Glassnode: Data reveals the logic behind the rise of BTC and ETH

Original author: Ding HAN, Checkmate, CryptoVizArt, UkuriaOC, Alice Kohn, Glassnode

Summary

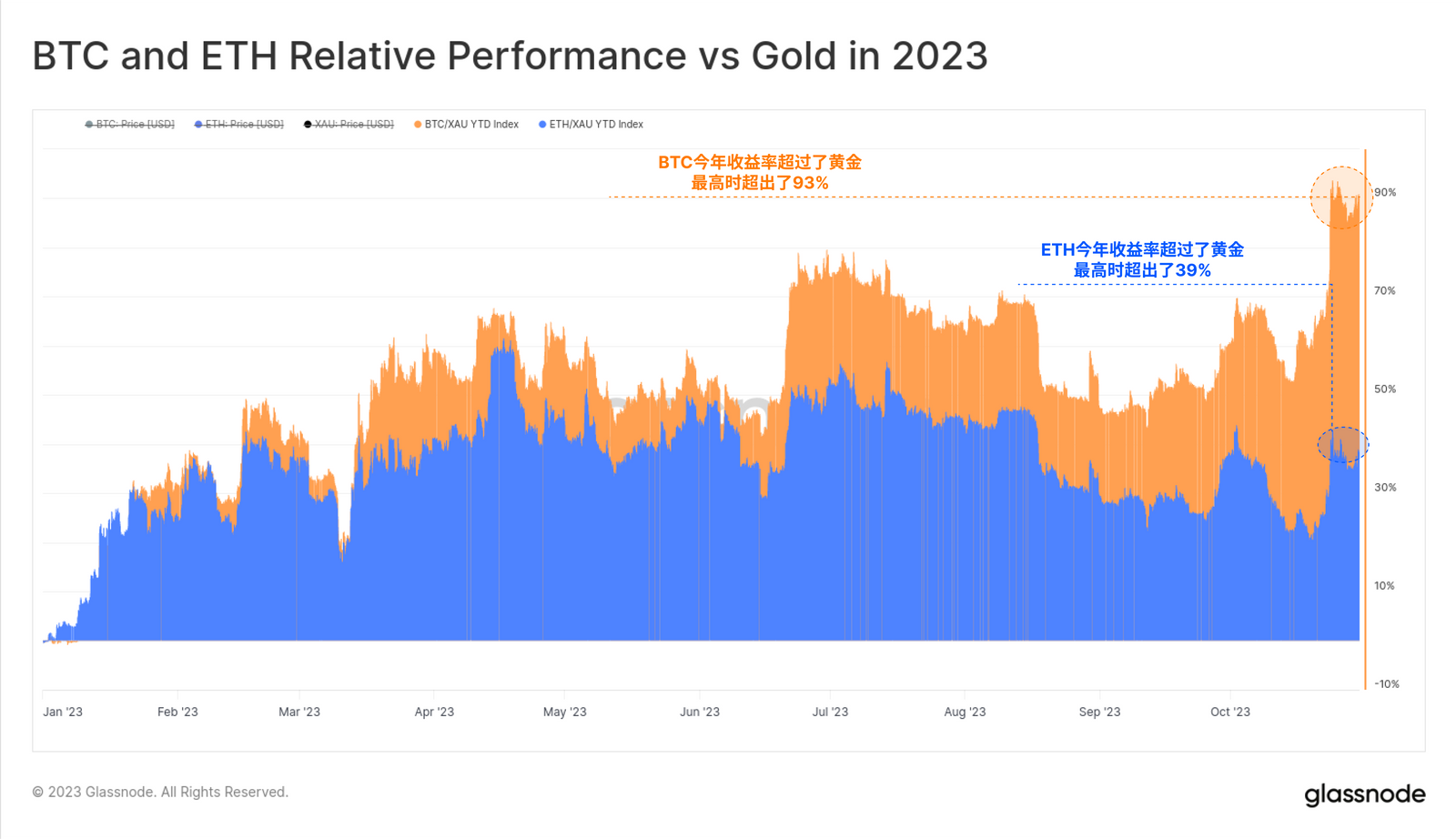

The digital asset market has delivered impressive returns in 2023, with BTC and ETH outperforming traditional assets such as gold by 93% and 39% respectively.

The two major digital assets have seen significantly smaller market corrections than in previous cycles, indicating investor support and positive capital inflows.

Our Altseason indicator shows the first significant appreciation against the US dollar since the highs of this cycle. However, it’s worth noting that this comes against the backdrop of Bitcoin’s continued rise in dominance, with Bitcoin’s market capitalization increasing by 110% year-to-date.

Bitcoin prices have risen more than 30% in recent weeks, driven in part by positive developments related to the numerous Bitcoin ETF applications submitted to the SEC for approval. Also worth noting is the relative performance of Bitcoin and digital assets as a whole compared to traditional asset classes such as commodities, precious metals, stocks and bonds.

In this week’s report, we explore this impressive relative performance of digital assets in 2023. BTC and ETH have significantly outperformed traditional assets so far, while also experiencing smaller drawdowns compared to previous cycles.

relative toughness

The chart below compares BTC and ETH prices in gold terms, showing performance compared to traditional defensive stores of value. In 2023, BTC appreciated 93% compared to gold, while ETH gained 39%. Against the backdrop of increasing global uncertainty, the strong performance of digital assets may have attracted the attention of many traditional investors.

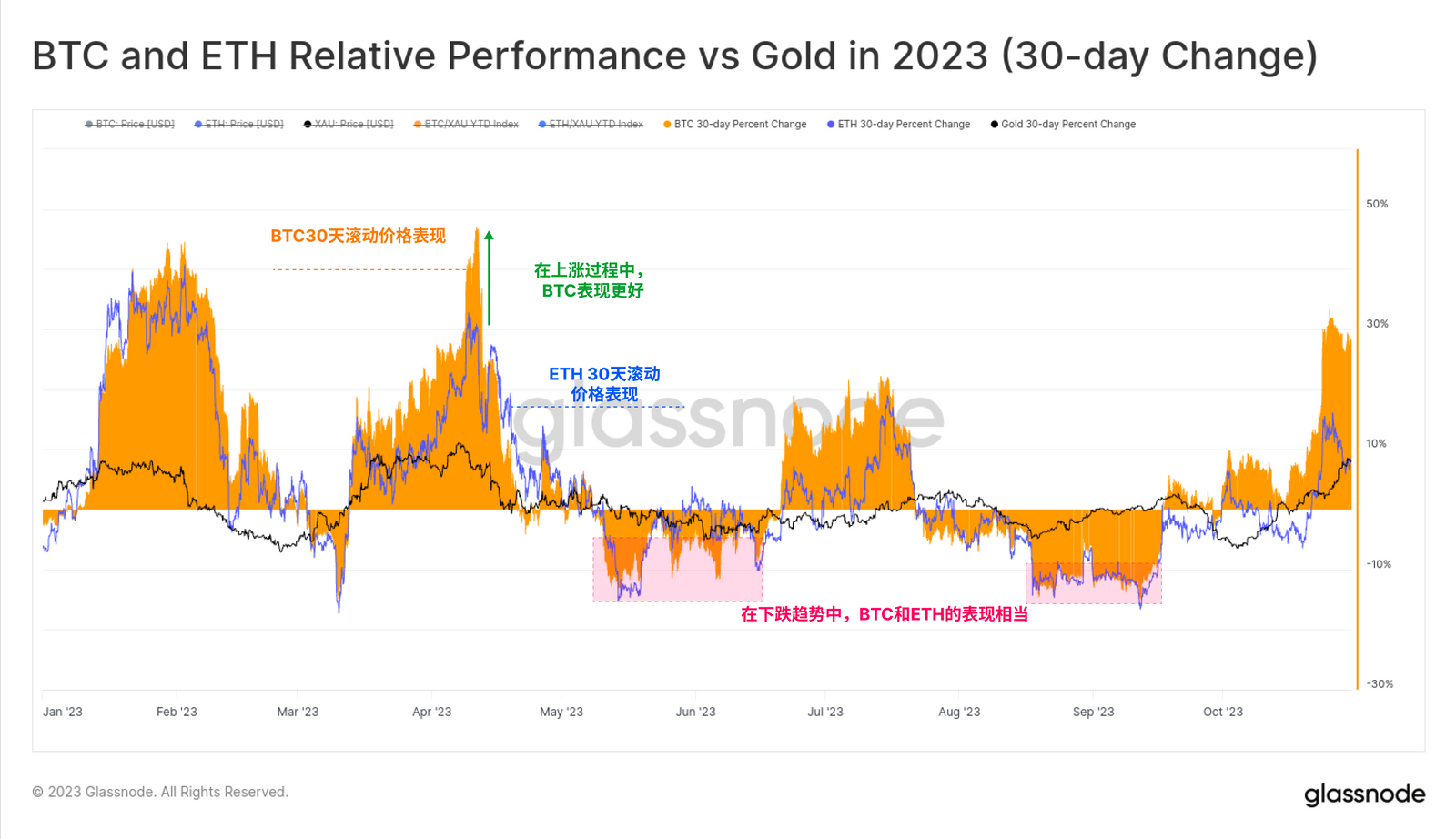

We can see that BTC and ETH returns have been closely correlated throughout 2023 based on a rolling 30-day benchmark. Both assets have experienced declines of similar magnitude, but Bitcoin has been stronger during its upswings.

We can also see that the relative volatility of both digital assets exceeds that of gold (black), which has seen smaller price swings in both directions.

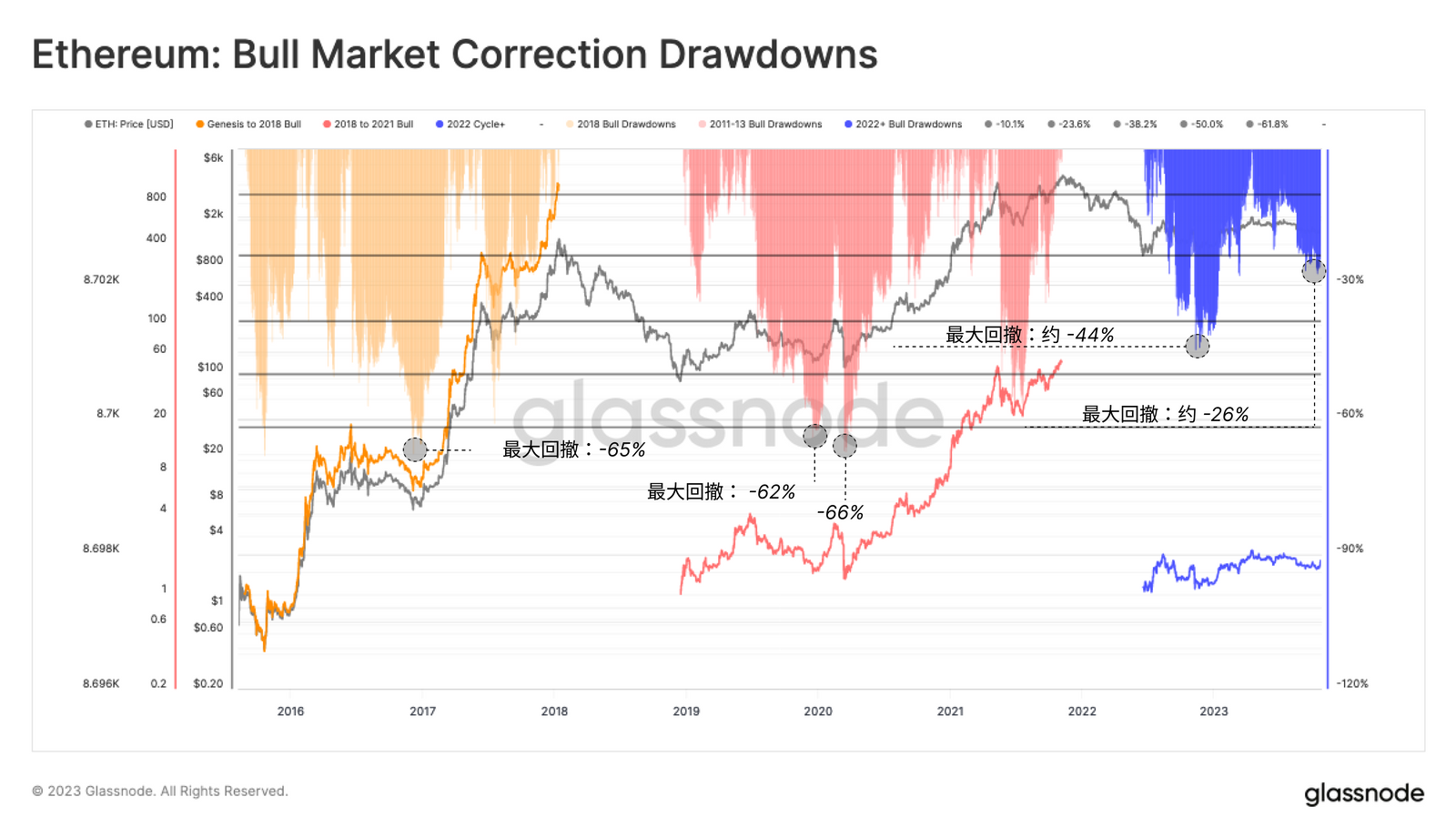

The relative strength of digital assets can also be observed by evaluating the deepest corrections within macro uptrends. Here, we will evaluate this metric for ETH so that we can see the performance relative to the USD (an external benchmark), but also compared to the market leader BTC (an internal benchmark).

We believe the cycle low for ETH/USD will occur in June 2022, following the collapse of 3AC, Celcius and LUNA-UST. Since then, the deepest ETH/USD correction relative to local highs has been -44%, which was set when FTX failed. Today, ETH is trading $2,118, or 2.6%, down from its 2023 peak, which is significantly stronger than the -60% or larger retracements seen in previous cycles.

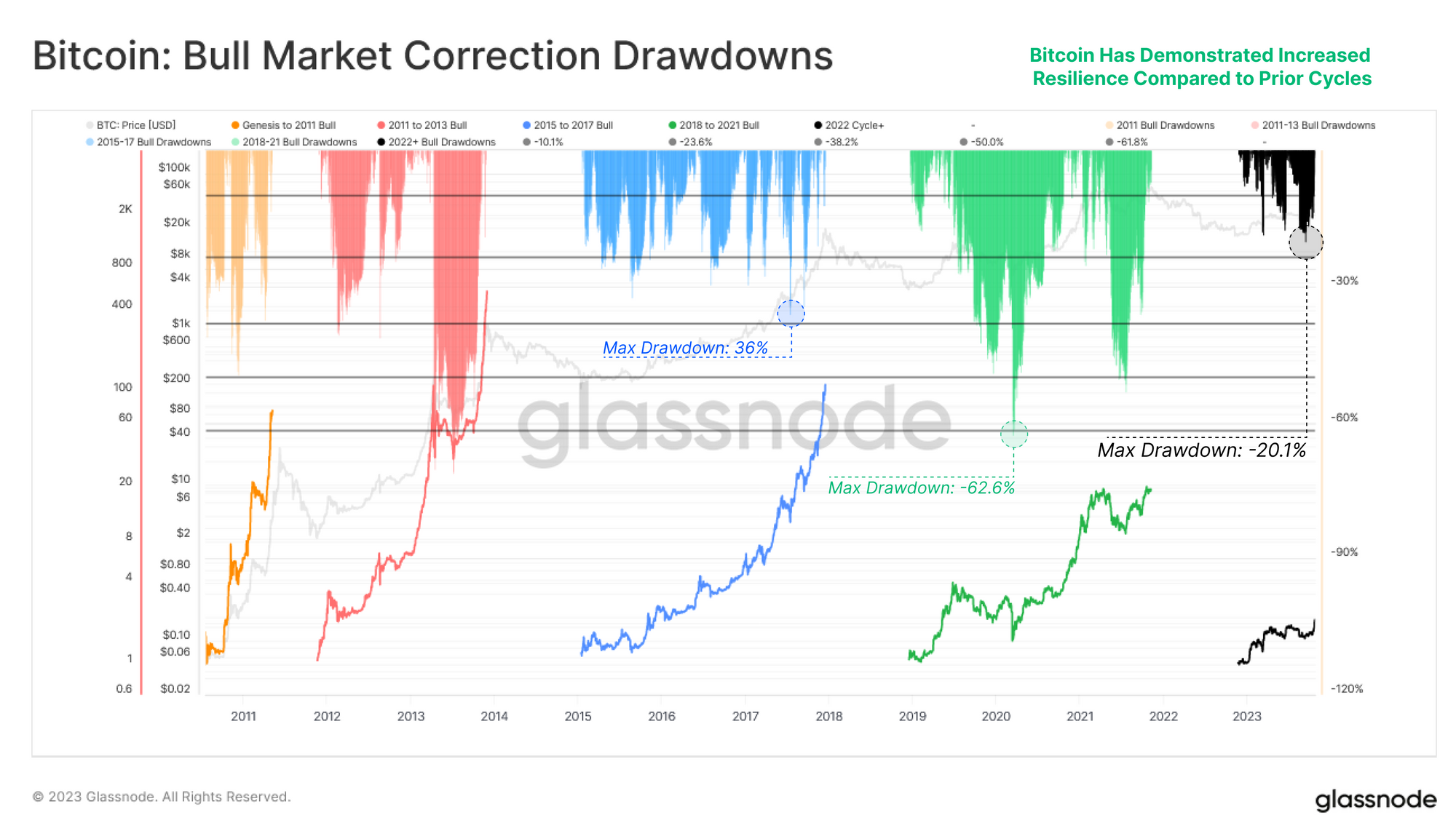

BTC’s performance has been comparable, with its deepest retracement in 2023 being only -20.1%. The 2016-17 bull market frequently saw corrections of over -25%, while 2019 saw a retracement of over -62% from the July 2019 peak of $14,000.

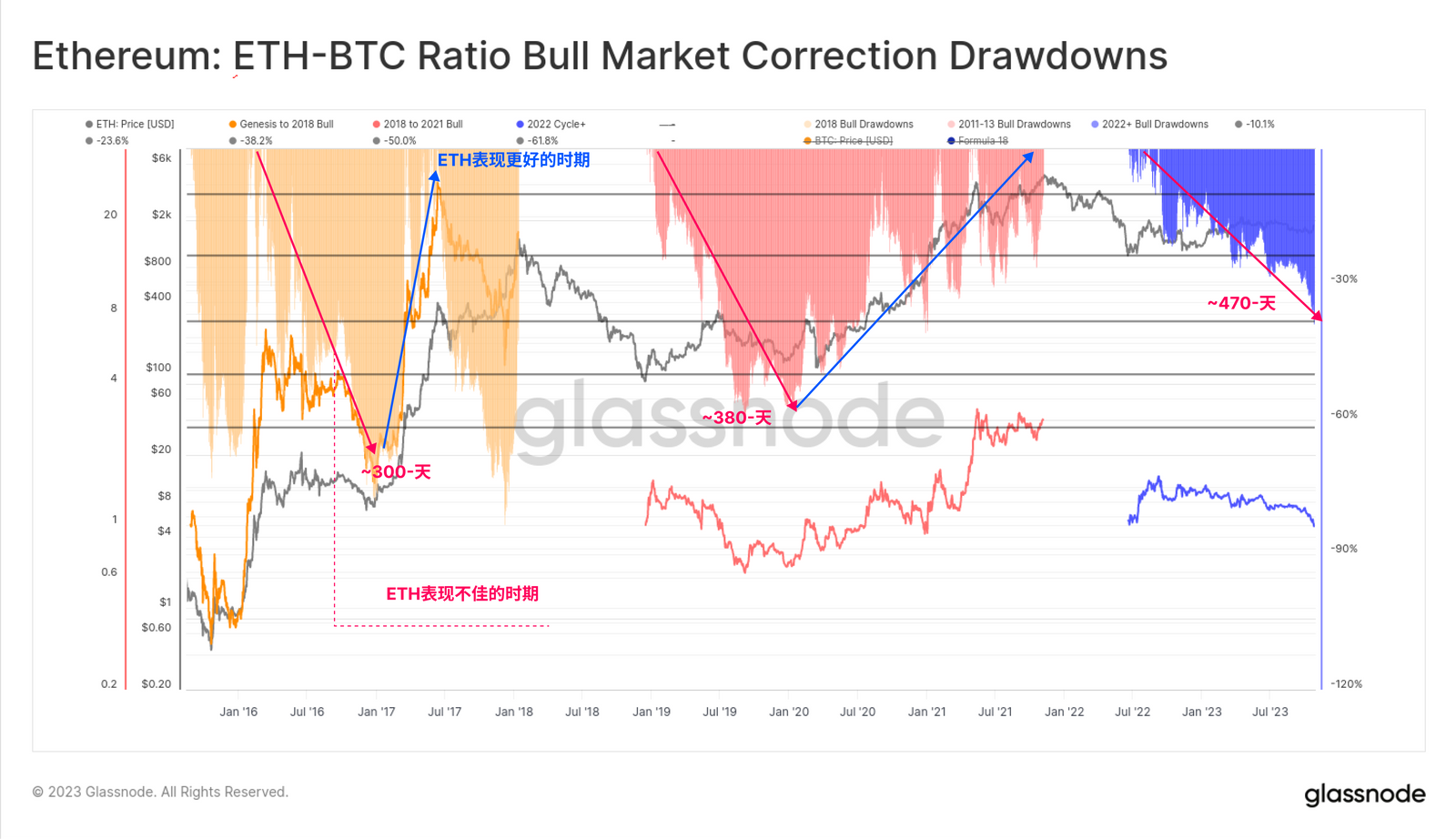

To assess capital flows within the digital asset market, a useful reference is to look for periods when ETH has outperformed relative to BTC. The chart below shows the depth of the maximum retracement of the ETH-BTC ratio compared to the local highs of the current uptrend.

Previous cycles have seen ETH retrace over -50% relative to the baseline during bear recovery phases, with the current retracement reaching -38%. Of particular concern is the duration of this trend, with ETH having depreciated relative to BTC for more than 470 days to date. This highlights an underlying trend between cycles, where BTC dominance increases over longer periods of time during the post-bear market hangover.

We can also use this tool to monitor inflection points in cycles of rising and falling risk.

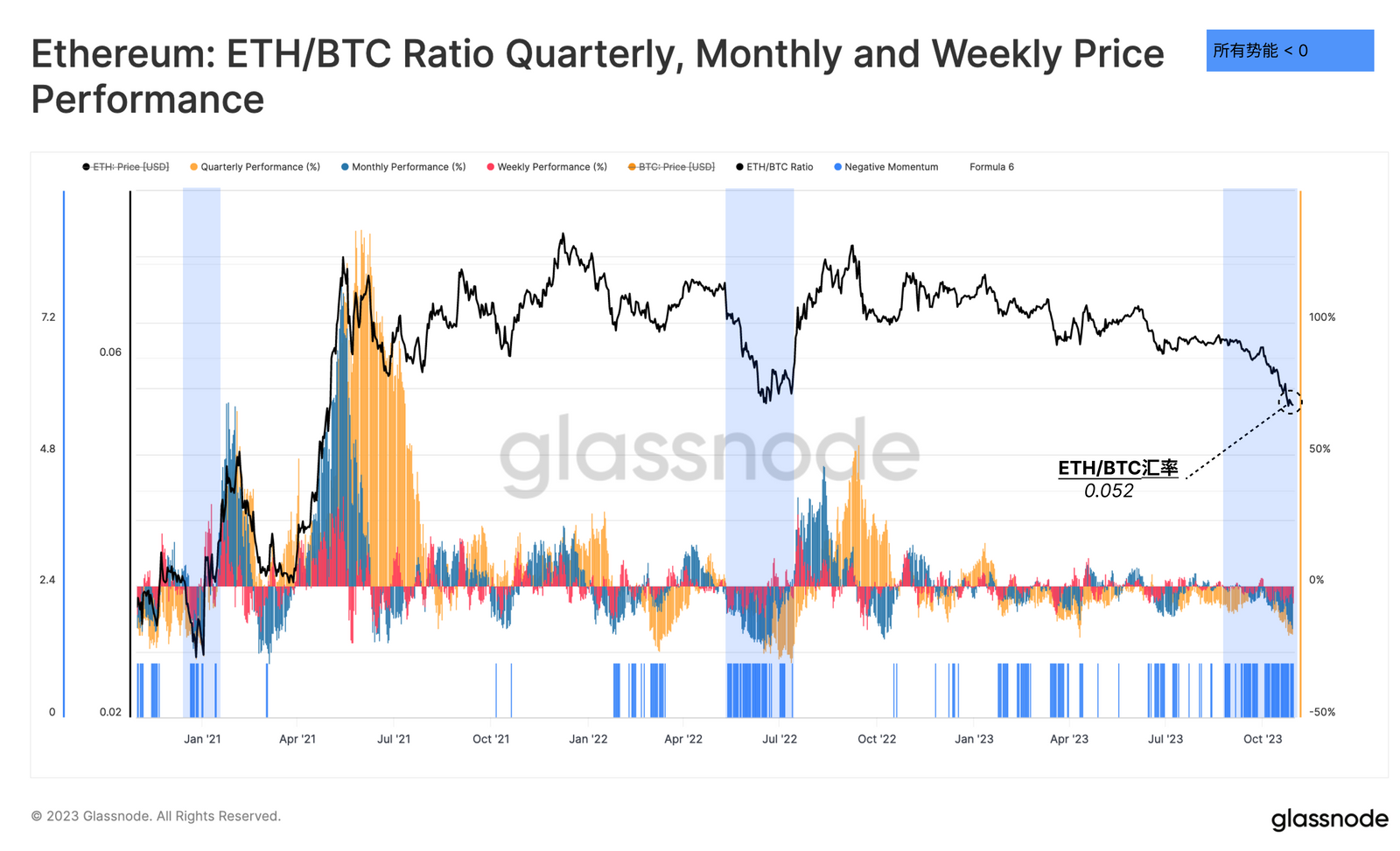

This chart gives another perspective on the relative performance of the ETH/BTC ratio, showing the quarterly, weekly, and weekly rolling ROI oscillators for the ETH/BTC ratio. A barcode indicator (blue) then highlights periods when all three timeframes showed ETH underperforming relative to BTC.

Here we can see that the recent weakness in the ETH/BTC ratio is similar to what happened in May – July 2022, with the price ratio reaching the same level of 0.052.

Investor Sentiment Trends

Digging deeper into the Ethereum price model, we note that ETH is trading at $1,800, which is 22% higher than the realized price ($1,475). The realized price is typically considered the average cost basis of all coins in the supply, priced based on the time of the last transaction.

This suggests that the average ETH holder is holding on to a modest profit, but it is still well below the extreme price levels that often occur during bull market euphoria.

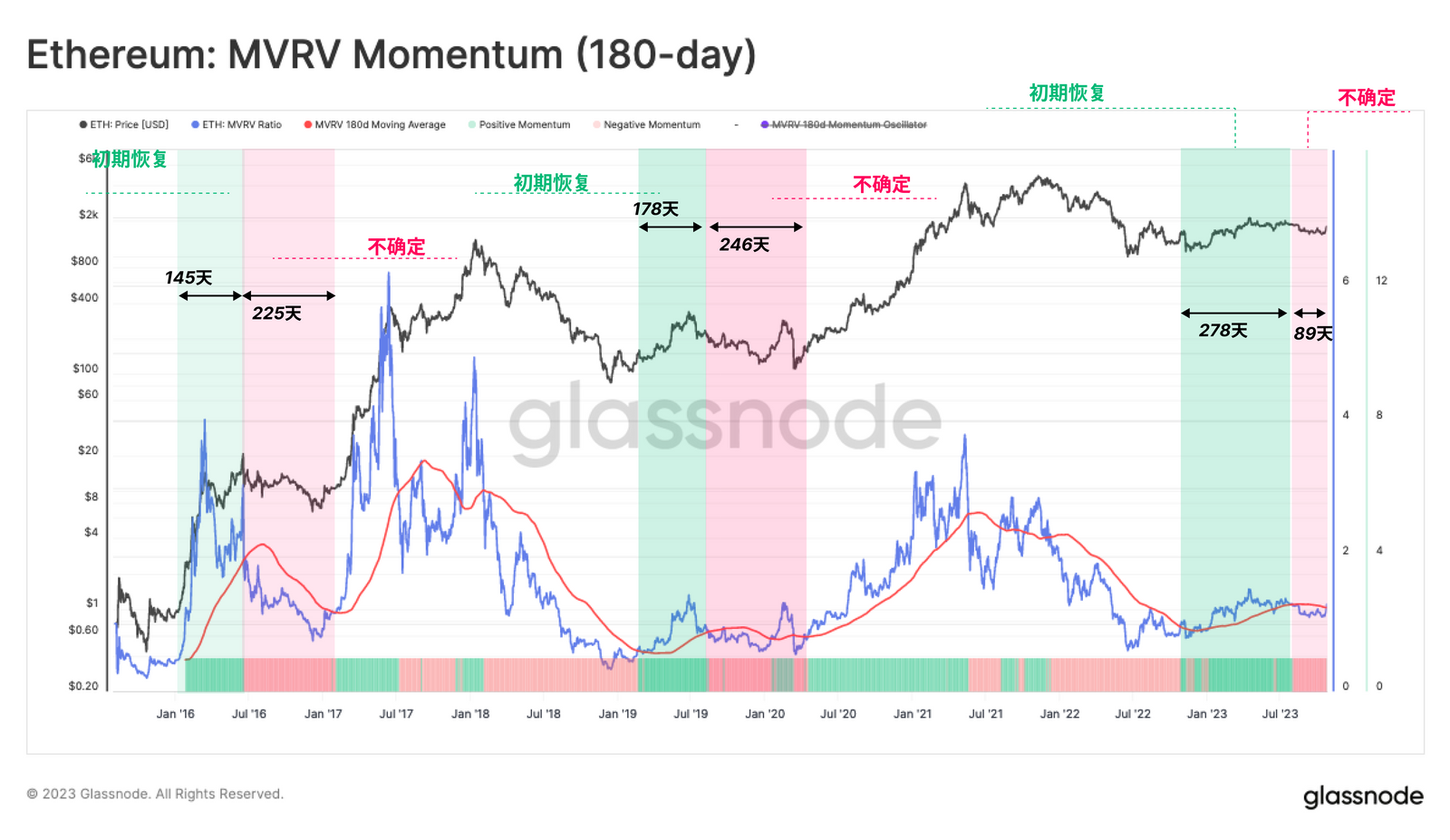

Another way to visualize changes in profitability for investors is through the MVRV ratio, which is the ratio between price and realized price. In this case, we compare the MVRV ratio to its 180-day moving average as a tool to monitor trends.

When the MVRV ratio is above this long-term average, it indicates that investors profitability is improving significantly, which is usually a sign of a rising market. However, despite ETH’s good market performance at the beginning of the year, the market is still in a state of negative momentum according to this metric. It appears that the aftermath of the 2022 bear market is still slowly dissipating.

changes in confidence

We can also use the Investor Confidence in Trend metric to measure the relative performance of Ethereum investor profitability. We attempt to gauge changes in Ethereum investor sentiment by comparing the difference between cost benchmarks for holders and sellers.

When the cost basis of sellers is lower than that of currency holders, it means that red sentiment is biased towards negative;

On the contrary, if the sellers cost basis is high, it shows that green sentiment is optimistic.

Orange transition sentiment is when the cost basis fluctuates close to the holders cost basis.

Altcoin Season: USD….but not BTC

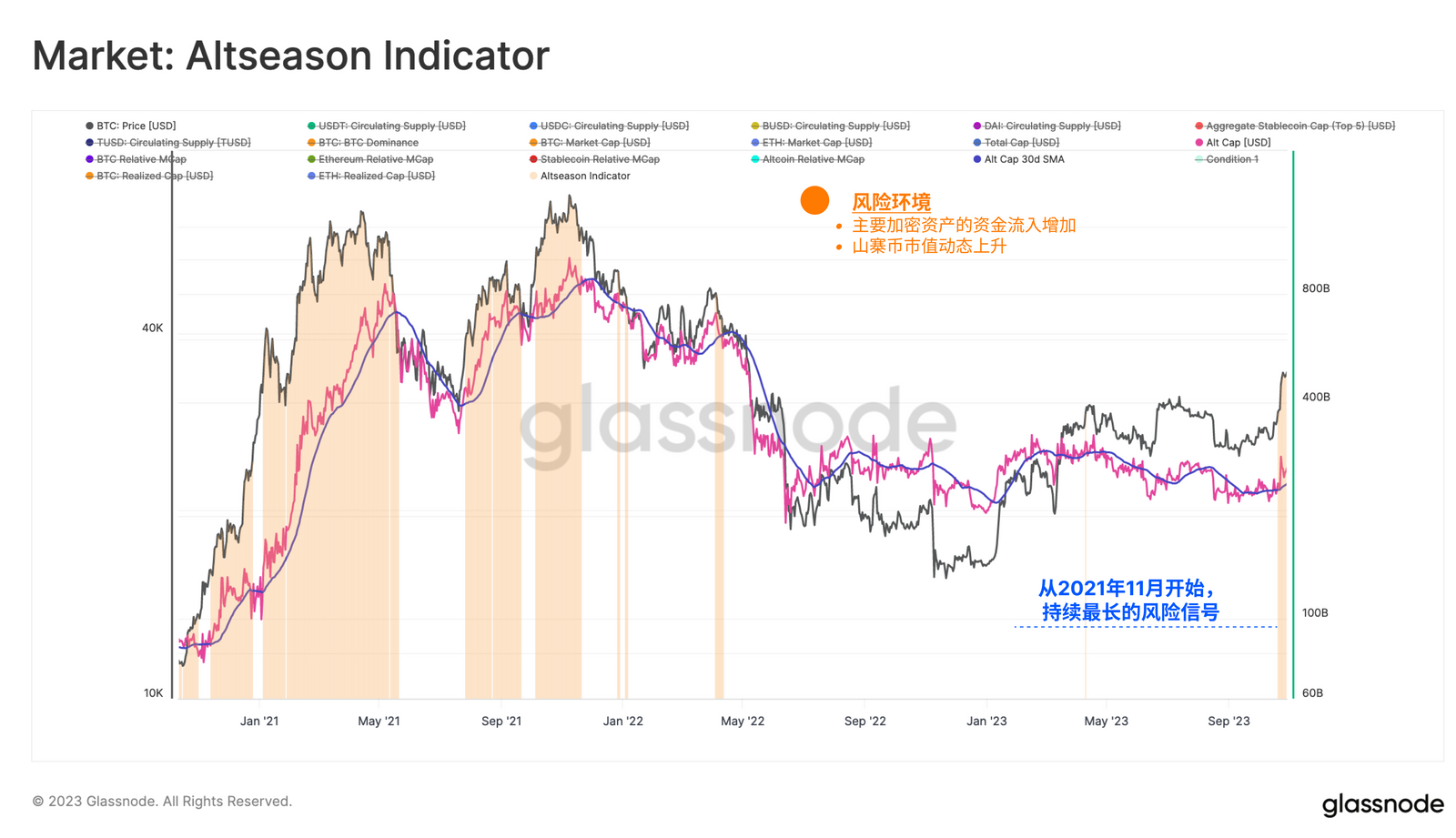

Building on the previous work, we were able to carry out a new iteration of the altcoin indicator. In this model, we use the previously defined risk environment as our first condition, requiring capital inflows into BTC, ETH, and stablecoins. We also added a second condition, which is positive momentum in the total altcoin market capitalization (total cryptocurrency market capitalization excluding BTC, ETH, and stablecoins).

Here, we are looking for periods when the total altcoin valuation was greater than its 30 D SMA. The indicator showed positive value on October 20, before Bitcoin surged from $29,500 to $35,000.

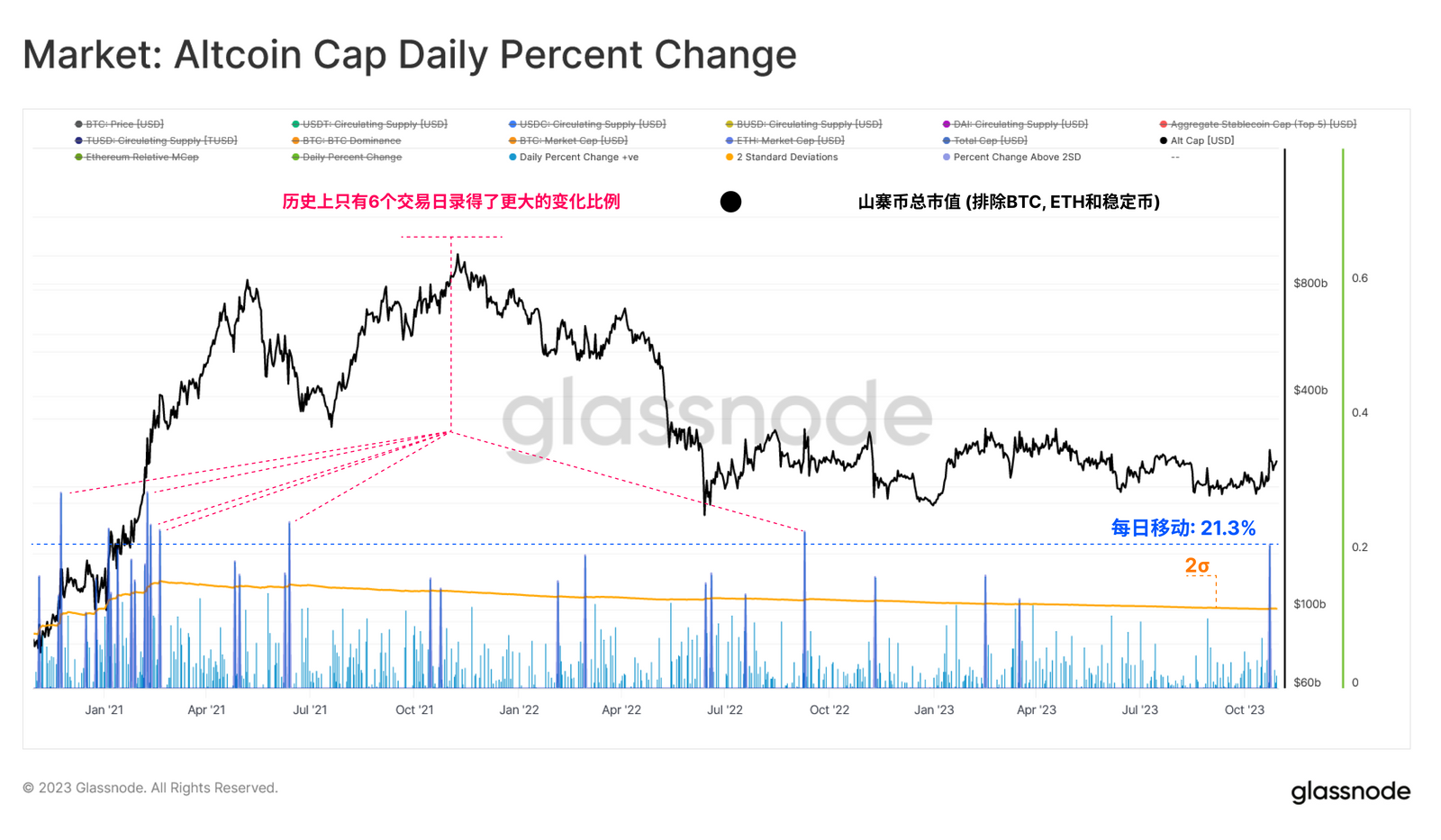

A high level of confidence in the digital asset is evident when assessing the recent performance of total altcoin market capitalization.

The local uptick recorded a +21.3% increase in the sectors valuation, with only six trading days seeing larger percentage changes. This highlights the waterfall effect of investor capital as Bitcoin’s dominance tends to spark an increase in altcoin valuations compared to fiat currencies.

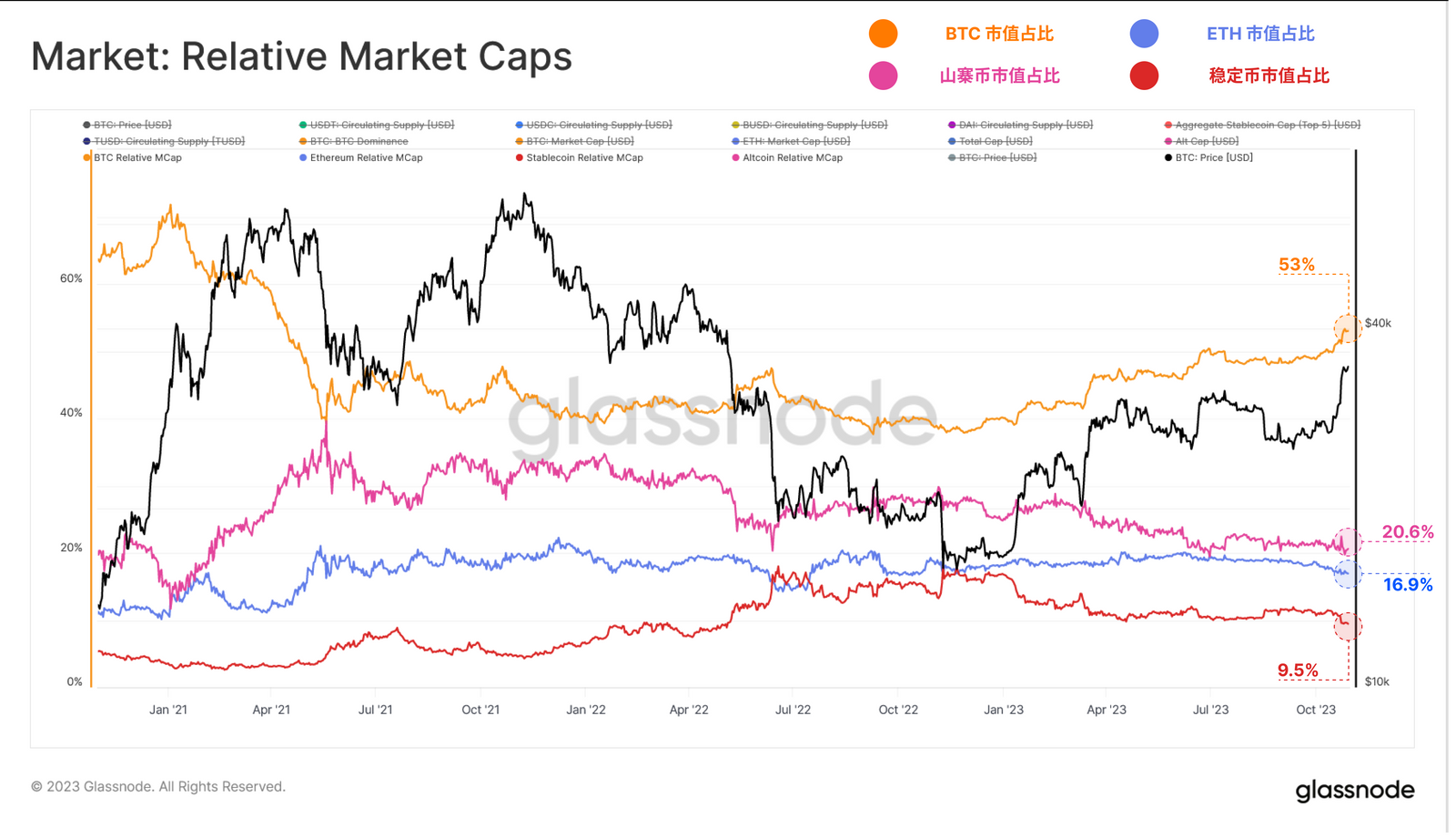

However, it is important to remember that Bitcoin’s dominance continues to rise. From a relative perspective, BTC now controls over 53% of digital asset market valuations, while Ethereum, large altcoins, and stablecoins have all experienced a relative decline in their dominance in 2023. Bitcoin’s dominance has risen from a cyclical low of 38% set in late 2022.

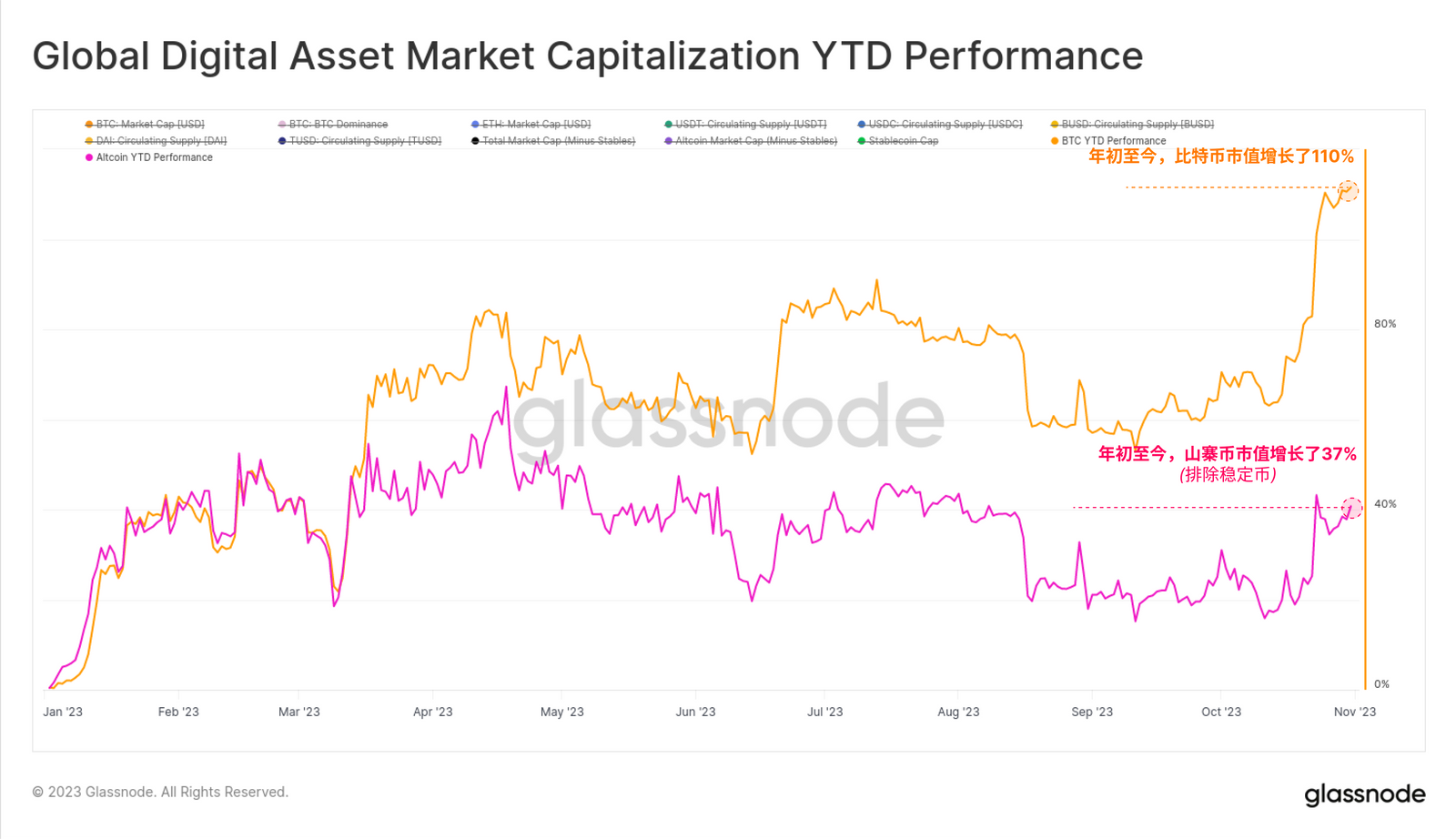

Finally, we can compare Bitcoin’s annual growth rate to the total altcoin market cap (excluding stablecoins). Bitcoin market capitalization increased by 110% in 2023, while altcoin market capitalization increased by 37%, an impressive but relatively small increase.

This highlights an interesting market dynamic, where the altcoin space is outperforming fiat currencies and traditional assets like gold, but significantly underperforming Bitcoin.

Conclusion and summary

The digital asset market posted impressive returns in 2023, leaving the initial recovery phase and entering an uptrend once again. For market leaders BTC and ETH, the 2023 market correction is significantly shallower than previous cycle uptrends, suggesting investor support and positive capital inflows are taking place.

Looking at multiple indicators, including the Altcoin Indicator we developed, we have seen the market valuation of the altcoin industry rise significantly for the first time since the peak of the last cycle. However, it is important to note that this performance is relative to fiat currency (i.e. the US dollar). In the field of digital assets, Bitcoin’s dominance continues to rise, resulting in an annual growth rate of Bitcoin’s market capitalization exceeding 110%.