Detailed explanation of GMX_V2’s strategy to become a casino owner

GMX_V2 Strategies to become a casino owner

This article will discuss the new mechanism and participation plan of GMX V2 from the perspective of on-chain liquidity providers (casino owners). The main contents include the following four parts:

GMX Casino Principles

The core and mechanism of GMX V2

Barbell Set for GMX V2

Hedging options for GMX V2

GMX Casino Principles

The GMX operating model is based on the concept of casino gaming, where liquidity providers (LPs) are casino owners and dealers are players.

The project applied a casino owner always wins mentality when designing its current operating model, and in the process, GMX has achieved some success, raising approximately $600 million in TVL and hundreds of millions in transaction fees.

The GMX V1 model has some limitations. First, the cryptocurrency market is characterized by unidirectional trends (traders tend to either buy in large amounts or sell in large amounts), so GMXs open interest is usually quite high. Additionally, GMX v1 has no funding rate mechanism to regulate trader activity, meaning liquidity providers suffer losses when market movements align with their bets.

The core of GMX V2

Ensure the security and balance of the protocol

The core of GMX V2 is to ensure the security and balance of the protocol, and maintain the balance of long and short positions by modifying the fee mechanism to reduce the probability of GMX experiencing systemic risks when facing severe market fluctuations. Through the setting of the isolation pool, high-risk trading assets can be increased while controlling the overall risk. By cooperating with Chainlink, we can provide more timely and effective oracle services and reduce the probability of price attacks. The project team also considered the relationship between traders, liquidity providers, GMX holders and the continued development of the project, and ultimately adjusted and balanced the protocol revenue distribution.

The mechanism of GMX V2

1. Isolation pool

LP can perform risk management such as currency selection and hedging with a higher degree of freedom in the isolation pool of GMX_V2.

2. Expand variety

GMX_V2 adds SOL/XRP/LTC/DOGE. SOL/XRP uses the native currency as the underlying liquidity support, while DOGE and LTC use ETH as the underlying liquidity support.

3. Reduce transaction fees

GMX_V2 reduces transaction fees from the previous 0.1% to 0.05% or 0.07%. Fees are charged based on whether opening a position is beneficial to the balance of long and short. If it is beneficial, lower fees are charged.

4. Price impact

GMX_V2 increases the price impact fee. The larger the position, the more unfavorable it is to the long and short balance, the more fees will be charged. The price impact fee simulates the dynamic process of price changes in the order book trading market, that is, the larger the position, the greater the impact on the price. This design can increase the cost of price manipulation, reduce price manipulation attacks, prevent price crashes or surges, and maintain balanced long and short positions to maintain good liquidity.

5. Funding rate

GMX_V2 increases the funding rate, and the funding rate will be adjusted in stages. When the position/full position of the strong party is between 0.5 – 0.7, the funding rate is at a lower level; when it reaches 0.7, it will be raised to a higher level. Increase the arbitrage space and promote the entry of arbitrage funds, thus restoring the long-short balance.

6. Liquidity Incentive (ARB)

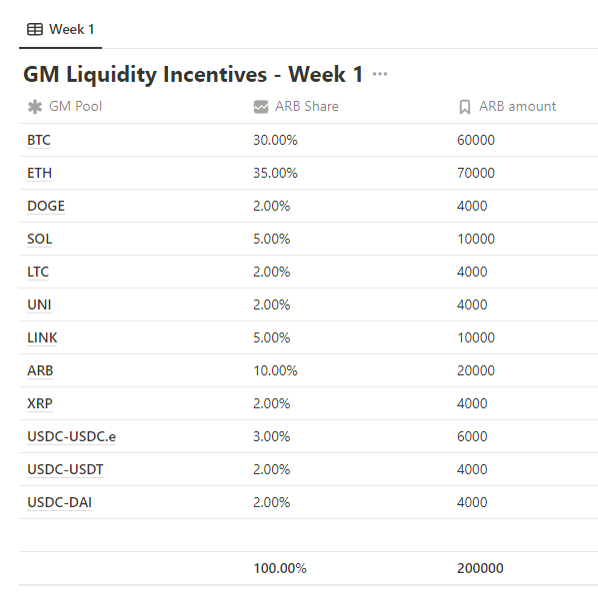

Data Sources:https://gmxio.notion.site/GMX-S-T-I-P-Incentives-Distribution-1a5ab9ca432b4f1798ff8810ce51fec3

GMX_V2 has recently added liquidity incentives. The above data is the data of the liquidity incentive ARB tokens provided in the first week recently. This incentive will be regularly distributed to LPs every week according to the number of incentives of different varieties according to the proportion of the corresponding pool.

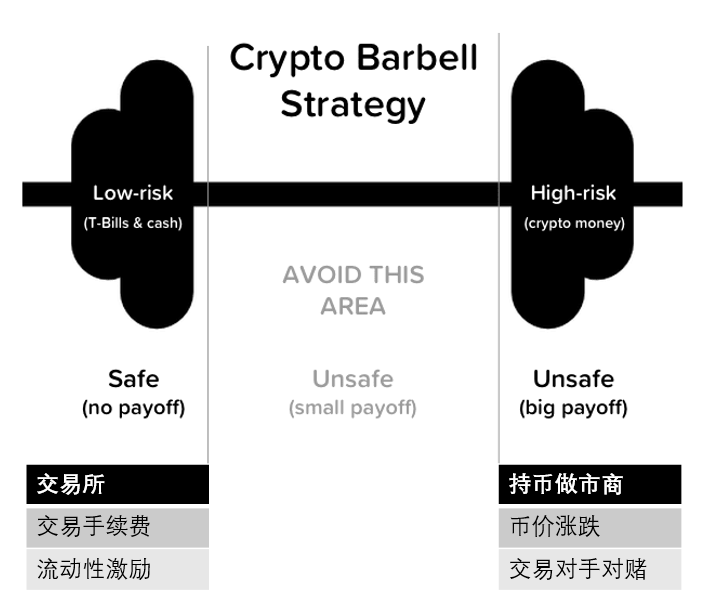

Barbell combination for GMX_V2

There are two main sources of risk returns through GMX_V2, one is low risk and the other is high risk. Low-risk returns mainly come from transaction fees paid by counterparties and regular weekly liquidity incentives; while high-risk returns The income mainly comes from the rise and fall of the currency price of the currency held and the profit and loss of the counterpartys betting.

Price(High Risk):Refers to the source of risk and return for currency-holding market makers, which is mainly composed of the rise and fall of token prices and the profits and losses of counterparties.

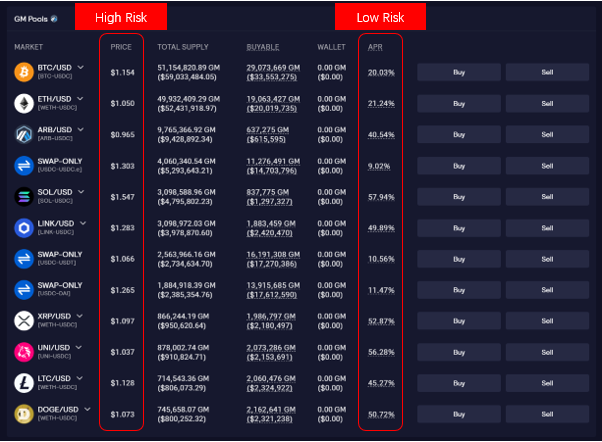

APR(Low Risk): Base APY refers to the fee income paid by the counterparty, and Bonus APY refers to the income from liquidity incentives.

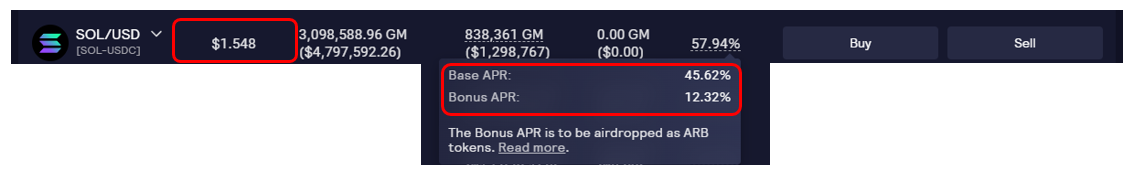

Select SOL (2023.11.13) as an example

The Price of SOL is 1.548. Since its official launch on August 4, 2023, the price of SOL has increased by 155% from 22.79 to 58.2. To establish a pool, you will need to purchase about half of the SOL coins and USDC stable coins, half of which SOL contributed about 72.5% of the income from the increase, which means that Trader has 17.8% of the income in the larger rising market, which means that the Trader P/L part of LP has lost approximately -17.8%; as for APY, the annual interest rate is based on Charges are calculated over the past 7 days. Base APY depends on the annualized fee income (45.62%) brought by the overall SOL transaction volume corresponding to the supply volume of the pool. Bonus APY refers to the incentive brought by the current incentive of 10,000 ARBs in the first week corresponding to the supply volume of the pool. Annualized return (12.32%).

Therefore, several factors need to be considered when selecting a pool, including price momentum, counterparty profit and loss ratio, trading volume, pool supply, and the number of trading incentives.

Hedging options for GMX V2

If investors believe that the counterparty is likely to lose money in the long term and want to hedge against the impact of profit and loss caused by sharp price increases and decreases, they can use futures contracts and call options to hedge price risks.

Fully hedged:The disadvantage of real-time monitoring of the number of tokens in the pool and complete hedging on a centralized exchange is that it will occupy a large amount of hedging funds. In the event of a strong rise, there will be a risk of insufficient margin leading to contract liquidation.

Option Hedging:Monitor the number of tokens in the pool in real time and buy call and put options on a centralized options exchange. The disadvantage is that you need to pay the option fee for a long time.

If professional investors have the ability to time their investments, they can hedge against market conditions that are unfavorable to LPs.

Timing hedging:Professional investors can use the markets trend and volatility environment to coordinate with trend strategies for timing hedging, avoiding the consequences of the currency-holding market makers substantial profits from counterparties when the market rises and the huge losses from currency holdings when the market falls. risk.

Summarize

The delivery of GMX V2 basically meets market expectations, showing that the GMX team has strong protocol design capabilities. From a mechanism perspective, V2 increases the balance of the liquidity pool, expands the types of trading assets, and provides a variety of collateral positions. For liquidity providers and traders, there are more investment options, better risk balance, and lower fees. Liquidity providers can use GMX V2 to implement currency selection, timing, hedging and other solutions to better manage the risk of casino strategies and obtain more diversified and stable investment returns in the long term.

refer to:

GMX v2 operating mode analysis:https://www.binance.com/de/feed/post/799559

LD Capital: Changes and Impact of GMX V2https://www.odaily.news/post/5189148

Twitter: @DerivativesCN

Website: https://dcbot.ai/