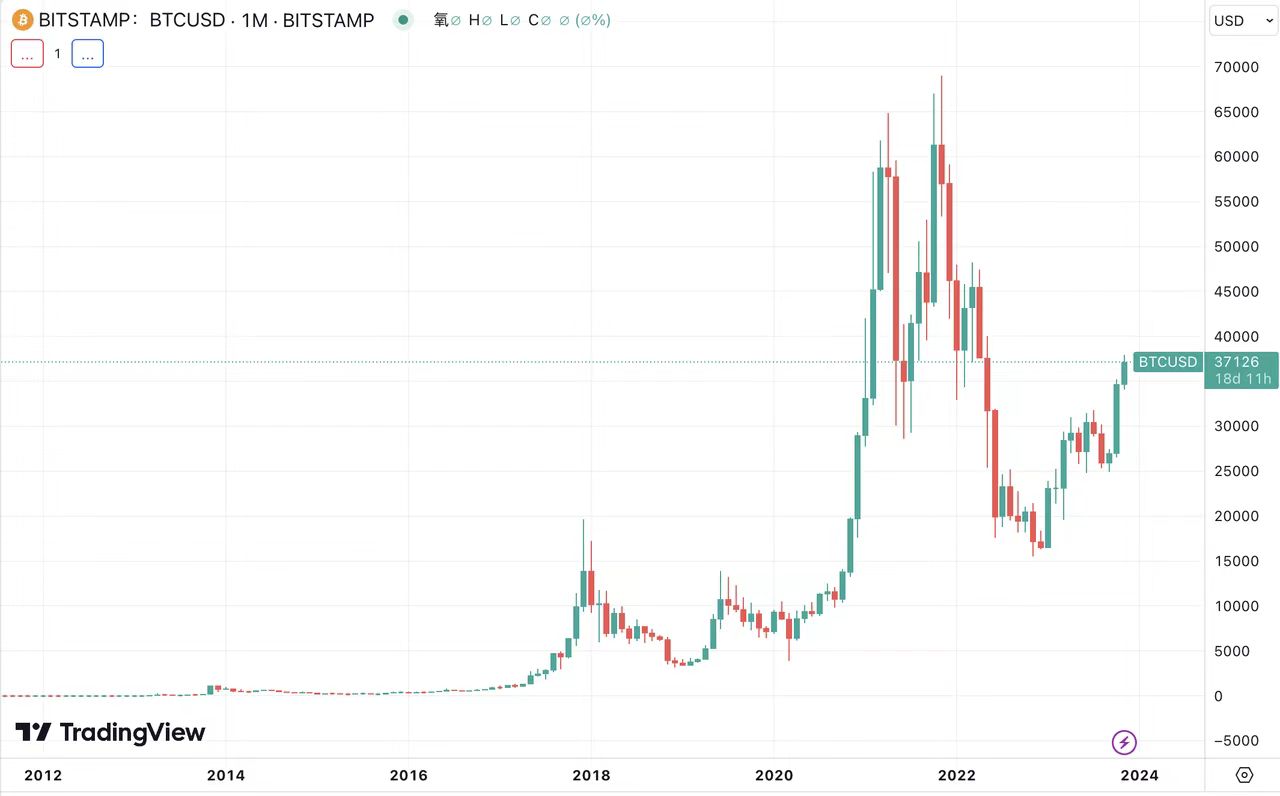

After more than ten years, the encryption industry has rapidly strengthened its connection with traditional financial markets and the real world through technological innovation, application iteration, and exploration and compliance. Taking the cycle as a guide, looking back at the past three rounds of bull and bear markets in the encryption industry, it is not difficult to find that the resonance of new funds, new narratives and new technologies ultimately determines the arrival of the bull market. Based on the narrative dimension, briefly describe the three bull-bear cycles of the encryption industry:

2009-2015: The first bull-bear cycle, innovative experiments, opening up a new world

At 6:15 pm on January 3, 2009, the Bitcoin genesis block was generated in a small server in Helsinki, the Netherlands, marking the official birth of Bitcoin. At this stage, Bitcoin was still limited to niche experiments by professional developers and early explorers, mainly due to the popularization of the concept and the formation of early consensus. Then the prototype of the industry infrastructure began to emerge. With the launch of early exchanges such as Mt. Gox, Bitcoin entered the trading era and ushered in a speculative boom. Its early trading price was $0.0008, and it soared to the highest point of the current bull market of $1,202 in 2013, before entering a downward trend and bottoming in 2015.

2015-2018: The second bull market cycle, the ICO era, and the formation of infrastructure

The market has completed repairs and reopened a new cycle. With the entry of speculative funds, the influx of developers, the iteration of innovative technologies, and narrative developments such as the Bitcoin halving, it has paved the way for the arrival of the bull market. At the same time, peripheral industries such as encrypted media, mining machines and mines, data tools, and encrypted funds began to take shape. In 2017, under the combined influence of narratives such as the explosion of the ICO model and the blooming of second-generation public chains such as Ethereum, speculation broke out. Various wealth-making myths frequently appeared in the news. The price of Bitcoin hit a record high of 19,800 on December 17. The crypto industry is starting to gain wider attention. Subsequently, the crypto industry entered a new round of bear market, accompanied by black swans and regulatory policies. BTC fell to around $3,000 in 2018 and struggled to develop amid doubts.

2018-2022: The third bull market cycle, mature infrastructure, and explosion of on-chain applications

After three years of silence, with the continuous upgrading of the Ethereum network, blockchain technology has moved from a bubble to an application stage. In 2020, many chain applications such as DeFi, NFT, DAO, GameFi, and IEO based on the Ethereum network exploded, attracting a large number of Institutional investors brought a large amount of new funds. At the same time, the huge imagination that the encryption industry continues to show has also attracted a large number of developers to enter. Through the continuous iteration and innovation of the underlying technology, it will further promote the encryption industry to move from virtuality to reality, and various infrastructures will continue to mature. Under the superposition of multiple positive factors, Bitcoin hit a record high of $69,000 on November 10, 2021, and then entered a long bear market that lasted more than 2 years.

2022-present: The fourth bull market cycle, compliance and application implementation have become development themes

Despite being hit hard by various black swan events, the industry continues to innovate and develop, and continues to move toward rationality and value investment. With the establishment and improvement of the encryption regulatory framework, the expected approval of BlackRock’s Bitcoin Spot ETF, Web3+AI, and the rise of the Bitcoin ecosystem, a new round of bull market is brewing.

Bitcoin has rebounded from the troughs of the bear market several times and hit all-time highs, showing great elasticity. As of November 3, Bitcoin has surpassed Tesla with a market value of US$726 billion, ranking 11th in the world. This means strong liquidity support and global recognition behind it. However, as the depth and breadth of liquidity in the crypto industry continues to increase, the market will become more rational and mature, and Bitcoin volatility may further decrease. As an emerging financial industry, the encryption industry continues to extend towards multiple narratives, no longer relying on a single narrative of Bitcoin halving, and constantly exploring future development and creating new imaginations. However, this process is full of thorns and twists and turns, and industry players who are not determined will be forced out.

Knowing and doing of head organizations

Under pressure in a bear market that lasts for several years, faith will fail in the face of reality. As high-quality projects and institutions in the industry that have successfully survived the bear market cycle, explore how they understand the market by discussing macroeconomics, bear market strategies, focus, and more with dappOS, Taiko, Celestia, and OKX Ventures.

The crypto industry cannot exist independently of macroeconomic cycles;According to Daniel Wang of Layer 2 Network Taiko,Currently, the price of virtual assets has a strong positive correlation with the real economy or Wall Street. Therefore, if the real economy is not good, it will be difficult for virtual assets to stand out and have an independent bull market. Unless there are more regional conflicts, or major countries are interested in the U.S. dollar. Bonds lose confidence, or ETF applications are approved, causing the correlation to turn from positive to negative at least in some countries, which may cause a small bull market. But I think a big bull market may require more patience. If it is a strategic long-term investment, fixed investment That’s good, there’s no need to judge whether it’s bullish or bearish in the short term. Don’t invest money that you need urgently. Your mentality is very important.”

Daniel Wang is a firm long-term investor, and this thinking is also reflected in Taikos development strategy, that is, he maintains the unity of knowing and doing. According to Daniel Wang, Taiko has now launched five test networks, testing different second-layer network protocol designs, economic models, proof systems, multi-hop cross-chain bridges and other design elements. We are currently waiting patiently for EIP 4844 to go online. After that, one or two testnets will be launched, and it should be not far from the mainnet. Taiko is a ZK-Rollup equivalent of Ethereum, aiming to extend Ethereum by supporting all EVM opcodes in a decentralized, permissionless and secure Layer 2 architecture, and is considered a Layer 2 newcomer by the industry.

Head of Celestia, the first “modular blockchain”It is more determined on the track it is deeply involved in, We believe that modular blockchain, this category will drive encryption innovation in the next decade.

OKX Ventures Researcher KiwiRemaining optimistic about the development trend of the crypto industry in the second half of the year, he believes that although the world is currently experiencing an unstable macroeconomic situation, when the traditional financial system becomes more volatile, people may be more willing to hold and use cryptocurrencies. Moreover, the current activity on the chain continues to increase, and the number of addresses and users on each chain has been growing steadily. For example, the cumulative number of Bitcoin addresses is approximately 1.2 billion, and the number of active addresses is approximately 1 million. The application ecosystem on the chain is booming, and Ethereum has completed Shanghai is being upgraded, Cancun is about to be upgraded, and the rapid construction of various infrastructures is accelerating. These are all signs of the industrys improvement. In addition, if the expectation of Bitcoin halving is combined with the double detonation of the expectation of approval of Bitcoin spot ETF application, it may trigger huge demand from institutions.

Kiwi said that on-chain transaction volume, active addresses and miner fees can reflect the intensity of market activities and the behavior of participants. These fundamental data are of great value for discovering projects, discovering trends, and making judgments. In addition to on-chain data such as transaction volume, active addresses, miner fees, network hash rate, token supply, etc., he pays relatively more attention to developer activity data, including submitting code, releasing new versions, etc., which shows the vitality and future prospects of the project. Prospects.

dappOS person in chargeSaid, “As the inflation problem becomes more obvious, the new generation of people will turn to cryptocurrency, and in the future Web3 and blockchain applications will enter people’s daily lives. dappOS is an intent-centered operating protocol designed to Make dApps as user-friendly as mobile apps. I will always remain optimistic about the crypto industry. Those who benefit the most during the bull market are the ones who gain a foothold at the bottom of the bear market. Patience and discipline are the two things that will make it through the bear market. Key factors. In addition, it is very important to keep learning. New things are happening in the Web3 industry every day. Asking questions, reading articles, listening to the opinions of industry professionals and KOLs, continuing to pay attention to the data on the chain, and starting to form your own opinions will all Help you see market trends first.

By communicating with these high-quality projects and institutions, we can accurately extract the two key words optimism and long-term. They always insist on deep cultivation, keep learning, and be friends of time. In the future, young people in the new era will become a key group for the adoption of applications in the encryption industry.

Conclusion

No matter what it has experienced, the trend of the Bitcoin and crypto market is still upward, and has driven endless innovations in the industry, achieving financial democratization, awakening of personal sovereignty awareness, return of data rights, privacy protection, trust reform, and even changing the development direction of the Internet. , this is cool enough! What we have to do is focus on participation and freedom at the same time.